33% found this document useful (6 votes)

13K views3 pagesSample Filled Form 12B

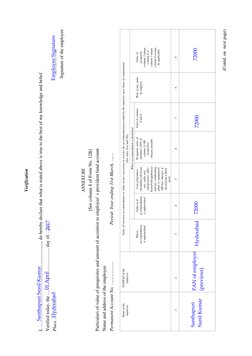

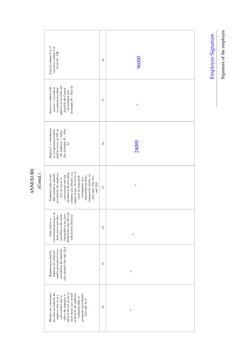

1. Santhapuri Sunil Kumar was employed by ABC Company Ltd for 3 years and provided details of income and taxes paid for the year ending March 31, 2017.

2. The total salary excluding allowances was Rs. 360000 and house rent allowance was Rs. 72000. Perquisites and other benefits amounted to Rs. 24000.

3. A total of Rs. 456000 was subject to tax deduction, of which Rs. 16000 was deducted for life insurance premium and Rs. 5500 was deducted towards provident fund contribution. The total tax deducted during the year was Rs. 5500.

Uploaded by

Sanjay sharmaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

33% found this document useful (6 votes)

13K views3 pagesSample Filled Form 12B

1. Santhapuri Sunil Kumar was employed by ABC Company Ltd for 3 years and provided details of income and taxes paid for the year ending March 31, 2017.

2. The total salary excluding allowances was Rs. 360000 and house rent allowance was Rs. 72000. Perquisites and other benefits amounted to Rs. 24000.

3. A total of Rs. 456000 was subject to tax deduction, of which Rs. 16000 was deducted for life insurance premium and Rs. 5500 was deducted towards provident fund contribution. The total tax deducted during the year was Rs. 5500.

Uploaded by

Sanjay sharmaCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

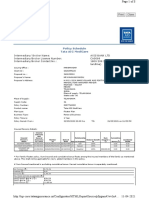

![1FORM NO. 12B

[See rule 26A]

Form for furnishing details of income under section 192(2) for the year ending 31

st March, ………](https://screenshots.scribd.com/Scribd/252_100_85/356/442004186/1.jpeg)