Professional Documents

Culture Documents

100000000494378

Uploaded by

Dalbir Singh0 ratings0% found this document useful (0 votes)

464 views1 pageBill hotel

Original Title

100000000494378c7585900-97a6-4a23-8b0e-76adab7cc68f

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBill hotel

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

464 views1 page100000000494378

Uploaded by

Dalbir SinghBill hotel

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

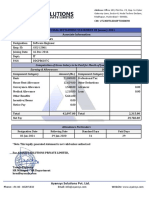

TELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED

Intelenet House,Plot CST No 1406-A/28,Mindspace,Malad(West),Mumbai-400090,India

Payslip for the month of October 2019

Employee Code 100000000494378 PF Account Number

Employee Name Hardip Singh Permanent Account Number CNAPS7394Q

Location Mohali Aadhar No 312616074762

Bank Name ICICI BANK LIMITED Grade Grade IV

Payment Mode Cheque Designation MANAGER- QUALITY

Bank Account Number 006601522061 Days Worked 31

Date of Joining 20 Aug 2019 Previous Monthly LOP 0

Date of Birth 07 Oct 1985 Paid Leave 42

UAN Number LOP 0

Esic Account Number

Earnings Monthly Rate Current Month Arrears Total Deductions Amount

Basic Salary 35362.00 35362.00 49051.00 84413.00 Professional Tax 600.00

House Rent Allowance 21216.00 21216.00 29429.00 50645.00 Provident Fund 4,380.00

FBP Allowance 1846.00 1846.00 2561.00 4407.00 Income Tax 2,931.00

Incentive 0.00 15912.00 0.00 15912.00 Arrears PF 5,886.00

National Holiday Basic 0.00 1141.00 0.00 1141.00 LWF Deduction 15.00

National Holiday Payment 0.00 744.00 0.00 744.00 Mediclaim 850.00

Salary Advance 79,662.00

Insurance 1,151.00

Gross Earnings 157,262.00 Total Deductions 95,475.00

Net Salary : 61,787.00

In words : Sixty One Thousand Seven Hundred Eighty Seven Only (All Amount Is In )

Income Tax Calculation for the financial Year 2019-2020

Particular Cumulative Projected Current Annual Details Of Exemption U/S 10

Basic Salary 0.00 176810.00 84413.00 261223.00 Driver Allowance Exemption 0

House Rent 0.00 106080.00 50645.00 156725.00 Food Coupon Exemption 0

Allowance

Gratuity Exemption 0

FBP Allowance 0.00 9230.00 4407.00 13637.00

HRA Exemption 38124

Incentive 0.00 0.00 15912.00 15912.00

Leave Travel Exemption 0

National Holiday 0.00 0.00 1141.00 1141.00

Basic Telephone Exemption 0

National Holiday 0.00 0.00 744.00 744.00

Payment

Investment Details

National Pension Scheme 6924.00

Salary For The Year 449382.00 PF + VPF 31481.00

Tuition Fees 24000.00

Gross Salary 449382.00 PPF 80000.00

Add : Previous Employer Salary 279733.00 Insurance Premium 25000.00

Less : Deduction U/S 10 14804.00 Mediclaim 80D 2001.00

Gross Taxable Income 714311.00

LESS : Profession Tax 2600.00 HRA Details

Less : Standard Deduction 50000.00

Month HRARecd RentPaid RentPaidLessBasic Basic/4050 HraExempt

LESS : Deduction Under section 80C 150000.00

LESS : Deduction US/80CCG, 80EE,80D,80DD,80DDB,80CCD 8925.00 AUG 8213 8200 6831 5476 5476

SEP 21216 8200 4664 14145 4664

Net Taxable Income (Rounded Off) 502890.00

OCT 21216 8200 4664 14145 4664

Income Tax Deduction

87A 0.00 Monthly Tax deducted in Salary

Income Tax Payable 13078.00 Month One Time Tax Monthly Tax Total Tax

Surcharge 0.00

October 601 2330 2931

Education Cess 523.00

Total Income Tax & Surcharge Payable 13601.00

Esop Tax to be Recovered in this Month 0.00

Esop Tax Already Deducted 0.00

Less Tax Deducted at source till current month 2931.00

Less Tax Deducted by Previous Employer 2407.00

Balance Tax Payable/Refundable 10670.00

Average Tax Payable per Month 2134.00

You might also like

- Sify Technologies payslip title for Vinod Kumar BoseDocument1 pageSify Technologies payslip title for Vinod Kumar BoseJOOOOONo ratings yet

- Payslip 2018 2019 1 100000000439462 IGSLDocument1 pagePayslip 2018 2019 1 100000000439462 IGSLMandeep Ranga100% (1)

- Payslip 2023 2024 5 100000000546055 IGSL PDFDocument1 pagePayslip 2023 2024 5 100000000546055 IGSL PDFKapilNo ratings yet

- 100000000494378Document1 page100000000494378Dalbir SinghNo ratings yet

- Payslip 2023 2024 5 200000000029454 IGSLDocument2 pagesPayslip 2023 2024 5 200000000029454 IGSLMohit SagarNo ratings yet

- Employee Details Payment & Working Days Details Location Details Nilu KumariDocument1 pageEmployee Details Payment & Working Days Details Location Details Nilu KumariRohit raagNo ratings yet

- OYO Hotel and Homes Private Limited Pay Slip for August 2022Document2 pagesOYO Hotel and Homes Private Limited Pay Slip for August 2022Vivek ViviNo ratings yet

- Salary SlipDocument1 pageSalary SlipPranav Kumar100% (1)

- Pay Slip - 604316 - Mar-23Document1 pagePay Slip - 604316 - Mar-23ArchanaNo ratings yet

- Salary SlipDocument1 pageSalary SlipSanjay SolankiNo ratings yet

- Manpreet Kaur: EligibilityDocument1 pageManpreet Kaur: EligibilityRajesh KumarNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAmrit RajNo ratings yet

- Payslip - May - 2020 PDFDocument1 pagePayslip - May - 2020 PDFchanduNo ratings yet

- Full and Final Settlement Statement of January 2021 Associate InformationDocument1 pageFull and Final Settlement Statement of January 2021 Associate InformationB BhaskarNo ratings yet

- Amara Raja Batteries LimitedDocument1 pageAmara Raja Batteries LimitedNani AnugaNo ratings yet

- Durga Malleswara RaoDocument1 pageDurga Malleswara RaoRajesh pvkNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipRahimaNo ratings yet

- You Have Opted For Old Tax RegimeDocument2 pagesYou Have Opted For Old Tax RegimeRamsheed Ashraf100% (1)

- Cryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Document1 pageCryoliten India Softwares: A-5 Faizabad Road Near Bhootnath Market Uttar, Pradesh India - 226016Rohit raagNo ratings yet

- February 2017 Payslip for Thalari RaoDocument1 pageFebruary 2017 Payslip for Thalari RaoThammineni Vishwanath Naidu100% (1)

- Fortis Hospital February 2019 PayslipDocument1 pageFortis Hospital February 2019 PayslipmkumarsejNo ratings yet

- PaySlip-EXC0857 (KARAN PRADIPRAO MAHALLE) - AUG - 2020Document1 pagePaySlip-EXC0857 (KARAN PRADIPRAO MAHALLE) - AUG - 2020Karan Mahalle PatilNo ratings yet

- Amazon Development Center India Pvt. LTD: Amount in INRDocument1 pageAmazon Development Center India Pvt. LTD: Amount in INRSurya SudarshanNo ratings yet

- Salary Slip July 2023 - UnlockedDocument1 pageSalary Slip July 2023 - UnlockedPardeep AttriNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- Payslip details for Mr. Abhilash EDocument1 pagePayslip details for Mr. Abhilash Eabhilash eNo ratings yet

- Freudenberg Pay Slip September 2019Document1 pageFreudenberg Pay Slip September 2019sagar kardileNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountTinisharmaNo ratings yet

- Upspl Pay Slip Jan 2023 EngineerDocument1 pageUpspl Pay Slip Jan 2023 EngineerpraveenNo ratings yet

- INTELENET BUSINESS SERVICES PAYSLIPDocument1 pageINTELENET BUSINESS SERVICES PAYSLIPshail100% (1)

- Geojit Financial Services Pay SlipDocument1 pageGeojit Financial Services Pay Slipsanjit deyNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- Salary SlipDocument1 pageSalary SlipJames Jones100% (1)

- December Payslip for Sharath Pundamalli at Gem Source IT ConsultingDocument1 pageDecember Payslip for Sharath Pundamalli at Gem Source IT ConsultingSharathPundamalliNo ratings yet

- Samasta Microfinance Limited: Earnings DeductionsDocument1 pageSamasta Microfinance Limited: Earnings DeductionsDhirendraNo ratings yet

- AUGUST PayslipDocument1 pageAUGUST PayslipRakesh MandalNo ratings yet

- Cognizant Payslip for Feb2023Document2 pagesCognizant Payslip for Feb2023BADI APPALARAJUNo ratings yet

- Headstrong Services India Pvt Ltd Payslip For February 2014Document1 pageHeadstrong Services India Pvt Ltd Payslip For February 2014Swati JainNo ratings yet

- Shriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Document1 pageShriram Transport Finance Company Limited: Do Not Circulate Without Authorization Printed On 03/12/2009Ronald AllenNo ratings yet

- Upspl Pay Slip Dec 2022 EngineerDocument1 pageUpspl Pay Slip Dec 2022 EngineerpraveenNo ratings yet

- OE0036Document1 pageOE0036kumud kalaNo ratings yet

- Tata Consultancy Services PayslipDocument2 pagesTata Consultancy Services PayslipNilesh SurvaseNo ratings yet

- Salary Slip MayDocument1 pageSalary Slip MayhappytiwariNo ratings yet

- EazeWorkPaySlip86723 Salslip 1017Document1 pageEazeWorkPaySlip86723 Salslip 1017Dhiraj LokhandeNo ratings yet

- Shiv SlipDocument1 pageShiv SlipRohit raagNo ratings yet

- Payslip Aug2022Document1 pagePayslip Aug2022Raut AbhimanNo ratings yet

- 5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Document1 page5338 - August 2021 - 50GKBP45RLOWBH55BIZOX4Y54993178471246260287021635Shreyash SahayNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedBarath BiberNo ratings yet

- Essilor India Payslip TitleDocument1 pageEssilor India Payslip TitlekrishnaNo ratings yet

- Payslip October 2022Document1 pagePayslip October 2022Raja guptaNo ratings yet

- Employee Details Payment & Leave Details: Arrears Current AmountDocument1 pageEmployee Details Payment & Leave Details: Arrears Current AmountAshok KumarNo ratings yet

- MTHL PROJECT INSPECTION REPORTDocument1 pageMTHL PROJECT INSPECTION REPORTDeepak UpadhayayNo ratings yet

- 2412 Payslip JunDocument1 page2412 Payslip JunAnonymous 68rvpJvvNo ratings yet

- Pay SlioDocument1 pagePay SlioBenhar BenzzNo ratings yet

- 5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Document1 page5338 - October 2021 - 5YXKUD5541X4QNZGJD5VJ5YP4813393962643653930033920Shreyash SahayNo ratings yet

- Earnings Deductions: Eicher Motors LimitedDocument1 pageEarnings Deductions: Eicher Motors LimitedR SEETHARAMANNo ratings yet

- DellDocument1 pageDellNaresh Kumar Yadav (nari)No ratings yet

- Teleperformance Global Services Private Limited: Payslip For The Month of November 2021Document1 pageTeleperformance Global Services Private Limited: Payslip For The Month of November 2021gajala jamirNo ratings yet

- TELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED Payslip for December 2021Document1 pageTELEPERFORMANCE GLOBAL SERVICES PRIVATE LIMITED Payslip for December 2021gajala jamirNo ratings yet

- Monthly Payslip AnalysisDocument1 pageMonthly Payslip Analysisgajala jamir50% (2)

- Temporary Access AgreementDocument6 pagesTemporary Access AgreementRaymond RomanoNo ratings yet

- Sample Position Paper REDDocument24 pagesSample Position Paper REDYeyen M. EvoraNo ratings yet

- Badal Haji I SaveDocument5 pagesBadal Haji I SaveShadaitul M ZinNo ratings yet

- IRCTC E-ticket details for travel from VRL to ADIDocument3 pagesIRCTC E-ticket details for travel from VRL to ADIArun Kumar GoyalNo ratings yet

- Mallya - Notice To RBI GovernorDocument84 pagesMallya - Notice To RBI GovernorNagaraja Mysuru RaghupathiNo ratings yet

- Agreement For Car RentalDocument6 pagesAgreement For Car RentalJIA JIN ANGNo ratings yet

- Plug Valve Specification for Carlsberg BreweryDocument7 pagesPlug Valve Specification for Carlsberg BreweryNarayana MugalurNo ratings yet

- Jeevan Nishchay FINALDocument14 pagesJeevan Nishchay FINALsandy dheerNo ratings yet

- Issue 4Document2 pagesIssue 4Ningkan HamiltonNo ratings yet

- Micro Finance PolicyDocument85 pagesMicro Finance PolicyBelkis RiahiNo ratings yet

- EPC AgreementDocument139 pagesEPC AgreementSwanandNo ratings yet

- CSAV Claims ProcedureDocument4 pagesCSAV Claims ProcedureKwalar KingNo ratings yet

- GREECE & PORTUGAL - Tourist & Business Visa Requirements PDFDocument1 pageGREECE & PORTUGAL - Tourist & Business Visa Requirements PDFFrancesca CapalaNo ratings yet

- Ca Inter TaxationDocument29 pagesCa Inter TaxationKathan TrivediNo ratings yet

- Flexi Income Goal: Bajaj Allianz LifeDocument10 pagesFlexi Income Goal: Bajaj Allianz LifeSudhirGajareNo ratings yet

- New India Assurance Agent's Manual: An Essential GuideDocument192 pagesNew India Assurance Agent's Manual: An Essential GuideVinay SinghNo ratings yet

- International Finance Question & AnswersDocument22 pagesInternational Finance Question & Answerspranjalipolekar100% (1)

- Wallem V Prudential, 2003Document5 pagesWallem V Prudential, 2003Randy SiosonNo ratings yet

- Q1. Define Tax and Explain The Important Characteristics of TaxDocument37 pagesQ1. Define Tax and Explain The Important Characteristics of TaxSuryanarayana Murthy YamijalaNo ratings yet

- Group A5 Solution Manzana InsuranceDocument2 pagesGroup A5 Solution Manzana Insurancemanjeet39No ratings yet

- Case Digest - Assignment 2Document6 pagesCase Digest - Assignment 2Alphonse Louie Enriquez BelarminoNo ratings yet

- Sol Chap 5-7Document56 pagesSol Chap 5-7Anonymous QEcQfTeHl100% (1)

- Whats Wrong WarrenDocument7 pagesWhats Wrong WarrenbassoarnoNo ratings yet

- Madayaw Festival event proposalDocument25 pagesMadayaw Festival event proposalNicole ApolinarNo ratings yet

- RA 6942-Increasing The Insurance Benefits of The Local Govt OfficialsDocument6 pagesRA 6942-Increasing The Insurance Benefits of The Local Govt OfficialsRocky MarcianoNo ratings yet

- Kanishka Project FinalDocument90 pagesKanishka Project FinalnilkeshrocksNo ratings yet

- Motor Vehicle PolicyDocument36 pagesMotor Vehicle PolicyKimmy2010No ratings yet

- Gard Guidance To The Rules 2018Document18 pagesGard Guidance To The Rules 2018Anonymous UCveMQNo ratings yet

- Principles and Practice of Taxation Lecture Notes PDFDocument20 pagesPrinciples and Practice of Taxation Lecture Notes PDFAbhishek K. Singh100% (1)

- Final Exams in Taxation IssuesDocument3 pagesFinal Exams in Taxation IssuesThea BaltazarNo ratings yet