Professional Documents

Culture Documents

Executive Summary - Stainless Steel Market

Uploaded by

Agustina EffendyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Executive Summary - Stainless Steel Market

Uploaded by

Agustina EffendyCopyright:

Available Formats

Indonesia’s Market for Stainless Steel

THE INDONESIA’S MARKET

FOR STAINLESS STEEL

EXECUTIVE SUMMARY

Market background

• The global economic crisis has changed the shape of the world economy. The

crisis that began in the United States in 2007 spread worldwide, with no

exception to developing countries including Indonesia. However, until the third

quarter of 2008 the Indonesian economy was still charting above 6% growth

with continued healthy performance in the financial sector reflected in a stable

exchange rate. However, toward the end of 2008, the fallout from the crisis

began to take hold. Weakening exports, pressure on the balance of payments

and turmoil on the money market took their toll on Indonesia’s economic growth.

• During 2008, Indonesian’s economy maintained adequate performance amid the

global turmoil. Overall economic growth reached 6.1% in 2008, slightly below

the 6.3% recorded in the previous year. This growth was primarily driven by

private consumption and exports.

• On the demand side, the effect of weakening global demand in the first half of

2008 was still offset by high world commodity prices. As a result, exports and

investments maintained growth. In the second half of 2008, however, Indonesian

exports were hit by the downturn in global economic growth and heightened

uncertainty on financial markets, and slowed significantly during the final quarter

of the year.

• Bank Indonesia projects a drop in economic growth in 2009 to around 4.0% with

downside risk if the global economic downturn is greater than predicted. The

more modest growth in Indonesia cannot be regarded as bad when compared to

the many other countries forecasted to record negative growth.

• One of the advantages of the Indonesian economy is the large population that

represents a potential market supporting economic growth. During 2009,

Prepared by Data Consult 3

Indonesia’s Market for Stainless Steel

economic growth in Indonesia will be driven primarily by domestic demand and

especially household consumption. Despite predictions of slowing, household

consumption is still expected to show resilience, particularly in view of the

government plans for an added fiscal stimulus in 2009.

• Manufacturing industry growth in 2009 is forecasted to reach 2.0%, down

significantly from the preceding year. The reason for this flagging performance is

weakening exports in tandem with slowing domestic demand. The global

economic crisis will give significant blow to export oriented manufacturing,

including textiles and textile products, footwear, electronics, automotives, wood

and wood handicrafts.

• Weak domestic and external demand will force companies in the manufacturing

sector to suspend production in a move to avoid excessive build-up of stocks.

Stainless steel market

• The market size of stainless steel in Indonesia hasfluctuated with increasing

trend from around 76.4 thousand tons in 2001 to 140.7 thousand tons in 2005 ,

declined slightly to 123.9 thousand tons in 2006 , but revived strongly

afterward to to 322 thousand tons in 2008.

• The market value has also increased from only US$ 117 million in 2001 to

around US$ 200 million in 2005 and rocketed to around US$ 563 million in

2008.

• The average growth of market size in the last 8 years is 32% a year, while in

the last five years the average growth is almost 50% a year.

• The spectacular market growth of over 100% in 2008 was driven by the rising

demand for flat products particularly of cold rolled products of less than 600

mm wide. These type of products are used mainly by automotive component

industry, electrical component , commercial kitchen products and gasket

manufacturing.

Prepared by Data Consult 4

Indonesia’s Market for Stainless Steel

• The market is dominated by flat products accounting for around 75% and the

remaining share for bars & wires ( 17.5%), tubular (2.7%) and fitting and

flanges (4.6 %). In terms of value, the composition is 67 % for flat products, 16

% for bars and wires, 5 % for tubulars and 12 % flanges and fittings. There is a

trend of increasing share of bars and wires, while the shares of tubulars and

fittings tend to decrease over the last 8 years.

• The Indonesia’s consumption of stainless steel is still small, only around

320,000 tons or around 5% of the total consumption of carbon steel which is

around 7.5 million tons a year. Per capita stainless steel consumption is

around 1.5 kg as compared to 33 kg for carbon steel.

• The market is still fully dependent on import for stainless steel materials as

there has not any stainless steel making company yet in the country. There

are two cold rolling mills, but both of them use imported materials for their

productions. There are plans to develop nickel smelter and stainless steel

making plants, but these projects are suspended .

Flat products

• The market size of flat products totals 243 thousand tons with a value of

around US$ 394 million in 2008. However, around 30% million is used by

existing cold rolling millers. Imported hot rolled flat stainless steel amounted to

167.1 thousand tons or 61.4 % , while cold rolled flat stainless steel 105.2

thousand tons or 38.6 % of total import in 2008.

• In the meantime, since 2006, there has been a notable volume of export of

cold rolled flat stainless steel due to the operations of cold milling mill of PT

Jindal Stainless Steel which is export oriented.

• A study made to import documents in 2006 revealed that 40% of flat stainless

steel imported consist of SS 200 series and 38% of 300 series. Most of SS

Prepared by Data Consult 5

Indonesia’s Market for Stainless Steel

200 series consist of SS 201 or J 4 grade which are imported mainly by PT

Jindal Stainless Indonesia.

• Including Jindal, about 70% of imports are done by end users, and only 30 %

by traders / stockiest. However, if Jindal is excluded, the composition of

imports is 62% by direct users and 38% by traders.

• Excluding , Jindal , top five importers are PT Kingfurn International ( furniture

industry), PT Sutindo Raya Mulia ( Trader), PT Steel Pipe Industry Indonesia (

Pipe industry), PT Heisei Stainless Steel Industry ( Pipe indusry ) and PT JFE

Shoji Steel ( trading and coil center).

• Top five suppliers are Acerinox, Malaysia , Sunstar Logistic, Singapore , Inox

Stal Handelsselskab, JFE Shoji Trade Corp , and Oitokumpu Stainless OY

• The automotive components and kitchenware industries are two largest

segments of end users of flat stainless steel, contributing 26 % and 22%

respectively to total market. Stainless pipe industry is the third largest user of

flat stainless steel particularly of hot rolled products. Other major users are

plant equipment fabricators, furniture manufacturers, steel constructions and

agriculture equipment manufacturers.

Bars and wires

• Total market of stainless steel bars and wires is estimated at 56.4 thousand

tons valued at US$ 92.4 million ( CIF value) in 2008

• The annual growth in 2001 and 2008 is around 45 % with substiantial growth

experienced in 2008

• In terms of value , the structure of the market consists of 69 % SS 304, 12 %

SS 316 and 8 % of special grades

• HS 722 300.00 ( Wire of stainless steel ) is the main types of bars and wires

imported into Indonesia. Import of this product totalled US$ 27 million or 30 %

of total import.

• About 75% of imports are done by end users, and only 25% by traders /

stockiest.

Prepared by Data Consult 6

Indonesia’s Market for Stainless Steel

• Top five importers are PT Alam Lestari Unggul ( Wire ), PT Sutindo Raya

Mulia ( stockiest), PT Avesta Welding ( welding electrodes), PT Good Rich

Pindad Aeronautical ( airacraft component), and PT MCI Prima Gasket ( Gasket

industry)

• Top five suppliers are Thengzhou Tengda ( China), Menam Stainless Wire (

Thailand), Kuang Tai Metal Industrial ( Taiwan) , Nippon Reinz Co ( Japan) and

Light Metal Sdn Bhd ( Malaysia).

• Wire and welding electrode industry is the largest segment of end users of rod

, bar and wire stainless steel , contributing 43 % to total market , followed by

bolt and nut industry ( 13.5%) and furniture industry (7.1%). PT Alam Lestari

Unggul and PT Avesta Welding are two largest users of stainless steel bars

and wires. PT Alam Lestari Unggul is a wire producer that use stainless steel

bars for their raw materials, while PT Avesta Welding uses stainless steel core

wire for their materials.

• Bolt and nut industry is also a major user of stainless steel wires. One of the

major bolt and nut producer, PT Moon Lion Industries use XM7B stainless

steel wire of of 2.17-5.25 mm diameters. . This company use 200-250 tons

stainless steel wires a year.

Tubular products

• Total market of stainless steel tubular products is estimated at 14.8 thousand

tons in 2008 valued at around US$ 60 million ( CIF value) .

• Import is dominated by welded stainless steel pipe of HS 730640 ( other

tubes, welded 12.5 mm lt, diameter less than 37.5 mm of stainless steel) and

HS 730449 (tubes,pipe&hollow profiles,stainless steel ,smls,of circ cross

sect,nes)

• The main grades of stainless steel imported are SS 304 ( 73 %) , SS 316 (

13%) and SS 400 ( 7%). The main countries of origin are Taiwan, Japan,

Germany, China and Korea.

Prepared by Data Consult 7

Indonesia’s Market for Stainless Steel

• Around 80 % of stainless steel of tubular products are imported by direct end

users and only around 20% by traders/ stockist. Major importing end users

include PT Siemens Indonesia ( Electrical equipment), PT Indah Kiat, (Pulp and

Paper), PT AT Indonesia ( Automotive component).

• Top five importers are PT Siemens Indonesia ( electreical), Indah Kiat group (

pulp and paper) , PT AT Indonesia ( automotive component), PT Komponen

Futaba ( automotive component) and Sutindo Raya Mulia ( trader)

• Top five suppliers are Thengzhou Tengda ( China), Menam Stainless Wire (

Thailand), Kuang Tai Metal Industrial ( Taiwan) , Nippon Reinz Co ( Japan) and

Light Metal Sdn Bhd ( Malaysia).

• Automotive industry is also the largest user of stainless steel tubular products

accounting for about 27% of the total market. Other major end users are Pulp

and paper industry ( 19%) and electrical equipment industry.

Fittings and Flanges

• Total market of stainless steel fittings and flanges is estimated at US$ 67.0

million ( CIF value) in 2008, a sharp increase as compared to only US$ 29

million in 2007.

• The market is dominated by products of HS No.730721 (stainless steel

flanges) accounting for 92% and the rest by stainless fittings ( HS 730723) .

• Around 90% of products are imported by direct end users and only 10% by

traders/ stockist.

• Major importing end users include marine construction/ equipment fabricators,

power plant projects, mining contractors, oil and gas companies, shipbuilding

company, plant equipment and heavy equipment assemblers.

• Flanges and fittings of stainless steels are used mainly by Electric power

generation/ equipment, steel construction , oil and gas industries. These three

segments contributed a combined market share of 77% . PLN , the state

electricity company is the largest user of flanges and fittings .

Prepared by Data Consult 8

Indonesia’s Market for Stainless Steel

Market prospects

The weakening global demand due to global economic recessions will effect

demand for various export products of Indonesia including those related with

stainless steel based products such as commercial kitchenwareaand home

appliances. The worsening outlook for the world economy also prompted

business to postpone investment spending and to pursue efficiency improvements,

resulting in slowed investment growth with knock-on effects on public purchasing

power.

One of the advantages of the Indonesian economy is the large population that

represents a potential market supporting economic growth. Despite predictions of

slowing, household consumption is still expected to show resilience, particularly in

view of the government plans for an added fiscal stimulus in 2009.

Although not as strong as previous years especially in 2008, the market for

stainless steel products will be still quite prospective , as some of their downstream

products such as home appliances, and automotive components have still

encouraging prospects. Although expecting a downturn in the market size as

compared to the exceptionally high market in 2008, the market size in the following

years are expected to be still larger than the situation in 2007.

Recommendations

The study recommends several prospective market segments to be further studied

to explore their buying preferences, their processing facilities , sources of raw

materials , market growth etc. These recommended prospective market segments

are automotive component industry, kitchenware, plant equipment, wire industry,

food processing, pulp and paper, electrical components and steel constructions.

Please email to survey_dataconsult@yahoo.com to obtain the full report.

Enclosed is the list of content of the report

Prepared by Data Consult 9

Indonesia’s Market for Stainless Steel

E MARKET INTELLIGENT REPORT :

STAINLESS STEEL IN INDONESIA

LIST OF CONTENTS

Page

Executive Summary viii

CHAPTER I – INTRODUCTION 1

CHAPTER II – MARKET BACKGROUND

2.1 Global economic crisis to slow down economic growth 3

2.2. Indonesian economy in 2008 4

2.3 Indonesian economy outlook for 2009 8

2.4. Manufacturing sector the backbone of the economy 9

2.5. Trend of construction sector 12

CHAPTER III – TECHNICAL ASPECTS 15

3.1 Definitions and product characteristics 15

3.2 Properties 17

3.3 Technical standard 20

3.4 Application of stainless steel 24

CHAPTER IV – MARKET SIZE OF STAINLESS STEEL PRODUCTS 27

4.1. The market rose sharply in 2008 27

4.2. Flat products dominating the market 29

4.3. New stainless steel making plant under preparations 31

Prepared by Data Consult 10

Indonesia’s Market for Stainless Steel

Page

CHAPTER V - FLAT STAINLESS STEEL

5.1. Trade classification 33

5.2. Market overview 34

5.3. Two cold rolling mills in operation 36

5.4. Imports fluctuated with strong upward trend 39

5.4.1. Hot rolled flat stainless steel dominating the market 39

5.4.2. Singaore became the largest exporter to Indoensia 44

5.5. Imports dominated by grade 300 and 200 series of stainless steel 46

5.6. Cold rolling millers the largest importer 48

5.6. Key overseas suppliers 55

CHAPTER VI- STAINLESS STEEL ROD,BAR AND WIRE

6.1. Trade classifications 60

6.2. Market overview 62

6.3. Strong imports since 2005 64

6.4. Market dominated by SS 304 grade 65

6.5. End users importers have significant role 67

6.6. Key overseas suppliers 72

CHAPTER VII STAINLESS STEEL TUBULAR PRODUCTS 77

7.1. Product description and trade classifications 77

7.2. Market overview 80

7.3. Development of imports of tubular products 81

7.4 SS 304 dominating tubular markegt 82

7.5. Paper and automotive component industry the major users 83

7.6. Key overseas suppliers 84

Prepared by Data Consult 11

Indonesia’s Market for Stainless Steel

Page

80

CHAPTER VIII - STAINLESS STEEL FLANGES AND FITTINGS

8.1 Product desctiptions and trade classification 89

8.2 Market overview 90

8.3. Development of imports 91

8.4. Specification of tubes imported 92

8.5. Endusers are direct importers 97

8.6. Key overseas suppliers 99

CHAPTER IX – MARKET SEGMENTS OF STAINLESS STEEL 101

9.1. Flat products 101

9.2. Rod, bars and wires 102

9.3. Stainless steel tubular products 104

9.4. Stainless steel flanges and fittings 105

9.5. Summary of the market segments 106

CHAPTER X – PROFILE OF MAJOR END USERS OF STAINLESS 112

STEEL

10.1. PT Sunstar Engineering Indonesia 112

10.2. PT Kingfurn International 113

10.3. PT Steel Pipe Industry of Indonesia (SPINDO) 114

10.4. PT Nayati Indonesia 117

10.5. PT Heisei Stainless Steel Industry 119

10.6. PT Metalina Tunggal 122

10.7. PT Alam Lestari Unggul 124

CHAPTER XI – PROFILE OF MAJOR TRADERS OF STAINLESS 127

STEEL

11.1 PT Sutindo Raya Mulia 127

Prepared by Data Consult 12

Indonesia’s Market for Stainless Steel

Page

11.2 PT Angkasa Perindo Sakti 135

11.3 PT Dihen Bersama 139

CHAPTER XII – CONCLUSIONS AND RECOMMENDATIONS 143

12.1. Concluding summary 143

12.2. Recommendations 147

LIST OF TABLES

No Page

2.1. GDP growth and distribution by expenditures, 2005-2008 5

2.2. GDP and other key economic indicators, 2002-2008 7

2.3. Economic growth outlook by sector 9

2.4. Composition of GDP at current market price by sector, 2004-2008 10

2.5. Construction value completed by ICA by type of construction work, 12

2002-2007

2.6. Share of construction value completed by ICA by type of

consutruction works, 2002-2007

4.1. Development of market size of stainless steel in Indonesia, 2001- 27

2008

4.2. Development of market value of stainless steel in Indonesia, 2001- 28

2008

5.1. Market size, import and export of flat stainless steel, 2001-2008 35

5.2. Producers of stainless steel coil/ plate as recorded by the ministry of 37

Industry

5.3. Specifications of products of domestric stainless steel producers 38

5.4. Stainless steel coil/plate production by company and grade, 2008 86

5.5. Development of Indonesia/s import volume of flat stainless steel, 40

2001-2008

5.6. Development of Indonesia/s import value of flat stainless steel, 42

2001-2008

Prepared by Data Consult 13

Indonesia’s Market for Stainless Steel

5.7 Imports of flat stainless steel by main countries of origins, 2001- 45

2008

5.8 Structure of flat stainless steel improts, by grade, 2006-2008 46

5.9. Importers of SS 304 flat stainless steel, 2006 49

5.10. Importers of SS400 series of flat stainless steel and their imports, 51

2006

5.11. Selected imorters of SS316 52

5.12. Size ofstainless steel coil and plate imported by selectd end users, 53

traders

5.13. Overseas suppliers of flat stainless steel products, 2006 55

5.14. Counries of origin and ain suppliers, 2006 56

6.1. Import volume development of stainless steel bars and wires, 2001- 64

2008

6.2. Import value development of stainless steel bars and wires, 2001- 65

2008

6.3. Imports of stainless steel bars and wires by grade, 2008 66

6.4. Main importers of stainless steel bars and wire products of SS 304 68

grade, 2006

6.5. Main importers of stailess steel bars and wire products of SS 316 69

grade, 2006

6.6. Main importers of stailess steel bars and wire products of Special 70

grade , 2006

6.7. Imports of stainless steel barfs and wire products of SS 304 grade 71

by trading companies

6.8. Suppliers of stainless steel bars and wires, 2006 73

6.9. Country of origins and main suppliers of stainless steel bars and 74

wires, 2006

7.1. Import development of stainless steel tubuars, 2001-2008 81

7.2. Importers of stainless steel tubulars by grade, 2006 83

7.3. Main suppliers of tubulars and countries of origin, 2006 85

7.4. Main suppliers of stainless steel tubulars and their importers, 2006 86

8.1. Import development of stainless steel tubularf products, 2001-2008 91

Prepared by Data Consult 14

Indonesia’s Market for Stainless Steel

8.2. Type of products imported by selected end users 92

8.3. Main imporers of stainless steel fittings and flanges 98

8.4. Suppliers of stainless steel fittings and flanges, with export value 99

more than US$ 100,000 in 2006

8.5. Other main sjuppliers of stainless steel fittings and flanges, 2006 100

9.1. Market segment of flat stainless steel, 2007 101

9.2. Market segments of stainless steel bars and wires 103

9.3. Market segments of stainless steel tubulars, 2007 104

9.4. Market segments of stainless steel fittings and flanges, 2007 106

9.5. Type of stainless steel used bhy selected industrial users 107

9.6. Summary of market segments of stainles steel in terms of volume, 108

2007

9.7. Summary of market segments of stainles steel in terms of value 109

2007

9.7. Importers of stainless stel buy market segments 110

10.1. Specification of stainless steel used by PT Kingfurn International 113

10.2 Specification of stainless steel used by SPINDO 115

10.3. Specification of stainless steel used by PT Nayati Indonesia 118

10.4. Specification of stainless steel used by PT Heisei Stainless Steel 120

Industry

10.5. Specification of stainless steel used by PT Metalina Tunggal 123

10.6. Specification of stainless steel used by PT Alam Lestari Unggul 125

11.1. Specification of stainless steel imported by PT Sutindo Raya Mulia 127

11.2. Specification of stainless steel imported by PT Angkasa Perindo 136

Sakti

11.3 Specification of stainless steel imported by PT Dihen Bersama 139

LIST OF GRAPHS/ CHARTS

No Page

4.1. Development of market volume and value of stainless steel, 28

Prepared by Data Consult 15

Indonesia’s Market for Stainless Steel

Indonesia, 2001-2008

4.2. Market structure by type of products ( in volume), 2008 29

4.3. Development of market volume of stainless steel in Indonesia by 30

type of products, 2001-2008

4.4. Development of market valueof stainless steel in Indonesia by type 30

of products, 2001-2008

4.5. Per capaitaq consumption of stainless steel in Indonesia, 2001- 31

2008

5.1. Market development , import and export of flat stainless steel, 35

2001-2008

5.2. Development of import volume and value of flat steel, 2001-2008 44

5.3. Import of flat stainless steel by grade, 2006-2008 47

6.1. Market size ( import) of stainless steel bars and wires, 2001-2008

6.2. Market structure of stainless steel bars and wires by grade

7.2. Market structure of stainless steel tubular by grade 82

8.1. The market of stainless steel fittings and flanges, 2001-2008 91

9.1. Market segmentation of flat stainless steel 102

9.2. Market segmentation of stainless steel bars and wires 103

9.3. Market segmentation of stainless steel tubulars 105

9.4. Market segmentation of stainless steel fittings and flanges 105

9.5. Summary of marke segments of stainless steel 109

APPENDICES

1. Directory of stainless steel traders 149

2. Directory of stainless steel industrial users 163

Please email to survey_dataconsult@yahoo.com to obtain the full report.

Prepared by Data Consult 16

You might also like

- The Iron Puddler My life in the rolling mills and what came of itFrom EverandThe Iron Puddler My life in the rolling mills and what came of itNo ratings yet

- (Jaso) F102-09Document16 pages(Jaso) F102-09AJ100% (1)

- Austenitizing Heat Treatment PDFDocument20 pagesAustenitizing Heat Treatment PDFsivajirao70100% (1)

- Material Identification NumbersDocument2 pagesMaterial Identification Numbersrajatapc12007No ratings yet

- Causes of Casting Defects With RemediesDocument6 pagesCauses of Casting Defects With RemediesKavita KaleNo ratings yet

- Classification of SteelsDocument6 pagesClassification of SteelsMark Anthony Asañez BrianNo ratings yet

- Riview On Cold Drawing Process PDFDocument7 pagesRiview On Cold Drawing Process PDFAmandeep Singh GujralNo ratings yet

- Nisshin Steel Cold Rolled Special Steel StripDocument28 pagesNisshin Steel Cold Rolled Special Steel StripekopujiantoeNo ratings yet

- Ball Joint TesterDocument3 pagesBall Joint TesterManikanta MechNo ratings yet

- Industrial Fasteners, Nuts & BoltsDocument79 pagesIndustrial Fasteners, Nuts & BoltsMudduKrishna shettyNo ratings yet

- Wilsons LTD Nickel Alloy AMS 5662 Alloy 718 450Document3 pagesWilsons LTD Nickel Alloy AMS 5662 Alloy 718 450Ray Mark De TorresNo ratings yet

- Filter NotesDocument46 pagesFilter Notestanzil10100% (1)

- Preventing Scale Loss During Heat Treatment & Hot Forging - With ImagesDocument17 pagesPreventing Scale Loss During Heat Treatment & Hot Forging - With ImagesSrikar Shenoy100% (1)

- Imds Recommendation 001 Annex IDocument33 pagesImds Recommendation 001 Annex IAnjali DeshpandeNo ratings yet

- Metal Repairs: Laser WeldingDocument24 pagesMetal Repairs: Laser WeldingV DhinakaranNo ratings yet

- General Tolerances For Linear and Angular Dimnsions (Din Iso 2768 t1)Document1 pageGeneral Tolerances For Linear and Angular Dimnsions (Din Iso 2768 t1)VIVEK UPADHYAYNo ratings yet

- Is 209 - 1992 Zinc Ingot - SpecificationDocument5 pagesIs 209 - 1992 Zinc Ingot - SpecificationRam NiwasNo ratings yet

- A 48 Gray Iron CastingsDocument5 pagesA 48 Gray Iron Castingswasatiah05No ratings yet

- Casting DefectsDocument23 pagesCasting DefectsRamanujam RadhakrishnanNo ratings yet

- SIS-S 501 50 AG Hot Rolled Steel Rounds (Up To Dia 180mm)Document5 pagesSIS-S 501 50 AG Hot Rolled Steel Rounds (Up To Dia 180mm)Rajoo PrajapatiNo ratings yet

- IIW - International Institute of WeldingDocument3 pagesIIW - International Institute of WeldingNilesh MistryNo ratings yet

- ChassisDocument30 pagesChassisRavi KiranNo ratings yet

- Superglaze Aluminum Mig Welding GuideDocument28 pagesSuperglaze Aluminum Mig Welding Guidetastaman123No ratings yet

- Mil DTL 24211CDocument8 pagesMil DTL 24211CmurphygtNo ratings yet

- Alluminio Inglese Binder PDFDocument28 pagesAlluminio Inglese Binder PDFrudi 01No ratings yet

- Is 1570 7Document18 pagesIs 1570 7Raj K Sharma100% (1)

- SurveyScoringGuidelines W-HTX 2000Document58 pagesSurveyScoringGuidelines W-HTX 2000guzinetti100% (1)

- Ferrous Metals: General Grade Cast IronsDocument8 pagesFerrous Metals: General Grade Cast IronskkamalakannaNo ratings yet

- ISO 9692 3 2002 Joint PreparationDocument16 pagesISO 9692 3 2002 Joint PreparationLHYT NTUANo ratings yet

- Cold Rolled Steel Sheet: Cat - No.B1E-002-03Document27 pagesCold Rolled Steel Sheet: Cat - No.B1E-002-03Frankie Ting100% (1)

- White Paper Automated Ultrasonic Inspection of Tube To Tube Sheet WeldsDocument7 pagesWhite Paper Automated Ultrasonic Inspection of Tube To Tube Sheet WeldsdanemsalNo ratings yet

- Raw vs. Part Heat Treatments - What Is The Difference.Document4 pagesRaw vs. Part Heat Treatments - What Is The Difference.skluxNo ratings yet

- Cast Iron BMEDocument2 pagesCast Iron BMEsahitya karaheNo ratings yet

- Scope Aluminum 6061 Catalogue enDocument4 pagesScope Aluminum 6061 Catalogue ensav33No ratings yet

- Corrosion Testing and MeasurementsDocument9 pagesCorrosion Testing and MeasurementsVaish NaviNo ratings yet

- Astm B240-09 PDFDocument4 pagesAstm B240-09 PDFRaúlNo ratings yet

- Is 15582 2005Document17 pagesIs 15582 2005sarath6725No ratings yet

- Testbars Vs Casting PropertiesDocument36 pagesTestbars Vs Casting Propertiescastco@iafrica.comNo ratings yet

- Astm E10 2001 PDFDocument9 pagesAstm E10 2001 PDFSofiaJabadanEspulgarNo ratings yet

- Effect of Boron PDFDocument8 pagesEffect of Boron PDFKishan krNo ratings yet

- Casting DefectDocument5 pagesCasting DefectSaurabhNo ratings yet

- Conformal Cooling 140217011257 Phpapp01 PDFDocument50 pagesConformal Cooling 140217011257 Phpapp01 PDFcute7707No ratings yet

- AQL 2.5 (Normal)Document3 pagesAQL 2.5 (Normal)Jahidul IslamNo ratings yet

- MCM AllDocument7 pagesMCM AllPalanisamy RajaNo ratings yet

- 1.1 Lean SystemDocument21 pages1.1 Lean SystemSujoy DattaNo ratings yet

- NitridingDocument13 pagesNitridingShashidhar Ks KadamaNo ratings yet

- Lecture 18 - Powder MetallurgyDocument13 pagesLecture 18 - Powder MetallurgyKonark PatelNo ratings yet

- Wire RoadDocument16 pagesWire Road02081987No ratings yet

- Din Etg 100Document1 pageDin Etg 100durgeshdesignNo ratings yet

- Geomet 500 PDFDocument2 pagesGeomet 500 PDFKaran Chadha100% (1)

- Reduction of Unforged Bar Bulb in Engine Valve ManufacturingDocument6 pagesReduction of Unforged Bar Bulb in Engine Valve ManufacturingSurajNo ratings yet

- M6x1.0x23 Long HHS Control PlanDocument2 pagesM6x1.0x23 Long HHS Control PlanDhanluxmi AutomaticsNo ratings yet

- 150 Sample-Chapter PDFDocument25 pages150 Sample-Chapter PDFMochammad Waris SNo ratings yet

- Hammer Drive ScrewDocument1 pageHammer Drive ScrewNisa BN QANo ratings yet

- Troubleshooting Induction Hardening Problems - Part 1Document2 pagesTroubleshooting Induction Hardening Problems - Part 1Jader PitangueiraNo ratings yet

- Omni Block - BrochureDocument2 pagesOmni Block - BrochureJames100% (1)

- ISO M ThreadDocument2 pagesISO M ThreaddineshkshirsagarNo ratings yet

- Ti SPC Ohe Fasteners 0120 PDFDocument31 pagesTi SPC Ohe Fasteners 0120 PDFCounter RoverNo ratings yet

- TOOL AND DIE STEEL FinalDocument73 pagesTOOL AND DIE STEEL FinalSapan KansaraNo ratings yet

- Indonesia Cable Market by Agustina DataconsultDocument9 pagesIndonesia Cable Market by Agustina DataconsultAgustina EffendyNo ratings yet

- Executive Summary RevisedDocument17 pagesExecutive Summary RevisedAgustina EffendyNo ratings yet

- Executive Summary Auto PartsDocument17 pagesExecutive Summary Auto PartsAgustina EffendyNo ratings yet

- Executive Summary IPP - IcnDocument18 pagesExecutive Summary IPP - IcnAgustina EffendyNo ratings yet

- A Study On Mental Health and Quality of Work Life Among Teachers Working in Corporate SchoolsDocument6 pagesA Study On Mental Health and Quality of Work Life Among Teachers Working in Corporate SchoolsKannamma ValliNo ratings yet

- Q2 Module 2 CESC WEEK 2Document17 pagesQ2 Module 2 CESC WEEK 2rectojhon7100% (1)

- E-Booklet Tacompact Board 2021Document6 pagesE-Booklet Tacompact Board 2021embenNo ratings yet

- Bank Soal LettersDocument17 pagesBank Soal Lettersderoo_wahidahNo ratings yet

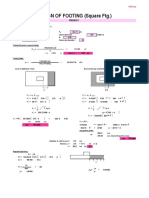

- Design of Footing (Square FTG.) : M Say, L 3.75Document2 pagesDesign of Footing (Square FTG.) : M Say, L 3.75victoriaNo ratings yet

- The Application of A Continuous Strip of Woven Material To A Body PartDocument15 pagesThe Application of A Continuous Strip of Woven Material To A Body Partczeremar chanNo ratings yet

- Mannitol For Reduce IOPDocument7 pagesMannitol For Reduce IOPHerryantoThomassawaNo ratings yet

- STAAD Seismic AnalysisDocument5 pagesSTAAD Seismic AnalysismabuhamdNo ratings yet

- Astm D2940 D2940M 09Document1 pageAstm D2940 D2940M 09INDIRA DEL CARMEN BERMEJO FERN�NDEZNo ratings yet

- 2018 Master Piping Products Price ListDocument84 pages2018 Master Piping Products Price ListSuman DeyNo ratings yet

- UnderstandingcpucoresDocument5 pagesUnderstandingcpucoresAbdul NabiNo ratings yet

- Teshome Tefera ArticleDocument5 pagesTeshome Tefera ArticleMagarsa GamadaNo ratings yet

- Datascope System 98Document16 pagesDatascope System 98Guillermo ZalazarNo ratings yet

- CS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemDocument29 pagesCS 252: Computer Organization and Architecture II: Lecture 5 - The Memory SystemJonnahNo ratings yet

- Khrone 5 Beam Flow Meter DatasheetDocument16 pagesKhrone 5 Beam Flow Meter DatasheetAnoop ChulliyanNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthFaidah Palawan AlawiNo ratings yet

- Forecasting and Demand Management PDFDocument39 pagesForecasting and Demand Management PDFKazi Ajwad AhmedNo ratings yet

- Packing Shipping InstructionsDocument2 pagesPacking Shipping InstructionsJ.V. Siritt ChangNo ratings yet

- Caso 1 - Tunel Sismico BoluDocument4 pagesCaso 1 - Tunel Sismico BoluCarlos Catalán CórdovaNo ratings yet

- Autonics KRN1000 DatasheetDocument14 pagesAutonics KRN1000 DatasheetAditia Dwi SaputraNo ratings yet

- Centaur Profile PDFDocument5 pagesCentaur Profile PDFChandra MohanNo ratings yet

- E-Payment (Telecom Operatoers)Document12 pagesE-Payment (Telecom Operatoers)Ahmed SelimNo ratings yet

- (English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)Document6 pages(English) 362L Stereoselective Wittig Reaction - Synthesis of Ethyl Trans-Cinnamate (#7) (DownSub - Com)moNo ratings yet

- Cortex - M1: Technical Reference ManualDocument174 pagesCortex - M1: Technical Reference ManualSzilárd MájerNo ratings yet

- Manual Teclado GK - 340Document24 pagesManual Teclado GK - 340gciamissNo ratings yet

- MockboardexamDocument13 pagesMockboardexamJayke TanNo ratings yet

- High-Rise Climb V0.6a Smokeydots PDFDocument10 pagesHigh-Rise Climb V0.6a Smokeydots PDFHer Lan ONo ratings yet

- Project SummaryDocument59 pagesProject SummarynaseebNo ratings yet

- Complete Governmental Structure of PakistanDocument6 pagesComplete Governmental Structure of PakistanYa seen khan0% (1)

- Comprehensive Accounting Cycle Review ProblemDocument11 pagesComprehensive Accounting Cycle Review Problemapi-253984155No ratings yet