Professional Documents

Culture Documents

Digest Succ

Uploaded by

Arvin RobertOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

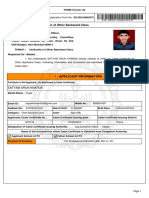

Digest Succ

Uploaded by

Arvin RobertCopyright:

Available Formats

PABLO LORENZO, as trustee of the estate of Whether the compensation of the trustees

Thomas Hanley v. JUAN POSADAS, JR., Collector should be part of the estate subject to tax.

of Internal Revenue. G.R. No. L-43082. June 18,

1937

FACTS: RULING:

Thomas Hanley died, leaving a will and considerable YES. The delinquency in payment occurred when

amount of real and personal properties. The will Moore became trustee. The interest due should be

bequeathed Matthew Hanley, Thomas' nephew, the computed from that date and it is error of Lorenzo to

money and the real estate. Also stipulated was that compute it one month later. A surcharge 25 per

the property will only be given ten years after centum should be added to the tax and interest due

Thomas' death. and unpaid within ten days after the date of notice.

The CIR communicated with Moore and a date was

The CFI appointed PJM Moore as considered trustee

to administer the real properties. Moore acted as fixed. As the tax and interest due were not paid on

trustee until he resigned and Pablo Lorenzo was that date, the estate became liable for the payment of

appointed in his stead. the surcharge.

Juan Posadas, the CIR, assessed inheritance tax NO. The Court held that a transmission by

against the estate amounting to P2,057.74. Lorenzo inheritance is taxable at the time of the predecessor's

death, notwithstanding the postponement of the

paid the tax after he was ordered by the CFI due to

actual possession or enjoyment of the estate by the

the CIR's motion. Lorenzo claimed that the beneficiary, and the tax measured by the value of the

inheritance tax should have been assessed after 10 property transmitted at that time regardless of its

years and asked for a refund. appreciation or depreciation.

NO. A trustee, no doubt, is entitled to receive a fair

The CIR denied the protest and reassessed Lorenzo of compensation for his services . But from this it does

P1,191.27 which represents interest due on the tax not follow that the compensation due him may

and which was not included in the original lawfully be deducted in arriving at the net value of

assessment. However, the CFI dismissed this the estate subject to tax

counterclaim and also denied Lorenzo’s claim for

refund against the CIR, thus the case.

RABADILLA vs. CA

ISSUES :Whether the estate was delinquent in paying

the inheritance. June 29, 2000

Whether the inheritance tax be computed

from its value ten years later.

Belleza, (75) (sic) piculs of Export sugar and (25)

FACTS:

piculs of Domestic sugar, until the said Maria

Marlina Coscolluela y Belleza dies.

In a Codicil appended to the Last Will and

Testament of testatrix Aleja Belleza, Dr. Jorge

Dr. Jorge Rabadilla died. Private respondent

Rabadilla, predecessor-in-interest of the herein

brought a complaint, to enforce the provisions of

petitioner, Johnny S. Rabadilla, was instituted as a

subject Codicil.

devisee of parcel of land. The Codicil provides that

Jorge Rabadilla shall have the obligation until he ISSUE:

dies, every year to give Maria Marlina Coscolluela y

WON the obligations of Jorge Rabadilla subject Codicil were transmitted to his forced heirs,

under the Codicil are inherited by his heirs. at the time of his death. And since obligations not

extinguished by death also form part of the estate

HELD:

of the decedent; corollarily, the obligations imposed

by the Codicil on the deceased Dr. Jorge Rabadilla,

Under Article 776 of the NCC, inheritance

were likewise transmitted to his compulsory heirs

includes all the property, rights and obligations of a

upon his death.

person, not extinguished by his death. Conformably,

whatever rights Dr. Jorge Rabadilla had by virtue of

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Jurisdiction Is The Key FactorDocument6 pagesJurisdiction Is The Key Factorrhouse_1100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Notes-Executors and EstatesDocument15 pagesNotes-Executors and EstatesrmaqNo ratings yet

- NesDocument99 pagesNesMichelleBanilaEvangelista100% (1)

- CPA BEC 1 - Corporate GovernanceDocument3 pagesCPA BEC 1 - Corporate GovernanceGabrielNo ratings yet

- 10 Limitations of Government LawyersDocument11 pages10 Limitations of Government LawyersArvin RobertNo ratings yet

- Position PaperDocument7 pagesPosition PaperRaniel CalataNo ratings yet

- Case Digest COLDocument2 pagesCase Digest COLshamilleNo ratings yet

- Protest PetitionDocument3 pagesProtest PetitionMeenakshi Sharma88% (8)

- Knitjoy Manufacturing VDocument5 pagesKnitjoy Manufacturing VArvin RobertNo ratings yet

- Part 3 Case Digest Eladla de Lima vs. Laguna Tayabas CoDocument13 pagesPart 3 Case Digest Eladla de Lima vs. Laguna Tayabas CoJay-r Mercado ValenciaNo ratings yet

- Define Ostensible Agency Act orDocument3 pagesDefine Ostensible Agency Act orArvin RobertNo ratings yet

- Civil Cases Obligations With A Period To NovationDocument143 pagesCivil Cases Obligations With A Period To NovationAntonJohnVincentFriasNo ratings yet

- Sps. Franco Vs IAC..Case DigestDocument3 pagesSps. Franco Vs IAC..Case DigestMitchi Barranco100% (1)

- The Hercules Industries V SOLEDocument2 pagesThe Hercules Industries V SOLEArvin Robert100% (1)

- Freelance Writer AgreementDocument2 pagesFreelance Writer AgreementAesthetic100% (1)

- Cariño v. Insular Gov (Digest)Document1 pageCariño v. Insular Gov (Digest)Janlucifer RahlNo ratings yet

- Treaty of Paris of 1898Document2 pagesTreaty of Paris of 1898Arvin RobertNo ratings yet

- MIAA Vs CA DigestDocument2 pagesMIAA Vs CA DigestArvin RobertNo ratings yet

- RA 11232 Codal LawPhilDocument54 pagesRA 11232 Codal LawPhilArvin RobertNo ratings yet

- Petition For AdoptionDocument3 pagesPetition For AdoptionArvin RobertNo ratings yet

- Pablo LorenzoDocument2 pagesPablo LorenzoArvin RobertNo ratings yet

- Digest SuccDocument2 pagesDigest SuccArvin RobertNo ratings yet

- Sanyo PhilDocument2 pagesSanyo PhilArvin RobertNo ratings yet

- De Guzman v. Court of AppealsDocument3 pagesDe Guzman v. Court of AppealsArvin RobertNo ratings yet

- RP Indonesia Vs VizonDocument10 pagesRP Indonesia Vs VizonArvin GuevarraNo ratings yet

- RP Indonesia Vs VizonDocument10 pagesRP Indonesia Vs VizonArvin GuevarraNo ratings yet

- GoodmoralDocument1 pageGoodmoralArvin RobertNo ratings yet

- Apeco (Guevarra, Arvin)Document5 pagesApeco (Guevarra, Arvin)Arvin RobertNo ratings yet

- GoodmoralDocument1 pageGoodmoralArvin RobertNo ratings yet

- In Re EdillionDocument1 pageIn Re EdillionScribd ManNo ratings yet

- GoodmoralDocument1 pageGoodmoralArvin RobertNo ratings yet

- Sanchez Vs RigosDocument1 pageSanchez Vs RigosArvin RobertNo ratings yet

- Second Division: - Versus - AUSTRIA-MARTINEZDocument21 pagesSecond Division: - Versus - AUSTRIA-MARTINEZArvin GuevarraNo ratings yet

- Apeco (Guevarra, Arvin)Document5 pagesApeco (Guevarra, Arvin)Arvin RobertNo ratings yet

- CASE DIGEST: Victoriano Vs Elizalde Rope Workers' UnionDocument6 pagesCASE DIGEST: Victoriano Vs Elizalde Rope Workers' UnionArvin RobertNo ratings yet

- Outline Usufruct and EasementDocument10 pagesOutline Usufruct and EasementJanusz Paolo LarinNo ratings yet

- Spouses Doromal Vs CaDocument11 pagesSpouses Doromal Vs CaArvin RobertNo ratings yet

- BailDocument11 pagesBailArvin RobertNo ratings yet

- Sanchez Vs RigosDocument1 pageSanchez Vs RigosArvin RobertNo ratings yet

- Philippine Mining ActDocument13 pagesPhilippine Mining ActArvin RobertNo ratings yet

- Assignment What Is The Contract of Pledge? What Are The Requisites of A Contract of Pledge?Document9 pagesAssignment What Is The Contract of Pledge? What Are The Requisites of A Contract of Pledge?Arvin RobertNo ratings yet

- Villamil V Villarosa (G.R. 177187)Document8 pagesVillamil V Villarosa (G.R. 177187)p95No ratings yet

- 6th Week TortsDocument7 pages6th Week TortsJohn Patrick VergaraNo ratings yet

- Benjamin C. Santos & Ofelia Calcetas-Santos Law OfficesDocument8 pagesBenjamin C. Santos & Ofelia Calcetas-Santos Law OfficesAnonymousNo ratings yet

- BAR Ques Oct 2017Document4 pagesBAR Ques Oct 2017Meenacshi RamgutteeNo ratings yet

- Cleaves v. American Management Services Central, L. L. C. Et Al - Document No. 3Document2 pagesCleaves v. American Management Services Central, L. L. C. Et Al - Document No. 3Justia.comNo ratings yet

- Euthanasia and The LawDocument3 pagesEuthanasia and The LawbhagatNo ratings yet

- G.R. No. 154689 Unicorn Safety and OthersDocument23 pagesG.R. No. 154689 Unicorn Safety and OthersAnonymous suicwlwNo ratings yet

- Ballb SyllabusDocument74 pagesBallb SyllabusRaza KhanNo ratings yet

- 23 SCRA 1183 - Civil Law - Land Titles and Deeds - Systems of Registration Prior To PD 1529 - Spanish TitlesDocument19 pages23 SCRA 1183 - Civil Law - Land Titles and Deeds - Systems of Registration Prior To PD 1529 - Spanish TitlesRogie ToriagaNo ratings yet

- United States Air Force Court of Criminal AppealsDocument9 pagesUnited States Air Force Court of Criminal AppealsScribd Government DocsNo ratings yet

- Jones V Padavatton (1969) :: No ContractDocument2 pagesJones V Padavatton (1969) :: No ContractheretostudyNo ratings yet

- And Contempt: For Media Law and Ethics by Ana Marie Quijano-Benedicto and Nons SuperableDocument23 pagesAnd Contempt: For Media Law and Ethics by Ana Marie Quijano-Benedicto and Nons SuperablebobbyrickyNo ratings yet

- 28 Usc 2201 CaseDocument3 pages28 Usc 2201 CaseravenmailmeNo ratings yet

- Crim Pro Case Digest Assignment Report - RojasDocument2 pagesCrim Pro Case Digest Assignment Report - RojasNika RojasNo ratings yet

- GR No L 44485Document4 pagesGR No L 44485Ranger Rodz TennysonNo ratings yet

- Encarnacion V CADocument2 pagesEncarnacion V CADeaNo ratings yet

- Tully v. IDS/American Express, 4th Cir. (2003)Document8 pagesTully v. IDS/American Express, 4th Cir. (2003)Scribd Government DocsNo ratings yet

- Application Form For Verification of Other Backward Class ToDocument7 pagesApplication Form For Verification of Other Backward Class Toprashant mhatreNo ratings yet