Professional Documents

Culture Documents

Quiz 1 - Solution

Uploaded by

Ayra BernabeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Quiz 1 - Solution

Uploaded by

Ayra BernabeCopyright:

Available Formats

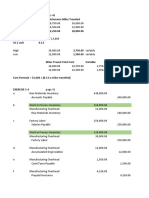

Problem 4 - Ram Company

1, Entries

a. Materials 150,000.00

Accounts payable 150,000.00

b. Payroll 75,000.00

Withholding taxes payable 11,200.00

SSS Premiums payable 2,400.00

Phil Health contribu 375.00

Pag-ibig fund contributions payable 1,620.00

Accrued payroll 59,405.00

Work in process 56,000.00

Factory overhead control 19,000.00

Payroll 75,000.00

c. Materials 20,000.00

Accounts payable 20,000.00

d. Factory overhead control 5,595.00

SSS premiums payable 3,600.00

Phil Health contributions payable 375.00

Pag-ibig fund contributions payable 1,620.00

e. Work in process 85,000.00

Factory overhead control 11,000.00

Materials 96,000.00

f. Accounts payable 4,000.00

Materials 4,000.00

g. Accounts payable 148,300.00

Accrued payroll 59,405.00

Cash 207,705.00

h. Factory overhead control 24,900.00

Miscellaneous accounts 24,900.00

i. Work in process 67,200.00

Factory OH Applied (56,000 x 120%) 67,200.00

j. Finished goods 165,000.00

Work in process 165,000.00

k. Accounts receivable 190,000.00

Sales 190,000.00

Cost of goods sold 120,000.00

Finished goods 120,000.00

2. Statement of cost of goods sold

. Direct materials used

Purchases 170,000

Less: Purchase returns 4,000

Total available for use 166,000

Less: Ind. Mat. used 11,000

Mat.- October 31 70,000 81,00075,000

Direct labor

Factory overhead

Total manufacturing costs

Less: Work in process, October 31

Cost of goods manufactured

Less: Finished goods – March 31

Cost of goods sold, normal

Less: OA-FO

Cost of goods sold, actual

Actual factory overhead (FO Control ) 60,495.00

Less: Applied factory overhead 67,200.00

Over applied factory overhead 6,705.00

85,000

56,000

67,200

208,200

43,200

165,000

45,000

120,000

6,705

113,295

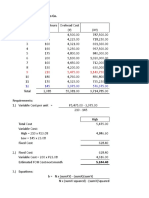

Problem 4 - Ram Company

1, Entries

a. Materials 180,000.00

Accounts payable 180,000.00

b. Payroll 80,000.00

Withholding taxes payable 11,200.00

SSS Premiums payable 2,400.00

Phil Health contribu 375.00

Pag-ibig fund contributions payable 1,620.00

Accrued payroll 64,405.00

Work in process 60,000.00

Factory overhead control 20,000.00

Payroll 80,000.00

c. Materials 20,000.00

Accounts payable 20,000.00

d. Factory overhead control 5,595.00

SSS premiums payable 3,600.00

Phil Health contributions payable 375.00

Pag-ibig fund contributions payable 1,620.00

e. Work in process 120,000.00

Factory overhead control 10,000.00

Materials 130,000.00

f. Accounts payable 5,000.00

Materials 5,000.00

g. Accounts payable 148,300.00

Accrued payroll 64,405.00

Cash 212,705.00

h. Factory overhead control 24,900.00

Miscellaneous accounts 24,900.00

i. Work in process 72,000.00

Factory OH Applied (60,000 x 120%) 72,000.00

j. Finished goods 180,000.00

Work in process 180,000.00

k. Accounts receivable 210,000.00

Sales 210,000.00

Cost of goods sold 140,000.00

Finished goods 140,000.00

2. Statement of cost of goods sold

. Direct materials used

Purchases 200,000

Less: Purchase returns 5,000

Total available for use 195,000

Less: Ind. Mat. used 10,000

Mat.- October 31 65,000 75,00075,000

Direct labor

Factory overhead

Total manufacturing costs

Less: Work in process, October 31

Cost of goods manufactured

Less: Finished goods – March 31

Cost of goods sold, normal

Less: OA-FO

Cost of goods sold, actual

Actual factory overhead (FO Control ) 60,495.00

Less: Applied factory overhead 72,000.00

Over applied factory overhead 11,505.00

120,000

60,000

72,000

252,000

72,000

180,000

40,000

140,000

11,505

128,495

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- Cost Accounting Chap 5Document4 pagesCost Accounting Chap 5nicoleNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Toaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRDocument12 pagesToaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRMeg Lorenz DayonNo ratings yet

- Solution To Quiz 2Document4 pagesSolution To Quiz 2GianJoshuaDayritNo ratings yet

- Cost Accounting WorksheetDocument2 pagesCost Accounting WorksheetLEON JOAQUIN VALDEZNo ratings yet

- Journal EntriesDocument4 pagesJournal EntriesDoneagle VillaluzNo ratings yet

- Group 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Document31 pagesGroup 10 - Chapter 12 - Group Assignment No. 10 Exercises 1 & 2 Pages 331 - 334Carla TalanganNo ratings yet

- BSMA 1A Quiz 3 Cost Accounting CycleDocument5 pagesBSMA 1A Quiz 3 Cost Accounting CycleMaeca Angela SerranoNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersJolina MostalesNo ratings yet

- Cost Accounting Chapter 5 AnswersDocument11 pagesCost Accounting Chapter 5 AnswersMark Angelo AlvarezNo ratings yet

- Quiz 2Document4 pagesQuiz 2Nicole Kyle AsisNo ratings yet

- M4 Answer Key 1 Nad 3Document11 pagesM4 Answer Key 1 Nad 3JOSCEL SYJONGTIANNo ratings yet

- AaaaDocument7 pagesAaaadiane camansagNo ratings yet

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Document81 pagesAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaNo ratings yet

- Job Order CostingDocument6 pagesJob Order CostingTrixie DacanayNo ratings yet

- Praktikum - Cost - Jordan Junior - 1832148Document24 pagesPraktikum - Cost - Jordan Junior - 1832148Jordan JuniorNo ratings yet

- Journal Entries (COST)Document2 pagesJournal Entries (COST)CarlNo ratings yet

- Chapter 01 - Answers - Job Order CostingDocument15 pagesChapter 01 - Answers - Job Order CostingEmmanuelle MazaNo ratings yet

- 1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Document14 pages1 T-Accounts Cash Accounts Receivable Finished Goods 94,000 100,000 65,000Shien Angel Delos ReyesNo ratings yet

- Chapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyDocument4 pagesChapter 5 Job Order Costing 2019 Problem 2 Golden Shower CompanyCertified Public AccountantNo ratings yet

- Job Order Costing Work Sheet - Answered REALDocument16 pagesJob Order Costing Work Sheet - Answered REALEllah MaeNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingenzoNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Problem 9.10 SolutionDocument4 pagesProblem 9.10 SolutionPrincess Dhazerene M. ReyesNo ratings yet

- CB Niat 2019 Exam SolutionsDocument14 pagesCB Niat 2019 Exam Solutionsdean garciaNo ratings yet

- Activity 4 Job Order CostingDocument4 pagesActivity 4 Job Order CostingJOSCEL SYJONGTIANNo ratings yet

- Case 1 For PrintDocument8 pagesCase 1 For PrintRichardDinongPascualNo ratings yet

- Assignment Lesson 3 ExerciseDocument9 pagesAssignment Lesson 3 ExerciseRica Joy BejaNo ratings yet

- Latihan Soal AMLDocument3 pagesLatihan Soal AMLSaskia ArumNo ratings yet

- Bsa - 1201 A2Document7 pagesBsa - 1201 A2ALYSSA SERRANONo ratings yet

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- JD Repair ShopDocument10 pagesJD Repair ShopMYDMIOSYL ALABE100% (1)

- JD Repair Shop TransactionsDocument14 pagesJD Repair Shop TransactionsAndrew Sy Scott100% (1)

- Singer LTD SolutionDocument2 pagesSinger LTD SolutionWaseim khan Barik zaiNo ratings yet

- Solution Assignment. Adjusting EntriespdfDocument3 pagesSolution Assignment. Adjusting EntriespdfKim Patrick VictoriaNo ratings yet

- 07 - Briggita Rapunzel Citra Respati - Tugas 2Document5 pages07 - Briggita Rapunzel Citra Respati - Tugas 207Briggita Rapunzel Citra RespatiNo ratings yet

- Required: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeDocument3 pagesRequired: 1. Cost of Goods Manufactured 2. Cost of Goods Sold 3. Net IncomeKean Brean GallosNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Remson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditDocument2 pagesRemson Mark C. Macawile MCP Quiz Part 2: Transaction Account Title Debit CreditMarcus McWile MorningstarNo ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- Accounts-Individual Assignment 2 - q3 IDocument1 pageAccounts-Individual Assignment 2 - q3 ISshanthineNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- Toaz - Info Chapter 5 2019 Problem 1 Alexis Company PRDocument3 pagesToaz - Info Chapter 5 2019 Problem 1 Alexis Company PRAngela Ruedas33% (3)

- I. Entries For The Transaction of Ram CompanyDocument4 pagesI. Entries For The Transaction of Ram CompanyHafida TOMAWISNo ratings yet

- Chapter 5 AssignmentDocument10 pagesChapter 5 AssignmentJohnray ParanNo ratings yet

- Name: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Document5 pagesName: Pamulagan, Cherry Mae G Section: BSA 1-C Code: 3020Cherry MaeNo ratings yet

- COSTACCDocument9 pagesCOSTACCVillaluna Janne ChristineNo ratings yet

- Chap1-3 Illustration ProblemsDocument8 pagesChap1-3 Illustration ProblemscykablyatNo ratings yet

- Job Order Costing Process Costing Batch Costing Contract Costing Marginal CostingDocument8 pagesJob Order Costing Process Costing Batch Costing Contract Costing Marginal CostingHamza AsifNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- AC 212 Test 1 SolutionDocument4 pagesAC 212 Test 1 SolutionJoyce PamendaNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Latihan Soal - 261121-DPKDocument6 pagesLatihan Soal - 261121-DPKsitepu1223No ratings yet

- Investigations, Offenses and Penalties: Section 156 - Cease and Desist OrderDocument10 pagesInvestigations, Offenses and Penalties: Section 156 - Cease and Desist OrderAyra BernabeNo ratings yet

- Close CorporationDocument14 pagesClose CorporationAyra BernabeNo ratings yet

- Case SudyDocument2 pagesCase SudyAyra BernabeNo ratings yet

- HO13-The Nano WorldDocument6 pagesHO13-The Nano WorldAyra BernabeNo ratings yet

- Answer Sheet: Midterm ExaminationDocument2 pagesAnswer Sheet: Midterm ExaminationAyra BernabeNo ratings yet

- Appraisal RightDocument7 pagesAppraisal RightAyra BernabeNo ratings yet

- Varieties and Registers of Spoken and Written LanguageDocument17 pagesVarieties and Registers of Spoken and Written LanguageAyra BernabeNo ratings yet

- Business Ethics: Former CEO Mike JeffriesDocument13 pagesBusiness Ethics: Former CEO Mike JeffriesAyra BernabeNo ratings yet

- Internal Controls and YouDocument124 pagesInternal Controls and YouAyra BernabeNo ratings yet

- Chapter 6 - JITDocument14 pagesChapter 6 - JITAyra BernabeNo ratings yet

- Lesson 1: Republic Act 1425 (Rizal Law)Document4 pagesLesson 1: Republic Act 1425 (Rizal Law)Ayra BernabeNo ratings yet

- ID: Ma07brew 6-1: ACCT201B Practice Exam Chapter 6Document10 pagesID: Ma07brew 6-1: ACCT201B Practice Exam Chapter 6Ayra BernabeNo ratings yet

- Practice Problems - Present Value With AnswersDocument5 pagesPractice Problems - Present Value With AnswersAyra BernabeNo ratings yet

- Case Study 7Document2 pagesCase Study 7QinSiangAngNo ratings yet

- 01-Sithind001b - Updated To Sit07v2.3Document13 pages01-Sithind001b - Updated To Sit07v2.3Samuel Fetor YaoNo ratings yet

- Internship Ahsan AkhterDocument42 pagesInternship Ahsan Akhterinzamamalam515No ratings yet

- Annual Report 2008Document60 pagesAnnual Report 2008webmaster@sltda100% (1)

- ReceiptDocument2 pagesReceiptshaikh rehmanNo ratings yet

- IRR of RA 9295 2014 Amendments - Domestic Shipping Development ActDocument42 pagesIRR of RA 9295 2014 Amendments - Domestic Shipping Development ActIrene Balmes-LomibaoNo ratings yet

- BSV11102 CW1 D1 22-23 (Project Appraisal & Finance)Document8 pagesBSV11102 CW1 D1 22-23 (Project Appraisal & Finance)Muhammad AhmadNo ratings yet

- G.R. No. 117188 - Loyola Grand Villas Homeowners (South) AssociationDocument12 pagesG.R. No. 117188 - Loyola Grand Villas Homeowners (South) AssociationKristine VillanuevaNo ratings yet

- Rakuten - Affiliate Report 2016 - Forrester ConsultingDocument13 pagesRakuten - Affiliate Report 2016 - Forrester ConsultingtheghostinthepostNo ratings yet

- Multiple Choice Question 61Document8 pagesMultiple Choice Question 61sweatangeNo ratings yet

- A Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofDocument88 pagesA Project Report On "Study of Marketing Strategies" and "Consumer Buying Behaviour" ofAkash SinghNo ratings yet

- Business Names For Sale Business Name Generator WLRTX PDFDocument2 pagesBusiness Names For Sale Business Name Generator WLRTX PDFisraelbongo7No ratings yet

- Options Trading Strategies: Understanding Position DeltaDocument4 pagesOptions Trading Strategies: Understanding Position Deltasubash1983No ratings yet

- New Business Models For Creating Shared ValueDocument21 pagesNew Business Models For Creating Shared ValueDhiya UlhaqNo ratings yet

- Comparative Analysis of BanksDocument31 pagesComparative Analysis of BanksRohit SoniNo ratings yet

- SLAuS 700 PDFDocument9 pagesSLAuS 700 PDFnaveen pragash100% (1)

- Social Cost Benefit AnalysisDocument13 pagesSocial Cost Benefit AnalysisMohammad Nayamat Ali Rubel100% (1)

- AHOLD CaseDocument20 pagesAHOLD Caseakashh200875% (4)

- Internal Audit & Verification ScheduleDocument1 pageInternal Audit & Verification ScheduleSean DelauneNo ratings yet

- Compendium of GOs For Epc in AP PDFDocument444 pagesCompendium of GOs For Epc in AP PDFPavan CCDMC100% (1)

- 1Document2 pages1mjNo ratings yet

- Cta 2D CV 09396 D 2019apr08 Ass PDFDocument205 pagesCta 2D CV 09396 D 2019apr08 Ass PDFMosquite AquinoNo ratings yet

- AWS High Performance ComputingDocument47 pagesAWS High Performance ComputingNineToNine Goregaon East MumbaiNo ratings yet

- Internship Report at PT - Lennor - FinalDocument34 pagesInternship Report at PT - Lennor - FinalUmmu Aya SofiaNo ratings yet

- GE MatrixDocument26 pagesGE MatrixFijo JoseNo ratings yet

- 9708 s04 QP 4Document4 pages9708 s04 QP 4Diksha KoossoolNo ratings yet

- Problemson CVPanalysisDocument11 pagesProblemson CVPanalysisMark RevarezNo ratings yet

- Engineering Economics FormularsDocument9 pagesEngineering Economics FormularsFe Ca Jr.No ratings yet

- CIR Vs ST LukeDocument7 pagesCIR Vs ST LukeMark Lester Lee Aure100% (2)

- OR2 Review 2013 PDFDocument17 pagesOR2 Review 2013 PDFhshshdhdNo ratings yet