Professional Documents

Culture Documents

Post-Closing Trial Balance

Uploaded by

Nicole Andrea Tuazon0 ratings0% found this document useful (0 votes)

99 views8 pages Here is the post-closing trial balance:

Debit Credit

Cash $10,000

Accounts Receivable 100,000

Inventory 100

Lee Kage, Capital 38,000

Equipment 35,000

Accumulated Depreciation 2,500

Accounts Payable 25,000

Rent Deposit 8,000

Total $218,600 $218,600

Original Description:

Original Title

6. Post-Closing Trial Balance

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document Here is the post-closing trial balance:

Debit Credit

Cash $10,000

Accounts Receivable 100,000

Inventory 100

Lee Kage, Capital 38,000

Equipment 35,000

Accumulated Depreciation 2,500

Accounts Payable 25,000

Rent Deposit 8,000

Total $218,600 $218,600

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

99 views8 pagesPost-Closing Trial Balance

Uploaded by

Nicole Andrea Tuazon Here is the post-closing trial balance:

Debit Credit

Cash $10,000

Accounts Receivable 100,000

Inventory 100

Lee Kage, Capital 38,000

Equipment 35,000

Accumulated Depreciation 2,500

Accounts Payable 25,000

Rent Deposit 8,000

Total $218,600 $218,600

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 8

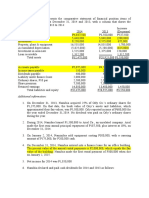

ANVIL-SONDE CONSTRUCTION CORPORATION ANVIL-SONDE CONSTRUCTION CORPORATION

INCOME STATEMENT INCOME STATEMENT

For the period ended July 31,2010 For the period ended July 31,2010

Revenues: Construction Revenue 7,400,000

Construction Revenue P 7,400,000 Less: Cost of Construction Materials P 2,250,000

Architectural Service Revenue 263,000 Gross Profit 5,150,000

Total Revenues 7,663,000

Less:Cost and Expenses:

Cost and Expenses: Salaries Expense 480,000

Bad Debts Expense 120,000

Cost of Construction Materials P 2,250,000

Transportation Expense 15,450

Salaries Expense 480,000

Depreciation Expense 25,000

Bad Debts Expense 120,000

Office Supplies Expense 2,950

Transportation Expense 15,450

Utilities Expense 10,300

Depreciation Expense 25,000

Taxes and Licenses 15,400

Office Supplies Expense 2,950

Miscellaneous Expense 6,850

Utilities Expense 10,300

Total Costs and Expenses P 675,950

Taxes and Licenses 15,400

Net Income from Operations 4,474,050

Interest Expense 9,000 Add:Architectural Service Revenue 263,000

Miscellaneous Expense 6,850 Less:Interest Expense 9,000

Total Costs and Expenses P 2,934,950

Net Income P 4,728,050 Net Income P 4,728,050

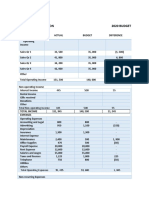

Sales 10,000

less: Sales returns and allowances (100)

Sales Discount (200)

Net sales 9,700

Less: Cost of Goods Sold

Merchandise Inventory, beginning 2,000

Add: Purchases(including freight in) 1,500

Less: Purchase Discounts (100)

Purchase returns and allowances (200)

s

ood Cost of Goods Available for sale 3,200

g

s ol d Less: Merchandise Inventory, end (700) 2,500

Un GROSS MARGIN 7,200

Less: Operating Expenses

Marketing and Selling 1,000

General and Administrative 1,500 2,500

Operating Income 4,700

Add: Other Income 300

Less: Other expense (200)

Net income 4,800

Sales 1,000 100%

Cost of Goods Sold 800 80%

Gross Margin 200 20%

Operating Expenses 150 15%

Net income 50 5%

Terms to research on

• Freight in (asset)

• Freight out (expense)

• Debit memo

• Credit memo

• Operating cycle

• Periodic inventory system

• Perpetual inventory system

• FOB shipping point

• FOB destination

• Sales tax

• Trade discounts

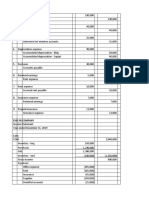

WESLEY VENTURES PARTNERSHIP

Balance Sheet

As of July 31, 2010

ASSETS

Current Assets

Cash P 12,498

Accounts Receivable 16,850

Merchandise Inventory 94,320

Prepaid Advertising 5,000

Total Current Assets P 128,668

Property, Plant and Equipment

Office Equipment P 35,500

Less: Accum Depn - Office Equip't. (2,500)

Store Equipment 62,000

Total Property, Plant and Equipment 95,000

TOTAL ASSETS P 223,668

LIABILITIES

Accounts Payable P 50,000

Accrued Interest Expense 1,250

Total Current Liabilties P 51,250

EQUITY

Paid-up Capital P 150,000

Add: Net income, ending 11/30/08 22,418

Total Equity P 172,418

TOTAL LIABILITIES AND EQUITY P 223,668

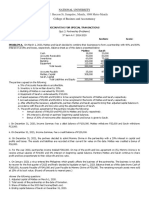

CLOSING ENTRIES

journal entries that bring temporary accounts to zero balance

and transfer their balances to the permanent capital account.

prevent the mixing of revenues, expense and withdrawal

accounts of one period to the next accounting period.

Steps:

1. Close revenue accounts to Income Summary.

2. Close expense accounts to Income Summary.

3. Close Income Summary to Capital account.

4. Close Drawing to Capital account.

**Close beginning inventory (for merchandising)

ILLUSTRATION:

Cash 10,000

Accounts Receivable 100,000

Allowance for Doubtful Accounts 1,000

Unused Supplies 100

Accounts Payable 25,000

Unearned Interest Income 200

Lee Kage, Capital 40,000

Lee Kage, Drawing 2,000

Salary Expense 124,000

Service Income 190,050

Supplies Expense 400

Rent Expense 16,000

Doubtful Accounts 750

Interest Income 1,000

Accrued Salary Payable 4,000

Rent Deposit 8,000

Post-closing Trial Balance

Trial balance prepared after the closing

entries.

Trial balance of real accounts.

Basis for the opening entry into the new

books of accounts.

You might also like

- Forensic Audit and Environmental AuditDocument19 pagesForensic Audit and Environmental AuditAbrha636No ratings yet

- 2019A QE Strategic Cost Management FinalDocument5 pages2019A QE Strategic Cost Management FinalJam Crausus100% (1)

- 123Document13 pages123Nicole Andrea TuazonNo ratings yet

- Taxation Under The Train Law: 1 - PageDocument30 pagesTaxation Under The Train Law: 1 - PageMae50% (2)

- (Afar) Week1 Compiled QuestionsDocument78 pages(Afar) Week1 Compiled QuestionsBeef Testosterone84% (25)

- (Afar) Week1 Compiled QuestionsDocument78 pages(Afar) Week1 Compiled QuestionsBeef Testosterone84% (25)

- Bond accounting and finance questionsDocument27 pagesBond accounting and finance questionsCharity Laurente Bureros83% (6)

- Ðöńg Qüïz Šët - : Financial Accounting & ReportingDocument13 pagesÐöńg Qüïz Šët - : Financial Accounting & ReportingMonica MonicaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Shareholder's EquityDocument31 pagesShareholder's EquityAmmie Lemie100% (2)

- Standard Costing QuizzerDocument92 pagesStandard Costing QuizzerJessa Basarte40% (5)

- Aaconapps2 03RHDocument12 pagesAaconapps2 03RHAngelica DizonNo ratings yet

- Chap 5 - Variable CostingDocument21 pagesChap 5 - Variable CostingWil G. Binuya Jr.83% (6)

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Accounting For Income TaxDocument26 pagesAccounting For Income TaxNicole Andrea TuazonNo ratings yet

- Random Problem 2 (Pinky)Document23 pagesRandom Problem 2 (Pinky)spur iousNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Risks and Returns Chapter Explains Financial Leverage ImpactDocument24 pagesRisks and Returns Chapter Explains Financial Leverage ImpactJohn Rey EnriquezNo ratings yet

- Agency AccountingDocument27 pagesAgency AccountingAurcus Jumskie33% (3)

- Hapter: Income TaxesDocument40 pagesHapter: Income TaxesGray JavierNo ratings yet

- 14 x11 Financial Management B PDFDocument10 pages14 x11 Financial Management B PDFChristine FerrerasNo ratings yet

- Partnership AcctgDocument4 pagesPartnership Acctgcessbright100% (1)

- Toaz - Info Afar Backflush Costing With Answers 1 PRDocument5 pagesToaz - Info Afar Backflush Costing With Answers 1 PRNicole Andrea TuazonNo ratings yet

- LA SALLE UNIVERSITY PARTNERSHIPS EXAMDocument11 pagesLA SALLE UNIVERSITY PARTNERSHIPS EXAMNicole Andrea TuazonNo ratings yet

- Consignment & FranchiseDocument9 pagesConsignment & FranchiseHeinie Joy Paule100% (1)

- Palepu AVB Edisi 5 - CH 4Document12 pagesPalepu AVB Edisi 5 - CH 4angelNo ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- BTNS Services Income Statement for Year Ending Dec 31, 201ADocument2 pagesBTNS Services Income Statement for Year Ending Dec 31, 201AIvan CutiamNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Solution NIngDocument3 pagesSolution NIngfahim tusarNo ratings yet

- Less: Cost of Goods Sold: Capital ExpenditureDocument3 pagesLess: Cost of Goods Sold: Capital Expenditurefahim tusarNo ratings yet

- Prepare SCI for Service and MerchandisingDocument10 pagesPrepare SCI for Service and MerchandisingJessamine Romano AplodNo ratings yet

- IAS 7 Cash Flow StatementDocument5 pagesIAS 7 Cash Flow Statementchalah DeriNo ratings yet

- Easters Company Ins PaidDocument10 pagesEasters Company Ins PaidNoeme LansangNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- 03 Activity 1Document1 page03 Activity 1bea santiagoNo ratings yet

- Problem Solving 1: RequirementsDocument4 pagesProblem Solving 1: RequirementsMariz TimarioNo ratings yet

- WorkDocument4 pagesWorkhassan KyendoNo ratings yet

- Rui Company FS FINALDocument20 pagesRui Company FS FINALNikkiNo ratings yet

- Year 1Document15 pagesYear 1James De TorresNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Revision Questions - 2 Statement of Cash Flows - SolutionDocument7 pagesRevision Questions - 2 Statement of Cash Flows - SolutionNadjah JNo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- Ultimate Book of Accountancy: Brilliant ProblemsDocument9 pagesUltimate Book of Accountancy: Brilliant ProblemsPramod VasudevNo ratings yet

- Jullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Document5 pagesJullie-Ann Ybañez - ACC000-TLA7-2 Financial Statements - Sheet1Jullie-Ann YbañezNo ratings yet

- Statement of Comprehensive IncomeDocument5 pagesStatement of Comprehensive IncomeNicole CalmaNo ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Basic Financial StatementsDocument4 pagesBasic Financial StatementsKng PuestoNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Financial Statment 12 JulyDocument13 pagesFinancial Statment 12 JulyMuhammad AshhadNo ratings yet

- Toy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitDocument12 pagesToy Factory Worksheet For The Year Ended Dec. 31, 20X4 Account Titles Trial Balance Adjustments Debit Credit DebitShiela EscobarNo ratings yet

- Capital and Revenue TransactionsDocument7 pagesCapital and Revenue Transactionscarolm790No ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- Fina 470 Project Two - Check PointDocument9 pagesFina 470 Project Two - Check PointMitchell ParrottNo ratings yet

- Generales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Document12 pagesGenerales, Capital, 01/01/2022 650,000 Add: Profit 0 Total 650,000 Less: Withdrawals 0 Total: 650,000Kirstelle VelezNo ratings yet

- Lotus Income StatementDocument6 pagesLotus Income StatementJoseph AsisNo ratings yet

- Answers in AbmDocument6 pagesAnswers in AbmJEANNE DENISSE MENDOZANo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- PT 2 and PT 3Document4 pagesPT 2 and PT 3Mariz Timario0% (2)

- Answer Sheet Mock Test 23Document5 pagesAnswer Sheet Mock Test 23Nam Nguyễn HoàngNo ratings yet

- Financial Accounting hw1Document5 pagesFinancial Accounting hw1Jermaine M. SantoyoNo ratings yet

- Anya Forger CorporationDocument2 pagesAnya Forger CorporationMondays AndNo ratings yet

- ACC124 Part2Document6 pagesACC124 Part2Christine LigutomNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- Twinnies Corporation 2020 BudgetDocument2 pagesTwinnies Corporation 2020 BudgetMariya BhavesNo ratings yet

- Manufacturing statement and financialsDocument3 pagesManufacturing statement and financialselmudaaNo ratings yet

- 2 Exercises On FS 2023-2024 Additional For GformDocument2 pages2 Exercises On FS 2023-2024 Additional For GformAmelia Dela CruzNo ratings yet

- BSA2201 BDD MBCarolino M8Activityno.2Document5 pagesBSA2201 BDD MBCarolino M8Activityno.2Earl Carolino100% (1)

- Financial Statement Analysis of Everest EmporiumDocument8 pagesFinancial Statement Analysis of Everest EmporiumArthur Richard SumaldeNo ratings yet

- OlleDocument1 pageOlleG & E ApparelNo ratings yet

- Appendix 2 Problem 67 ADocument7 pagesAppendix 2 Problem 67 AzhakiraatiqaNo ratings yet

- Ass 2Document14 pagesAss 2Beza AbrNo ratings yet

- RequiredDocument15 pagesRequiredCheska Anne Mikka RoxasNo ratings yet

- Far (Semestral Project)Document5 pagesFar (Semestral Project)Diana Rose RioNo ratings yet

- Line ItemDocument295 pagesLine ItemEve Rose Tacadao IINo ratings yet

- Keith Corporation Generates Significant Positive Cash FlowsDocument24 pagesKeith Corporation Generates Significant Positive Cash FlowsMaiko KopadzeNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Mahusay-Bsa416 Module 3Document9 pagesMahusay-Bsa416 Module 3Jeth MahusayNo ratings yet

- ACC12 - Statement of Cash FlowsDocument1 pageACC12 - Statement of Cash FlowsVimal KvNo ratings yet

- Reviewer On Partnership Problems - Q2 PDFDocument3 pagesReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- Financial Accounting 2 - Liabilities MCQ (SolvingDocument16 pagesFinancial Accounting 2 - Liabilities MCQ (SolvingNicole Andrea TuazonNo ratings yet

- Local Media2092635344Document2 pagesLocal Media2092635344LouisAnthonyHabaradasCantillonNo ratings yet

- Chapter 13 14 Afar PDF FreeDocument13 pagesChapter 13 14 Afar PDF FreeNiki HanNo ratings yet

- IFRS 15 Revenue QuizletDocument2 pagesIFRS 15 Revenue QuizletNicole Andrea TuazonNo ratings yet

- Pre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsDocument11 pagesPre Review 1 SEM S.Y. 2011-2012 Practical Accounting 1 / Theory of AccountsKristine JarinaNo ratings yet

- IFRS 15 Revenue QuizletDocument2 pagesIFRS 15 Revenue QuizletNicole Andrea TuazonNo ratings yet

- 12 x10 Financial Statement Analysis PDFDocument22 pages12 x10 Financial Statement Analysis PDFAdam SmithNo ratings yet

- Responsibility Accounting and Transfer PricingDocument13 pagesResponsibility Accounting and Transfer PricingNicole Andrea TuazonNo ratings yet

- APB 18: The Equity Method of Accounting For Investments in Common StockDocument10 pagesAPB 18: The Equity Method of Accounting For Investments in Common StockNicole Andrea TuazonNo ratings yet

- Conceptual Framework: Objective of Financial ReportingDocument47 pagesConceptual Framework: Objective of Financial Reporting버니 모지코No ratings yet

- Solutions CH 6 PDFDocument62 pagesSolutions CH 6 PDF21aberckmuellerNo ratings yet

- BKAN1013 Chapter 2Document70 pagesBKAN1013 Chapter 2Halinnie SueNo ratings yet

- 2ND Online Quiz Level 1 Set A (Questions)Document5 pages2ND Online Quiz Level 1 Set A (Questions)Vincent Larrie MoldezNo ratings yet

- A) Prepare An Answer Sheet With The Following Column HeadingsDocument3 pagesA) Prepare An Answer Sheet With The Following Column Headingsabegail soquinaNo ratings yet

- Intercompany Transactions ConsolidationDocument1 pageIntercompany Transactions ConsolidationErjohn Papa0% (1)

- Accounting For Sales PDFDocument20 pagesAccounting For Sales PDFJasmine Acta100% (1)

- General Journal April 1-30 EntriesDocument17 pagesGeneral Journal April 1-30 EntriesgegegeeNo ratings yet

- Balance Sheet Financial PositionDocument5 pagesBalance Sheet Financial Positionmohamed almougtabaNo ratings yet

- ACCOUNTS Secret SauseDocument71 pagesACCOUNTS Secret SauseDesi TVNo ratings yet

- Adobe Scan Aug 29, 2022-1Document5 pagesAdobe Scan Aug 29, 2022-1Piyush GoyalNo ratings yet

- Illustrative Problems Formation of PartnershipDocument12 pagesIllustrative Problems Formation of PartnershipSassy GirlNo ratings yet

- IFRS Conceptual Framework GuideDocument10 pagesIFRS Conceptual Framework GuideRobbie CruzNo ratings yet

- Statement of Cash Flow Analysis: Kathmandu University School of Management (KUSOM)Document61 pagesStatement of Cash Flow Analysis: Kathmandu University School of Management (KUSOM)ginish12No ratings yet

- Solved Sum of Financial RatiosDocument11 pagesSolved Sum of Financial RatiosJessy NairNo ratings yet

- Chap. 9 - Discussion AssignmentsDocument3 pagesChap. 9 - Discussion AssignmentsEdi HermawanNo ratings yet

- Elisa Beauty SalonDocument6 pagesElisa Beauty SalonAnanda DwilestariNo ratings yet

- Notes To The Financial Statements: 1. General InformationDocument46 pagesNotes To The Financial Statements: 1. General InformationyasinNo ratings yet

- Wey MGRL 9e ExProbB Ch07 Incremental-AnalysisDocument9 pagesWey MGRL 9e ExProbB Ch07 Incremental-AnalysisElleana YauriNo ratings yet

- (ANSWER) - 04 - Completing The Accounting CycleDocument9 pages(ANSWER) - 04 - Completing The Accounting CycledeltakoNo ratings yet

- CW 3 SolutionDocument2 pagesCW 3 SolutionMtl AndyNo ratings yet

- The Relationship Between Accounting and TaxationDocument24 pagesThe Relationship Between Accounting and TaxationfatrNo ratings yet

- Makalah Tentang Asset (Bahasa Inggris)Document5 pagesMakalah Tentang Asset (Bahasa Inggris)Ilham Sukron100% (1)

- AdjustingDocument7 pagesAdjustingKrisha JohnsonNo ratings yet

- Ch04 6e Slutions HoyleDocument44 pagesCh04 6e Slutions HoyleJackie PerezNo ratings yet

- Tablas Caso Examen HHCDocument12 pagesTablas Caso Examen HHCCristian MuñozNo ratings yet