Professional Documents

Culture Documents

Quick Terms

Quick Terms

Uploaded by

NANDHA KUMAR TOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quick Terms

Quick Terms

Uploaded by

NANDHA KUMAR TCopyright:

Available Formats

Quick Transfer Terms of Service (Terms & Conditions)

The "Quick Transfer" facility enables INB / SBI Anywhere App users to send

small value remittances to Beneficiaries without registering them.

Remitter can send funds to both Intra and Inter Bank beneficiary.

Using Onlinesbi.com

If the beneficiary’s account is maintained with a bank other than SBI, two

options viz. IMPS and NEFT are available for sending remittance.

If mode of transfer chosen is NEFT, Transaction will be processed maximum

within next working day depending on NEFT settlement time.

Quick Transfer facility using IMPS mode will remit funds instantly and is

available 24*7*365.

Auto refund for the failed IMPS or NEFT transaction will be credited to

customers’ account on next working day.

Transaction limit: Rs. 10,000/- per day and per transaction limit.

No Service charge is being levied if the beneficiary’s account is maintained

with SBI. Following Service charges are levied if the beneficiary’s account is

maintained with a Bank other than SBI;

Mode Service Charge

NEFT NIL

IMPS Upto Rs. 10,000 NIL

Please note that while the service charges for NEFT mode will be recovered in

addition to the remittance amount, the service charges for IMPS mode will be

recovered separately from your debit account.

Using SBI Anywhere Apps:

Users can transfer funds only using IMPS service available 24*7*365

Quick Transfer in Mobile Banking will remit funds instantly.

Auto refund for the failed IMPS transaction will be credited to customers

account on next working day.

Transaction limit: Rs. 10,000/- per transaction and Rs. 25,000/- per day.

Following Service charges are levied for Quick transfer service through SBI

Anywhere Apps:

Mode Service Charge

IMPS Upto Rs. 10,000 NIL

Terms of Usage of Quick Transfer service:

User can transfer funds to the Beneficiary without having requiring to register

the Beneficiary

User need to enter Beneficiary account number twice, of which one will be

masked, to ensure that customer enters correct data.

Every transaction will be approved only once the user provides OTP which will

be sent on users registered mobile number and e-mail, wherever applicable.

Customer will solely be responsible for correctness of the beneficiary

credentials entered and Bank will bear no liability in case of incorrect data

entered.

You might also like

- Nri Savings Account Downgrade FormDocument2 pagesNri Savings Account Downgrade Formjksankar0% (1)

- Quick TermsDocument1 pageQuick Termstusharjha.bittNo ratings yet

- Quick Transfer Terms of Service (Terms & Conditions)Document1 pageQuick Transfer Terms of Service (Terms & Conditions)SATHISH KUMARNo ratings yet

- Internet Banking FeaturesDocument7 pagesInternet Banking FeaturesDhrumi PatelNo ratings yet

- Central Bank of India Payment and Settlement SystemDocument11 pagesCentral Bank of India Payment and Settlement SystemAnuradha SinghNo ratings yet

- NEFT (National Electronic Fund Transfer)Document9 pagesNEFT (National Electronic Fund Transfer)KavithaNo ratings yet

- Functioning & Usage of Electric Money Transfers-Rtgs, Neft, Imps, UpiDocument18 pagesFunctioning & Usage of Electric Money Transfers-Rtgs, Neft, Imps, UpikanikaNo ratings yet

- Mobile Banking Guidelines To CustomerDocument3 pagesMobile Banking Guidelines To CustomerVaibhav BulkundeNo ratings yet

- NEFTDocument2 pagesNEFT2067 SARAN.MNo ratings yet

- Real Time Gross Settlement (RTGS)Document5 pagesReal Time Gross Settlement (RTGS)Vinit MathurNo ratings yet

- Unit 2 - BilpDocument14 pagesUnit 2 - BilpYashika GuptaNo ratings yet

- Rtgs and NeftDocument31 pagesRtgs and NeftPravah Shukla100% (5)

- Services 432Document22 pagesServices 432Bhisham Pal RajoraNo ratings yet

- Interbank Mobile Payment ServiceDocument24 pagesInterbank Mobile Payment ServiceThilaga Senthilmurugan100% (1)

- Payment and Settlement Systems in IndiaDocument23 pagesPayment and Settlement Systems in IndiagopubooNo ratings yet

- Mitc For Bob Lite Savings AccountDocument4 pagesMitc For Bob Lite Savings AccountramsanjayyNo ratings yet

- HO:Banking Operations Dept. Taking Banking Technology To The Common Man Chennai - 1Document6 pagesHO:Banking Operations Dept. Taking Banking Technology To The Common Man Chennai - 1Firdous HussainNo ratings yet

- Mobile Banking: State Bank Freedom - Your Mobile Your BankDocument4 pagesMobile Banking: State Bank Freedom - Your Mobile Your Bankhell_hello11No ratings yet

- INDIAN OVERSEAS BANK - Payment & Settlement MethodsDocument8 pagesINDIAN OVERSEAS BANK - Payment & Settlement Methodssoniya dhyaniNo ratings yet

- NeftDocument3 pagesNeftjasminnaurNo ratings yet

- Rtgs & Neft: December 2012Document6 pagesRtgs & Neft: December 2012senthilkumarskNo ratings yet

- Diagram of NeftDocument2 pagesDiagram of Neftkrunal3726No ratings yet

- Payment & Settlement SystemDocument29 pagesPayment & Settlement SystemnirajagarwalaNo ratings yet

- SUPERCARD Most Important Terms and Conditions (MITC)Document14 pagesSUPERCARD Most Important Terms and Conditions (MITC)Diwana Hai dilNo ratings yet

- Benefits of Post Office Savings AccountsDocument7 pagesBenefits of Post Office Savings Accounts2K22/BAE/79 KESHAV GARGNo ratings yet

- Customer'S Faqs For Interbank Mobile Payment Service (Imps) : October, 2010Document6 pagesCustomer'S Faqs For Interbank Mobile Payment Service (Imps) : October, 2010Ram MurthyNo ratings yet

- Mobile Banking FAQ Updated PDFDocument11 pagesMobile Banking FAQ Updated PDFP N rajuNo ratings yet

- Banking and NBFC - Module 6 NBFC Advisory and Non-Fund Based ServicesDocument69 pagesBanking and NBFC - Module 6 NBFC Advisory and Non-Fund Based Servicesnandhakumark152No ratings yet

- Interbank Mobile Payment ServiceDocument2 pagesInterbank Mobile Payment ServicePrincePSNo ratings yet

- Imps PDFDocument3 pagesImps PDFVirendra kambliNo ratings yet

- Basic Savings Bank Deposit Account SocsDocument6 pagesBasic Savings Bank Deposit Account Socstrue chartNo ratings yet

- Module 4Document100 pagesModule 4mansisharma8301No ratings yet

- UBL Business PartnerDocument3 pagesUBL Business PartnerwaqasCOMSATSNo ratings yet

- Online Inter Bank Fund Transfer Through NEFT: FAQ OnDocument3 pagesOnline Inter Bank Fund Transfer Through NEFT: FAQ Onarti guptaNo ratings yet

- Recent Trends in Banking ServicesDocument6 pagesRecent Trends in Banking ServicesShereen FathimaNo ratings yet

- M2N12816457Document1 pageM2N12816457janacadNo ratings yet

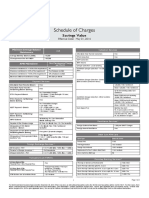

- Schedule of Charges: Savings ValueDocument2 pagesSchedule of Charges: Savings ValueNavjot SinghNo ratings yet

- ContractsDocument15 pagesContractsNnNo ratings yet

- M2N12500728Document1 pageM2N12500728nareshreddy_nare2987No ratings yet

- NEFT Vs RTGSDocument4 pagesNEFT Vs RTGSneehuneehuneehu12345No ratings yet

- NEFTDocument2 pagesNEFTAtharvaNo ratings yet

- Monthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Document2 pagesMonthly Average Balance Tex Basic - Rs 25,000 Tex Advantage - Rs 75,000Shoaib MohammedNo ratings yet

- Digital Products Latest Changes SummaryDocument5 pagesDigital Products Latest Changes Summaryjyzdmk2p8gNo ratings yet

- BM Remit FAQs enDocument7 pagesBM Remit FAQs enopera miniNo ratings yet

- E-Payment Mechanism of BanksDocument16 pagesE-Payment Mechanism of BanksMeenakshi SharmaNo ratings yet

- Conversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountDocument2 pagesConversion Form Customer Undertaking For Converting Existing Savings Account To Senior Citizen AccountIlyas SafiNo ratings yet

- Digital Banking UpdatesDocument46 pagesDigital Banking Updatesvivek_anandNo ratings yet

- Business LoanDocument1 pageBusiness Loank kaulNo ratings yet

- To View The Live Member Banks For Imps Click. HereDocument4 pagesTo View The Live Member Banks For Imps Click. Heremanoj AgarwalNo ratings yet

- Types of AccountsDocument7 pagesTypes of AccountsAnna LeeNo ratings yet

- SABB VISA Direct Campaign QA 1Document3 pagesSABB VISA Direct Campaign QA 1JavedNo ratings yet

- RTGSDocument15 pagesRTGSSneha KakatkarNo ratings yet

- Rtgs & Neft DetailsDocument4 pagesRtgs & Neft DetailsKiran MesaNo ratings yet

- ASY Aisa: Mobile BankingDocument17 pagesASY Aisa: Mobile BankingFaraz Alam100% (2)

- Terms and Conditions (Mobile Banking Service)Document5 pagesTerms and Conditions (Mobile Banking Service)PriyaNo ratings yet

- Bob Neft RtgsDocument3 pagesBob Neft RtgsTarak M ShahNo ratings yet

- FAQ Mobile BankingDocument5 pagesFAQ Mobile BankingAshif RejaNo ratings yet

- Procedural GuidelinesDocument1 pageProcedural GuidelinesNaman ParikNo ratings yet

- Iobuser ManualDocument16 pagesIobuser Manualrajubajaj030No ratings yet

- Peer-Graded Assignment: Weekly Challenge 2: Create Personas For Your Portfolio ProjectDocument15 pagesPeer-Graded Assignment: Weekly Challenge 2: Create Personas For Your Portfolio ProjectASH TVNo ratings yet

- Shoe Billing New UtkarshDocument15 pagesShoe Billing New UtkarshUtkarsh Singh SikarwarNo ratings yet

- DDDL7 ReadmeDocument6 pagesDDDL7 ReadmePhil B.No ratings yet

- SG Dashcam Viewer Users ManualDocument49 pagesSG Dashcam Viewer Users Manuall00z3rxNo ratings yet

- Webinar: Microcables - Optimal Solution For Denser and Faster Fiber DeploymentDocument22 pagesWebinar: Microcables - Optimal Solution For Denser and Faster Fiber DeploymentFederico MaggiNo ratings yet

- Drivers Read Me SonyDocument6 pagesDrivers Read Me SonytotocacatttNo ratings yet

- Course Title:-Advanced Computer Networking Group Presentation On NFV FunctionalityDocument18 pagesCourse Title:-Advanced Computer Networking Group Presentation On NFV FunctionalityRoha CbcNo ratings yet

- HCIqDocument78 pagesHCIqOanh NguyenNo ratings yet

- Test 1 Form 5 MathsDocument5 pagesTest 1 Form 5 MathsThiyaku MaruthaNo ratings yet

- RFS Radiaflex Brochure2013-06Document24 pagesRFS Radiaflex Brochure2013-06Anexa PlusNo ratings yet

- Control System Toolbox - Designing Cascade Control System With PI Controllers DemoDocument5 pagesControl System Toolbox - Designing Cascade Control System With PI Controllers Demojricardo01976No ratings yet

- Data Structures and Algorithms: CS3007 CEN2018Document20 pagesData Structures and Algorithms: CS3007 CEN2018Khawaja Muhammad Awais ArifNo ratings yet

- Factor Analysis: Statistical Methods and Practical Issues, Volume 14 Volume 1978Document5 pagesFactor Analysis: Statistical Methods and Practical Issues, Volume 14 Volume 1978Raja Shahid RasheedNo ratings yet

- Cf.250 Functional Design: Oracle R12 AP PARD Layout SolutionDocument24 pagesCf.250 Functional Design: Oracle R12 AP PARD Layout SolutionbishwabengalitolaNo ratings yet

- Carlos Silva General CharacteristicsDocument2 pagesCarlos Silva General CharacteristicsAmine MohamedNo ratings yet

- DES-1241.prepaway - Premium.exam.60q: Number: DES-1241 Passing Score: 800 Time Limit: 120 Min File Version: 1.0Document22 pagesDES-1241.prepaway - Premium.exam.60q: Number: DES-1241 Passing Score: 800 Time Limit: 120 Min File Version: 1.0Emre Halit POLAT50% (2)

- Pan Sharpening Algorithm 1Document30 pagesPan Sharpening Algorithm 1RichaSinhaNo ratings yet

- Manual de Usuario FBP Probe Microscope JDSUDocument12 pagesManual de Usuario FBP Probe Microscope JDSUAngel ContrerasNo ratings yet

- Real-Time Star Identification Using Synthetic Radial Pattern and Its Hardware ImplementationDocument9 pagesReal-Time Star Identification Using Synthetic Radial Pattern and Its Hardware ImplementationYans PangerunganNo ratings yet

- Question Bank - Permutation and Combination - IIT JEE - Toppr1Document4 pagesQuestion Bank - Permutation and Combination - IIT JEE - Toppr1AshutoshYelgulwarNo ratings yet

- Group2SADProposal Super Final Revised 1Document93 pagesGroup2SADProposal Super Final Revised 1AzeruxNo ratings yet

- LA3-Accept String and Display Its LengthDocument6 pagesLA3-Accept String and Display Its LengthVidya Ashok NemadeNo ratings yet

- Cad RubricDocument4 pagesCad Rubricapi-269248833No ratings yet

- Get All Alfresco Tags With CMIS - StackDocument4 pagesGet All Alfresco Tags With CMIS - StackpmrreddyNo ratings yet

- S14046 - CP Pricelist 01-07-2017Document96 pagesS14046 - CP Pricelist 01-07-2017amitvaze316No ratings yet

- Yield Curve Nelson Siegel SvenssonDocument13 pagesYield Curve Nelson Siegel Svenssonbxt5ys72d8No ratings yet

- m57 SMSC Datasheet PDFDocument5 pagesm57 SMSC Datasheet PDFsrboghe651665No ratings yet

- ENGG CUTOFF 2023 HK R2kannadaDocument45 pagesENGG CUTOFF 2023 HK R2kannadakiran smNo ratings yet

- RUCKUS ICX Switches in The DatacenterDocument3 pagesRUCKUS ICX Switches in The DatacenteralemnehNo ratings yet

- Write Optimized DSODocument7 pagesWrite Optimized DSOmig007No ratings yet