Professional Documents

Culture Documents

Letters of Credit

Uploaded by

may castanarCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Letters of Credit

Uploaded by

may castanarCopyright:

Available Formats

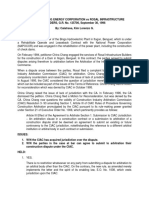

LETTERS OF CREDIT

A commercial, financial device that allows transaction to push through because it secures both concerns

of buyer and seller. Usually used in cross-border transactions.

BUYER/IMPORTER (PHILIPPINES) SELLER/EXPORTER (SINGAPORE)

Wants security of goods Wants security of payment

Q: Who issues the letter of credit?

The Issuing Bank issues the letter of credit upon application of the applicant/buyer/importer.

Q: Is the liability of an Issuing Bank in the form of a Guaranty?

No, because the liability of the Issuing Bank is direct and primary even if there’s no privity of contract

between the IB and the parties of the main contract.

Q. Is a Letter of Credit a contract por atrui?

No, it’s an independent contract providing for separate, independent obligations from the main

contract between the buyer and seller.

CORRESPONDENT BANKS

Notifying Bank Negotiating Bank Confirming Bank

LIABILITY

BEFORE NEGOTIATION

No liability with respect to the seller Assumes a direct

obligation to the

AFTER NEGOTIATION seller and its liability

Assumes no There’s liability because a contractual relationship will is a primary one as if

liability to Seller. then prevail between the negotiating bank and the seller. the corres-pondent

a) Upfront, pay the seller; or bank itself had

b) Ask first for reimbursement from IB, after which it issued the letter of

will pay seller. Upon delay by IB, NB has the obligation credit.

to timely pay seller.

OBLIGATION

To notify and/or

transmit to the Acts as if itself had

beneficiary the Buys or discounts a draft under the letter of credit issued the letter of

existence of the credit.

letter of credit

Feati Bank and Trust Company v. CA

The letter by Issuing Bank merely provided that the petitioner “forward the enclosed original credit to the

beneficiary.” Thus, it is indubitable that the petitioner is only a notifying bank and not a confirming bank

as ruled by the courts below. A notifying bank is not a privy to the contract of sale between the buyer and

the seller, its relationship is only with that of the issuing bank and not with the beneficiary to whom he

assumes no liability.

Q. What is a Bill of Lading?

The Contract of Carriage between the shipper (S) and the carrier (ship). It function also as a receipt by

the carrier of the goods. It is a tendered document submitted to the IB for the release of payment to

S. As a requirement, the consignee must be the buyer such that the only person who can retrieve the

cargo is the consignee (B).

KINDS OF LC

COMMERCIAL LC STAND-BY LC

Non-sale contract, serves as a guarantee that the

Associated with a contract of sale; serves as a

other party will perform its obligation under the

guarantee for the payment of money

contract

Triggered by fulfillment on the part of seller Triggered by non-fulfillment

PROCESS PROCESS

1. Main contract 1. Main contract

2. Application by B 2. Application by B

3. Issuance of LC by IB 3. Issuance of LC by IB

4. IB will give LC to S 4. IB will give LC to S

5. Shipping of goods by S 5. Shipping of goods by S

6. Redemption of payment and obtaining of 6. Redemption of payment and obtaining of

documents by IB documents by IB

7. Reimbursement to IB and obtaining of 7. Reimbursement to IB and obtaining of

documents by S documents by S

Transfield Philippines vs Luzon Hydro Electric Corp

Independence Principle

Provides that the obligation under the LC is independent from the obligation in the main contract.

GR: The independent nature of the letter of credit may be:

(a) independence in toto where the credit is independent from the justification aspect and is a

separate obligation from the underlying agreement like for instance a typical standby; or

(b) independence may be only as to the justification aspect like in a commercial letter of credit or

repayment standby, which is identical with the same obligations under the underlying agreement.

In both cases the payment may be enjoined if in the light of the purpose of the credit the payment

of the credit would constitute fraudulent abuse of the credit.

XPN. Fraud exception rule.*

1.

2.

3.

*Determined by the court upon filing of injunction.

* The fraud contemplated is Dolo Incidente, such as when the tendered document is defrauded or fake.

Q. What if there are defects in the goods?

Under the independence principle, regardless of any defect in the main contract, the IB will not look

at it as long as the presentment is valid and complete.

You might also like

- Letter of CreditDocument16 pagesLetter of CreditMeng GoblasNo ratings yet

- Letters of CreditDocument3 pagesLetters of CreditAndrea Ivy DyNo ratings yet

- Letter of CreditDocument2 pagesLetter of CreditRobNo ratings yet

- Standby Letter of CreditDocument1 pageStandby Letter of Creditheenasaluja89No ratings yet

- Letters of CreditDocument6 pagesLetters of CreditUlrich SantosNo ratings yet

- Negotiable Instruments LawDocument78 pagesNegotiable Instruments LawKatherine Mae AñonuevoNo ratings yet

- LOC ReviewerDocument12 pagesLOC ReviewerIvan LuzuriagaNo ratings yet

- In General: Purpose of Letters of CreditDocument5 pagesIn General: Purpose of Letters of CreditRod Ralph ZantuaNo ratings yet

- 1st Exam Credit Transactions Past Exam CompilationDocument8 pages1st Exam Credit Transactions Past Exam CompilationCassy VeranaNo ratings yet

- Bank GuaranteeDocument2 pagesBank GuaranteehhhhhhhuuuuuyyuyyyyyNo ratings yet

- Letters of CreditDocument11 pagesLetters of CreditCyr Evaristo Franco100% (1)

- Letter of CreditDocument9 pagesLetter of CreditceeshaaNo ratings yet

- Contract of AgencyDocument15 pagesContract of AgencyYannah HidalgoNo ratings yet

- Warehouse Receipts Law NotesDocument7 pagesWarehouse Receipts Law NotesRia De AndaNo ratings yet

- 6Document10 pages6ampfcNo ratings yet

- Feati Bank V CADocument4 pagesFeati Bank V CAGabe RuaroNo ratings yet

- Letters of CreditDocument12 pagesLetters of CreditMykee NavalNo ratings yet

- BPI Investment Corp V. CA (2002): Loan Contract Perfected Upon Release of FundsDocument12 pagesBPI Investment Corp V. CA (2002): Loan Contract Perfected Upon Release of FundsryuseiNo ratings yet

- Title Vi SalesDocument38 pagesTitle Vi SalesSHeena MaRie ErAsmoNo ratings yet

- Credit Transactions Case DoctrinesDocument14 pagesCredit Transactions Case DoctrinesKobe BullmastiffNo ratings yet

- Medida V CADocument2 pagesMedida V CAJaz SumalinogNo ratings yet

- NIL Bar QuestionsDocument3 pagesNIL Bar QuestionsbreeH20No ratings yet

- Mercantile Law EssentialsDocument7 pagesMercantile Law EssentialsAndrei Arkov100% (1)

- ReSA Regulatory Framework Banking LawsDocument8 pagesReSA Regulatory Framework Banking LawsAmphee ZyNo ratings yet

- Velasquez v. Solidbank CorporationDocument1 pageVelasquez v. Solidbank CorporationTeff Quibod67% (3)

- 36 - de Barreto V Villanueva - PeraltaDocument3 pages36 - de Barreto V Villanueva - PeraltaTrixie PeraltaNo ratings yet

- Type of DepositDocument12 pagesType of DepositgaganngulatiiNo ratings yet

- Commercial Letters of Credit - Used As ADocument1 pageCommercial Letters of Credit - Used As ATerence ValdehuezaNo ratings yet

- Bank of America v. CA (Mulingtapang)Document4 pagesBank of America v. CA (Mulingtapang)Jake PeraltaNo ratings yet

- de Barreto V VillanuevaDocument1 pagede Barreto V VillanuevaAyra CadigalNo ratings yet

- Deposits Part 1 Digest 2Document12 pagesDeposits Part 1 Digest 2kmanligoyNo ratings yet

- UP Law F2021: Yau Chu v. CADocument1 pageUP Law F2021: Yau Chu v. CAJuno GeronimoNo ratings yet

- Nonato v. IAC, 140 SCRA 255 (1985)Document2 pagesNonato v. IAC, 140 SCRA 255 (1985)Angela AquinoNo ratings yet

- De La Cavada V DiazDocument2 pagesDe La Cavada V DiazEmma GuancoNo ratings yet

- General Banking LawDocument21 pagesGeneral Banking LawCresteynNo ratings yet

- LC & Standby LCDocument8 pagesLC & Standby LCmanith_kim13No ratings yet

- Bank Guarantee TitleDocument2 pagesBank Guarantee TitleAdnan AminNo ratings yet

- Ust Law Pre-Week Notes 2019: Kinds of Bank Role LiabilityDocument83 pagesUst Law Pre-Week Notes 2019: Kinds of Bank Role LiabilityFarasha uzmaNo ratings yet

- UST Preweek MercDocument83 pagesUST Preweek MercMela Bela100% (2)

- Jurists Lecture (Special Commercial Laws)Document27 pagesJurists Lecture (Special Commercial Laws)Lee Anne YabutNo ratings yet

- Ust Mercantile Pre-Week Bar PDFDocument59 pagesUst Mercantile Pre-Week Bar PDFAnonymous Mickey MouseNo ratings yet

- Mercantile Law Bar QDocument106 pagesMercantile Law Bar QMark Joseph DelimaNo ratings yet

- Essential guide to Letters of Credit and Trust Receipts LawDocument10 pagesEssential guide to Letters of Credit and Trust Receipts Lawraing3198No ratings yet

- Pre Week 2017 Banking SPCLDocument10 pagesPre Week 2017 Banking SPCLZacky AzarragaNo ratings yet

- Rights and Obligations of PartiesDocument11 pagesRights and Obligations of PartiesJasOn EvangelistaNo ratings yet

- Pi Sigma/ Pi Sigma Delta 18Document4 pagesPi Sigma/ Pi Sigma Delta 18Eduard Loberez ReyesNo ratings yet

- Independent Guarantees ExplainedDocument37 pagesIndependent Guarantees ExplainedChristine Fong100% (2)

- Letter of Credit Q&A GuideDocument7 pagesLetter of Credit Q&A GuideIra Francia Alcazar100% (1)

- 4special LawsDocument21 pages4special LawsPablo EschovalNo ratings yet

- Letters of Credit BasicsDocument11 pagesLetters of Credit BasicsEduard Angelo RodrigueraNo ratings yet

- Marx Notes - Special Commercial Laws (Divina) PDFDocument67 pagesMarx Notes - Special Commercial Laws (Divina) PDFjica GulaNo ratings yet

- LETTERS OF CREDIT EXPLAINEDDocument49 pagesLETTERS OF CREDIT EXPLAINEDJon Raymer OclaritNo ratings yet

- Letter of CreditDocument182 pagesLetter of CreditEva Mariela Ambrona Ruiz-CaleroNo ratings yet

- Article 4: Credit Vs ContractDocument7 pagesArticle 4: Credit Vs ContractSudhir Kochhar Fema AuthorNo ratings yet

- Last Part Credit..Document11 pagesLast Part Credit..Cheenee Nuestro SantiagoNo ratings yet

- Lecture Notes SpeccomDocument7 pagesLecture Notes Speccomjolly faith pariñasNo ratings yet

- What are Letters of CreditDocument8 pagesWhat are Letters of CreditAnonymous X5ud3UNo ratings yet

- Case DigestDocument4 pagesCase DigestGail FernandezNo ratings yet

- Letters of CreditDocument4 pagesLetters of CreditAdrian MiraflorNo ratings yet

- LETTERS OF CREDIT EXPLAINEDDocument3 pagesLETTERS OF CREDIT EXPLAINEDwewNo ratings yet

- Art. 177 - Gigantoni vs. People of The Phil.Document1 pageArt. 177 - Gigantoni vs. People of The Phil.Ethan KurbyNo ratings yet

- China Chang Jiang vs Rosal Infrastructure: CIAC jurisdiction over construction disputes under 37 charsDocument2 pagesChina Chang Jiang vs Rosal Infrastructure: CIAC jurisdiction over construction disputes under 37 charsKim Lorenzo Calatrava100% (1)

- Intro and History of FederalismDocument17 pagesIntro and History of FederalismEdwin C. MonaresNo ratings yet

- Do You Need A Counsel Even If You Are Not Under Custodial Investigation?Document7 pagesDo You Need A Counsel Even If You Are Not Under Custodial Investigation?Ja CinthNo ratings yet

- 10 Landmark Judgments On NI ActDocument22 pages10 Landmark Judgments On NI ActVikas Singh100% (2)

- Contractor AgreementDocument9 pagesContractor AgreementVenkat RajuNo ratings yet

- Incident Complaint Personal InjuryDocument3 pagesIncident Complaint Personal InjuryAlan Sackrin, Esq.100% (1)

- 15.loadstar Shipping VsDocument1 page15.loadstar Shipping VsMaggieNo ratings yet

- Hate Speech and Related Matters: DR Venkat IyerDocument14 pagesHate Speech and Related Matters: DR Venkat IyerNiren YadavNo ratings yet

- Political Liberty As Non Denomination - PettitDocument4 pagesPolitical Liberty As Non Denomination - PettitsickdiculousNo ratings yet

- JCT Minor Works Building ContractDocument43 pagesJCT Minor Works Building ContractTNo ratings yet

- Foundation of Moral Life ReflectionDocument1 pageFoundation of Moral Life ReflectionJovelyn TakilidNo ratings yet

- Chemphil Export V CADocument3 pagesChemphil Export V CASef KimNo ratings yet

- Judgments of Adminstrative LawDocument22 pagesJudgments of Adminstrative Lawpunit gaurNo ratings yet

- Public Liability Insurance Act 1991Document4 pagesPublic Liability Insurance Act 1991Anchit SinglaNo ratings yet

- Santos Evangelista V Alto Surety G.R. No. L-11139Document4 pagesSantos Evangelista V Alto Surety G.R. No. L-11139newin12No ratings yet

- Group Iii: Articles 102-111 Labor Code of The PhilippinesDocument18 pagesGroup Iii: Articles 102-111 Labor Code of The PhilippinesChristine Joy PamaNo ratings yet

- Virtue Ethics - A Contemporary Introduction (2019, Routledge)Document249 pagesVirtue Ethics - A Contemporary Introduction (2019, Routledge)bobob100% (3)

- Mamaril v. BSPDocument2 pagesMamaril v. BSPJonathan BravaNo ratings yet

- Kidnapping and Abduction: Indian Penal CodeDocument26 pagesKidnapping and Abduction: Indian Penal CodeRahul TambiNo ratings yet

- Assigned Case Digest on ADR Dispute ResolutionDocument2 pagesAssigned Case Digest on ADR Dispute ResolutionEdwin VillaNo ratings yet

- Regulation of Laundry Receipts in ManilaDocument5 pagesRegulation of Laundry Receipts in ManilashezeharadeyahoocomNo ratings yet

- General Principles of TaxationDocument53 pagesGeneral Principles of TaxationGelai RojasNo ratings yet

- 8 SLU-LHS Faculty and Staff vs. Dela CruzDocument20 pages8 SLU-LHS Faculty and Staff vs. Dela CruzNikki Tricia Reyes SantosNo ratings yet

- HanlonDocument3 pagesHanlonNic NalpenNo ratings yet

- Psiko HukumDocument32 pagesPsiko HukumRini PuspitasariNo ratings yet

- PDS CSCForm212 Revised2017Document4 pagesPDS CSCForm212 Revised2017Joseph100% (1)

- Rule 58Document7 pagesRule 58Dennis Aran Tupaz AbrilNo ratings yet

- A Short Defense of Allodial MonarchyDocument3 pagesA Short Defense of Allodial MonarchyScotty Bowden100% (1)

- People vs. DanielDocument28 pagesPeople vs. DanielFlo Payno33% (3)