Professional Documents

Culture Documents

Cost Exercise For Chapter Two

Uploaded by

naaninigist0 ratings0% found this document useful (0 votes)

2 views1 pageOriginal Title

Cost Exercise for Chapter Two (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views1 pageCost Exercise For Chapter Two

Uploaded by

naaninigistCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

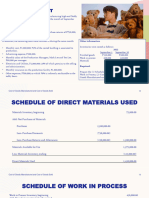

Ex 1: The following cost data relate to Taylor Products Company for the year ended June 30, 2005.

Direct Materials $ 55,600

Direct Labor 72,400

Factory Overhead 36,500

Work in process inventory, July 1, 2004 38,200

Work in process inventory, June 30, 2005 34,800

Required:

1. Calculate the manufacturing costs for the year.

2. Calculate the cost of goods manufactured for the year.

Ex 2: Iowa Products Company accumulated the following data for 2005.

Jan 1, 2005 Dec 31, 2005

Inventories:

Finished Goods $ 52,000 $ 54,000

Work in Process 29,600 27,800

Raw materials 14,200 15,000

Direct labor 95,000

Raw material purchase s 138,000

Indirect labor 15,300

Indirect materials and supplies 10,800

Factory utilities 18,600

Depreciation expense- Factory 14,000

Factory rent 18,000

Payroll taxes- Factory wages 8,100

Repairs and maintenance 6,000

Insurance expense- Factory 6,800

Miscellaneous factory expenses 5,200

Sales 710,000

Sales discount 12,000

Selling expenses 95,600

General expenses 75,300

Interest expenses 7,000

Required:

1. Prepare a statement of cost of goods manufactured.

2. Prepare an income statement (assume an income tax rate of 25%)

You might also like

- Quiz 1 - Cost Terms, Inventory - PrintableDocument8 pagesQuiz 1 - Cost Terms, Inventory - PrintableEdward Prima KurniawanNo ratings yet

- Job CostingDocument35 pagesJob Costingjpg17100% (2)

- MANUFACTURING and Partnership AccountsDocument40 pagesMANUFACTURING and Partnership Accountslord67% (3)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Managerial Accounting - ExercisesDocument60 pagesManagerial Accounting - ExercisesNúmero CuatroNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- 1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsDocument8 pages1.1 Exercises - Cost Accounting, Cost Concepts, Understanding and Classifying CostsMeg sharkNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Bsa - 1201 A2Document7 pagesBsa - 1201 A2ALYSSA SERRANONo ratings yet

- Practice Questions: TH THDocument3 pagesPractice Questions: TH THAhsan MemonNo ratings yet

- WB Job OrderDocument30 pagesWB Job OrderSaleh AlizadeNo ratings yet

- Financial Statement BasicsDocument30 pagesFinancial Statement BasicsMaira SattiNo ratings yet

- Acc 202 Exercise MyselfDocument5 pagesAcc 202 Exercise Myselfnhidiepnguyet08112004No ratings yet

- Tutorial AnswersDocument3 pagesTutorial AnswersshivnilNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- Notes On Process Costing System - PDF - ProtectedDocument14 pagesNotes On Process Costing System - PDF - Protectedhildamezmur9No ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- AccountsDocument14 pagesAccountsgokulamaromal2001No ratings yet

- Cost Sheet HandoutDocument7 pagesCost Sheet HandoutSidhant AirenNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Cost SheetDocument6 pagesCost SheetAishwary Sakalle100% (1)

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Activity 1 AnswersDocument5 pagesActivity 1 AnswersClyn CFNo ratings yet

- CostConExercise - COGM & COGSDocument3 pagesCostConExercise - COGM & COGSLee Tarroza100% (1)

- Chap 1 Problems Cost SheetDocument5 pagesChap 1 Problems Cost SheetRositaNo ratings yet

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Assignment Print ViewQ5 PDFDocument3 pagesAssignment Print ViewQ5 PDFabdulraheem.eesNo ratings yet

- COGS Practise Questions 2 SolutionDocument13 pagesCOGS Practise Questions 2 SolutionBisma ShahabNo ratings yet

- Accounting For Manufctuirng - PQ)Document6 pagesAccounting For Manufctuirng - PQ)usama sarwerNo ratings yet

- Cost AccountingDocument8 pagesCost Accountingtushar sundriyalNo ratings yet

- MA-II Assignment I - Cost SheetDocument3 pagesMA-II Assignment I - Cost Sheetshriya2413100% (1)

- E1049217046 18320 141590299475Document14 pagesE1049217046 18320 141590299475Sumit PattanaikNo ratings yet

- Cost Accounting and ControlDocument8 pagesCost Accounting and ControlJevbszen RemiendoNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Final Account - 6-9-21Document9 pagesFinal Account - 6-9-21rohit bhoirNo ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- MFG - PL QuestionDocument3 pagesMFG - PL Questionane9sdNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- Task 1: Cost Classfication Task 1 Has 3 Questions in TotalDocument3 pagesTask 1: Cost Classfication Task 1 Has 3 Questions in TotalNgọc Trâm TrầnNo ratings yet

- Module 2 - Problems On Cost SheetDocument8 pagesModule 2 - Problems On Cost SheetSupreetha100% (1)

- Assignment 4Document1 pageAssignment 4Hassan KhanNo ratings yet

- 1.5 manact เฉลย file 1.2 extra class 2-2022Document32 pages1.5 manact เฉลย file 1.2 extra class 2-2022Chokthawee RattanawetwongNo ratings yet

- Cost Sheet QuestionsDocument4 pagesCost Sheet QuestionsAbhishekNo ratings yet

- Cost Activity 1Document12 pagesCost Activity 1Dark Ninja100% (1)

- Cost Sheet QuestionsDocument7 pagesCost Sheet QuestionsGurpreet Singh100% (1)

- Job and Batch CostingDocument4 pagesJob and Batch CostingAmber Kelly0% (1)

- Discussion 3 Accounting Cycle For Manufacturing BusinessDocument12 pagesDiscussion 3 Accounting Cycle For Manufacturing BusinessRHEGIE WAYNE PITOGONo ratings yet

- Cost Accounting and Control 3Document4 pagesCost Accounting and Control 3Davis MonNo ratings yet

- SampleproblemsDocument5 pagesSampleproblemsCristine Joy BenitezNo ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- BusinessManagement MidtermDocument6 pagesBusinessManagement MidtermHoàng Thị Phương TrinhNo ratings yet

- Optimizing Factory Performance: Cost-Effective Ways to Achieve Significant and Sustainable ImprovementFrom EverandOptimizing Factory Performance: Cost-Effective Ways to Achieve Significant and Sustainable ImprovementNo ratings yet