Professional Documents

Culture Documents

Heinz@ Ritu

Uploaded by

virgo_etcOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Heinz@ Ritu

Uploaded by

virgo_etcCopyright:

Available Formats

HEINZ

Fiscal 2003 was a generally positive and productive year for Heinz, it improved their global portfolio of

brands and better positioned their company against goals of sustainable growth and shareholder value. The year

experienced successful spin-off and merger of their North American pet food and tuna businesses and their U.S

retail soup and baby food businesses with Del Monte

Corporation. This transaction, which was outlined in last year’s Annual Report and completed just five months later

greatly reduced their debt, resulted in improved margins and generally repositioned Heinz to capitalize on its

stronger core global brands.

The vision for HIENZ articulated by chairman and CEO William R.Johnson is sufficiently clear and well

defined. The key goals which were outlined in last years annual report was just completed 5 months later

after it was been stated, which proves his efficiency towards accomplishment of stated goals.

Company’s objectives are well stated and appropriate

Strategy that Johnson outlined for the company was based on Four Imperatives:

DRIVE PROFITABLE GROWTH: through superior products and

Packaging, everyday price/value, accelerated innovation and creative marketing.

REMOVE THE CLUTTER through simplified business structure, Improved accountability and greater focus in our

portfolio through continued reduction of marginal SKUs and non-core businesses and assets.

SQUEEZE OUT COSTS

SQUEZZ OUT COST: through reduced fixed costs, a more productive supply chain, improved cash management and

greater efficiency in working capital and capital expenditures.

MEASURE AND RECOGNIZE PERFORMANCE through a balanced scorecard that aligns management

compensation to key financial and non-financial indicators based on the ultimate goal of building sustainable

earnings growth..

YES, I would be satisfied with what Johnson has told about the company’s direction performance targets and

strategy. Because of company ability to execute successfully against its strategy of strengthening its core brands and

businesses worldwide.

Going forward, Heinz’s growth strategy is based on dividend still offers an attractive yield above 3%—better than

the industry average and in the top 20% of the S&P 500. Company stated intent to pay out 45%–50% of earnings to

shareholders in the form of dividends.

Shareholder return has increased approximately 17%.Being a shareholder I I am truly snd completely satisfied with

company’s performance.

SUBMITTED BY:

RITU SISODIA (91153)

You might also like

- Mead Johnson 2012 Annual Report Highlights Strong GrowthDocument16 pagesMead Johnson 2012 Annual Report Highlights Strong GrowthJorge LevyNo ratings yet

- F&NDocument2 pagesF&NThomas NgNo ratings yet

- Corporate Finance - Hill Country Snack FoodDocument11 pagesCorporate Finance - Hill Country Snack FoodNell MizunoNo ratings yet

- HSH Hillshire Brands Sept 2013 Investor Slide Deck Powerpoint PDFDocument38 pagesHSH Hillshire Brands Sept 2013 Investor Slide Deck Powerpoint PDFAla BasterNo ratings yet

- Pepsico Inc 2016 Annual ReportDocument152 pagesPepsico Inc 2016 Annual ReportceciliaNo ratings yet

- RF GL Annual Report 2017Document57 pagesRF GL Annual Report 2017lkra006No ratings yet

- 2018 Annual Report PDFDocument162 pages2018 Annual Report PDFMaissam MustafaNo ratings yet

- Nyse FFG 2012Document17 pagesNyse FFG 2012Bijoy AhmedNo ratings yet

- Dear Fellow Shareholders,: Indra K. Nooyi, Chairman and Chief Executive OfficerDocument4 pagesDear Fellow Shareholders,: Indra K. Nooyi, Chairman and Chief Executive OfficerSathish SatzNo ratings yet

- Chipotle Analyst's Report - 15 March 2017Document19 pagesChipotle Analyst's Report - 15 March 2017Nhan NguyenNo ratings yet

- Marks and Spencer Annual Report and Financial Statements 2012Document116 pagesMarks and Spencer Annual Report and Financial Statements 2012abhishekmonNo ratings yet

- Enduring Value: 2012 Annual Report - Executive Summary: Our Financial, Environmental, Social and Governance PerformanceDocument16 pagesEnduring Value: 2012 Annual Report - Executive Summary: Our Financial, Environmental, Social and Governance PerformancekirkhereNo ratings yet

- Third Point Nestle LetterDocument8 pagesThird Point Nestle LetterZerohedgeNo ratings yet

- Nyse FFG 2017Document17 pagesNyse FFG 2017Bijoy AhmedNo ratings yet

- 2017 q4 Cef Investor Letter1Document6 pages2017 q4 Cef Investor Letter1Kini TinerNo ratings yet

- Lowes Project 2017Document100 pagesLowes Project 2017Sharlene WhitakerNo ratings yet

- Canyon Ranch CaseDocument12 pagesCanyon Ranch CaseMohammad Kaml SHNo ratings yet

- KDC Annual Report 2011 FINA enDocument38 pagesKDC Annual Report 2011 FINA enWayne NguyenNo ratings yet

- Pershing Square 3Q-2016 Investor LetterDocument16 pagesPershing Square 3Q-2016 Investor LettersuperinvestorbulletiNo ratings yet

- VF Fy2022 Shareholderletter Digital FinalDocument116 pagesVF Fy2022 Shareholderletter Digital Finalfasek62909No ratings yet

- 2015 Danone Annual ReportDocument102 pages2015 Danone Annual ReportyassineNo ratings yet

- JSainsbury AR 09Document104 pagesJSainsbury AR 09dushyantswamiNo ratings yet

- Investment Analysis ReportDocument40 pagesInvestment Analysis ReportBere MartínezNo ratings yet

- Valeant Pharmaceuticals JPM Presentation 01-10-2017Document26 pagesValeant Pharmaceuticals JPM Presentation 01-10-2017medtechyNo ratings yet

- Tata Tertib Pelaksanaan Seleksi Cpns Kemristekdikti 2018Document13 pagesTata Tertib Pelaksanaan Seleksi Cpns Kemristekdikti 2018evamayfaaNo ratings yet

- HERO Annual Report 2011Document145 pagesHERO Annual Report 2011Rahmat W WibowoNo ratings yet

- About The National FoodsDocument40 pagesAbout The National FoodsChill ChaudharyNo ratings yet

- ABC AnnualReport 2019-FinalDocument16 pagesABC AnnualReport 2019-FinalMuhammad Aulia RachmanNo ratings yet

- Maggie Wilderotter The EvolutioDocument10 pagesMaggie Wilderotter The Evolutiogs randhawaNo ratings yet

- President CEO Revenue Sales in Nashville TN Resume Walter WasyliwDocument3 pagesPresident CEO Revenue Sales in Nashville TN Resume Walter WasyliwWalterWasyliw2No ratings yet

- Financial Planning ForecastingDocument12 pagesFinancial Planning ForecastingAnanda RiskiNo ratings yet

- CEO Speech - FINALDocument9 pagesCEO Speech - FINALEmilNo ratings yet

- Adairs 2019 Annual Report PDFDocument96 pagesAdairs 2019 Annual Report PDFWinston BoonNo ratings yet

- Dean Foods Company 2017 Annual ReportDocument114 pagesDean Foods Company 2017 Annual ReportEMS Metalworking MachineryNo ratings yet

- Entrepreneurship Planning The EnterpriseDocument15 pagesEntrepreneurship Planning The Enterprisecharlie besabellaNo ratings yet

- Director VP Business Development in Chicago IL Resume Steven HepburnDocument3 pagesDirector VP Business Development in Chicago IL Resume Steven HepburnStevenHepburnNo ratings yet

- Nestle Financial Report AnalysisDocument15 pagesNestle Financial Report AnalysisSyed Ali Messam ShamsiNo ratings yet

- Big Lots Inc: Stock Report - July 23, 2016 - Nys Symbol: Big - Big Is in The S&P Midcap 400Document11 pagesBig Lots Inc: Stock Report - July 23, 2016 - Nys Symbol: Big - Big Is in The S&P Midcap 400Luis Fernando EscobarNo ratings yet

- McDonald's 2010 Strategies: People, Products, Place, Price & PromotionDocument1 pageMcDonald's 2010 Strategies: People, Products, Place, Price & PromotionHella Mae RambunayNo ratings yet

- Medtronic Investor Meeting - Omar IshrakDocument19 pagesMedtronic Investor Meeting - Omar IshrakmedtechyNo ratings yet

- Pepsico Accounting ProjectDocument6 pagesPepsico Accounting Projectapi-2811075140% (1)

- Case1 Ben and Jerrys HomemadeDocument4 pagesCase1 Ben and Jerrys HomemadeJelyn Marie FlorNo ratings yet

- PPT - C02 - Company and Marketing StrategyDocument68 pagesPPT - C02 - Company and Marketing StrategyYasmina AlyNo ratings yet

- Nestle Startegy - Rev2Document1 pageNestle Startegy - Rev2shehabaldinNo ratings yet

- PepsiCo Victor&AdrianaDocument4 pagesPepsiCo Victor&AdrianaAdriana BoixareuNo ratings yet

- Ar2011 Dairy FarmDocument68 pagesAr2011 Dairy Farmtenglumlow100% (1)

- Vice President Finance CFO in ST Louis MO Resume John PinsDocument2 pagesVice President Finance CFO in ST Louis MO Resume John PinsJohnPinsNo ratings yet

- Heinz 2012 Annual ReportDocument104 pagesHeinz 2012 Annual Reportmohammedakbar88No ratings yet

- Director Operations District Manager in AZ CA Resume Rene BriedeDocument2 pagesDirector Operations District Manager in AZ CA Resume Rene BriedeReneBriedeNo ratings yet

- Vice President Sales Consumer Goods in Phoenix AZ Resume Todd RuehsDocument2 pagesVice President Sales Consumer Goods in Phoenix AZ Resume Todd RuehsTodd Ruehs1No ratings yet

- Crest Nicholson Holdings Annual Report (2013)Document157 pagesCrest Nicholson Holdings Annual Report (2013)Forko ForkovNo ratings yet

- CFODocument3 pagesCFOapi-78978616No ratings yet

- TJX 2021 Annual Report and 10 KDocument92 pagesTJX 2021 Annual Report and 10 Krroll65100% (1)

- Birla RetailDocument200 pagesBirla RetailTotmolNo ratings yet

- Hill Country Snack Foods CoDocument9 pagesHill Country Snack Foods CoZjiajiajiajiaPNo ratings yet

- Director Strategy Marketing Brand in West Palm Beach FL Resume Pete ParisDocument1 pageDirector Strategy Marketing Brand in West Palm Beach FL Resume Pete ParisPeteParisNo ratings yet

- T 8Document3 pagesT 8Hamayoon AhmedNo ratings yet

- Staying Ahead of the Hammer: How to Build and Manage Your Business to Achieve Long-Term High GrowthFrom EverandStaying Ahead of the Hammer: How to Build and Manage Your Business to Achieve Long-Term High GrowthNo ratings yet

- Goldman Sachs-opinion-The Procter & Gamble CompanyDocument37 pagesGoldman Sachs-opinion-The Procter & Gamble CompanyUnnikrishnan SNo ratings yet

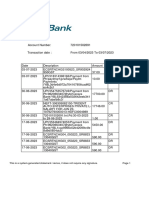

- Statement 1688358203630Document3 pagesStatement 1688358203630Chinmay RajNo ratings yet

- Trevor Young Resume 1-26-10Document3 pagesTrevor Young Resume 1-26-10trevoryoung00No ratings yet

- GSTIN: 37AAECH7604N1Z7: Hansem Building Systems India PVT LTDDocument5 pagesGSTIN: 37AAECH7604N1Z7: Hansem Building Systems India PVT LTDSanthosh Kumar .RNo ratings yet

- Azure SOX Guidance PDFDocument7 pagesAzure SOX Guidance PDFajsosaNo ratings yet

- Exercise 3 ObliconDocument2 pagesExercise 3 ObliconJedd NastorNo ratings yet

- Option Strategies Kay 2016Document78 pagesOption Strategies Kay 2016ravi gantaNo ratings yet

- Leave and License AgreementDocument4 pagesLeave and License AgreementAmitabh AbhijitNo ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFDocument43 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFWilliamCartersafg100% (11)

- Sharpe RatiosDocument56 pagesSharpe RatiosbobmezzNo ratings yet

- Independent Equity ResearchDocument12 pagesIndependent Equity ResearchsubodhsharmaNo ratings yet

- Quiz 1 AnswersDocument6 pagesQuiz 1 AnswersAlyssa CasimiroNo ratings yet

- Forum 6Document1 pageForum 6cecillia lissawatiNo ratings yet

- Garuda Indonesia I.1 Garuda Indonesia at GlanceDocument14 pagesGaruda Indonesia I.1 Garuda Indonesia at GlanceveccoNo ratings yet

- Heikin ++Document21 pagesHeikin ++BipinNo ratings yet

- Analyze Costs and Benefits of Public ProjectsDocument33 pagesAnalyze Costs and Benefits of Public ProjectsMey MeyNo ratings yet

- Chapter 1 Capital MarketsDocument7 pagesChapter 1 Capital MarketsNovel LampitocNo ratings yet

- Who Is The Ostensible OwnerDocument10 pagesWho Is The Ostensible OwnerdeepakNo ratings yet

- Tugas Kelompok 5 - Studi Kasus Franklin LumberDocument30 pagesTugas Kelompok 5 - Studi Kasus Franklin LumberAgung IswaraNo ratings yet

- GayanDocument23 pagesGayanijayathungaNo ratings yet

- Guía Banca v5-2Document94 pagesGuía Banca v5-2raffaeleNo ratings yet

- Final Exam With AnswerDocument8 pagesFinal Exam With Answerg409863No ratings yet

- NONCURRENT ASSET HELD FOR SALE AND DISCONTINUED OPERATIONDocument10 pagesNONCURRENT ASSET HELD FOR SALE AND DISCONTINUED OPERATIONXNo ratings yet

- CFAS Module 1 - ReviewerRRRDocument4 pagesCFAS Module 1 - ReviewerRRRAthena LedesmaNo ratings yet

- Foreign Market Entry StrategyDocument121 pagesForeign Market Entry StrategyDivya singhNo ratings yet

- 9 - ch27 Money, Interest, Real GDP, and The Price LevelDocument48 pages9 - ch27 Money, Interest, Real GDP, and The Price Levelcool_mechNo ratings yet

- 4B. Cost of CapitalDocument10 pages4B. Cost of Capitalshadhat331No ratings yet

- EM5 UNIT 3 INTEREST FORMULAS & RATES Part 2Document7 pagesEM5 UNIT 3 INTEREST FORMULAS & RATES Part 2MOBILEE CANCERERNo ratings yet

- Swan Energy LTDDocument29 pagesSwan Energy LTDvsrsNo ratings yet

- Bintang Persada Hotel Breakfast CouponDocument4 pagesBintang Persada Hotel Breakfast CouponPutu BudaNo ratings yet