Professional Documents

Culture Documents

BR Fee Table 2019

Uploaded by

angel perezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

BR Fee Table 2019

Uploaded by

angel perezCopyright:

Available Formats

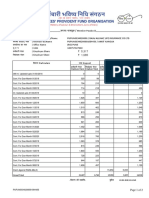

稅務局 Inland Revenue Department

商業登記費及徵費收費表 Business Registration Fee and Levy Table

收費基準

商業登記證分一年有效期及三年有效期兩種,除經一站式公司註冊及商業登記服務成立的本地公司外,應繳金額以登記證的開始生效日釐訂。對於非本地公司新

開業務,其首張登記證的開始生效日期是有關業務的開業日期,不是申請商業登記或分行登記日期。

於一站式公司註冊及商業登記服務下成立的本地公司,其首張商業登記證的應繳金額是以其向公司註冊處提出相關的成立法團遞呈日期釐訂,而該登記證的開始

生效日期是它的註冊日期。至於其後發出的續證,應繳金額則以續證的開始生效日釐訂。

Basis of charge

There are two types of business registration certificate, namely 1-year certificate and 3-year certificate. Except for the first registration certificate of local companies falling

within the one-stop company and business registration, the amount payable under a certificate depends on the commencement date of the registration certificate. For a new

business other than a local company, the commencement date of its first registration certificate is its date of commencement of business, not the date of application for

business or branch registration.

For local companies falling within the one-stop company and business registration, the amount payable for the first registration certificate depends on the date of making the

related incorporation submission to the Companies Registry and the commencement date of the registration certificate is the date of incorporation. For renewal of certificates,

the amount payable is determined by reference to the commencement date of the relevant renewal certificate.

商業登記證 Business Registration Certificate 分行登記證 Branch Registration Certificate

日期 一年證 1-year certificate 三年證 3-year certificate 一年證 1-year certificate 三年證 3-year certificate

Date 登記費 徵費 總數 登記費 徵費 總數 登記費 徵費 總數 登記費 徵費 總數

Fee Levy Total Fee Levy Total Fee Levy Total Fee Levy Total

$ $ $ $ $ $ $ $ $ $ $ $

2019 年 4 月 1 日或以後

0 250 250 3,200 750 3,950 0 250 250 116 750 866

on or after 1 April 2019

01.04.2017 – 31.03.2019 2,000 250 2,250 5,200 750 5,950 73 250 323 189 750 939

01.04.2016 – 31.03.2017 0 250 250 3,200 750 3,950 0 250 250 116 750 866

01.04.2014 – 31.03.2016 2,000 250 2,250 5,200 750 5,950 73 250 323 189 750 939

19.07.2013 – 31.03.2014 0 250 250 3,200 750 3,950 0 250 250 116 750 866

01.04.2012 – 18.07.2013 0 450 450 3,200 1,350 4,550 0 450 450 116 1,350 1,466

01.08.2011 – 31.03.2012 2,000 450 2,450 5,200 1,350 6,550 73 450 523 189 1,350 1,539

01.08.2009 – 31.07.2011 0 450 450 3,200 1,350 4,550 0 450 450 116 1,350 1,466

You might also like

- D. Michael Quinn-Same-Sex Dynamics Among Nineteenth-Century Americans - A MORMON EXAMPLE-University of Illinois Press (2001)Document500 pagesD. Michael Quinn-Same-Sex Dynamics Among Nineteenth-Century Americans - A MORMON EXAMPLE-University of Illinois Press (2001)xavirreta100% (3)

- Rent Ledger YEVDocument1 pageRent Ledger YEVRobert KeyNo ratings yet

- Things in The Classroom WorksheetDocument2 pagesThings in The Classroom WorksheetElizabeth AstaizaNo ratings yet

- Complete Cocker Spaniel Guide 009 PDFDocument119 pagesComplete Cocker Spaniel Guide 009 PDFElmo RNo ratings yet

- 稅務局 Inland Revenue Department: Business Registration Fee and Levy TableDocument1 page稅務局 Inland Revenue Department: Business Registration Fee and Levy Table彭黑郎No ratings yet

- BR FeeDocument1 pageBR FeeNiqueNo ratings yet

- Brfee TableDocument1 pageBrfee Tablecsl K360No ratings yet

- Guideline On Fees For Audits Done On Behalf of The Auditor-GeneralDocument5 pagesGuideline On Fees For Audits Done On Behalf of The Auditor-GeneralGavin HenningNo ratings yet

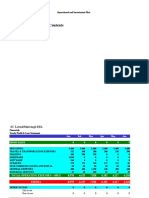

- Schwinn 12 Month Cash FlowDocument2 pagesSchwinn 12 Month Cash Flowrozav13No ratings yet

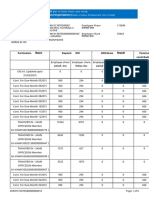

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer Sharetejas bavkarNo ratings yet

- Book 1Document17 pagesBook 1HanneleyNo ratings yet

- Bsbfin601 A2Document8 pagesBsbfin601 A2Kitpipoj PornnongsaenNo ratings yet

- GNRTK00205010000000078 NewDocument12 pagesGNRTK00205010000000078 NewMithlesh YadavNo ratings yet

- The Happy Giraffe Budget Spreadsheet 2023 7 2Document120 pagesThe Happy Giraffe Budget Spreadsheet 2023 7 2Raheem BanguraNo ratings yet

- Statement of Account Summary: Social Security SystemDocument2 pagesStatement of Account Summary: Social Security SystemMaria Isabelle RiveraNo ratings yet

- Employment Income TaxDocument5 pagesEmployment Income TaxYehualashet MekonninNo ratings yet

- Statement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Document1 pageStatement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Ankit VermaNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6Document3 pagesRevised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6GwenNo ratings yet

- Mashin TaxDocument6 pagesMashin TaxSharavkhorol ErdenebayarNo ratings yet

- DOCS2Document1 pageDOCS2Office OfficeNo ratings yet

- Servicentro Arequipa S.R.L.: Registro de Compras Del Mes de Abril SolesDocument2 pagesServicentro Arequipa S.R.L.: Registro de Compras Del Mes de Abril SolesMiguel Flores CornejoNo ratings yet

- THTHA02040910000013386 NewDocument3 pagesTHTHA02040910000013386 NewMR ANIkETNo ratings yet

- THTHA02040910000013386 NewDocument3 pagesTHTHA02040910000013386 NewMR ANIkETNo ratings yet

- Deuda CoactivaDocument2 pagesDeuda CoactivaJUAN CARLOS AGUILAR LOAYZANo ratings yet

- Confirmation Certificate For Sales Tax FormatDocument1 pageConfirmation Certificate For Sales Tax FormatAazmi KhanNo ratings yet

- Particulars िववरण Deposit जमा Withdraw िनकासी Pension contribution पेंशन अंशदानDocument3 pagesParticulars िववरण Deposit जमा Withdraw िनकासी Pension contribution पेंशन अंशदानSandeepNairNo ratings yet

- MH Ban 00354150000286272Document3 pagesMH Ban 00354150000286272faizmohammad0502No ratings yet

- MRNOI00400090000013191Document2 pagesMRNOI00400090000013191Ramesh MishraNo ratings yet

- Arrears Report From Overdue 3-MONTHS To 9999-MONTHS: Bike Station Sendirian BerhadDocument10 pagesArrears Report From Overdue 3-MONTHS To 9999-MONTHS: Bike Station Sendirian BerhadHelang Bike StationNo ratings yet

- Trade Limit FeaturesDocument53 pagesTrade Limit FeaturesDIKSASINDO Syafira NurfaIzahNo ratings yet

- CASHFLOW PROJECTS-Frognal TRDDocument5 pagesCASHFLOW PROJECTS-Frognal TRDIsaac MangochiNo ratings yet

- District Insurance Office: East Godavari: Financial Year: 2014-2015Document1 pageDistrict Insurance Office: East Godavari: Financial Year: 2014-2015Gowtham KanukolanuNo ratings yet

- 3.2 Financial PlanDocument6 pages3.2 Financial PlanMerca Rizza SolisNo ratings yet

- October 2016 EIS Tables 8.1-8.5 PDFDocument5 pagesOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNo ratings yet

- October 2016 EIS Tables 8.1-8.5 PDFDocument5 pagesOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNo ratings yet

- October 2016 EIS Tables 8.1-8.5 PDFDocument5 pagesOctober 2016 EIS Tables 8.1-8.5 PDFKelvin MgigaNo ratings yet

- India Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Document4 pagesIndia Post Payments Bank Limited Income Tax Computation For The Financial Year 2019-2020Swati Rohan JadhavNo ratings yet

- DSNHP00188740000012998 NewDocument2 pagesDSNHP00188740000012998 NewMuhammad Sajid Abdulgani JambagiNo ratings yet

- Ea - 2 2 02 0202020202020202020202Document41 pagesEa - 2 2 02 0202020202020202020202Loydifer ..No ratings yet

- Withholding TaxDocument46 pagesWithholding TaxDura LexNo ratings yet

- 002325200037530Document2 pages002325200037530Anil PuvadaNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDawood KhanNo ratings yet

- 04handout2 CostAcctgRecitationDocument3 pages04handout2 CostAcctgRecitationDummy GoogleNo ratings yet

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDocument2 pagesLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareAnkit KanojiaNo ratings yet

- DownloadDocument3 pagesDownloadjaison josephNo ratings yet

- Particulars िववरण Deposit जमा Withdraw िनकासी Pension contribution पेंशन अंशदानDocument6 pagesParticulars िववरण Deposit जमा Withdraw िनकासी Pension contribution पेंशन अंशदानRame eshaNo ratings yet

- Salary Structure CalculatorDocument6 pagesSalary Structure CalculatorNawaz AhmedNo ratings yet

- Presentashon Setar Reforma Fiscal 2019-Fase 1Document12 pagesPresentashon Setar Reforma Fiscal 2019-Fase 1Christopher MaduroNo ratings yet

- Financial Services Co BudgetsDocument113 pagesFinancial Services Co BudgetsTheodor BondocNo ratings yet

- 216-2001 (PLG) Settlement of Overdue NCL in Simple InterestDocument4 pages216-2001 (PLG) Settlement of Overdue NCL in Simple InterestArun JerardNo ratings yet

- Servicentro Arequipa S.R.L.: Registro de Compras Del Mes de Abril SolesDocument1 pageServicentro Arequipa S.R.L.: Registro de Compras Del Mes de Abril SolesMiguel Flores CornejoNo ratings yet

- DSNHP00200200000013109 NewDocument11 pagesDSNHP00200200000013109 Newtumpa mandalNo ratings yet

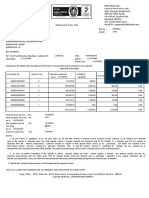

- This Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is RequiredDocument1 pageThis Bill Is Net of Earlier Adjustment in Previous Advice. This Is A Computer Generated Payment Advice, Hence No Signature Is Requiredtapas kumar biswalNo ratings yet

- Agency Description HSL AgencyDocument40 pagesAgency Description HSL AgencyHazraphine LinsoNo ratings yet

- Tap 2021Document2 pagesTap 2021PCS COMPANYNo ratings yet

- Tps Parli: Pay Fixation Arrears: Apr-2018 To Sep-2018Document1 pageTps Parli: Pay Fixation Arrears: Apr-2018 To Sep-2018Rajesh SirsathNo ratings yet

- 40.youth IntegrateDocument2 pages40.youth Integratekhanty chantakeutNo ratings yet

- Master of Education ECE LocalDocument2 pagesMaster of Education ECE LocalSilah JamesNo ratings yet

- InfosysDocument6 pagesInfosysAmisha ShrivastavNo ratings yet

- PF No: BG/BNG/0035224/000/1203501 EPS-95 No: BG/BNG/0035224/000/1203501Document1 pagePF No: BG/BNG/0035224/000/1203501 EPS-95 No: BG/BNG/0035224/000/1203501Avinash DhumalNo ratings yet

- Your Account SummaryDocument4 pagesYour Account SummaryZackNo ratings yet

- Interest CertificateDocument1 pageInterest CertificateKishan cpNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- E-Governance Horizon Report 2007 PDFDocument240 pagesE-Governance Horizon Report 2007 PDFtouhedurNo ratings yet

- Astm C1898 20Document3 pagesAstm C1898 20Shaik HussainNo ratings yet

- 12-Zoomlion 70t Crawler Crane Specs - v2.4Document2 pages12-Zoomlion 70t Crawler Crane Specs - v2.4Athul BabuNo ratings yet

- Skylab Our First Space StationDocument184 pagesSkylab Our First Space StationBob AndrepontNo ratings yet

- 7 кмжDocument6 pages7 кмжGulzhaina KhabibovnaNo ratings yet

- Baybay - Quiz 1 Code of EthicsDocument2 pagesBaybay - Quiz 1 Code of EthicsBAYBAY, Avin Dave D.No ratings yet

- Anglicisms in TranslationDocument63 pagesAnglicisms in TranslationZhuka GumbaridzeNo ratings yet

- 1907 EMarketer GEN XDocument16 pages1907 EMarketer GEN XRodolfo CampaNo ratings yet

- Task Performance Valeros Roeul GDocument6 pagesTask Performance Valeros Roeul GAnthony Gili100% (3)

- Adobe Scan Sep 06, 2023Document1 pageAdobe Scan Sep 06, 2023ANkit Singh MaanNo ratings yet

- Guidebook On Mutual Funds KredentMoney 201911 PDFDocument80 pagesGuidebook On Mutual Funds KredentMoney 201911 PDFKirankumarNo ratings yet

- Surefire Hellfighter Power Cord QuestionDocument3 pagesSurefire Hellfighter Power Cord QuestionPedro VianaNo ratings yet

- Thick Teak PVT LTD Aoa and MoaDocument17 pagesThick Teak PVT LTD Aoa and MoaVj EnthiranNo ratings yet

- Chapter 14ADocument52 pagesChapter 14Arajan35No ratings yet

- Novi Hervianti Putri - A1E015047Document2 pagesNovi Hervianti Putri - A1E015047Novi Hervianti PutriNo ratings yet

- Deep MethodDocument13 pagesDeep Methoddarkelfist7No ratings yet

- Use Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)Document7 pagesUse Reuse and Salvage Guidelines For Measurements of Crankshafts (1202)TASHKEELNo ratings yet

- GMAT Sentence Correction Practice Test 03Document5 pagesGMAT Sentence Correction Practice Test 03krishnachivukulaNo ratings yet

- Didhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersDocument20 pagesDidhard Muduni Mparo and 8 Others Vs The GRN of Namibia and 6 OthersAndré Le RouxNo ratings yet

- Chap6 Part1Document15 pagesChap6 Part1Francis Renjade Oafallas VinuyaNo ratings yet

- Kangaroo High Build Zinc Phosphate PrimerDocument2 pagesKangaroo High Build Zinc Phosphate PrimerChoice OrganoNo ratings yet

- Determination of Physicochemical Pollutants in Wastewater and Some Food Crops Grown Along Kakuri Brewery Wastewater Channels, Kaduna State, NigeriaDocument5 pagesDetermination of Physicochemical Pollutants in Wastewater and Some Food Crops Grown Along Kakuri Brewery Wastewater Channels, Kaduna State, NigeriamiguelNo ratings yet

- Three Categories of AutismDocument14 pagesThree Categories of Autismapi-327260204No ratings yet

- Lunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Document2 pagesLunch Hour Meetings: Kiwanis Mission:: - Officers & Directors, 2018-2019Kiwanis Club of WaycrossNo ratings yet

- Komatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop ManualDocument20 pagesKomatsu Hydraulic Excavator Pc290lc 290nlc 6k Shop Manualmallory100% (47)

- Music 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Document4 pagesMusic 10: 1 Quarterly Assessment (Mapeh 10 Written Work)Kate Mary50% (2)