Professional Documents

Culture Documents

Union Carbide & Netscape Case Analysis: Winning Business & IPO Valuation

Uploaded by

Vasundhara ChaturvediOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Union Carbide & Netscape Case Analysis: Winning Business & IPO Valuation

Uploaded by

Vasundhara ChaturvediCopyright:

Available Formats

Union Carbide Case

1. How difficult was it for First Boston to be selected by Union Carbide for its $2.5 billion recapitalization

program?

2. What did Bruce Jamerson and his team do to win this business?

3. Is there anything they should have done differently?

4. How well positioned is First Boston to build a relationship with Union Carbide?

Netscape’s IPO Case

1. Why has Netscape been so successful to date? What appears to be its strategy? What must be

accomplished if it is to be highly successful going concern in the long run? How risky is its current

competitive position?

2. Does Netscape need to go public to satisfy its capital needs? What would you estimate might be the

magnitude of its capital needs over the next 3 to 5 years? What sources other than the public equity

market could be tapped to satisfy those needs?

3. Why, in general, do companies go public? What are the advantages and disadvantages of public

ownership?

4. The case points out that the IPO market is sometimes characterized as a “hot issue” market, and that

many IPOs are viewed in retrospect as having been “underpriced.” What might explain these

phenomena? Should the Netscape board be concerned about underpricing? Why or why not?

5. Can the recommended offering price of $28 per share for Netscape’s stock be justified? In valuing

Netscape, make the following assumptions:

Total cost of revenues remains at 10.4% of total revenues,

R&D remains at 36.8% of total revenues,

Other operating expenses decline on a strait-line basis from 80.9% of revenues in 1995 to 20.9%

of revenues in 2001 (this would give Netscape a ratio of operating income to revenues close to

Microsoft’s which is about 34%),

Capital expenditures decline from 45.8% of revenues in 1995 to 10.8% of revenues in 2001,

Depreciation is held constant at 5.5% of revenues,

Changes in net working capital of essentially zero,

Long-term steady-state growth of 4% annually after 2005, and

A long-term riskless interest rate of 6.71%.

Given these assumptions, and starting from its current sales base of $16.625 million, how fast must

Netscape grow on an annual basis over the next ten years to justify a $28 share value?

6. As an executive in Netscape, what would you recommend with respect to the proposed offering

price? As an investor in Netscape, what would you recommend? As the manager of an institutional

fund who was willing to buy and hold Netscape’s stock at the originally proposed price of $14 per

share, would you be willing to buy and hold at an initial offering price of $28 per share? In your

answer, consider also the proposed increase in number of shares offered from 3.5 million to 5 million

You might also like

- Module 4 Guideline Case Questions PDFDocument3 pagesModule 4 Guideline Case Questions PDFAreeb Javaid100% (1)

- Case QuestionsDocument5 pagesCase Questionsaditi_sharma_65No ratings yet

- UntitledDocument13 pagesUntitledJocelyn GiselleNo ratings yet

- Suraj Lums Edu PKDocument9 pagesSuraj Lums Edu PKalice123h21No ratings yet

- Investment Banking: Individual Assignment 2Document5 pagesInvestment Banking: Individual Assignment 2Aakash Ladha100% (3)

- Netscape HomeworkDocument3 pagesNetscape HomeworkJaime Zulueta0% (2)

- The Well-Timed Strategy (Review and Analysis of Navarro's Book)From EverandThe Well-Timed Strategy (Review and Analysis of Navarro's Book)No ratings yet

- FINA 6092 Case QuestionsDocument7 pagesFINA 6092 Case QuestionsKenny HoNo ratings yet

- FM2 Câu hỏi ôn tậpDocument7 pagesFM2 Câu hỏi ôn tậpĐoàn Trần Ngọc AnhNo ratings yet

- Questions Azxcfor PreparationDocument2 pagesQuestions Azxcfor Preparationsomu9006No ratings yet

- Strategy Papers and Cases QuestionsDocument9 pagesStrategy Papers and Cases QuestionsMuhammad Ahmed0% (1)

- Netscape Growth Rate Needed to Justify $28 Share PriceDocument9 pagesNetscape Growth Rate Needed to Justify $28 Share PriceRasheeq Rayhan100% (1)

- Multinational Corporations and Emerging MarketsFrom EverandMultinational Corporations and Emerging MarketsRating: 1 out of 5 stars1/5 (1)

- Champion Road Case Report v6Document19 pagesChampion Road Case Report v6h9902600No ratings yet

- Whole Foods Market 2008: Assessing Strategy, Values and Financial PerformanceDocument26 pagesWhole Foods Market 2008: Assessing Strategy, Values and Financial PerformanceMiscue JoNo ratings yet

- Problems and Questions - 3Document6 pagesProblems and Questions - 3mashta04No ratings yet

- Questions For Preparation Macr 2019Document4 pagesQuestions For Preparation Macr 2019Abhay PrakashNo ratings yet

- Ifm AssignmentDocument4 pagesIfm AssignmentKanupriya Kohli100% (2)

- Buffett and Beyond: Uncovering the Secret Ratio for Superior Stock SelectionFrom EverandBuffett and Beyond: Uncovering the Secret Ratio for Superior Stock SelectionNo ratings yet

- Case QuestDocument6 pagesCase QuestAbdul Kodir0% (1)

- Go Long: Why Long-Term Thinking Is Your Best Short-Term StrategyFrom EverandGo Long: Why Long-Term Thinking Is Your Best Short-Term StrategyNo ratings yet

- FM 2 - Midterm ExamDocument5 pagesFM 2 - Midterm ExamNANNo ratings yet

- Coursework 1-Corporate FinanceDocument3 pagesCoursework 1-Corporate Financeyitong zhangNo ratings yet

- The Cost of Doing Business Study, 2019 EditionFrom EverandThe Cost of Doing Business Study, 2019 EditionNo ratings yet

- BUS 475 Week 2 Knowledge CheckDocument7 pagesBUS 475 Week 2 Knowledge CheckErika ToniNo ratings yet

- Capital for Champions: SPACs as a Driver of Innovation and GrowthFrom EverandCapital for Champions: SPACs as a Driver of Innovation and GrowthNo ratings yet

- PRQZ 2Document26 pagesPRQZ 2Hoa Long ĐởmNo ratings yet

- Finance Interview QuestionsDocument15 pagesFinance Interview QuestionsJitendra BhandariNo ratings yet

- 06 AnsDocument4 pages06 AnsAnonymous 8ooQmMoNs1No ratings yet

- Finance Assignment Ratio - Financial ManagementDocument9 pagesFinance Assignment Ratio - Financial ManagementKelly Brook100% (3)

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaNo ratings yet

- Snap IPODocument6 pagesSnap IPOSon NguyenNo ratings yet

- Risk and Return in Practice - ProblemsDocument6 pagesRisk and Return in Practice - ProblemsKinNo ratings yet

- 2 - 16th April 2008 (160408)Document5 pages2 - 16th April 2008 (160408)Chaanakya_cuimNo ratings yet

- Capital Budgeting Practice QuestionsDocument6 pagesCapital Budgeting Practice QuestionsjezNo ratings yet

- Alex Navab - Overview of Private EquityDocument21 pagesAlex Navab - Overview of Private EquityAlyson Davis100% (16)

- Lessons from Private Equity Any Company Can UseFrom EverandLessons from Private Equity Any Company Can UseRating: 4.5 out of 5 stars4.5/5 (12)

- Case Study AnacompDocument5 pagesCase Study Anacomppiscia1No ratings yet

- ARM SolDocument32 pagesARM SolRizwan AhmadNo ratings yet

- Entrepreneurship Questions ExamDocument3 pagesEntrepreneurship Questions ExamTodoran Ada100% (1)

- 1103 CaseDocument8 pages1103 Casezmm45x7sjtNo ratings yet

- Chapter 6 Prospective Analysis: ForecastingDocument10 pagesChapter 6 Prospective Analysis: ForecastingSheep ersNo ratings yet

- Living on the Fault Line, Revised Edition: Managing for Shareholder Value in Any EconomyFrom EverandLiving on the Fault Line, Revised Edition: Managing for Shareholder Value in Any EconomyRating: 3.5 out of 5 stars3.5/5 (3)

- Valuing Teuer Furniture Using DCF and Multiples MethodsDocument5 pagesValuing Teuer Furniture Using DCF and Multiples MethodsFaria CHNo ratings yet

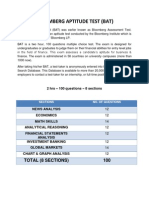

- Bloomberg Aptitude Test (BAT)Document10 pagesBloomberg Aptitude Test (BAT)Shivgan Joshi100% (1)

- FINA 410 - Exercises (NOV)Document7 pagesFINA 410 - Exercises (NOV)said100% (1)

- Corporate Financial Analysis: A Comprehensive Beginner's Guide to Analyzing Corporate Financial risk, Statements, Data Ratios, and ReportsFrom EverandCorporate Financial Analysis: A Comprehensive Beginner's Guide to Analyzing Corporate Financial risk, Statements, Data Ratios, and ReportsNo ratings yet

- Rosetta Stone IPO ValuationDocument16 pagesRosetta Stone IPO Valuationdxc1267075% (4)

- Business Administration Past PapersDocument35 pagesBusiness Administration Past PapersBilal Hussain0% (3)

- Sample Interview QuestionsDocument4 pagesSample Interview QuestionsDeepakNo ratings yet

- Tutorial Questions FinDocument16 pagesTutorial Questions FinNhu Nguyen HoangNo ratings yet

- Rosetta Stone IPO ValuationDocument16 pagesRosetta Stone IPO Valuationjack louis100% (1)

- Finance and the Multinational Firm: The New Role of Firms AbroadDocument13 pagesFinance and the Multinational Firm: The New Role of Firms AbroadFatin AfifaNo ratings yet

- STR 581 Capstone Final Exam All Part 1-2-3Document7 pagesSTR 581 Capstone Final Exam All Part 1-2-3johnNo ratings yet

- Problems and Questions - 4Document4 pagesProblems and Questions - 4mashta04No ratings yet

- MEG CV 2 CaseDocument10 pagesMEG CV 2 Casegabal_m50% (2)

- Tutorial Question (New) - Sem1, 2024Document20 pagesTutorial Question (New) - Sem1, 2024phamminhngoc2k4No ratings yet

- Sodium Lignosulfonate MSDS: Section 1: Chemical Product and Company IdentificationDocument5 pagesSodium Lignosulfonate MSDS: Section 1: Chemical Product and Company IdentificationYasdiOKNo ratings yet

- Letter of RecommendationDocument2 pagesLetter of RecommendationnaveenNo ratings yet

- (Eng) Advanced Concept Training - 2d Concrete Members en 1992 - 2017Document69 pages(Eng) Advanced Concept Training - 2d Concrete Members en 1992 - 2017Muscadin MakensonNo ratings yet

- Statement of Financial Affairs: United States Bankruptcy Court Southern District of New YorkDocument42 pagesStatement of Financial Affairs: United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- Panjab University, Chandigarh: (Theory Examinations) TIME OF EXAMINATION: 9.30 A.M. To 12.30 P.MDocument3 pagesPanjab University, Chandigarh: (Theory Examinations) TIME OF EXAMINATION: 9.30 A.M. To 12.30 P.MManav ChhabraNo ratings yet

- Labview ProgrammingDocument20 pagesLabview ProgrammingJames WoodNo ratings yet

- Nato Military Policy On Public AffairsDocument21 pagesNato Military Policy On Public AffairsiX i0No ratings yet

- Tafila Technical University Course Syllabus for Manufacturing Processes (1) / Metal CuttingDocument4 pagesTafila Technical University Course Syllabus for Manufacturing Processes (1) / Metal CuttingG. Dancer GhNo ratings yet

- RICEFW Explained - Customization and Changes in SAPDocument20 pagesRICEFW Explained - Customization and Changes in SAPRoshan AhireNo ratings yet

- Music Business Chapter 9 Music PublishingDocument27 pagesMusic Business Chapter 9 Music Publishingcmk97No ratings yet

- DCM300E Clamp Meter Measures Earth Leakage CurrentDocument2 pagesDCM300E Clamp Meter Measures Earth Leakage CurrentKatamba RogersNo ratings yet

- 5.1 Quadratic Functions: 344 Learning ObjectivesDocument15 pages5.1 Quadratic Functions: 344 Learning ObjectiveskhadijaNo ratings yet

- 5 BFU 07406 Assessment of Credit ApplicationsDocument109 pages5 BFU 07406 Assessment of Credit ApplicationsDeogratias MsigalaNo ratings yet

- 20170322190836toms CaseDocument9 pages20170322190836toms CaseJay SadNo ratings yet

- Parts List of Engine Assy Ofdz-00536Document1 pageParts List of Engine Assy Ofdz-00536CwsNo ratings yet

- BEETLE /M-II Plus: POS System For The Highest Standards of PerformanceDocument2 pagesBEETLE /M-II Plus: POS System For The Highest Standards of PerformanceHeather JensenNo ratings yet

- Q 0092r1 - Mastersizer 3000 MAZ6222 2022 Kimia FarmaDocument4 pagesQ 0092r1 - Mastersizer 3000 MAZ6222 2022 Kimia FarmaCapital ExpenditureNo ratings yet

- 1ST Quarter Exam Mapeh 8Document7 pages1ST Quarter Exam Mapeh 8John Rey Manolo BaylosisNo ratings yet

- Study Plan VMware VSphere 6.5Document11 pagesStudy Plan VMware VSphere 6.5Milan PatelNo ratings yet

- Tools, Plans, and DIY Projects Index PDFDocument5 pagesTools, Plans, and DIY Projects Index PDFCivil War75% (4)

- Dynamic Programming Algorithm Explained in ECE 551 LectureDocument11 pagesDynamic Programming Algorithm Explained in ECE 551 Lectureadambose1990No ratings yet

- Cleaning Validation Master Plan PDFDocument9 pagesCleaning Validation Master Plan PDFBREWSKINo ratings yet

- Industrial Radiography Image Forming Techniques English 4Document114 pagesIndustrial Radiography Image Forming Techniques English 4Narasimha Murthy InampudiNo ratings yet

- Feaps PortfolioDocument17 pagesFeaps Portfolioapi-317208189No ratings yet

- Fundamentals WindDocument67 pagesFundamentals WindwlyskrdiNo ratings yet

- ZEOLITEDocument13 pagesZEOLITEShubham Yele100% (1)

- VampireRev4-Page Editable PDFDocument4 pagesVampireRev4-Page Editable PDFNicholas DoranNo ratings yet

- Solar Bloc DatasheetDocument2 pagesSolar Bloc DatasheetandresNo ratings yet

- Independent ConsultantDocument8 pagesIndependent ConsultantNaveen GowdaNo ratings yet

- Jurnal SinusitisDocument49 pagesJurnal SinusitisAramanda Dian100% (1)