Professional Documents

Culture Documents

Allowance For Doubtful Accounts Allowance For Doubtful Accounts +

Uploaded by

Steven SandersonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Allowance For Doubtful Accounts Allowance For Doubtful Accounts +

Uploaded by

Steven SandersonCopyright:

Available Formats

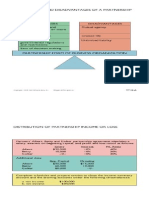

PERCENTAGE OF SALES VS.

PERCENTAGE OF RECEIVABLE METHODS

PERCENTAGE OF PERCENTAGE OF

SALES METHOD RECEIVABLES METHOD

ADJUSTING ENTRY

Bad Debts Expense 3,000 Bad Debts Expense 2,658

Allowance for Allowance for

Doubtful Accounts 3,000 Doubtful Accounts 2,658

Allowance for Allowance for

Doubtful Accounts Doubtful Accounts

150 150

3,000 2,658

3,150 2,808

Balance of Amount

Amount Determined

Determined

From Net Sales

From Aging Schedule

If the Allowance account had a $150 debit balance before adjustments, the adjusting

entry using the percentage of sales method would not change. If the percentage of

receivable method is used, the adjusting entry would have to take into consideration

the debit balance in the Allowance account by adding the debit balance to the

required Allowance account balance obtained from the aging schedule.

ADJUSTING ENTRY

Bad Debts Expense 3,000 Bad Debts Expense 2,958

Allowance for Allowance for

Doubtful Accounts 3,000 Doubtful Accounts 2,958

($150 + $2,808 = $2,958)

Allowance for Allowance for

Doubtful Accounts Doubtful Accounts

150 3,000 150 2,958

2,850 2,808

Copyright 1999 John Wiley & Sons, Inc. Weygandt/Principles 5e T T 8–D

You might also like

- Chapters 10,11 and 12 Assessment QuestionsDocument10 pagesChapters 10,11 and 12 Assessment QuestionsSteven Sanderson100% (1)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Reaction Paper To Chater 13Document2 pagesReaction Paper To Chater 13Steven Sanderson100% (5)

- Reaction Paper To Chapter 6Document3 pagesReaction Paper To Chapter 6Steven Sanderson100% (1)

- Reaction Report To Student OrientationDocument1 pageReaction Report To Student OrientationSteven SandersonNo ratings yet

- Chapter 10 Reactioin PaperDocument2 pagesChapter 10 Reactioin PaperSteven SandersonNo ratings yet

- Chapter 20 Reaction PaperDocument3 pagesChapter 20 Reaction PaperSteven Sanderson100% (4)

- Chapters 7,8,9 Assesment QuestionsDocument9 pagesChapters 7,8,9 Assesment QuestionsSteven Sanderson100% (3)

- Chapters 13, 14, 15, 16 Assessment QuestionsDocument11 pagesChapters 13, 14, 15, 16 Assessment QuestionsSteven Sanderson100% (5)

- Chapter 19,20,21,22 Assesment QuestionsDocument19 pagesChapter 19,20,21,22 Assesment QuestionsSteven Sanderson100% (3)

- Chapter One and 2 Assessment QuestionsDocument6 pagesChapter One and 2 Assessment QuestionsSteven Sanderson100% (3)

- Chap 19 - Selected Ex & ProbDocument6 pagesChap 19 - Selected Ex & ProbSteven Sanderson100% (1)

- Chapters 3,4,5 and 6 Assesment QuestionsDocument10 pagesChapters 3,4,5 and 6 Assesment QuestionsSteven Sanderson100% (4)

- Chapter 21 Reaction PaperDocument4 pagesChapter 21 Reaction PaperSteven Sanderson100% (1)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Acct II - Chapter 15 Lecture NotesDocument4 pagesAcct II - Chapter 15 Lecture NotesSteven Sanderson100% (1)

- Accounting II - Chap 14 Lecture NotesDocument6 pagesAccounting II - Chap 14 Lecture NotesSteven Sanderson100% (4)

- Chap 12 - Selected Ex & ProbDocument2 pagesChap 12 - Selected Ex & ProbSteven SandersonNo ratings yet

- CH 14Document54 pagesCH 14Steven SandersonNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Chap 13 - Selected Ex & ProbDocument1 pageChap 13 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 14 - Selected Ex & ProbDocument8 pagesChap 14 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 15 - Selected Ex & ProbDocument7 pagesChap 15 - Selected Ex & ProbSteven SandersonNo ratings yet

- Acounting II - Chap 12 Accounting Principles - Part II - SLNDocument12 pagesAcounting II - Chap 12 Accounting Principles - Part II - SLNSteven Sanderson100% (2)

- Chapter 13 - Teaching ExhibitsDocument6 pagesChapter 13 - Teaching ExhibitsSteven SandersonNo ratings yet

- Chap 18 - Selected Ex & ProbDocument6 pagesChap 18 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap 16 - Selected Ex & ProbDocument3 pagesChap 16 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chap. 23 - Selected Ex. & Prob.Document5 pagesChap. 23 - Selected Ex. & Prob.Steven SandersonNo ratings yet

- Chap 20 - Selected Ex & ProbDocument3 pagesChap 20 - Selected Ex & ProbSteven SandersonNo ratings yet

- Chapter 13 - Lecture NotesDocument6 pagesChapter 13 - Lecture NotesSteven Sanderson100% (3)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Holder in Due Course CasesDocument9 pagesHolder in Due Course CasesGela Bea BarriosNo ratings yet

- Compilation of Cases Credit TransactionsDocument347 pagesCompilation of Cases Credit TransactionsebenezermanzanormtNo ratings yet

- General Awareness MCQ New AugDocument7 pagesGeneral Awareness MCQ New AugManish SinghNo ratings yet

- Epilogue Magazine, September 2009Document80 pagesEpilogue Magazine, September 2009Epilogue MagazineNo ratings yet

- KYC Master Directions 2016 - Presentations For RefDocument15 pagesKYC Master Directions 2016 - Presentations For RefAnagha LokhandeNo ratings yet

- Boa HelpDocument2 pagesBoa HelpJorge LuissNo ratings yet

- FIN80004 Lecture1Document28 pagesFIN80004 Lecture1visha183240No ratings yet

- Subprime CrisisDocument18 pagesSubprime CrisisRicha SinghNo ratings yet

- Department of Financial Institutions ESBMDocument34 pagesDepartment of Financial Institutions ESBMAnu VanuNo ratings yet

- TVM Complete TemplateDocument17 pagesTVM Complete TemplateAlok RajNo ratings yet

- Welcome Package (GIC-220610049)Document3 pagesWelcome Package (GIC-220610049)vivekNo ratings yet

- GW 2013 Arab World Sample PagesDocument9 pagesGW 2013 Arab World Sample PagesAlaaNo ratings yet

- 6 PakistanDocument62 pages6 PakistanKhalil Ur Rehman YousafzaiNo ratings yet

- HSBC 1billon Euro e Clear 16 Pages of SBLC 62+2% LoiDocument12 pagesHSBC 1billon Euro e Clear 16 Pages of SBLC 62+2% LoiKaran LA100% (2)

- How To Configure SSL For SAP HANA XS Engine Using SAPCryptoDocument4 pagesHow To Configure SSL For SAP HANA XS Engine Using SAPCryptopraveenr5883No ratings yet

- Saji DDDD DDDDDocument37 pagesSaji DDDD DDDDTalha Iftekhar Khan SwatiNo ratings yet

- Proforma 1EDocument3 pagesProforma 1EEric HernandezNo ratings yet

- Gov Uscourts Nysd 524076 1 0Document95 pagesGov Uscourts Nysd 524076 1 0ForkLogNo ratings yet

- Kalpana Bisen Paper On Dress CodeDocument19 pagesKalpana Bisen Paper On Dress CodeKalpana BisenNo ratings yet

- Vietnam Financial Structure: The Overview of Direct and Indirect Finance in Viet Nam 1Document5 pagesVietnam Financial Structure: The Overview of Direct and Indirect Finance in Viet Nam 1Hiền NguyễnNo ratings yet

- Sukanya Samriddhi Calculator VariableDocument38 pagesSukanya Samriddhi Calculator VariableRam SewakNo ratings yet

- 0813897476 (1)Document2 pages0813897476 (1)Raja RazaliaNo ratings yet

- NPO Master ProblemDocument3 pagesNPO Master ProblemSaurabh AdakNo ratings yet

- VII Semester QuestionsDocument8 pagesVII Semester QuestionsRadha SundarNo ratings yet

- Universak BankingDocument33 pagesUniversak BankingprashantgoruleNo ratings yet

- People Vs Puig and PorrasDocument1 pagePeople Vs Puig and Porraskarl doceoNo ratings yet

- Allahabad Bank - Internet Banking System 6 PDFDocument1 pageAllahabad Bank - Internet Banking System 6 PDFarjunv_14No ratings yet

- Power of AttorneyDocument1 pagePower of AttorneyAubrien Fachi MusambakarumeNo ratings yet

- Banking Law (Part 7 Case Digests)Document14 pagesBanking Law (Part 7 Case Digests)Justice PajarilloNo ratings yet

- Bet You Thought (Federal Reserve) PDFDocument21 pagesBet You Thought (Federal Reserve) PDFtdon777100% (6)