Professional Documents

Culture Documents

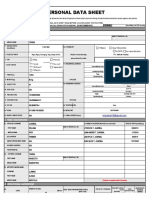

Referral Information: Borrower Spouse

Uploaded by

Tin-tin Reyes Jr.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Referral Information: Borrower Spouse

Uploaded by

Tin-tin Reyes Jr.Copyright:

Available Formats

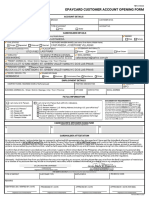

Open and fill out this form using Adobe Acrobat Reader for optimal experience.

HOME LOAN APPLICATION FORM

(FOR INDIVIDUAL / SOLE PROPRIETORSHIP)

(mm/dd/yyyy)

Borrower Type

For BDO Use Only: Program/Promotion: Date:

✔ Principal Co-Borrower

REFERRAL INFORMATION

Unit / Branch Developer Broker / Referrer

Marirose Gumarang Sioson

Others

BORROWER’S INFORMATION

*Name (First, Middle, Last) *Date of Birth (mm/dd/yyyy) *Place of Birth

REYES, ISIDRO MARTIN JR. FERRER 11/03/1976 TUGUEGARAO, CAGAYAN

*Gender ✔ Male *Civil Status Single ✔ Married Separated No. of Dependents *Citizenship ✔ Filipino

Female Annulled / Divorced Widow/er 0 Foreigner, ACR No.

*TIN *SSS / GSIS No. *Mobile. No. Prepaid

930775422000 117233731 9175530136 ✔ Postpaid

Residence Phone No. (Area Code, Number) (Area Code, Number) Fax No. (Area Code, Number) *Email Address

2 imr@reyesfajardolaw.com

*Mother’s Maiden Name (First, Middle, Last) *Father’s Name (First, Middle, Last)

NIEVES DANAO REYES ISIDRO SADDUL REYES

*Present Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Length of Stay (Year/s | Month/s)

38 Bismark St., Provident Village, Jesus Dela Pena, Marikina 1804 9

Home Ownership Owned ✔ Rented Mortgaged Used Free Living with Relatives

*Permanent Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Length of Stay (Year/s | Month/s)

38 Bismark St., Provident Village, Jesus Dela Pena, Marikina 1804 9

Previous Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Length of Stay (Year/s | Month/s)

Are you related to a BDO employee?

If Yes, indicate full name (First, Middle, Last) and relationship

SPOUSE’S INFORMATION

*Name (First, Middle, Last) Date of Birth (mm/dd/yyyy) Place of Birth

RUBY ELIZABETH PEREZ REYES 12/16/1977 TUGUEGARAO, CAGAYAN

Citizenship ✔ Filipino TIN SSS / GSIS No.

Foreigner, ACR No. 937782408000 0115962934

Mobile No. Prepaid Email Address

277286883 9285241909 ✔ Postpaid chuchay_perezreyes@yahoo.com

LOAN INFORMATION

Loan Amount Term Fixing Period

2,744,000 10 3

Loan Purpose

Purchase of Vacant Lot Purchase of Condominium

Purchase of House & Lot Construction of House Reimbursement of Acquisition Cost

✔ Purchase of Townhouse Renovation / House Improvement Equity Loan, please specify

COLLATERAL INFORMATION

Property Address Present Registered Owner

Lot 3-F, Road Lot 1, Bamboo Villas Townhouse, Brgy., Pinagbuhatan, Pasig City BDO Unibank Inc.

TCT / CCT No. Contact Person Contact No.

EMPLOYMENT / BUSINESS INFORMATION

BORROWER SPOUSE

*Employment Type Employed Self-Employed (w/ Business) OFW / Immigrant ✔ Employed Self-Employed (w/ Business) OFW / Immigrant

Private ✔ Self-Employed (Professional) Others ✔ Private Self-Employed (Professional) Others

Government Government

NGO NGO

*Business Type Single Proprietorship ✔ Partnership Corporation Single Proprietorship Partnership ✔ Corporation

*Employer / Business Name and Address (No. / Street / Barangay / Municipality or City / Province / Country)

Reyes-Fajardo and Associates, Unit 12F, IBM Plaza Bldg., 08 Eastwood Ave., Eastwood Cyberpark, Bagumbayan, QUezon City

*Phone / Fax No. 23526146

*Email Address rfa@reyesfajardolaw.com

*Nature of Business Professional Partnership

Years of Employment / Business 10/20

Position / Title Partner

LOAN ADMINISTRATOR (if OFW or IMMIGRANT)

Name (First, Middle, Last) Date of Birth (mm/dd/yyyy) Citizenship Filipino

Foreigner, ACR No.

Address (No. / Street / Barangay / Municipality or City / Province / Country) Zip Code Relationship to Borrower Contact No.

Name of Spouse (First, Middle, Last) Date of Birth (mm/dd/yyyy) Contact No.

(*) Mandatory Field/s REVISED AS OF JUNE 2019

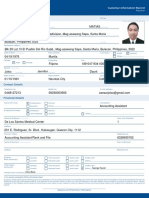

INCOME DETAILS

BORROWER SPOUSE

Gross Monthly Income 70,000 50,000

Other Monthly Income

(Please specify)

50,000 50,000

Total Monthly Income

120,000 50,000

Combined Gross

Monthly Income 170,000

Monthly Expenses 13,000 10,000 30,000

Rentals Loans and Credit Cards Other Expenses

FINANCIAL INFORMATION / BANK RELATIONSHIP

Deposits Bank Branch Type of Account Account No. Date Opened (mm/yyyy) Outstanding Balance

BDO IBM Plaza Savings 002880411846 350,000

BDO Tanong Savings 007740057638 200,000

BDO IBM PLaza Savings 002880132742 800,000

Loans Bank Type of Loan Original Loan Amount Date Granted (mm/yyyy) Maturity Date (mm/yyyy) Monthly Payment

TRADE REFERENCES

Major Company Name Contact Person / Position Contact No.

Customers

Major Company Name Contact Person / Position Contact No.

Suppliers

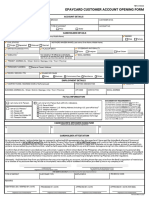

UNDERTAKING

1. The Borrower hereby certifies that the provided information are true and correct and shall form part of the loan documents and the signatures indicated herein are genuine. The Borrower’s or his authorized representative’s provision of

any information which is not true or updated may cause BDO Unibank, Inc. (BDO) to automatically reject the Borrower's loan application or cancel its approval.

2. The Borrower authorizes BDO to obtain relevant information as it may require concerning this application from other institutions/persons. All information obtained by or provided to BDO pursuant to this application shall be BDO's

property whether or not the loan is granted.

3. The Borrower agrees that this loan application shall be subject to Applicable Laws1 (including BSP circulars, rules, and regulations), and policies of BDO and undertake to comply with/submit all the loan requirements.

4. The Borrower hereby waives in favor of BDO confidentiality of client information including without limitation, the provisions of Republic Act Nos. 1405 (The Law on Secrecy of Bank Deposits), 6426 (Foreign Currency Deposit Act), and

Section 55.1.b of Republic Act No. 8791 (General Banking Law) and any law relating to the secrecy of bank deposits for purposes of BDO's evaluation of the Borrower's application herein. The Borrower authorizes BDO to: (a) pursuant to

BSP Circular No. 472 Series of 2005 as implemented by BIR Revenue Regulation RR-4 2005, conduct random verification with the Bureau of Internal Revenue in order to establish authenticity of the ITR, accompanying financial statements

and such other documents/information/data submitted by the Borrower, and/or (b) obtain or disclose such information regarding the Borrower or the loan/credit facilities applied for hereunder to any party as BDO may deem necessary

or as may be required or allowed by Applicable Laws. The Borrower also authorizes BDO to request information regarding the status of any court case to which the Borrower is a party.

5. The Borrower authorizes BDO to conduct, through its representative accredited appraisers, an appraisal of any or all of the collateral to be used for this loan. The Borrower also agrees that the appraisal report will be forwarded directly

to BDO for its sole use only.

6. Any payment of bank fees (appraisal fee, mortgage registration expenses, insurance premium, DST, notarial fee, handling fee, cancellation fee, and other amounts as may be required upon loan application and/or for the release of loan

proceeds) should only be through a BDO branch, otherwise, payments shall not be honored or recognized.

7. In case of disapproval, the Borrower understands that BDO is under no obligation to disclose the reason/s for such disapproval.

8. The Borrower further certifies that the proceeds of the loan, if this application is approved, will be used solely for the purpose stated in this application.

9. The Borrower hereby authorizes BDO, its parent, subsidiaries, affiliates, and their respective representatives and agents (“BDO Group”) to send notices, offers and announcements to the Borrower as BDO or any member of the BDO

Group may deem proper, including without limitation, information regarding the status of the Borrower's loan application, details concerning the Borrower’s approved/availed loan, and product offers via email, as well as broadcast

messaging service, multi-media messaging service, and/or short messaging service as these terms are defined in the regulations of the National Telecommunications Commission (NTC). The Borrower agrees to hold BDO free and

harmless against any loss, injury or damage that the Borrower may suffer in relation to any notification/announcement sent by BDO to the Borrower in the format stated herein. It is agreed and understood that unless and until BDO is in

receipt of a written notice from the Borrower not to be sent such messages, the Borrower's authority as given herein shall be deemed continuing, valid and effective.

DATA PRIVACY CONSENT

In compliance with the requirements of the Data Privacy Act (“DPA”), the Borrower authorizes the general use and sharing of information obtained in the course of any transaction/s (which may include any transaction, business or other

form of commercial relationship) with any member of the BDO Group or from third parties. The data, which include personal information or sensitive personal information2 may be collected, processed, stored, updated, or disclosed by

BDO or continually be collected, stored, processed and/or shared for five (5) years from the conclusion of the Borrower’s transaction with any member of the BDO Group or until the expiration of the retention limits set by applicable law,

whichever comes later, (i) for legitimate purposes3, (ii) to implement transactions which the Borrower requests, allows, or authorizes, (iii) to offer and provide new or related products and services of the BDO Group or third parties, and

(iv) to comply with the BDO Group’s internal policies and its reporting obligations4 to Governmental Authorities5 under Applicable Laws.

The Borrower allows members of the BDO Group to process, collect, use, store, or disclose information (including without limitation, the Borrower’s credit data in connection with any credit availment with BDO) to other members, to

Governmental Authorities, to all credit information bureaus, including without limitation the Credit Information Corporation defined in R.A. No. 9510, and to any third party (local or overseas) who acquires or will acquire the rights and

obligations of any member of the BDO Group; who is in negotiations with any member of the BDO Group in connection with the possible sale, acquisition or restructuring of any member of the BDO Group; who processes information,

transactions, services, or accounts, on behalf of the BDO Group (including but not limited to courier agencies; telecommunication information technology companies; payment, payroll, collection, training, and storage agencies; entities

providing customer support, and other similar entities); or who requires the information for market research, product and business analysis, audit and administrative purposes, offering of products and services, or for marketing or

advertising activities undertaken by the BDO Group.

The Borrower understands that should the Borrower wish to access, update, or correct certain information, or withdraw consent to the use of any of the information provided herein, the Borrower may communicate with BDO's Data

Protection Officer at data_protection_officer_bdounibankinc@bdo.com.ph. The Borrower may file complaints with, and/or seek assistance from the National Privacy Commission.

1 Refers to any statute, law, constitution, regulation, rule, ordinance, order, decree, directive, guideline, policy, requirement or governmental restriction or any similar form of decision of, or determination of any of the foregoing by, any

national, regional or local government or political subdivision, commission, authority, tribunal, agency or entity of the Republic of the Philippines or a foreign country, as may be applicable.

2 Name, address, gender, age, marital status, contact details, birthday, SSS/GSIS, TIN, education, employment or financial or medical information, spouse details, preferences, behavior, and other information classified as “personal

data,” “personal information,” or “sensitive personal information” under the DPA, and those of the Borrower’s authorized representatives, as well as accounts, transactions, and communications.

3 Including but not limited to credit and risk management, know your customer checks, prevention and detection of fraud or crime, system or product development and planning, cross-selling, direct marketing, profiling, complaints

management, insurance, audit and administrative purposes, and relationship management.

4 Means obligations of the BDO Group to comply with (a) Applicable Law, and internal policies or procedures, or (b) any demand and/or request from Government Authorities for purposes of reporting, regulatory trade reporting,

disclosure or other obligations under Applicable Law.

5 Refers to the government of the Republic of the Philippines or a foreign country, as may be applicable, or any political subdivision thereof, and any entity exercising executive, legislative, judicial, regulatory or administrative functions

of or pertaining to the government.

Isidro Martin F. Reyes Jr. Ruby Elizabeth P. Reyes

Signature of Borrower Date Signature of Spouse/Co-Borrower/Co-Maker Date

over Printed Name over Printed Name

Credit Card

By signing in this section, the Borrower agrees that this shall serve as the Borrower's application for issuance of BDO Credit Card/s. The Borrower undertakes to submit documents as may be deemed necessary by BDO. The Borrower

authorizes BDO to conduct whatever credit investigation and verification with government agencies or third parties to ascertain credit standing, financial capability of the Borrower, and establish the authenticity of the information declared

and/or documents submitted. The Borrower further waives applicable confidentiality rules and laws. The Borrower understands that the issuance of a BDO Credit Card shall be subject to credit evaluation and discretion of BDO.

Further, the Borrower agrees that in case of issuance of two or more BDO Credit Cards, BDO may give a separate Credit Card Limit for each of the Card issued or a consolidated Shared Credit Card Limit for existing and future BDO Credit

Cards, expressed in Philippine Pesos. The Borrower understands that Shared Credit Card Limit is the Credit Limit assigned to a Cardholder across all issued BDO Credit Cards. Any request for increase in Credit Limit may be accommodated

by BDO, subject to compliance with BDO’s requirements.

Isidro Martin F. Reyes Jr.

Signature of Borrower over Printed Name Date

The BDO, BDO Unibank, and other BDO-related trademarks are owned by BDO Unibank, Inc.

SAVE SUBMIT RESET

You might also like

- Home Loan FormDocument2 pagesHome Loan FormJohn Michael RasalanNo ratings yet

- Referral InformationDocument2 pagesReferral Informationabe madridNo ratings yet

- AL Form Individual RevisedDocument3 pagesAL Form Individual RevisedMicaela ImperialNo ratings yet

- Bdo Application FormDocument2 pagesBdo Application FormAnonymous pnCfNWeCUZ100% (1)

- BDO Auto LoanDocument2 pagesBDO Auto LoanRalph Christian Lusanta FuentesNo ratings yet

- KYC For Beneficial Owner and Third Party PayorDocument2 pagesKYC For Beneficial Owner and Third Party PayorQIANo ratings yet

- PagIBIG Loan FormDocument2 pagesPagIBIG Loan FormgdlveeplNo ratings yet

- Application Form 8140623012344Document4 pagesApplication Form 8140623012344gunasekaran_mbaNo ratings yet

- Biodata Form PDF - SMF V4.0 NNDocument5 pagesBiodata Form PDF - SMF V4.0 NNrizky rahman saputra rizkyNo ratings yet

- Application Form 8051022036713Document4 pagesApplication Form 8051022036713Shiva reddy KalluriNo ratings yet

- PafpDocument1 pagePafpremea estrellaNo ratings yet

- Pag-Ibig MPL FormDocument2 pagesPag-Ibig MPL Formcliford caballeroNo ratings yet

- SLF065 MultiPurposeLoanApplicationForm V03 PDFDocument2 pagesSLF065 MultiPurposeLoanApplicationForm V03 PDFElle VillanNo ratings yet

- Ibong AdarnaDocument2 pagesIbong Adarnadelmundonicole2No ratings yet

- EPAI Application-RevisedDocument1 pageEPAI Application-Revisedjori mart morenoNo ratings yet

- Calamity Loan Application Form: Filipino FilipinoDocument2 pagesCalamity Loan Application Form: Filipino Filipinoaljhondelacruz22No ratings yet

- Individual Enrollment Form For Group Insurance - John Cedesan VictaDocument1 pageIndividual Enrollment Form For Group Insurance - John Cedesan VictaCedie VictaNo ratings yet

- Customer Information Form Individual PDFDocument2 pagesCustomer Information Form Individual PDFDessa Mae SarmientoNo ratings yet

- CS Form No. 212 Revised Personal Data Sheet 2 - New With PICSDocument14 pagesCS Form No. 212 Revised Personal Data Sheet 2 - New With PICSSaz RobNo ratings yet

- Epaycard - Customer - Account - Opening - Form - BUSTAMANTE, ARGEE LDocument1 pageEpaycard - Customer - Account - Opening - Form - BUSTAMANTE, ARGEE LJoanne Bernadette IcaroNo ratings yet

- Caof Form PQ Jessa 77 166Document1 pageCaof Form PQ Jessa 77 166Brian LNo ratings yet

- Caof Form - PQ (Jessa)Document1 pageCaof Form - PQ (Jessa)Daisyrie Castañeda CallaoNo ratings yet

- HDMF Loan FormDocument2 pagesHDMF Loan FormDivina Gammoot100% (3)

- Umid Customer Information RecordDocument2 pagesUmid Customer Information RecordEdaj Catabman Sotnas SoledNo ratings yet

- List of Enrollees COOPERATIVE NAME: - FIRST COMMUNITY COOPERATIVEDocument8 pagesList of Enrollees COOPERATIVE NAME: - FIRST COMMUNITY COOPERATIVECooperative Health Management FederationNo ratings yet

- Bi Form Cgaf-002-Rev 3.1 Erwin MeijndersDocument2 pagesBi Form Cgaf-002-Rev 3.1 Erwin MeijndersjanhinolanNo ratings yet

- SB Bonifacio G. GalayDocument3 pagesSB Bonifacio G. GalayJeorel QuiapoNo ratings yet

- Https Pmkisan - Gov.in EditSelfRegisterFarmerDetailnew - Aspx RefNo 4JxvGRE6kgXlih4TRuyUvG15MgvF6Zikd9aIG5akosQDocument2 pagesHttps Pmkisan - Gov.in EditSelfRegisterFarmerDetailnew - Aspx RefNo 4JxvGRE6kgXlih4TRuyUvG15MgvF6Zikd9aIG5akosQSantanu MaityNo ratings yet

- Application Form 8071023005624Document4 pagesApplication Form 8071023005624Aahil AaryanNo ratings yet

- Approved Format of Ration Card For Digitization in ERCMSDocument2 pagesApproved Format of Ration Card For Digitization in ERCMSRizwan HassanNo ratings yet

- Security Bank Credit Card Supplementary FormDocument3 pagesSecurity Bank Credit Card Supplementary FormRBCD INDUSTRIAL SUPPLYNo ratings yet

- Metrobank Branch Application Form No Cards With PEP 2Document2 pagesMetrobank Branch Application Form No Cards With PEP 2Gil Angelo Del ValleNo ratings yet

- EasyWay-Account-Opening-Form-June-2022 EasyWay Logo ColorDocument1 pageEasyWay-Account-Opening-Form-June-2022 EasyWay Logo Coloractivarico1984No ratings yet

- BBG-CIR-Personal-09-06-2017 (BDO Open Account Form) PDFDocument2 pagesBBG-CIR-Personal-09-06-2017 (BDO Open Account Form) PDFiam cjNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Document2 pagesMulti-Purpose Loan (MPL) Application Form: (E.g., JR., II) (For Married Women) (Check If Applicable Only)Lenaj EbronNo ratings yet

- EPay Card Customer Acct. Opening FormDocument1 pageEPay Card Customer Acct. Opening FormMakishimu Morlaugh58% (12)

- AF - Sole and CAL BB DocusignDocument9 pagesAF - Sole and CAL BB DocusignManuel Castro IINo ratings yet

- Multi-Purpose Loan (MPL) Application Form: Hernani S. YapDocument2 pagesMulti-Purpose Loan (MPL) Application Form: Hernani S. YaplejigeNo ratings yet

- Assignment of Policy Form: Individual Policyowner APIDocument3 pagesAssignment of Policy Form: Individual Policyowner APIGold LeonardoNo ratings yet

- Report 1708438619109Document3 pagesReport 1708438619109xoxo sophieeNo ratings yet

- Biodata Form PDF - SMF V4.0Document5 pagesBiodata Form PDF - SMF V4.01902020102No ratings yet

- NEW - Epaycard Customer Account Opening Form...Document1 pageNEW - Epaycard Customer Account Opening Form...ジョン ジーNo ratings yet

- HLF182 ApplicationFullRiskBasedPricing V03Document2 pagesHLF182 ApplicationFullRiskBasedPricing V03Eve GranadaNo ratings yet

- Pru LifeDocument4 pagesPru Lifeshieladestacamento1957No ratings yet

- PDS MedinaDocument4 pagesPDS MedinaRashiel Jane CelizNo ratings yet

- CIS Individual EditableDocument6 pagesCIS Individual EditableJUNIE DAVE ORQUITANo ratings yet

- Latest 2021 Cs Form No 212 Pds Pro Cabajes 2021Document35 pagesLatest 2021 Cs Form No 212 Pds Pro Cabajes 2021bevlesoyNo ratings yet

- Multi-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpDocument2 pagesMulti-Purpose Loan (MPL) Application Form: Crown Hotel Management CorpMA BethNo ratings yet

- New Accreditation Form UCPBDocument2 pagesNew Accreditation Form UCPBHershey Ramos SabinoNo ratings yet

- JITENDRADocument2 pagesJITENDRAAsrar KhanNo ratings yet

- New UBP Corporate Card Application - Employee - New Fillable (SCO)Document5 pagesNew UBP Corporate Card Application - Employee - New Fillable (SCO)HazelNo ratings yet

- Cir 230601481100Document2 pagesCir 230601481100Harold ColonNo ratings yet

- 2021 Loanappformsoleprop 85 X 13Document4 pages2021 Loanappformsoleprop 85 X 13Jeffrey Ru LouisNo ratings yet

- PDS ManelynDocument7 pagesPDS ManelynRenalyn CatalanNo ratings yet

- AAF004 OfferPurchaseNegotiatedRetailSale V03 PDFDocument2 pagesAAF004 OfferPurchaseNegotiatedRetailSale V03 PDFJerson Obo67% (3)

- Request For Reprinting of Pag-Ibig Loyalty Card: Icapin Romir Mendoza 0018 Cortez ST., Dalig, Batingan, Binangonan, RizalDocument1 pageRequest For Reprinting of Pag-Ibig Loyalty Card: Icapin Romir Mendoza 0018 Cortez ST., Dalig, Batingan, Binangonan, RizalRomir IcapinNo ratings yet

- New Existing Deposits Loans Others Cards: Contact InformationDocument3 pagesNew Existing Deposits Loans Others Cards: Contact InformationErminaldo MineroNo ratings yet

- Marketplace Seller Terms of ServiceDocument25 pagesMarketplace Seller Terms of ServiceTin-tin Reyes Jr.No ratings yet

- RP Questionnaire - Individual BorrowerDocument2 pagesRP Questionnaire - Individual BorrowerTin-tin Reyes Jr.No ratings yet

- Authorization Letter To Conduct Bank and Trade ChecksDocument1 pageAuthorization Letter To Conduct Bank and Trade ChecksTin-tin Reyes Jr.100% (1)

- A. Foreign Account Tax Compliance Act (FATCA) Due Diligence FormDocument1 pageA. Foreign Account Tax Compliance Act (FATCA) Due Diligence FormTin-tin Reyes Jr.No ratings yet

- A4 Supplemental Form For Online Gaming Business - v2Document1 pageA4 Supplemental Form For Online Gaming Business - v2Tin-tin Reyes Jr.No ratings yet

- Cars Should Be Banned in The CityDocument2 pagesCars Should Be Banned in The CityImmaNo ratings yet

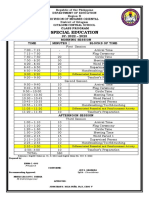

- Sped Class Program 2022 2023Document2 pagesSped Class Program 2022 2023Jay GranadaNo ratings yet

- Voting Requirements Under The ConstitutionDocument3 pagesVoting Requirements Under The ConstitutionSelina Alessandra Miranda100% (1)

- Ys%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankaDocument112 pagesYs%, XLD M Dka S%L Iudcjd Ckrcfha .Eiü M %H: The Gazette of The Democratic Socialist Republic of Sri LankasiyamsankerNo ratings yet

- Day 7 Mat152 WS PDFDocument6 pagesDay 7 Mat152 WS PDFKimNo ratings yet

- Felongco vs. Dictado, RTJ-86-50Document27 pagesFelongco vs. Dictado, RTJ-86-50Norbert DiazNo ratings yet

- The UDHR and The Indian Constitution A ComparisonDocument5 pagesThe UDHR and The Indian Constitution A ComparisonSaiby KhanNo ratings yet

- MInimum Tax and Turnover - M. M. Akram Reported Judgements - THE COMMISSIONER-IR, ZONE-1, LTU, KARACHI Vs M - S. KASB BANK LIMITED, KARACHIDocument10 pagesMInimum Tax and Turnover - M. M. Akram Reported Judgements - THE COMMISSIONER-IR, ZONE-1, LTU, KARACHI Vs M - S. KASB BANK LIMITED, KARACHIAns usmaniNo ratings yet

- Great White Shark Enterprises, Inc. vs. Daniel Caralde (GR No. 192294, 21 November 2012)Document3 pagesGreat White Shark Enterprises, Inc. vs. Daniel Caralde (GR No. 192294, 21 November 2012)Archibald Jose Tiago ManansalaNo ratings yet

- 27 Gallemit vs. TabilaranDocument7 pages27 Gallemit vs. TabilaranYaz CarlomanNo ratings yet

- Medical Law and Ethics Thesis TopicsDocument5 pagesMedical Law and Ethics Thesis Topicsrqaeibifg100% (1)

- Ra 7279Document23 pagesRa 7279Vholts Villa VitugNo ratings yet

- InvoiceSimple PDF TemplateDocument1 pageInvoiceSimple PDF TemplateSd AmanNo ratings yet

- Special Power of AttorneyDocument3 pagesSpecial Power of AttorneyFarrukh TabishNo ratings yet

- Reliance Activa Insurance PolicyDocument6 pagesReliance Activa Insurance PolicydsethiaimtnNo ratings yet

- CRPC Moot Court Memorial by Kumar Prabhakar Section 1 Ballb Sem 4Document11 pagesCRPC Moot Court Memorial by Kumar Prabhakar Section 1 Ballb Sem 4Kumar PrabhakarNo ratings yet

- Explanation of Economic Torts in UK & AustraliaDocument50 pagesExplanation of Economic Torts in UK & AustraliaMuhwezi Nicholas TrevorNo ratings yet

- Alex Remick Fraud Case, KHDocument34 pagesAlex Remick Fraud Case, KHWait What?100% (1)

- Investigative Report WritingDocument8 pagesInvestigative Report WritingPretzel CagmatNo ratings yet

- Higher Education Loans Board: Bomet County Education Fund Loan Application FormDocument8 pagesHigher Education Loans Board: Bomet County Education Fund Loan Application FormArnold SigeyNo ratings yet

- Manosca v. Court of Appeals, 252 SCRA 412 (1996)Document3 pagesManosca v. Court of Appeals, 252 SCRA 412 (1996)LeyardNo ratings yet

- International Standard: Friction Stir Welding - Aluminium Specification and Qualification of Welding ProceduresDocument7 pagesInternational Standard: Friction Stir Welding - Aluminium Specification and Qualification of Welding ProceduresAngel Stiven Romero DiazNo ratings yet

- Cases On Conflicts of LawDocument7 pagesCases On Conflicts of Lawarellano lawschoolNo ratings yet

- Erie Doctrine ChartDocument3 pagesErie Doctrine ChartAlexis R GaryNo ratings yet

- Durilag, Sarah MichelleDocument3 pagesDurilag, Sarah MichelleSarah Michelle DurilagNo ratings yet

- Alliance Air Aviation Limited: Walk-in-InterviewDocument12 pagesAlliance Air Aviation Limited: Walk-in-InterviewShivendra PrasadNo ratings yet

- Biker Trash Network Biker News Sonny Barger Dead at 83Document4 pagesBiker Trash Network Biker News Sonny Barger Dead at 83Com PuterNo ratings yet

- Masanguid, Remmon Lloyd P.: Section 48. XXX After A Policy of LifeDocument13 pagesMasanguid, Remmon Lloyd P.: Section 48. XXX After A Policy of LifeRemmon MasanguidNo ratings yet

- Trademark OutliningDocument65 pagesTrademark OutliningAna FosterNo ratings yet

- 10C... For PF WithdrwalDocument2 pages10C... For PF WithdrwalSasanka SekharNo ratings yet