Professional Documents

Culture Documents

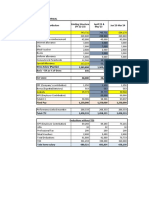

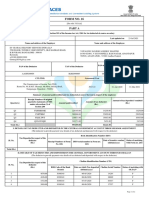

Statement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020

Uploaded by

Ankit VermaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020

Uploaded by

Ankit VermaCopyright:

Available Formats

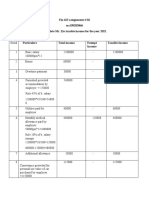

Statement showing Tax deducted without taking into A/c of interest & L.I.

C credit & others

for the year 2019-2020

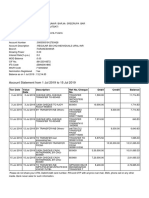

S. Pension for the month Amount Dearence Medical Total Tax Net Paid Remarks

n. of Payable Allowence Deducted

s

1. 03/2019 43808.00 3943.00 1000.00 48751.00 607.00 48144.00

Payable in April

2 D.A for JAN,FEB. & MARCH ------- 3945.00 ------- 3945.00 57.00 3888.00

2019

3 04/2019 43808.00 5257.00 1000.00 50065.00 950.00 49115.00

4 05/2019 43808.00 5257.00 1000.00 50065.00 950.00 49115.00

5 06/2019 43808.00 5257.00 1000.00 50065.00 950.00 49115.00

6 07/2019 43808.00 5257.00 1000.00 50065.00 950.00 48115.00

7 08/2019 43808.00 5257.00 1000.00 50065.00 950.00 49115.00

8 09/2019 43808.00 5257.00 1000.00 50065.00 950.00 49115.00

9 10/2019 43808.00 5257.00 1000.00 50065.00 950.00 49115.00

10 Arrear dues for 07/08/09/10 ----- 8764.00 ----- 8764.00 177.00 8587.00

i.e July,Aug,Sept& Oct

@2191x4

11 11/2019 43808.00 7447.00 1000.00 52255.00 1802.00 50453.00

12 12/2019 43808.00 7447.00 1000.00 52255.00 1802.00 50453.00

13 Arrear of enhanced pension 198753.00 ------- ------ 198753.00 29454.00 169299.00

upto Dec 2019 on 20th

Jan2020

14 01/2020 49530.00 8420.00 1000.00 58950.00 9137.00 49813.00

15 02/2020 49530.00 8420.00 1000.00 58950.00 9137.00 49813.00

16 Total

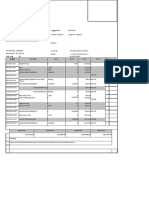

Notes:-1. Interst accrued to me has not been taken into Account because I being above 85 yrs of age it is from all means free

upto 50000/- under Section 194 A.

2. Jeevan Akshya policy No 53080512 every month credited Rs.200/- is Tax free

3. I C I C I Prudential Policy 20373631 for Charu Verma my Grand Daughter Which I do pay would automatically online be

taken on 31/10/2020 from my A/c no 10287403745 for which I shall get Tax-benefit under 80 C

You might also like

- Office of the Accountant General GPF statementDocument12 pagesOffice of the Accountant General GPF statementNani Gopal SahaNo ratings yet

- Martin Dow Marker Specialities (PVT) LimitedDocument2 pagesMartin Dow Marker Specialities (PVT) LimitedShan AhmadNo ratings yet

- Customer ID 2268769 Login History Realized GainsDocument1 pageCustomer ID 2268769 Login History Realized GainsNatarajan NallathambiNo ratings yet

- EMI Moratorium Non Arrer Letter M004200524 20200520Document3 pagesEMI Moratorium Non Arrer Letter M004200524 20200520SivaReddyNo ratings yet

- Mahabang Dahilig Senior High School Canteen Report August 2019-2020Document21 pagesMahabang Dahilig Senior High School Canteen Report August 2019-2020Roanne Anuran MendozaNo ratings yet

- Gujjaru Malini,: Date:19-05-2020 ToDocument2 pagesGujjaru Malini,: Date:19-05-2020 TogujjarugopikumareNo ratings yet

- Welcome LetterDocument3 pagesWelcome Letterhariharasudhan hariharasudhanNo ratings yet

- Ooccmkn01 PDFDocument1 pageOoccmkn01 PDFnnuuyy 22No ratings yet

- Directorate of Panchayats Thiruvananthapuram: Name Shri./Smt. P V BeenaDocument1 pageDirectorate of Panchayats Thiruvananthapuram: Name Shri./Smt. P V BeenaIsacjohnkurishinkalNo ratings yet

- Account statement for Siddharth ExportsDocument9 pagesAccount statement for Siddharth Exportssourav84No ratings yet

- PATNA ACCOUNT STATEMENTDocument1 pagePATNA ACCOUNT STATEMENTRAJU GUPTANo ratings yet

- Extrato de Conta de Clientes Completo: Data Saldo Crédito Débito Documento Desconto Dif. Arred. Dif. Cambio N.ºDocument2 pagesExtrato de Conta de Clientes Completo: Data Saldo Crédito Débito Documento Desconto Dif. Arred. Dif. Cambio N.ºFabiao Dos Santos PatrícioNo ratings yet

- BKU UANG INTERNAL BUKU KAS BUKUDocument10 pagesBKU UANG INTERNAL BUKU KAS BUKUpuskesmas picungNo ratings yet

- Customer PositionDocument10 pagesCustomer PositionSharif MahmudNo ratings yet

- PRAjv Py ER83 Z Iz FSDocument4 pagesPRAjv Py ER83 Z Iz FSvasanthaNo ratings yet

- EPF Passbook Details for Member SAJID ABDULGANI JAMBAGIDocument2 pagesEPF Passbook Details for Member SAJID ABDULGANI JAMBAGIMuhammad Sajid Abdulgani JambagiNo ratings yet

- Casa Detail IdDocument1 pageCasa Detail IdAero TiketNo ratings yet

- A Round Date Total Students Total Amount No of CollegeDocument2 pagesA Round Date Total Students Total Amount No of CollegeRamesh DeshmukhNo ratings yet

- Account Statement From 4 Apr 2019 To 5 Aug 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 4 Apr 2019 To 5 Aug 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceJatinder SinghNo ratings yet

- GuideDocument2 pagesGuideRAHUL SINGHNo ratings yet

- Account Statement From 1 Jul 2019 To 15 Jul 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jul 2019 To 15 Jul 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancetapasNo ratings yet

- Kuwait Finance House transaction historyDocument8 pagesKuwait Finance House transaction historyMohi UddinNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 08/11/2019Document2 pagesHDFC Bank LTD Repayment Schedule: Date: 08/11/2019YOGESH A NNo ratings yet

- Repayment PDFDocument2 pagesRepayment PDFYOGESH A NNo ratings yet

- HDFC Bank LTD Repayment Schedule: Date: 08/11/2019Document2 pagesHDFC Bank LTD Repayment Schedule: Date: 08/11/2019YOGESH A NNo ratings yet

- Date VCH Type Balance 01-12-2018 04-12-2018 04-01-2019 04-02-2019 04-03-2019 04-04-2019 04-05-2019 04-06-2019 21-06-2019 04-07-2019 04-08-2019 04-09-2019 04-10-2019Document2 pagesDate VCH Type Balance 01-12-2018 04-12-2018 04-01-2019 04-02-2019 04-03-2019 04-04-2019 04-05-2019 04-06-2019 21-06-2019 04-07-2019 04-08-2019 04-09-2019 04-10-2019సాయి కశ్యప్No ratings yet

- Kisenyi-Final Legit Accounts New FolderDocument1,494 pagesKisenyi-Final Legit Accounts New FolderKamoga RonaldNo ratings yet

- Adhe Nur AfdiDocument1 pageAdhe Nur Afdiel fitriana susantiNo ratings yet

- KARPIgcgg 6 G 5Document2 pagesKARPIgcgg 6 G 5Yoslan DamanikNo ratings yet

- Account StatementDocument1 pageAccount StatementKholisile50% (2)

- Welcome Letter PDFDocument3 pagesWelcome Letter PDFKRISHNA DAS0% (1)

- GVDCVXCDocument35 pagesGVDCVXCCuentas por PagarNo ratings yet

- Statement1502202012115828 PDFDocument8 pagesStatement1502202012115828 PDFMonishSachinNo ratings yet

- August 2019Document5 pagesAugust 2019Rajraj SarangiNo ratings yet

- Del Carmen Medical Clinic and Hospital IncDocument5 pagesDel Carmen Medical Clinic and Hospital IncElaine Ched AguilarNo ratings yet

- Date Transaction Description Chq/Ref. No Value Date Debit Amount Credit Amount Closing BalanceDocument5 pagesDate Transaction Description Chq/Ref. No Value Date Debit Amount Credit Amount Closing BalancerfdfasdfNo ratings yet

- AccountStatement-Fri Aug 09 15:57:43 GMT+05:00 2019Document1 pageAccountStatement-Fri Aug 09 15:57:43 GMT+05:00 2019BáçhàSháràrTìíNo ratings yet

- Suncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingDocument6 pagesSuncoast Account Statement: Access Your Account: Sunnet Online Banking Sunmobile App Suntel Phone BankingolaNo ratings yet

- Salary Statement - BOIDocument25 pagesSalary Statement - BOIabuNo ratings yet

- Check Voucher: 1/10/2020 Cash Meralco Bill For SeptemberDocument2 pagesCheck Voucher: 1/10/2020 Cash Meralco Bill For SeptemberLeizel Delos AngelesNo ratings yet

- Statement of Account: Tapo, Janrouel ADocument1 pageStatement of Account: Tapo, Janrouel AAnonymous iV7rq4jWNo ratings yet

- Bharat Sanchar Nigam Limited: (A Govt - of India Enterprise)Document1 pageBharat Sanchar Nigam Limited: (A Govt - of India Enterprise)herojit ngangbamNo ratings yet

- Laporan Transaksi Rekening BNI TaplusDocument2 pagesLaporan Transaksi Rekening BNI TaplusAramiko YPNo ratings yet

- Installment Schedule Document 82232731811Document2 pagesInstallment Schedule Document 82232731811Nining LisniawatiNo ratings yet

- Ledger Confirmation F.Y. 2019-20Document1 pageLedger Confirmation F.Y. 2019-20GaganDasPapaiNo ratings yet

- CONCILIACIONDocument7 pagesCONCILIACIONSuprefectura Distrital MitoNo ratings yet

- Account Statement As of 23-10-2020 09:17:02 GMT +0530Document19 pagesAccount Statement As of 23-10-2020 09:17:02 GMT +0530padma princessNo ratings yet

- May 2019Document3 pagesMay 2019Rajraj SarangiNo ratings yet

- Soa RJ3036TW0028191Document2 pagesSoa RJ3036TW0028191DARK X Pro GamingNo ratings yet

- Borgo Fratte Rosa SRLDocument1 pageBorgo Fratte Rosa SRLCorina Oana TrifanescuNo ratings yet

- Shubam Roy PDFDocument11 pagesShubam Roy PDFparul jainNo ratings yet

- STATEMENT OF ACCOUNT RevisedDocument2 pagesSTATEMENT OF ACCOUNT RevisedJose VillarealNo ratings yet

- 1574232351010UmIJGvBtcedncXYm PDFDocument2 pages1574232351010UmIJGvBtcedncXYm PDFbhaskarNo ratings yet

- Monthly Revenue and Transfer ReportsDocument6 pagesMonthly Revenue and Transfer ReportsuwiNo ratings yet

- Reglamento General de La Actividad AseguradoraDocument1,099 pagesReglamento General de La Actividad AseguradoraLucas Francisco Dieguez SolignacNo ratings yet

- Cooperative Bank Account Statement DetailsDocument30 pagesCooperative Bank Account Statement Detailsmamo kebabowNo ratings yet

- Wage Arrear Prog 2021 Final1Document9 pagesWage Arrear Prog 2021 Final1MADHUR KULSHRESTHANo ratings yet

- KDMAL00237990000014051 New PDFDocument2 pagesKDMAL00237990000014051 New PDFSintu DasNo ratings yet

- Type of Charge Charge Amount (INR) Charges Applied To Your Account Are As Follows (If Any)Document3 pagesType of Charge Charge Amount (INR) Charges Applied To Your Account Are As Follows (If Any)Jayveer MisraNo ratings yet

- A Investment Platform for Future: Self Help a Self Operating BankingFrom EverandA Investment Platform for Future: Self Help a Self Operating BankingNo ratings yet

- Statement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Document1 pageStatement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Ankit VermaNo ratings yet

- Cargo HandlingDocument74 pagesCargo HandlingCamilo Gonzalez Bejarano75% (4)

- Seamanship 2 - Cargo Handling and StowageDocument6 pagesSeamanship 2 - Cargo Handling and StowageFrenzie Mae Vasquez Rivera67% (3)

- Seamanship 2 - Cargo Handling and StowageDocument6 pagesSeamanship 2 - Cargo Handling and StowageFrenzie Mae Vasquez Rivera67% (3)

- Statement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Document1 pageStatement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Ankit VermaNo ratings yet

- Statement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Document1 pageStatement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Ankit VermaNo ratings yet

- Transport Economics and Optimization: AssignmentDocument1 pageTransport Economics and Optimization: AssignmentAnkit VermaNo ratings yet

- Ert PDFDocument70 pagesErt PDFAnkit VermaNo ratings yet

- Statement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Document1 pageStatement Showing Tax Deducted Without Taking Into A/c of Interest & L.I.C Credit & Others For The Year 2019-2020Ankit VermaNo ratings yet

- Case Study - NegotiationDocument1 pageCase Study - NegotiationAnkit VermaNo ratings yet

- Project AnkitDocument9 pagesProject AnkitAnkit VermaNo ratings yet

- Cargo Handling in Vishakhapatnam Port Trust' Project Report'Document61 pagesCargo Handling in Vishakhapatnam Port Trust' Project Report'Ankit VermaNo ratings yet

- Unit 5: Breach of Contract and Its Remedies: Learning OutcomesDocument10 pagesUnit 5: Breach of Contract and Its Remedies: Learning Outcomesmelovebeingme100% (1)

- Transport Economics and Optimization: AssignmentDocument1 pageTransport Economics and Optimization: AssignmentAnkit VermaNo ratings yet

- Strategic Sourcing InsightsDocument48 pagesStrategic Sourcing InsightsShubham RawatNo ratings yet

- Project AnkitDocument2 pagesProject AnkitAnkit VermaNo ratings yet

- Transport Economics and Optimization: AssignmentDocument1 pageTransport Economics and Optimization: AssignmentAnkit VermaNo ratings yet

- The Indian Contract Act, 1872Document9 pagesThe Indian Contract Act, 1872Venugopal PandeyNo ratings yet

- Mumbai Port Traffic Handled Over 5 YearsDocument1 pageMumbai Port Traffic Handled Over 5 YearsAnkit VermaNo ratings yet

- Unit 5: Breach of Contract and Its Remedies: Learning OutcomesDocument10 pagesUnit 5: Breach of Contract and Its Remedies: Learning Outcomesmelovebeingme100% (1)

- Project AnkitDocument2 pagesProject AnkitAnkit VermaNo ratings yet

- Chartering Negotiations - Offering and CounteringDocument15 pagesChartering Negotiations - Offering and CounteringAnkit VermaNo ratings yet

- 54803bos43938cp1 U1 PDFDocument27 pages54803bos43938cp1 U1 PDFJAINo ratings yet

- Unit 5: Breach of Contract and Its Remedies: Learning OutcomesDocument10 pagesUnit 5: Breach of Contract and Its Remedies: Learning Outcomesmelovebeingme100% (1)

- The Indian Contract Act, 1872Document9 pagesThe Indian Contract Act, 1872Venugopal PandeyNo ratings yet

- Terms of PaymentDocument14 pagesTerms of PaymentAnkit VermaNo ratings yet

- 54803bos43938cp1 U1 PDFDocument27 pages54803bos43938cp1 U1 PDFJAINo ratings yet

- Contex Corp vs CIRDocument2 pagesContex Corp vs CIRAudrey Deguzman67% (3)

- VAT PresentationDocument12 pagesVAT Presentationhamza rahmanNo ratings yet

- Types of TaxesDocument6 pagesTypes of TaxesRohan DangeNo ratings yet

- CIR v. American Express International G.R. No. 152609, June 29, 2005Document2 pagesCIR v. American Express International G.R. No. 152609, June 29, 2005Susannie AcainNo ratings yet

- Anurag Revised Salary Breakup FY23-24Document2 pagesAnurag Revised Salary Breakup FY23-24SathyanarayanaAmbatiNo ratings yet

- Question Text: Correct Mark 2.00 Out of 2.00Document5 pagesQuestion Text: Correct Mark 2.00 Out of 2.00Nor-izzah Robles UgalinganNo ratings yet

- Bahasa Inggris PPHDocument9 pagesBahasa Inggris PPHRiska UsmawardaniNo ratings yet

- BIR Form 1901Document2 pagesBIR Form 1901Jap Algabre40% (5)

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNo ratings yet

- Tax Invoice: Company's State Code - 24 - GujaratDocument4 pagesTax Invoice: Company's State Code - 24 - GujaratVipul RathodNo ratings yet

- Salary Slip (30356680 April, 2019) PDFDocument1 pageSalary Slip (30356680 April, 2019) PDFMuhammad Farukh IbtasamNo ratings yet

- IRS Publication 904, Interrelated Computations For Estate and Gift Taxes (1985)Document28 pagesIRS Publication 904, Interrelated Computations For Estate and Gift Taxes (1985)Sora FonNo ratings yet

- "Form No. 15G: AO No. AO Type Range Code Area CodeDocument2 pages"Form No. 15G: AO No. AO Type Range Code Area CodePruthvish ShuklaNo ratings yet

- Payslip 9 2021.pdf3301655635205489526Document1 pagePayslip 9 2021.pdf3301655635205489526ShecallsmefraudNo ratings yet

- Pet Kingdom Tax ReturnDocument26 pagesPet Kingdom Tax ReturnRaychael Ross100% (2)

- FORM 16 TDS CERTIFICATEDocument6 pagesFORM 16 TDS CERTIFICATEVinuthna ChinnapaNo ratings yet

- Final ProjectDocument5 pagesFinal ProjectAkshayNo ratings yet

- BIR Payment Form TitleDocument2 pagesBIR Payment Form Titleeugene badere50% (2)

- Southwestern University School of Law Taxation Review Final Exam March 9, 2021Document2 pagesSouthwestern University School of Law Taxation Review Final Exam March 9, 2021Jezro P. GomezNo ratings yet

- CIR vs. B.F. Goodrich 104171Document1 pageCIR vs. B.F. Goodrich 104171magenNo ratings yet

- Fin - 623 Assignment 2Document5 pagesFin - 623 Assignment 2Abdussalam gillNo ratings yet

- PT. Alfa Laval Indonesia salary slipsDocument4 pagesPT. Alfa Laval Indonesia salary slipsputri endah rahmawatiNo ratings yet

- Tax implications of sale and leaseback agreementsDocument10 pagesTax implications of sale and leaseback agreementskoketso rahabNo ratings yet

- Abatement and CondonationDocument2 pagesAbatement and CondonationBibo GuntherNo ratings yet

- Form ITR-VDocument2 pagesForm ITR-VSumit ManglaniNo ratings yet

- 2021 Tax Return: Prepared ByDocument4 pages2021 Tax Return: Prepared ByDennis0% (1)

- Tutorial 9 - PIT1 QuestionDocument5 pagesTutorial 9 - PIT1 QuestionHien Bach Thi Tra QTKD-3KT-18No ratings yet

- HK Taxation Semester PlanDocument5 pagesHK Taxation Semester PlanDimitriNo ratings yet

- Journalize The Transactions Journalize The FollowingDocument4 pagesJournalize The Transactions Journalize The FollowingDoreenNo ratings yet

- LastPayCertificateDocument2 pagesLastPayCertificatePawan Kumar RaiNo ratings yet