Professional Documents

Culture Documents

Sme Law

Uploaded by

Eyock PierreOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sme Law

Uploaded by

Eyock PierreCopyright:

Available Formats

LAW No.

·.Jf; 1 ["1./

-, ',' ,,';

r;~. (1 ~~

OF

-------

TO PROMOTE SMALL - AND MEDIUM - SIZED

ENTERPRISES IN CAMEROON

The National Assembly deliberated and

adopted, the President of the Republic hereby

enacts the law set out below:

CHAPTER I

GENERAL PROVISIONS

SECTION 1. - This law lays down general rules for the

promotion of small- and medium-sized enterprises, abbreviated

as "SMEs", in accordance with the Cameroon Investment

Charter.

SECTION 2.- (1) The SMEs governed by this law shall include:

very small enterprises (VSEs), small-sized enterprises (SEs)

and medium-sized enterprises (MEs).

(2) SMEs shall, from their inception and

depending on the number of permanent employees and

turnover, be registered in the National SME File in one of the

above-mentioned categories according to the procedure laid

down by regulation.

(3) The national file shall be a database listing

SMEs operating in Cameroon. It shall be kept by the Ministry in

charge of SMEs or any other body authorized to do so.

(4) Registration in the National SME File shall give

an entitlement 'to the benefits provided by State public

programmes for SMEs.

SECTION 3.- An SME shall be deemed to have been set up

when it fulfils the conditions for legal existence and the

formalities specified by the laws and regulations in force.

SECTION 4.- A very small enterprise, abbreviated as "VSE",

shall be an enterprise with no more than 5 (five) employees

and an annual pre-tax turnover of no. more than 15 (fifteen)

million CFA francs.

SECTION 5.- A small-sized enterprise, abbreviated as "SE",

shall be an enterprise with 6 (siX) to 20 (twenty) employees

and an annual pre-tax turnover of more than 15 (fifteen)

million CFA francs and less than 100 (one hundred)million CFA

francs.

SECTION 6. - A medium-sized enterprise, abbreviated as "'ME",

shall be an enterprise with 21 (twenty-one) to 100 (one

hundred) employees and an annual pre-tax turnover of more

2

than 100 (one hundred) million CFA francs and less than

Ibillion CFA francs.

SECTION 7 .- In case of difficulty classifying an enterprise in

one of the categories listed in Sections 3, 4 and 5 above, the

main criterion considered,shall be the annual pre-tax turnover.

SECTION 8. - The national SME promotion policy shall be

centred on providing start-up support, incubation, development

and financing of SMEs.

CHAPTER II

SME START-UP

SECTION 9.- SME start-up support shall entail :

- streamlining of procedures;

- establishment of a one-stop shop for the fulfilment of

administrative formalities for starting SMEs;

- reduction of timelines for starting SMEs;

- provision of information on investment opportunities;

. dissemination of the corporate culture in SMEs;

- multiform assistance to SME promoters.

SECTION 10.- (1) The procedures for supporting start-ups

shall comply with the laws in force.

(2) The time-frames for setting up of SMEs, as

well as procedures for the establishment of the one-stop shop

for SME start-up administrative formalities shall be defined by

decree.

CHAPTER III

SME INCUBATION

SECTION 11.- (1) SME incubation shall be a specific strategy

for supporting the setting up of SMEs to disseminate the

corporate culture and support budding entrepreneurs in all

operations required to build their capacities, project ideas and

initiatives.

(2) Incubation shall take place in the structures

provided for that purpose and in line with the national

programme defined by the Ministry in charge of SMEs.

3

SECTION 12. - (1) SME incubation structures shall be

responsible for the' reception, training and support of

enterprises less than 5(five) years old.

(2) Their role shall be to:

b support SME promoters;

.. identify the entrepreneurial potentials of SMEs

and develop the skills of their promoters;

.. help SMEs to set up networks of effective

relations;

.. acquaint SMEs with business opportunities

and advisory services;

.. enable SME promoters to witness the actual

business world.

SECTION 13.- (1) SME incubation structures may be public or

private.

(2) Private incubation structures shall be

approved by the Ministry in charge of SMEs.

(3) Public incubation structures shall forge

partnerships with the Ministry in charge of SMEs.

(4 J Enterprise incubators shall have access to

econorij,ic activity zones set up by regional and local authorities

or developed for that purpose by public bodies.

SECTION 14.- The functions of SME incubation structures shall

be discharged under conditions laid down by regulation.

CHAPTER IV

SME DEVELOPMENT SUPPORT

SECTION 15.- (1) Support to the development of SMEs shall

be all the actions and resources contributing to the

improvement of SME performances and competitiveness on

domestic and international markets.

(2) It shall be provided through:

," general support;

.. specific support;

.. facilitation;

.. upgrading.

SECTION 16. - General support shall include, besides the

measures provided by the Investment Charter, all other

technical, financial and managerial measures that may be taken

for the benefit of enterprises, excepting for the benefits defined

by special regimes.

SECTION 17.- (1) Specific support shall seek to build capacities

of some SMEs in strategic or social sectors, as well as SMEs

promoting scientific and technical research results.

(2) The conditions for general and specific

support shall be laid down by regulation.

SECTION 18.- Facilitation shall seek to ease SME access to

financing, technical and technological innovations, modern

management methods and various resources intended for their

development.

SECTION 19. - (1) The upgrading of SMEs shall be an ongoing

process of promoting SMEs to enhance their competitiveness and

performance by building their production, organization and

managerial capacities, in keeping with the standards in force in

the sector.

~ (2) SMEs shall be upgraded by the Ministry in

charge of SMEs, through programmes conducted by Trades

Chambers, bodies approved to do so, or development partners.

SECTION 20. - Upgrading shall be reserved for SMEs having a

strong growth potential or operating in strategic sectors.

SECTION 21.- SMEs included in the upgrading programme may

enjoy special financial support for the·implementation of their

tangible and/or intangible investments as well as the

restructuring of their management.

SECTION 22.- SMEs may,· within the framework of the

application of their upgrading plan, benefit from tax and

customs incentives, as well as various facilities provided for by

the investment support regulations in force.

SECTION 23.- The organization of SME upgrading activities as

well as conditions for the intervention of public authorities,

approved bodies and development partners shall be laid down by

regulation. .

SECTION 24.- The State shall contribute to SME development

by putting in place a quota system for awarding public contracts

on a priority basis to SMEs in line with its international

commitments.

SECTION 25.- (1) State support to SME development may be

enhanced through special support programmes under conditions

defined by contract with major public, semi-public and private

sector enterprises or regional and local authorities.

(2) Accordingly, incentives for subcontracting

may be put in place for SMEs operating nationwide and/or

specific partnerships.

SECTION 26.- Regional and local authorities and public

development programmes contributing to SME promotion may,

to that end, forge partnerships with the Ministry in charge of

SMEs.

SECTtbN 27.- (1) An SME promotion Agency is hereby set up

for SME promotion and facilitation.

(2) The organization and functioning of the SME

Promotion Agency shall be laid down by decree of the President

of the Republic.

CHAPTER V,

SME FINANCING SUPPORT

SECTION 28.- (1) The State, Regional and Local Authorities,

development partners or any approved body may provide

support for the financing of SMEs.

(2) Regional and Local Authorities and

development partners shall provide support in keeping with the

agreements and conventions signed to that end.

SECTION 29.- Public authorities shall promote SME access to

financing by:

.. sett;ing up special bodies and/or programmes tailored to

SME financing needs;

.. formulating incentive laws or regulations to encourage

the financial system to provide support to SMEs ;

.. supporting the setting up of institutions specializing in

SME financing.

SECTION 30.- (1) The State shall, in collaboration with

banking and financial institutions, facilitate SME access to

financing.

(2) The State shall help put in place bodies or

venture capital or specific assistance lines to finance SME

investments.

SECTION 31.- Leasing and mutual guarantee establishments,

mutual funds, guarantee funds and regional financing

institutions may be set up to finance SMEs under conditions laid

down by decree ..

SECTi'tlN 32.- (1) To sustain SME support and development

financing, and SME sector incubation and modernization

operations, an earmarked account known as "SME Promotion

Fund" shall be opened at the Treasury.

(2) The resources of the SME Promotion Fund,

whose ceiling shall be fixed annually by the finance law, shall

be derived from:

.. sundry State contributions;

.. funds obtained from international cooperation;

.. any other resources authorized by the finance law under

SME promotion.

SECTION 33.- The conditions of the functioning and

intervention of the SME Promotion Fund shall be laid down by

regulation.

SECTION 34.- Approved SME management centres shall

provide accounting and tax management assistance to SMEs in

accordance with the regulations in force.

CHAPTER VI

SME MERGERS

SECTION 35.- (1) SMEs may freely merge by sector, activity

or sub-sector, in accordance with the laws and regulations in

force.

(2) Such mergers may be carried out on a

regional basis

SECTION 36.- SME mergers that have been set up legally shall

be entered in the National SME Database.

SECTION 37.-SME mergers may be given special treatment.

As such, they may be given priority in State support under

partnership established for SME development.

CHAPTER VII

SME REPRESENTATION

SECTION 38.- SME mergers entered in the National SME

Database shall represent their members among public

authorities or Trades Chambers.

SECTION 39.- To defend the interests of their members or

branch of activity, SME mergers may forge partnership with

Trades Chambers as well as Regional and Local Authorities.

SECTION 40.- The Chamber of Commerce, Industry, Mines

and Handicrafts shall represent SMEs operating in the

commercial, industrial, mining and handicrafts sectors, in

accordance with the regulations in force.

SECTION 41.- The Chamber of Agriculture, Fisheries, Livestock

and forestry shall represent SMEs operating in the agro-

forestry, forestry and fisheries sectors, in accordance with the

regulations in force.

CHAPTER VII

OBLIGATIONS OF SMEs

SECTION 42.- (1) SMEs and SME mergers governed by this

law must fulfil their legal obligationsr in particularr fiscalr

corporate and financial obligations,

(2) The said obligations shall be to:

- keep regular and reliable accounts in accordance with

the system in force ;

• duly file their annual tax returns;

inform the Ministry in charge of SMEs in the event of

transferr discontinuance of business or bankruptcy;

• carry out their investment programmes in accordance

with this law;

· open a current account in a banking, micro-credit or

post office institution;

• allow the competent authorities of the Ministry in charge

of SMEs to control their functioning and use of the

benefits granted them;

· pay their social security taxes and employers'

contributions.

~

SECTION 43.- (1) SMEs and SME mergers operating in

violation of the legal obligations in force may not benefit from

the promotion measures provided for by this law.

SECTION 44.- SMEs and SME mergers enjoying public

assistance and support may, in case of need, be audited by one

or several auditors or any other structure designated for that

purpose.

CHAPTER IX

PENALTIES AGAINST SMEs

SECTION 45.- (1) Without prejudice to the statutory penalties

in force, any defaulting SME enjoying public assistance and

support that violate any of the obligations referred to above

shall be liable to one of the following penalties :

.. temporary suspension of assistance and support for no

more than 6 (six) months;

.. forfeiture of assistance or guarantee provided by a

financing institution.

(2) The penalties provided for in sub-section

(1) above shall be inflicted by the Minister in charge of SMEs,

SECTION 46.- (1) A warning shall be a written admonition

addressed to a defaulting SME by the Ministry in charge of

SMEs requiring it to fulfil its obligations in accordance with the

instruments in force and commitments made.

(2) A written warming shall be issued where,

following control, it is established that an SME receiving public

assistance and support is not fulfilling its obligations.

SECTION 47.- (1) The temporary suspension of public

assistance and support shall be a temporary stoppage of the

promotion of a defaulting SME, for not more than 6 (six)

months, to cause it to fulfil its obligations.

(2) Temporary suspension shall be

pronounced where an SME enjoying public assistance and

support sanctioned with a written warning, fails to fulfil the

obligations for which it was reprimanded after 3 (three)

months.

SECTIQN 48.- Any defaulting SME may, by petition, request to

be rehabilitated by the competent authority once the flaws that

caused temporary suspension have been corrected.

SECTION 49.- (1) The forfeiture of assistance and guarantee

prOVided by a funding body shall be the loss of entitlement to

assistance and support.

(2) Forfeiture shall be pronounced when an SME

enjoying public assistance and support that has been

suspended temporarily fails to continue fulfilling its obligations

after 6 (six) months.

SECTION 50.- Defaulting SMEs sanctioned by forfeiture may

be rehabilitated by the competent authority only after fulfilling

their obligations before the expiry of a period of 5 (five) years.

CHAPTER X

FINAL PROVISIONS

SECTION 51.- (1) The Minister in charge of SMEs shall submit an

evaluation report on the implementation of the SME promotion

policy annually to the Prime Minister, Head of Government who

shall be in charge of its popularisation.

(2) A copy of the report provided for in sub-

section (1) above shall be forwarded to the Presidency of'the

Republic.

SECTION 52.~ All previous provisions repugnant to this law are .

hereby repealed.

SECTION 53.- This law shall be registered, published according to

the procedure of urgency and inserted in the Official Gazette in

English and French.

YAOUNDE, 11 3 AVR ')n10

A

E REPUBLIC

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Startup Fundraising 101Document15 pagesStartup Fundraising 101Bernard Moon100% (5)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Introduction To Global Investment Banking - Merrill LynchDocument28 pagesIntroduction To Global Investment Banking - Merrill LynchAlexander Junior Huayana Espinoza100% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- David H Friedman I Bet You ThoughtDocument36 pagesDavid H Friedman I Bet You Thoughtncwazzy100% (3)

- English 4 IT. Praktyczny Kurs Języka Angielskiego Dla Specjalistów IT I Nie Tylko PDFDocument283 pagesEnglish 4 IT. Praktyczny Kurs Języka Angielskiego Dla Specjalistów IT I Nie Tylko PDFFranciszek Franko100% (4)

- Fin 3403 Review 2 (ch5,6,7)Document20 pagesFin 3403 Review 2 (ch5,6,7)MichaelFraserNo ratings yet

- Mini Steel Plant 790699Document57 pagesMini Steel Plant 790699Eyock PierreNo ratings yet

- Employee Communication EffectivenessDocument118 pagesEmployee Communication EffectivenessRaja Reddy100% (1)

- Q3F - Investment in Associate - 2ndsem 2019-202Document6 pagesQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- Role of Local Government in Promotion of TourismDocument17 pagesRole of Local Government in Promotion of Tourismhayat_shaw100% (5)

- CH 3 Bus Envt Hsstimes SlideDocument63 pagesCH 3 Bus Envt Hsstimes Slidedhaanya goelNo ratings yet

- Sawyers - Introduction To Managerial AccountingDocument29 pagesSawyers - Introduction To Managerial AccountingTrisha Mae AlburoNo ratings yet

- Crown Cork and SealDocument33 pagesCrown Cork and SealRena SinghiNo ratings yet

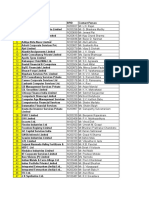

- 35 110 HwcpresentationactualDocument43 pages35 110 HwcpresentationactualEyock PierreNo ratings yet

- 2017 Effective Project Management in Steel IndustryDocument9 pages2017 Effective Project Management in Steel IndustryEyock PierreNo ratings yet

- A Project Report OnDocument54 pagesA Project Report OnEyock PierreNo ratings yet

- Determinants of Working Capital Investment: A Study of Malaysian Public Listed FirmsDocument25 pagesDeterminants of Working Capital Investment: A Study of Malaysian Public Listed FirmsEyock PierreNo ratings yet

- Shimizu Corporation: Company ProfileDocument6 pagesShimizu Corporation: Company ProfileEyock PierreNo ratings yet

- ( - ) PROJECT Design-Build Contract Term SheetDocument26 pages( - ) PROJECT Design-Build Contract Term SheetEyock PierreNo ratings yet

- 2ndarticle COUNTRYREPORT CameroonHCSDocument16 pages2ndarticle COUNTRYREPORT CameroonHCSEyock PierreNo ratings yet

- Primary Health Care Systems (Primasys) : Case Study From CameroonDocument16 pagesPrimary Health Care Systems (Primasys) : Case Study From CameroonEyock PierreNo ratings yet

- Project Information Memorandum: Medica Synergie Private LimitedDocument41 pagesProject Information Memorandum: Medica Synergie Private LimitedEyock PierreNo ratings yet

- Name of Project Milk Processing Plant-DhekiajuliDocument1 pageName of Project Milk Processing Plant-DhekiajuliEyock PierreNo ratings yet

- Development and Upgrading of Public Primary Healthcare Facilities With Essential Surgical Services Infrastructure - A Strategy Towards Achieving Universal Health Coverage in TanzaniaDocument14 pagesDevelopment and Upgrading of Public Primary Healthcare Facilities With Essential Surgical Services Infrastructure - A Strategy Towards Achieving Universal Health Coverage in TanzaniaEyock PierreNo ratings yet

- Infrastructure Costs in HospitalsDocument9 pagesInfrastructure Costs in HospitalsEyock PierreNo ratings yet

- Name of Project Spices Park For Ginger and Turmeric ProcessingDocument1 pageName of Project Spices Park For Ginger and Turmeric ProcessingEyock PierreNo ratings yet

- Setting Up Polytechnics PDFDocument1 pageSetting Up Polytechnics PDFEyock PierreNo ratings yet

- Name of Project Engineering College at NalbariDocument1 pageName of Project Engineering College at NalbariEyock PierreNo ratings yet

- Name of Project Industrial Growth Centre (IGC), Balipara, SonitpurDocument1 pageName of Project Industrial Growth Centre (IGC), Balipara, SonitpurEyock PierreNo ratings yet

- Name of Project Setting Up of Handloom Production Unit at HPC, DhemajiDocument1 pageName of Project Setting Up of Handloom Production Unit at HPC, DhemajiEyock PierreNo ratings yet

- Name of Project Operation of Freight FerryDocument1 pageName of Project Operation of Freight FerryEyock PierreNo ratings yet

- Name of Project Pig Processing Plant and FarmDocument1 pageName of Project Pig Processing Plant and FarmEyock PierreNo ratings yet

- ProgressionsDocument55 pagesProgressionsbrana456No ratings yet

- Bing Crosby Minute Maid Corp V EatonDocument4 pagesBing Crosby Minute Maid Corp V EatonCarlo MercadoNo ratings yet

- Romania Tax Summaries 2014 2015 PDFDocument70 pagesRomania Tax Summaries 2014 2015 PDFMariusMartonNo ratings yet

- Body Power CaseDocument7 pagesBody Power Casekewlkewl123No ratings yet

- Home Price Indices DefineDocument2 pagesHome Price Indices DefineanandubeyNo ratings yet

- Kathmandu Financial Group Case Study AnalysisDocument7 pagesKathmandu Financial Group Case Study Analysisjayan_unnithan2265No ratings yet

- Pure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECDocument25 pagesPure Jump Lévy Processes For Asset Price Modelling: Professor of Finance University Paris IX Dauphine and ESSECBob ReeceNo ratings yet

- Post Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesDocument6 pagesPost Graduate Diploma in Management: Narsee Monjee Institute of Management StudiesprachiNo ratings yet

- Accounting For Managers PurdueDocument6 pagesAccounting For Managers PurdueEy ZalimNo ratings yet

- Mission Australia Annual Report 2011Document68 pagesMission Australia Annual Report 2011Gaurav NaharNo ratings yet

- Deposite Position of Nabil Bank LimitedDocument24 pagesDeposite Position of Nabil Bank LimitedYoung Visionaries100% (2)

- Module - 4 Money Market & Capital Market in IndiaDocument11 pagesModule - 4 Money Market & Capital Market in IndiaIshan GoyalNo ratings yet

- Finance - United UtilitiesDocument4 pagesFinance - United UtilitiesRohit DhoundiyalNo ratings yet

- PRC2019 FSDocument4 pagesPRC2019 FSDonaldDeLeonNo ratings yet

- Alternative Investment2Document39 pagesAlternative Investment2kenNo ratings yet

- India's Biggest Project Dholera ProjectDocument6 pagesIndia's Biggest Project Dholera Projectkishan prajapatiNo ratings yet

- Advanced Financial Accounting and Reporting - TOSDocument5 pagesAdvanced Financial Accounting and Reporting - TOSAllen GonzagaNo ratings yet

- Homework - Set - Solutions Finance 2.2 PDFDocument18 pagesHomework - Set - Solutions Finance 2.2 PDFAnonymous EgWT5izpNo ratings yet

- Contact Details of RTAsDocument18 pagesContact Details of RTAsmugdha janiNo ratings yet