Professional Documents

Culture Documents

Government Grants

Uploaded by

Jason COriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Government Grants

Uploaded by

Jason CCopyright:

Available Formats

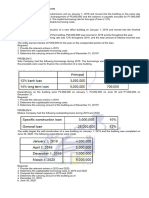

GOVERNMENT GRANTS

Entity Z received the following grants on January 7, 2019:

1. P1,000,000 cash conditioned on the acquisition of equipment.

2. Land with fair value of P800,000 conditioned on the construction of a building on the land.

3. P600,000 cash as aid on a planned environmental project – a clean up drive in coastal areas within the

community.

4. P200,000 cash as aid on losses incurred from a recent typhoon.

The following transactions occurred in 2019 after the receipt of the grants:

a. Equipment was acquired for P1,200,000 on March 4, 2019. The equipment was assessed to have a 5-year useful

life and a 10% residual value. Entity Z uses the straight-line method of depreciation.

b. Construction of a building on the land received from the government was started. Total construction costs

incurred amounted to P2,000,000. The building was finished on August 10, 2019 and is estimated to have a

useful life of 30 years and a residual value of 300,000.

c. The clean up drive was started in 2019. Total costs incurred in 2019 amounted to P200,000. Estimated costs to

be incurred in the future is P520,000.

In 2020, clean-up costs were incurred amounting to 240,000. Estimated costs to be incurred in the future is P230,000.

On January 13, 2021, the government demanded repayment of the P600,000 cash given as grant. The entity repaid the

grant on the same date.

On August 5, 2021, the government demanded repayment of the P1,000,000 given as cash grant due to compliance

issues. The entity made the repayment on the same date.

Required:

1. Prepare the journal entries in 2019, 2020, and 2021 under:

a. Gross presentation.

b. Net presentation.

2. Compute the amount of government grant recognized as income in:

a. 2019.

b. 2020.

c. 2021.

3. What is the carrying amount of the equipment on December 31, 2021?

4. What is the carrying amount of the building as of December 31, 2021?

5. What is the deferred income on government grant as of December 31, 2021?

You might also like

- Chapter 10 - Government Grant Defraying Safety Problem 1: Answer KeyDocument5 pagesChapter 10 - Government Grant Defraying Safety Problem 1: Answer KeyMark IlanoNo ratings yet

- CHAPTER 25 - Borrowing CostsDocument6 pagesCHAPTER 25 - Borrowing CostsRosee D.No ratings yet

- 1 - Exercises On Relevant Cost 1Document7 pages1 - Exercises On Relevant Cost 1Temesgen AbezaNo ratings yet

- MODULE 2: Government Grants & Government AssistanceDocument2 pagesMODULE 2: Government Grants & Government AssistancePauline Joy GenalagonNo ratings yet

- Quiz 1 Lump Sum Liquidation Answer Key PeresDocument7 pagesQuiz 1 Lump Sum Liquidation Answer Key PeresChelit LadylieGirl FernandezNo ratings yet

- Beldad - Assignment No. 2 - BSOA 3CDocument2 pagesBeldad - Assignment No. 2 - BSOA 3CMarjorie BeldadNo ratings yet

- Assignment 2.1 AccountingDocument7 pagesAssignment 2.1 AccountingColine DueñasNo ratings yet

- Notes Payable and Debt-RestructuringDocument15 pagesNotes Payable and Debt-RestructuringkyramaeNo ratings yet

- Practical AccountingDocument13 pagesPractical AccountingDecereen Pineda RodriguezaNo ratings yet

- Accounting For Promissory Notes-WITH ANSWERS ON CLASSROOM EXERCISES PDFDocument56 pagesAccounting For Promissory Notes-WITH ANSWERS ON CLASSROOM EXERCISES PDFGio DavidNo ratings yet

- ACFAR 2132 PAA1 InventoriesDocument15 pagesACFAR 2132 PAA1 InventoriesGabrielle Joshebed AbaricoNo ratings yet

- Chap 004 BDocument72 pagesChap 004 BJessica ColaNo ratings yet

- De LeonDocument6 pagesDe Leoncristina seguinNo ratings yet

- Smartbooks Lea Victoria PronuevoDocument72 pagesSmartbooks Lea Victoria PronuevoLEA VICTORIA PRONUEVONo ratings yet

- Investagrams Virtual Trading RIVERADocument3 pagesInvestagrams Virtual Trading RIVERACarlo RiveraNo ratings yet

- College of Accountancy: Midterm Examination in Financial Accounting and ReportingDocument6 pagesCollege of Accountancy: Midterm Examination in Financial Accounting and ReportingALMA MORENANo ratings yet

- Basic Concepts of Government AccountingDocument10 pagesBasic Concepts of Government AccountingLyra EscosioNo ratings yet

- Quiz On Partnership FormationDocument2 pagesQuiz On Partnership FormationVher Christopher DucayNo ratings yet

- RIVERA, Lyka A. (Assign 4 - Law)Document4 pagesRIVERA, Lyka A. (Assign 4 - Law)Lysss EpssssNo ratings yet

- 2ND Auditing ExamDocument11 pages2ND Auditing ExamAsfawosen DingamaNo ratings yet

- AE10 - Chapter 10 ReportingDocument30 pagesAE10 - Chapter 10 ReportingMacalandag, Angela Rose100% (1)

- GUINTO - Activity 1 - Loans and Impairment ReceivableDocument4 pagesGUINTO - Activity 1 - Loans and Impairment ReceivableGUINTO, DAN FRANCIS B.No ratings yet

- Part 2 - Long ProblemsDocument2 pagesPart 2 - Long ProblemsAccounting 201No ratings yet

- 07audit of PPEDocument9 pages07audit of PPEJeanette FormenteraNo ratings yet

- Partnership AcctgDocument14 pagesPartnership AcctgcessbrightNo ratings yet

- Investment Property Is Defined As Property (Land and Building of Part of A Building or Both) HeldDocument11 pagesInvestment Property Is Defined As Property (Land and Building of Part of A Building or Both) HeldRNo ratings yet

- ACCCOB1 Module 2Document57 pagesACCCOB1 Module 2Ayanna CameroNo ratings yet

- Assignment 3.1 Production Planning - Case StudyDocument25 pagesAssignment 3.1 Production Planning - Case StudyRaquel MarianoNo ratings yet

- Partnership Formation: Only Statement 1 Is TrueDocument1 pagePartnership Formation: Only Statement 1 Is TrueVon Andrei MedinaNo ratings yet

- CH 30 - First Time Adoption of PFRSDocument2 pagesCH 30 - First Time Adoption of PFRSJoyce Anne GarduqueNo ratings yet

- Business Law 2Document6 pagesBusiness Law 2JavidNo ratings yet

- Journalizing Exercise 2Document1 pageJournalizing Exercise 2DZEJLA REYELE PEREZNo ratings yet

- Law Report FinalsDocument11 pagesLaw Report FinalsPatriciaNo ratings yet

- Song Fo v. Hawaiian PhilippinesDocument4 pagesSong Fo v. Hawaiian Philippinescmv mendozaNo ratings yet

- Section 11-16Document6 pagesSection 11-16Jane GonzalesNo ratings yet

- Pamantasan NG Lungsod NG Maynila (University of The City of Manila) PLM Business School Accounting DepartmentDocument10 pagesPamantasan NG Lungsod NG Maynila (University of The City of Manila) PLM Business School Accounting DepartmentAndrea BaldonadoNo ratings yet

- Unit VIII Accounting For Long Term Construction ContractsDocument8 pagesUnit VIII Accounting For Long Term Construction ContractsNovylyn AldaveNo ratings yet

- Assignment 9 1Document2 pagesAssignment 9 1mia uyNo ratings yet

- Adjusting EntriesDocument6 pagesAdjusting EntriesJanna PleteNo ratings yet

- Quiz 2 Cost AccountingDocument1 pageQuiz 2 Cost AccountingRocel DomingoNo ratings yet

- 2nd Assignment LT21ADocument4 pages2nd Assignment LT21AAra Jane T. PiniliNo ratings yet

- SbaDocument4 pagesSbaahyenn cabello100% (1)

- Contract Recognition Task: Property of STIDocument1 pageContract Recognition Task: Property of STIJohn SantosNo ratings yet

- Magnificent Contract of Lease Warehouse SmallDocument4 pagesMagnificent Contract of Lease Warehouse SmallVdl Comm WhseNo ratings yet

- OBLICON Study GuideDocument2 pagesOBLICON Study GuideCess ChanNo ratings yet

- Interest-Bearing Notes ReceivableDocument2 pagesInterest-Bearing Notes Receivablewarsidi100% (1)

- Filipinos Buying BehaviorDocument4 pagesFilipinos Buying BehaviorMaria Regina EspejoNo ratings yet

- Far FPBDocument16 pagesFar FPBMae Marcos SaguipedNo ratings yet

- Principles of Marketing: Section: B (Case Study) Name: Sakib, Nazmun Sadman ID: 19-41255-3 (Group-6)Document4 pagesPrinciples of Marketing: Section: B (Case Study) Name: Sakib, Nazmun Sadman ID: 19-41255-3 (Group-6)rashiqul rijveNo ratings yet

- Lumasag, Ac T. CODE 3056: Let's CheckDocument4 pagesLumasag, Ac T. CODE 3056: Let's CheckKayla Hingking ToraynoNo ratings yet

- Notes ReceivableDocument1 pageNotes ReceivableJohn Carlo Lorenzo75% (4)

- Partnership Formation and Operation.Document4 pagesPartnership Formation and Operation.May RamosNo ratings yet

- Prepaid Expenses and Deffered ChargesDocument13 pagesPrepaid Expenses and Deffered ChargesKristy Marie Lastimosa Grefalda100% (1)

- Partnership FormationDocument3 pagesPartnership FormationTon Martinez ArcenasNo ratings yet

- p1 Quiz With TheoryDocument16 pagesp1 Quiz With TheoryRica RegorisNo ratings yet

- Accounting For Borrowing Costs and GG ProblemsDocument2 pagesAccounting For Borrowing Costs and GG ProblemsRenalyn Ps MewagNo ratings yet

- Exercises - Wasting Assets, Borrowing Costs, and Government GrantsDocument3 pagesExercises - Wasting Assets, Borrowing Costs, and Government GrantsMeeka CalimagNo ratings yet

- Ai-1 RM8Document5 pagesAi-1 RM8Sheena0% (1)

- 6978 - Government Grant and Borrowing CostDocument2 pages6978 - Government Grant and Borrowing CostRaquel Villar DayaoNo ratings yet

- Government Grant and Borrowing CostDocument2 pagesGovernment Grant and Borrowing CostMaximusNo ratings yet

- Wait! Exclusive 30 Day Trial To The World's Largest Digital LibraryDocument7 pagesWait! Exclusive 30 Day Trial To The World's Largest Digital LibraryJason CNo ratings yet

- 005 PDFDocument1 page005 PDFJason CNo ratings yet

- 003 PDFDocument1 page003 PDFJason CNo ratings yet

- 005 PDFDocument1 page005 PDFJason CNo ratings yet

- 003 PDFDocument1 page003 PDFJason CNo ratings yet

- 005 PDFDocument1 page005 PDFJason CNo ratings yet

- 003 PDFDocument1 page003 PDFJason CNo ratings yet

- SMS ZähringenDocument9 pagesSMS ZähringenJason CNo ratings yet

- Mosaics of DelosDocument17 pagesMosaics of DelosJason CNo ratings yet

- SMS ZähringenDocument9 pagesSMS ZähringenJason CNo ratings yet

- MuwaqqitDocument7 pagesMuwaqqitJason CNo ratings yet

- MuwaqqitDocument7 pagesMuwaqqitJason CNo ratings yet

- Thank You For ReadingDocument3 pagesThank You For ReadingJason CNo ratings yet

- Government GrantsDocument1 pageGovernment GrantsJason CNo ratings yet

- 6 Cell ReferencesDocument16 pages6 Cell ReferencesJason CNo ratings yet

- Types of StrokesDocument19 pagesTypes of StrokesJason CNo ratings yet

- Business Process Outsourcing (BPO)Document42 pagesBusiness Process Outsourcing (BPO)Christine CalimagNo ratings yet

- 2 Graphs LectureDocument6 pages2 Graphs LectureJason CNo ratings yet

- 2 Graphs LectureDocument6 pages2 Graphs LectureJason CNo ratings yet

- Thank You For ReadingDocument3 pagesThank You For ReadingJason CNo ratings yet

- Health and Economic DevelopmentDocument1 pageHealth and Economic DevelopmentJason CNo ratings yet

- Phed 1032 - Physical Activity Towards Health and Fitness (Swimming)Document32 pagesPhed 1032 - Physical Activity Towards Health and Fitness (Swimming)Morbid FreelanceNo ratings yet

- Products and ServicesDocument31 pagesProducts and ServicesJason CNo ratings yet

- The Philippine Constitution 1Document18 pagesThe Philippine Constitution 1Jason CNo ratings yet

- Econ Discussion 1Document18 pagesEcon Discussion 1Jason CNo ratings yet

- 1st Midterm Deptal QuizDocument2 pages1st Midterm Deptal QuizJason C0% (2)

- The Philippine Constitution 1Document18 pagesThe Philippine Constitution 1Jason CNo ratings yet

- Econ Discussion 1Document18 pagesEcon Discussion 1Jason CNo ratings yet

- United Nations SummaryDocument1 pageUnited Nations SummaryJason CNo ratings yet