Professional Documents

Culture Documents

Topic 28: Financial Asset at Amortized Cost

Uploaded by

emman neri0 ratings0% found this document useful (0 votes)

5 views1 pageThis document discusses several topics related to financial accounting:

1) Financial assets measured at amortized cost include transaction costs in the carrying amount and use the effective interest method to calculate interest income.

2) The market price of bonds is calculated by discounting future cash flows using the yield or effective interest rate.

3) Under the fair value option, all changes in fair value are recognized in profit or loss and interest income uses the nominal rather than effective interest rate.

Original Description:

Original Title

Funds-Other-Investments.docx

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses several topics related to financial accounting:

1) Financial assets measured at amortized cost include transaction costs in the carrying amount and use the effective interest method to calculate interest income.

2) The market price of bonds is calculated by discounting future cash flows using the yield or effective interest rate.

3) Under the fair value option, all changes in fair value are recognized in profit or loss and interest income uses the nominal rather than effective interest rate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views1 pageTopic 28: Financial Asset at Amortized Cost

Uploaded by

emman neriThis document discusses several topics related to financial accounting:

1) Financial assets measured at amortized cost include transaction costs in the carrying amount and use the effective interest method to calculate interest income.

2) The market price of bonds is calculated by discounting future cash flows using the yield or effective interest rate.

3) Under the fair value option, all changes in fair value are recognized in profit or loss and interest income uses the nominal rather than effective interest rate.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

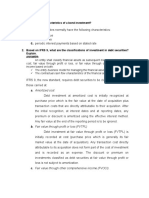

TOPIC 28: FINANCIAL ASSET AT Under the FV option, all changes in the fair value are

AMORTIZED COST recognized in P &L.

Moreover, under the FV option, the interest income

Any transaction cost is part of the cost of financial is based on the nominal interest rate rather than using

asset measured at amortized cost the effective rate. There is no discount/premium

Under the effective interest method, the interest amortization.

income is computed by multiplying the carrying

amount by the effective rate

The nominal/stated rate is used in computing accrued TOPIC 31: INVESTMENT PROPERTY

interest or interest receivable

Only land and building can qualify

TOPIC 29: MARKET PRICE OF BONDS If the investment property is accounted for under the

fair value model, no depreciation is recognized.

In computing the market price of term bonds; get the If accounted for under the cost model, depreciation is

present value of the nominal interest payments using to be computed.

the yield/effective rate and the PV of the principal Property held by a subsidiary in the ordinary course

using also the yield-effective rate and add the two of business is included in the subsidiary’s inventory

PVs to get the market price. A land leased by the parent company to its subsidiary

If there is discount, ER>NR under an operating lease is an owner’s occupied

If there is premium, ER<NR property for purposes of consolidated financial

Serial bonds are those that mature in installments statements.

Formula to get the PV of a serial bond: However, from the perspective of the separate

(Installment payment + Nominal interest payment) financial statements of the parent such asset is an

(Present value of 1) investment property

Movable property like machinery cannot qualify for

TOPIC 30: BOND INVESTMENT- investment property

FVOCI/FAIR VALUE OPTION TOPIC 32: FUND AND OTHER

If the business model is to collect contractual cash INVESTMENTS

flows (primarily for principal and interest) and to sell Any income earned on the sinking fund investments

the financial asset, it is recorded at the FV through should form part of the sinking fund balance

OCI The annual deposits to the fund and the interest

In this case, interest income is recognized using the earned on those deposits should form part of the non-

effective interest method as in amortized cost current sinking fund

measurement The future value factor of an annuity due is used if

On derecognition, the cumulative gain/loss in other the annual deposits are made at the beginning of each

comprehensive income shall be reclassified to profit year

or loss Annual deposit to a fund is computed by dividing the

The increase in unrealized gain is reported in the amount of the fund by the future value factor

statement of comprehensive income but the Increase in the cash surrender value decreases life

cumulative unrealized gain is reported in the insurance expense

statement of changes in owner’s equity Gain on Life Insurance Settlement:

PFRS 9 provides that an entity at initial recognition Proceeds

may irrevocably designate a financial asset as Less: Cash Surrender Value

measured at FVTPL even if the said FA satisfies the Unexpired Life Insurance

amortized cost measurement

You might also like

- Synthesis FAR2ndDayDocument5 pagesSynthesis FAR2ndDayJane DizonNo ratings yet

- What Are The Characteristics of A Bond Investment? AnswerDocument4 pagesWhat Are The Characteristics of A Bond Investment? AnswerAllysa Jane FajilagmagoNo ratings yet

- H.09 Accounting For InvestmentsDocument14 pagesH.09 Accounting For Investmentschen.abellar.swuNo ratings yet

- Investment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Document11 pagesInvestment Strategy Analysis Level 3 - Ifrs 9,10,3,11 & Ias 28Richie BoomaNo ratings yet

- Definition .: The Philippine Securities and Exchange Commission deDocument15 pagesDefinition .: The Philippine Securities and Exchange Commission demiya girlNo ratings yet

- Chapter 9Document18 pagesChapter 9Rubén ZúñigaNo ratings yet

- PFRS 9 Financial Instruments GuideDocument11 pagesPFRS 9 Financial Instruments Guidejsus22100% (1)

- Investment NotesDocument12 pagesInvestment NotesLenrey CobachaNo ratings yet

- LessorDocument5 pagesLessorHridya sNo ratings yet

- Consolidation Subsequent To Acquisition Date: AFM491 Advanced Financial AccountingDocument46 pagesConsolidation Subsequent To Acquisition Date: AFM491 Advanced Financial AccountingIzzy BNo ratings yet

- Chapter 8 Leases Pt2Document4 pagesChapter 8 Leases Pt2EUNICE NATASHA CABARABAN LIMNo ratings yet

- Accounting for associates and financial instrumentsDocument29 pagesAccounting for associates and financial instrumentsHiền MỹNo ratings yet

- CH 5 Cost of Capital Theory (510139)Document10 pagesCH 5 Cost of Capital Theory (510139)Syeda AtikNo ratings yet

- SMEs - ASSETS measurement and accountingDocument21 pagesSMEs - ASSETS measurement and accountingToni Rose Hernandez LualhatiNo ratings yet

- Investment in Equity Securities 2Document26 pagesInvestment in Equity Securities 2Mhelka Tiodianco0% (1)

- CH11Document56 pagesCH11Daniel BermanNo ratings yet

- Week 04 Risk ManagementDocument16 pagesWeek 04 Risk ManagementChristian Emmanuel DenteNo ratings yet

- Unit-6 Investment AccountingDocument37 pagesUnit-6 Investment Accountingkawanalavesh4No ratings yet

- Final Group 2Document17 pagesFinal Group 2Asnia Fuentabella ImamNo ratings yet

- Particulars As Required by The Standards As Presented by The Company Assessment Recognition PrinciplesDocument7 pagesParticulars As Required by The Standards As Presented by The Company Assessment Recognition Principleskiema katsutoNo ratings yet

- Chapter 4 Investments in Equity SecuritiesDocument25 pagesChapter 4 Investments in Equity SecuritiesCarylle silveoNo ratings yet

- Ia FinalsDocument10 pagesIa FinalsdesblahNo ratings yet

- Chapter 19 - Financial Asset at Amortized Cost Bond InvestmentDocument8 pagesChapter 19 - Financial Asset at Amortized Cost Bond InvestmentmercyvienhoNo ratings yet

- Module 8 - Bonds PayableDocument6 pagesModule 8 - Bonds PayableLui100% (2)

- Gross Income: Definition Means All Gains, Profits, and IncomeDocument19 pagesGross Income: Definition Means All Gains, Profits, and IncomeKathNo ratings yet

- Module 2 Investment Property and FundsDocument6 pagesModule 2 Investment Property and FundsCharice Anne VillamarinNo ratings yet

- MATERIALDocument8 pagesMATERIALVatsal ParmarNo ratings yet

- Investment in Equity Securities 2Document6 pagesInvestment in Equity Securities 2RomeNo ratings yet

- Effective Interest MethodDocument1 pageEffective Interest MethodWinter SnowNo ratings yet

- Investment in Debt SecuritiesDocument7 pagesInvestment in Debt SecuritiesRoma Suliguin0% (1)

- Borrowing Cost - Investment in AssociatesDocument16 pagesBorrowing Cost - Investment in AssociatesJomerNo ratings yet

- Acc2 ReviewerDocument4 pagesAcc2 ReviewerJian AlberioNo ratings yet

- 06 Equity InvestmentsDocument8 pages06 Equity InvestmentsAllegria AlamoNo ratings yet

- Accounting For InvestmentsDocument17 pagesAccounting For InvestmentsPradeep Gupta100% (1)

- Financial Management Unit 2Document10 pagesFinancial Management Unit 2Janardhan VNo ratings yet

- Financial Assets Classification GuideDocument8 pagesFinancial Assets Classification GuideKing BelicarioNo ratings yet

- Investment AccountsDocument10 pagesInvestment AccountsMani kandan.GNo ratings yet

- Invest in Debt Securities GuideDocument31 pagesInvest in Debt Securities GuideJohn Francis Idanan100% (1)

- M3 Accele 4Document15 pagesM3 Accele 4Julie Marie Anne LUBINo ratings yet

- Horngren Ima15 Im 17Document19 pagesHorngren Ima15 Im 17Ahmed AlhawyNo ratings yet

- Audit of Stockholder’s Equity, Share Based Payment & Book ValueDocument6 pagesAudit of Stockholder’s Equity, Share Based Payment & Book ValueJessalyn DaneNo ratings yet

- Financial Assets at Amortized CostDocument8 pagesFinancial Assets at Amortized CostbluemajaNo ratings yet

- Philippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Document13 pagesPhilippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Thalia UyNo ratings yet

- RewiewerDocument34 pagesRewiewerMickaella VergaraNo ratings yet

- PAS 40Investment Property(1)Document3 pagesPAS 40Investment Property(1)Joshua Kadatar Chinalpan IINo ratings yet

- Chap 002Document52 pagesChap 002Kiky Agustyan TanoewidjajaNo ratings yet

- Financial Statement Accounting PoliciesDocument9 pagesFinancial Statement Accounting PoliciesMy NameNo ratings yet

- FM 1 - CH 5 NoteDocument12 pagesFM 1 - CH 5 NoteEtsub SamuelNo ratings yet

- Property, Plant & EquipmentDocument19 pagesProperty, Plant & EquipmentErika Mae LegaspiNo ratings yet

- EFU Accounting PoliciesDocument9 pagesEFU Accounting PoliciesJaved AkramNo ratings yet

- Summary (NEW Lease)Document3 pagesSummary (NEW Lease)Anonymous AGI7npNo ratings yet

- Lesson 13Document9 pagesLesson 13Jamaica bunielNo ratings yet

- Investment in Equity SecuritiesDocument4 pagesInvestment in Equity SecuritiesElaineJrV-IgotNo ratings yet

- Module 4 - Financial Instruments (Assets)Document9 pagesModule 4 - Financial Instruments (Assets)Luisito CorreaNo ratings yet

- Lecture Notes - Investment in AssociatesDocument2 pagesLecture Notes - Investment in Associatesariannealcaraz6No ratings yet

- Classroom Notes 6390 and 6391Document2 pagesClassroom Notes 6390 and 6391Mary Grace Galleon-Yang OmacNo ratings yet

- Module 5Document7 pagesModule 5lilian.doan98No ratings yet

- Investment in Debt SecuritiesDocument29 pagesInvestment in Debt SecuritiesDjunah ArellanoNo ratings yet

- MF Module 1Document75 pagesMF Module 1Gouri K MakatiNo ratings yet

- CHAPTER 7 Joint Product and By-Product CostingDocument21 pagesCHAPTER 7 Joint Product and By-Product CostingMudassar Hassan100% (1)

- CHAPTER 7 Joint Product and By-Product CostingDocument21 pagesCHAPTER 7 Joint Product and By-Product CostingMudassar Hassan100% (1)

- Audit Planning, Client Understanding, Risk AssessmentDocument44 pagesAudit Planning, Client Understanding, Risk Assessmentjamie_xiNo ratings yet

- Chapter 4 PDFDocument45 pagesChapter 4 PDFemman neriNo ratings yet

- Partnership Liquidation CalculationDocument2 pagesPartnership Liquidation CalculationRonnelson PascualNo ratings yet

- Barangay Accounting System Manual: For Use by City/ Municipal AccountantsDocument104 pagesBarangay Accounting System Manual: For Use by City/ Municipal Accountantsemman neriNo ratings yet

- PPE Accounting Guide: Depreciation, Revaluation, and DerecognitionDocument21 pagesPPE Accounting Guide: Depreciation, Revaluation, and Derecognitionemman neriNo ratings yet

- Corporate Governance Outline 2Document36 pagesCorporate Governance Outline 2emman neriNo ratings yet

- Mock Qualifying Exam List of Takers and Room Assignment With SeatplanDocument4 pagesMock Qualifying Exam List of Takers and Room Assignment With Seatplanemman neriNo ratings yet

- CHAPTER 15 PPE (PART 1) - Reviewer - For Distribution PDFDocument20 pagesCHAPTER 15 PPE (PART 1) - Reviewer - For Distribution PDFemman neriNo ratings yet

- ManAcc RF - NF DataDocument5 pagesManAcc RF - NF Dataemman neriNo ratings yet

- M03 Toda3929 12E IM C03Document10 pagesM03 Toda3929 12E IM C03emman neriNo ratings yet

- BA23 Chapter 5 PDFDocument25 pagesBA23 Chapter 5 PDFemman neriNo ratings yet

- Calculate Capitalizable Borrowing CostsDocument13 pagesCalculate Capitalizable Borrowing Costsemman neriNo ratings yet

- Accounts Receivable and Payable Journal EntriesDocument9 pagesAccounts Receivable and Payable Journal Entriesemman neriNo ratings yet

- CPA firm considerations accepting new clientsDocument19 pagesCPA firm considerations accepting new clientsNathalie PadillaNo ratings yet

- BA23 Chapter 6 PDFDocument35 pagesBA23 Chapter 6 PDFemman neriNo ratings yet

- BA23 Chapter 7 PDFDocument26 pagesBA23 Chapter 7 PDFemman neriNo ratings yet

- Chapter 9: Agricultural Transformation and Rural DevelopmentDocument12 pagesChapter 9: Agricultural Transformation and Rural Developmentemman neri100% (1)

- Chapter 9: Agricultural Transformation and Rural DevelopmentDocument12 pagesChapter 9: Agricultural Transformation and Rural Developmentemman neri100% (1)

- MidTerm Exam, Partnership Formation, Operation and DissolutionDocument3 pagesMidTerm Exam, Partnership Formation, Operation and DissolutionIñego Begdorf100% (5)

- Xu Jpia Accomplishment Report For S.Y. 2019 - 2020Document1 pageXu Jpia Accomplishment Report For S.Y. 2019 - 2020emman neriNo ratings yet

- SixDocument25 pagesSixWhite Knight100% (1)

- M11 Toda3929 12E IM C11Document9 pagesM11 Toda3929 12E IM C11emman neriNo ratings yet

- In Partial Fulfillment of The Requirements in AEC 106 Partnership and CorporationDocument9 pagesIn Partial Fulfillment of The Requirements in AEC 106 Partnership and Corporationemman neriNo ratings yet

- Xu Jpia Accomplishment Report For S.Y. 2019 - 2020Document1 pageXu Jpia Accomplishment Report For S.Y. 2019 - 2020emman neriNo ratings yet

- Chapter 9-Cost Accounting For Service Businesses: Multiple ChoiceDocument23 pagesChapter 9-Cost Accounting For Service Businesses: Multiple Choiceemman neriNo ratings yet

- Accounting for Factory Overhead CostsDocument33 pagesAccounting for Factory Overhead Costsemman neri100% (1)

- Jpia Payment Sheet 2019Document38 pagesJpia Payment Sheet 2019emman neriNo ratings yet

- Methodology and Analytical Framework: G20 Anti-Corruption Open Data Principles AssessmentDocument18 pagesMethodology and Analytical Framework: G20 Anti-Corruption Open Data Principles Assessmentemman neriNo ratings yet

- Complete The Questions With The Correct Question Words From The List BesideDocument2 pagesComplete The Questions With The Correct Question Words From The List BesideЮлия БратчикNo ratings yet

- Case AnalysisDocument4 pagesCase AnalysisAirel Eve CanoyNo ratings yet

- Report For Court, Sale of Dowling College Brookhaven CampusDocument26 pagesReport For Court, Sale of Dowling College Brookhaven CampusRiverheadLOCALNo ratings yet

- Igbe Religion's 21st Century Syncretic Response to ChristianityDocument30 pagesIgbe Religion's 21st Century Syncretic Response to ChristianityFortune AFATAKPANo ratings yet

- 7 Tips For A Tidy Desk - ExercisesDocument4 pages7 Tips For A Tidy Desk - Exercisesjosh acNo ratings yet

- Finaflex Main Catalog 2022Document50 pagesFinaflex Main Catalog 2022Benlee Calderón LimaNo ratings yet

- Calculating parameters for a basic modern transistor amplifierDocument189 pagesCalculating parameters for a basic modern transistor amplifierionioni2000No ratings yet

- Azure Blockchain Workbench guideDocument183 pagesAzure Blockchain Workbench guideAhmed AyadNo ratings yet

- CatalogueDocument36 pagesCataloguehgwlin100% (1)

- FABM 1 Module by L. DimataloDocument109 pagesFABM 1 Module by L. Dimataloseraphinegod267No ratings yet

- Lirik LaguDocument34 pagesLirik LaguAdjie SatryoNo ratings yet

- The Irish Light 10Document28 pagesThe Irish Light 10Twinomugisha Ndinyenka RobertNo ratings yet

- American RegimeDocument13 pagesAmerican RegimeMR P PinnyNo ratings yet

- Aqa Textiles Gcse Coursework Grade BoundariesDocument4 pagesAqa Textiles Gcse Coursework Grade Boundariesrqaeibifg100% (2)

- 21st Century Theories of EducationDocument53 pages21st Century Theories of Educationdaffodil198100% (1)

- Wind LoadsDocument5 pagesWind LoadsMGNo ratings yet

- Members From The Vietnam Food AssociationDocument19 pagesMembers From The Vietnam Food AssociationMaiquynh DoNo ratings yet

- 1562229628974192Document33 pages1562229628974192Phuong NgocNo ratings yet

- q2 Wk1 Worksheet1 Music8Document10 pagesq2 Wk1 Worksheet1 Music8Michie Maniego - GumanganNo ratings yet

- Cagayan Electric vs. CIRDocument4 pagesCagayan Electric vs. CIRGladys BantilanNo ratings yet

- Chem 6AL Syllabus Winter 2021Document5 pagesChem 6AL Syllabus Winter 2021John SmithNo ratings yet

- 2018 Nissan Qashqai 111809Document512 pages2018 Nissan Qashqai 111809hectorNo ratings yet

- Decision Criteria For Ethical ReasoningDocument14 pagesDecision Criteria For Ethical ReasoningZara ImranNo ratings yet

- Human Rights DefinitionDocument2 pagesHuman Rights DefinitionFathiah MhNo ratings yet

- Group Arrival ProceduresDocument3 pagesGroup Arrival Proceduresashlesha thopteNo ratings yet

- Bankruptcy Judge Imposes Sanctions On CounselDocument17 pagesBankruptcy Judge Imposes Sanctions On Counsel83jjmackNo ratings yet

- Maceda Vs Energy Reg BoardDocument4 pagesMaceda Vs Energy Reg BoardJay Mark Esconde100% (1)

- Can or Can't Esl Worksheet With Animals Vocabulary For Kids PDFDocument2 pagesCan or Can't Esl Worksheet With Animals Vocabulary For Kids PDFופאאכאלד50% (4)

- Chapter 2 - DynamicsDocument8 pagesChapter 2 - DynamicsTHIÊN LÊ TRẦN THUẬNNo ratings yet

- The Complete Motown CatalogueDocument10 pagesThe Complete Motown Cataloguehermeto0% (1)