Professional Documents

Culture Documents

Assessments 2-Cash Theories - 20July2019JT PDF

Assessments 2-Cash Theories - 20July2019JT PDF

Uploaded by

Joseph II MendozaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assessments 2-Cash Theories - 20July2019JT PDF

Assessments 2-Cash Theories - 20July2019JT PDF

Uploaded by

Joseph II MendozaCopyright:

Available Formats

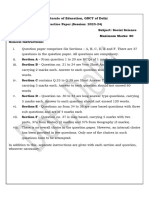

QUESTIONS

(1-5). Define Cash (5points)

(6-7) For an item to be considered unrestricted cash it must be ______ and _______

(8) Why are PDCs received cannot be considered as cash when received?

(9) True or False: To be reported as cash, an item must be unrestricted in use.

(10-12) What are the cash items included in cash?

(13) Only highly liquid investments that are acquired __________ maturity can qualify as cash

equivalents.

(14) True or False: Equity securities cannot qualify as cash equivalents because shares do have a

maturity date.

(15) True or False: Preference shares with specified redemption date and acquired 3 months after

redemption date can qualify as cash equivalents.

(16) True or False: An overdraft can also be offset against the other bank account if the amount is not

material.

(17) A _________ is a check that is not encashed by the payee within a relatively long period of time.

(18-19) What are the two methods of handling/(recording) the petty cash transactions.

(20)__________ is the one usually followed in handling petty cash transactions.

ANSWERS

1. Cash includes money and any other negotiable instrument

2. that is payable in money

3. and acceptable by the bank

4. for deposit

5. and immediate credit

(6) readily available in the payment of current obligations and

(7) not be subject to any restriction, contractual or otherwise

(8) Postdated checks received cannot be considered as cash yet because these

are unacceptable by the bank for deposit and immediate credit or outright

encashment.

(9) True: To be reported as “cash”, an item must be unrestricted in use.

Cash items included in cash are:

(10) Cash on hand,

(11) Cash in bank,

(12) Cash fund

(13) Only highly liquid investments that are acquired 3_months before

maturity can qualify as cash equivalents.

(14) True: Equity securities cannot qualify as cash equivalents because shares

do not have a maturity date.

(15) False: Preference shares with specified redemption date and acquired 3

months after redemption date can qualify as cash equivalents.

(16) True: An overdraft can also be offset against the other bank account if the

amount is not material.

(17) Stale check: a check that is not encashed by the payee within a relatively

long period of time.

(18-19) Two methods of handling the petty cash: (18) Imprest fund system &

(19) Fluctuating fund system

(20) Imprest system is the one usually method followed in handling petty cash

transactions.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Corporate Banking InterviewDocument12 pagesCorporate Banking InterviewAlethea AineNo ratings yet

- Mock 10 SolnDocument68 pagesMock 10 SolnShaitan MishraNo ratings yet

- The RSI Trading ExamplesDocument64 pagesThe RSI Trading ExamplesIbrahim100% (3)

- Marriott Equity Research ReportDocument14 pagesMarriott Equity Research ReportHaohan Xu100% (1)

- Mario Veridiano y Sapi vs. People G.R. No 200370 7june2017 - 27Mar2022JMdigestDocument2 pagesMario Veridiano y Sapi vs. People G.R. No 200370 7june2017 - 27Mar2022JMdigestJoseph II MendozaNo ratings yet

- MENDOZA - Paras Versus Paras A.C. No. 5333, March 13, 2017Document2 pagesMENDOZA - Paras Versus Paras A.C. No. 5333, March 13, 2017Joseph II MendozaNo ratings yet

- Applied Auditing (ACC512A) : 1 Semester SY 2019-2020Document2 pagesApplied Auditing (ACC512A) : 1 Semester SY 2019-2020Joseph II MendozaNo ratings yet

- People vs. Jaime Sison Et Al G.R. No 238453 31july2019 - 27Mar2022JMdigestDocument2 pagesPeople vs. Jaime Sison Et Al G.R. No 238453 31july2019 - 27Mar2022JMdigestJoseph II Mendoza100% (3)

- Enumerations: Questions: Match The Statements On The Left That Best Describes The Terminologies On The RightDocument2 pagesEnumerations: Questions: Match The Statements On The Left That Best Describes The Terminologies On The RightJoseph II MendozaNo ratings yet

- Seatwork 3-Liabilities 22Aug2019JMDocument3 pagesSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaNo ratings yet

- Assessment 3-Bank Recon&ProofofCash - 26Jul2019JMDocument1 pageAssessment 3-Bank Recon&ProofofCash - 26Jul2019JMJoseph II MendozaNo ratings yet

- 05 Digested - Planas v. Comelec - 28Jun18JMDocument1 page05 Digested - Planas v. Comelec - 28Jun18JMJoseph II MendozaNo ratings yet

- Pfrs For Smes - 31aug20118Document6 pagesPfrs For Smes - 31aug20118Joseph II MendozaNo ratings yet

- 04 Digested - Mutuc v. COMELEC - 25Jun18JMDocument1 page04 Digested - Mutuc v. COMELEC - 25Jun18JMJoseph II MendozaNo ratings yet

- 04 Digested - Mutuc v. COMELEC - 25Jun18JMDocument1 page04 Digested - Mutuc v. COMELEC - 25Jun18JMJoseph II MendozaNo ratings yet

- 03 Digested - Manila Prince Hotel V GSIS - 24Jun18JMDocument1 page03 Digested - Manila Prince Hotel V GSIS - 24Jun18JMJoseph II MendozaNo ratings yet

- 02 Digested - Macariola Vs Asuncion - 24Jun18JMDocument1 page02 Digested - Macariola Vs Asuncion - 24Jun18JMJoseph II MendozaNo ratings yet

- 01 Digested - People Vs Perfecto - 24Jun18JMDocument1 page01 Digested - People Vs Perfecto - 24Jun18JMJoseph II MendozaNo ratings yet

- Harvest Interview Series Ori Eyal of Emerging Value Capital ManagementDocument6 pagesHarvest Interview Series Ori Eyal of Emerging Value Capital ManagementCanadianValueNo ratings yet

- Teacher'S Notes Unit 8: Planning: I/ LISTENING 1/ Talks About ProjectsDocument7 pagesTeacher'S Notes Unit 8: Planning: I/ LISTENING 1/ Talks About ProjectsLe GiangNo ratings yet

- ChallanDocument1 pageChallanShahzaib AhmadNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ajinkya BagadeNo ratings yet

- Cash BookDocument14 pagesCash BookSi Brian TohNo ratings yet

- Case AnalysisDocument2 pagesCase AnalysisKarla Joi Perez SalisiNo ratings yet

- Allowance For Doubtful Accounts Allowance For Doubtful Accounts +Document1 pageAllowance For Doubtful Accounts Allowance For Doubtful Accounts +Steven SandersonNo ratings yet

- PhonePe Statement Feb2024 Mar2024Document13 pagesPhonePe Statement Feb2024 Mar2024chetantyagi434No ratings yet

- Scheduled Bank Non Scheduled Bank PDFDocument6 pagesScheduled Bank Non Scheduled Bank PDFSelvaraj Villy100% (1)

- MCQ's (Synonyms) - Modern Prose & Heroes: Inter Part Ii English Guess PaperDocument17 pagesMCQ's (Synonyms) - Modern Prose & Heroes: Inter Part Ii English Guess PaperSajid aliNo ratings yet

- Autoclave Food Waste DataDocument40 pagesAutoclave Food Waste DataDevNo ratings yet

- Economics Research PaperDocument10 pagesEconomics Research Papervmadhvi62No ratings yet

- RBL Bank PDFDocument2 pagesRBL Bank PDFALLtyNo ratings yet

- 10 Socialscience Eng PP 2023-24-2Document9 pages10 Socialscience Eng PP 2023-24-2Tapas BanerjeeNo ratings yet

- Line, Shella Mae S.levine - Midterm-Lesson-1-Module-In-The-Contemporary-World-1Document4 pagesLine, Shella Mae S.levine - Midterm-Lesson-1-Module-In-The-Contemporary-World-1Shella Mae Line50% (2)

- Renewal Intimation Letter: TrejharaDocument1 pageRenewal Intimation Letter: TrejharaDocuVisersNo ratings yet

- Ford in AlgeriaDocument22 pagesFord in Algeriashamins123No ratings yet

- Organizational Change Models A Comparison.Document27 pagesOrganizational Change Models A Comparison.Carlos Ortiz100% (3)

- TextDocument2 pagesTextJane NaomiNo ratings yet

- Golar FLNG PresentationDocument19 pagesGolar FLNG Presentationstavros7100% (1)

- Features Affecting The Appeal of DestinationsDocument40 pagesFeatures Affecting The Appeal of DestinationsRahemah 拉希马 AlliNo ratings yet

- 3G Awareness QuestionnaireDocument2 pages3G Awareness QuestionnairebuddeyNo ratings yet

- PETER PAN GenerationDocument10 pagesPETER PAN Generationfionarml4419No ratings yet

- CURTIS. Commodities and Sexual SubjuctivitesDocument28 pagesCURTIS. Commodities and Sexual SubjuctivitesMónica OgandoNo ratings yet

- Human Experience and Place: Sustaining IdentityDocument4 pagesHuman Experience and Place: Sustaining Identityming34No ratings yet

- 9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperDocument8 pages9706 Accounting: MARK SCHEME For The May/June 2008 Question PaperShona MaheshwariNo ratings yet