Professional Documents

Culture Documents

Government Accounting

Uploaded by

Kenneth Christian WilburCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Accounting

Uploaded by

Kenneth Christian WilburCopyright:

Available Formats

INTANGIBLE ASSETS – GROUP 4

Objective: To apply the recognition and measurement criteria on intangible assets.

Time required:

Group work - 10 minutes

Presentation - 15 minutes

Total 25 minutes

Instructions:

1. Read the assigned case and discuss with your group.

2. Answer the questions at the end of each case.

3. Write the answers on a separate yellow paper with complete solutions and

explanations.

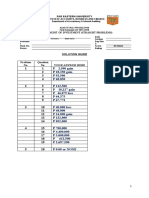

Case 1:

On February 1, 2015, Agency A purchased a new software package to operate its production

equipment for P600,000, including P50,000 non-refundable purchase taxes. Training costs to

train production staff in how to operate the new software were incurred amounting to P10,000.

In March 1 2015, the following costs were incurred to make further modifications necessary to

get the new software to function as intended by management.

a. Material – P21,000

b. Labor – P11,000

c. Depreciation of plant and equipment while it was used to perform the modifications – P5,000

The new software was ready for use on April 30, 2015.

1. Should Agency A recognize the software package as an intangible asset? Why or why not?

2. If the answer for number 1 is yes, what is the cost of the software at initial recognition?

Case 2:

On January 1, 2015, Agency A issued to Agency B license to use its software for a 10 year

period. The license was given free of charge without imposing specified future performance

conditions. At the date the right was acquired, its carrying amount and fair value were

P1,500,000 and P1,000,000, respectively.

1. At what cost should Agency B initially recognize the software license?

INTANGIBLE ASSETS – GROUP 4

Case 3:

On 1 April 2015, Agency C exchanged an aircraft with a carrying amount of P6,000,000 for a

copyright whose fair value cannot be reliably measured.

1. What is the cost of the copyright at initial recognition?

2. If on the date of acquisition, the fair value of the copyright was P4,000,000, at what cost

should the copyright be initially recognized?

Case 4:

On January 1, 2015, Agency A spent P8,575,000 developing a new computer software. Of this

amount, P3,575,000 was spent before technological feasibility was established for the software.

The software is expected to increase total cost savings by P16,000,000 and to operate with an

estimated useful life of 10 years. On December 31, 2015, Agency A successfully completed the

software.

Requirements:

a. Prepare journal entries for the foregoing facts.

b. Prepare the entry to record amortization at December 31, 2015.

c. At what amount should the computer software be reported in the December 31, 2015

Statement of Financial Position?

d. What information should be disclosed in the notes to Financial Statements?

You might also like

- Better Feedback for Better Teaching: A Practical Guide to Improving Classroom ObservationsFrom EverandBetter Feedback for Better Teaching: A Practical Guide to Improving Classroom ObservationsNo ratings yet

- Quiz 8 - Audit of Inventory (Straight Prob - KEY)Document8 pagesQuiz 8 - Audit of Inventory (Straight Prob - KEY)Kenneth Christian Wilbur100% (1)

- Quiz 8 - Audit of Inventory (Straight Prob - KEY)Document8 pagesQuiz 8 - Audit of Inventory (Straight Prob - KEY)Kenneth Christian Wilbur100% (1)

- Astm d1194Document3 pagesAstm d1194Pablo MenendezNo ratings yet

- Competency Assessment 3Document11 pagesCompetency Assessment 3NicoleVenturaTadejaNo ratings yet

- As 2124 2125 2127-1986 (Reference Use Only) General Conditions of ContractDocument8 pagesAs 2124 2125 2127-1986 (Reference Use Only) General Conditions of ContractSAI Global - APACNo ratings yet

- 100 Case Study In Project Management and Right Decision (Project Management Professional Exam)From Everand100 Case Study In Project Management and Right Decision (Project Management Professional Exam)Rating: 4 out of 5 stars4/5 (3)

- University of San Jose-Recoletos: Intangible Assets - Research and Development Department Quiz 5 (Type Text)Document5 pagesUniversity of San Jose-Recoletos: Intangible Assets - Research and Development Department Quiz 5 (Type Text)hyunsuk fhebieNo ratings yet

- Unit II - Audit of Intangibles and Other Assets - Final - t31314Document9 pagesUnit II - Audit of Intangibles and Other Assets - Final - t31314Jake BundokNo ratings yet

- Code of Practice For Concrete Structures For The Storage of Líquids NZS 3106-1986Document79 pagesCode of Practice For Concrete Structures For The Storage of Líquids NZS 3106-1986Josué Azurín RendichNo ratings yet

- Auditing Problems: Problem 1Document4 pagesAuditing Problems: Problem 1Krizelle Jo MarquezNo ratings yet

- Raudah Al-Qayyumiah by Muhammad Ihsan Mujaddidi, Volume 2 (Urdu)Document491 pagesRaudah Al-Qayyumiah by Muhammad Ihsan Mujaddidi, Volume 2 (Urdu)Talib GhaffariNo ratings yet

- Core 5 - Clean Public AreasDocument48 pagesCore 5 - Clean Public AreasArnel Himzon50% (2)

- Lesson 1 Use of Tools and EquipmentDocument7 pagesLesson 1 Use of Tools and EquipmentGrace PilapilNo ratings yet

- Quiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Document6 pagesQuiz 11 - Audit of Investment (STRAIGHT PROB - KEY)Kenneth Christian WilburNo ratings yet

- Grammar B2+ - 4 Participle ClausesDocument9 pagesGrammar B2+ - 4 Participle ClausesТатьяна РадионоваNo ratings yet

- Reviewer - Intangible AssetsDocument7 pagesReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- Quiz - Intangible Assets With QuestionsDocument3 pagesQuiz - Intangible Assets With Questionsjanus lopezNo ratings yet

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- Chapter 8 Intangible AssetsDocument12 pagesChapter 8 Intangible AssetsKrissa Mae Longos100% (3)

- Chapter-4 Homework ReceivablesDocument3 pagesChapter-4 Homework ReceivablesKenneth Christian WilburNo ratings yet

- Dungeon Magazine 173Document116 pagesDungeon Magazine 173John CrossNo ratings yet

- Quiz 12 - Subs Test - Audit of Investment (Q)Document3 pagesQuiz 12 - Subs Test - Audit of Investment (Q)Kenneth Christian WilburNo ratings yet

- Property, Plant and EquipmentDocument6 pagesProperty, Plant and Equipmentela kikay40% (5)

- Q4 - Audit of Receivables (Prob - KEY)Document5 pagesQ4 - Audit of Receivables (Prob - KEY)Kenneth Christian Wilbur100% (1)

- As 1926.3-2010 Swimming Pool Safety Water Recirculation SystemsDocument8 pagesAs 1926.3-2010 Swimming Pool Safety Water Recirculation SystemsSAI Global - APAC0% (3)

- Case DigestsDocument2 pagesCase DigestsKenneth Christian WilburNo ratings yet

- Grade 7 TleDocument4 pagesGrade 7 TleKRIZZEL CATAMIN50% (2)

- Accounting EquationDocument2 pagesAccounting Equationanalea aguirreNo ratings yet

- Project Management Casebook: Instructor's ManualFrom EverandProject Management Casebook: Instructor's ManualNo ratings yet

- Quiz 9 - Subs Test - Audit of Inventory (KEY)Document4 pagesQuiz 9 - Subs Test - Audit of Inventory (KEY)Kenneth Christian WilburNo ratings yet

- 24 Philip Morris Vs Fortune TobaccoDocument3 pages24 Philip Morris Vs Fortune TobaccoSilver Anthony Juarez PatocNo ratings yet

- Lesson 16 - Property, Plant and Equipment, Part 1Document9 pagesLesson 16 - Property, Plant and Equipment, Part 1Gwaaaiii TamanoNo ratings yet

- 7e's DLL - ACCOUNTING EQUATION For Observation1Document3 pages7e's DLL - ACCOUNTING EQUATION For Observation1Marilyn Nelmida Tamayo100% (1)

- Full Download Principles of Corporate Finance 10th Edition Brealey Solutions ManualDocument14 pagesFull Download Principles of Corporate Finance 10th Edition Brealey Solutions Manualdrockadeobaq95% (20)

- Audit of Ppe ModuleDocument19 pagesAudit of Ppe ModuleEunice Enriquez100% (4)

- Chapter-5 Homework InventoriesDocument4 pagesChapter-5 Homework InventoriesKenneth Christian Wilbur0% (1)

- (Problems) - Audit of Prepayments and Intangible AssetsDocument13 pages(Problems) - Audit of Prepayments and Intangible Assetsapatos0% (1)

- Daily RoutinesDocument6 pagesDaily RoutinesRandi KokoNo ratings yet

- IntangiblesDocument3 pagesIntangiblesJP DCNo ratings yet

- 09.27.2017 Intangible AssetsDocument7 pages09.27.2017 Intangible AssetsPatOcampo0% (2)

- Unit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516Document8 pagesUnit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516mimi96No ratings yet

- Quizzer - IaDocument2 pagesQuizzer - IajeffreeNo ratings yet

- Tasks IAS 38Document9 pagesTasks IAS 38Lolita IsakhanyanNo ratings yet

- Finacc4 Assignment 4 Intangible Assets Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each Problem. Problem 1Document4 pagesFinacc4 Assignment 4 Intangible Assets Submit All Your Answers in An Excel File. Use One Worksheet (Not File) For Each Problem. Problem 1Hazel Rose CabezasNo ratings yet

- AP Problems 2015Document20 pagesAP Problems 2015Rodette Adajar Pajanonot100% (1)

- Non Current Assets 2019ADocument4 pagesNon Current Assets 2019AKezy Mae GabatNo ratings yet

- Acc313 314 Audit of Intangibles For PostingDocument4 pagesAcc313 314 Audit of Intangibles For PostingJonalyn May De VeraNo ratings yet

- Answer: 85,000Document4 pagesAnswer: 85,000Cheveem Grace EmnaceNo ratings yet

- Mukaeb Motors Level 4 Practical Coc ExamDocument8 pagesMukaeb Motors Level 4 Practical Coc ExamMulugeta AbebeNo ratings yet

- Research and Development CostDocument17 pagesResearch and Development CostKaye Choraine NadumaNo ratings yet

- Exercises - Intangible Assets (Eng) - StudentsDocument6 pagesExercises - Intangible Assets (Eng) - StudentsMAI PHAN THỊ HIỀNNo ratings yet

- Intangible AssetsDocument4 pagesIntangible AssetsEuniceChungNo ratings yet

- Computer System Servicing (Grade 11) : I. ObjectivesDocument2 pagesComputer System Servicing (Grade 11) : I. ObjectivesRalfh Pescadero De GuzmanNo ratings yet

- Unit 15 PDFDocument7 pagesUnit 15 PDFsmu4mbaNo ratings yet

- CSS - TGDocument150 pagesCSS - TGJenniferBanogonNo ratings yet

- CHAPTER 12: Events After Reporting Period: Problem 1Document3 pagesCHAPTER 12: Events After Reporting Period: Problem 1Mark IlanoNo ratings yet

- AUD02 - 10 - Audit of Other Assests - Illustrative ProblemsDocument3 pagesAUD02 - 10 - Audit of Other Assests - Illustrative ProblemsRenelyn FiloteoNo ratings yet

- Unit 1. HandoutDocument3 pagesUnit 1. HandoutDaphneNo ratings yet

- Assignment 1 Front Sheet: Qualification BTEC Level 5 HND Diploma in Computing Unit Number and Title Submission DateDocument25 pagesAssignment 1 Front Sheet: Qualification BTEC Level 5 HND Diploma in Computing Unit Number and Title Submission DateLam Thai Duy (FGW DN)No ratings yet

- Ias 16 HW1Document3 pagesIas 16 HW1Raashida RiyasNo ratings yet

- Ppes Problem 5-3 Domingo Company Acquires A New: Dr. To Machinery and Equipment of P29,333,333Document7 pagesPpes Problem 5-3 Domingo Company Acquires A New: Dr. To Machinery and Equipment of P29,333,333Hell LuciNo ratings yet

- Investment Property and Other InvestmentsDocument4 pagesInvestment Property and Other InvestmentsMiguel MartinezNo ratings yet

- Competency Based Learning Material: Heating and Ventilating Air Conditioning (Hvac)Document53 pagesCompetency Based Learning Material: Heating and Ventilating Air Conditioning (Hvac)Renzo M. JognoNo ratings yet

- CF07 - Property Plant and Equipment Acquisition, Classification and DepreciationDocument9 pagesCF07 - Property Plant and Equipment Acquisition, Classification and DepreciationABMAYALADANO ,ErvinNo ratings yet

- Delina GDF AssignmentDocument12 pagesDelina GDF Assignmentnandhu prasadNo ratings yet

- 23 Accounintg AnswersDocument5 pages23 Accounintg Answerselsana philipNo ratings yet

- Pacrim Careers Provides Training To Individuals Who Pay Tuition DirectlyDocument1 pagePacrim Careers Provides Training To Individuals Who Pay Tuition DirectlyTaimour HassanNo ratings yet

- Ma PrelimDocument2 pagesMa PrelimLouisse Jeofferson TolentinoNo ratings yet

- Corpo Prob and AnsDocument16 pagesCorpo Prob and AnsILOVE MATURED FANSNo ratings yet

- Intermediate Accounting Exam 11Document2 pagesIntermediate Accounting Exam 11BLACKPINKLisaRoseJisooJennieNo ratings yet

- Cand's PackDocument9 pagesCand's PackDereje GerluNo ratings yet

- AP.3403 Audit of Intangible AssetsDocument3 pagesAP.3403 Audit of Intangible AssetsMonica GarciaNo ratings yet

- Audit of PPEDocument6 pagesAudit of PPEJuvy DimaanoNo ratings yet

- FinAcc 1 Quiz 6Document10 pagesFinAcc 1 Quiz 6Kimbol Calingayan100% (1)

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJennieNo ratings yet

- Coursework 6 - Intangible AssetsDocument3 pagesCoursework 6 - Intangible AssetsNezer VergaraNo ratings yet

- Assessment Pack: Open Learning for Sales ProfessionalsFrom EverandAssessment Pack: Open Learning for Sales ProfessionalsSally VinceNo ratings yet

- Joint Products-By ProductsDocument19 pagesJoint Products-By ProductsKenneth Christian WilburNo ratings yet

- Quiz 2 - Corp Liqui and Installment SalesDocument8 pagesQuiz 2 - Corp Liqui and Installment SalesKenneth Christian WilburNo ratings yet

- LABORATORIES - It Is Defined As A Place Equipped For Experimental Study in ADocument1 pageLABORATORIES - It Is Defined As A Place Equipped For Experimental Study in AKenneth Christian WilburNo ratings yet

- Aklan State Univeristy School of Management SchoolDocument4 pagesAklan State Univeristy School of Management SchoolKenneth Christian WilburNo ratings yet

- Chapter-2 Homework MisstatementsDocument4 pagesChapter-2 Homework MisstatementsKenneth Christian WilburNo ratings yet

- Controls TestDocument19 pagesControls TestKenneth Christian WilburNo ratings yet

- Chapter-3 Homework CashDocument5 pagesChapter-3 Homework CashKenneth Christian WilburNo ratings yet

- Theories: Far Eastern University - Manila Quiz No. 1Document6 pagesTheories: Far Eastern University - Manila Quiz No. 1Kenneth Christian WilburNo ratings yet

- Quiz 10 - Audit of Investment (BASIC PROB - KEY)Document5 pagesQuiz 10 - Audit of Investment (BASIC PROB - KEY)Kenneth Christian WilburNo ratings yet

- Q3 - Audit of Cash (S. Prob - KEY)Document7 pagesQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Q2 - Correction of Errors (S. Prob - KEY)Document7 pagesQ2 - Correction of Errors (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Q3 - Audit of Cash (S. Prob - KEY)Document7 pagesQ3 - Audit of Cash (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Q2 - Correction of Errors (S. Prob - KEY)Document7 pagesQ2 - Correction of Errors (S. Prob - KEY)Kenneth Christian WilburNo ratings yet

- Final Exam - TaxDocument2 pagesFinal Exam - TaxKenneth Christian WilburNo ratings yet

- FAR-04 Share Based PaymentsDocument3 pagesFAR-04 Share Based PaymentsKim Cristian Maaño0% (1)

- Chapter-1 Homework Basic Concepts Part 1Document4 pagesChapter-1 Homework Basic Concepts Part 1Kenneth Christian WilburNo ratings yet

- Partnership ActivityDocument6 pagesPartnership ActivityKenneth Christian WilburNo ratings yet

- The Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BDocument5 pagesThe Accounting Equation & The Accounting Cycle: Steps 1 - 4: Acct 1A&BKenneth Christian WilburNo ratings yet

- ePMP - Release Notes - System Release 4.7.0.1Document7 pagesePMP - Release Notes - System Release 4.7.0.1Md. Ibrahim KhalilNo ratings yet

- Exploded View PV032Document7 pagesExploded View PV032Miroslaw LabudaNo ratings yet

- Battle of MaritsaDocument3 pagesBattle of MaritsaromavincesNo ratings yet

- UntitledDocument7 pagesUntitledHưng Thịnh NguyễnNo ratings yet

- Q3 Math 4 Module 3Document21 pagesQ3 Math 4 Module 3Lendy Patrice Dela CernaNo ratings yet

- Frozen Application LicenseDocument2 pagesFrozen Application LicenseMáté KissNo ratings yet

- MatematicasDocument5 pagesMatematicasluciabNo ratings yet

- LicenseDocument2 pagesLicenseDZ07 DZ07No ratings yet

- BrandingDocument4 pagesBrandingJeffrel ThurstonNo ratings yet

- Metro-Goldwyn-Mayer v. American Honda Motor CoDocument12 pagesMetro-Goldwyn-Mayer v. American Honda Motor Conicole hinanayNo ratings yet

- Zing Zing Zingat Lovers Group 2016 Dhankawadi - YoutubeDocument2 pagesZing Zing Zingat Lovers Group 2016 Dhankawadi - Youtubedeepakbhanwala66No ratings yet

- HG-K Module 3 RTPDocument16 pagesHG-K Module 3 RTPEdlyn Kay50% (2)

- Nonmetallic Outlet Boxes, Device Boxes, Covers, and Box SupportsDocument6 pagesNonmetallic Outlet Boxes, Device Boxes, Covers, and Box SupportssultanalamoudiNo ratings yet

- QCN 802.1qau-2010Document135 pagesQCN 802.1qau-2010Pradeep ChalicheemalaNo ratings yet

- Zagreb in Your Pocket PDFDocument35 pagesZagreb in Your Pocket PDFibane74No ratings yet

- Linux Device Drivers, Third Edition: by Jonathan Corbet, Alessandro Rubini, and Greg Kroah-HartmanDocument1 pageLinux Device Drivers, Third Edition: by Jonathan Corbet, Alessandro Rubini, and Greg Kroah-HartmanthundernhutNo ratings yet

- Westlaw UK Delivery SummaryDocument6 pagesWestlaw UK Delivery SummaryJordan MillwardNo ratings yet

- Top 10 of The Best Free Stock Photos and Images Websites, 100% FREEDocument4 pagesTop 10 of The Best Free Stock Photos and Images Websites, 100% FREERNo ratings yet

- Interval Football Throwing ProgramDocument1 pageInterval Football Throwing Programdr_finch511No ratings yet

- LCD ScreenDocument21 pagesLCD ScreenFagner Fernandes AraujoNo ratings yet