0% found this document useful (0 votes)

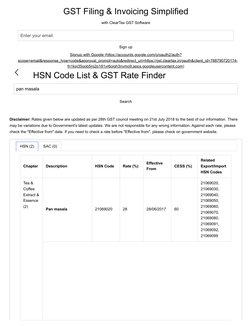

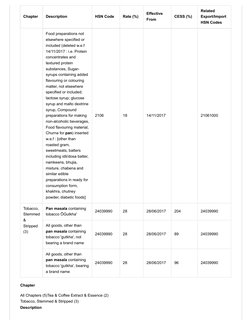

979 views5 pagesHSN Code and GST Rates for Pan Masala

The document provides information on GST rates and HSN codes for various goods including pan masala. It lists the HSN code (21069020), GST rate (28%), and cess (60%) for pan masala. The document also provides details on HSN codes and GST rates for food preparations and tobacco products including pan masala containing tobacco.

Uploaded by

Akhil KashyapCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

979 views5 pagesHSN Code and GST Rates for Pan Masala

The document provides information on GST rates and HSN codes for various goods including pan masala. It lists the HSN code (21069020), GST rate (28%), and cess (60%) for pan masala. The document also provides details on HSN codes and GST rates for food preparations and tobacco products including pan masala containing tobacco.

Uploaded by

Akhil KashyapCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd