Professional Documents

Culture Documents

Bsa - 1201 A2

Uploaded by

ALYSSA SERRANOOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bsa - 1201 A2

Uploaded by

ALYSSA SERRANOCopyright:

Available Formats

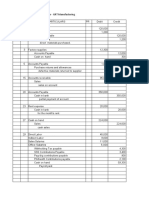

Exercise 3 p.

392 – 393

Date PARTICULARS Dr Cr

January

2 Raw Material X Purchases 20,000

Accounts Payable 20,000

Purchase of Material X on account

8 Raw Material Y Purchases 55,000

Accounts Payable 55,000

Purchase of Material Y on account

12 Factory Supplies 10,000

Cash 10,000

Purchase of factory materials

15 Direct Labor 9,000

Indirect Labor 3,000

Sales Salaries 2,000

Office salaries 2,000

Withholding Taxes Payable 1,700

Cash 14,300

Paid first half of payroll and collected employee taxes share

17 Factory Real Estate Taxes Expense 15,000

Factory Repairs Expense 30,000

Cash 445,000

Paid Factory expenses

20 Utilities Expense - Factory 6,750

Utilities Expense - Distribution 3,375

Utilities Expense - Administrative 3,375

Utilities Payable - Factory 6,750

Utilities Payable - Distribution 3,375

Utilities Payable - Administrative 3,375

Record utilities expense

26 Prepaid Factory insurance 48,000

Cash 48,000

Record prepaid insurance for 1 year

28 Cash 375,000

Sales 375,000

Record sales for the month

30 Direct Labor 9,000

Indirect Labor 3,000

Sales Salaries 2,000

Office Salaries 2,000

Withholding Taxes Payable 1,700

SSS Premiums Payable 1,350

PHILHEALTH Premiums Payable 750

HDMF Premiums Payable 600

Cash 11,600

Paid second half of salaries and collection of employee's taxes

share

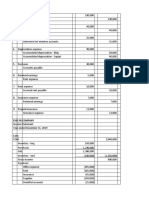

ADJUSTMENTS

A PhilHealth Contributions Expense - Factory 562.50

PhilHealth Contributions Expense - Distribution 187.50

PhilHealth Contributions Expense - Administrative 187.50

PHILHEALTH Premiums Payable - Factory 562.50

PhilHealth Premiums Payable - Distribution 187.50

PhilHealth Premiums Payable - Administrative 187.50

Payment of PhilHealth contributions expense

EC Contributions Expense - Factory 900

EC Contributions Expense - Distribution 150

EC Contributions Expense - Administrative 150

EC Premiums Payable - Factory 900

EC Premiums Payable - Distribution 150

EC Premiums Payable - Administrative 150

Payment of EC contributions expense

SSS Contributions Expense - Factory 1,312.50

SSS Contributions Expense - Distribution 218.75

SSS Contributions Expense - Administrative 218.75

SSS Premiums Payable - Factory 1,312.50

SSS Premiums Payable - Distribution 218.75

SSS Premiums Payable - Administrative 218.75

Payment of SSS contributions expense

HDMF Contributions Expense - Factory 450

HDMF Contributions Expense – Distribution 75

HDMF Contributions Expense - Administrative 75

HDMF Premiums Payable - Factory 450

HDMF Premiums Payable - Distribution 75

HDMF Premiums Payable - Administrative 75

Payment of HDMF Contributions Expense

B Depreciation Expense - Building - Factory 9,000

Depreciation Expense - Building - Distribution 1,500

Depreciation Expense - Building - administrative 1,500

Accumulated Depreciation - Building - Factory 9,000

Accumulated Depreciation - Building - Distribution 1,500

Accumulated Depreciation - Building - Administrative 1,500

Record depreciation of building

Depreciation Expense - Machineries - Factory 5,000

Accumulated Depreciation - Machineries - Factory 5,000

Record depreciation of machineries

C Factory insurance Expense 4,000

Prepaid Factory insurance 4,000

Expired insurance for one month

D Factory supplies expense 4,000

Factory Supplies 4,000

Record factory supplies used

E Raw Materials Inventory (X), end 1,000

Manufacturing Summary 1,000

Finished Goods, end (250 units x 43.74375) 10,935.93

Income and Expense Summary 10,935.93

Finished Goods Inventory

Work in Process Inventory

MALAKAS Manufacturing Corp.

STATEMENT OF COST OF GOODS MANUFACTURED

For the month ended, January 31, 2012

Direct Materials Used

Raw Materials,

beginning -

Add: Purchases

Raw Material X

Purchases 20,000

Raw Material Y

Purchases 55,000

Total

Purchases 75,000

Cost of Goods

Available for Sale 75,000

Less: Raw Materials,

end 1,000

Direct Materials Used 74,000

Direct Labor 18,000

Factory Overhead

Indirect

Labor 6,000

Factory supplies

expense 4,000

Factory insurance

Expense 4,000

Factory Real Estate

Taxes Expense 15,000

Factory Repairs

Expense 30,000

Utilities Expense -

Factory 6,750

PhilHealth Contributions Expense - Factory 562.50

EC Contributions

Expense - Factory 900

SSS Contributions Expense - Factory 1,312.50

HDMF Contributions Expense - Factory 450

Depreciation Expense - Building - Factory 9,000

Depreciation Expense - Machineries - Factory 5,000

Factory Overhead 82,975

Total Manufacturing Cost 174,975

Add: Work in Process, beg -

Cost of Goods put into

process 174,970

Less: Work in Process,

end 0

Cost of Goods

Manufactured 174,975

MALAKAS Manufacturing Corp.

STATEMENT OF COMPREHENSIVE INCOME

For the month ended, January 31, 2012

SALES 375,000.00

Less: Cost of Goods Sold

COST OF GOODS MANUFACTURED 174,975.00

Add: Finished Goods, beg -

COST OF GOODS AVAILABLE FOR SALE 174,975.00

Less: Finished Goods , end 10,935.93

COST OF GOODS SOLD 164,039.07

GROSS MARGIN 210,960.93 210,960.93

MARKETING and ADMINISTRATIVE EXPENSES 200,000.00

Sales Salaries 4,000.00 10,960.93

Office salaries 4,000.00

Utilities Expense - Distribution 3,375.00

Utilities Expense - Administrative 3,375.00

PhilHealth Contributions Expense - Distribution 93.75

PhilHealth Contributions Expense - Administrative 93.75

EC Contributions Expense - Distribution 150.00

EC Contributions Expense - Administrative 150.00

SSS Contributions Expense - Distribution 218.75

SSS Contributions Expense - Administrative 218.75

HDMF Contributions Expense - Distribution 75.00

HDMF Contributions Expense - Administrative 75.00

Depreciation Expense - Building - Distribution 1,500.00

Depreciation Expense - Building - administrative 1,500.00

TOTAL MARKETING and ADMINISTRATIVE EXPENSES 18,825.00

NET INCOME 192,135.93

You might also like

- Cost Exercise For Chapter TwoDocument1 pageCost Exercise For Chapter TwonaaninigistNo ratings yet

- Assignment 3Document5 pagesAssignment 3AIENNA GABRIELLE FABRONo ratings yet

- Manufacturing Reviewer ComputationsDocument11 pagesManufacturing Reviewer ComputationsNathaly Nicolle CapuchinoNo ratings yet

- Assignment 8Document13 pagesAssignment 8Jerickho JNo ratings yet

- FABRO Assignment 2 FARDocument6 pagesFABRO Assignment 2 FARAIENNA GABRIELLE FABRONo ratings yet

- MFG - PL QuestionDocument3 pagesMFG - PL Questionane9sdNo ratings yet

- Cost AccountingDocument7 pagesCost AccountingenzoNo ratings yet

- Solution Manufacturing Prob. GRT ManufacturingDocument15 pagesSolution Manufacturing Prob. GRT ManufacturingCarmi FeceroNo ratings yet

- Act 5Document1 pageAct 5Unknowingly AnonymousNo ratings yet

- CMC-MT-PRMX-2-Q P !Document7 pagesCMC-MT-PRMX-2-Q P !ritesh choudhuryNo ratings yet

- Managerial Accounting - ExercisesDocument60 pagesManagerial Accounting - ExercisesNúmero CuatroNo ratings yet

- Sdathn Ripsryd@r@ea@pis - Unit) : - SolutionDocument16 pagesSdathn Ripsryd@r@ea@pis - Unit) : - SolutionAnimesh VoraNo ratings yet

- AUDITING PROB Activity 2Document4 pagesAUDITING PROB Activity 2Joody CatacutanNo ratings yet

- Unit 3 COST Accounting CycleDocument6 pagesUnit 3 COST Accounting CycleJaizer TimbrezaNo ratings yet

- Cost AccountingDocument53 pagesCost Accountingpritika mishraNo ratings yet

- Cost of Gooods Manufactured 5,060,000Document5 pagesCost of Gooods Manufactured 5,060,000yayayaNo ratings yet

- Tutorial AnswersDocument3 pagesTutorial AnswersshivnilNo ratings yet

- Cost Accounting. ActivityDocument6 pagesCost Accounting. ActivityReida DelmasNo ratings yet

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinDocument11 pagesAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- Cost Sheet ProblemsDocument10 pagesCost Sheet Problemsprapulla sureshNo ratings yet

- Practice 1: Text Book: Managerial Accounting - Garrison and NoreenDocument4 pagesPractice 1: Text Book: Managerial Accounting - Garrison and NoreenMoin khanNo ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- Module 2 - Problems On Cost SheetDocument8 pagesModule 2 - Problems On Cost SheetSupreetha100% (1)

- Toaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRDocument12 pagesToaz - Info Chapter 3 Cost Accounting and Control by de Leon 2019 PRMeg Lorenz DayonNo ratings yet

- Costing Sem V - CHP 5 (Illustrations) - 70693Document12 pagesCosting Sem V - CHP 5 (Illustrations) - 70693Preeti KumariNo ratings yet

- Activity 1 AnswersDocument5 pagesActivity 1 AnswersClyn CFNo ratings yet

- Statement of Comprehensive Income Problems...Document2 pagesStatement of Comprehensive Income Problems...Darlyn Dalida San PedroNo ratings yet

- Chapter 2 - 1 - IllustrationDocument6 pagesChapter 2 - 1 - IllustrationYonas BamlakuNo ratings yet

- Year 1Document15 pagesYear 1James De TorresNo ratings yet

- Assignment 3 Accounting PDFDocument11 pagesAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Cost SheetDocument10 pagesCost Sheetchukku2803No ratings yet

- Final Account - 6-9-21Document9 pagesFinal Account - 6-9-21rohit bhoirNo ratings yet

- Cebu Wine FactoryDocument5 pagesCebu Wine FactorySally Ubando Delos ReyesNo ratings yet

- Practice Questions: TH THDocument3 pagesPractice Questions: TH THAhsan MemonNo ratings yet

- Quiz 1 - SolutionDocument8 pagesQuiz 1 - SolutionAyra BernabeNo ratings yet

- BACOSTMX Module 3 Self-ReviewerDocument5 pagesBACOSTMX Module 3 Self-ReviewerlcNo ratings yet

- Soal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document9 pagesSoal Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Discussion 3 Accounting Cycle For Manufacturing BusinessDocument12 pagesDiscussion 3 Accounting Cycle For Manufacturing BusinessRHEGIE WAYNE PITOGONo ratings yet

- Elyssa Reahna E. Veloz - Tla3.2Document8 pagesElyssa Reahna E. Veloz - Tla3.2jyendrinaNo ratings yet

- CostDocument3 pagesCostKyle Vincent SaballaNo ratings yet

- Acc 202 Exercise MyselfDocument5 pagesAcc 202 Exercise Myselfnhidiepnguyet08112004No ratings yet

- Cash and Accrual BasisDocument10 pagesCash and Accrual BasisNoeme LansangNo ratings yet

- Ca 4Document4 pagesCa 4lerabadolNo ratings yet

- Adm Excel EtDocument168 pagesAdm Excel EtShashank PullelaNo ratings yet

- COGS Practise Questions 2 SolutionDocument13 pagesCOGS Practise Questions 2 SolutionBisma ShahabNo ratings yet

- Assignment Print ViewQ5 PDFDocument3 pagesAssignment Print ViewQ5 PDFabdulraheem.eesNo ratings yet

- Post-Closing Trial BalanceDocument8 pagesPost-Closing Trial BalanceNicole Andrea TuazonNo ratings yet

- CHAPTER 3.costdocxDocument5 pagesCHAPTER 3.costdocxJapPy QuilasNo ratings yet

- Financial ManagementDocument9 pagesFinancial Managementkendrapancho9No ratings yet

- Introduction To Management AccountingDocument10 pagesIntroduction To Management AccountingPatrick Panlilio RetuyaNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- Corp AccountsDocument8 pagesCorp AccountsShreyNo ratings yet

- Journal Entries (COST)Document2 pagesJournal Entries (COST)CarlNo ratings yet

- Ong Motors CorporationDocument4 pagesOng Motors CorporationJudy Ann Acruz100% (1)

- Probs AnswerDocument4 pagesProbs AnswerLABASBAS, Alexidaniel I.No ratings yet

- Orca Share Media1646571581803 6906221771846243726Document12 pagesOrca Share Media1646571581803 6906221771846243726LACONSAY, Nathalie B.No ratings yet

- BAC1624 - Tutorial 1Document4 pagesBAC1624 - Tutorial 1Amiee Laa PulokNo ratings yet

- P1-1 P1-2 Jaja Bearings Company PPG CompanyDocument4 pagesP1-1 P1-2 Jaja Bearings Company PPG CompanyPrincesipieNo ratings yet

- Job CostingDocument18 pagesJob CostingPaula ChicoNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Serrano - Zge - 1107 M3laDocument3 pagesSerrano - Zge - 1107 M3laALYSSA SERRANONo ratings yet

- Bsa - 1201 A1Document4 pagesBsa - 1201 A1ALYSSA SERRANONo ratings yet

- Bsa - 1201 A2Document7 pagesBsa - 1201 A2ALYSSA SERRANONo ratings yet

- Bsa - 1201 A1Document4 pagesBsa - 1201 A1ALYSSA SERRANONo ratings yet

- Import Export Manager Interview QuestionsDocument2 pagesImport Export Manager Interview Questionsgoswamimk100% (2)

- Foundation OBDocument35 pagesFoundation OBSushant VermaNo ratings yet

- ISA-84.00.02 Part 4 (2002)Document58 pagesISA-84.00.02 Part 4 (2002)Sergio LungrinNo ratings yet

- Engineering Management Masters Thesis TopicsDocument5 pagesEngineering Management Masters Thesis Topicsgbtrjrap100% (2)

- Prajwalit Dalai Dessertation 2022Document81 pagesPrajwalit Dalai Dessertation 2022Praj Walit DalaiNo ratings yet

- Brand Awareness of Presto Lite BatteryDocument62 pagesBrand Awareness of Presto Lite Batteryravi_shah333No ratings yet

- Mba08226 - Sangeethanair - Roadmap - Sangeetha NairDocument1 pageMba08226 - Sangeethanair - Roadmap - Sangeetha NairKAMAL NAYANNo ratings yet

- 4-Column Bank Reconciliation in Class PracticeDocument4 pages4-Column Bank Reconciliation in Class PracticekosdaisyNo ratings yet

- Reading Data Science The Sexiest Job in The 21st CenturyDocument2 pagesReading Data Science The Sexiest Job in The 21st CenturyAtiq ur RehmanNo ratings yet

- Teaching PowerPoint Slides - Chapter 1Document24 pagesTeaching PowerPoint Slides - Chapter 1famin87No ratings yet

- HR Planning:: "Vivo Aims On Providing Quality Products and Superior Services."Document2 pagesHR Planning:: "Vivo Aims On Providing Quality Products and Superior Services."hamnah lateefNo ratings yet

- Brand Guidelines Oracle PDFDocument39 pagesBrand Guidelines Oracle PDFMarco CanoNo ratings yet

- Analysis of Supply Chain in Siddhi Engineers: Interim Report ONDocument6 pagesAnalysis of Supply Chain in Siddhi Engineers: Interim Report ONantrikshaagrawalNo ratings yet

- Ericsson Oil Gas Solution BriefDocument7 pagesEricsson Oil Gas Solution BriefTanesan WyotNo ratings yet

- School of Management Studies INDIRA GANDHI NATIONAL OPEN UNIVERSITY Proforma For Approval of Project Proposal (MS-100)Document12 pagesSchool of Management Studies INDIRA GANDHI NATIONAL OPEN UNIVERSITY Proforma For Approval of Project Proposal (MS-100)Pramod ShawNo ratings yet

- Pre-Feasibility Study-Guava Pulping & Squash Making UnitDocument16 pagesPre-Feasibility Study-Guava Pulping & Squash Making Unitnishi@sainiNo ratings yet

- Contract of SaleDocument4 pagesContract of Salecorvinmihai591No ratings yet

- ACCOUNTINGDocument12 pagesACCOUNTINGharoonadnan196No ratings yet

- Startups Are Hiring RemotelyDocument14 pagesStartups Are Hiring RemotelyMaheen ChaudhryNo ratings yet

- ACCT1002 M1 Workshop QuestionsDocument2 pagesACCT1002 M1 Workshop QuestionsMadeline WheelerNo ratings yet

- MP Boutique Standards 2020Document12 pagesMP Boutique Standards 2020YohannaNo ratings yet

- EXEMPTIONDocument15 pagesEXEMPTIONAndrey PavlovskiyNo ratings yet

- Letter of Invitation - DraftDocument3 pagesLetter of Invitation - DraftAidel BelamideNo ratings yet

- c15 PDFDocument47 pagesc15 PDFAnj CuregNo ratings yet

- Practical Accounting 2 Review: Installment SalesDocument22 pagesPractical Accounting 2 Review: Installment SalesJason BautistaNo ratings yet

- Lecture 5-6 BudgetingDocument15 pagesLecture 5-6 BudgetingAfzal AhmedNo ratings yet

- Oromia Regional Government - Phase II Expectations and WorkplanDocument4 pagesOromia Regional Government - Phase II Expectations and WorkplanÁkosSzabóNo ratings yet

- ACCO 420 Case 1 - FINALDocument5 pagesACCO 420 Case 1 - FINALJane YangNo ratings yet

- Guide BookDocument12 pagesGuide BookSHANKARI A/P SATHEES MoeNo ratings yet

- Medical Device Iso 13485Document25 pagesMedical Device Iso 13485rwillestone100% (2)