Professional Documents

Culture Documents

2019-09-16-NHAI-IDHHL-1363-Standard Operating Procedure of HAM Concessionaires Due To Change in Law of Introduction of GST Act, 2019

2019-09-16-NHAI-IDHHL-1363-Standard Operating Procedure of HAM Concessionaires Due To Change in Law of Introduction of GST Act, 2019

Uploaded by

Nagaraj Patil0 ratings0% found this document useful (0 votes)

80 views11 pagesOriginal Title

2019-09-16-NHAI-IDHHL-1363-Standard Operating Procedure of HAM Concessionaires due to change in law of introduction of GST act, 2019

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

80 views11 pages2019-09-16-NHAI-IDHHL-1363-Standard Operating Procedure of HAM Concessionaires Due To Change in Law of Introduction of GST Act, 2019

2019-09-16-NHAI-IDHHL-1363-Standard Operating Procedure of HAM Concessionaires Due To Change in Law of Introduction of GST Act, 2019

Uploaded by

Nagaraj PatilCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 11

onda wets warant wrfreacot Phone : 08194-22334

(age afar site rol Sara) E-mail : chi@nhai.org

aftdiverarataaa arg, 3.08. 8.2. B ai, nhaipiucta@gmail.com

Ree (TTE.AY) (Prt, 202) Rag - 489 403, wale. yaaa

y)

National Highways Authority of India etn

(Ministry of Road Transport and Highways) rouoapaceren

seria . r 4 202), Chitadurga ornate

NHAL/PIU-CPRIO°Eaning CTA BVE]3O1 5-38 788) 469 1 CN TTS 16-08220 19

To

M/s.PNC Chitradurga Highways Pvt. Ltd., M/s.TPF Getinsa Euroestudios S.L.

“Camp No.1, Sy. No.11/P1 & 12, In Association with Segmental Consulting

Secbara Village, Hireguntanur (Hobli), & Infrastructure Advisory (P) Ltd.

Chitradurga - 877 502. Chitradurga- 577502,

/sIRCON Davangere Haveri Highway M/s.Aarvee _—Associates_-—Architects

Ltd., House No.825/2, Plot No.35/36, 8% Engineers & Consultant Pvt, Ltd.,

Cross, 10 Main, Mruthunjaya Nagar, Ranebennuru-581 115.

Ranebennur ~ 581 115.

M/s. DBL Byrapura Chalakere Pvt. Ltd. M/s.TPF Getinsa Buroestudios S.L.

Challakere. In Association with Segmental Consulting

& Infrastructure Advisory (P) Ltd

Challakere.

Standard Operating Procedure for HAM Concessionaires due to Change in Law on

account of introduction of GST Act, 2017 - Reg.

Ref: NHAI HQ, New Delhi Policy Circular No.03.03.20/2019, Dt.29-07-2019 [(Decision

Taken on File No.NHAI/F&A/GST/2018-19/SM (Vol.II)]

Sir,

Please find enclosed a copy of the Circular cited, wherein, NHAI HQ, New Delhi

has issued a Policy Circular i.e. Standard Operating Procedure for HAM projects, due to

Change in Law on account of introduction of GST Act, 2017.

‘The above Policy Circular shall be applicable for HAM projects only, where the last

date for submission of bids was on or before 30-06-2017. For the projects, where last

date of submission of bids was on or after 01-07-2017 on Hybrid Annuity Mode, no

Change in Law would be applicable.

In this regard, NHAI HQ, New Delhi, vide Policy Circular cited, submitted a

example for calculation of relief due to Change in Law on account of introduction of GST

for HAM Project.

This is for your kind information and taking further action in the matter.

Thanking you,

Yours faithfully,

Nao did

(D Stinivasulta Naidu)

GM (Tech) &Project Director,

NHAI, PIU, Chitradurga.

Copy to:

RO, NHAI, Bangalore - for information please.

manent inn enoneonvenatnyentiy enn naumnePNC.AOCK

Corp. Office : G-5&6, Sector 10, Dwarka, New Delhi-110 075, Ph : 011-25074100/25074200, Website : www.nhal.gov.in

case atret att osrrt Fare) BAR) Fax: 91-11-25093507 / 25009514

National Highways Authority of India

(Ministry of Road Transport and Highways)

‘vis wa 6, Saet-10, weH, 3 Reet-110075

6.5 &6, Sector10, Dwar, New Deh: 1007S

NHAW/Policy/Finance/Accounting and Taxes/2019

No. 03.03.20/2019 dated the 29" July, 2019

[Decision taken on File No. NHAI/FEA/GST/2018-19/SM (Vol. II]

Subject: - Standard Operating Procedure for HAM Concessionaires due to Change in Law on

account of introduction of GST Act, 2017 - reg.

Background ‘

@. Goods and Service Tax Act, 2017 has been implemented in India with effect from

01.07.2017. The Act has subsumed various Indirect Taxes of both the Central & State

Governments, such as Central Excise Duty, Service Tax, Central Sales Tax (CST) / State

Value Added Tax (VAT), Additional Custom Duty (CVD) and Special Additional Duty (SAD)

apart from Entry Tax and Octroi Charges etc.

b, Subsequently, the NHAI had issued Standard Operating Procedures (SOP) for implementation

of GST Act, 2017 on EPC Contract Payments. Accordingly, excel based templates for

calculation of effect of GST incidence have been uploaded on public domain, i.e., NHAl

website,

¢. In the above SOP, NHAl had also approved payment of GST treating the Construction Support

of 40% in line with EPC Payments.

Applicability

This SOP is only applicable for HAM projects where the last date for submission of bids was

on or before 30.06.2017. For the projects where last date of submission of bids was on or

after 01.07.2017 on Hybrid Annuity Mode, no Change in Law would be applicable,

Relevant Clauses of the Concession Agreement

As per Article 35.1 of the Model Concession Agreement for HAM projects:

“Increase in casts

If as a result of Change in Law, the Concessionaire suffers an increase in costs or reduction

in net after-tax return or other financial burden, the aggregate financial effect of which

exceeds the higher of Rs. 1 crore (Rupees one crore) or 2% (two per cent) of the total

Annuity Payments in any Accounting Year, the Concessionaire may so notify the Authority

and propose amendments to this Agreement so as to place the Concessionaire in the

same financial position as it would have enjoyed had there been no such Change in Law

resulting in increased costs, reduction in return or other financial burden as aforesaid...”

ALPIU-CHUTRADURGA

nase ere

ENE yh

Further, Clause 23.1 of the Model Concession Agreement states that:

“The Parties further agree that the Bid Project Cost. specified hereinabove for payment

to the Concessionaire shall be inclusive of the cost of construction, interest during

construction, working capital, physical contingencies and all other costs, expenses and

charges for and in respect of construction of the Project, save and except any additional

costs arising on account of variation in Price Index, Change of Scope, Change in Law,

Force Majeure or breach of this Agreement, which costs shall be due and payable to the

Concessionaire in accordance with the provi

Process for release of payment due to “Change in Law” on implementation of GST

The following process shall be followed for release of payment to the Concessionaires of HAM

Projects due to Change in’'Law on account of implementation of GST:

1. The Concessionaire will issue a letter fo the Authority notifying that a Change in Law has

occurred. The Concessfonaire shall. also propose amendments to this Agreement so as to

place the Concessionaire in the'same financial position as it would have ehjoyed had there

been no such Change in Law.

2. Representatives from the Authority and the Concessfonaire shall. meet soon reasonably as

practicable but no later than 30 (thirty) days from the date of notice and either agree on

amendments to this Agreement or on any other mutually agreed arrangement. In the

present case SOP may be agreed by the Concessionaire.

3. The Concessionaire shall subjriit thé breakup of {ts Bid Project Cost (BPC) into compotients

which attract GST, and components which: do not attract GST, in the excel format. Such

breakup should match the details provided in the Firtancial Agreements and Financial Model

submitted at the time of Financial Close.

4, The Cohcessionaire shall submit relevant copies of GSTR 1 and GSTR 3B. The concessionaire

shall further submit a detailed breakup of components of EPC, cost under different major

heads (like Aggregates, Steel, Cement, Bitumen’etc...), and taxes applicable thereon prior to

30.06.2017.

5. A detailed calculation of impact of Change in Law due to introduction of GST so calculated

in the excel format, along with a certificate from the Statutory Auditor, will be submitted

by the Concessionaire to NHAI and the Independent Engineer.

6. As per GST Act, Profit component does not comes under the Negative list of items; hence,

GST is applicable on the Profit component.

7. The following templates are enclosed for calculation of GST impact-

a. Excel template for bifurcation of GST components (Annexure -1)

\y

10.

1.

12.

13.

14,

15,

16.

17.

b. Excel template for Project Constituents - separately for Composite/Regular Output

VAT Assessment (Annexure -Il)

c, Example for calculation of relief due to change in taw on account of introduction of

GST for HAM Project (Appendix-1) and calculation of impact for change in law due to

GST to be released (Appendix-Il)

The Independent Engineer will certify the quantities and work done details provided in the

detailed calculation submitted by the Concessionaire

The concerned RO / PD will cross-check the calculations submitted by the Concessionaire

and release the amount calculated. RO/PD may ask the Concessionaire to provide electronic

credit ledger by’showing the amount of input tax credit availed by Concessionaire.

). The Percentage band for each component of work in a project (Ref. Annex-lI of the Excel

Templates) should be considered based on the IE’s assessment on final cost components of

works in each project and approved by the concerned PD & RO

At the time of Completion of Construction, before issuance of PCOD/COD, Concessionaire

shall make a comprehensive reconciliation statement for GST at their end by following the

procedure mentioned above,

Once GST fs paid, it would riot be considered for revised Bid Project Cost and shall not form

a part of annuities payments.

The component distribution and percentage taxes as provided in the excel sheet are

indicative/notional only. Project specific components and lax rales are lo be recorded

properly as input in the excel sheet.

The concessioner at the time of claiming payments for each milestone, must submit the

authenticated copy of GST return submitted for last quarter and also declare any

amendment/revision made for earlier returns.

. Complete reconciliation to be made before payment of the GST amount for last milestone.

The Project Director must ensure, if there is any reduction in cost on implementation of

GST. In such cases recovery is to be effected,

GST to be paid to the Concessionaire after providing a copy of GSTR 1 and GSTR 38. Further,

comprehensive guidelines for submission of required documents against proof of deposition

of GST has already been mentioned in NHAl policy circular no, 3.3.18/2017 dated

14.11.2017. If input tax credit is availed by the Concessionaire, Concessionaire may be

asked to provide electronic credit ledger by showing the amount of input tax credit availed

by Concessionaire.

\s

18. PIUs shall be advised to send the GST liability calculation file to GST cell, NHAI HQ for

further scrutiny and vetting by GST Consultant. However, payment shall be released by

respective PIUs with the approval of RO concerned. All the calculations as per Annexure and

‘Appendix as per Para 7 above along with supporting documents duly certified by

PD/RO/IE/Concessionaire shall be forwarded for ‘in principle approval’ of HQ before fifteen

days prior to certification/payment to be released against Milestone, payment as per the

provision mentioned under Clause No. 23.4 of NCA.

49. The payment: made. urider “Change in Law”, as per the terms of Concession Agreement, is

subject to anti-profiteering clause as per'the GST Act, 2017.

20. In case of any clarifications, RO/PD shall contact NHAl H@.for further guidance/direction.

eu

(sibs fan Nayak)

CGM (FA)

This issues with the approval of the Competent Authority.

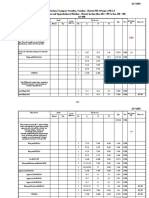

Appendix-1

Example for calculation of relief due to Change in Law on account of

introduction of GST for HAM Projects

Bid Project Cost: Rs. 999 Crores

Components of Bid Project Cost which do not attract GST:

ay pleas iseie) ii Evitetine

foie)

1 Interest During Construction 64: |

z Notional profit element/yield on equity/any other direct or B |

indirect return to the Concessionaire |

Total 7 7

Components of Bid Project Cost which attract GST:

zien

RE:

finer)

1 EPC Cost including Contingencies, price escalation, and other expenses 881

as per Financing Agreements

Operative Expenses

Financing Charges

Total

(5 Add: GST on adjusted value of work done (refer to attached excel sheet)

impact of Change in Law (5)-(4) oe -

Note : The amount of GST payments towards impact of Change of Law to be paid considering the %

of milestone based payment as defined under Concession Agreement Clause No. 23.4 of MCA.

\s

ov

_"Poseotou 99 Neus qunowe 3oU94y Atuo puE '4e9A BuRUNODDY Y>LE Wl 91019 191.AGF ccd)

StL 6iZb ayeg_suoieiado

612) 02-6402 S2\_ 5 6VLE JO ZL JeD4SWIWOD

selec

SBUS'%__61-8L07, 289K LS GHEE IO Gb e10z 101 406 g BUOISONW

SL6t'b

SL62' 64-8102) SPA = GIL) J0 xGz. BlOz‘OL'oz sep sunisoy

| sez | ser

CAO BERE | 6b BOZO SPA OLE JO KOR | f gloz'so'sh xs € auoIsOyWy

aEr't = j acre

br Qey'E BbLbO% SA ONL IO MOT Hafod PIGJONE —_LLOT LOE OE Zauoyseny,

(e107 oy sold 6bLL 49 08 “Sy

Nie SELIOZ SEP S2IOAU!) "ON = 6121400 | ald pla ORB! ZL07"Y0"0E J auoasony,

spaseaja. aq 0} 1s9 oy anp Mey UL aBUeYD Jo edu Jo LOREINDTe)

Ixipuaddy

mee a ta

aansop [ejoueny urnp peaoadde pee axeuorsseu09|

arp Aq parmugns [spo (epUEUIY axp sad se uoxEY aq [peys S09 9141

Rational Highways Authority of india

canpoaie = Ammen

Project Contras date

serene

Payment OTE

ear

Tacoma com [Pacer] We ova] Pas camel te S070 | Paypeiscaine’ | Spams | wanes

ec sonzorrriee| osemee. | sevceto

Werner [ater ota be rdere:

foto danztt| rnceresits ial cat ee

ana ape ise

gia omar ae.

tobe) |

Grom gal aioe

foes conttuents Parcentone mn lo

ere vaso cor aa]

Sliema at a3

eo ts a 5.

ics om

ean cake ejay ox

ames

Tse

iene

viene

lPs

yes aoa

lstimpleatins Fr baleen contpue | sce pac

: Sectoat eh

[exore PaRAETT

refs

filcone

age Se

Pe

een aro

ala

fr [ent or OR

a

[as

[ieee

[eR

lancet

[srs oar Tees

(Seeman)

tt wr ope ae ot 15 The Component Taxes eaten. aso be poe pcan my eps

en Ise say

patton Mra CHT ae]

esange in sess

2 Tecate of tas rE CT NAT ae oe tered

{Tae fo VAT/Outut VAT are 5 maybe apleale o reneive sates

‘These of sng socks are a conde ut to competes ees

erty Engines Project bee

Tia

in pa 8 nero Fat

ea

io BP

npn for bce

es yt

‘o

lar

ere

maori ot ia

ren cs RET

Peace

5)8\ alla slale)

werest | oat | eon

feat | | Toes

2 Tere uv v0up Vasey Dept mpi ae

{ht nat nga cn ects iad

1 re aor tenes tno ttn b pet wean ce

‘Labour and aie hrs Cla por he deta hen below

sh priang 9ereprvae In ae 8

alti scanner °

7 p14 VAT as per the ets given below

Shatner ae es ne ain

\

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Monthly Progress ReportDocument38 pagesMonthly Progress ReportNagaraj Patil100% (1)

- 243_FileM61433586 consultancy bid document STMCDocument103 pages243_FileM61433586 consultancy bid document STMCNagaraj PatilNo ratings yet

- 9 4 27Document2 pages9 4 27Nagaraj PatilNo ratings yet

- Public Authorities Under DRDO March 2020Document4 pagesPublic Authorities Under DRDO March 2020Nagaraj PatilNo ratings yet

- 1966 Rev-01 Delay Analysis Hospet Chitradurga-PSS - 21.8.20Document33 pages1966 Rev-01 Delay Analysis Hospet Chitradurga-PSS - 21.8.20Nagaraj PatilNo ratings yet

- Chatra BOQ - Balance Civil Works - 11.04.2022Document18 pagesChatra BOQ - Balance Civil Works - 11.04.2022Nagaraj PatilNo ratings yet

- Bridges 22+381Document20 pagesBridges 22+381Nagaraj PatilNo ratings yet

- MFC Hubli Final Bill Jan 2013Document12 pagesMFC Hubli Final Bill Jan 2013Nagaraj PatilNo ratings yet

- Bridges 03+890Document10 pagesBridges 03+890Nagaraj PatilNo ratings yet

- Tech BidDocument98 pagesTech BidNagaraj PatilNo ratings yet

- Bill of Quantities For Pkg. 1B - Km. 275+600 To 282+450: Bill No.1: Traffic During ConstructionDocument6 pagesBill of Quantities For Pkg. 1B - Km. 275+600 To 282+450: Bill No.1: Traffic During ConstructionNagaraj Patil100% (1)

- Quotation SioloamDocument1 pageQuotation SioloamNagaraj PatilNo ratings yet

- 28 - SuperpaveDocument10 pages28 - SuperpaveNagaraj PatilNo ratings yet

- Ham-2015.12.01-Hybrid Annuitymodel For ImplementingDocument7 pagesHam-2015.12.01-Hybrid Annuitymodel For ImplementingNagaraj PatilNo ratings yet

- Rti Request Details (आरटीआई अनुरोध िववरण) : Transferred From (से थानांत रत)Document1 pageRti Request Details (आरटीआई अनुरोध िववरण) : Transferred From (से थानांत रत)Nagaraj PatilNo ratings yet