Professional Documents

Culture Documents

BBG FATCA Personal 09 06 2017 PDF

BBG FATCA Personal 09 06 2017 PDF

Uploaded by

Grye RyeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BBG FATCA Personal 09 06 2017 PDF

BBG FATCA Personal 09 06 2017 PDF

Uploaded by

Grye RyeCopyright:

Available Formats

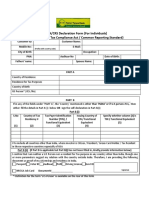

Foreign Account Tax Compliance Act (FATCA) Due Diligence Form

Personal

Please provide complete details and indicate NOT APPLICABLE to items/sections as deemed appropriate

Account Name Account Number

Questions Yes No

1. Are you an American Citizen?

2. Do you have dual citizenship? If YES Please indicate citizenships

a. b.

3. Are you a permanent resident of the U.S. / green card holder?

4. Were you born in the U.S.?

5. Do you have a residence address in the U.S.?

6. Do you have a phone number in the U.S.?

7. Do you have any instructions to transfer funds to an account in the U.S.?

8. Have you been to the U.S. in the last 3 years?

If any of the answers to questions stated above is YES, kindly specify required applicable information below:

A. Name

B. US Address

No. Street Subdivision/District/Town

City Country

C. US Telephone Number

D. US TIN or US SS Number

E. US P.O Box

F. Standing instructions to pay amount/transfer funds to an account maintained in the United States

G. Current Power of Attorney or signatory authority granted to a person with US address

H. An “in-care-of” address or “hold mail” US address

I. Length of stay in the US

Current Year No. of days Last Year No. of days Prior to Last Year No. of days Total Length of Stay

Certified true and correct

Signature over printed name by Account’s signatory/ies Date (mm-dd-yyyy)

For Bank's Use Only

Customer Information File Number Bank representative’s printed name over signature

Notes/Remarks (if any):

You might also like

- Motions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsFrom EverandMotions, Affidavits, Answers, and Commercial Liens - The Book of Effective Sample DocumentsRating: 4.5 out of 5 stars4.5/5 (14)

- Form W-8BEN Rev 920Document2 pagesForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- Jack Canfield S Key To Living The Law of Attraction - A Simple Guide To Creating The Life of Your Dreams PDFDocument3,592 pagesJack Canfield S Key To Living The Law of Attraction - A Simple Guide To Creating The Life of Your Dreams PDFRhys Palma0% (1)

- Certification Regarding Beneficial Owners of Legal Entity CustomersDocument4 pagesCertification Regarding Beneficial Owners of Legal Entity CustomersDon BetoNo ratings yet

- IRS 3949-A American Bankers AssociationDocument2 pagesIRS 3949-A American Bankers Associationrodclassteam100% (4)

- Power and Industrial Plant Engineering By:AlcorconDocument126 pagesPower and Industrial Plant Engineering By:AlcorconNelson Naval Cabingas77% (13)

- FATCA Due Diligence Form - PersonalDocument2 pagesFATCA Due Diligence Form - Personalreignchan640No ratings yet

- Fatca Crs Declaration Individuals PDFDocument2 pagesFatca Crs Declaration Individuals PDFfujstructuralNo ratings yet

- Myplan 2018 - EnglishDocument1 pageMyplan 2018 - EnglishkleansoulNo ratings yet

- HBL Additional Request Form (Conventional Banking)Document2 pagesHBL Additional Request Form (Conventional Banking)zakir soomroNo ratings yet

- Add Power of Attorney: 1. Account Holder InformationDocument3 pagesAdd Power of Attorney: 1. Account Holder InformationDavid BuchananNo ratings yet

- FLH060A Pag-IBIG Housing Loan Application - Co-Borrowers Folio052009 - FDocument2 pagesFLH060A Pag-IBIG Housing Loan Application - Co-Borrowers Folio052009 - FGenessa Sabejon RiveraNo ratings yet

- Pag-IBIG Housing Loan ApplicationDocument2 pagesPag-IBIG Housing Loan Applicationjcprado3No ratings yet

- Fillable W-8BEN 2023Document2 pagesFillable W-8BEN 2023marioNo ratings yet

- Certified Copies Identification FormDocument7 pagesCertified Copies Identification Formwinery.chen99No ratings yet

- Information Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960Document2 pagesInformation Referral: Form (2-2007) Department of The Treasury - Internal Revenue Service OMB # 1545-1960diversified1No ratings yet

- 4.fatca Self Declaraton Form Individuals PDFDocument2 pages4.fatca Self Declaraton Form Individuals PDFbala krishnanNo ratings yet

- DisputeDocument5 pagesDisputeCleveracciNo ratings yet

- Harry Thomas JR IRS Form 3949aDocument2 pagesHarry Thomas JR IRS Form 3949aWashington City Paper100% (1)

- Account Details Modification Deletion FormDocument2 pagesAccount Details Modification Deletion Formprabath_tooNo ratings yet

- Housing Loan Application (HLA, HQP-HLF-068, V03)Document2 pagesHousing Loan Application (HLA, HQP-HLF-068, V03)Chalseybriel Bate33% (3)

- TermSukuk App Form Individual E Mrs ANISHADocument2 pagesTermSukuk App Form Individual E Mrs ANISHAsunij.chackoNo ratings yet

- Information Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (Document2 pagesInformation Referral: Department of The Treasury - Internal Revenue Service Form (12-2005) OMB # 1545-1960 (IRSNo ratings yet

- Filer's Contact Information Section 1: Last Name First NameDocument6 pagesFiler's Contact Information Section 1: Last Name First NameBhavesh PadiyarNo ratings yet

- FATCA Form - Individual PDFDocument1 pageFATCA Form - Individual PDFThomas ArsenalNo ratings yet

- Individual Tax Residency Self Certification FormDocument5 pagesIndividual Tax Residency Self Certification FormYaacov KotlickiNo ratings yet

- Govt Central Registry Rules Form IDocument9 pagesGovt Central Registry Rules Form ISonam VijNo ratings yet

- Sav 2966Document2 pagesSav 2966Michael100% (1)

- TIAA Bank - Add Account HolderDocument2 pagesTIAA Bank - Add Account HolderDavid BuchananNo ratings yet

- Current Account Opening Form Single PDFDocument4 pagesCurrent Account Opening Form Single PDFSourabh TiwariNo ratings yet

- CIS TEMPLATE With Bank Coordinates 2Document4 pagesCIS TEMPLATE With Bank Coordinates 2MavisNo ratings yet

- FATCADocument2 pagesFATCAORIENNo ratings yet

- US Internal Revenue Service: f1040c - 2005Document4 pagesUS Internal Revenue Service: f1040c - 2005IRSNo ratings yet

- RMC No. 73-2019 - Annex ADocument1 pageRMC No. 73-2019 - Annex ALeo R.No ratings yet

- IRS fw7Document8 pagesIRS fw7Victor IkeNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument9 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeAdrián Vázquez SolísNo ratings yet

- Sav 1849Document2 pagesSav 1849Michael100% (1)

- Credit Card Application Public Supplementary SaveableDocument2 pagesCredit Card Application Public Supplementary Saveablemcad_marieNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument11 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeJazella IlejayNo ratings yet

- Usa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeDocument10 pagesUsa Tax Registration: It'S Quick and Easy To Organize Your Us Individual IncomeJordan Raji JrLcNo ratings yet

- Sav 1048Document7 pagesSav 1048Michael100% (2)

- Vendor Registration For Channel PartnersDocument6 pagesVendor Registration For Channel Partnerspinak powerNo ratings yet

- Additional Request Form (ARF) - FDocument2 pagesAdditional Request Form (ARF) - FAtif SyedNo ratings yet

- AP Individual Proprietor MSOSWALDocument21 pagesAP Individual Proprietor MSOSWALAshish AgarwalNo ratings yet

- For Re-KYC Nredocument NRI - 18.5Document4 pagesFor Re-KYC Nredocument NRI - 18.5rajucbit_2000No ratings yet

- A. Foreign Account Tax Compliance Act (FATCA) Due Diligence FormDocument1 pageA. Foreign Account Tax Compliance Act (FATCA) Due Diligence FormTin-tin Reyes Jr.No ratings yet

- Sav 2517Document2 pagesSav 2517MichaelNo ratings yet

- Canada EngDocument3 pagesCanada Engpaolomarabella8No ratings yet

- HCJXDocument4 pagesHCJXAdi GuptaNo ratings yet

- fw7 PDFDocument1 pagefw7 PDFRichard HughesNo ratings yet

- 1604CDocument1 page1604CNguyen LinhNo ratings yet

- Bank Branch Address Chnage FormDocument5 pagesBank Branch Address Chnage Formk15081982No ratings yet

- Know Your Client (KYC) Application Form (For Non-Individuals Only)Document2 pagesKnow Your Client (KYC) Application Form (For Non-Individuals Only)bhavesh jainNo ratings yet

- DCA Form PDFDocument1 pageDCA Form PDFShanmugamNo ratings yet

- Transmission Request FormDocument4 pagesTransmission Request FormVinayak SavanurNo ratings yet

- TimePayment Vendor ApplicationDocument2 pagesTimePayment Vendor Applicationapi-17419604No ratings yet

- US Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestFrom EverandUS Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestNo ratings yet

- Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!From EverandCredit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It!Rating: 1 out of 5 stars1/5 (2)

- WTP Schematic DiagramDocument3 pagesWTP Schematic DiagramRhys PalmaNo ratings yet

- Individual Forms Complete PDFDocument7 pagesIndividual Forms Complete PDFKrishna limNo ratings yet

- KantotDocument3 pagesKantotRhys PalmaNo ratings yet