Professional Documents

Culture Documents

170 HetNet Market Drivers PDF

Uploaded by

Tarek GARAOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

170 HetNet Market Drivers PDF

Uploaded by

Tarek GARACopyright:

Available Formats

SMALL CELL FORUM

RELEASE 7.0 scf.io

17:25

URBAN

RISE

RURAL

ENTERP

HOME

& REMO

TE

VIRTUAL

IZATIO

N

DOCUMENT

170.07.02

HetNet market drivers 2016-20

January 2016

Solving the HetNet puzzle

www.scf.io/ www.smallcellforum.org

SMALL CELL FORUM

RELEASE 7.0 scf.io

Small Cell Forum accelerates small cell adoption to drive the

wide-scale adoption of small cells and accelerate the delivery of

integrated HetNets.

We are not a standards organization but partner with organizations that inform

and determine standards development. We are a carrier-led organization. This

means our operator members establish requirements that drive the activities

and outputs of our technical groups.

We have driven the standardization of key elements of small cell technology

including Iuh, FAPI/SCAPI, SON, the small cell services API, TR‑069 evolution

and the enhancement of the X2 interface.

Today our members are driving solutions that include small cell/Wi-Fi

integration, SON evolution, virtualization of the small cell layer, driving mass

adoption via multi-operator neutral host, ensuring a common approach to

service APIs to drive commercialisation and the integration of small cells into

5G standards evolution.

The Small Cell Forum Release Program has now established business cases and

market drivers for all the main use cases. This document is part of

Release 7: HetNet and SON.

Small Cell Forum defines HetNet as a ‘multi-x environment – multi-technology,

multi-domain, multi-spectrum, multi-operator and multi-vendor. It must

be able to automate the reconfiguration of its operation to deliver assured

service quality across the entire network, and flexible enough to accommodate

changing user needs, business goals and subscriber behaviors.’

Small Cell Forum Release website can be found here: www.scf.io

All content in this document including links and references are for informational

purposes only and is provided “as is” with no warranties whatsoever including

any warranty of merchantability, fitness for any particular purpose, or any

warranty otherwise arising out of any proposal, specification, or sample.

No license, express or implied, to any intellectual property rights is granted

or intended hereby.

If you would like more information about Small Cell Forum or would

like to be included on our mailing list, please contact:

Email info@smallcellforum.org

Post Small Cell Forum, PO Box 23, GL11 5WA UK

Member Services memberservices@smallcellforum.org

Executive summary

In 2010, the emerging drivers for a HetNet were relatively simple in business terms.

Operators needed to keep up with the relentless rise in demand for mobile data,

including video, coupled with an equally relentless pressure on the price customers

would pay per megabyte. That required a new approach to network economics, and

architectures that could deliver massive capacity in a targeted, repeatable and

scalable manner in order to maximise cost efficiency.

Demands on the network are increasing all the time as operators look well beyond

their commercial roots. Their challenge for 2020, if they are to reap healthy profits

from their network investments, is to undergo digital transformation, which involves

branching out from the homogeneous business model, as well as the homogeneous

networks, of the past. They will become IT platforms, cloud providers, wholesalers and

vertical market specialists as well as MNOs, and will be handling a huge diversity of

devices with different demands on the network. All this will require dramatic change to

their processes, partnerships, management systems and, of course, their networks.

The Small Cell Forum now defines the HetNet as a ‘multi-x environment – multi-

technology, multi-domain, multi-spectrum, multi-operator and multi-vendor. It must

be able to automate the reconfiguration of its operation to deliver assured service

quality across the entire network, and flexible enough to accommodate changing user

needs, business goals and subscriber behaviours.’

In a survey of 72 Tier 1 and 2 MNOs worldwide, conducted by Rethink Technology

Research in the first quarter of 2016, two-thirds of respondents said that a HetNet

deployment would be either ‘critical’ or ‘very important’ to achieving their business

objectives in 2020. In their definition of the key elements of that HetNet, most of the

most significant enablers were at the heart of the Small Cell Forum’s current work

program and its new Integrated HetNet Architecture [1]. These include support for

multiple radios, spectrum bands and domains, as well as self-optimizing networks

(SON), virtualization, integrated management and support for the IT cloud and mobile

edge environments.

According to the survey, the key drivers for investing in these new HetNets (and in

time, 5G), will expand between 2016 and 2020. For the short term (2016-2018), the

use cases which were most commonly cited by the respondents are dominated by the

enterprise (a top three priority for 36%). This was followed by various use cases

driven by consumer video, including the rise of multiscreen viewing and multi-play

bundles.

By 2020, the use cases for the HetNet are expected to be more diverse and driving

brand new revenue streams. For incremental revenues, there will be a shift to

connected ‘things’ as well as people, to wholesale models and to a new generation of

video-based services and user experiences.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02

40

35

30

% of MNOs

25

20

15

10

5

0

2016 2020

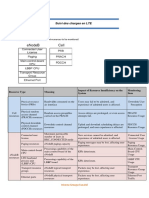

Percentage of MNOs placing each HetNet use case into their top three in terms of potential to

deliver additional revenue within 12 months of deployment.

Source: Rethink Technology Research operator survey Q116.

Among some of the most prominent specific application drivers, by environment, are:

2016-2018 2020

Consumer Multiplay and multiscreen Video-driven user experiences

video e.g., virtual reality gaming

Mobile multicast services

Enterprise High quality voice and data for IoT and Industrial Internet

mobile-first New mobile cloud services for

VoLTE and ViLTE productivity and customers

MEC applications e.g., local Big data analytics

PBX integration On-demand capacity for

enterprises

Urban and rural (outdoor) Dense targeted capacity esp Fully integrated smart

for video transport and city services

Full coverage for remote New interfaces to urban

communities and M2M services e.g., virtual reality

Smart city applications Big data analytics

Temporary or moving D2D applications

networks e.g., public safety

Wholesale (MNO or neutral Flexible allocation of Network slicing to enable

host) bandwidth to MVNOs large numbers of specialized

WiFi/cellular managed providers e.g., in IoT

services

Neutral host networks

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02

SCF is committed to a program which puts foundational elements in place to support

current market drivers, and to address challenges to deployment - but which are also

open and adaptable, so that operators can invest now in platforms which will later be

able to support unforeseen new use cases and 5G.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02

Contents

1. Introduction: The changing HetNet vision ........................1

2. The evolving nature of the HetNet ....................................4

3. Overall business drivers for the HetNet ............................8

4. Technology elements to deliver the HetNet’s business

goals ..............................................................................11

5. The essential role of SON ...............................................13

6. Key use cases supported by the new HetNets ................22

7. Challenges ......................................................................30

8. Conclusion: Future-proofing ...........................................33

References ................................................................................34

Tables

Table 3–1 Operator HetNet requirements, and key enablers, 2008-20 .................. 8

Table 4–1 Key technology enablers which will enable the HetNet to deliver

operators’ primary network goals. ....................................................11

Table 5–1 Benefits of SON for small cell HetNets. Source: Small Cell Forum .........13

Figures

Figure 1–1 The HetNet cycle: New business demands drive new network

capabilities, which in turn enable new services and revenue streams. .... 1

Figure 1–2 The increasingly complicated HetNet access network ........................... 2

Figure 1–3 The Small Cell Forum’s HetNet2020 vision ......................................... 3

Figure 2–1 Importance of a HetNet strategy to achieving MNOs’ business

objectives by 2020, and to driving new revenues. ............................... 4

Figure 2–2 Technologies which underpin the HetNet. ........................................... 5

Figure 2–3 Elements considered essential to a HetNet, now and by 2020. .............. 6

Figure 3–1 Key operator requirements by importance to the business case, now

and anticipated in 2020. Importance of HetNet and SON to deliver

these requirements. .......................................................................10

Figure 4–1 Percentage of MNOs which expect to deploy key technology enablers

of HetNet, by 2016 and by 2020 ......................................................12

Figure 5–1 Top four reasons to deploy small cell and HetNet SON. .......................14

Figure 5–2 Percentage of small cells deployed at high density, indicating the

point at which SON becomes essential to the business case. ...............15

Figure 5–3 Percentage of the small cell installed base which is SON-enabled, by

density .........................................................................................17

Figure 5–4 Number of MNOs out of 124 initiating SON projects (in-house or

outsourced) between 2014 and 2019, and the capex and services

budget. On average, MNOs will initiate two new SON projects in this

period. .........................................................................................18

Figure 5–5 Percentage of small cells in a particular band configuration, which are

actively SON-enabled. ....................................................................19

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02

Figure 5–6 Installed base of SON-managed cell sites (macro and small) by SON

architecture ..................................................................................20

Figure 5–7 Most important SON functions by 2020, by % of MNOs which are

actively deploying or planning SON. Sample: 120 MNOs or

subsidiaries, 43 of which are actively supporting SON. Operators were

asked for all their most important use cases, then of the 11 which

were cited most commonly, they were asked to rank their top five in

terms of the network business case. ................................................21

Figure 6–1 % of MNOs placing each HetNet use case into their top three in terms

of potential to deliver additional revenue within 12 months of

deployment ...................................................................................23

Figure 6–2 Mobile video will account for 55% of mobile data traffic by 2020. ........24

Figure 6–3 Most important drivers to deploy enterprise HetNet, compared to

those for the whole industry. ...........................................................26

Figure 6–4 A HetNet example: Reliance Jio’s JioSON, designed to deliver new

user experiences despite a challenging spectrum situation ..................27

Figure 6–5 Two of the Small Cell Forum's deployment stories demonstrating

benefits of both urban and rural usage .............................................28

Figure 6–6 Small cell installed base by service provider ownership 2013-20 ..........29

Figure 7–1 Most important challenges to deploying a HetNet – % of MNOs

placing each challenge in their top three ...........................................31

Figure 7–2 Key HetNet/SON issues addressed in Small Cell Forum’s 2016 work

program and Release 7 ...................................................................32

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02

1. Introduction: The changing HetNet vision

The idea of a wireless heterogeneous network (HetNet) may not have changed in its

essence – it still involves the combination of several types of network technology to

deliver high quality wireless services, high levels of capacity and maximum efficiency

of operational and deployment costs. However, its criticality in mobile network

operators’ (MNOs) strategic planning has increased dramatically as carriers come

under ever-intensifying business pressures. Two-thirds of Tier 1 and 2 MNOs,

surveyed in the first quarter of 2016, say that a HetNet will be ‘critical’ or ‘very

important’ to their commercial success between now and 2020 [2], while the figure

rises to 72% when brand new revenue models are considered.

To support this rising burden of responsibility for the MNOs’ future prosperity, the

actual shape of the HetNet is having to change too. The technologies which operators

include in their definition of HetNet have expanded considerably since 2010, when

Ericsson wrote ‘Heterogeneous network involves a mix of radio technologies and cell

types working together seamlessly’ [3]. That statement remains true, but operators

are now planning HetNets which also harness multiple technologies in the software

layers, and use emerging methods such as SON (self-optimizing networks) and

virtualization to pull all the elements together in a seamless whole.

So the first HetNets, which are being deployed now, will lay the foundations of very

different HetNets by 2020, in response to a widening range of market drivers and

business models. The common factor will be the ever-intensifying push to increase the

network’s capacity and efficiency, combined with a rising focus on diversity, as MNOs

look for a wider variety of revenue streams, some of them requiring dissimilar network

behaviors. And the common thread is that most operators believe they have

inadequate spectrum to support those new revenues, unless they adopt a radically

different architecture.

New services

and Rising traffic

revenues

Digitalization

Higher

New network

capacity and

capabilities

efficiency

Multilayered

network,

automation

Figure 1–1 The HetNet cycle: New business demands drive new network capabilities, which

in turn enable new services and revenue streams.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 1

To support that diversity, and push the efficiency boundaries even further, a range of

emerging technologies will be harnessed, in different combinations according to the

individual MNO’s strategy. The cornerstones, on top of the multi-layered access

network, will be increasing automation, orchestration and virtualization. And the

overall outcome will be rising digitalization – bringing more and more use cases into

the digital domain in order to drive entirely new business models and ecosystems.

This paper will examine the key market drivers behind that cyclical process – the

business cases which are driving HetNet deployments now, and those which will be

prominent around 2020, as operators look towards 5G.

These will underpin the evolution of the HetNet architecture, both to enhance current

3G/4G systems to support both massive broadband and IoT, but also to future-proof

those deployments and provide a smooth migration to 5G when that is finalized. In

network terms, this will see a transformation from the RAN-oriented visions of 2010

(Figure 1-2) to the multi-layered, business-driven vision unveiled by the Small Cell

Forum in February 2016 (Figure 1-3).

Figure 1–2 The increasingly complicated HetNet access network

Source: IEEE [4]

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 2

Figure 1–3 The Small Cell Forum’s HetNet2020 vision

Source: Small Cell Forum

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 3

2. The evolving nature of the HetNet

In 2010, the emerging drivers for a HetNet were relatively simple in business terms.

Operators needed to keep up with the relentless rise in demand for mobile data,

including video, coupled with an equally relentless pressure on the price customers

would pay per megabyte. That required a new approach to network economics, and

architectures that could deliver massive capacity in a targeted, repeatable and

scalable manner in order to maximise cost efficiency.

Demands on the network are increasing all the time as operators look well beyond

their commercial roots. Their challenge for 2020, if they are to reap healthy profits

from their network investments, is to undergo digital transformation, which involves

branching out from the homogeneous consumer focused business model, as well as

the homogeneous networks, of the past. They will become IT platforms, cloud

providers, wholesalers and vertical market specialists as well as MNOs, and will be

handling a huge diversity of devices with different demands on the network. All this

will require dramatic change to their processes, partnerships, management systems

and, of course, their networks.

In a survey of 72 Tier 1 and 2 MNOs worldwide, conducted by Rethink Technology

Research in the first quarter of 2016, two-thirds of respondents said that a HetNet

deployment would be either ‘critical’ or ‘very important’ to achieving their business

objectives in 2020. When focused specifically on generating new revenue streams in

areas like digital services and the Internet of Things (IoT), the HetNet became even

more important, with 72% placing it in the top two categories. Only 12% of MNOs do

not believe a HetNet to be important to their goals.

45

40

35

30

% of MNOs

25

20

15

10

0

Critical Very important Important Fairly important Unimportant

Overall business Driving new revenues

Figure 2–1 Importance of a HetNet strategy to achieving MNOs’ business objectives by 2020,

and to driving new revenues.

Source: Rethink Technology Research survey (72 MNOs)

The focus on directly generating new revenues highlights an important change in

network thinking. It is increasingly hard to justify the roll-out of new architectures

purely on the basis of erecting flood barriers against the data tide. Operators need to

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 4

ensure their HetNet can also support new business cases, to open up new markets,

broaden the value chain, and increase the return on their investments.

So the availability of dense small cell networks is starting to enable new business

cases in areas like mobile enterprise, context-aware services and the Internet of

Things (IoT). In turn, as those markets develop, they will drive new requirements and

technologies into the next wave of the HetNet.

That means the HetNet is no longer just about multiple layers of macro and small

cells, or even about seamless Wi-Fi/cellular, but about a wide range of technologies at

all layers of the network stack.

This is clear from the definitions of HetNet, as set out by the Small Cell Forum’s

working groups on HetNet and SON [SCF172]. This includes a wide variety of radio

elements and spectrum options, as summarized in Figure 2-2, but also includes other

emerging technologies like mobile edge computing, device-to-device communications,

virtualized RANs and backhaul networks.

Figure 2–2 Technologies which underpin the HetNet.

Source: Small Cell Forum

The operator survey also reflects the rising variety of technologies which will make up

the HetNet between 2016 and 2020 (and beyond). The respondents have varying

interpretations of HetNet, and place different weight on each element according to

their particular business case, but overall, they see the platform as one that goes well

beyond the access layer, and must be planned and deployed accordingly (see Figure

2-3).

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 5

120

96 96

100 92 94 90

86

82 80

76

80

% of MNOs

70

60

48

40

36

40

18

20 12 10

2016 2020

Figure 2–3 Elements considered essential to a HetNet, now and by 2020.

Source: Rethink Technology Research MNO survey March 2016

These responses indicate the evolving nature of the HetNet, with emerging approaches

like virtualization, SON, SDN orchestration and mobile edge computing (MEC)

becoming more important in the later part of the decade, as standards mature and

start to drive new use cases. In this way, business goals and technology evolution will

continue to drive one another in parallel, well into the 5G era.

However, in an environment of rapid change, it is critical that there are some constant

foundations, enabling operators to future-proof their deployments and to support new

use cases, without fundamental architecture changes. These foundation stones are the

heart of the work of the Small Cell Forum’s HetNet and SON work programs. Since

small cells are fundamental to dense, flexible HetNets in any definition, the Forum is

ideally placed to drive the foundations of the HetNet, based on operator requirements,

and feeding into standards bodies and the broader mobile ecosystem.

These foundations include elements which underpin first generation HetNets and will

continue to do so in the 2020s:

• Wide variety of cell sizes and access point form factors from macrocells to

tiny embedded radios.

• Seamless use of many spectrum bands – TDD and FDD, licensed, shared and

unlicensed - with hand-off and aggregation to maximize flexibility and overall

capacity.

• Integration of different architectures including cellular small cells, DAS, Wi-Fi,

vRAN.

• High levels of automation via SON and orchestration.

• The new economics and flexible resource management of virtualization.

• Rising importance of IT/cloud platforms and APIs to provide an efficient and

open approach to service delivery.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 6

That will lead to a multi-layered HetNet which is heavily software-driven. As the Small

Cell Forum puts it: ‘HetNet2020 is about driving standards for next generation

networks that will be about interfaces and APIs, not just hardware form factors.’(See

Figure 1-3)

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 7

3. Overall business drivers for the HetNet

In business case terms, too, MNOs will have some constants:

• Ever-increasing need for capacity which will drive rising base station density

• Drive towards truly ubiquitous coverage.

• Rising expectations of QoS and QoE.

But there will be diversification in the use cases for these dense, ubiquitous networks.

In particular, capabilities which are originally implemented to support consumer data

and people-driven applications will increasingly be harnessed to target less familiar

sectors – mobile enterprise, IoT, the Industrial Internet. And the range of services

which can be offered to those markets – many of which have mainly used wireline or

private networks before, or been unconnected – will be enhanced by further

enrichment of the HetNet, for instance as it evolves to become a full IT environment

via developments in the cloud and MEC.

Table 3—1 summarizes the first three generations of HetNet drivers, and maps the

key technology enablers, outlined in the previous chapter, to those broad drivers. The

evolution will continue in the 2020s, making it essential that the HetNets which are

deployed now are standards-based but flexible, and capable of embracing new

technologies and use cases in future as these emerge.

Table 3–1 Operator HetNet requirements, and key enablers, 2008-20

Based on input from Forum member operators and the HetNet and SON work program

champions, and the results of the Rethink study, it is clear that the use case drivers

for HetNet and SON deployment are already becoming more diverse and complex.

However, a generic set of requirements underpins nearly all those specific use cases

and these are the core drivers of investment in HetNet.

According to the operator survey, the most important of these (see Figure 3-1) are:

1. Ubiquitous coverage especially indoors

2. Ultra-density without interference to maximize capacity

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 8

3. Automation for massive scalability

4. Reduce total cost of ownership and cost of data delivery

5. Intelligent use of multiple sources of spectrum including licence-exempt and

shared, and a rising use of TDD (unpaired) bands which are well-suited to

dense small cells

6. Flexibility to swap technologies and spectrum in and out

7. Flexibility to support multiple business models (e.g., neutral host, vertical)

8. Support for IoT-optimized networks as well as broadband

9. Support for a full IT environment, increasingly in the cloud, to enable new

services

10. Support for new value chains

According to the operators, these 10 factors will be critical to deliver a new generation

of services and revenues and to support new partners and customers. Most

importantly, they are sufficiently generic to support use cases which have not yet

been defined or even imagined. In all cases, these objectives can be helped by

deploying elements of HetNet; in some cases, HetNet is the only way to deliver them.

In the survey, respondents were first asked for an unprompted list of key drivers to

deploy a HetNet. They were then asked to rank the 10 drivers which emerged most

commonly, on a scale of 1 to 10 (10 being most important to their current and future

business strategy). For 2016, the top priorities are still to increase coverage and

capacity to unprecedented levels in order to enhance their competitiveness and

quality, mainly in conventional services like consumer data or video; and to reduce the

total cost of delivering those data services. However, there is already a perceived need

to make more flexible use of different spectrum and technology types in order to

improve the overall economic and performance outcomes.

By 2020, operators expect capacity, coverage and cost still to be key drivers of HetNet

investment, but many other factors will achieve equal importance to the increasingly

complex business plan. Among these, intelligent use of different types of spectrum,

including licence-exempt, will match the need for ultra-dense capacity as a HetNet

driver (both average a rating of 9.4 by 2020), indicating the rising challenge for MNOs

to match their capacity needs with their access to airwaves.

Also achieving high average ratings in 2020 plans are networks which will support

flexibility in the business model, including neutral host and network sharing options;

optimization for IoT/M2M alongside data; massive scalability through automation; and

support for IT cloud services, both for end users and for big data purposes.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 9

10

9

Average rating 1-10

8

7

6

5

4

3

2

1

0

Priority 2016 Priority 2020 How essential is HetNet/SON?

Figure 3–1 Key operator requirements by importance to the business case, now and

anticipated in 2020. Importance of HetNet and SON to deliver these

requirements.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 10

4. Technology elements to deliver the HetNet’s business goals

The MNO respondents to the Rethink survey were also asked to rate the importance of

a HetNet to delivering these commercial goals. While they believed some of the goals

could be achieved, at least in part, by other means, especially in the early years, by

2020 a HetNet was considered to be critical to most of them. With regard to ultra-

dense capacity and the related issue of automation/scalability, a HetNet’s importance

was rated over 9 out of 10 on average.

Table 4—1 indicates the top technology enablers for these business requirements, as

rated by the operators. Nearly all these enablers form part of the Forum’s updated

HetNet definitions and roadmap.

Business requirement Technology enabler Technology enabler

deploying now emerging

Ubiquitous coverage especially Small cells for in-fill Virtualized gateways

indoors Inside-out coverage

Ultra-density without Streamlined deployment vRAN

interference to maximize processes

capacity

Automation for massive Self-organizing network Advanced self-optimizing

scalability Standardized deployment network

Reduce total cost of New infrastructure access New form factors

ownership and cost of data Commoditized cells Virtualization

delivery Infrastructure access

Intelligent use of multiple Wi-Fi integration (LWA : LTE LTE in 5 GHz (LAA: License

sources of spectrum including Wi-Fi integration) Assisted LTE Access)

TDD, licence-exempt and

shared

Flexibility to swap Carrier aggregation Virtualization

technologies and spectrum in

and out

Flexibility to support multiple MOCN, MORAN Virtualization, network slicing

business models (e.g., neutral

host, vertical)

Support for IoT-optimized GSM Enhanced small cells, NB-IoT, network slicing

networks as well as Cat-1

broadband

Support for a full IT Service provider IT, open APIs MEC

environment, increasingly in

the cloud, to enable new

services

Support for context Location and presence Full context, understanding of

awareness the user based on artificial

intelligence

Table 4–1 Key technology enablers which will enable the HetNet to deliver operators’

primary network goals.

Source: Rethink MNO survey.

Awareness of the gulf between currently installed mobile networks, and the

technologies needed to achieve their 2020 business goals, will drive a wave of

investment in many of the core elements of the modern HetNet, over the coming few

years (see Figure 4-1). The most immediate areas of investment will be those

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 11

technologies which are most mature and available in 2016, and which are perceived to

be foundation stones for all the others.

In particular, small cells fall into this category, especially in the non-residential

categories, which will enjoy significant growth for the rest of the decade. A total of

45% of MNOs expect to invest in this area in 2016, a figure which will rise to 84% by

2020 according to operators’ current expectations.

100

90

80

70

% of MNOs

60

50

40

30

20

10

0

2016 2020

Figure 4–1 Percentage of MNOs which expect to deploy key technology enablers of HetNet,

by 2016 and by 2020

As other recent studies have indicated, the enterprise sector will be the most

important growth driver for small cells, because this is the area where the most

immediate HetNet-driven growth models are perceived (see 6b).

Another area of HetNet focus in the short term will be the use of licence-exempt

spectrum, integrated intelligently with licensed-band networks, whether harnessing

Wi-Fi or, from late 2016, LTE in the 5 GHz band.

Once the cornerstones of multiple layers of cells and spectrum have been laid, the

other key enablers will start to be built alongside. SON and optimized IoT connections

will experience particularly sharp growth in adoption, the former increasingly essential

as networks become denser, the latter important to a key area of revenue

diversification. Multi-operator technologies like MOCN and MORAN will secure an

enhanced role as MNOs look for a more multi-faceted delivery model, and the software

elements will also move to the heart of HetNet planning with open APIs and MEC

creating a rich IT services platform, and virtualization bringing new efficiencies and

flexibility to the RAN itself and to network management and orchestration.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 12

5. The essential role of SON

Self-organizing network (SON) technology has shifted from being focused mainly on

housekeeping functions, notably Automatic Neighbor Relations (ANR), to being an

essential part of wider strategies to optimize the RAN. SON will be an essential enabler

of dense HetNets, because it will be impractical to optimize large numbers of small

access points – whether metrocells, Wi-Fi APs, distributed radios or DAS antennas -

without a considerable degree of automation and flexibility. The rise of vRAN will

intensify this interest among carriers, and give rise to new categories such as Cloud

SON.

The latter will aim to align the SON domain with the move towards centralizing and

virtualizing network intelligence, turning it into a full network operating system, which

can predict cause and effect, and coordinate responses, dynamically. The evolution of

the SON, and broader management and orchestration, aspects of the HetNet are set

out in full in the Small Cell Forum’s new Integrated HetNet Architecture Framework. 1

This describes how SON is central to enabling emerging dense HetNets – what the

Forum defines as ‘multi-x’ – “multi-technology, multi-domain, multi-spectrum, multi-

operator and multi-vendor. It must be able to automate the reconfiguration of its

operation to deliver assured service quality across the entire network, and flexible

enough to accommodate changing user needs, business goals and subscriber

behaviors.”

Key drivers to deploy SON

SON will be essential to that goal. According to the Small Cell Forum’s HetNet/SON

working group, SON’s chief benefits fall into two main categories, economic and

operational, as summarized in Table 5-1.

Economic benefits Operational benefits for small cells

Leverage automation to reduce Network management automation

implementation and deployment costs (IMPEX)

Increase efficiency of deployed assets to Network performance optimization

reduce CAPEX including equipment and

spectrum

Leverage automation, optimization and self- A uniform Multi HetNet Multi RAN supported

healing to reduce HetNet OPEX SON platform to reduce the HetNet OPEX and

CAPEX

Improved network robustness

Network self-healing

Table 5–1 Benefits of SON for small cell HetNets. Source: Small Cell Forum

This indicates how skilful optimization can help achieve the three most important

objectives of a mobile network deployment:

• Reduced operating costs and total cost of ownership through automation,

enabling the MNO to support the users’ demand for rising volumes of data,

while still achieving return on investment.

• Reduced capex investment in new infrastructure. New build-outs may be able

to be postponed by using existing resources more efficiently and targeting

capacity where it is needed. Integration of SON data with analytics and other

1

Small Cell Forum, SCF172 Integrated HetNet Architecture Framework, May 2016,

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 13

network quality functions, and the rise of virtualized SON platforms, will all

help squeeze the maximum capacity from existing 4G and even 3G networks.

• Improved end-to-end quality of experience (QoE) across the entire HetNet for

subscribers. This has become, in recent years, the primary factor which

persuades consumers and enterprises to change operator, rather than cost or

other deciders. That has led operators to take a keen interest in all methods

of optimizing their networks, from video caching to personalization, to

support a strong QoE – not just from a RAN metrics point of view, but in

terms of real world experience. Automated optimization can play an

important part in this by carrying out certain tasks in near-real time and on

very dense networks, and by freeing up human skills to address additional

QoE functions.

These overall drivers are reflected in the results of a survey of over 120 MNOs and

subsidiaries, conducted in April 2016 by Rethink Technology Research. Of these, 43

were already deploying SON in some area of their network. Respondents were asked

to name all their drivers to deploy SON by 2020. Of the 10 which were most

commonly cited, they were asked to select their top four in terms of business case

impact (see Figure 5-1).

Opex reduction was placed in the top four by 79% of the operators, followed by

improvement of quality of experience for the customer (58%) and reducing the cost of

scaling up to dense high capacity networks (54%). Other important drivers included

the ability to integrate new spectrum bands, especially unlicensed, as Wi-Fi and LTE in

unlicensed bands become an integral part of the HetNet. Lower time to deploy dense

networks, support for multivendor HetNets and the ability to target capacity and

network resources where they are needed were also important factors.

23 Reduce opex

23 79 Improve customer QoE

28 Reduce cost of high capacity

Densify the network efficiently

29 Integrate unlicensed spectrum

58 Lower time to deploy

29 Enable multivendor networks

Target capacity where it is needed

32 Enable plug and play

54

44 Delay major capex projects

Figure 5–1 Top four reasons to deploy small cell and HetNet SON.

Source: Rethink Technology Research, MNO survey, April 2016

SON is essential to dense HetNets

As operators embark on densification projects, SON becomes increasingly vital to

performance and return on investment.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 14

In a recent study by Rethink Technology Research, which surveyed over 120 mobile

operators or operating subsidiaries 2, it emerged that automation and SON become

entirely critical to the HetNet business case at a density level of about 10 cells per

macro/50 cells per square km point (Figure 5–2), though SON was considered highly

desirable beyond three cells per macro/15 per square km. 3 to reduce deployment time

and interference risk. In these less dense cases, SON is often used to speed up more

basic processes and free up engineers for more complex tasks, still done manually. In

very dense networks, a far wider range of tasks is typically automated in order to

keep deployment time and cost down.

Figure 5–2 provides a top level indicator of when SON is becoming critical to the

industry as a whole, though the density and approach of different operators to their

small cell build-outs will vary widely. Many MNOs will continue to adopt an in-fill

approach, and will not need densification for some years to come if their macro

networks are largely addressing their capacity needs. But many others are already

embarking on density programs. We believe that availability of a broad range of SON

capabilities (see below for examples) will be desirable for the industry this year, as

dense or hyper-dense deployments will already account for almost 40% of cells by the

end of 2016. It is worth noting, however, that these are concentrated in the hands of

a fairly small number of large-scale system integrators, some of whom are using their

own inhouse tools and methods. By 2017, the availability of a wide range of SON

capabilities will have become critical because there will be a larger number of

operators moving towards density, and dense or hyperdense deployments will account

for the largest number of small cells in that year (54%). Many of these operators will

only activate their plans if they can easily access SON tools.

100

Full SON Full SON

90

desirable essentia

80

% of cells deployed

70

60

50

40

30

20

10

0

2014 2015 2016 2017 2018 2019 2020

Moderate or non-dense

Figure 5–2 Percentage of small cells deployed at high density, indicating the point at which

SON becomes essential to the business case.

2

Rethink Technology Research, RAN Service, ‘SON trends and deployments 2014-2020’, May 2016,

www.rethinkresearch.biz

3

Ibid

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 15

Low density small cells <20 per square km

Medium density 20-75 per square km

Dense 75-200 per square km

Hyperdense >200 per square km

In the same study, MNOs were asked to name three challenges which might cause

them to postpone wide-scale HetNet roll-out for at least 12 months. Confidence they

could manage and optimize a large, complex network with thousands of elements and

multivendor kit emerged as the most important, named as a top three issue by 64%

of respondents, followed by total cost of ownership, and the ability to scale up to huge

numbers of cells, particularly in terms of logistics (sites, deployment process,

planning).

These issues of network configuration and management are partly addressed by SON

and this can have a direct impact on TCO too. By implementing SON and optimization

to the best degree considered possible, the opex bill for a HetNet can be cut by 22%

for macrocell deployments and 45% for small cells, according to a range of

calculations. 4

The survey shows that, according to MNOs’ deployment assumptions, adoption of SON

will be rapid in dense and hyperdense networks of over 75 cells per square kilometer

(see Figure 5–3). In hyperdense networks, typically indoors in areas like sports

venues, active SON 5 penetration will top 90% from the start of deployment (a few

pioneering projects from 2015 at this density). By 2020, the figure will be 99% and a

far wider range of SON functions will be in place, moving beyond table stakes like

ANR.

In less dense networks, activation of SON will be slower because it will be less urgent,

though in many cases, especially where the small cells have challenges in interworking

with the macro and with Wi-Fi, SON will be valuable even without high density. By

2018, 40% of the installed base of medium density cells will be managed by SON, and

by 2020, more than 80% of the base, even at low density, will have SON capabilities

as early generation systems are phased out, and SON becomes a default option for

new deployments.

4

Qualcomm, Rethink, Amdocs

5

Penetration of SON which is being actively use – i.e., as opposed to SON-enabled Aps, where the SON is

present but not actively used by the MNO (mainly D-SON)

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 16

120

100

% of cells SON-enabled

80

60

40

20

0

2014 2015 2016 2017 2018 2019 2020

Hyperdense Dense Medium dense Non-dense

Figure 5–3 Percentage of the small cell installed base which is SON-enabled, by density

Some key trends in SON will make it increasingly important as an enabler of new

HetNet use cases, as detailed in the Integrated HetNet Architecture Framework (see

above). These include:

• Greater integration with OSS and FCAPS layers, to obtain richer network data

• Greater integration with analytics and big data systems

• Application awareness to enhance the focus on user experience and

personalization

• Implementation within a software-defined network

• Extension to new types of networks, including Wi-Fi and backhaul.

We will see the technology becoming more integrated within an overall network

software platform that allows numerous functions to exchange information and so

provide richer sources of data for optimization. This will increasingly be in the cloud.

The operators which have advanced plans to deploy SON, to enable dense small cell

networks and so to transform the economics of their 4G roll-outs, are as diverse as SK

Telecom in South Korea, Sprint in the US and Vodafone India. In India, for instance,

where the pressure to deploy mobile networks economically is particularly high, the

large MNOs are enthusiastic adopters of SON. Bharti Airtel is deploying the technology

for new and some legacy networks in city centers, and Vodafone has implemented

Cisco SON across one-third of its cells already. Reliance Jio’s Award hybrid SON

architecture is deployed across the true Jio HetNet platform in India.

Many MNOs see the HetNet as a way to mix and match their suppliers as well as their

spectrum and base station platforms. SON platforms which can manage hardware

from many vendors, and interoperate with one another, are critical enablers for

densification and future 5G architectures, and so are the focus of activity by several

industry bodies such as the Small Cell Forum and the NGMN Alliance.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 17

SON deployment patterns

All this means that operators increasingly need to plan for networks which are far

denser and far more optimized, a tough dual challenge. SON will become an essential

element in the toolkit. The initiation of SON projects for LTE or 3G/LTE will rise

steadily from 2016 (see Figure 5–4), peaking in 2019 as many MNOs come near the

end of their 4G densification and start to think about 5G (not forecast in this study

but, as described above, certain to be heavily reliant on SON advances).

With a compound annual growth rate (CAGR) of 10% between 2014 and 2020, SON’s

capex growth will be twice that of the full RAN software category. In Rethink’s survey

of 124 MNOs, 95% intended to implement some form of SON by 2020. Between them,

a total of 265 new SON projects would be initiated during the period, totalling a spend

of $10.6bn on software and services over the six years.

2,000 60

1,800

50

1,600

1,400

40

No of MNOs

1,200

$m

1,000 30

800

20

600

400

10

200

0 0

2014 2015 2016 2017 2018 2019 2020

Capex and services No of MNOs initiating projects

Figure 5–4 Number of MNOs out of 124 initiating SON projects (in-house or outsourced)

between 2014 and 2019, and the capex and services budget. On average, MNOs

will initiate two new SON projects in this period.

Source: Survey of 124 MNOs, 2016

The survey highlights some other key trends in SON deployment in dense multi-x

networks. One is that SON becomes more essential when operators are deploying cells

in multiple spectrum bands and in a separate layer from the macro. By 2020, over

three-quarters of small cells will be deployed in their own band, and about one-third of

those will be in unlicensed spectrum (excluding Wi-Fi). And 99% of those cells will be

actively SON-enabled (Figure 5–5).

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 18

120

99

100

90

76 77

% of small cells

80 74

60 54

50

39

40

23

18

20 14

11

7 8

0

2014 2015 2016 2017 2018 2019 2020

Same band as macro Separate band

Figure 5–5 Percentage of small cells in a particular band configuration, which are actively

SON-enabled.

The architectures of SON have been evolving too. Distributed-SON capabilities are

embedded in small cells and are a key factor in vendor differentiation, though they are

not always actively used by the operator, or integrated with other systems such as

OSS. Those D-SON features will remain a standard element of small cells, except in

the case of the very stripped-down vRAN end points of the future, which could be

organized and optimized entirely from the gateway or server.

Meanwhile there has been a significant trend for MNOs to adopt centralized SON

platforms, often to work alongside D-SON, in order to support a greater range and

complexity of functions. C-SON will also be an important element of the MNO strategy

to start to treat a large number of cells as a unified entity, balancing and reallocating

loads and resources around the network flexibly in order to maximize efficiency and

performance.

In this increasingly software-driven network environment, C-SON and hybrid

centralized/distributed platforms will see significant growth within the installed base

(Figure 5–6), so that sites with D-SON capabilities only will fall from 76% to 12%

between 2014 and 2020, while hybrid systems will rise from managing 10% of the

installed base of cells, to 55% in 2020.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 19

20,000

18,000

16,000

14,000

12,000

,000 sites

10,000

8,000

6,000

4,000

2,000

0

2014 2015 2016 2017 2018 2019 2020

Distributed Centralized Hybrid

Figure 5–6 Installed base of SON-managed cell sites (macro and small) by SON architecture

As outlined above, the SON functions which are in active use will expand. The 3GPP

and NGMN Alliance list a large number of these functions, but in reality, most MNOs

are supporting very few of them in early projects. Of the MNOs surveyed which were

already deploying small cell SON, the most commonly supported functions were

interference reduction, coverage and capacity optimization (CCO) and ANR. Of course,

these functions will remain essential to all SON projects, but they will become default

options.

When the MNOs which are deploying or planning SON by 2020 were asked which

functions would be most important to their HetNet business case, interference

reduction and CCO were still placed in the top five by almost 60% of respondents, but

other functions like handover optimization, load balancing and plug-and-play were

starting to take a more strategic position in the network plan (Figure 5–7). In

addition, cell outage detection (CoD) and cell outage compensation (CoC) are also

starting to be seen as important functions.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 20

100

% of MNOs plannnig SON

90

80

70

60

50

40

30

20

10

0

Deployed Top 5 priority

Figure 5–7 Most important SON functions by 2020, by % of MNOs which are actively

deploying or planning SON. Sample: 120 MNOs or subsidiaries, 43 of which are

actively supporting SON. Operators were asked for all their most important use

cases, then of the 11 which were cited most commonly, they were asked to rank

their top five in terms of the network business case.

The increasingly diverse range of functions which SON will enable, as the network

becomes denser and covers a wider variety of spectrum bands and cell types, points

towards 5G. The Small Cell Forum’s HetNet 2020 roadmap and work program sets out

an evolution to 5G via densification and virtualization, and in that process, SON will be

one of the most essential enablers.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 21

6. Key use cases supported by the new HetNets

The preceding chapter indicates that mobile operators have a clear vision of what their

networks will need to support, in order to deliver on their business plans, and that

many of these requirements are addressed by HetNet technologies. However, the

business case may not be sufficiently attractive if these new-look dense, flexible and

automated networks merely enhance existing use cases and revenue streams, by

adding a new level of capacity and efficiency. To justify the investment and ensure

operator growth, they must also support new types of business.

According to the survey, the key drivers in terms of potential new revenue and market

share change and expand between 2016 and 2020. The respondents were asked to list

important use cases which would be enabled or enhanced by a HetNet. From the 10

which were cited most often, they were then asked to select their top three, in terms

of their ability to deliver incremental revenue, for the short term (2016-18) and

anticipated for 2020.

A clear set of use cases emerged with short term potential to enhance the MNO’s

business right now, while others are expected to be having a measurable positive

impact by 2020, driven by new user requirements and enabled by new HetNet

capabilities (see Figure 6-1).

For the short term, the use cases for HetNets are dominated by the enterprise, both

voice (still a ‘killer app’ in this environment as many organizations go mobile-first) and

data. Achieving a more strategic role in enterprises through improved quality of

service, and layering new added value revenue generators on top of that, is a key goal

for many MNOs, and 36% placed this in their top three priorities for HetNet

deployment in 2016-2018.

This was followed by various use cases driven by consumer video, including the rise of

multiscreen viewing (video delivered with the same user interface to mobile, TV, PC

and car screens); and multiplay bundles (broadband, TV, mobile and voice, and

sometimes other options such as smart home).

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 22

40

35

30

% of MNOs

25

20

15

10

5

0

2016 2020

Figure 6–1 % of MNOs placing each HetNet use case into their top three in terms of potential

to deliver additional revenue within 12 months of deployment

While the near term business models may be about enhancing revenues from

conventional services – enterprise voice/data, video, urban and rural access – the

vision for 2020 sees a diversification of the use cases that can be supported by a more

sophisticated, software-driven HetNet. While consumer or enterprise data will remain

the bedrock of most operators’ revenues well into the next decade, in terms of brand

new revenues, there is a shift to connected ‘things’ as well as people, to wholesale

models and to a new generation of video-based services and user experiences.

Among some of the most prominent specific use cases are:

Consumer

The residential market already has a substantial base of small cells on which new

services can be built in future, and many operator deployments include early HetNet

elements such as integrated cellular and Wi-Fi connectivity, and self-configuring user

equipment. The most significant driver for HetNet expansion in the home market is

video and multiplay, but increasingly video – and other key consumer services driving

HetNet usage, like social media and augmented reality – are consumed seamlessly

within the home and on the move.

Video is the most bandwidth-hungry form of mobile traffic and the fastest growing

(see Figure 6-2). Not only does it require increasing capacity and QoS, but the

business models behind video content are evolving.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 23

Figure 6–2 Mobile video will account for 55% of mobile data traffic by 2020.

Source: Cisco VNI 2016 [5]

Many operators are developing multiplay bundles which usually combine wireline and

mobile access but may also be wireless-only. These have a positive effect on market

share and churn but require high capacity within the home. These multiplay bundles

will start to include IoT and cloud service options, such as home security monitoring

and photo storage, to increase the operator’s share of the household’s digital

spending.

Meanwhile, multiscreen services are also an important way to enhance the video case,

delivering video and applications, with the same user interface, to many screens such

as smartphones, TVs, tablets and in-car systems.

Both these approaches are seen as helping to improve the business case for video,

which can otherwise be regarded merely as a drain on the network’s capacity, since

they add elements such as personalization and optimized QoS to look beyond the ‘best

effort YouTube’ model. But this requires HetNet capabilities such as targeted capacity,

and personalization, enabled by small cells with presence awareness; as well as

efficient use of licensed and unlicensed spectrum to optimize the cost efficiency and

QoE.

The more services and screens are involved, the more the deployment will require

dense capacity throughout the home, presence awareness to trigger certain actions

(turning off the alarms when a householder enters, perhaps), plus seamless hand-off

to the macro network when the user moves outside or to the car. These usage

patterns will require intelligence to be placed close to the user to optimize QoS for

voice and video; to support context awareness and personalization; and to turn the in-

home network into an IT platform to deliver new services and added-value

applications.

By 2020, a new generation of video-driven services will be emerging. Delivering the

heavy-duty network demands of immersive video will, to an even greater extent,

make economic sense only if a wide variety of spectrum and networks can be

harnessed as required, and if HetNet-based capabilities like MEC (for instance, for

video caching) can be used to increase efficiency; and in this new mobile consumer

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 24

environment, the context awareness supported by small cells will be critical to a new

generation of user experiences based around artificial intelligence and VR.

Enterprise

The enterprise is the fastest growing segment for the deployment of small cell

HetNets. According to Q1-2016 figures from Mobile Experts [6], non-residential small

cells, mainly enterprise, accounted for two-thirds of 2015’s $1bn revenue figure, and

40% of unit shipments in the fourth quarter. Shipments are forecast to rise by 270 per

cent in the enterprise segment in 2016, from about 400,000 in 2015, and the sector

will deliver $6 billion in equipment revenues in 2020.

Those forecasts reflect the increasing significance of high quality mobile voice and

data to all kinds of businesses, and that will provide an opportunity for MNOs to

enhance their strategic role in this sector by enabling business-critical in-building

networks and then delivering high quality services, such as VoLTE-based rich

communications, on top.

In a survey of over 500 enterprises worldwide, conducted by Nemertes for the Small

Cell Forum in the fourth quarter of 2015 [7], it emerged that 14% had already

deployed some small cells, while a further 46% expected to do so within two years,

and 23% were evaluating them. Overwhelmingly the most important reason for

enterprise interest in small cells was poor in-building coverage, whether for employees

or, in a public-facing enterprise like a retail mall, for customers and visitors. Almost

94% said that the quality of in-building cellular performance affected their business,

42% very seriously.

Initially, the operators see the enterprise opportunity lying mainly in supporting

business-class QoS in voice and data, which is almost impossible to achieve, in most

environments, without indoor small cells.

As the enterprise case broadens, other HetNet technologies will take a central enabling

role, including licence-exempt spectrum for intelligent access; MEC for new cloud

services and for offloading functions like PBX integration to the local network;

virtualization gateways to improve the planning and economics of a large enterprise

small cell network. Towards 2020, enterprise use cases will increasingly include IoT

and Industrial Internet services such as smart factory, as well as neutral host

systems, as seen in Figure 6-3, which compares the drivers for deploying an

enterprise HetNet to those for the industry as a whole. In the enterprise space, indoor

services, an IT applications platform, the IoT and virtualization are significantly bigger

drivers than they are for the MNO model overall.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 25

70

% placing in top 3

60

50

40

30

20

10

0

Global Enterprise

Figure 6–3 Most important drivers to deploy enterprise HetNet, compared to those for the

whole industry.

Source: Rethink Technology Research MNO survey Q415 [8]

The more challenging the indoor environment, the more critical a dense HetNet will

become, as seen in this Small Cell Forum case study of a deployment in a stadium in

Beijing: http://www.smallcellforum.org/site/wp-content/uploads/2016/01/Huawei-

BeijingWorkersStadium.pdf

Another important emerging trend in enterprise HetNet is support for wholesale and

on-demand services. In this sector, MNOs often need to work with specialized

integrators, cloud services providers and vertical market players, creating a more

complex value chain than in consumer and urban segments. It will be important for

MNOs to be able to support many types of services and partners flexibly on their

HetNets.

Network-as-a-service (NWaaS) - which includes wholesaling to other service providers

and providing on-demand capacity and applications to enterprise customers – was

rated as a top three source of new revenue by almost one-quarter of respondents,

only bettered by emerging new services based on video, such as immersive gaming

and virtual reality content. Both these are examples of emerging services which will be

enabled by key elements of the HetNet. Efficient and flexible allocation of network

resources to enterprises and service providers will rely on virtualization as well as the

ability to target capacity where it is required, and in the most efficient spectrum.

Urban and rural

As in the enterprise market, there will be different phases of services which operators

will deploy for the outdoor urban and rural markets. They will, in general, start by

addressing the fundamental issue of high quality, consistent voice and data services,

which rely on achieving coverage everywhere and then targeting dense capacity where

required – a flexible approach which is only possible using a small cell HetNet layer,

increasingly with added flexibility enabled by virtualization.

When strong coverage and capacity are achieved, the operators will look to generate

additional revenue streams on top of that foundation. In the survey, the most

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 26

promising urban and rural added-value business cases, enabled by HetNets, were

perceived to be:

• Smart city/M2M

• Smart transport

• Citizen access

• Public safety

• Remote working

• Digital divide

Issues of spectrum availability dominate operators’ options for deploying services to

dense populations. An extreme example is in India, where new entrant Reliance Jio, as

well as established market leader Bharti Airtel, are both embarking on ambitious small

cell HetNet plans as they struggle to serve one of the world’s largest mobile

populations with very constrained spectrum resources (see Figure 6-4).

Figure 6–4 A HetNet example: Reliance Jio’s JioSON, designed to deliver new user

experiences despite a challenging spectrum situation

Two case studies which highlight the ability of a flexible HetNet to improve urban and

rural services are included in the Small Cell Forum’s growing database of deployment

stories. The first shows Softbank trialling virtualized small cells and nFAPI in a densely

populated Tokyo street [9] while the second, also in Japan, focuses on bringing

services to a remote ski resort [10].

Two case studies which highlight the ability of a flexible HetNet to improve urban and

rural services are included in the Small Cell Forum’s growing database of deployment

stories. The first shows Softbank trialling virtualized small cells and nFAPI in a densely

populated Tokyo street, while the second, also in Japan, focuses on bringing services

to a remote ski resort.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 27

Figure 6–5 Two of the Small Cell Forum's deployment stories demonstrating benefits of both

urban and rural usage

Wholesale and MVNO+

One of the interesting aspects of the evolving HetNet business model is the potential

for the small cells to be deployed or managed by a separate operator from the macro

layer MNO. Options range from an MVNO, such as a cable provider, deploying its own

small cells –by obtaining licensed spectrum and deploying LTE-Unlicensed or LAA in

5 GHz; to a wholesaler rolling out small cells, again with an MNO agreement for a wide

area anchor network, and then supporting multiple service providers on its network.

In the latter model, the wholesaler may be the MNO itself, or a third party. The

resulting ‘network as a service’ platform would increasingly be hosted in the cloud,

allocating bandwidth flexibly and on-demand between different service providers, and

between different technologies such as cellular metrocells and Wi-Fi.

In 2013, 92% of small cells were deployed by the same operator which controlled the

macro network, and interworking with the macro layer (see Figure 6-5). Only 4% were

interworking with a third party macro, and similar number were completely standalone

hotspots. By 2020 the picture will be very different, with 25% of installed small cells

interworking with a third party MNO network, and 45% with a virtualized layer such as

a cloud-hosted NWaaS platform.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 28

25,000

No of cells 20,000

15,000

10,000

5,000

0

2013 2014 2015 2016 2017 2018 2019 2020

Standalone

Interworking with virtualized layer

Figure 6–6 Small cell installed base by service provider ownership 2013-20

Source: Rethink Technology Research [11]

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 29

7. Challenges

While operators have a clear view of the potential of HetNets of various kinds to

address their key business drivers, there are, of course, challenges to achieving their

goals. As well as defining foundation stones for current and future HetNets, the Small

Cell Forum also aims to address barriers to deployment in order to boost operator

confidence and accelerate adoption.

As outlined by the Forum’s HetNet and SON work programs, the most important

challenges to address are:

Multi-vendor interoperability

HetNet SON parameter coordination for interoperability and deployment cost reduction

for both C-SON and D-SON is still maturing, some difficult issues remain to be solved

and some interfaces implementations are fragmented.

SON evolution

SON features are evolving with each 3GPP release and SON API must evolve and

adapt as SON becomes increasingly a tool for end-to-end automation.

SON benchmarking

Functional and performance expectations for SON features in the HetNet are not well

defined.

Backhaul SON

Backhaul evolution including self-backhaul is a key component of the HetNet and small

cell deployment.

Deployment

Deployment of SON small cell solutions can have broad network implications. What

are the deployment and maintenance challenges?

HetNet capacity planning

Capacity planning in the HetNet is complex and directly impacts the role of Small Cells

in the HetNet.

NFV implications

NFV is impacting the deployment options and interfaces of the HetNet. What are the

implications of network virtualization on SON for small cells?

Unlicensed spectrum in the HetNet

New dimensions of the HetNet are gaining traction with Wi-Fi offloading and LAA as

primary examples. What are the driving use cases for coordinated network operation

with LTE? What are the technical challenges to co-exist in the HetNet?

Indoor location

E911 and Enterprise enterprise applications require indoor location technology. How

do small cells meet the requirements? How to ensure multivendor interoperability?

Energy savings

Leveraging SON for significant energy savings requires clear coverage and capacity

use cases in the HetNet.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 30

Operational support implications:

Legacy OSS systems need to evolve from siloed capabilities responsible for a single

domain into services that deliver automated service quality management across the

entire HetNet (see SCF172 for the way forward in addressing this challenge [Error!

Bookmark not defined.]).

Many of these challenges have both technology and organizational aspects, which may

be equally important. For instance, operators attach significant importance to issues of

end-to-end automation (including civil works around sites, access to city

infrastructure, and workflow management) – this may be as important to achieving

mass scale as automation once the network is in place. The Forum will be studying

templates and processes to ensure that deployment and running of HetNets is

increasingly simplified, even if the networks themselves become more complex and

multi-faceted.

The importance of logistical as well as technical issues is seen in the results of the

MNO survey. Asked to name their most important challenges to HetNet deployment,

the respondents then selected the three most important to their business case, from a

list of 10 (see Figure 7-1). The issues of deploying a HetNet at large scale – essential

to many of the use cases highlighted above – dominate, with 57% naming automation

as their most important challenge, and 49% naming deployment logistics. Between

those two came spectrum availability (49%) – while the ability to harness more

sources of spectrum is a key driver for HetNet, doubts about being able to access

those airwaves remain an important barrier.

14

21 49

Deployment logistics/workflow

Large-scale automation

29

Backhaul

Immature standards - SON, NFV

Spectrum availability

17

57 Future proofing - SDN, 5G

Multivendor integration

18

Effective capacity planning

IoT support

22 Place in enterprise value chain

50

24

Figure 7–1 Most important challenges to deploying a HetNet – % of MNOs placing each

challenge in their top three

The Small Cell Forum’s HetNet and SON work programs are designed to advance the

technologies which will be needed to address the key HetNet drivers outlined in this

paper; and also to lower the barriers to deployment so that a mass-scale ecosystem

with trusted building blocks and processes can be achieved quickly. Figure 7-2

indicates how current work items map directly onto the burning issues identified by

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 31

the Forum’s members and the MNO community. These items will form Release 7 – a

two-part release consisting of ‘HetNet and SON Foundations’ and then a more in-depth

‘HetNet and SON’ body of work to be published in June 2016 and available on

http://scf.io/

Figure 7–2 Key HetNet/SON issues addressed in Small Cell Forum’s 2016 work program and

Release 7

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 32

8. Conclusion: Future-proofing

Perhaps the most important market requirement is flexibility, since so much is

currently unknown about 5G – and because there will be future waves of 5G beyond

the Release 15 standards, as there have been in 4G. That means the HetNet will

continue to evolve, as will the business cases it enables.

The Forum is committed to a program which puts building blocks in place to support

current market drivers, but which are also open and adaptable, so that operators can

invest now in platforms which will later be able to support unforeseen new use cases.

Report title: HetNet market drivers 2016-2020

Issue date: 03 May 2016

Version: 170.07.02 33

References

1 [SCF172] ‘Integrated HetNet Architecture Framework’, Small Cell Forum,

May 2016

2 Rethink Technology Research, survey (72 MNOs)

3 Ericsson: HetNet infographic, 2010

4 IEEE, ‘System Architecture and Key Technologies for 5G Heterogeneous Cloud

Radio Access Networks’, December 2014, http://arxiv.org/pdf/1412.6677.pdf

5 Cisco VNI

6 Mobile Experts survey, May 2016

7 Nemertes survey, Dec 2015

8 Rethink survey (72 MNOs)

9 http://www.smallcellforum.org/site/wp-

content/uploads/2016/01/SoftbankAirspan_nFAPI_Tokyo.pdf

10 http://www.smallcellforum.org/site/wp-

content/uploads/2016/01/Softbank_RuralRemote.pdf

11 Rethink Technology Research, RAN Service operator survey on NWaaS, March

2016 http://www.rethinkresearch.biz

Report title: HetNet market drivers 2016-2020