Professional Documents

Culture Documents

Act 4

Uploaded by

shanikaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Act 4

Uploaded by

shanikaCopyright:

Available Formats

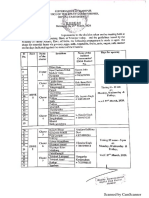

1/23/2020 FINANCE ACT, 1994

FINANCE ACT, 1994

Section 4 - Insertion of New Section 5A

After section 5 of the Income-tax Act, the following section shall be inserted and shall be deemed to

have been inserted with effect from the 1st day of April, 1963, namely :-

'5A. Apportionment of income between spouses governed by Portuguese Civil Code. - (1) Where

the husband and wife are governed by the system of community of property (known under the

Portuguese Civil Code of 1860 as "COMMUNIAO DOS BENS") in force in the State of Goa and in

the Union territories of Dadra and Nagar Haveli and Daman and Diu, the income of the husband

and of the wife under any head of income shall not be assessed as that of such community of

property (whether treated as an association of persons or a body of individuals), but such income

of the husband and of the wife under each head of income (other than under the head "Salaries")

shall be apportioned equally between the husband and the wife and the income so apportioned

shall be included separately in the total income of the husband and of the wife respectively, and

the remaining provisions of this Act shall apply accordingly.

(2) Where the husband or, as the case may be, the wife governed by the aforesaid system of

community of property has any income under the head "Salaries", such income shall be included

in the total income of the spouse who has actually earned it.'

Disclaimer :

The document is being furnished for information and research purpose only. The content of the document have been obtained

from sources we believe to be trustworthy. The Content provided herein is on “As Is” or “As Available Basis”. Whilst we

endeavor to keep the information up to date and correct, Manupatra makes no representation or warranty as to the accuracy,

completeness or correctness of the content. In some cases the Principal Acts and/or Amendment Acts may not be available.

Principal Acts may or may not include subsequent amendments. Manupatra expressly disclaims all responsibility for any loss,

injury, liability or damage of any kind resulting from and arising out of, or any way related to the above Content. For

authoritative text, please refer relevant government publication or the gazette notification.

www.manupatrafast.in/ba/dispbot.aspx?nActCompID=40870 1/1

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- THE FILIPINO IS WORTH DYINGDocument2 pagesTHE FILIPINO IS WORTH DYINGDanitza1459100% (2)

- Introduction - EvidenceDocument14 pagesIntroduction - EvidenceshanikaNo ratings yet

- The Trials of Rizal Bill: Learning ObjectivesDocument3 pagesThe Trials of Rizal Bill: Learning ObjectivesRammele Opemia NonNo ratings yet

- HinduDocument1 pageHindushanikaNo ratings yet

- SHANIKA IT LAW InterimDocument8 pagesSHANIKA IT LAW InterimshanikaNo ratings yet

- ManipurDocument2 pagesManipurshanikaNo ratings yet

- Consequentialism 1Document14 pagesConsequentialism 1shanikaNo ratings yet

- Act 13Document1 pageAct 13shanikaNo ratings yet

- Act 2Document1 pageAct 2shanikaNo ratings yet

- Act 6Document1 pageAct 6shanikaNo ratings yet

- Internal TradeDocument28 pagesInternal TradeshanikaNo ratings yet

- Act 10bDocument1 pageAct 10bshanikaNo ratings yet

- ActDocument1 pageActshanikaNo ratings yet

- Act 12Document1 pageAct 12shanikaNo ratings yet

- Act 7Document1 pageAct 7shanikaNo ratings yet

- Act 1Document1 pageAct 1shanikaNo ratings yet

- Act 8Document1 pageAct 8shanikaNo ratings yet

- Act 3Document1 pageAct 3shanikaNo ratings yet

- Witnesses in Criminal Trials: Their Role and EfficacyDocument66 pagesWitnesses in Criminal Trials: Their Role and EfficacyShivam AggarwalNo ratings yet

- Act 9Document1 pageAct 9shanikaNo ratings yet

- ActDocument2 pagesActshanikaNo ratings yet

- Submitted By:-: Public International LawDocument4 pagesSubmitted By:-: Public International LawshanikaNo ratings yet

- Act 5Document1 pageAct 5shanikaNo ratings yet

- Committees Towards Electoral ReformsDocument5 pagesCommittees Towards Electoral Reformsshanika100% (1)

- TrackedDocument1 pageTrackedshanikaNo ratings yet

- Company Law 2Document30 pagesCompany Law 2shanikaNo ratings yet

- Law of Evidence - InterimDocument6 pagesLaw of Evidence - InterimshanikaNo ratings yet

- Law of Evidence - InterimDocument6 pagesLaw of Evidence - InterimshanikaNo ratings yet

- TrackedDocument1 pageTrackedshanikaNo ratings yet

- United Nations Nations UniesDocument12 pagesUnited Nations Nations UniesshanikaNo ratings yet

- DocumentDocument1 pageDocumentshanikaNo ratings yet

- OPP-20 Rev 0 RMU For Housing SocietyDocument4 pagesOPP-20 Rev 0 RMU For Housing SocietyOmer Abdul RazzaqNo ratings yet

- Aquino Vs SSS 1Document1 pageAquino Vs SSS 1Glendie LadagNo ratings yet

- 2021ElliottFEC PRDocument12 pages2021ElliottFEC PRWYMT TelevisionNo ratings yet

- Does a lease contract provide for automatic renewalDocument1 pageDoes a lease contract provide for automatic renewalClark LimNo ratings yet

- Barangay Samara: Office of The Sangguniang Barangay Series of 2018Document1 pageBarangay Samara: Office of The Sangguniang Barangay Series of 2018Maria RinaNo ratings yet

- Medical Malpractice and Negligence StandardsDocument2 pagesMedical Malpractice and Negligence StandardsRuthy SegoviaNo ratings yet

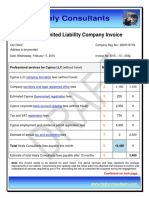

- Draft Invoice Cyprus LLC MigrationDocument7 pagesDraft Invoice Cyprus LLC MigrationShehryar KhanNo ratings yet

- CF-Chap 02-Analysis of Financial StatementDocument58 pagesCF-Chap 02-Analysis of Financial StatementM7No ratings yet

- Certificate of EarningsDocument1 pageCertificate of EarningsRiasat AliNo ratings yet

- What Is FCCB?: Foreign Currency Convertible Bond Is A Type of ConvertibleDocument8 pagesWhat Is FCCB?: Foreign Currency Convertible Bond Is A Type of ConvertiblesbghargeNo ratings yet

- Lea 2Document2 pagesLea 2Rosaly Bontia100% (1)

- Swot Analysis of MCBDocument5 pagesSwot Analysis of MCBzaighum sultanNo ratings yet

- Aadvik Ipr Psda 8 SemDocument12 pagesAadvik Ipr Psda 8 SemZubu KhshNo ratings yet

- 1 Assignment TO BIG TOO FAILDocument2 pages1 Assignment TO BIG TOO FAILHaroon Z. ChoudhryNo ratings yet

- Read MeDocument2 pagesRead MeMacha MumbaiNo ratings yet

- 2.110 Cost or Price ReasonablenessDocument4 pages2.110 Cost or Price ReasonablenessferryNo ratings yet

- Derrida Kafka EssayDocument18 pagesDerrida Kafka EssayKushal HaranNo ratings yet

- Credit Limit Inc ReqDocument2 pagesCredit Limit Inc Reqmatt luiNo ratings yet

- Transcript Insights on Demurer Evidence MotionDocument14 pagesTranscript Insights on Demurer Evidence MotionGlem100% (1)

- Forensic Analysis Claims On International ConstructionDocument4 pagesForensic Analysis Claims On International Constructionjowimad100% (1)

- Acebedo Optical Vs CADocument1 pageAcebedo Optical Vs CAJane EnriquezNo ratings yet

- Patrick Caronan Vs Richard CaronanDocument8 pagesPatrick Caronan Vs Richard CaronanJosh CabreraNo ratings yet

- Registration Form CRO0601096-IPCDocument2 pagesRegistration Form CRO0601096-IPCHimanshi VohraNo ratings yet

- Feleke Firewall Note 2023Document21 pagesFeleke Firewall Note 2023Abni booNo ratings yet

- Transfer of JudgesDocument5 pagesTransfer of JudgesRAJANo ratings yet

- 8 Financial Literacy Lesson1Document6 pages8 Financial Literacy Lesson1hlmd.blogNo ratings yet

- Ways of Eradicating Disciplinary Problems Among Students in SMK Seri GombakDocument3 pagesWays of Eradicating Disciplinary Problems Among Students in SMK Seri GombakFaiz AsohanNo ratings yet

- De Lima vs. Guerrero (843 SCRA 1, 20 Oct. 2017)Document101 pagesDe Lima vs. Guerrero (843 SCRA 1, 20 Oct. 2017)Eugene DayanNo ratings yet