Professional Documents

Culture Documents

01

Uploaded by

Pranit Satyavan NaikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

01

Uploaded by

Pranit Satyavan NaikCopyright:

Available Formats

Abstract

International Taxation is gaining importance because of the globalization of business activities and

business activities being spread over various countries. As large multinational organization have cross

country business operations, the manner in which they discharge the tax obligations in various countries also

becomes a bone of contention. India has introduced many measures to charge an appropriate tax in case of

cross country transactions.

Contemporary Issues in International Taxation

(A) Double Taxation Relief

1. Double Taxation Relief

Double taxation means taxation of same income of a person in more than one country. This results due

to countries following different rules for income taxation. There are two main rules of income taxation i.e.

(a) Source of income rule and (b) residence rule.

As per source of income rule, the income may be subject to tax in the country where the source of such

income exists (i.e. where the business establishment is situated or where the asset/property is located)

whether the income earner is a resident in that country or not.

On the other hand, residence rule stipulates that the power to tax should rest with the country in which

tax payee resides. In other words, the income earner may be taxed on the basis of his residential status in that

country. For example if a person is resident of a country, he may have to pay tax on any income earned

outside that country as well.

Further some countries may follow a mixture of the above two rules.

Thus problem of double taxation arises if a person is taxed in respect of any income on the basis of

source of income rule in one country and on the basis of residence in another country or on the basis of

mixture of above two rules.

In India, the liability under the Income-tax Act arises on the basis of the residential status of the assessee

during the previous year. In case the assessee is resident in India, he also has to pay tax on the income which

accrues or arises outside India, and also received outside India. The position in many other countries being

also broadly similar, it frequently happens that a person may be found to be a resident in more than one

country or that the same item of his income may be treated as accruing, arising or received in more than one

country with the result that the same item becomes liable to tax in more than one country.

Relief against such hardship can be provided mainly in two ways: (a) Bilateral relief, (b) Unilateral

relief.

2. Bilateral relief

The Governments of two countries can enter into Double Taxation Avoidance Agreements (DTAA's) so

that the same income may not be taxed twice. DTAA's lay down the rule of taxation of the income by the

source country and the residence country. Such rules are laid for various categories of income, for example

interest, dividend, royalties, capital gains, business income, salary income etc. Each such category is dealt

with by separate article in DTAA.

Thus DTAA's are entered into to provide relief against such Double Taxation, worked out on the basis of

mutual agreement between the two concerned sovereign states. This may be called a scheme of ‘bilateral

relief’ as both concerned powers agree as to the basis of the relief to be granted by either of them.

Bilateral relief may be granted in either one of the following two methods—

(a) Exemption method: Where two countries agree that income from various specified sources which are

likely to be taxed in both the countries should either be taxed only in one of them or that each of the

two countries should tax only a particular specified portion of the income so that there is no

overlapping. Such an agreement will result in a complete avoidance of double taxation of the same

income in the two countries. This is known as exemption method of relief.

(b) Tax credit method: This method does not envisage any such scheme of single taxability but merely

provides that, if any item of income is taxed in both the countries, the assessee should get relief in a

particular manner. Under this method, the assessee is liable to have his income taxed in both the

countries but is given a deduction, from the tax payable by him in the country of residence, of a part

of the taxes paid by him thereon, in the source country usually the lower of the two taxes paid. This

is known as tax credit method of relief.

In practice the former type of method also works in the same way as the later.

If the agreement with the foreign country is under clause (b) above for relief against double taxation and

not under clause (a) for the avoidance of double taxation, the assessee must show that the identical

income has been doubly taxed and that he has paid tax both in India and in the foreign country, on the

same income. Further, relief from Indian income tax is to be granted on the production of proof of

assessment in that country.

3. Unilateral relief

The above procedure for granting relief will not be sufficient to meet all cases. No country will be in a

position to arrive at such agreement as envisaged above with all the countries of the world for all time. The

hardship of the taxpayer, however, is a crippling one in all such cases. Some relief can be provided even in

such cases by home country irrespective of whether the other country concerned has any agreement with

India or has otherwise provided for any relief at all in respect of such double taxation. This relief is known

as unilateral relief.

(B) Transfer Pricing & Other Anti-Avoidance Measures

The increasing participation of multinational groups in economic activities in the country has given rise

to new and complex issues emerging from transactions entered into between two or more enterprises

belonging to the same multinational group.

Business may be carried on between a resident and a person who is non-resident or not ordinarily

resident in India, and owing to close connection between them, the course of business may be so arranged

that the resident makes either no profits or less than the ordinary profits in that business. Such an

arrangement would deprive that Indian revenue of the tax which would otherwise be payable by the resident.

With a view to provide a statutory framework which can lead to computation of reasonable, fair and

equitable profits and tax in India, in the case of such multinational enterprises, new set of special provisions

relating to avoidance of tax have been introduced under Chapter X in the Income-tax Act. These provisions

are also known as Transfer Pricing provisions.

The transfer price is that price which is arrived at when two associated or related enterprises deal with

each other. Since, the enterprises involved are related entities, they can manipulate prices in a manner

whereby the profits are transferred to the entity of that country, where the tax rates are lower. To prevent this

erosion of tax which was otherwise leviable in India, these provision have been introduced.

These provisions relate to:

(a) Computation of income from international transactions having regard to the arm's length price

[Section 92];

(b) Meaning of associated enterprise [Section 92A];

(c) Meaning of international transaction [Section 92B];

(d) Computation of arm's length prices [Section 92C];

(e) Reference to transfer pricing officer [Section 92CA];

(f) Power of Board to make safe harbour rules [Section 92CB];

(g) Advance pricing agreement [Section 92CC];

(h) Effect to advance pricing agreement [Section 92CD];

(i) Secondary adjustment in certain cases [Section 92CE]

(j) Maintenance and keeping of information and documents by persons entering into international

transactions [Section 92D];

(k) Report from an accountant to be furnished by persons entering into international transaction [Section

92E];

(l) Definitions of certain terms relevant to computation of arm's length price [Section 92F].

Besides the above, Chapter X also contains the following sections relating to avoidance of tax by

entering into transactions with non-residents.

Section 93: Avoidance of income tax by transactions resulting in transfer of income to non-residents.

Section 94A: Special measures in respect of transactions with persons located in notified jurisdictional

area.

Section 94B: Limitation on interest deduction in certain cases.

Chapter X also contains section 94 which is relating to avoidance of tax by certain transactions in

securities. The same is not specifically meant for non-residents.

(C) Limitation of interest deduction in certain cases [Section 94B]

A company is typically financed or capitalized through a mixture of debt and equity. The way a

company is capitalized often has a significant impact on the amount of profit it reports for tax purposes as

the tax legislations of countries typically allow a deduction for interest paid or payable in arriving at the

profit for tax purposes while the dividend paid on equity contribution is not deductible. Therefore, the higher

the level of debt in a company, and thus the amount of interest it pays, the lower will be its taxable profit.

For this reason, debt is often a more tax efficient method of finance than equity. Multinational groups are

often able to structure their financing arrangements to maximize these benefits. For this reason, country's tax

administrations often introduce rules that place a limit on the amount of interest that can be deducted in

computing a company's profit for tax purposes. Such rules are designed to counter cross-border shifting of

profit through excessive interest payments, and thus aim to protect a country's tax base.

Under the initiative of the G-20 countries, the Organization for Economic Co-operation and

Development (OECD) in its Base Erosion and Profit Shifting (BEPS) project had taken up the issue of base

erosion and profit shifting by way of excess interest deductions by the MNEs in Action plan 4. The OECD

has recommended several measures in its final report to address this issue.

In view of the above, the Act has inserted a new section 94B, in line with the recommendations of

OECD BEPS Action Plan 4, which provides as under:

(D) General Anti-Avoidance Rule [Chapter X-A]

1. Applicability of General Anti-Avoidance Rule [Section 95]

Notwithstanding anything contained in the Act, an arrangement entered into by an assessee may be

declared to be an impermissible avoidance arrangement and the consequence in relation to tax arising

therefrom may be determined subject to the provisions of this Chapter. [Section 95(1)]

This Chapter shall apply in respect of any assessment year beginning on or after 1.4.2018. [Section

95(2)]

Explanation.—For the removal of doubts, it is hereby declared that the provisions of this Chapter may be

applied to any step in, or a part of, the arrangement as they are applicable to the arrangement.

(1) Meaning of arrangement [Section 102(1)]: "Arrangement" means any step in, or a part or whole of,

any transaction, operation, scheme, agreement or understanding, whether enforceable or not, and

includes the alienation of any property in such transaction, operation, scheme, agreement or

understanding.

(2) Meaning of step [Section 102(9): "Step" includes a measure or an action, particularly one of a series

taken in order to deal with or achieve a particular thing or object in the arrangement.

Chapter X-A not to apply in certain cases [Rule 10U]

(1) The provisions of Chapter X-A shall not apply to—

(a) an arrangement where the tax benefit in the relevant assessment year arising, in aggregate, to all the

parties to the arrangement does not exceed a sum of rupees three crore;

(b) a Foreign Institutional Investor, –

(i) who is an assessee under the Act;

(ii) who has not taken benefit of an agreement referred to in section 90 or section 90A as the case

may be; and

(iii) who has invested in listed securities, or unlisted securities, with the prior permission of the

competent authority, in accordance with the Securities and Exchange Board of India (Foreign

Institutional Investor) Regulations, 1995 and such other regulations as may be applicable, in

relation to such investments;

(c) a person, being a non-resident, in relation to investment made by him by way of offshore derivative

instruments or otherwise, directly or indirectly , in a Foreign Institutional Investor;

(d) any income accruing or arising to, or deemed to accrue or arise to, or received or deemed to be

received by, any person from transfer of investments made before the 1st day of April, 2017 by such

person.

(2) Without prejudice to the provisions of rule 10U(1)(d), the provisions of Chapter X-A shall apply to

any arrangement, irrespective of the date on which it has been entered into, in respect of the tax benefit

obtained from the arrangement on or after the 1st day of April, 2017.

For the purposes of rule 10U,—

(i) “Foreign Institutional Investor” shall have the same meaning as assigned to it in the Explanation to

section 115AD;

(ii) “off shore derivative instrument” shall have the same meaning as assigned to it in the Securities and

Exchange Board of India (Foreign Institutional Investor) Regulations, 1995 issued under Securities

and Exchange Board of India Act, 1992;

(iii) “Securities and Exchange Board of India” shall have the same meaning as assigned to it in clause

(a) of sub-section (1) of section 2 of the Securities and Exchange Board of India Act, 1992;

(iv) “tax benefit” as defined in section 102(10) [See box under section 96(1)] and computed in

accordance with Chapter X-A shall be with reference to—

(a) sub-clauses (a) to (e) of the said clause , the amount of tax; and

(b) sub-clause (f) of the said clause, the tax that would have been chargeable had the increase in loss

referred to therein been the total income.

2. Impermissible avoidance arrangement [Section 96]

(1) Meaning of impermissible avoidance arrangement [Section 96(1)]: An impermissible avoidance

arrangement means an arrangement, the main purpose of which is to obtain a tax benefit, and it—

(a) creates rights, or obligations, which are not ordinarily created between persons dealing at arm's

length;

(b) results, directly or indirectly, in the misuse, or abuse, of the provisions of this Act;

(c) lacks commercial substance or is deemed to lack commercial substance under section 97, in whole or

in part; or

(d) is entered into, or carried out, by means, or in a manner, which are not ordinarily employed for bona

fide purposes.

(2) Arrangement to be presumed for obtaining a tax benefit unless proved to the contrary [Section

96(2)]: An arrangement shall be presumed, unless it is proved to the contrary by the assessee, to have been

entered into, or carried out, for the main purpose of obtaining a tax benefit, if the main purpose of a step in,

or a part of, the arrangement is to obtain a tax benefit, notwithstanding the fact that the main purpose of the

whole arrangement is not to obtain a tax benefit.

3. Arrangement to lack commercial substance [Section 97]

(1) When will an arrangement be deemed to lack commercial substance? [Section 97(1)]: An

arrangement shall be deemed to lack commercial substance, if—

(a) the substance or effect of the arrangement as a whole, is inconsistent with, or differs significantly

from, the form of its individual steps or a part; or

(b) it involves or includes—

(i) round trip financing;

(ii) an accommodating party;

(iii) elements that have effect of offsetting or cancelling each other; or

(iv) a transaction which is conducted through one or more persons and disguises the value, location,

source, ownership or control of funds which is the subject matter of such transaction; or

(c) it involves the location of an asset or of a transaction or of the place of residence of any party which

is without any substantial commercial purpose other than obtaining a tax benefit (but for the

provisions of this Chapter) for a party; or

(d) it does not have a significant effect upon the business risks or net cash flows of any party to the

arrangement apart from any effect attributable to the tax benefit that would be obtained (but for the

provisions of this Chapter).

(2) Round trip financing [Section 97(2)]: For the purposes of section 97(1), round trip financing

includes any arrangement in which, through a series of transactions—

(a) funds are transferred among the parties to the arrangement; and

(b) such transactions do not have any substantial commercial purpose other than obtaining the tax

benefit (but for the provisions of this Chapter),

without having any regard to—

(A) whether or not the funds involved in the round trip financing can be traced to any funds transferred

to, or received by, any party in connection with the arrangement;

(B) the time, or sequence, in which the funds involved in the round trip financing are transferred or

received; or

(C) the means by, or manner in, or mode through, which funds involved in the round trip financing are

transferred or received.

(3) Accommodating party [Section 97(3)]: For the purposes of this Chapter, a party to an arrangement

shall be an accommodating party, if the main purpose of the direct or indirect participation of that party in

the arrangement, in whole or in part, is to obtain, directly or indirectly, a tax (but for the provisions of this

Chapter) for the assessee whether or not the party is a connected person in relation to any party to the

arrangement.

(4) Clarification on arrangement lacks commercial substance [Section 97(4)]: For the removal of

doubts, it is hereby clarified that the following may be relevant but shall not be sufficient for determining

whether an arrangement lacks commercial substance or not, namely:—

(i) the period or time for which the arrangement (including operations therein) exists;

(ii) the fact of payment of taxes, directly or indirectly, under the arrangement;

(iii) the fact that an exit route (including transfer of any activity or business or operations) is provided by

the arrangement.

4. Consequences of impermissible avoidance arrangement [Section 98]

(1) Consequences in relation to tax of impermissible avoidance arrangement [section 98(1)]: If an

arrangement is declared to be an impermissible avoidance arrangement, then, the consequences, in relation

to tax, of the arrangement, including denial of tax benefit or a benefit under a tax treaty, shall be

determined, in such manner as is deemed appropriate, in the circumstances of the case, including by way of

but not limited to the following, namely:—

(a) disregarding, combining or recharacterising any step in, or a part or whole of, the impermissible

avoidance arrangement;

(b) treating the impermissible avoidance arrangement as if it had not been entered into or carried out;

(c) disregarding any accommodating party or treating any accommodating party and any other party as

one and the same person;

(d) deeming persons who are connected persons in relation to each other to be one and the same person

for the purposes of determining tax treatment of any amount;

(e) reallocating amongst the parties to the arrangement—

(i) any accrual, or receipt, of a capital nature or revenue nature; or

(ii) any expenditure, deduction, relief or rebate;

(f) treating—

(i) the place of residence of any party to the arrangement; or

(ii) the situs of an asset or of a transaction,

at a place other than the place of residence, location of the asset or location of the transaction as

provided under the arrangement; or

(g) considering or looking through any arrangement by disregarding any corporate structure.

Determination of consequences of impermissible avoidance arrangement [Rule 10UA]

For the purposes of section 98(1), where a part of an arrangement is declared to be an impermissible

avoidance arrangement, the consequences in relation to tax shall be determined with reference to such part

only.

(1) Meaning of benefit [Section 102(3)]: "benefit" includes a payment of any kind whether in tangible or

intangible form.

(2) For the purposes of section 98(1),—

(i) any equity may be treated as debt or vice versa;

(ii) any accrual, or receipt, of a capital nature may be treated as of revenue nature or vice versa; or

(iii) any expenditure, deduction, relief or rebate may be recharacterised. [Section 98(2)]

5. Treatment of connected person and accommodating party [Section 99]

For the purposes of this Chapter, in determining whether a tax benefit exists,—

(i) the parties who are connected persons in relation to each other may be treated as one and the same

person;

(ii) any accommodating party may be disregarded;

(iii) the accommodating party and any other party may be treated as one and the same person;

(iv) the arrangement may be considered or looked through by disregarding any corporate structure.

(E) Equalisation Levy

With the expansion of information and communication technology, the supply and procurement of

digital goods and services have undergone exponential expansion everywhere, including India.

Currently in the digital domain, business may be conducted without regard to national boundaries and

may dissolve the link between an income-producing activity and a specific location. From a certain

perspective, business in digital domain doesn't seem to occur in any physical location but instead takes place

in the nebulous world of "cyberspace." Persons carrying business in digital domain could be located

anywhere in the world. Entrepreneurs across the world have been quick to evolve their business to take

advantage of these changes. It has also made it possible for the businesses to conduct themselves in ways

that did not exist earlier, and given rise to new business models that rely more on digital and

telecommunication network, do not require physical presence, and derives substantial value from data

collected and transmitted from such networks.

These new business models have created new tax challenges. The typical direct tax issues relating to e-

commerce are the difficulties of characterizing the nature of payment and establishing a nexus or link

between a taxable transaction, activity and a taxing jurisdiction, the difficulty of locating the transaction,

activity and identifying the taxpayer for income tax purposes. The digital business fundamentally challenges

physical presence-based permanent establishment rules. If permanent establishment (PE) principles are to

remain effective in the new economy, the fundamental PE components developed for the old economy i.e.

place of business, location, and permanency must be reconciled with the new digital reality.

The Organization for Economic Cooperation and Development (OECD) has recommended, in Base

Erosion and Profit Shifting (BEPS) project under Action Plan 1, several options to tackle the direct tax

challenges which include modifying the existing Permanent Establishment (PE) rule to include that where an

enterprise engaged in fully de-materialized digital activities would constitute a PE if it maintained a

significant digital presence in another country's economy. It further recommended a virtual fixed place of

business PE in the concept of PE i,e creation of a PE when the enterprise maintains a website on a server of

another enterprise located in a jurisdiction and carries on business through that website. It also

recommended to impose of a final withholding tax on certain payments for digital goods or services

provided by a foreign e-commerce provider or imposition of a equalisation levy on consideration for certain

digital transactions received by a non-resident from a resident or from a non-resident having permanent

establishment in other contracting state.

Considering the potential of new digital economy and the rapidly evolving nature of business operations

it is found essential to address the challenges in terms of taxation of such digital transactions as mentioned

above. In order to address these challenges, Chapter VIII titled "Equalisation Levy" has been inserted in the

Finance Act, which provides as under:

(F) Power of Board to make safe harbour rules [Section 92CB]

Section 92C of the Income-tax Act provides for adjustment in the transfer price of an international

transaction with an associated enterprise if the transfer price is not equal to the arm's length price. As a

result, a large number of such transactions are being subjected to adjustment giving rise to considerable

dispute.

To overcome this, section 92CB was inserted to empower Board to formulate safe harbour rules. Section

92CB(1) provides as under:

The determination of arm's length price under section 92C or section 92CA shall be subject to safe

harbour rules.

Further as per section 92CB(2), the Board may, for the purposes of section 92CB(1), make rules for safe

harbour.

"Safe harbour" means circumstances in which the income-tax authorities shall accept the transfer price

declared by the assessee.

Safe harbour rules for international transactions have since been notified by the CBDT by Notification

No. 73/2013, dated 18.9.2013 as amended by Notification No. 11/2015, dated 4.2.2015 and further amended

by Notification No. 46/2017, dated 7.6.2017 which contain rules 10TA to 10TG.

(G) Board with the approval of Central Government allowed to

enter into Advance Price Agreement [Section 92CC]

1. CBDT may enter into advance pricing agreement with any person [Section 92CC(1)]: The

Board, with the approval of the Central Government, may enter into an advance pricing agreement with

any person, determining the arm’s length price or specifying the manner in which arm’s length price is to

be determined, in relation to an international transaction to be entered into by that person.

Advance pricing agreement cannot be entered for Specified Domestic Transactions.

2. Manner of determination of arm's length price [Section 92CC(2)]: The manner of determination

of arm’s length price referred to in section 92CC(1), may include the methods referred to in section

92C(1) (i.e. 5 methods) or any other method, with such adjustments or variations, as may be necessary or

expedient so to do.

3. Advance pricing agreement to override section 92C or section 92CA [Section 92CC(3)]:

Notwithstanding anything contained in section 92C or section 92CA, the arm’s length price of any

international transaction, in respect of which the advance pricing agreement has been entered into, s hall be

determined in accordance with the advance pricing agreement so entered. Thus, in this case A.O. can

neither use the methods given in a section 92C or nor can refer the case to TPO under section 92CA.

4. Period of validity of advance pricing agreement [Section 92CC(4)]: The agreement referred to in

section 92CC(1) shall be valid for such period not exceeding five consecutive previous years as may be

specified in the agreement.

5. Binding nature of advance pricing agreements [Section 92CC(5)]: The advance pricing

agreement entered into shall be binding—

(a) on the person in whose case, and in respect of the transaction in relation to which, the agreement

has been entered into; and

(b) on the Principal Commissioner or Commissioner, and the income-tax authorities subordinate to

him, in respect of the said person and the said transaction.

6. Agreement not to be binding if there is a change in law or facts [Section 92CC(6)]: The

agreement referred to in section 92CC(1) shall not be binding if there is a change in law or facts having

bearing on the agreement so entered.

7. Agreement may be declared void ab initio in certain circumstances [Section 92CC(7)]: The

Board may, with the approval of the Central Government, by an order, declare an agreement to be void ab

initio, if it finds that the agreement has been obtained by the person by fraud or misrepresentation of facts.

8. Consequences if agreement is declared void ab initio under section 92CCC(7) [Section

92CC(8)]: Upon declaring the agreement void ab initio,—

(a) all the provisions of the Act shall apply to the person as if such agreement had never been entered

into; and

(b) notwithstanding anything contained in the Act, for the purpose of computing any period of

limitation under this Act, the period beginning with the date of such agreement and ending on the

date of order under section 92CC(7) shall be excluded.

However, where immediately after the exclusion of the aforesaid period, the period of limitation,

referred to in any provision of this Act, is less than sixty days, such remaining period shall be extended to

sixty days and the aforesaid period of limitation shall be deemed to be extended accordingly.

9. Board to prescribe scheme, manner and procedure in this case [Section 92CC(9)]

The Board may, for the purposes of this section, prescribe a scheme (including for rollback years, see

section 92CC(9A) below) specifying therein the manner, form, procedure and any other matter generally in

respect of the advance pricing agreement.

In this connection, the Board has notified the advance pricing scheme (including for rollback years)

which contains rules from 10F to 10T (Rule 10MA and Rule 10RA specifically cover rollback of the

agreement and procedure thereof).

10. Agreement so entered may also be made applicable for international transactions entered into

in maximum four preceding previous years [Section 92CC(9A)]

The agreement referred to in section 92CC(1), may, subject to such conditions, procedure and manner as

may be prescribed, provide for determining the arm's length price or specify the manner in which arm's

length price shall be determined in relation to the international transaction entered into by the person during

any period not exceeding four previous years preceding the first of the previous years referred to in section

92CC(4), and the arm's length price of such international transaction shall be determined in accordance with

the said agreement.

11. Proceeding shall be deemed to be pending if application made under section 92CC(1)

[Section 92CC(10)]: Where an application is made by a person for entering into an agreement referred to

in section 92CC(1), the proceeding shall be deemed to be pending in the case of the person for the

purposes of the Act.

Effect of Advance Price Agreement [Section 92CD]

1. Assessee to file modified return of income in accordance with the advance pricing agreement

[Section 92CD(1)]

Notwithstanding anything to the contrary contained in section 139, where any person has entered into

an agreement and prior to the date of entering into the agreement, any return of income has been furnished

under the provisions of section 139 for any assessment year relevant to a previous year to which such

agreement applies, such person shall furnish, within a period of three months from the end of the month in

which the said agreement was entered into, a modified return in accordance with and limited to the

agreement.

Save as otherwise provided in this section, all other provisions of this Act shall apply accordingly as if

the modified return is a return furnished under section 139.

2. Assessing Officer to assess or reassess the completed assessment according to advance price

agreement [Section 92CD(3)]

If the assessment or reassessment proceedings for an assessment year relevant to a previous year to

which the agreement applies have been completed before the expiry of period allowed for furnishing of

modified return under section 92CD(1), the Assessing Officer shall, in a case where modified return is

filed in accordance with the provisions of section 92CD(1), proceed to assess or reassess or recompute the

total income of the relevant assessment year having regard to and in accordance with the agreement.

3. Assessing Officer to complete assessment according to modified return if it is pending on the

date of filing modified return [Section 92CD(4)]

Where the assessment or reassessment proceedings for an assessment year relevant to the previous

year to which the agreement applies are pending on the date of filing of modified return in accordance

with the provisions of section 92CD(1), the Assessing Officer shall proceed to complete the assessment or

reassessment proceedings in accordance with the agreement taking into consideration the modified return

so furnished.

4. Period of completion of assessment on the basis of modified return [Section 92CD(5)]

(A) In case assessment or re-assessment has been already completed

Notwithstanding anything contained in section 153 or section 153B or section 144C, the order of

assessment, reassessment or recomputation of total income under section 92CD(3) shall be passed within a

period of one year from the end of the financial year in which the modified return under section 92CD(1) is

furnished.

(B) In case assessment or reassessment is pending

Similarly, the period of limitation as provided in section 153 or section 153B or section 144C for

completion of pending assessment or reassessment proceedings referred to in section 92CD(4) shall be

extended by a period of twelve months.

(H) Advance Rulings

Advance ruling under the Income Tax Act could be sought by:

(A) any person who is—

(i) a non-resident.

(ii) resident having transactions with non-residents.

(iii) a resident.

(iv) a public sector company

(B) an applicant as defined in section 28E(c) of the Customs Act, 1962;

(C) an applicant as defined in section 23A(c) of the Central Excise Act, 1944;

(D) an applicant as defined in section 96A(b) of the Finance Act, 1994 relating to service tax law;

Further, the advance ruling is to be given on questions specified in relation to transaction by the

applicant himself and not by any other person. However, the applicant can be a representative assessee on

behalf of trust through which it has made investments in India.

Questions on which advance ruling can be sought

The advance rulings can be sought on any question in relation to a transaction by the applicant. The

following points however in this regard may be noted:

(a) Even though the word used in the definition is 'question', it is clear that the applicant can raise more

than one question in one application. This has been made amply clear by Column No. 8 of the form

of application for obtaining an advance ruling (Form No. 34C) and Column No. 7 of Form Nos. 34D

and 34E.

(b) Though the word "question" is unqualified, it is only proper to read it as a reference to questions, of

law or fact, pertaining to the income-tax liability of the applicant qua the transaction undertaken or

proposed to be undertaken by him.

(c) The questions may be on points of law as well as on fact; therefore, mixed questions of law and fact

can also be included in the application. The questions should be so drafted that each question is

capable of a brief answer. This may need breaking-up of complex questions into two or more simple

questions.

(d) The questions should arise out of the statement of facts given with the application. No ruling will be

given on a purely hypothetical question. Questions not specified in the application can not be urged.

Normally, a question is not allowed to be amended but in deserving cases the Authority may allow

amendment of one or more questions.

(e) Subject to the limitations referred to above the question may relate to any aspect of the applicant's

liability including international aspects and aspects governed by double tax agreements. The

questions may cover aspects of allied Laws that may have a leaning on tax liability such as the Law

of Contracts, the Law of Trusts and the like, but the question must have a direct bearing with Indian

Income-tax Act.

Kinds of questions on which ruling is mostly sought for non-resident

Questions relating to the transactions undertaken or proposed to be undertaken:

(a) by a non-resident

or

(b) between a resident and a non-resident

mostly relates to section 9(1) dealing with income deemed to accrue or arise in India, which can be

classified as under:

1. Income from any Business Connection/Permanent Establishment in India

2. Income from the operation of ships or air craft

3. Interest payable outside India

4. Royalty payable outside India

5. Fee for technical services payable outside India

6. Salary earned in India

7. Capital Gain from transfer of a capital assets situate in India

8. Income from property, asset or any source in India

Beside the above, the questions can relate to withholding tax under section 195 of the Income Tax Act.

Reference

Chapter 1 to 5 of Part II of Direct Tax Laws and International Taxation, 38th Edition,

by. Dr. Girish Ahuja and Dr. Ravi Gupta

Dr. RAVI GUPTA did his graduation and post-graduation from Shri Ram College of

Commerce. Thereafter, he did LL.B. from Delhi University and MBA (Finance) from Faculty of

Management Studies, Delhi. He has been awarded a Ph.D. degree in International Finance by the

Delhi University. He is a faculty member at Shri Ram College of Commerce (Delhi University) and

also has vast practical experience in handling tax matters of trade and industry. He has addressed

more than 2000 seminars on Direct Taxes organized by ICAI, Chambers of Commerce,

Universities, etc. He was appointed by the Government of India as a member of the Committee

constituted for Simplification of Income Tax Act. He is an independent director of many reputed

companies. He had been nominated by the Government to the Central Council of the Institute of

Chartered Accountants of India.

You might also like

- R SquareDocument20 pagesR SquarePranit Satyavan NaikNo ratings yet

- Mutual FundDocument18 pagesMutual FundPranit Satyavan NaikNo ratings yet

- E - Content On IFRSDocument20 pagesE - Content On IFRSPranit Satyavan NaikNo ratings yet

- Research Aptitude by Talvir PDFDocument27 pagesResearch Aptitude by Talvir PDFPranit Satyavan Naik50% (2)

- E - Content On IFRSDocument20 pagesE - Content On IFRSPranit Satyavan NaikNo ratings yet

- E - Content On IFRSDocument20 pagesE - Content On IFRSPranit Satyavan NaikNo ratings yet

- Course Data Analysis For Social Science Teachers Topic Module Id 1.3Document7 pagesCourse Data Analysis For Social Science Teachers Topic Module Id 1.3Abdul MohammadNo ratings yet

- 01Document10 pages01Pranit Satyavan NaikNo ratings yet

- Patanjali CSVDocument19 pagesPatanjali CSVPranit Satyavan NaikNo ratings yet

- 01Document10 pages01Pranit Satyavan NaikNo ratings yet

- 1995 Acquired A British Co Royal EnfieldDocument2 pages1995 Acquired A British Co Royal EnfieldPranit Satyavan NaikNo ratings yet

- Sidbi 091222013919 Phpapp01Document16 pagesSidbi 091222013919 Phpapp01Shikha ChawlaNo ratings yet

- FactoringDocument2 pagesFactoringPranit Satyavan NaikNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Aadvik Ipr Psda 8 SemDocument12 pagesAadvik Ipr Psda 8 SemZubu KhshNo ratings yet

- PRAYAS - 2022 Test - 24: EconomyDocument42 pagesPRAYAS - 2022 Test - 24: EconomyShiv Shakti SinghNo ratings yet

- SCO - GOLDBULLION - CIF HI Switz Thai 12% 9 3Document4 pagesSCO - GOLDBULLION - CIF HI Switz Thai 12% 9 3Luis Fernando Parra Zapata Medellín Líderes INo ratings yet

- 1971 1999 PDFDocument74 pages1971 1999 PDFSheraz UmarNo ratings yet

- RecoverPoint Implementation Student GuideDocument368 pagesRecoverPoint Implementation Student Guidesorin_gheorghe2078% (9)

- Fauquier Supervisors May 14, 2020, AgendaDocument3 pagesFauquier Supervisors May 14, 2020, AgendaFauquier NowNo ratings yet

- Introduction of HDFCDocument2 pagesIntroduction of HDFCALi AsamdiNo ratings yet

- Chapter 3.1 - Proposal and AcceptanceDocument67 pagesChapter 3.1 - Proposal and AcceptanceJanani VenkatNo ratings yet

- State Wise Police Awardees ListDocument2 pagesState Wise Police Awardees ListHeaven ViewsNo ratings yet

- Copyright - Part IIIDocument26 pagesCopyright - Part IIImeomeo meoNo ratings yet

- Ra 4200Document34 pagesRa 4200sajdy100% (1)

- LAWS1052 Legal Research NotesDocument17 pagesLAWS1052 Legal Research NotesBaar SheepNo ratings yet

- University ActDocument3 pagesUniversity Actking.achiever923No ratings yet

- Intermediate Accounting 1 - InventoriesDocument9 pagesIntermediate Accounting 1 - InventoriesLien LaurethNo ratings yet

- Canoreco v. Torres GR 127249 2-27-1998Document10 pagesCanoreco v. Torres GR 127249 2-27-1998HjktdmhmNo ratings yet

- King's Transport V Viljoen 1954 (1) Sa 133 (C)Document6 pagesKing's Transport V Viljoen 1954 (1) Sa 133 (C)Rodney UlyateNo ratings yet

- Thefold64 Fractal Pyramid Ikegami 0Document15 pagesThefold64 Fractal Pyramid Ikegami 0kevybNo ratings yet

- Authorization To Use and Charge Credit Card 1 1Document1 pageAuthorization To Use and Charge Credit Card 1 1Raine Nathalia Cruzat0% (1)

- Pro-choice or pro-life? The case for women's rights and rape victimsDocument2 pagesPro-choice or pro-life? The case for women's rights and rape victimsTreseaNo ratings yet

- WWVP Identity Requirements - Access CanberraDocument2 pagesWWVP Identity Requirements - Access CanberraMaría CalderónNo ratings yet

- Plata v. YatcoDocument2 pagesPlata v. YatcoShalom MangalindanNo ratings yet

- Screenshot 2023-12-01 at 22.49.33Document30 pagesScreenshot 2023-12-01 at 22.49.33abualevelsNo ratings yet

- Incoming Passenger Card Australia EditableDocument2 pagesIncoming Passenger Card Australia EditableINDERPREETNo ratings yet

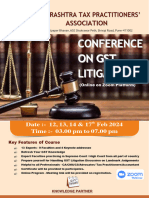

- Conference On GST Litigation-2024Document6 pagesConference On GST Litigation-2024tsdhameliya1No ratings yet

- Improving Micro Savings Mobilization Using A Mobile AppDocument3 pagesImproving Micro Savings Mobilization Using A Mobile AppAnonymous hi0qt7uNo ratings yet

- Chola MS: Motor Policy Schedule Cum Certificate of InsuranceDocument2 pagesChola MS: Motor Policy Schedule Cum Certificate of InsuranceSRI DURGA KEDARI0% (1)

- Davao Del Sur - MunDocument41 pagesDavao Del Sur - MunireneNo ratings yet

- 2013 2015 Ethics Bar ExaminationsDocument61 pages2013 2015 Ethics Bar ExaminationsMiley Lang100% (1)

- PNB Vs CA (83 SCRA 237)Document1 pagePNB Vs CA (83 SCRA 237)sherrylmelgarNo ratings yet

- Dulalia vs. CruzDocument6 pagesDulalia vs. CruzAdrianne BenignoNo ratings yet