Professional Documents

Culture Documents

Managerial Finance CH 3

Uploaded by

MPOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Managerial Finance CH 3

Uploaded by

MPCopyright:

Available Formats

The DuPont analysis stresses that ROA is affected by 3 factors:

High profit margins

Rapid turnover of assets

Use of debt

ROA = Net Income Sales

x

Sales Total Assets

Therefore, higher Net income (or high profit margins) = higher ROA

ROA = PM x AASSET TURNOVER

PM = Net Income / Sales

THEREFORE HIGHER SALES = HIGHER PM AND HIGHER ROA

Also, higher Asset Turnover increases ROA

ROE = ROA x Equity Multiplier

EM = Total Assets / Equity, so a higher Total Assets = higher EM and a higher ROE.

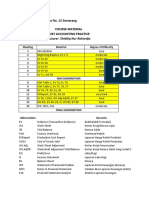

Chapter 3

Problem 3.22

THE SPORTS CAR TIRE COMPANY

Income Statement

Sales 20,000

Less: Cost of Goods Sold 9,000

Gross Profit 11,000

Less: Selling and Administrative Expense 4,000

Less: Lease Expense 1,000

Operating Profit* 6,000

Less: Interest Expense 500

Earnings Before Taxes 5,500

Less: Taxes (40%) 2,200

Earnings After Taxes 3,300

*Operating Profit also known as Earnings Before Interest and Taxes (EBIT)

Additional Information:

Total Assets = 40,000

a. Interest Coverage

Interest Coverage = EBIT/Interest

Interest Coverage = 12 This ratio tells us that earnings are 12 tim

(Note: Interest Coverage Ratio also known as "Times Interest Earned") interest expense, or earnings could dimin

current level and still cover interest obliga

b. Fixed Charge Coverage

Fixed Charge Coverage = Income before fixed charges and taxes/Fixed charges

Fixed Charge Coverage = (EBIT + Lease Expense)/(Interest Expense + Lease Expense)

Fixed Charge Coverage = 4.67 This ratio tells us that "earnings" are more

4.67 times greater than fixed obligations,

Set model for DuPont system and proceed could diminish to 21% of the current leve

these obligations.

ROA = PM x TATO = NI/S x S/A

ROE = ROA x EM = NI/A x A/E = PM x TATO x EM = NI/S x S/A x A/E

c. Profit Margin = NI/S

PM = 0.17 Each dollar of sales produces BLANK cent

or 16.50% (percent)

d. Total Asset Turnover = S/A

TATO = 50.0% Each dollar of assets produces BLANK cen

e. Return on Assets = Profit Margin x Total Asset Turnover

ROA = PM x TATO =

ROA = 0.08 Each dollar of assets produces BLANK cen

or 8.25% (percent) This company has a relatively high profit m

As a check, ROA also = NI/A is relatively capital intensive. It takes cons

capital to produce sales, but sales are pro

ROA = 0.0825

or 8.25% (percent)

tells us that earnings are 12 times larger than

xpense, or earnings could diminish to 12 times less than the

vel and still cover interest obligations.

tells us that "earnings" are more than

s greater than fixed obligations, or earnings

minish to 21% of the current level and still cover

ar of sales produces BLANK cents of earnings

ar of assets produces BLANK cents of sales

ar of assets produces BLANK cents of earnings.

pany has a relatively high profit margin and

ly capital intensive. It takes considerable

produce sales, but sales are profitable.

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Shareholder - Value - Creation Final VBM Intro and Indicators Final BestDocument93 pagesShareholder - Value - Creation Final VBM Intro and Indicators Final Bestsuparshva99iimNo ratings yet

- 3 - Topic3 Financial and Operating Leveraging-EditedDocument44 pages3 - Topic3 Financial and Operating Leveraging-EditedCOCONUTNo ratings yet

- CH03答案Document11 pagesCH03答案zmm45x7sjtNo ratings yet

- Quiz 6 NotesDocument14 pagesQuiz 6 NotesEmily SNo ratings yet

- Tugas 2 - Dita Sari LutfianiDocument5 pagesTugas 2 - Dita Sari LutfianiDita Sari LutfianiNo ratings yet

- Bodie10ce SM CH19Document12 pagesBodie10ce SM CH19beadand1No ratings yet

- Brought To YouDocument35 pagesBrought To YouJoseph Mejia LaosNo ratings yet

- Ratio Analysis I. Profitability RatiosDocument4 pagesRatio Analysis I. Profitability RatiosEnergy GasNo ratings yet

- Financial Analysis Cheat Sheet 1709070577Document2 pagesFinancial Analysis Cheat Sheet 1709070577herrerofrutosNo ratings yet

- Problem 6-7: Asset Utilization Ratios Measure How Efficient A Business Is at Using Its Assets To Make MoneyDocument11 pagesProblem 6-7: Asset Utilization Ratios Measure How Efficient A Business Is at Using Its Assets To Make MoneyMinza JahangirNo ratings yet

- Roce - Discount Cash FlowDocument9 pagesRoce - Discount Cash FlowHyun KimNo ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisJuhi TiwariNo ratings yet

- 05fin221 spr08 Feb14Document11 pages05fin221 spr08 Feb14Sharath KumarNo ratings yet

- Attock Cement Ratio Analysis 2019 by RizwanDocument8 pagesAttock Cement Ratio Analysis 2019 by RizwanHayat budhoooNo ratings yet

- Tutorial 7 - (Solution) Analysis of Financial StatementsDocument4 pagesTutorial 7 - (Solution) Analysis of Financial StatementsSamer LaabidiNo ratings yet

- Abfm CH 8 Part 5Document5 pagesAbfm CH 8 Part 5leelavishnupriyaNo ratings yet

- Module 2 - Asset Based Valuation For Going Concern Opportunities Part 1Document2 pagesModule 2 - Asset Based Valuation For Going Concern Opportunities Part 1Marlou AbejuelaNo ratings yet

- Ratio Analysis SummaryDocument5 pagesRatio Analysis SummaryPhuoc TruongNo ratings yet

- Ans Key Ass 4 6Document7 pagesAns Key Ass 4 6JessaNo ratings yet

- Week 1 Minicase Computron Industries Members:: Current Assets Current Liability 2680000 1039800Document10 pagesWeek 1 Minicase Computron Industries Members:: Current Assets Current Liability 2680000 1039800Eve Grace SohoNo ratings yet

- Net Economic Value Added From Year To Year: Group 7Document17 pagesNet Economic Value Added From Year To Year: Group 7James Ryan AlzonaNo ratings yet

- Demo LeverageDocument18 pagesDemo LeverageIftikhar baigNo ratings yet

- Unit - 6 محاسبه اداريهDocument47 pagesUnit - 6 محاسبه اداريهsuperstreem.9No ratings yet

- FM AssignmentDocument7 pagesFM Assignmentkartika tamara maharaniNo ratings yet

- Breakeven AnalysisDocument7 pagesBreakeven AnalysisMohit SidhwaniNo ratings yet

- Performance Evaluation in Decentralized FirmsDocument27 pagesPerformance Evaluation in Decentralized FirmsXinjie MaNo ratings yet

- Chapter 19: Financial Statement AnalysisDocument11 pagesChapter 19: Financial Statement AnalysisSilviu TrebuianNo ratings yet

- TIFA CheatSheet MM X MLDocument10 pagesTIFA CheatSheet MM X MLCorina Ioana BurceaNo ratings yet

- Leverage: Analysis (Analysis Dan Implikasi Pengungkit)Document28 pagesLeverage: Analysis (Analysis Dan Implikasi Pengungkit)arigiofaniNo ratings yet

- Financial AnalysisDocument11 pagesFinancial AnalysisSlamet SetyowibowoNo ratings yet

- AB BANK PLC DUPONT ANAYLSIS Riyad FileDocument5 pagesAB BANK PLC DUPONT ANAYLSIS Riyad FilesonayemkNo ratings yet

- IFM11 Solution To Ch09 P11 Build A ModelDocument18 pagesIFM11 Solution To Ch09 P11 Build A ModelDiana SorianoNo ratings yet

- Ab Bank PLC Dupont AnaylsisDocument5 pagesAb Bank PLC Dupont AnaylsissonayemkNo ratings yet

- Notes On Ratio AnalysisDocument12 pagesNotes On Ratio AnalysisVaishal90% (21)

- (PDF) FinMan Cabrera SM (Vol1)Document22 pages(PDF) FinMan Cabrera SM (Vol1)Florie May SaynoNo ratings yet

- FM Chap 6 8 ProbsDocument41 pagesFM Chap 6 8 ProbsMychie Lynne Mayuga91% (11)

- AcctngWorks - Financial Ratio - Computation and InterpretationDocument3 pagesAcctngWorks - Financial Ratio - Computation and InterpretationyannaNo ratings yet

- Analysis of Financial Statements: S A R Q P I. QuestionsDocument22 pagesAnalysis of Financial Statements: S A R Q P I. QuestionsEstudyanteNo ratings yet

- Fa Cheat Sheet MM MLDocument8 pagesFa Cheat Sheet MM MLIrina StrizhkovaNo ratings yet

- Final Cheat Sheet FA ML X MM UpdatedDocument8 pagesFinal Cheat Sheet FA ML X MM UpdatedIrina StrizhkovaNo ratings yet

- Leverage AND TYPES of LeaverageDocument10 pagesLeverage AND TYPES of Leaveragesalim1321100% (2)

- Quick Reference To Managerial AccountingDocument2 pagesQuick Reference To Managerial AccountingAmilius San Gregorio100% (1)

- TOPIC 9 - Capital Structure and LeverageDocument28 pagesTOPIC 9 - Capital Structure and LeveragePhuong VuongNo ratings yet

- Formula For Ratio AnalysisDocument8 pagesFormula For Ratio AnalysiszainNo ratings yet

- Operating and Financial LeverageDocument31 pagesOperating and Financial LeveragebharatNo ratings yet

- 05 BEP and LeverageDocument30 pages05 BEP and LeverageAyushNo ratings yet

- Financial Analysis Final (Autosaved)Document159 pagesFinancial Analysis Final (Autosaved)sourav khandelwalNo ratings yet

- Assignment: Ratio AnalysisDocument8 pagesAssignment: Ratio AnalysisMahnoor MaqsoodNo ratings yet

- Chapter 12 - AnswerDocument22 pagesChapter 12 - AnswerLove FreddyNo ratings yet

- Corp RatiosDocument1 pageCorp RatiosVishal PaulNo ratings yet

- Bholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Document9 pagesBholu Baba Jamshedpur If Any Query Mail To (91) 9431757848 Why Fear When I Am Here.......Chirag MalhotraNo ratings yet

- FMFTutorialDocument7 pagesFMFTutorialJane liewNo ratings yet

- Cma Formula SheetDocument7 pagesCma Formula Sheetanushkamohanan0No ratings yet

- CMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionDocument7 pagesCMA FORMULA SHEET NEW SYLLABUS-Executive-RevisionGANESH KUNJAPPA POOJARINo ratings yet

- Evaluating A Firm's Financial Performance (Ratio Analysis)Document64 pagesEvaluating A Firm's Financial Performance (Ratio Analysis)numlit1984No ratings yet

- Financial Administration Exercises 1Document8 pagesFinancial Administration Exercises 1ScribdTranslationsNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Awais Safdar FeasDocument15 pagesAwais Safdar FeasawaissafdarNo ratings yet

- 3 8 12 Prof. Kalpesh GeldaDocument5 pages3 8 12 Prof. Kalpesh GeldaSaurabh UpadhyayNo ratings yet

- Jawaban 2a Cost AccDocument20 pagesJawaban 2a Cost AccPriscila SiskaNo ratings yet

- MLCF Annual Report 2014Document169 pagesMLCF Annual Report 2014M Umar FarooqNo ratings yet

- Summative Test (Fabm2)Document2 pagesSummative Test (Fabm2)Zybel RosalesNo ratings yet

- Audit Mcqs 150Document23 pagesAudit Mcqs 150Nikhil62% (26)

- Global Semi Trailer Sales Market Report 2017Document3 pagesGlobal Semi Trailer Sales Market Report 2017Shaun Martin0% (1)

- Chapter I Company ProfileDocument62 pagesChapter I Company ProfileSherlin DisouzaNo ratings yet

- Hilton CH 2 Select SolutionsDocument12 pagesHilton CH 2 Select SolutionsUmair AliNo ratings yet

- Mas-07: Responsibility Accounting & Transfer PricingDocument7 pagesMas-07: Responsibility Accounting & Transfer PricingClint AbenojaNo ratings yet

- Ratios - Group AssignmentDocument5 pagesRatios - Group AssignmentAmit ShuklaNo ratings yet

- 1) Introduce The Graph: Write at Least 150 WordsDocument7 pages1) Introduce The Graph: Write at Least 150 WordsSaomNo ratings yet

- Results Accountability - PPT NotesDocument72 pagesResults Accountability - PPT NotesEmma WongNo ratings yet

- RTP June 2018 QnsDocument14 pagesRTP June 2018 QnsbinuNo ratings yet

- CR Questions July 2015Document16 pagesCR Questions July 2015JianHao SooNo ratings yet

- Latihan 3.4Document6 pagesLatihan 3.4Amelia Fauziyah rahmahNo ratings yet

- Westlake Lanes Case AnalysisDocument10 pagesWestlake Lanes Case AnalysisTony JosephNo ratings yet

- Management Accounting Bms-Iii: Manjiri DigheDocument67 pagesManagement Accounting Bms-Iii: Manjiri Dighebhavivyas71No ratings yet

- Submitted By: Sibeesh Sreenivasan 200700091: Case Study: Continental AirlinesDocument45 pagesSubmitted By: Sibeesh Sreenivasan 200700091: Case Study: Continental AirlinesSibeeshCSree67% (6)

- Accounting Concepts and PrinciplesDocument2 pagesAccounting Concepts and PrinciplesAnne AlagNo ratings yet

- Ca5101 Adjusting Entries La 1Document13 pagesCa5101 Adjusting Entries La 1Michael MagdaogNo ratings yet

- Structure of The Tissex CompanyDocument7 pagesStructure of The Tissex CompanyZlatan Mehic100% (1)

- Individual Case Study Mazda: ACCT2158Document12 pagesIndividual Case Study Mazda: ACCT2158HieuNo ratings yet

- Accounting For Income TaxDocument26 pagesAccounting For Income TaxKelly Ng67% (6)

- Business: What Is Aggregator Business Model?Document6 pagesBusiness: What Is Aggregator Business Model?Jayesh FlimsNo ratings yet

- Acctg143 Finals 2019Document16 pagesAcctg143 Finals 2019Carlito B. BancilNo ratings yet

- CH 08 Return On Invested Capital and Profitability AnalysisDocument37 pagesCH 08 Return On Invested Capital and Profitability AnalysisHuong NguyenNo ratings yet

- CDP Jaitwara EnglishDocument376 pagesCDP Jaitwara EnglishCity Development Plan Madhya PradeshNo ratings yet

- PrakbiDocument195 pagesPrakbiTheresia TjiaNo ratings yet

- Advance Financial AccountingDocument37 pagesAdvance Financial AccountingDr. Kaustubh JianNo ratings yet