Professional Documents

Culture Documents

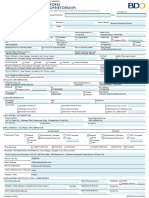

A. Foreign Account Tax Compliance Act (FATCA) Due Diligence Form

Uploaded by

Tin-tin Reyes Jr.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A. Foreign Account Tax Compliance Act (FATCA) Due Diligence Form

Uploaded by

Tin-tin Reyes Jr.Copyright:

Available Formats

A.

Foreign Account Tax Compliance Act (FATCA) Due Diligence Form

Individual

Please provide complete details and indicate NOT APPLICABLE to items/sections as deemed appropriate

ISIDRO MARTIN F. REYES JR. RUBY ELIZABETH P. REYES

Questions Borrower’s Name Spouse’s Name Co-Borrower’s Name

Yes No Yes No Yes No

1. Are you an American citizen? □ □ □ □ □ □

2. Are you a dual citizen? If so, indicate

countries of citizenship.

3. Are you a permanent resident of the U.S. /

green card holder? □ □ □ □ □ □

4. Were you born in the U.S.? □ □ □ □ □ □

5. Do you have a residence address in the

U.S.? □ □ □ □ □ □

6. Do you have a phone number in the U.S.? □ □ □ □ □ □

7. Do you have any instructions to transfer

funds to an account in the U.S.? □ □ □ □ □ □

8. Have you been to the U.S. in the last 3

years? □ □ □ □ □ □

If any of the answers to questions stated above is YES, kindly specify the required applicable information below. If more than

two (2) answered YES, please fill out a separate form.

□ Borrower □ Spouse □ Co-Borrower

A. Name:

B. U.S. Address:

No. Street: Subdivision/District/Town:

City: Country:

C. U.S. Telephone Number:

D. U.S. TIN:

E. U.S. P.O Box:

F. Standing instructions to pay amount/transfer funds to an account maintained in the United States:

G. Current power of attorney or signatory authority granted to a person with U.S. address:

H. An “in-care-of” address or “hold mail” address:

I. Length of stay in U.S.

Current Year No. of days Last Year No. of Days Prior to Last Year No. of Days Total Length of Stay

Please see guidelines on how to compute for the length of stay in U.S. by following the computation of substantial presence

test below:

Qualification/Eligibility for substantial presence test must involve being physically present in the United States on at least:

a. 31 days during the current year and;

b. 183 days during the 3-year period that includes the current year and the 2 years immediately before that, counting:

i. All the days you were present in the current year and;

ii. 1/3 of the days you were present in the first year before the current year, and;

iii. 1/6 of the days you were present in the second year before the current year

Client Conforme:

ISIDRO MARTIN F. REYES JR. RUBY ELIZABETH P. REYES

Borrower Signature Spouse Signature Co-Borrower Signature

over Printed Name / Date over Printed Name / Date over Printed Name / Date

For Bank’s Use Only

Customer Information File Number Bank Representative Signature over Printed Name

Notes/Remarks (if any):

You might also like

- How to Buy a Home in USA; Complete Guide to American Dream: Foreign Consulting, #1From EverandHow to Buy a Home in USA; Complete Guide to American Dream: Foreign Consulting, #1No ratings yet

- FATCADocument1 pageFATCAMarizelle KannoNo ratings yet

- Application For Naturalization: Part 1. Your Name (The Person Applying For Naturalization)Document10 pagesApplication For Naturalization: Part 1. Your Name (The Person Applying For Naturalization)HKF1971No ratings yet

- Form 13614-c Intake - Interview Quality Review Sheet 2Document4 pagesForm 13614-c Intake - Interview Quality Review Sheet 2api-593063995No ratings yet

- Foreign Account Tax Compliance Act QuestionnaireDocument1 pageForeign Account Tax Compliance Act QuestionnaireHerwin NavarreteNo ratings yet

- I134 SampleDocument8 pagesI134 SampleKatiuska BlancoNo ratings yet

- (A) Applicant (B) Co-ApplicantDocument3 pages(A) Applicant (B) Co-ApplicantYvonne Romine CameronNo ratings yet

- FATCADocument1 pageFATCAmuslimnswNo ratings yet

- 5.tax Interview Questions Virtual Interview FiverrDocument4 pages5.tax Interview Questions Virtual Interview Fiverrfrantzloppe05No ratings yet

- US Internal Revenue Service: f1040c - 2005Document4 pagesUS Internal Revenue Service: f1040c - 2005IRSNo ratings yet

- K-1 Questionnaire/Beneficiary: 1. Informations About YouDocument5 pagesK-1 Questionnaire/Beneficiary: 1. Informations About YouZach FortNo ratings yet

- Please Provide Complete Details and Indicate NOT APPLICABLE To Items/sections As Deemed AppropriateDocument1 pagePlease Provide Complete Details and Indicate NOT APPLICABLE To Items/sections As Deemed AppropriateRhys PalmaNo ratings yet

- US Internal Revenue Service: f1040c - 1992Document4 pagesUS Internal Revenue Service: f1040c - 1992IRSNo ratings yet

- Claim For Lost, Stolen or Destroyed United States Savings BondsDocument6 pagesClaim For Lost, Stolen or Destroyed United States Savings BondsJoy MillerNo ratings yet

- N 400Document10 pagesN 400joshuayoon100% (1)

- Cleveland State University Residency Petition For Tuition PurposesDocument7 pagesCleveland State University Residency Petition For Tuition PurposesjerrytouilleNo ratings yet

- Ca Potential Client Intake FormDocument5 pagesCa Potential Client Intake Formbash shangNo ratings yet

- Foreign Account Tax Compliance ActDocument1 pageForeign Account Tax Compliance Actjerald tanNo ratings yet

- Request For Determination of Possible Loss of United States NationalityDocument8 pagesRequest For Determination of Possible Loss of United States NationalityAfzal Imam100% (1)

- N 400frco VegaDocument20 pagesN 400frco VegaGiselle LNo ratings yet

- Formulario n4003Document20 pagesFormulario n4003andykam26No ratings yet

- Toms River AppDocument5 pagesToms River AppheathertappingNo ratings yet

- COMMERCIAL LOAN Application - Full or Stated DocumentationDocument5 pagesCOMMERCIAL LOAN Application - Full or Stated DocumentationJulio Cesar NavasNo ratings yet

- Personal Details For Each Person Included in This ApplicationDocument22 pagesPersonal Details For Each Person Included in This ApplicationMartin KyuksNo ratings yet

- Application Form United States: 1. Personal DetailsDocument4 pagesApplication Form United States: 1. Personal DetailsDapur DemokNo ratings yet

- Part A Application For Rentstart Bond Loan DCJ3049ADocument5 pagesPart A Application For Rentstart Bond Loan DCJ3049Atanchiatcorandy8No ratings yet

- Petition For Alien Fiancé (E) : Uscis Form I-129FDocument13 pagesPetition For Alien Fiancé (E) : Uscis Form I-129Fmganeslagon100% (1)

- Residency InformationDocument2 pagesResidency InformationhardknockgospelNo ratings yet

- N 400Document20 pagesN 400Leo FerrNo ratings yet

- Affidavit of Support: Part 1. Information About YouDocument8 pagesAffidavit of Support: Part 1. Information About YouRaini TorresNo ratings yet

- Application: Personal InformationDocument6 pagesApplication: Personal Informationnana2gbkeNo ratings yet

- DH3050 Tenancy Assistance Application 03.21Document16 pagesDH3050 Tenancy Assistance Application 03.21Sarah VirziNo ratings yet

- Account Opening Form For FI 24 08 2014Document1 pageAccount Opening Form For FI 24 08 2014Shyam RoutNo ratings yet

- Exchange Visitor InformationDocument3 pagesExchange Visitor InformationPrathamesh ParabNo ratings yet

- Read The Instructions Completely Before Filling Out This Application. Please Print in Black Ink or Type AnswersDocument2 pagesRead The Instructions Completely Before Filling Out This Application. Please Print in Black Ink or Type AnswersTerry PopeNo ratings yet

- Wrap ZIF FillableDocument1 pageWrap ZIF FillableWakeAndBake: GossipTvNo ratings yet

- 2020 02 24 Housing ApplicationDocument6 pages2020 02 24 Housing ApplicationMAMIRASNo ratings yet

- Contract Between Sponsor and Household Member: Physical AddressDocument8 pagesContract Between Sponsor and Household Member: Physical AddressLinesh BrahmakhatriNo ratings yet

- 4657 File Sample Credit Analysis Report Blank and CompletedDocument10 pages4657 File Sample Credit Analysis Report Blank and CompletedpriyankaNo ratings yet

- IRS fw7Document8 pagesIRS fw7Victor IkeNo ratings yet

- USAVISADocument6 pagesUSAVISATwila AmanoNo ratings yet

- FATCA Questionnaire and Declaration FormDocument1 pageFATCA Questionnaire and Declaration FormAlok KapoorNo ratings yet

- Visa Questionnaire EmptyDocument10 pagesVisa Questionnaire EmptyEdwin RodriguezNo ratings yet

- MAP Law Will Intake Form 2015Document18 pagesMAP Law Will Intake Form 2015bash shang100% (1)

- fw7 PDFDocument1 pagefw7 PDFRichard HughesNo ratings yet

- Full Name of Party Filing Document Mailing Address (Street or Post Office Box) City, State and Zip Code Telephone Email AddressDocument16 pagesFull Name of Party Filing Document Mailing Address (Street or Post Office Box) City, State and Zip Code Telephone Email AddressfreeNo ratings yet

- Asylum Support Application Form ASF1Document36 pagesAsylum Support Application Form ASF1cococatelulNo ratings yet

- Test Questions - Midterm - Persons & Family - 2020Document8 pagesTest Questions - Midterm - Persons & Family - 2020Franklin PabelloNo ratings yet

- Core Residency Questions: PART A. Student Basic Information. All Students Must Complete This SectionDocument4 pagesCore Residency Questions: PART A. Student Basic Information. All Students Must Complete This SectionsometimespaulNo ratings yet

- Form.: International Financial CertificationDocument2 pagesForm.: International Financial CertificationSamNo ratings yet

- DS 11 FormDocument6 pagesDS 11 FormTayeb QayomiNo ratings yet

- Je 2903221110057Document5 pagesJe 2903221110057Sandeep BoraNo ratings yet

- G 1151Document2 pagesG 1151Riku NikuNo ratings yet

- Thinking About Applying For Naturalization?: Use This List To Help You Get Ready!Document2 pagesThinking About Applying For Naturalization?: Use This List To Help You Get Ready!Susana BorrelliNo ratings yet

- Thinking About Applying For Naturalization?: Use This List To Help You Get Ready!Document2 pagesThinking About Applying For Naturalization?: Use This List To Help You Get Ready!Lara Silva AndradeNo ratings yet

- Form CV Family DetailsDocument9 pagesForm CV Family DetailsPete NuchNo ratings yet

- US Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestFrom EverandUS Immigration Exam Study Guide in English and Albanian: Study Guides for the US Immigration TestNo ratings yet

- Marketplace Seller Terms of ServiceDocument25 pagesMarketplace Seller Terms of ServiceTin-tin Reyes Jr.No ratings yet

- RP Questionnaire - Individual BorrowerDocument2 pagesRP Questionnaire - Individual BorrowerTin-tin Reyes Jr.No ratings yet

- Authorization Letter To Conduct Bank and Trade ChecksDocument1 pageAuthorization Letter To Conduct Bank and Trade ChecksTin-tin Reyes Jr.100% (1)

- Referral Information: Borrower SpouseDocument2 pagesReferral Information: Borrower SpouseTin-tin Reyes Jr.No ratings yet

- A4 Supplemental Form For Online Gaming Business - v2Document1 pageA4 Supplemental Form For Online Gaming Business - v2Tin-tin Reyes Jr.No ratings yet

- Specimen Signature Card Name (In Print)Document1 pageSpecimen Signature Card Name (In Print)RestyNo ratings yet

- DeathDocument1 pageDeathPavan KumarNo ratings yet

- Nonimmigrant Visa - Confirmation PageelllDocument2 pagesNonimmigrant Visa - Confirmation PageelllForeigner VeaceslavNo ratings yet

- Sample PassportDocument5 pagesSample PassportZahid5391No ratings yet

- GuinobatanDocument74 pagesGuinobatanAngelika CalingasanNo ratings yet

- Republic of Kenya. Ministry of State For Immigration and Registration of Persons. Nyayo House. 2006Document29 pagesRepublic of Kenya. Ministry of State For Immigration and Registration of Persons. Nyayo House. 2006Lucas Daniel Smith100% (1)

- Boarding PassDocument3 pagesBoarding PassHabibur RahmanNo ratings yet

- Is Valid Only With Original Photo IDDocument2 pagesIs Valid Only With Original Photo IDchandanNo ratings yet

- Citizenship InstructionsDocument6 pagesCitizenship InstructionsRahul Naik100% (20)

- 190 Applicant ChecklistDocument3 pages190 Applicant Checklistpriya_psalmsNo ratings yet

- Deferment of Study Tangguh Pengajian NewDocument3 pagesDeferment of Study Tangguh Pengajian NewSyafiq SyaziqNo ratings yet

- Application Form Surrender of Indian PassportDocument1 pageApplication Form Surrender of Indian Passportvidhyaa1011No ratings yet

- The Human Rights of Stateless Persons PDFDocument33 pagesThe Human Rights of Stateless Persons PDFMarch ElleneNo ratings yet

- Verification of Swedish Citizenship 2022Document2 pagesVerification of Swedish Citizenship 2022Sava BozicNo ratings yet

- Ambe Consultancy Services Pvt. LTD.: Personal ParticularsDocument2 pagesAmbe Consultancy Services Pvt. LTD.: Personal ParticularsSai Sudheer KattaNo ratings yet

- Antyodaya-Saral PortalDocument2 pagesAntyodaya-Saral PortalkarbmatNo ratings yet

- Human Rights and Social JusticeDocument7 pagesHuman Rights and Social JusticeErica Mae MendiolaNo ratings yet

- Revised Cef-1: Republic of The Philippines Commission On ElectionsDocument7 pagesRevised Cef-1: Republic of The Philippines Commission On ElectionsFebwin Villaceran100% (1)

- CandidateHallTicket PDFDocument1 pageCandidateHallTicket PDFSASWAT MISHRANo ratings yet

- Personal Cover Letter Schengen VisaDocument3 pagesPersonal Cover Letter Schengen VisaRiyas75% (8)

- Application Form For STEMDocument1 pageApplication Form For STEMArturo TJ PacificadorNo ratings yet

- COA Request FormDocument2 pagesCOA Request Formmittal4662No ratings yet

- The Tragedy of South Sudan - The Way ForwardDocument3 pagesThe Tragedy of South Sudan - The Way ForwardiihaoutreachNo ratings yet

- Saudi Iqama Rules and Violations and PenaltiesDocument9 pagesSaudi Iqama Rules and Violations and Penaltiesahmer09No ratings yet

- Apply Online For A Schengen Visa in Order To Visit Sweden - Swedish Migration AgencyDocument3 pagesApply Online For A Schengen Visa in Order To Visit Sweden - Swedish Migration AgencyKashif RiazNo ratings yet

- Appointment Reciept ABDULLAHDocument3 pagesAppointment Reciept ABDULLAHZaibunnisa MalikNo ratings yet

- Aadhar Self AttestedDocument2 pagesAadhar Self AttestedswathiNo ratings yet

- MCQ On Human Rights LawDocument4 pagesMCQ On Human Rights LawShubhangi Pandey100% (1)

- 23 07 Paris Man BoardingPassDocument5 pages23 07 Paris Man BoardingPasscrystalNo ratings yet

- Gender Equality Is A Human RightDocument7 pagesGender Equality Is A Human RightAadil KakarNo ratings yet