Professional Documents

Culture Documents

RBFI Project Proposal Group 1

Uploaded by

shivam kumar0 ratings0% found this document useful (0 votes)

8 views1 pageFinancial inclusion

Original Title

RBFI_Project_Proposal_Group_1

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentFinancial inclusion

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views1 pageRBFI Project Proposal Group 1

Uploaded by

shivam kumarFinancial inclusion

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

RBFI PROJECT PROPOSAL

PRESENTED BY: GROUP 1 DATE: 27.12.2019

LALITENDU BAL – 1810081

SUDHANSU SEKHAR NAHAK – 1810048

ASHUTOSH KUMAR GUPTA – 1810015

TOPIC: Understanding the AP Crisis of 2010 and the Malegam Committee’s

Recommendations and its effect on the MFI Sector

INTRODUCTION

After the liberalization of India’s economy in 1991, the private sector increasingly started to

extend the credit to the subprime borrowers to fill the gaps created by Banks’ reluctance to step

in. Soon, the Indian MFI sector saw itself being one of the largest in the world and, more

importantly, saw Andhra Pradesh at the hub of this growth story. But soon, the sector witnessed

huge defaults at the hands of their borrowers, forcing the entire industry into a crisis. The

government saw many instances of coercive lending practices and exorbitant interest rate

levied on the borrowers

Following this, the Malegam committee was set up and the various provisions were made

concerning monitoring and managing operations of the MFI sector as well as protecting the

interest of the borrowers.

OBJECTIVE

This report will critically examine the events that led to the crisis, the policy decisions that

followed and how the MFI Sector shaped up in the year following the crisis. Below is the

structure of the report.

STRUCTURE

1. ABSTRACT: A Brief about what the report is all about and what it is going to cover.

2. INTRODUCTION: A brief background of the MFI Sector, its History, and how it was instituted

in the country and the guidelines which monitored the sector before the crisis.

3. BACKDROP OF THE AP CRISIS: The incidents, decisions, and path that lead to the AP Crisis.

4. THE CRISIS EXPLAINED – ANALYSIS: The Crisis explained in detail with the help of

secondary research and data and understanding the effect of the extent of the crisis on the entire

NFBC sector, specifically the MFI Sector.

5. MALEGAM COMMITTEE RECOMMENDATIONS: Understanding various regulations and

guidelines issued by the Malegam Committee and various revisions of the same in the context of

the crisis and analyzing the decisions made in terms of the long-term repercussions.

6. THE RECOVERY OF THE MFI SECTOR – THE AFTER EFFECTS: The after-effects of

the Malegam Committee recommendations and various regulatory provisions.

7. INDUSTRY’S OPINION ON THE TOPIC: In this section, we will get an Industry Perspective

on the entire issue and try to understand the crisis through the Lens of the MFI Leadership.

8. THE ROAD AHEAD: Here, we will briefly discuss how the MFI sector has moved forward since

then and taken some of the broader steps related to sustainable growth.

9. CONCLUSIONS AND RECOMMENDATIONS: We will sum up the report and give our

recommendations if any.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Aayo Sawan: Slab 1st July 2020 To 30th Sept 2020 July 2020 Aug 2020Document4 pagesAayo Sawan: Slab 1st July 2020 To 30th Sept 2020 July 2020 Aug 2020shivam kumarNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- MC1 - MSR - EMails - SlidewareDocument22 pagesMC1 - MSR - EMails - Slidewareshivam kumarNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- DS1-Lec1 2Document114 pagesDS1-Lec1 2shivam kumarNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Procter & Gamble Company: Examining Product DecisionsDocument8 pagesProcter & Gamble Company: Examining Product Decisionsshivam kumarNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Conditional Probability: Ds1 - AgDocument24 pagesConditional Probability: Ds1 - Agshivam kumarNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- MSR - Slideware On Resumes & BiographiesDocument20 pagesMSR - Slideware On Resumes & Biographiesshivam kumarNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Probability Puzzles PDFDocument1 pageProbability Puzzles PDFshivam kumarNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Financial Statement Analysis TATA Steel and JSW SteelDocument22 pagesFinancial Statement Analysis TATA Steel and JSW Steelshivam kumarNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Contribution of Smartphones To Digital Governance in IndiaDocument68 pagesContribution of Smartphones To Digital Governance in Indiashivam kumarNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Customer Avatar Canvas: Before Avatar/Persona AfterDocument1 pageCustomer Avatar Canvas: Before Avatar/Persona AfterBBMS ResearcherNo ratings yet

- Presentation On: Make in IndiaDocument20 pagesPresentation On: Make in Indiashivam kumarNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Case Competition Handbook - 180 DC DTUDocument53 pagesCase Competition Handbook - 180 DC DTUArpit Jain100% (1)

- Search Engine Marketing Jargon BusterDocument4 pagesSearch Engine Marketing Jargon Bustershivam kumarNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Business Consultancy at Backward Districts - 12th July 2020Document26 pagesBusiness Consultancy at Backward Districts - 12th July 2020shivam kumarNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- What Is Exchange Traded Fund MeaningDocument8 pagesWhat Is Exchange Traded Fund Meaningshivam kumarNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Manacc CaseDocument3 pagesManacc Caseshivam kumarNo ratings yet

- Fileinbox PDFDocument186 pagesFileinbox PDFGaurav GuptaNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Session 4 Open EconomyDocument55 pagesSession 4 Open Economyshivam kumarNo ratings yet

- National Pension Scheme in IndiaDocument4 pagesNational Pension Scheme in Indiashivam kumarNo ratings yet

- RMD - Sessions 1,2,3Document89 pagesRMD - Sessions 1,2,3shivam kumarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Auditing Icwai Group I Objective Type Questions and Answers: Narayan@icwahelpn - Co.inDocument11 pagesAuditing Icwai Group I Objective Type Questions and Answers: Narayan@icwahelpn - Co.inHaider ShoaibNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Canara Bank ChargesDocument8 pagesCanara Bank Chargesaca_trader100% (1)

- Heuristic Analysis of "Growth of PayTM"Document10 pagesHeuristic Analysis of "Growth of PayTM"Sumit BasantrayNo ratings yet

- RbiDocument3 pagesRbiRaviteja ChodisettyNo ratings yet

- Submitted By:: Mohi Ud Din Islamic University Neraian Sharif (Ajk)Document4 pagesSubmitted By:: Mohi Ud Din Islamic University Neraian Sharif (Ajk)banthNo ratings yet

- Claims Against Fund Managers On The RiseDocument2 pagesClaims Against Fund Managers On The RiseTheng RogerNo ratings yet

- Final FormatingDocument69 pagesFinal FormatingSyed Munawar Abbas NaqviNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- GDV Recall Non-Automotive 2004Document4 pagesGDV Recall Non-Automotive 2004goransimaNo ratings yet

- Bard NoteDocument20 pagesBard NoteAmulya Kumar SahuNo ratings yet

- A Day in The Life of A Shipbroker - Shipping and Freight ResourceDocument5 pagesA Day in The Life of A Shipbroker - Shipping and Freight ResourcetaufiqNo ratings yet

- BNI Mobile Banking: Histori TransaksiDocument7 pagesBNI Mobile Banking: Histori TransaksiErwin NasrullahNo ratings yet

- Dividend Decision AT Icici: Master of Business AdministrationDocument71 pagesDividend Decision AT Icici: Master of Business AdministrationSaas4989 Saas4989No ratings yet

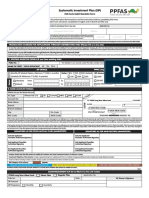

- Ppfas Sip FormDocument2 pagesPpfas Sip FormAmol ChikhalkarNo ratings yet

- ICICI Prudential Life Insurance CompanyDocument6 pagesICICI Prudential Life Insurance CompanyRamandeep Singh ThindNo ratings yet

- Credit Card Error CodesDocument4 pagesCredit Card Error Codescurbstone Security ServicesNo ratings yet

- Report Income Protection and Educational PlanningDocument4 pagesReport Income Protection and Educational PlanningSyai GenjNo ratings yet

- Rohan Dhall: Career SummaryDocument5 pagesRohan Dhall: Career SummarySudhir Kumar SinghNo ratings yet

- Tata MotorsDocument3 pagesTata MotorsSiddharth YadiyapurNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Lifecomm ProductDocument9 pagesLifecomm Productphani100% (2)

- Details of Subjectwise Question Paper PatternDocument2 pagesDetails of Subjectwise Question Paper PatternRishi Gourav ReddyNo ratings yet

- Pilar de Lim V Sun Life Assurance Company of CanadaDocument1 pagePilar de Lim V Sun Life Assurance Company of Canadakenken320No ratings yet

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDocument5 pagesMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiNo ratings yet

- Dic. Rom-EnglDocument175 pagesDic. Rom-EngltucurinaNo ratings yet

- Accounting For LeasesDocument9 pagesAccounting For LeasesNelson Musili100% (3)

- Terms and Condition: 1. Sharing of Data With IBLDocument3 pagesTerms and Condition: 1. Sharing of Data With IBLChannaNo ratings yet

- Annuity CommissionsDocument18 pagesAnnuity CommissionsScott Dauenhauer, CFP, MSFP, AIFNo ratings yet

- Appendices To Substantive Defenses To Consumer Debt Collection Suits TDocument59 pagesAppendices To Substantive Defenses To Consumer Debt Collection Suits Tdbush2778No ratings yet

- Proposal Eta Theke BanaisiDocument109 pagesProposal Eta Theke BanaisiMaruf Hasibul IslamNo ratings yet

- How The Common Global Implementation and ISO 20022 Standards Can Help You Interface With Bank NetworksDocument18 pagesHow The Common Global Implementation and ISO 20022 Standards Can Help You Interface With Bank Networksaxime100% (1)

- Credit Digest PledgeDocument4 pagesCredit Digest PledgejNo ratings yet