Professional Documents

Culture Documents

2 Exercises On FS 2023-2024 Additional For Gform

Uploaded by

Amelia Dela CruzOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2 Exercises On FS 2023-2024 Additional For Gform

Uploaded by

Amelia Dela CruzCopyright:

Available Formats

Exercise Unit 2

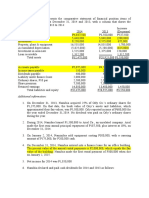

1.The accounts of Gloria Detoya Traders contain the following amounts at December 31, 2022:

Trial Balance

Account Titles DR CR

Cash 304,500

Accounts Receivable 484,200

Merchandise Inventory 528,000

Store Supplies 10,600

Office Supplies 6,360

Prepaid Insurance 4,600

Land 145,000

Building 202,600

Accum. Depreciation-Building 82,500

Office Equipment 86,000

Accum. Depreciation -Office Eq. 50,000

Accounts Payable 206,830

Salaries Payable 20,000

Interest Payable 38,400

Long-term Notes Payable 480,000

Detoya, Capital 593,920

Detoya, Withdrawals 200,000

Sales 2,463,500

Sales Returns & Allowances 27,500

Sales Discounts 42,750

Purchases 1,264,000

Purchases Returns & Allow. 56,400

Purchases Discounts 21,360

Transportation In 82,360

Sales Salaries Expense 225,000

Office Salaries Expense 171,000

Store Supplies Expense 15,400 -

Office Supplies Expense 12,040

Insurance Expense- Selling 5,600

Insurance Expense- General 3,600

Transportation Out 57,400

Utilities Expense 48,000

Depreciation Expense-Building 26,000

Depreciation Expense- Office Eq. 22,000

Interest Expense 38,400

Total 4,012,910 4,012,910

Merchandise inventory, beginning P528,000; Merchandise inventory, ending P483,000

Required: Prepare the income statement, statement of changes in equity and

statement of financial position.

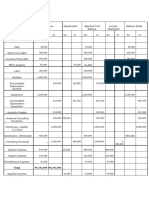

2. The statement of financial position of Pedro Company, for December 31, 2022 and 2021, are as follows:

2022 2021

Cash P 68,000 P 42,500

Accounts receivable (net) 61,000 70,200

Inventories 121,000 105,000

Investments ..... 100,000

Equipment 515,000 425,000

Accumulated depreciation-equipment (153,000) (175,000)

P612,000 P567,700

Accounts payable P 59,750 P 47,250

Bonds payable, due 2010 ..... 75,000

Common stock, P20 par 375,000 325,000

Premium on common stock 50,000 25,000

Retained earnings 127,250 95,450

P612,000 P567,700

Additional information:

(a) Net income, P71,800.

(b) Depreciation reported on income statement, P38,000.

(c) Fully depreciated equipment costing P60,000 was scrapped, no salvage, and equipment was

purchased for P150,000.

(d) Bonds payable for P75,000 were retired by payment at their face amount.

(e) 2,500 shares of common stock were issued at P30 for cash.

(f) Cash dividends declared and paid, P40,000.

(g) Investments of P100,000 were sold for P125,000.

Required: Prepare a statement of cash flows using the indirect method.

You might also like

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- H I ĐĂNG Assigment 3 1641Document17 pagesH I ĐĂNG Assigment 3 1641Huynh Ngoc Hai Dang (FGW DN)No ratings yet

- Debt RestructureDocument10 pagesDebt RestructureBeryl VerzosaNo ratings yet

- Auditing Problems3Document32 pagesAuditing Problems3Kimberly Milante100% (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Assessment MerchandisingDocument2 pagesAssessment MerchandisingPauline BiancaNo ratings yet

- Ap-Problems - 2015Document20 pagesAp-Problems - 2015jayson100% (1)

- Adjusting EntriesDocument5 pagesAdjusting EntriesM Hassan BrohiNo ratings yet

- Suza Business Plan (Honey Popcorn)Document49 pagesSuza Business Plan (Honey Popcorn)Cartoon WalaNo ratings yet

- Od InterventionsDocument63 pagesOd Interventionsdeepalisharma94% (17)

- A Budget Is A Plan Expressed in QuantitativeDocument14 pagesA Budget Is A Plan Expressed in QuantitativeNidhi RanaNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Cash Flow 05 With Answers Just Give SolutionsDocument21 pagesCash Flow 05 With Answers Just Give SolutionsEdi wow WowNo ratings yet

- Account Description Debit CreditDocument2 pagesAccount Description Debit Creditpamela dequillamorte100% (1)

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- Vestiaire Collective The Challenges of Second-Hand LuxuryDocument13 pagesVestiaire Collective The Challenges of Second-Hand LuxuryNikith NatarajNo ratings yet

- Cash Flow Statement QuizDocument7 pagesCash Flow Statement QuizAngelo HilomaNo ratings yet

- Reviewer Midterm Accounting Exercises in Financial and Accouting ReportingDocument20 pagesReviewer Midterm Accounting Exercises in Financial and Accouting ReportingFiel Marie SateraNo ratings yet

- Activity 6 Statement of Cash FlowsDocument2 pagesActivity 6 Statement of Cash Flowsnglc srzNo ratings yet

- Competency AssessmentDocument5 pagesCompetency AssessmentMiracle FlorNo ratings yet

- Exercises On Closing Entries & Reversing EntriesDocument3 pagesExercises On Closing Entries & Reversing EntriesRoy BonitezNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Financial Statements With Notes To FsDocument2 pagesFinancial Statements With Notes To Fsdimpy dNo ratings yet

- Module 10 Financial StatementsDocument17 pagesModule 10 Financial StatementsChristine CariñoNo ratings yet

- Buscom SeatworkDocument3 pagesBuscom SeatworkTintin AquinoNo ratings yet

- Tutorial 14 Introductory Accounting Teaching Assistant TeamDocument2 pagesTutorial 14 Introductory Accounting Teaching Assistant TeamAris KurniawanNo ratings yet

- Cash Flows from Operating, Investing, & Financing Activities of Lesotho CoDocument4 pagesCash Flows from Operating, Investing, & Financing Activities of Lesotho CoKarlo D. ReclaNo ratings yet

- Complete Financial Statements With SCF Direcdt MethodDocument23 pagesComplete Financial Statements With SCF Direcdt MethodJuja FlorentinoNo ratings yet

- Review For Quiz 3 Part 2Document18 pagesReview For Quiz 3 Part 2Mariah ValizadoNo ratings yet

- Soal Cash FlowDocument6 pagesSoal Cash FlowSantiNo ratings yet

- Cash ExampleDocument1 pageCash ExampleFRANCIS IAN ALBARACIN IINo ratings yet

- Presentation of Properly Classified FSDocument9 pagesPresentation of Properly Classified FSpapa1No ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Len Company acquires 80% of Lyn Company stock and consolidates financialsDocument14 pagesLen Company acquires 80% of Lyn Company stock and consolidates financialsMerliza JusayanNo ratings yet

- PT 2 and PT 3Document4 pagesPT 2 and PT 3Mariz Timario0% (2)

- Financial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsDocument5 pagesFinancial Reporting and Analysis End-Term Examination Answer ALL Questions. Show Your WorkingsUrvashi BaralNo ratings yet

- CASH FLOW AND INCOME STATEMENT PROBLEMSDocument17 pagesCASH FLOW AND INCOME STATEMENT PROBLEMSIris MnemosyneNo ratings yet

- Chapter 12 Exercises Indirect Method Cash Flow StatementsDocument2 pagesChapter 12 Exercises Indirect Method Cash Flow StatementsAreeba QureshiNo ratings yet

- 5.2. Unit 5 AAB AP A2 Report SunDocument5 pages5.2. Unit 5 AAB AP A2 Report SunHằng Nguyễn ThuNo ratings yet

- Chapter 13 Homework Assignment #2 QuestionsDocument8 pagesChapter 13 Homework Assignment #2 QuestionsCole Doty0% (1)

- Intermediate Accounting 3 - Statement of Cash Flows ProblemsDocument3 pagesIntermediate Accounting 3 - Statement of Cash Flows ProblemsSARAH ANDREA TORRESNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Far01 - The Financial Statements PresentationDocument10 pagesFar01 - The Financial Statements PresentationRNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- FAR Activity Feb 19 With AnswersDocument16 pagesFAR Activity Feb 19 With AnswersCybill AiraNo ratings yet

- CH 5Document2 pagesCH 5tigger5191No ratings yet

- A1 FS PreparationDocument1 pageA1 FS PreparationJudith DurensNo ratings yet

- Bba 122 Fai 11 AnswerDocument12 pagesBba 122 Fai 11 AnswerTomi Wayne Malenga100% (1)

- Worksheet Quiz ExampleDocument5 pagesWorksheet Quiz ExampleFrenzearl ArmadaNo ratings yet

- DagohoyDocument6 pagesDagohoylinkin soyNo ratings yet

- HTB Financial StatementsDocument7 pagesHTB Financial StatementsNajihah RazakNo ratings yet

- CHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgDocument6 pagesCHATTO - Finals - Summer 2022 - Cash Flows & Cap. BudgJULLIE CARMELLE H. CHATTONo ratings yet

- Output No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond PapersDocument2 pagesOutput No. 2 - PAS 1 Instruction: Write Your Answers On Long Bond Papersnmdl123No ratings yet

- University of Caloocan City: Name: Score: Course/Year & Section: DateDocument3 pagesUniversity of Caloocan City: Name: Score: Course/Year & Section: DatePatricia Camille Austria0% (1)

- pdf-topic-no-2-statement-of-cash-flows-pdf_compressDocument3 pagespdf-topic-no-2-statement-of-cash-flows-pdf_compressMillicent AlmueteNo ratings yet

- Auditing Practice Problem 5Document2 pagesAuditing Practice Problem 5Maria Fe FerrarizNo ratings yet

- Home Office, Branch Accounting & Business CombinationDocument5 pagesHome Office, Branch Accounting & Business CombinationPaupauNo ratings yet

- 05 Completing The Accounting Cycle PROBLEMSDocument5 pages05 Completing The Accounting Cycle PROBLEMSbetlogNo ratings yet

- B2 2021 Nov AnsDocument13 pagesB2 2021 Nov AnsRashid AbeidNo ratings yet

- 150.curren and Non Current Assets and Liabilities 2Document3 pages150.curren and Non Current Assets and Liabilities 2Melanie SamsonaNo ratings yet

- Tutorials Topic 7Document9 pagesTutorials Topic 7haniNo ratings yet

- Discussion Problems - Consolidation Subsequent To Date of AcquisitionDocument2 pagesDiscussion Problems - Consolidation Subsequent To Date of AcquisitionMikee CincoNo ratings yet

- IAS 7 Cash Flow Statement QuestionDocument3 pagesIAS 7 Cash Flow Statement QuestionamitsinghslideshareNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- Statement of Financial PerformanceDocument3 pagesStatement of Financial PerformanceJudith DurensNo ratings yet

- Cash Flow - Additional Exercises - SOLDocument5 pagesCash Flow - Additional Exercises - SOLMathieu HindyNo ratings yet

- Reading in Visual Art Reviewer For MidtermsDocument11 pagesReading in Visual Art Reviewer For MidtermsAmelia Dela CruzNo ratings yet

- AnalysisDocument2 pagesAnalysisAmelia Dela CruzNo ratings yet

- Domino TheoryDocument2 pagesDomino TheoryAmelia Dela CruzNo ratings yet

- Martyrdom GomDocument2 pagesMartyrdom GomAmelia Dela CruzNo ratings yet

- Domino Theory Mid AnswerDocument8 pagesDomino Theory Mid AnswerAmelia Dela CruzNo ratings yet

- Business LawDocument5 pagesBusiness LawAmelia Dela CruzNo ratings yet

- Operational Plan Ingredients Ingredients Description CostDocument10 pagesOperational Plan Ingredients Ingredients Description CostAmelia Dela CruzNo ratings yet

- What Is Good LifeDocument1 pageWhat Is Good LifeAmelia Dela CruzNo ratings yet

- Availability As of December 1, 2020: Classification Phase LOT Area List Price Exclusive of Vat & Oc Allocation StatusDocument7 pagesAvailability As of December 1, 2020: Classification Phase LOT Area List Price Exclusive of Vat & Oc Allocation StatusMia NungaNo ratings yet

- Divya PDFDocument3 pagesDivya PDFedivyaNo ratings yet

- Export Overdues Export Overdues: Prepared By: Hina MukarramDocument24 pagesExport Overdues Export Overdues: Prepared By: Hina MukarramAnonymous NM8Ej4mONo ratings yet

- CH 1 IntroDocument5 pagesCH 1 IntroJawad AhmadNo ratings yet

- Invoice SummaryDocument3 pagesInvoice SummaryoluwainvNo ratings yet

- Zambia Bata Shoe Company PLC Swot Analysis BacDocument13 pagesZambia Bata Shoe Company PLC Swot Analysis Bacphilipmwangala0No ratings yet

- International Purchasing Environment Doc2Document5 pagesInternational Purchasing Environment Doc2Eric Kipkemoi33% (3)

- India's Growing ParticipationDocument3 pagesIndia's Growing ParticipationAnonymous ceYk4p4No ratings yet

- Trips AgreementDocument3 pagesTrips Agreementsreedevi sureshNo ratings yet

- Module 8 - Standard CostingDocument49 pagesModule 8 - Standard Costingkaizen4apexNo ratings yet

- Work Breakdown Structure: Credit Card Fraud DetectionDocument4 pagesWork Breakdown Structure: Credit Card Fraud DetectionFinger igNo ratings yet

- BAAB1014 Assignment EliteDocument5 pagesBAAB1014 Assignment Elitejinosini ramadasNo ratings yet

- BOOOOMDocument221 pagesBOOOOMScrappy WellNo ratings yet

- 568066067-The-Performance-Pyramid للاستفادةDocument11 pages568066067-The-Performance-Pyramid للاستفادةworood.khalifih90No ratings yet

- Hatem Saber CVDocument3 pagesHatem Saber CVHatem1No ratings yet

- Document 6Document91 pagesDocument 6Mansi SuvariyaNo ratings yet

- Marco Polo Shipping Company Pte LTD V Fairmacs Shipping & Transport Services Pte LTDDocument9 pagesMarco Polo Shipping Company Pte LTD V Fairmacs Shipping & Transport Services Pte LTDEH ChngNo ratings yet

- Group C ActivityDocument3 pagesGroup C ActivityGerard Andrei B. DeinlaNo ratings yet

- BCG MatrixDocument15 pagesBCG MatrixIndranil AichNo ratings yet

- Topflightfares - Book Online Flight TicketsDocument1 pageTopflightfares - Book Online Flight TicketsOldtexas LaurettaNo ratings yet

- Moranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFDocument1 pageMoranda Sills LLP Served 10 Years Auditor Financial Statements Highland Bank Trust Firm Co q71787860 PDFIlham TaufanNo ratings yet

- Finance Wizard Challenge: Project Problem StatementDocument3 pagesFinance Wizard Challenge: Project Problem StatementAnay GuptaNo ratings yet

- PCI DSS v4 0 DESV FAQsDocument3 pagesPCI DSS v4 0 DESV FAQsjldtecnoNo ratings yet

- 01 Excel Test CL 11 and BelowDocument23 pages01 Excel Test CL 11 and BelowVinod KumarNo ratings yet