Professional Documents

Culture Documents

Ratios Sheet

Ratios Sheet

Uploaded by

Bianca LismanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ratios Sheet

Ratios Sheet

Uploaded by

Bianca LismanCopyright:

Available Formats

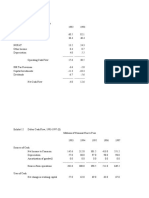

Profitability:

Efficiency:

𝑊𝑎𝑔𝑒𝑠

𝐸𝑚𝑝𝑙𝑜𝑦𝑒𝑒 𝑅𝑎𝑡𝑖𝑜:

𝐺𝑟𝑜𝑠𝑠 𝑃𝑟𝑜𝑓𝑖𝑡 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝐺𝑃𝑀:

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝑊𝐶𝑇:

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑊𝑜𝑟𝑘𝑖𝑛𝑔 𝐶𝑎𝑝𝑖𝑡𝑎𝑙

𝑂𝑃𝑀:

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟:

𝐸𝐵𝑇 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑁𝑒𝑡 𝐹𝑖𝑥𝑒𝑑 𝐴𝑠𝑠𝑒𝑡𝑠

𝑃𝑟𝑒𝑡𝑎𝑥 𝑀𝑎𝑟𝑔𝑖𝑛:

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟:

𝑃𝑟𝑜𝑓𝑖𝑡 𝑀𝑎𝑟𝑔𝑖𝑛: 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒

𝑅𝑂𝐸:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑆𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠′ 𝐸𝑞𝑢𝑖𝑡𝑦 Liquidity:

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐴𝑠𝑠𝑒𝑡𝑠

𝑅𝑂𝐴F : 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑅𝑎𝑡𝑖𝑜:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 + 𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐸𝑥𝑝𝑒𝑛𝑠𝑒 (1 − 𝑡𝑎𝑥 𝑟𝑎𝑡𝑒) 𝑄𝑢𝑖𝑐𝑘 𝐴𝑠𝑠𝑒𝑡𝑠

𝑅𝑂𝐴G : 𝑄𝑢𝑖𝑐𝑘 𝑅𝑎𝑡𝑖𝑜:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐼𝑛𝑐𝑜𝑚𝑒 𝐶𝑎𝑠ℎ + 𝐶𝑎𝑠ℎ 𝐸𝑞𝑢𝑖𝑣𝑎𝑙𝑒𝑛𝑡𝑠

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝑅𝑂𝐴: 𝐶𝑎𝑠ℎ 𝑅𝑎𝑡𝑖𝑜:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠 𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

𝐶𝑎𝑠ℎ + 𝐶𝑎𝑠ℎ 𝐸𝑞𝑢𝑖𝑣𝑎𝑙𝑒𝑛𝑡𝑠 + 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠

𝐹𝑖𝑛𝑎𝑛𝑐𝑖𝑎𝑙 𝐿𝑒𝑣𝑒𝑟𝑎𝑔𝑒: ROE − ROA 𝐷𝐼𝑅:

𝐷𝑎𝑖𝑙𝑦 𝐶𝑎𝑠ℎ 𝐸𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒𝑠

𝐿𝑖𝑎𝑏𝑖𝑙𝑖𝑡𝑖𝑒𝑠

ROE = ROA + (ROA − 𝑖) × 𝐶𝐶𝑅: DOH + DSO − Avg. Days of Payables

𝑆𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠 V 𝐸𝑞𝑢𝑖𝑡𝑦

ROE Decomposition:

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠

𝑅𝑂𝐸: ×

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐸𝑞𝑢𝑖𝑡𝑦

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠

𝑅𝑂𝐴: ×

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠

𝑅𝑂𝐸: × ×

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑒𝑞𝑢𝑖𝑡𝑦

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝐸𝐵𝑇 𝐸𝐵𝐼𝑇 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠

𝑅𝑂𝐸: × × × ×

𝐸𝐵𝑇 𝐸𝐵𝐼𝑇 𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑠𝑠𝑒𝑡𝑠 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐸𝑞𝑢𝑖𝑡𝑦

Efficiency & Liquidity:

𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑 𝐷𝑎𝑦𝑠 𝑖𝑛 𝑌𝑒𝑎𝑟

𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑡𝑢𝑟𝑛𝑜𝑣𝑒𝑟: 𝐷𝑆𝑂:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟

𝐷𝑎𝑦𝑠 𝑖𝑛 𝑌𝑒𝑎𝑟 𝐶𝑜𝑠𝑡 𝑜𝑓 𝐺𝑜𝑜𝑑𝑠 𝑆𝑜𝑙𝑑

𝐷𝑂𝐻: 𝑃𝑎𝑦𝑎𝑏𝑙𝑒𝑠 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟:

𝐼𝑛𝑣𝑒𝑛𝑡𝑜𝑟𝑦 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟 𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑃𝑎𝑦𝑎𝑏𝑙𝑒

𝑁𝑒𝑡 𝑆𝑎𝑙𝑒𝑠 𝐷𝑎𝑦𝑠 𝑖𝑛 𝑌𝑒𝑎𝑟

𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟: 𝐴𝑣𝑔. 𝐷𝑎𝑦𝑠 𝑜𝑓 𝑃𝑎𝑦𝑎𝑏𝑙𝑒𝑠:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑁𝑒𝑡 𝑅𝑒𝑐𝑒𝑖𝑣𝑎𝑏𝑙𝑒𝑠 𝐴𝑐𝑐𝑜𝑢𝑛𝑡𝑠 𝑃𝑎𝑦𝑎𝑏𝑙𝑒 𝑇𝑢𝑟𝑛𝑜𝑣𝑒𝑟

Valuation (1):

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠ℎ𝑎𝑟𝑒𝑠

𝐷𝐸𝑃𝑆:

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑_𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑜𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑎𝑛𝑑 𝑝𝑜𝑡𝑒𝑛𝑡𝑖𝑎𝑙 𝑠ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 − 𝑃𝑟𝑒𝑓𝑒𝑟𝑟𝑒𝑑 𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠

𝐸𝑃𝑆:

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑_𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑜𝑟𝑑𝑖𝑛𝑎𝑟𝑦 𝑠ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔 𝑓𝑜𝑟 𝑡ℎ𝑒 𝑝𝑒𝑟𝑖𝑜𝑑

𝐸𝐵𝑇𝐷𝐴

𝐸𝐵𝑇𝐷𝐴 𝑝𝑒𝑟 𝑠ℎ𝑎𝑟𝑒:

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑_𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

𝑂𝑝𝑒𝑟𝑎𝑡𝑖𝑛𝑔 𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤

𝐶𝐹𝑃𝑆:

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑_𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

𝐶𝑜𝑚𝑚𝑜𝑛 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑑𝑒𝑐𝑙𝑎𝑟𝑒𝑑

𝐷𝑖𝑃𝑆:

𝑊𝑒𝑖𝑔ℎ𝑡𝑒𝑑_𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑛𝑢𝑚𝑏𝑒𝑟 𝑜𝑓 𝑠ℎ𝑎𝑟𝑒𝑠 𝑂𝑢𝑡𝑠𝑡𝑎𝑛𝑑𝑖𝑛𝑔

𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒

𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑌𝑖𝑒𝑙𝑑:

𝑀𝑎𝑟𝑘𝑒𝑡 𝑃𝑟𝑖𝑐𝑒 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒

𝐶𝑜𝑚𝑚𝑜𝑛 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑑𝑒𝑐𝑙𝑎𝑟𝑒𝑑

𝐷𝑖𝑣𝑖𝑑𝑒𝑛𝑑 𝑃𝑎𝑦𝑜𝑢𝑡 𝑅𝑎𝑡𝑖𝑜:

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠ℎ𝑎𝑟𝑒𝑠

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠ℎ𝑎𝑟𝑒𝑠 − 𝐶𝑜𝑚𝑚𝑜𝑛 𝑑𝑖𝑣𝑖𝑑𝑒𝑛𝑑𝑠 𝑑𝑒𝑐𝑙𝑎𝑟𝑒𝑑

𝑅𝑒𝑡𝑒𝑛𝑡𝑖𝑜𝑛 𝑅𝑎𝑡𝑒 (𝑏):

𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 𝑎𝑣𝑎𝑖𝑙𝑎𝑏𝑙𝑒 𝑓𝑜𝑟 𝑐𝑜𝑚𝑚𝑜𝑛 𝑠ℎ𝑎𝑟𝑒𝑠

Valuation (2):

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑀𝑎𝑟𝑘𝑒𝑡 𝑃𝑟𝑖𝑐𝑒 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒

𝑃/𝐸:

𝐸𝑎𝑟𝑛𝑖𝑛𝑔𝑠 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒 CCR: Cash Convertion Ratio

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑀𝑎𝑟𝑘𝑒𝑡 𝑃𝑟𝑖𝑐𝑒 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒 CFPS: Cash Flow per Share

𝑃/𝐶𝐹:

𝐶𝑎𝑠ℎ 𝐹𝑙𝑜𝑤 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒

DEPS: Diluited EPS

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑀𝑎𝑟𝑘𝑒𝑡 𝑃𝑟𝑖𝑐𝑒 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒

𝑃/𝑆:

𝑆𝑎𝑙𝑒𝑠 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒 DiPS: Dividends per Share

𝐶𝑢𝑟𝑟𝑒𝑛𝑡 𝑀𝑎𝑟𝑘𝑒𝑡 𝑃𝑟𝑖𝑐𝑒 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒 DIR: Defensive Interval Ratio

𝑃/𝐵𝑉:

𝐵𝑜𝑜𝑘 𝑉𝑎𝑙𝑢𝑒 𝑃𝑒𝑟 𝑆ℎ𝑎𝑟𝑒

DOH: Average days of inventory on hand

𝑆𝐺𝑅: Retention Rate × ROE

DSO: Average days of sales outstanding

Solvency: D_t_A Ratio: Debt to Assets Ratio

𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 D_t_E Ratio: Debt to Equity Ratio

𝐷_𝑡_𝐴 𝑅𝑎𝑡𝑖𝑜:

𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

D_t_C Ratio: Debt to Capital Ratio

𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡

𝐷_𝑡_𝐸 𝑅𝑎𝑡𝑖𝑜:

𝑆𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠′ 𝐸𝑞𝑢𝑖𝑡𝑦 EPS: Earning per Share

𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 FLR: Financial Leverage Ratio

𝐷_𝑡_𝐶 𝑅𝑎𝑡𝑖𝑜:

𝑇𝑜𝑡𝑎𝑙 𝐷𝑒𝑏𝑡 + 𝑆𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠′ 𝐸𝑞𝑢𝑖𝑡𝑦

GPM: Gross Profit Margin

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑇𝑜𝑡𝑎𝑙 𝐴𝑠𝑠𝑒𝑡𝑠

𝐹𝐿𝑅:

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑆𝑡𝑜𝑐𝑘ℎ𝑜𝑙𝑑𝑒𝑟𝑠′ 𝐸𝑞𝑢𝑖𝑡𝑦 i: Average interest rate on debt

𝐸𝐵𝐼𝑇

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐶𝑜𝑣𝑒𝑟𝑎𝑔𝑒: OPM: Operating Profit Margin

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑃𝑎𝑦𝑚𝑒𝑛𝑡𝑠

SGR: Sustainable Growth Rate

𝐸𝐵𝐼𝑇 + 𝐿𝑒𝑎𝑠𝑒 𝑃𝑎𝑦𝑚𝑒𝑛𝑡𝑠

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝐶𝑜𝑣𝑒𝑟𝑎𝑔𝑒:

𝐼𝑛𝑡𝑒𝑟𝑒𝑠𝑡 𝑃𝑎𝑦𝑚𝑒𝑛𝑡𝑠 + 𝐿𝑒𝑎𝑠𝑒 𝑃𝑎𝑦𝑚𝑒𝑛𝑡𝑠 WCT: Working Capital Turnover

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Noel Redding Estate v. Sony Music EntertainmentDocument4 pagesNoel Redding Estate v. Sony Music EntertainmentBillboardNo ratings yet

- As 3818.11-2009 Timber - Heavy Structural Products - Visually Graded Utility PolesDocument7 pagesAs 3818.11-2009 Timber - Heavy Structural Products - Visually Graded Utility PolesSAI Global - APACNo ratings yet

- As As As As As As As Problema Orientala in Cadrul Relatiilor Inte As As As As AsDocument1 pageAs As As As As As As Problema Orientala in Cadrul Relatiilor Inte As As As As AsBianca LismanNo ratings yet

- As As As As As As As Problema Orientala in Cadrul Relatiilor Internatio A As As As As AsDocument1 pageAs As As As As As As Problema Orientala in Cadrul Relatiilor Internatio A As As As As AsBianca LismanNo ratings yet

- As As As As As As As Problema Orientala in Cadrul Relatiilor Internationale As As As As As As AsDocument1 pageAs As As As As As As Problema Orientala in Cadrul Relatiilor Internationale As As As As As As AsBianca LismanNo ratings yet

- As As As As As As As Problema Orientala in Cadrul Relatiilor Internatio As As As As As AsDocument1 pageAs As As As As As As Problema Orientala in Cadrul Relatiilor Internatio As As As As As AsBianca LismanNo ratings yet

- As As As As As As As As As As As As As AsDocument1 pageAs As As As As As As As As As As As As AsBianca LismanNo ratings yet

- Italian Carnival: CarnevaleDocument5 pagesItalian Carnival: CarnevaleBianca LismanNo ratings yet

- GRAD Provv Matr Extra Ue I Livello 13-14Document17 pagesGRAD Provv Matr Extra Ue I Livello 13-14Bianca LismanNo ratings yet

- People of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDocument26 pagesPeople of The Philippines, Plaintiff-Appellee, vs. Bryan Ganaba Y Nam-Ay, Accused-Appellant. DecisionDar , john Joshua S.No ratings yet

- James Holmes Order To Limit Pre Trial PublicityDocument4 pagesJames Holmes Order To Limit Pre Trial PublicityNickNo ratings yet

- United States Court of Appeals, Eleventh CircuitDocument5 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsNo ratings yet

- Landicho Vs RelovaDocument6 pagesLandicho Vs Relovakikhay11No ratings yet

- Watson v. Caruso 424 F. Supp. 3d 231, 247 (D. Conn. 2019) Case NotesDocument10 pagesWatson v. Caruso 424 F. Supp. 3d 231, 247 (D. Conn. 2019) Case NotesSamuel RichardsonNo ratings yet

- Mr. Balaji Manoharan: TCS Confidential Ref: TCS/2019-20/BPS-BPO2/882137Document3 pagesMr. Balaji Manoharan: TCS Confidential Ref: TCS/2019-20/BPS-BPO2/882137BalajiNo ratings yet

- Amar Remedies LTDDocument3 pagesAmar Remedies LTDDiscover KapitalNo ratings yet

- Case DigestDocument10 pagesCase DigestRomy IanNo ratings yet

- Volume 42, Issue 49 - December 9, 2011Document52 pagesVolume 42, Issue 49 - December 9, 2011BladeNo ratings yet

- Aws Elastic BeanstalkDocument1,087 pagesAws Elastic BeanstalkSai MadhaviNo ratings yet

- Chapter Notes (2) : Fall of Venice Challenges Faced by Venice Between 15 and 18 Century A) Foreign Threats Involvement in MainlandDocument6 pagesChapter Notes (2) : Fall of Venice Challenges Faced by Venice Between 15 and 18 Century A) Foreign Threats Involvement in MainlanddenlinNo ratings yet

- 17 Yanas v. AcaaylarDocument1 page17 Yanas v. AcaaylarUPM ALSNo ratings yet

- A Project Report On "Cashless Economy in India": Subject: Economics For Managers Component: CECDocument59 pagesA Project Report On "Cashless Economy in India": Subject: Economics For Managers Component: CECAreyou NormalNo ratings yet

- Lightfield Less Lethal Research Contract With Allegheny County JailDocument30 pagesLightfield Less Lethal Research Contract With Allegheny County JailAllegheny JOB WatchNo ratings yet

- MCDSFSDocument168 pagesMCDSFSptmaadiNo ratings yet

- Cyberratings Cloud Network Firewall ReportDocument16 pagesCyberratings Cloud Network Firewall ReportelochoNo ratings yet

- Manila: Professional Regulation CommissionDocument27 pagesManila: Professional Regulation CommissionPhilBoardResultsNo ratings yet

- ToyWorks With Income Statement and Balance SheetDocument19 pagesToyWorks With Income Statement and Balance SheetMervin MalaranNo ratings yet

- Bid Document ItahariDocument330 pagesBid Document ItahariSarrows PrazzapatiNo ratings yet

- Types of Credit BSBA 3B, GROUP 2Document20 pagesTypes of Credit BSBA 3B, GROUP 2Rizzle RabadillaNo ratings yet

- PFRS 16 Summary - With TaxDocument56 pagesPFRS 16 Summary - With Taxsherryl caoNo ratings yet

- DTS Sample Training AgreementDocument3 pagesDTS Sample Training AgreementRico T. MusongNo ratings yet

- Child Justice Act 75 of 2008: (English Text Signed by The President)Document89 pagesChild Justice Act 75 of 2008: (English Text Signed by The President)Aldrin ZlmdNo ratings yet

- JilaDocument614 pagesJilaPeter AlexanderNo ratings yet

- FIN604 - HW03 - Farhan Zubair - 18164052Document9 pagesFIN604 - HW03 - Farhan Zubair - 18164052ZNo ratings yet

- Steve McEwen Agent Brochure 2012 v. 2.0Document20 pagesSteve McEwen Agent Brochure 2012 v. 2.0Steve McEwenNo ratings yet

- Pepsi CoDocument6 pagesPepsi CoRyan Patrick GlennNo ratings yet

- COA CIRCULAR LETTER NO. 2004-004 - October 5, 2004Document2 pagesCOA CIRCULAR LETTER NO. 2004-004 - October 5, 2004KeleeNo ratings yet