Professional Documents

Culture Documents

Effective Interest Method

Uploaded by

Winter Snow0 ratings0% found this document useful (0 votes)

3 views1 pageThe document discusses methods for calculating interest on bonds using effective interest rates. It explains that the effective interest method compares interest earned to interest received to determine if there is premium amortization or discount amortization. The effective interest rate is applied to the carrying amount to calculate interest earned, while the nominal rate is applied to the face amount to calculate interest received. The effective rate will be lower than the nominal rate for bonds with premiums, and higher than the nominal rate for bonds with discounts. Bonds can be classified as FVOCI if the business model includes both collecting cash flows and selling assets, with gains/losses in OCI reclassified to profit/loss on disposal. Under the fair value option, all changes in

Original Description:

Original Title

EFFECTIVE INTEREST METHOD

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses methods for calculating interest on bonds using effective interest rates. It explains that the effective interest method compares interest earned to interest received to determine if there is premium amortization or discount amortization. The effective interest rate is applied to the carrying amount to calculate interest earned, while the nominal rate is applied to the face amount to calculate interest received. The effective rate will be lower than the nominal rate for bonds with premiums, and higher than the nominal rate for bonds with discounts. Bonds can be classified as FVOCI if the business model includes both collecting cash flows and selling assets, with gains/losses in OCI reclassified to profit/loss on disposal. Under the fair value option, all changes in

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageEffective Interest Method

Uploaded by

Winter SnowThe document discusses methods for calculating interest on bonds using effective interest rates. It explains that the effective interest method compares interest earned to interest received to determine if there is premium amortization or discount amortization. The effective interest rate is applied to the carrying amount to calculate interest earned, while the nominal rate is applied to the face amount to calculate interest received. The effective rate will be lower than the nominal rate for bonds with premiums, and higher than the nominal rate for bonds with discounts. Bonds can be classified as FVOCI if the business model includes both collecting cash flows and selling assets, with gains/losses in OCI reclassified to profit/loss on disposal. Under the fair value option, all changes in

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

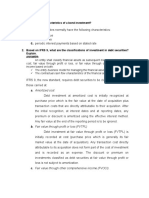

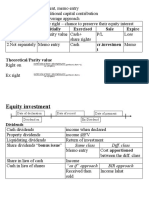

EFFECTIVE INTEREST METHOD: Amortized Cost, FVOCI & FVPL

Two kinds of interest rate:

1. Nominal Rate – coupon rate/stated rate

2. Effective rate – yield rate/market rate which is the actual or true rate of interest

EFFECTIVE INTEREST METHOD

- Simply requires the comparison between interest earned/interest income & interest

received

IE/II IR = Premium amort. or Discount amort.

IE/II = effective rate x carrying amount

IR = nominal rate x face amount

Effective rate vs Nominal Rate

Cost = Face Value ER=NR

Because premium is a loss on the part of the

Bond Premium ER<NR

bondholder

Because discount is a gain on the part of the

Bond Discount ER>NR bondholder

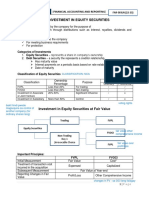

Bond Investment FVOCI

- when the business model includes selling the financial asset in addition to collecting

contractual cash flows.

NOTE: Discount amortization must still be in accordance with the effective interest table of

amortization regardless of the change in market value.

NOTE: The cumulative gain or loss previously recognized in OCI is reclassified to profit or loss on

disposal of the investment

Fair value option

- Investment in bonds can be designated without revocation as measured at fair value

through profit or loss even if the bonds are held for collection as a business model

- All changes in fair value are recognized in profit or loss. Accordingly, any transaction cost

incurred is an outright expense.

- The interest income is based on the nominal interest rate rather than effective interest

rate.

You might also like

- Chapter 19 - Financial Asset at Amortized Cost Bond InvestmentDocument8 pagesChapter 19 - Financial Asset at Amortized Cost Bond InvestmentmercyvienhoNo ratings yet

- Investment in Debt SecuritiesDocument31 pagesInvestment in Debt SecuritiesJohn Francis Idanan100% (1)

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Chapter 6-Income ApproachDocument37 pagesChapter 6-Income ApproachHosnii QamarNo ratings yet

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- 1 IFRS 9 - Financial InstrumentsDocument31 pages1 IFRS 9 - Financial InstrumentsSharmaineMirandaNo ratings yet

- Corporate Finance ProjectDocument13 pagesCorporate Finance ProjectAbhay Narayan SinghNo ratings yet

- Return On Investment: Assignment-2Document7 pagesReturn On Investment: Assignment-2Vineet AgrawalNo ratings yet

- Chapter 9Document18 pagesChapter 9Rubén ZúñigaNo ratings yet

- Quiz On Debt InvestmentDocument2 pagesQuiz On Debt InvestmentYa NaNo ratings yet

- Module 3Document79 pagesModule 3kakimog738No ratings yet

- Topic 28: Financial Asset at Amortized CostDocument1 pageTopic 28: Financial Asset at Amortized Costemman neriNo ratings yet

- Financial Assets at Amortized CostDocument8 pagesFinancial Assets at Amortized CostbluemajaNo ratings yet

- Dividend Policy: e As Cost of Equity in TheDocument43 pagesDividend Policy: e As Cost of Equity in TheVelayudham ThiyagarajanNo ratings yet

- What Are The Characteristics of A Bond Investment? AnswerDocument4 pagesWhat Are The Characteristics of A Bond Investment? AnswerAllysa Jane FajilagmagoNo ratings yet

- Exam NotesDocument7 pagesExam NotesAmit VadiNo ratings yet

- What Does The DFL of 3 Times Imply?Document7 pagesWhat Does The DFL of 3 Times Imply?Sushil ShresthaNo ratings yet

- ACC414 CH4 Reporting Financial PerformanceDocument5 pagesACC414 CH4 Reporting Financial PerformanceNapat InseeyongNo ratings yet

- 10th Week of Lectures: Financial Management - MGT201Document15 pages10th Week of Lectures: Financial Management - MGT201Syed Abdul Mussaver ShahNo ratings yet

- Dividend Policy: e As Cost of Equity in TheDocument43 pagesDividend Policy: e As Cost of Equity in TheBala RanganathNo ratings yet

- Chapter 17 - Financial Asset at Amortized CostDocument2 pagesChapter 17 - Financial Asset at Amortized Costlooter198100% (1)

- MF Module 1Document75 pagesMF Module 1Gouri K MakatiNo ratings yet

- FAR-Lecture 3Document9 pagesFAR-Lecture 3wingsenigma 00No ratings yet

- Analysis For The Investor: Chapter # 10Document17 pagesAnalysis For The Investor: Chapter # 10fahad BataviaNo ratings yet

- Analysis For The Investor: Chapter # 10Document17 pagesAnalysis For The Investor: Chapter # 10Fahad BataviaNo ratings yet

- Chap 5Document6 pagesChap 5Quyên NguyễnNo ratings yet

- Chapter I InvestmentDocument6 pagesChapter I InvestmentPratik NirmalNo ratings yet

- Topic 6 COMMON STOCKDocument34 pagesTopic 6 COMMON STOCKnurul shafifah bt ismailNo ratings yet

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Document8 pagesInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadNo ratings yet

- Operating, Financial & Combined LeverageDocument14 pagesOperating, Financial & Combined LeverageRajesh KumarNo ratings yet

- Income Statement Revenues - Expenses Net IncomeDocument4 pagesIncome Statement Revenues - Expenses Net IncomeTanishaq bindalNo ratings yet

- Bonds PayableDocument3 pagesBonds PayableRussel CorpuzNo ratings yet

- Finance Terminology - List of Financial Terms With ExamplesDocument7 pagesFinance Terminology - List of Financial Terms With Examplesdevendra_tomarNo ratings yet

- Chapter 5 Bonds and Stock ValuationDocument16 pagesChapter 5 Bonds and Stock ValuationEstores Ronie M.No ratings yet

- Why & How To InvestDocument6 pagesWhy & How To InvestDeepak JashnaniNo ratings yet

- Accounting Review YeahDocument13 pagesAccounting Review YeahHakim AshariNo ratings yet

- Pas 28Document3 pagesPas 28Jay JavierNo ratings yet

- CH 9 Lecture NotesDocument14 pagesCH 9 Lecture NotesraveenaatNo ratings yet

- Reporting Intercorporate InterestDocument10 pagesReporting Intercorporate InterestArchit AgrawalNo ratings yet

- Profitability AnalysisDocument12 pagesProfitability AnalysisJudyeast AstillaNo ratings yet

- Exam NotesDocument9 pagesExam NotesEven JayNo ratings yet

- Assessing Financial Viability of The Project: R I (R I)Document4 pagesAssessing Financial Viability of The Project: R I (R I)wolverineorigins02No ratings yet

- Finance-Basic Concepts: R Srinivasan FCA, FAFD, RV & RPDocument18 pagesFinance-Basic Concepts: R Srinivasan FCA, FAFD, RV & RPusne902No ratings yet

- Working NotesDocument9 pagesWorking NotesShekhar PanseNo ratings yet

- Ugc Net Mang Unit5Document74 pagesUgc Net Mang Unit5santosh kumarNo ratings yet

- ReportDocument105 pagesReportGanesh JounjalNo ratings yet

- Chapter 2 Income Statement With Review QuestionsDocument50 pagesChapter 2 Income Statement With Review QuestionsGunduz MirzaliyevNo ratings yet

- H.09 Accounting For InvestmentsDocument14 pagesH.09 Accounting For Investmentschen.abellar.swuNo ratings yet

- Debit and Credit: Capital Reserve Means The Part of Profit Reserved by The Company For A Particular Purpose Such As ToDocument6 pagesDebit and Credit: Capital Reserve Means The Part of Profit Reserved by The Company For A Particular Purpose Such As Tosahibakhurana12No ratings yet

- IA Unit 5Document7 pagesIA Unit 5Avila VarshiniNo ratings yet

- Reporting Intercorporate Interests: Douglas CloudDocument98 pagesReporting Intercorporate Interests: Douglas CloudRendra Arief Hidayat.No ratings yet

- Acctg3-7 Debt SecuritiesDocument2 pagesAcctg3-7 Debt Securitiesflammy07No ratings yet

- CHAPTER 5 Notes ReceivablesDocument2 pagesCHAPTER 5 Notes Receivableschoigyu031301No ratings yet

- UntitledDocument9 pagesUntitledAva WeltyNo ratings yet

- Chapter Four: The Cost of Capital 4.1. The Concept of Cost of CapitalDocument9 pagesChapter Four: The Cost of Capital 4.1. The Concept of Cost of Capitalmelat felekeNo ratings yet

- David Corporate AssignmentDocument13 pagesDavid Corporate Assignmentsamuel debebeNo ratings yet

- Financial Management:: Prepared byDocument19 pagesFinancial Management:: Prepared byHimanshu MehraNo ratings yet

- Ifrs 9Document2 pagesIfrs 9Dawar Hussain (WT)No ratings yet

- Topic 9Document19 pagesTopic 9sarahNo ratings yet