Professional Documents

Culture Documents

Solution To Quiz 2

Solution To Quiz 2

Uploaded by

GianJoshuaDayritOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Solution To Quiz 2

Solution To Quiz 2

Uploaded by

GianJoshuaDayritCopyright:

Available Formats

Problem 1)

1) Spoiled Goods Inventory 250.00

Factory Overhead Control 250.00

Work in Process 500.00

Accounts Receivable 14,250.00

Sales 14,250.00

Cost of Goods Sold 9,500.00

Work in Process 9,500.00

2) Spoiled Goods Inventory 250.00

Work in Process 250.00

Accounts Receivable 14,625.00

Sales 14,625.00

Cost of Goods Sold 9,750.00

Work in Process 9,750.00

Problem 2)

a) Materials Inventory 30,000.00

Accounts Payable 30,000.00

b) Accounts Payable 3,500.00

Materials Inventory 3,500.00

c) Work in Process 22,500.00

Factory Overhead Control 5,500.00

Materials Inventory 28,000.00

d) Payroll 46,200.00

Accrued Payroll 42,350.00

SSS Prem. Pay. 1,800.00

Philhealth Prem. Pay. 600.00

HDMF Prem. Pay. 550.00

Wtaxes Payable 900.00

Accrued Payroll 42,350.00

Cash 42,350.00

e) Work in Process 18,000.00

Factory Overhead Control 7,000.00

Selling Expenses 9,500.00

Administrative Expenses 11,700.00

Payroll 46,200.00

f) Factory Overhead Control 1,870.00

Selling Expenses 1,220.00

Administrative Expenses 610.00

SSS Prem. Pay. 2,050.00

Philhealth Prem. Pay. 600.00

HDMF Prem. Pay. 550.00

EC Prem. Pay. 500.00

g) SSS Prem. Pay. 3,850.00

Philhealth Prem. Pay. 1,200.00

HDMF Prem. Pay. 1,100.00

EC Prem. Pay. 500.00

Cash 6,650.00

h) Accounts Payable 22,300.00

Cash 22,300.00

i) Work in Process 19,800.00

Factory Overhead Applied 19,800.00

j) Factory Overhead Control 1,100.00

Selling Expenses 660.00

Administrative Expenses 440.00

Cash 2,200.00

k) Factory Overhead Control 3,300.00

Cash 3,300.00

l) Finished Goods 46,000.00

Work in Process 46,000.00

m) Accounts Receivable 75,000.00

Sales 75,000.00

Cost of Goods Sold 40,000.00

Finished Goods Inventory 40,000.00

n) Sales Returns 10,500.00

Accounts Receivable 10,500.00

Finished Goods Inventory 5,600.00

Cost of Goods Sold 5,600.00

o) Cash 55,000.00

Accounts Receivable 55,000.00

p) Factory Overhead Control 900.00

Selling Expenses 400.00

Administrative Expenses 550.00

Accum. Dep'n.Factory Machinery and Equipment 900.00

Accumulated Depreciation Store Furniture 400.00

Accumulated Depreciation Office Furniture 550.00

q) Factory Overhead Applied 19,800.00

Factory Overhead Control 19,670.00

Over Applied Factory Overhead 130.00

Over Applied Factory Overhead 130.00

Cost of Goods Sold 130.00

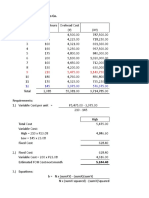

Problem 3)

EOQ = 80.00

Total Ordering Costs 625.00

Total Carrying Costs 625.00

Problem 4:

1) Annual Setup Cost 1,944.00

Annual Carrying Cost 600.00

2) EOQ 720.00

Annual Setup Cost 1,080.00

Annual Carrying Cost 1,080.00

Problem 5)

Using High and Low; 1,800 is considered to be outliers

b= 2.50

a= 6,750.00

Equation Y = 6,750 + 2.50X

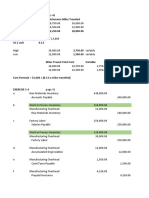

Using Method of least Square

b= 143.75

a= 4,879.06

Equation Y = 4,879.06 + 143.75X

Year Smelting Costs Kilograms of Iron Smelted

2011 12,000.00 50.20

2012 12,900.00 55.60

2013 13,500.00 60.00

2014 12,750.00 54.00

2015 14,100.00 64.40

Total P65,250 284.2

X Y XY X^2

2011 50.20 12,000.00 602,400.00 2,520.04

2012 55.60 12,900.00 717,240.00 3,091.36

2013 60.00 13,500.00 810,000.00 3,600.00

2014 54.00 12,750.00 688,500.00 2,916.00

2015 64.40 14,100.00 908,040.00 4,147.36

Total 284.20 65,250.00 3,726,180.00 16,274.76

Mean 71.05 16,312.50

Variable 86,850.00 143.75

604.16

Fixed 6,098.83

n*Sum-XY - (Sum-X * Sum-Y)

Variable Cost (b) =

n*Sum-X^2 - (Sum-X)^2

Fixed Cost = Y-Bar - (b * X-Bar)

You might also like

- 11e Ch3 Mini Case Planning MemoDocument10 pages11e Ch3 Mini Case Planning MemoHao Cui0% (1)

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- HANDOUT-business TaxesDocument29 pagesHANDOUT-business TaxesGianJoshuaDayrit67% (3)

- Cost Accounting Chap 5Document4 pagesCost Accounting Chap 5nicoleNo ratings yet

- AaaaDocument7 pagesAaaadiane camansagNo ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- Quiz 1 - SolutionDocument8 pagesQuiz 1 - SolutionAyra BernabeNo ratings yet

- Activity 4 Cost Accounting Answer KeyDocument6 pagesActivity 4 Cost Accounting Answer KeyJamesNo ratings yet

- Maria2 103130Document4 pagesMaria2 103130Clay MaaliwNo ratings yet

- Problem 1 A Cost of Machinery 285,000.00Document10 pagesProblem 1 A Cost of Machinery 285,000.00Leilalyn NicolasNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- Book 1Document12 pagesBook 1Vincent Luigil AlceraNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingTrixie DacanayNo ratings yet

- Singer LTD SolutionDocument2 pagesSinger LTD SolutionWaseim khan Barik zaiNo ratings yet

- Accounting - Activity 2Document10 pagesAccounting - Activity 2PATRICIA CHUANo ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Answer Sheet Work RelatedDocument41 pagesAnswer Sheet Work RelatedjoyhhazelNo ratings yet

- Quantity Schdule: Beginning Work in Process 5,000.00 Started in Process 100,000.00 105,000.00Document7 pagesQuantity Schdule: Beginning Work in Process 5,000.00 Started in Process 100,000.00 105,000.00Anne MendozaNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Latihan Soal AMLDocument3 pagesLatihan Soal AMLSaskia ArumNo ratings yet

- Answer To Exercises To AnswerDocument9 pagesAnswer To Exercises To AnswerLEONNA BEATRIZ LOPEZNo ratings yet

- The Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Document19 pagesThe Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Allondra DapengNo ratings yet

- Midterm Review SolutionsDocument8 pagesMidterm Review SolutionsnamiyuartsNo ratings yet

- Chap1-3 Illustration ProblemsDocument8 pagesChap1-3 Illustration ProblemscykablyatNo ratings yet

- Chap 03Document10 pagesChap 03Farooq HaiderNo ratings yet

- Maria 081947Document4 pagesMaria 081947Clay MaaliwNo ratings yet

- Assign1 AlmarioDocument13 pagesAssign1 AlmarioEula EalenaNo ratings yet

- Tut 8 - Management AccountingDocument29 pagesTut 8 - Management AccountingTao LoheNo ratings yet

- BSMA 1A Quiz 3 Cost Accounting CycleDocument5 pagesBSMA 1A Quiz 3 Cost Accounting CycleMaeca Angela SerranoNo ratings yet

- M4 Answer Key 1 Nad 3Document11 pagesM4 Answer Key 1 Nad 3JOSCEL SYJONGTIANNo ratings yet

- Praktikum - Cost - Jordan Junior - 1832148Document24 pagesPraktikum - Cost - Jordan Junior - 1832148Jordan JuniorNo ratings yet

- Dente Q2Document3 pagesDente Q2hanna fhaye denteNo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersMark Angelo AlvarezNo ratings yet

- Pasahol-Far-Adjusting Entries 2Document7 pagesPasahol-Far-Adjusting Entries 2Angel Pasahol100% (1)

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersJolina MostalesNo ratings yet

- Solution To Final QuizzesDocument8 pagesSolution To Final QuizzesNikki GarciaNo ratings yet

- FAMA '22 SolutionDocument4 pagesFAMA '22 SolutionRushil JoshiNo ratings yet

- Home Office Branch AgencyyyDocument9 pagesHome Office Branch AgencyyyIyah AmranNo ratings yet

- Practical Accounting 2 1Document24 pagesPractical Accounting 2 1NCTNo ratings yet

- Problem 5-51 BlocherDocument2 pagesProblem 5-51 BlocherAlif ArmadanaNo ratings yet

- Account Titles Unadjusted Trial Adjustments Balance Dr. Cr. DRDocument6 pagesAccount Titles Unadjusted Trial Adjustments Balance Dr. Cr. DRJohn Gabriel BondoyNo ratings yet

- 5 - ABC (Solution)Document32 pages5 - ABC (Solution)Mubashir HasanNo ratings yet

- Accounting For FOH Part 11Document16 pagesAccounting For FOH Part 11Shania LiwanagNo ratings yet

- Chapter 27Document12 pagesChapter 27Crizel DarioNo ratings yet

- Group ActivityDocument3 pagesGroup ActivitySeulgi MoonNo ratings yet

- Fundamentals of AccountingDocument2 pagesFundamentals of AccountingDiane SorianoNo ratings yet

- COSTACCDocument9 pagesCOSTACCVillaluna Janne ChristineNo ratings yet

- Activity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachDocument4 pagesActivity-Based Costing Answers To End of Chapter Exercises: A) Tradtional Costing ApproachJay BrockNo ratings yet

- Independent Acquisitions: A. Orient Company 285,000.00Document6 pagesIndependent Acquisitions: A. Orient Company 285,000.00JC NicaveraNo ratings yet

- Chapter 01 - Answers - Job Order CostingDocument15 pagesChapter 01 - Answers - Job Order CostingEmmanuelle MazaNo ratings yet

- Cost Charged To Department II Total in Process Added Unit Cost 1-Oct This Month EUP CostDocument7 pagesCost Charged To Department II Total in Process Added Unit Cost 1-Oct This Month EUP CostCristel BautistaNo ratings yet

- Solution To CH 7 Ex 3 P 127 129Document5 pagesSolution To CH 7 Ex 3 P 127 129April Joy InductaNo ratings yet

- COMPREHENSIVE PROBLEM - Lost UnitsDocument1 pageCOMPREHENSIVE PROBLEM - Lost Unitsaey de guzmanNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Appendix 2 Problem 67 ADocument7 pagesAppendix 2 Problem 67 AzhakiraatiqaNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- Job Order Costing Work Sheet - Answered REALDocument16 pagesJob Order Costing Work Sheet - Answered REALEllah MaeNo ratings yet

- CA-Inter-Costing-A-MTP-2-May 2023Document13 pagesCA-Inter-Costing-A-MTP-2-May 2023karnimasoni12No ratings yet

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- Wrap Up Quiz Midterms Answer KeyDocument4 pagesWrap Up Quiz Midterms Answer KeyGianJoshuaDayritNo ratings yet

- Review Materials For STSDocument5 pagesReview Materials For STSUnnamed homosapienNo ratings yet

- Chapter 3 WorkbookDocument4 pagesChapter 3 WorkbookGianJoshuaDayritNo ratings yet

- Bustax Very Easy Quiz1Document9 pagesBustax Very Easy Quiz1GianJoshuaDayritNo ratings yet

- Midterms IntaccDocument13 pagesMidterms IntaccGianJoshuaDayritNo ratings yet

- Purchasing Power of PesoDocument2 pagesPurchasing Power of PesoGianJoshuaDayritNo ratings yet

- Lecture Scrap Spoiled and DefectiveDocument4 pagesLecture Scrap Spoiled and DefectiveGianJoshuaDayritNo ratings yet

- How Does It Affect The Economies in The Philippines WORD REFERENCES PPT ContentDocument3 pagesHow Does It Affect The Economies in The Philippines WORD REFERENCES PPT ContentGianJoshuaDayritNo ratings yet

- Assignment 2 - STSDocument1 pageAssignment 2 - STSGianJoshuaDayrit100% (1)

- Seatwork - INTANGIBLE ASSETSDocument32 pagesSeatwork - INTANGIBLE ASSETSGianJoshuaDayritNo ratings yet

- Report On Cost AuditDocument15 pagesReport On Cost AuditMH (Mahmudul Hasan)100% (1)

- Auditing Standard ASA 570: Going ConcernDocument32 pagesAuditing Standard ASA 570: Going Concernbrian_dinh_5No ratings yet

- Accounting Cycle of A Service Business: Chapter 10-11Document2 pagesAccounting Cycle of A Service Business: Chapter 10-11des marzanNo ratings yet

- Coa - M2009-049 AarDocument5 pagesCoa - M2009-049 AarSharaJaenDinorogBagundolNo ratings yet

- 23 Service Cost AllocationDocument16 pages23 Service Cost AllocationKim TaengoossNo ratings yet

- Boynton SM Ch.17Document20 pagesBoynton SM Ch.17Eza R86% (7)

- AJMSVol 8no 1January-March2019pp 41-47Document8 pagesAJMSVol 8no 1January-March2019pp 41-47Excel Kiểm toánNo ratings yet

- AP Long SeatworkDocument7 pagesAP Long SeatworkLeisleiRagoNo ratings yet

- Lecture 2Document41 pagesLecture 2khoo zitingNo ratings yet

- Audit UniverseDocument4 pagesAudit UniverseIra BenitoNo ratings yet

- Career Essay Research Graphic OrganizerDocument3 pagesCareer Essay Research Graphic Organizerapi-233639833No ratings yet

- Solution Manual For Internal Auditing Assurance and Consulting Services 2nd Edition by RedingDocument9 pagesSolution Manual For Internal Auditing Assurance and Consulting Services 2nd Edition by RedingBrianWelchxqdm100% (38)

- ACC111 Course CompactDocument2 pagesACC111 Course CompactKehindeNo ratings yet

- 2020 Chapter 3 Audit of Cash Student GuideDocument29 pages2020 Chapter 3 Audit of Cash Student GuideBeert De la CruzNo ratings yet

- Record Retention GuideDocument10 pagesRecord Retention GuidepghmaleNo ratings yet

- Strama 1 Reporting SampleDocument19 pagesStrama 1 Reporting SampleMark Roger II HuberitNo ratings yet

- Quality Management in The Automotive Industry: Process AuditDocument208 pagesQuality Management in The Automotive Industry: Process AuditRaquelNo ratings yet

- FS1Q20 - ERAA - FinalDocument151 pagesFS1Q20 - ERAA - FinalAkbar Rianiri BakriNo ratings yet

- Iaao Glossary PDFDocument202 pagesIaao Glossary PDFJigesh MehtaNo ratings yet

- SC Scheme For Middle Income Group Gor Legal AidDocument6 pagesSC Scheme For Middle Income Group Gor Legal AidLatest Laws Team100% (1)

- Country's Risk ManagementDocument14 pagesCountry's Risk ManagementJohn FirmineNo ratings yet

- Quality Department Annual PlanDocument24 pagesQuality Department Annual PlanKumaravelNo ratings yet

- Annual Report 2019Document180 pagesAnnual Report 2019snm1976No ratings yet

- World Bank Inspection Panel Report PDFDocument110 pagesWorld Bank Inspection Panel Report PDFSISAY TSEGAYENo ratings yet

- PDF IfrsDocument4 pagesPDF IfrsroutraykhushbooNo ratings yet

- The Audit ProcessDocument4 pagesThe Audit Processpanda 1No ratings yet

- BAJA Annual Report 2017Document131 pagesBAJA Annual Report 2017ulfa himaNo ratings yet

- Fraud Detection With Active DataDocument35 pagesFraud Detection With Active DataRic Nacional100% (1)

- Chap 015Document19 pagesChap 015RechelleNo ratings yet