Professional Documents

Culture Documents

Factoring Advantages and Dis Advantages

Factoring Advantages and Dis Advantages

Uploaded by

Siva RockOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Factoring Advantages and Dis Advantages

Factoring Advantages and Dis Advantages

Uploaded by

Siva RockCopyright:

Available Formats

Factoring advantages and dis advantages

Factoring is essentially a financial tool that allows you to finance your slow-paying invoices

from creditworthy customers. Using your invoices as collateral, the finance company

advances funds to your company – providing you the resources to pay important expenses.

any business financing solution, factoring has both advantages and disadvantages.

Advantages of Factoring

Factoring has the following advantages:

Improved cash flow. The most important advantage of factoring your invoices is that

your cash flow improves – putting you in a better position to cover company expenses.

Extend payment terms with confidence. You can extend 30- to 60-day payment

terms to customers confidently because you do not need to wait that long to get funds

out of your invoices.

Easy qualification requirements. Unlike other business financing solutions, factoring

is relatively easy to qualify for. Most companies that have solid customers and do NOT

have major problems should qualify.

Quick funding. The factoring line can be deployed quickly – usually in a week or two –

allowing you to respond quickly if your company is in a crunch.

Line flexibility. Since the line is based on your invoices (their dollar amount and

quality), the line can grow and adapt to increasing revenues. This important advantage

provides a financial platform that can support growth.

Simpler application. Invoice financing has a simpler application process that most

other solutions.

Disadvantages of Factoring

However, invoice financing is not perfect for every company. Factoring has some

disadvantages that you should be aware of so that you can make an informed decision.

Some disadvantages include:

Cost. The cost of factoring financing is much higher than the cost of other types of

funding.

Solves a very specific problem. Factoring is designed specifically to address the

cash flow problems created by slow-paying customers. If you have other problems, or if

you need capital to buy equipment, factoring offers little (if any) help.

Your customers will know. Your customers will know that you are using this type of

financing. They receive a Notice of Assignment advising them of your factoring

relationship.

Your invoices will be verified. Most factoring companies verify your invoices with

your customers to ensure that they are accurate and that your customers are satisfied

with the products/services.

Conclusion

This article does not provide an exhaustive list of advantages and disadvantages of

factoring invoices. However, it should help you determine whether factoring is the right

solution for your company.

You might also like

- Trait TheoryDocument30 pagesTrait TheoryGyanendra TiwariNo ratings yet

- Fire Drill Exercise (September 27, 2018)Document5 pagesFire Drill Exercise (September 27, 2018)Christian LopezNo ratings yet

- Notes.-Legal Systems. - IIPM. - MBA. & LCP FormDocument17 pagesNotes.-Legal Systems. - IIPM. - MBA. & LCP FormamitkaraliaNo ratings yet

- Planning For Health PromotionDocument55 pagesPlanning For Health Promotionsweetsai05No ratings yet

- NPA ManagementDocument18 pagesNPA ManagementVincy LuthraNo ratings yet

- Joint Affidavit of ArrestDocument3 pagesJoint Affidavit of ArrestPCpl J.B. Mark Sanchez67% (3)

- Galleon - September 2009 ExposureDocument14 pagesGalleon - September 2009 Exposuremarketfolly.comNo ratings yet

- Director's Personal Liability - Hindrance To Business Decision?Document3 pagesDirector's Personal Liability - Hindrance To Business Decision?ADITYA BANERJEENo ratings yet

- Theories of Corporate GovernanceDocument10 pagesTheories of Corporate GovernanceSuryaa Rajendran100% (1)

- Benefits of Joint Stock CompanyDocument2 pagesBenefits of Joint Stock CompanyMaria ShahidNo ratings yet

- Tandon Committee Report On Working CapitalDocument4 pagesTandon Committee Report On Working CapitalMohitAhujaNo ratings yet

- Sources of Long-Term FinanceDocument17 pagesSources of Long-Term FinanceGaurav AgarwalNo ratings yet

- Shreya Bhotica Mba CFDDocument12 pagesShreya Bhotica Mba CFDNancy Verma100% (1)

- Management of Funds Entire SubjectDocument85 pagesManagement of Funds Entire SubjectMir Wajahat Ali100% (1)

- Project Finance (Smart Task 1)Document14 pagesProject Finance (Smart Task 1)Aseem VashistNo ratings yet

- Unit - 4 Study Material ACGDocument21 pagesUnit - 4 Study Material ACGAbhijeet UpadhyayNo ratings yet

- Ethical Issues in FinaceDocument19 pagesEthical Issues in Finaceshrikant hegadi100% (1)

- Asset Management Company AnalysisDocument2 pagesAsset Management Company AnalysisDhoni KhanNo ratings yet

- Objectives of The Dividend PolicyDocument2 pagesObjectives of The Dividend Policy2801 Dewan Foysal HaqueNo ratings yet

- The Cadbury Committee Report On Corporate GovernanceDocument15 pagesThe Cadbury Committee Report On Corporate GovernanceDiksha VashishthNo ratings yet

- Compensation Management: Components of Compensation SystemDocument9 pagesCompensation Management: Components of Compensation SystemgopareddykarriNo ratings yet

- Methods of Price Level AccountingDocument17 pagesMethods of Price Level AccountingKuladeepa KrNo ratings yet

- Chapter01 2Document10 pagesChapter01 2Subhankar PatraNo ratings yet

- Hire PurchaseDocument16 pagesHire PurchasebrekhaaNo ratings yet

- Harshad Mehta and Ketan Parikh ScamDocument6 pagesHarshad Mehta and Ketan Parikh ScamAnkur MadaanNo ratings yet

- 3P - Finance With Other DisciplinesDocument2 pages3P - Finance With Other DisciplinesRaju RajendranNo ratings yet

- Control by Exception or Management by ExceptionDocument2 pagesControl by Exception or Management by Exceptionbaranidharan .kNo ratings yet

- Presentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDDocument12 pagesPresentation On Ratio Analysis:: A Case Study On RS Education Solutions PVT - LTDEra ChaudharyNo ratings yet

- Directives - Unified Directives 2067 EnglishDocument474 pagesDirectives - Unified Directives 2067 EnglishManoj ThapaliaNo ratings yet

- A Study On Cash Flow @@@tata Type 2Document69 pagesA Study On Cash Flow @@@tata Type 2aurorashiva1No ratings yet

- Resource Planning in A Development BankDocument16 pagesResource Planning in A Development BankLaveena BachaniNo ratings yet

- Unit IV - (Managerial Economics) Market Structures & Pricing StrategiesDocument37 pagesUnit IV - (Managerial Economics) Market Structures & Pricing StrategiesAbhinav SachdevaNo ratings yet

- Memorandum 2Document4 pagesMemorandum 2Catie MaasNo ratings yet

- Corporate Finance Current Papers of Final Term PDFDocument35 pagesCorporate Finance Current Papers of Final Term PDFZahid UsmanNo ratings yet

- AFM Question Bank For 16MBA13 SchemeDocument10 pagesAFM Question Bank For 16MBA13 SchemeChandan Dn Gowda100% (1)

- Dividend PolicyDocument8 pagesDividend PolicySumit PandeyNo ratings yet

- ABC Shipyard ScamDocument23 pagesABC Shipyard ScamvrayNo ratings yet

- Ethical Issues in HRDocument2 pagesEthical Issues in HRNixon GeorgeNo ratings yet

- 14 Corporate GovernanceDocument19 pages14 Corporate GovernanceAhmed hassanNo ratings yet

- Increased Concern of HRMDocument30 pagesIncreased Concern of HRMAishwarya Chachad33% (3)

- New Trends in Financing Working Capital by BanksDocument9 pagesNew Trends in Financing Working Capital by BanksAparna Karuvallil100% (1)

- International Compensation MGMTDocument30 pagesInternational Compensation MGMTIqbal SyedNo ratings yet

- MBA-Nayak PPT 1Document15 pagesMBA-Nayak PPT 1Anveshak PardhiNo ratings yet

- Hire Purchase Finance and Consumer CreditDocument18 pagesHire Purchase Finance and Consumer Creditchaudhary9240% (5)

- Week 7Document7 pagesWeek 7SanjeevParajuliNo ratings yet

- Working CapitalDocument66 pagesWorking CapitalAamit KumarNo ratings yet

- UnderwritingDocument6 pagesUnderwritingarmailgmNo ratings yet

- It Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesDocument24 pagesIt Is A Stock Valuation Method - That Uses Financial and Economic Analysis - To Predict The Movement of Stock PricesAnonymous KN4pnOHmNo ratings yet

- FRS 18, Accounting PoliciesDocument8 pagesFRS 18, Accounting PoliciesveemaswNo ratings yet

- Indian Value System & Business EthicsDocument22 pagesIndian Value System & Business Ethicsarpit0104100% (1)

- Capital StructureDocument4 pagesCapital StructureNaveen GurnaniNo ratings yet

- Q - 5 Changing Role of Bank in IndiaDocument3 pagesQ - 5 Changing Role of Bank in IndiaMAHENDRA SHIVAJI DHENAKNo ratings yet

- Tax Consideration in Project FinancesDocument18 pagesTax Consideration in Project FinancesMukesh Kumar SharmaNo ratings yet

- Designing A Global Financing StrategyDocument23 pagesDesigning A Global Financing StrategyShankar ReddyNo ratings yet

- Makerere University College of Business and Management Studies Master of Business AdministrationDocument15 pagesMakerere University College of Business and Management Studies Master of Business AdministrationDamulira DavidNo ratings yet

- Pepsi and Coke Financial ManagementDocument11 pagesPepsi and Coke Financial ManagementNazish Sohail100% (1)

- Effectiveness of Training at Canara Bank PROJECT REPORTDocument60 pagesEffectiveness of Training at Canara Bank PROJECT REPORTBabasab Patil (Karrisatte)0% (1)

- Discuss The Relevance of Dividend Policy in Financial Decision MakingDocument6 pagesDiscuss The Relevance of Dividend Policy in Financial Decision MakingMichael NyamutambweNo ratings yet

- Source of Uncertainty in CashDocument2 pagesSource of Uncertainty in Cashps44025No ratings yet

- Finance Term PaperDocument29 pagesFinance Term PaperPlato KhisaNo ratings yet

- Inter-Firm ComparisonDocument5 pagesInter-Firm Comparisonanon_672065362100% (1)

- Chapter 4Document24 pagesChapter 4FăÍż SăįYąðNo ratings yet

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorFrom EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorNo ratings yet

- Value Chain Management Capability A Complete Guide - 2020 EditionFrom EverandValue Chain Management Capability A Complete Guide - 2020 EditionNo ratings yet

- The Annoying Fortune TellerDocument5 pagesThe Annoying Fortune TellerCristian VeraNo ratings yet

- Greeting CardDocument6 pagesGreeting CardElsaNo ratings yet

- Silver King Price ListDocument8 pagesSilver King Price ListUsman KhalidNo ratings yet

- Subsidiary Ledger FY2018Document204 pagesSubsidiary Ledger FY2018carmzy_ela24No ratings yet

- E BookDocument8 pagesE BookHit razNo ratings yet

- Entrepreneur Development, Ch-1Document13 pagesEntrepreneur Development, Ch-1ROHITHNo ratings yet

- WHO Acceleration Action Plan To Stop ObesityDocument21 pagesWHO Acceleration Action Plan To Stop Obesitysubdit pmgNo ratings yet

- Aztec Unit 6Document11 pagesAztec Unit 6Jamal Al-deenNo ratings yet

- ROXAS vs. BALIWAG Full TextDocument11 pagesROXAS vs. BALIWAG Full TextGirlai BibancoNo ratings yet

- 6 10 RespectDocument22 pages6 10 Respectbtec jNo ratings yet

- School Canteen WordDocument20 pagesSchool Canteen WordReHopNo ratings yet

- What Is MboDocument14 pagesWhat Is MboHitesh Pant100% (1)

- Threat Analysis Report: Hash Values File Details EnvironmentDocument4 pagesThreat Analysis Report: Hash Values File Details Environmenttodo nothingNo ratings yet

- A Study of Foreign Exchange Exposure in The Indian IT SectorDocument14 pagesA Study of Foreign Exchange Exposure in The Indian IT SectorAnish AnishNo ratings yet

- Amit ManochaDocument3 pagesAmit Manochapeter samuelNo ratings yet

- The 15-Year-Old Son of The FamilyDocument3 pagesThe 15-Year-Old Son of The FamilyLara Mae CaidoNo ratings yet

- Democracy Is The Best Form of GovernmentDocument4 pagesDemocracy Is The Best Form of GovernmentEka Puspa Krisna MurtiNo ratings yet

- Regular VerbsDocument2 pagesRegular VerbsFarfros FarfrosNo ratings yet

- Save Energy For Benefit of Self and Nation: Tender Notice NoDocument12 pagesSave Energy For Benefit of Self and Nation: Tender Notice NoJEETENDRA KUMARNo ratings yet

- Instructionvaluation2006 by CPWDDocument35 pagesInstructionvaluation2006 by CPWDVENKATESWARA RAO VOONANo ratings yet

- AssignmentDocument5 pagesAssignmenthavilahconcept1No ratings yet

- Kababaihan, Ganito Tayo Iginuhit NG Lipunan (Text Explanation)Document6 pagesKababaihan, Ganito Tayo Iginuhit NG Lipunan (Text Explanation)Ishi EvansNo ratings yet

- Model Agreement For An Assured Shorthold Tenancy and Accompanying GuidanceDocument50 pagesModel Agreement For An Assured Shorthold Tenancy and Accompanying GuidancesokrisbaNo ratings yet

- Martinez Final ResearchDocument15 pagesMartinez Final ResearchFerdinand MartinezNo ratings yet

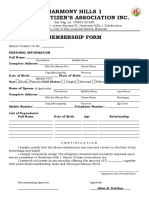

- Harmony Hills 1 Senior Citizen Association Inc Membership FormDocument2 pagesHarmony Hills 1 Senior Citizen Association Inc Membership FormRoxanne Tiffany Dotillos Sarino100% (1)