Professional Documents

Culture Documents

IUMC - Management Accounting - Fall 2019 - Quiz

Uploaded by

M Usama Ahmed KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IUMC - Management Accounting - Fall 2019 - Quiz

Uploaded by

M Usama Ahmed KhanCopyright:

Available Formats

Managerial

IQRA University, Main Campus, Karachi Accounting

Quiz 3A

Name of Student: ___________________________________; Reg. ID : _______________________________

Question: Special Order Decision

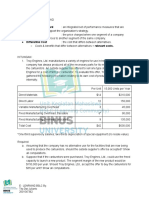

Kneller Co. manufactures and sells medals for winners of athletic and other events. Its manufacturing plant has the

capacity to produce 23,000 medals each month; current monthly production is 10,000 medals. The company

normally charges $82 per medal. Cost data for the current level of production are shown below:

Variable costs: $

Direct materials 397,500

Direct labor 127,200

Selling and administrative 20,600

Fixed costs:

Manufacturing 118,800

Selling and administrative 65,000

The company has just received a special one-time order for 400 medals at $63 each. For this particular order, no

variable selling and administrative costs would be incurred. This order would also have no effect on fixed costs.

However, for this special one-time order a specific cutter machine to emboss logo will be required which may be

rented for $ 1500 for required period. Assume that direct labor is a variable cost.

Required: Should the company accept this special order?

Managerial

IQRA University, Main Campus, Karachi Accounting

Quiz 3B

Name of Student: ___________________________________; Reg. ID : _______________________________

Question: Production under Constrained Resources

Glover Company makes three products in a single facility. These products have the following unit product costs:

Product

A B C

Direct materials $ 35.10 $ 51.60 $ 58.00

Direct labor 22.50 25.10 15.90

Variable manufacturing overhead 2.30 1.70 1.60

Fixed manufacturing overhead 12.20 7.80 8.40

Unit product cost $ 72.10 $ 86.20 $ 83.90

Additional data concerning these products are listed below.

Product

A B C

Mixing minutes per unit 1.30 0.80 0.20

Selling price per unit $ 81.00 $ 103.40 $ 96.90

Variable selling cost per unit $ 2.90 $ 3.40 $ 3.20

Monthly demand in units 3100 4400 2400

The mixing machines are potentially the constraint in the production facility. A total of 7930 minutes are available

per month on these machines. Direct labor is a variable cost in this company.

Required:

a. How many minutes of mixing machine time be required to satisfy demand for all three products?

b. How much of each product should be produced to maximize net operating income?

A B C

Optimal production

c. Up to how much should the company be willing to pay for one additional hour of mixing machine time if the company

has made the best use of the existing mixing machine capacity?

You might also like

- Cost & Managerial Accounting II EssentialsFrom EverandCost & Managerial Accounting II EssentialsRating: 4 out of 5 stars4/5 (1)

- Question - Parallel Quiz - Final Term - Cost Accounting 22 - 23Document6 pagesQuestion - Parallel Quiz - Final Term - Cost Accounting 22 - 23Gistima Putra JavandaNo ratings yet

- Imba Case 3: Situation OneDocument6 pagesImba Case 3: Situation OneK IdolsNo ratings yet

- 2014 - Quiz 3Document12 pages2014 - Quiz 3rohitmahato10No ratings yet

- QUIZ 2 - SEO optimized titleDocument5 pagesQUIZ 2 - SEO optimized titleAkshit GoyalNo ratings yet

- Final 20151Document13 pagesFinal 20151Giner Mabale StevenNo ratings yet

- 2019 7010 3C Cost and Management Accounting PDFDocument6 pages2019 7010 3C Cost and Management Accounting PDFMuabecho FatimatuNo ratings yet

- Section C Part 2 MCQDocument344 pagesSection C Part 2 MCQSaiswetha BethiNo ratings yet

- Assignment 3Document3 pagesAssignment 3solomon adamuNo ratings yet

- UTS Akuntansi Manajemen - MM 2023Document1 pageUTS Akuntansi Manajemen - MM 2023Zahra AtyasNo ratings yet

- Pma Test 1 2022Document6 pagesPma Test 1 2022Janielle LambertNo ratings yet

- Individual assignment (Fall 2023)2.docx2Document10 pagesIndividual assignment (Fall 2023)2.docx2RealGenius (Carl)No ratings yet

- VM Costing ImpDocument22 pagesVM Costing ImpSinsNo ratings yet

- Exam 19111Document6 pagesExam 19111atallah97No ratings yet

- Application of Marginal Costing in Decision Making-Questions Example 1: Make or BuyDocument3 pagesApplication of Marginal Costing in Decision Making-Questions Example 1: Make or BuyDEVINA GURRIAHNo ratings yet

- Individual assignment (Fall 2023)2Document11 pagesIndividual assignment (Fall 2023)2RealGenius (Carl)No ratings yet

- MAs and Cost 2Document17 pagesMAs and Cost 2VtgNo ratings yet

- 106fex 2nd Sem 21 22Document9 pages106fex 2nd Sem 21 22Trine De LeonNo ratings yet

- Acct 2 0Document9 pagesAcct 2 0Kamran HaiderNo ratings yet

- 8a Acct2112 Week 8 Tute Q & S Ic s2 2023Document8 pages8a Acct2112 Week 8 Tute Q & S Ic s2 2023z8gss49hf4No ratings yet

- The Islamic University of Gaza Faculty of Commerce Department of AccountingDocument8 pagesThe Islamic University of Gaza Faculty of Commerce Department of AccountingAhmed RazaNo ratings yet

- Muhammad Farid - Assignment 2Document2 pagesMuhammad Farid - Assignment 2Farid ChanchadNo ratings yet

- Model Solution - Assessment 2Document12 pagesModel Solution - Assessment 2rajeshkinger_1994100% (2)

- MCQsDocument3 pagesMCQsVikas guptaNo ratings yet

- MA2 (100 QS)Document30 pagesMA2 (100 QS)Alina NaeemNo ratings yet

- Ca 1Document2 pagesCa 1Alex LagmanNo ratings yet

- Intro To Cost AccountingDocument4 pagesIntro To Cost AccountingdollymbaikaNo ratings yet

- Optimum production levels of two products (39 charactersDocument16 pagesOptimum production levels of two products (39 charactersBilal KhalidNo ratings yet

- 602 Assignment 1Document8 pages602 Assignment 1Irina ShamaievaNo ratings yet

- Coverage of Learning ObjectivesDocument50 pagesCoverage of Learning ObjectivesMeNo ratings yet

- Paper 1 CA Inter CostingDocument8 pagesPaper 1 CA Inter CostingtchargeipatchNo ratings yet

- ACC10007 Sample Exam 2Document9 pagesACC10007 Sample Exam 2dannielNo ratings yet

- Bài Tập Tự LuậnDocument5 pagesBài Tập Tự Luậnhn0743644No ratings yet

- Maximize profit from make-or-buy decisionDocument3 pagesMaximize profit from make-or-buy decisionLula BellaNo ratings yet

- EXAM REVIEWDocument5 pagesEXAM REVIEWFredie LeeNo ratings yet

- Manacc Ans KeyDocument4 pagesManacc Ans KeyJimmer CapeNo ratings yet

- Lec7 ExerciseDocument5 pagesLec7 Exercise29 4ANo ratings yet

- BREAK EVEN ANALYSISDocument7 pagesBREAK EVEN ANALYSISZubair JuttNo ratings yet

- BUACC2614Document6 pagesBUACC2614SanjeevParajuliNo ratings yet

- Labour-PQDocument5 pagesLabour-PQRohaib MumtazNo ratings yet

- Sample PaperDocument7 pagesSample PapertusharNo ratings yet

- Managerial Accounting PDFDocument8 pagesManagerial Accounting PDFMeryana DjapNo ratings yet

- Activity Based Costing ER - NewDocument14 pagesActivity Based Costing ER - NewFadillah LubisNo ratings yet

- Latihan Soal Akmen CH 6 Variable CostDocument2 pagesLatihan Soal Akmen CH 6 Variable CostregitaNo ratings yet

- Exam 21082011Document8 pagesExam 21082011Rabah ElmasriNo ratings yet

- ACC 3200 Quiz 8Document7 pagesACC 3200 Quiz 8Jazzel MartinezNo ratings yet

- Cost Accounting: T I C A PDocument5 pagesCost Accounting: T I C A PShehrozSTNo ratings yet

- Assignment Based Cost Accounting Final Term Question PaperDocument8 pagesAssignment Based Cost Accounting Final Term Question PaperQadirNo ratings yet

- Exercise 5-25 Activity Levels and Cost Drivers: RequiredDocument20 pagesExercise 5-25 Activity Levels and Cost Drivers: RequiredDilsa JainNo ratings yet

- QP MBA FINANCIAL AND MANAGEMENT ACCOUNTING 803FI0C002 Trimester I Cjj8nC4tr8Document5 pagesQP MBA FINANCIAL AND MANAGEMENT ACCOUNTING 803FI0C002 Trimester I Cjj8nC4tr8Rushil JoshiNo ratings yet

- MCQ 1-Questions f5 AccaDocument6 pagesMCQ 1-Questions f5 AccaAmanda7100% (1)

- MFA - Assessment - 2 - SolutionDocument12 pagesMFA - Assessment - 2 - Solutionvishnu kanthNo ratings yet

- Accounting and FinanceDocument6 pagesAccounting and FinanceAisha KhanNo ratings yet

- 3 Soal AMB - Des2018Document4 pages3 Soal AMB - Des2018Try WijayantiNo ratings yet

- BA 7000 Study Guide 1Document11 pagesBA 7000 Study Guide 1ekachristinerebecaNo ratings yet

- Cma Final 2017 18Document3 pagesCma Final 2017 18BrijmohanNo ratings yet

- 820001-Cost and Management AccountingDocument4 pages820001-Cost and Management AccountingsuchjazzNo ratings yet

- Accounting 311 Exam #2Document3 pagesAccounting 311 Exam #2Karmel CadizNo ratings yet

- Assgnment 2 (f5) 10341Document11 pagesAssgnment 2 (f5) 10341Minhaj AlbeezNo ratings yet

- Liveloud SongsheetDocument20 pagesLiveloud SongsheetMhay Lee-VillanuevaNo ratings yet

- Programme VDZ CongressDocument2 pagesProgramme VDZ CongresssaeedhoseiniNo ratings yet

- DeweyDecimalClassificationChart PDFDocument1 pageDeweyDecimalClassificationChart PDFAdrian ValdesNo ratings yet

- Weekly Home Learning Plan: Placido T. Amo Senior High SchoolDocument12 pagesWeekly Home Learning Plan: Placido T. Amo Senior High SchoolMary Cherill UmaliNo ratings yet

- Lgesp - Pura Neguma Reference Manual For Project StaffDocument62 pagesLgesp - Pura Neguma Reference Manual For Project StaffmuthunayakeNo ratings yet

- Case Brief On R. v. Williams (1998) 1 S.C.R1. 1128Document5 pagesCase Brief On R. v. Williams (1998) 1 S.C.R1. 1128baba toundeNo ratings yet

- NACH FormDocument1 pageNACH FormPrem Singh Mehta75% (4)

- Regulations & Syllabus - Executive Mba: © ONLINE CAMPUS, Bangalore - 79 WebsiteDocument12 pagesRegulations & Syllabus - Executive Mba: © ONLINE CAMPUS, Bangalore - 79 WebsitepunNo ratings yet

- Triple broadband invoice duplicateDocument1 pageTriple broadband invoice duplicateJatin BansalNo ratings yet

- Kap 04 SparskruvarDocument17 pagesKap 04 SparskruvarbufabNo ratings yet

- Fabrication Procedure FlowDocument3 pagesFabrication Procedure FlowtrikjohNo ratings yet

- Pre-Employment Issues: by Group-6Document8 pagesPre-Employment Issues: by Group-6Debabratta PandaNo ratings yet

- The Science of Cop Watching Volume 004Document1,353 pagesThe Science of Cop Watching Volume 004fuckoffanddie23579No ratings yet

- Write To MD Complain Report3Document85 pagesWrite To MD Complain Report3Abhishek TiwariNo ratings yet

- Engineering Guide-Fans BlowerDocument4 pagesEngineering Guide-Fans BlowershaharyarNo ratings yet

- AMA - Australias Forest Industries at A GlanceDocument2 pagesAMA - Australias Forest Industries at A GlanceCarlos D. GuiradosNo ratings yet

- PR2012Mar8 - Leveraging Success From North East Asia To South East AsiaDocument2 pagesPR2012Mar8 - Leveraging Success From North East Asia To South East AsiaMrth ThailandNo ratings yet

- Lopez (Bussiness Meeting)Document2 pagesLopez (Bussiness Meeting)Ella Marie LopezNo ratings yet

- Rate Analysis m25Document2 pagesRate Analysis m25Biswajit Sinha100% (4)

- Hometown Brochure DesignDocument2 pagesHometown Brochure DesignTiffanymcliu100% (1)

- HistDocument1 pageHistapi-264492794No ratings yet

- US V RuizDocument2 pagesUS V RuizCristelle Elaine ColleraNo ratings yet

- Symbolism: Luzon Visayas MindanaoDocument2 pagesSymbolism: Luzon Visayas MindanaoOrlando Mangudadatu SaquilabonNo ratings yet

- Tahseen ShahDocument2 pagesTahseen ShahMuzafferuddin AhmedNo ratings yet

- Ebook - Asphalt Pavement Inspector's ManualDocument156 pagesEbook - Asphalt Pavement Inspector's Manualuputsvo52No ratings yet

- Robert Louis Stevenson (1850-1894)Document7 pagesRobert Louis Stevenson (1850-1894)Lorenzo MessinaNo ratings yet

- Ople VS Torres FullDocument11 pagesOple VS Torres FullKDNo ratings yet

- Medieval IndiaDocument61 pagesMedieval IndiaRahul DohreNo ratings yet

- Sin Missing The MarkDocument2 pagesSin Missing The MarkCeray67No ratings yet

- Understanding The Mindanao ConflictDocument7 pagesUnderstanding The Mindanao ConflictInday Espina-VaronaNo ratings yet