Professional Documents

Culture Documents

1st Practice Qs 99.2

1st Practice Qs 99.2

Uploaded by

BromanineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

1st Practice Qs 99.2

1st Practice Qs 99.2

Uploaded by

BromanineCopyright:

Available Formats

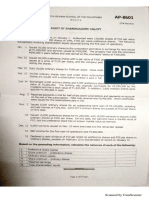

CURRENT LIABILITIES, PAYROLL, AND OTHER LIABILITIES PART I OF II

1. Notes may be issued

a. when assets are purchased

b. to creditor's to temporarily satisfy an account payable created earlier

c. when borrowing money

d. all of the above

2. On June 8, Alton Co. issued an $80,000, 6%, 120-day note payable on an overdue account payable to Seller

Co. Assume that the fiscal year of Alton Co. ends June 30. Which of the following relationships is true?

a. Alton is the creditor and credits Accounts Receivable

b. Seller is the creditor and debits Accounts Receivable

c. Seller is the borrower and credits Accounts Payable

d. Alton is the borrower and debits Accounts Payable

3. Which of the following would most likely be classified as a current liability?

a. Two-year Notes Payable

b. Bonds Payable

c. Mortgage Payable

d. Unearned Rent

4. Proper payroll accounting methods are important for a business for all the reasons below except

a. good employee morale requires timely and accurate payroll payments

b. payroll is subject to various state regulations

c. to help a business with cash flow problems by delayed payments of payroll taxes to state agencies

d. payroll and related payroll taxes have a significant effect on the net income of most businesses

5. The amount of national income taxes withheld from an employee's gross pay is recorded as a(n)

a. payroll expense

b. contra account

c. asset

d. liability

6. The total earnings of an employee for a payroll period is referred to as

a. take-home pay

b. pay net of taxes

c. net pay

d. gross pay

7. Payroll taxes levied against employees become liabilities

a. the first of the following month

b. when salary is accrued

c. when data is entered in a payroll register

d. at the end of an accounting period

8. The detailed record indicating the data for each employee for each payroll period and the cumulative total

earnings for each employee is called the

a. payroll register

b. payroll check

c. employee's earnings record

d. employer's earnings record

9. An aid in internal control over payrolls that indicates employee attendance is

a. time card

b. voucher system

c. payroll register

d. employee's earnings record

10. Which of the following is not an internal control procedure for payroll?

a. observe clocking in and out time for the employees

b. payroll depends on a fired employee's supervisor to notify them when an employee has been fired

c. payroll requires employees to show identification when picking up their paychecks

d. changes in pay rates on a computerized system must be tested by someone independent of payroll

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- RJR Nabisco ValuationDocument40 pagesRJR Nabisco ValuationEdisonCaguanaNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Intero Enterprises: Total Value 69,502.00Document1 pageIntero Enterprises: Total Value 69,502.00Ashish AgarwalNo ratings yet

- Technical AnalysisDocument34 pagesTechnical AnalysisBromanine100% (1)

- Agamata Answer KeyDocument5 pagesAgamata Answer KeyBromanineNo ratings yet

- Disruptive Strategy SyllabusDocument1 pageDisruptive Strategy SyllabusvineetNo ratings yet

- Intermediate Accounting IFRS Edition Chapter 18 RevenueDocument92 pagesIntermediate Accounting IFRS Edition Chapter 18 RevenueMagdalena Nababan100% (9)

- AK Mock BA 99.2 1st LEDocument4 pagesAK Mock BA 99.2 1st LEBromanineNo ratings yet

- AK Mock BA 118.1 2nd LEDocument6 pagesAK Mock BA 118.1 2nd LEBromanineNo ratings yet

- AK Mock BA 141 1st LEDocument2 pagesAK Mock BA 141 1st LEBromanineNo ratings yet

- 5ea7fb0c57f53 SEC Form 17A Dec2019Document222 pages5ea7fb0c57f53 SEC Form 17A Dec2019BromanineNo ratings yet

- Mock Board Answer KeyDocument2 pagesMock Board Answer KeyBromanineNo ratings yet

- University of The Philippines VisayasDocument2 pagesUniversity of The Philippines VisayasBromanineNo ratings yet

- Partners (Because TAC TCC PAC (New)Document5 pagesPartners (Because TAC TCC PAC (New)BromanineNo ratings yet

- Abatement: "A Reduction in The Assessment of Tax, Penalty or Interest When It Is Determined The Assessment Is Incorrect"Document1 pageAbatement: "A Reduction in The Assessment of Tax, Penalty or Interest When It Is Determined The Assessment Is Incorrect"BromanineNo ratings yet

- Revised CPALE Syllabus - EditableDocument19 pagesRevised CPALE Syllabus - EditableBromanineNo ratings yet

- 6th Practice Qs 99.2Document3 pages6th Practice Qs 99.2BromanineNo ratings yet

- PRTC Oct2019 1st PB Answer Key PDFDocument2 pagesPRTC Oct2019 1st PB Answer Key PDFBromanineNo ratings yet

- (Pfrs/Ifrs 16) LeasesDocument11 pages(Pfrs/Ifrs 16) LeasesBromanineNo ratings yet

- Audit of CashDocument4 pagesAudit of CashBromanineNo ratings yet

- Mas 8611 PDFDocument11 pagesMas 8611 PDFBromanineNo ratings yet

- AP 8603 - Audit of Property, Plant and EquipmentDocument6 pagesAP 8603 - Audit of Property, Plant and EquipmentBromanineNo ratings yet

- Single Entry and Error CorrectionDocument2 pagesSingle Entry and Error CorrectionBromanine0% (1)

- Ap 8605Document6 pagesAp 8605BromanineNo ratings yet

- Hyperinflation and Current CostDocument3 pagesHyperinflation and Current CostBromanineNo ratings yet

- AP 8601 - Audit of Shareholders' EquityDocument8 pagesAP 8601 - Audit of Shareholders' EquityBromanineNo ratings yet

- Opening BalancesDocument37 pagesOpening BalancesBromanineNo ratings yet

- FIN2704 Tutorial 1 Question 3 SolutionDocument5 pagesFIN2704 Tutorial 1 Question 3 SolutionAndrew TungNo ratings yet

- The Fidelity Guide To Equity InvestingDocument16 pagesThe Fidelity Guide To Equity InvestingsatyagoltiNo ratings yet

- Faith & Finance The Change of Face of Isalmic BankingDocument13 pagesFaith & Finance The Change of Face of Isalmic BankingDr-Mohammed FaridNo ratings yet

- Investment AccountDocument2 pagesInvestment AccountQuestionscastle Friend67% (3)

- MASCO 1e PDFDocument200 pagesMASCO 1e PDFyoge960No ratings yet

- ECO6201 - Chapter 5 - Production and Cost Analysis in The Short Run (Amended)Document36 pagesECO6201 - Chapter 5 - Production and Cost Analysis in The Short Run (Amended)Thomas WuNo ratings yet

- Business Plan Bahulu HouseDocument124 pagesBusiness Plan Bahulu Househusnasyahidah0% (1)

- Ra 9184 - Retention MoneyDocument2 pagesRa 9184 - Retention MoneyELMERNo ratings yet

- Caroll Wilson KubenkaDocument11 pagesCaroll Wilson Kubenkatomili85No ratings yet

- Property Inventory FormDocument9 pagesProperty Inventory FormMaria Len GalaponNo ratings yet

- Enabling Shelter StrategiesDocument65 pagesEnabling Shelter StrategiesHomayoun WahidyNo ratings yet

- Step Up Swaps-InfoDocument3 pagesStep Up Swaps-InfoRafael Lizana ZúñigaNo ratings yet

- MARK5814 - T1 2022 Digital Marketing of Cotton:On Individual Assignment Student Name: Word CountDocument11 pagesMARK5814 - T1 2022 Digital Marketing of Cotton:On Individual Assignment Student Name: Word Countpooja jainNo ratings yet

- Assessment of The Effects of One Stop Service Centers in Service Delivery To Small and Medium Enterprise in Manufacturing Sector: The Case of Mekell City TigrayDocument10 pagesAssessment of The Effects of One Stop Service Centers in Service Delivery To Small and Medium Enterprise in Manufacturing Sector: The Case of Mekell City TigrayInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Carbon Trust Annual Report 2012-2013Document79 pagesCarbon Trust Annual Report 2012-2013kr4m4rkNo ratings yet

- Jio BillDocument1 pageJio Billshiva keerthiNo ratings yet

- VRIO Analysis Making The Most of Organizational ResourcesDocument5 pagesVRIO Analysis Making The Most of Organizational ResourcesPHAM PHI HUNGNo ratings yet

- Cost Analysis and Control - HyundaiDocument7 pagesCost Analysis and Control - HyundaiSuresh100% (1)

- ECG Co. & Partners ProfileDocument10 pagesECG Co. & Partners ProfileReika KuaNo ratings yet

- Marketing Segmentation - Markets, Profiling, Targeting, and PositioningDocument3 pagesMarketing Segmentation - Markets, Profiling, Targeting, and PositioningCACANo ratings yet

- Best Corporate Governance Practice: Corporate Cultures and VisionDocument5 pagesBest Corporate Governance Practice: Corporate Cultures and VisionAnonymous aXFUF6No ratings yet

- PDFDocument14 pagesPDFAmol KareNo ratings yet

- Jsda Japan Annual Report 10Document35 pagesJsda Japan Annual Report 10cmarketNo ratings yet

- A4Document2 pagesA4Sayed Atique NewazNo ratings yet

- TMFE2202 3 HandoutDocument4 pagesTMFE2202 3 HandoutMacaraeg NicoleNo ratings yet

- KKKKKKKKDocument49 pagesKKKKKKKKkirankalkii44No ratings yet