Professional Documents

Culture Documents

Assignment 4

Assignment 4

Uploaded by

Hassan Khan0 ratings0% found this document useful (0 votes)

12 views1 pageThe document provides accounting information for Usama manufacturing company for the period ending June 30, 2005 including raw material purchases and inventory amounts, manufacturing expenses, depreciation expenses, and returns. It asks to calculate the cost of raw materials consumed and factory overhead for the period.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document provides accounting information for Usama manufacturing company for the period ending June 30, 2005 including raw material purchases and inventory amounts, manufacturing expenses, depreciation expenses, and returns. It asks to calculate the cost of raw materials consumed and factory overhead for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageAssignment 4

Assignment 4

Uploaded by

Hassan KhanThe document provides accounting information for Usama manufacturing company for the period ending June 30, 2005 including raw material purchases and inventory amounts, manufacturing expenses, depreciation expenses, and returns. It asks to calculate the cost of raw materials consumed and factory overhead for the period.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

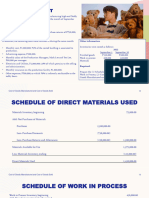

Q. 2 Usama manufacturing company submits the following information on June 30,2005.

Raw material inventory, July 1, 2004 25,000

Purchases 125,000

Power, heat and light 3,500

Indirect material purchased and consumed 5,500

Administrative expenses 24,000

Depreciation of plant 18,000

Purchases returns 7,000

Fuel expenses 29,000

Depreciation of building 8000

Carriage inwards 3,500

Bad debts 2,500

Indirect labor 4000

Other manufacturing expenses 15,000

Raw materials inventory, June 30,2005 26,000

Required:

1)Cost of raw material consumed.

2) Factory overhead

Q. 3 Following data relates to Qasim & Co,

Opening stock of raw material 52,000

Opening stock of work in process 46,000

Purchases of raw material 255,000

Direct labor cost 85,000

Factory overheads 76,000

Closing stock of raw material 61,000

Closing stock of work in process 36,000

Required: Prepare a statement showing total manufacturing cost.

Q. 4 FNS manufacturing company submits the following information on June 30,2005.

Sales for the year 450,000

Raw material inventory, July 1,2004 15,000

Finished goods inventory, July 1,2004 70,000

Purchases 120,000

Direct labor 65,000

Power, heat and light 2,500

Indirect material purchased and consumed 4,500

Administrative expenses 21,000

Depreciation of plant 14,000

Selling expenses 25,000

Depreciation of building 7,000

Bad debts 1,500

Indirect labor 3,000

Other manufacturing expenses 10,000

Work in process, July 1,2004 14,000

Work in process, June 30,2005 19,000

Raw materials inventory, June 30,2005 21,000

Finished goods inventory, June 30,2005 60,000

Required

2) Calculate cost of raw-material consumed

3) Calculate prime cost

4) Calculate total factory cost

You might also like

- Case Study #4: Kiwi Experience: 1. How Does KE Maintain A Continual Customer Focus?Document3 pagesCase Study #4: Kiwi Experience: 1. How Does KE Maintain A Continual Customer Focus?NgơTiênSinh0% (1)

- MANUFACTURING and Partnership AccountsDocument40 pagesMANUFACTURING and Partnership Accountslord67% (3)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Managerial Accounting - ExercisesDocument60 pagesManagerial Accounting - ExercisesNúmero CuatroNo ratings yet

- Job Order Costing: Illustrative ProblemsDocument30 pagesJob Order Costing: Illustrative ProblemsPatrick LanceNo ratings yet

- Week 2 Assignment SolutionDocument2 pagesWeek 2 Assignment Solutiontucker jacobsNo ratings yet

- Statement of Cost of Goods SoldDocument3 pagesStatement of Cost of Goods SoldMARIA67% (3)

- Laser Processing of Engineering Materials: Principles, Procedure and Industrial ApplicationFrom EverandLaser Processing of Engineering Materials: Principles, Procedure and Industrial ApplicationNo ratings yet

- Copywriting Course Outline W AssessmentsDocument9 pagesCopywriting Course Outline W AssessmentsTerry FlewNo ratings yet

- Financial Statement BasicsDocument30 pagesFinancial Statement BasicsMaira SattiNo ratings yet

- Accounting For Manufctuirng - PQ)Document6 pagesAccounting For Manufctuirng - PQ)usama sarwerNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- Cost Accounting Assignment 1Document2 pagesCost Accounting Assignment 1manoj dNo ratings yet

- Task 1: Cost Classfication Task 1 Has 3 Questions in TotalDocument3 pagesTask 1: Cost Classfication Task 1 Has 3 Questions in TotalNgọc Trâm TrầnNo ratings yet

- E1049217046 18320 141590299475Document14 pagesE1049217046 18320 141590299475Sumit PattanaikNo ratings yet

- COGS Practise Questions 2 SolutionDocument13 pagesCOGS Practise Questions 2 SolutionBisma ShahabNo ratings yet

- Manufacturing Accounts - Extra Questions - A LevelDocument6 pagesManufacturing Accounts - Extra Questions - A LevelMUSTHARI KHANNo ratings yet

- Problems On Cost Sheet: ST THDocument6 pagesProblems On Cost Sheet: ST THSouhardya MondalNo ratings yet

- MA-II Assignment I - Cost SheetDocument3 pagesMA-II Assignment I - Cost Sheetshriya2413100% (1)

- BUSI2083Document2 pagesBUSI2083Amandeep GillNo ratings yet

- MFG - PL QuestionDocument3 pagesMFG - PL Questionane9sdNo ratings yet

- Cost Sheet Class Practice QuestionsDocument2 pagesCost Sheet Class Practice QuestionsKajal YadavNo ratings yet

- Cost AcctngDocument3 pagesCost AcctngairaguevarraNo ratings yet

- COST SHEET OnlineDocument13 pagesCOST SHEET OnlineSoumendra RoyNo ratings yet

- Cost of Good Manufactured and Sold StatementDocument8 pagesCost of Good Manufactured and Sold StatementAyesha JavedNo ratings yet

- Practice of Cost of Good Sold Statement IIIDocument3 pagesPractice of Cost of Good Sold Statement IIIi200051 Muhammad HassaanNo ratings yet

- Cost Sheet QuestionsDocument4 pagesCost Sheet QuestionsAbhishekNo ratings yet

- Test 1 ProblemsDocument48 pagesTest 1 ProblemsKaira Arora50% (2)

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Managerial Accounting Exercises-1-4Document4 pagesManagerial Accounting Exercises-1-4Dayra ContrerasNo ratings yet

- Sir Syed University of Engineering & Technology: Answer ScriptDocument7 pagesSir Syed University of Engineering & Technology: Answer ScriptWasif FarooqNo ratings yet

- Cost Sheet HandoutDocument7 pagesCost Sheet HandoutSidhant AirenNo ratings yet

- Costing Aug2015Document2 pagesCosting Aug2015A BPNo ratings yet

- Managerial Accounting ExercisesDocument20 pagesManagerial Accounting ExercisesAyrton BenavidesNo ratings yet

- Cost Sheet QuestionsDocument7 pagesCost Sheet QuestionsGurpreet Singh100% (1)

- CH-1 Cost SheetDocument6 pagesCH-1 Cost SheetIftekhar Uddin M.D EisaNo ratings yet

- (New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationDocument4 pages(New Account Titles and Financial Statements) : Module 8: Introduction To Manufacturing OperationAshitero YoNo ratings yet

- Cost Accounting and ControlDocument8 pagesCost Accounting and ControlJevbszen RemiendoNo ratings yet

- Problem 1-20: 1 JGG Manufacturing Company Manufacturing CostDocument9 pagesProblem 1-20: 1 JGG Manufacturing Company Manufacturing CostMackenzie Heart Obien0% (1)

- Problem No 1: RequirementDocument4 pagesProblem No 1: Requirementnoman razaNo ratings yet

- Final Account - 6-9-21Document9 pagesFinal Account - 6-9-21rohit bhoirNo ratings yet

- Module 4 Cost AccountingDocument2 pagesModule 4 Cost AccountingSinclair Faith GalarioNo ratings yet

- Cost Sheet Practical Solevd QuestionsDocument6 pagesCost Sheet Practical Solevd QuestionsMansi VermaNo ratings yet

- Practice Questions: TH THDocument3 pagesPractice Questions: TH THAhsan MemonNo ratings yet

- Act 5Document1 pageAct 5Unknowingly AnonymousNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Cost AccountingDocument3 pagesCost Accountingdisturbedguy048No ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Chapter 14Document22 pagesChapter 14Dan ChuaNo ratings yet

- Cost ProblemsDocument7 pagesCost ProblemsMadanNo ratings yet

- Cost Sheet SumsDocument6 pagesCost Sheet SumsHanan MathewNo ratings yet

- Assignment Print ViewQ5 PDFDocument3 pagesAssignment Print ViewQ5 PDFabdulraheem.eesNo ratings yet

- Practical Problems and Solution of Cost SheetDocument7 pagesPractical Problems and Solution of Cost SheetAdityasai Gudimalla75% (4)

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Activity 1 AnswersDocument5 pagesActivity 1 AnswersClyn CFNo ratings yet

- Week 1 Activity Cost Classification and BehaviorDocument4 pagesWeek 1 Activity Cost Classification and BehaviorJosh YuuNo ratings yet

- AUDITING PROB Activity 2Document4 pagesAUDITING PROB Activity 2Joody CatacutanNo ratings yet

- Baya - Exercise 4 Job Order Costing, Accounting For MaterialDocument12 pagesBaya - Exercise 4 Job Order Costing, Accounting For MaterialAngelica BayaNo ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- Forest Products: Advanced Technologies and Economic AnalysesFrom EverandForest Products: Advanced Technologies and Economic AnalysesNo ratings yet

- Lesson One: Nature and Purpose of Cost AccountingDocument285 pagesLesson One: Nature and Purpose of Cost AccountingKevin WasongaNo ratings yet

- Have It All Hilton Grand VacationsDocument1 pageHave It All Hilton Grand Vacationsgt7nvvnvsjNo ratings yet

- The Latte Millionaire and The Residual Income LifestyleDocument61 pagesThe Latte Millionaire and The Residual Income LifestyleBruno RomanoNo ratings yet

- NFX Capital VU Inc.: Subject From To: DateDocument1 pageNFX Capital VU Inc.: Subject From To: DateHamza NajamNo ratings yet

- Rhina Calimlim Worksheet and Fin StatementsDocument11 pagesRhina Calimlim Worksheet and Fin StatementsDianna Rose MenorNo ratings yet

- Discuss What Is The Shariah Advisory Council of Bank Negara MalaysiaDocument2 pagesDiscuss What Is The Shariah Advisory Council of Bank Negara Malaysiaotaku himeNo ratings yet

- ... Four Types of Successful Customer Loyalty Programs and An Example For EachDocument3 pages... Four Types of Successful Customer Loyalty Programs and An Example For EachAnuj KambojNo ratings yet

- PCOM-Module 9-Midterm-MemoDocument3 pagesPCOM-Module 9-Midterm-MemoRoshwell RegalaNo ratings yet

- Grade 11 Unit 8Document2 pagesGrade 11 Unit 8Nipuni PereraNo ratings yet

- Accounting Ratios NewDocument3 pagesAccounting Ratios NewAnkit RoyNo ratings yet

- RPM Fitness RPM4000 4.5 HP Peak Motorized With Free Installation TreadmillDocument1 pageRPM Fitness RPM4000 4.5 HP Peak Motorized With Free Installation TreadmillYwiakabNo ratings yet

- Transaction SummaryDocument8 pagesTransaction SummaryBilal KhanNo ratings yet

- Full Download Economics 19th Edition Mcconnell Solutions ManualDocument35 pagesFull Download Economics 19th Edition Mcconnell Solutions Manualljajcnezerit100% (38)

- FM 2 - 3Document12 pagesFM 2 - 3drashteeNo ratings yet

- For PPEDocument286 pagesFor PPEkelvin mkweshaNo ratings yet

- Obe - Business Ethics-2Document8 pagesObe - Business Ethics-2Aries Gonzales CaraganNo ratings yet

- Tran Date Value Date Tran Particular Credit Debit BalanceDocument96 pagesTran Date Value Date Tran Particular Credit Debit BalanceGenji MaNo ratings yet

- Penyata Akaun / Statement of Account: Dilindungi Oleh PIDM Setakat RM250,000.00 Bagi Setiap PendepositDocument5 pagesPenyata Akaun / Statement of Account: Dilindungi Oleh PIDM Setakat RM250,000.00 Bagi Setiap PendepositMiko TehNo ratings yet

- Whole Foods Market - Me Case StudyDocument3 pagesWhole Foods Market - Me Case StudyMohammad Nowaiser MaruhomNo ratings yet

- MCS 214Document5 pagesMCS 214imranNo ratings yet

- Multinational Corporations (MNCS) : Linda Young Pols 400 International Political Economy Wilson Hall - Room 1122Document41 pagesMultinational Corporations (MNCS) : Linda Young Pols 400 International Political Economy Wilson Hall - Room 1122dhanrajkishoreNo ratings yet

- Pre-Launch Planning:: Priming Your Pharmaceutical Brand For Profit and SuccessDocument24 pagesPre-Launch Planning:: Priming Your Pharmaceutical Brand For Profit and SuccessVũ Nguyễn Quỳnh TrangNo ratings yet

- Creating A Financial Intelligence HR DepartmentDocument10 pagesCreating A Financial Intelligence HR Departmentrohan1deoreNo ratings yet

- Walton ReportDocument22 pagesWalton ReportAshhab Zaman Rafid71% (7)

- What Is Taxation?: Key TakeawaysDocument1 pageWhat Is Taxation?: Key TakeawaysFatima TawasilNo ratings yet

- 1 PurpleA MergedDocument263 pages1 PurpleA MergedKiranmaye VuyyuruNo ratings yet

- The Connected Consumer Q3 2023Document57 pagesThe Connected Consumer Q3 2023Kỳ Anh TôNo ratings yet

- Literature Review On Shopping MallDocument7 pagesLiterature Review On Shopping Mallea793wsz100% (1)