Professional Documents

Culture Documents

Income Tax Calculator 2018-2019

Uploaded by

Muhammad Hanif SuchwaniCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Calculator 2018-2019

Uploaded by

Muhammad Hanif SuchwaniCopyright:

Available Formats

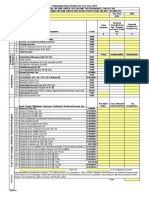

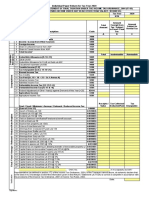

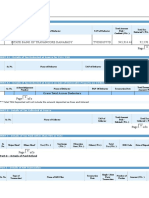

Calculator for Employee Tax Computation for 2018-2019

Instructions: Please note that this sheet will assist you to calculate your tax liability, tax credits and allowable deductions based on the information provided by you. The tax liability, tax credits and allowable deduction may change

due to change in your earnings. Please enter values in yellow highlighted cells only.

For any assistance, you may contact Payroll Section (Imran Thawar: Ext 8113, Zohaib Kadiwal: Ext 8105 or write to them on payroll@aku.edu)

Name Employee #

Date of Birth Full Time Teacher / Researcher (Yes, No) No

Last Year Taxable Income Paymonth Nov-18

Earning ID (Annual Income as per Employee Tax Computation Statement) From

Basic salary ###

Allowances ###

Other allowances ###

Extgratia ###

Leave encashment ###

Value of auto (if applicable) ###

Employer Provident Fund contribution above Rs. 150,000 ###

Overtime ###

Others

Others

Others

Applicable Salary for Income Tax -

Tax Savings From Allowable D

Form Ref. Maximum

Details Paid Allowable Tax Credit

S# Eligible

Gross t

Allowable deduction Full Tim

1 Zakat at Source - - -

2 Straight Line Donations - - -

3 Profit on Debt on House Loans (Purchase/Construction) - - -

Total - - - -

Tax Credits

4 Charitable donation (See Sec-61) - - -

5 Investment in Shares or Sukuks and / or Life Insurance Premium (Sec-62) - - -

6 Investment in Health Insurance Premium (Sec-62a) - - -

7 Contribution to Approved Pension Fund (See Sec-63) - - -

Total - - - -

Age Cu

Taxable Income Age

Gross Applicable Salary for Income Tax -

LeAllowable Deductions -

Net Applicable Salary for Income Tax -

Computation of Tax

Gross tax for the year -

Less:Full Time Teacher / Researcher -

Tax Paid upto previous month (Input from your current ETCS)

Tax Deducted in this month (Input from your current ETCS)

8-13 Advance Income Tax

Tax Credits -

Tax Payable / (Refundable) upto June 2019 -

Tax Saved due to Allowable deduction and Tax Credits -

Please note that Refunds can be claimed through FBR only by submitting your Annual Tax Return

Per Month Tax (Fill Paymonth Field) -

You might also like

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozal100% (1)

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKakz KarthikNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementGejehNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- Marketing Strategies of AdidasDocument58 pagesMarketing Strategies of Adidasjassi7nishadNo ratings yet

- Literature Case Study on Bus Terminals DesignDocument12 pagesLiterature Case Study on Bus Terminals Designsumitbhatia10bac2676% (21)

- PEZA Cost Benefit Analysis FormDocument2 pagesPEZA Cost Benefit Analysis FormMark Kevin SamsonNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKNNo ratings yet

- Introduction To PRIME-HRMDocument50 pagesIntroduction To PRIME-HRMApril Gan Casabuena100% (7)

- Darwin Route10 Pocket Maps/TimetableDocument2 pagesDarwin Route10 Pocket Maps/TimetableLachlanNo ratings yet

- Salary Tds Computation Sheet Sec 192bDocument1 pageSalary Tds Computation Sheet Sec 192bpradhan13No ratings yet

- Ja RawalDocument1 pageJa Rawalfigigob267No ratings yet

- Form_BDocument1 pageForm_BPrateek BaruahNo ratings yet

- Form BDocument2 pagesForm BPower MuruganNo ratings yet

- "Individual Paper Return For Tax Year 2021: SignatureDocument25 pages"Individual Paper Return For Tax Year 2021: SignatureWaqas MehmoodNo ratings yet

- Tax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortDocument17 pagesTax & TDS Calculation From Salary Income (20-21 Assess Year) - ShortMohammad Shah Alam ChowdhuryNo ratings yet

- Comparative DTTs of Pakistan With Flags Upto Apr 2015Document7 pagesComparative DTTs of Pakistan With Flags Upto Apr 2015ali razaNo ratings yet

- LGK Workshop 2010Document2 pagesLGK Workshop 2010kunhalparikhNo ratings yet

- 05-2022, CI - Assam - Form IV-A, MW ActDocument1 page05-2022, CI - Assam - Form IV-A, MW ActPragnaa ShreeNo ratings yet

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Document8 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2021-22Nitesh YNo ratings yet

- Tax Clearance Calculator Check ScenariosDocument1 pageTax Clearance Calculator Check ScenariospragatheeskNo ratings yet

- Lessee AccountingDocument7 pagesLessee AccountingYess poooNo ratings yet

- Payroll Appendix for DOTr Regional Franchising OfficeDocument2 pagesPayroll Appendix for DOTr Regional Franchising OfficePraise BuenaflorNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementUtiyyalaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFArifNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozalNo ratings yet

- CASHFLOW JuegoDocument1 pageCASHFLOW JuegoRebeca Valverde DelgadoNo ratings yet

- Individual Paper Return For Tax Year 2020: SignatureDocument26 pagesIndividual Paper Return For Tax Year 2020: SignaturejamalNo ratings yet

- 2021 GeneralDocument8 pages2021 GeneralWajiha HaroonNo ratings yet

- Appendix 20 - Sabudb - Far 2Document1 pageAppendix 20 - Sabudb - Far 2pdmu regionixNo ratings yet

- Itax Blank Format 22-23Document3 pagesItax Blank Format 22-23DSEU Campus GBPIT OkhlaNo ratings yet

- Govt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2022-23Document5 pagesGovt Sr. Sec School Dilod Hathi, Atru Baran: Income Tax Calculation (Ga-55) 2022-23Nitesh YNo ratings yet

- Pay SlipDocument2 pagesPay SlipYogendra RautNo ratings yet

- Individual Income Tax Return for Tax Year 2019Document48 pagesIndividual Income Tax Return for Tax Year 2019Mirza Naseer AbbasNo ratings yet

- RG 1Document4 pagesRG 1Nagendiran DevakumarNo ratings yet

- BIR Form No. 1600Document2 pagesBIR Form No. 1600Lorraine Steffany BanguisNo ratings yet

- Ola UttrakhandDocument1 pageOla UttrakhandRahul KumarNo ratings yet

- Income Tax Calculator FY 2023 24Document1 pageIncome Tax Calculator FY 2023 24Balamurali KirankumarNo ratings yet

- Register of Wages - 62006Document1 pageRegister of Wages - 62006samrat duttaNo ratings yet

- Individual Paper Return For Tax Year 2019: SignatureDocument10 pagesIndividual Paper Return For Tax Year 2019: SignatureEngr Saad Bin SarfrazNo ratings yet

- Icv Excel Sheet-MoiatDocument361 pagesIcv Excel Sheet-MoiatbswarajbhutadaNo ratings yet

- TRACES Annual Tax StatementDocument1 pageTRACES Annual Tax StatementabhitesplNo ratings yet

- FBR Tax FilingDocument48 pagesFBR Tax FilingMuhammad Waqas Hanif100% (1)

- 2005 EB 08 Export Terms Documentation and Payment MethodsDocument3 pages2005 EB 08 Export Terms Documentation and Payment Methodsshivamdubey12No ratings yet

- FSET-Recommended HW CH3Document1 pageFSET-Recommended HW CH3tabi10592No ratings yet

- General Instructions For The Completion PDF Form 1770 SDocument14 pagesGeneral Instructions For The Completion PDF Form 1770 SHafiedz S100% (1)

- Paye Coding Notice PDFDocument2 pagesPaye Coding Notice PDFNebu MathewsNo ratings yet

- Manual Return 2023Document28 pagesManual Return 2023arsalanghuralgtNo ratings yet

- RMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Document2 pagesRMC No. 73-2019 - 1604C Alphalist Format Jan 2018 Final2Leo R.No ratings yet

- Chapter 1 - Accounting in BusinessDocument1 pageChapter 1 - Accounting in BusinessLê Nguyễn Anh ThưNo ratings yet

- TDS - Working - CA Amit MahajanDocument9 pagesTDS - Working - CA Amit Mahajan42 Rahul RawatNo ratings yet

- MODIFIED - TIMTA Annexes For CREATE FAs of 20 June 2021Document14 pagesMODIFIED - TIMTA Annexes For CREATE FAs of 20 June 2021Sunshine PaglinawanNo ratings yet

- SPECIAL INSTRUCTIONS FOR LOAN TRANSACTIONDocument3 pagesSPECIAL INSTRUCTIONS FOR LOAN TRANSACTIONdean winterNo ratings yet

- Generate Bill Register ReportDocument2 pagesGenerate Bill Register ReportimonlyforsigninNo ratings yet

- OC6602302 PremiumPaymentCertificateDocument1 pageOC6602302 PremiumPaymentCertificateShreyas ShenoyNo ratings yet

- Nominal Roll 2017 18Document13 pagesNominal Roll 2017 18Sami UllahNo ratings yet

- Old Indirect tax Structure replaced by GSTDocument90 pagesOld Indirect tax Structure replaced by GSTPrasad Rao60% (5)

- OuterFVC 25639196 13137Document1 pageOuterFVC 25639196 13137Tarun Gulshan Dave ShrimaliNo ratings yet

- 1state Bank of Travancore Danapady TVDS01977D 945,914.44 92,570.00Document2 pages1state Bank of Travancore Danapady TVDS01977D 945,914.44 92,570.00Bhargavaramireddy GadeNo ratings yet

- Non-Sampling Invoice for Mauritanian AirlinesDocument1 pageNon-Sampling Invoice for Mauritanian AirlinesTaleb Boubacar RimNo ratings yet

- RM BadjaoDocument123 pagesRM BadjaoMiGz Maglonzo71% (7)

- Lesson 5 - Business ManagementDocument31 pagesLesson 5 - Business ManagementMarc Lewis BrotonelNo ratings yet

- Working With Sexual Issues in Systemic Therapy by Desa Markovic PDFDocument13 pagesWorking With Sexual Issues in Systemic Therapy by Desa Markovic PDFsusannegriffinNo ratings yet

- WHO Report On COVID-19 - April 22, 2020Document14 pagesWHO Report On COVID-19 - April 22, 2020CityNewsTorontoNo ratings yet

- Report on Socioeconomic Status of Tribal CommunitiesDocument431 pagesReport on Socioeconomic Status of Tribal CommunitiesAmlan MishraNo ratings yet

- CSS - 2 2 2023 CSS - 2Document1 pageCSS - 2 2 2023 CSS - 2Nirmal GeorgeNo ratings yet

- Financial Performance and Position HighlightsDocument100 pagesFinancial Performance and Position HighlightsSHAMSUL ARIF ZULFIKAR HUSNINo ratings yet

- Italian Renaissance Theatre DevelopmentsDocument3 pagesItalian Renaissance Theatre DevelopmentsAndrewNathanVesselNo ratings yet

- Jim McElwain ContractDocument15 pagesJim McElwain ContractColoradoanNo ratings yet

- Conceptual Framework and Accounting Standards (Valix, peralta, valix 2020) - Identifying Accounting ProcessDocument3 pagesConceptual Framework and Accounting Standards (Valix, peralta, valix 2020) - Identifying Accounting ProcessAngel heheNo ratings yet

- Deriv Investments (Europe) LimitedDocument9 pagesDeriv Investments (Europe) LimitedİHFKİHHKİCİHCİHCDSNo ratings yet

- Salem Steel PlantDocument69 pagesSalem Steel PlantKavuthu Mathi100% (2)

- The Intelligent Investor Chapter 6Document3 pagesThe Intelligent Investor Chapter 6Michael PullmanNo ratings yet

- ALL Night Long: THE Architectural Jazz OF THE Texas RangersDocument8 pagesALL Night Long: THE Architectural Jazz OF THE Texas RangersBegüm EserNo ratings yet

- Black Violet Pink 3D Company Internal Deck Business PresentationDocument16 pagesBlack Violet Pink 3D Company Internal Deck Business Presentationakumar09944No ratings yet

- On Insider TradingDocument17 pagesOn Insider TradingPranjal BagrechaNo ratings yet

- Straightforward Pre-intermediate Unit Test 4 Vocabulary and Grammar ReviewDocument3 pagesStraightforward Pre-intermediate Unit Test 4 Vocabulary and Grammar ReviewLaysha345678No ratings yet

- Constitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsDocument13 pagesConstitutional Law 1 Syllabus and Cases on Legislative and Executive DepartmentsAdrian AlamarezNo ratings yet

- Meezan BankDocument40 pagesMeezan BankShahid Abdul100% (1)

- (UPDATED) BCC Semifinalist GuidebookDocument4 pages(UPDATED) BCC Semifinalist GuidebookYohanes StefanusNo ratings yet

- Individual Account Opening Form: (Demat + Trading)Document27 pagesIndividual Account Opening Form: (Demat + Trading)Sarvar PathanNo ratings yet

- Submitted To: Jalal Ahmad Khan Name: Osama Yaqoob ID# 63125 Assignment# 3 Course: Managerial AccoutingDocument6 pagesSubmitted To: Jalal Ahmad Khan Name: Osama Yaqoob ID# 63125 Assignment# 3 Course: Managerial AccoutingOsama YaqoobNo ratings yet

- Letter From Canute FranksonDocument2 pagesLetter From Canute FranksonAbraham Lincoln Brigade ArchiveNo ratings yet

- COMOROS 01 SynopsisDocument99 pagesCOMOROS 01 SynopsisJaswinder SohalNo ratings yet

- History and Political Science: Solution: Practice Activity Sheet 3Document9 pagesHistory and Political Science: Solution: Practice Activity Sheet 3Faiz KhanNo ratings yet

- Madiha Riasat: ObjectiveDocument3 pagesMadiha Riasat: Objectivecallraza19No ratings yet