Professional Documents

Culture Documents

Takehome Bonds

Uploaded by

Ferl ElardoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Takehome Bonds

Uploaded by

Ferl ElardoCopyright:

Available Formats

NAME: _______________________ C/Y/S: __________ DATE: ______________

INSTRUCTIONS: IN A WORKSHEET, WRITE YOUR SOLUTIONS IN PROPER FORMAT, WITHOUT ERASURES.

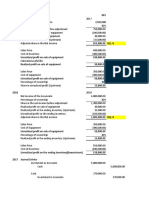

5,000 debenture bonds with face value of ₱1,000 per bond was issued by Shawn Tukan on August 1, 2017, at an annual effective

rate of 11%. Annual interest is payable starting July 31, 2018 at an annual rate of 13%. The bonds have a maturity of 5 years. All

of the bonds were retired on October 1, 2020 with a gain on sale of ₱257,886.

Compute the following:

Interest expense in fiscal year ending December 31, 2019.

Noncurrent liability as of December 31, 2019.

Current liability as of December 31, 2019.

Retirement price.

Unsecured convertible bonds with a face value of ₱9,000,000 dated June 1, 2017 were issued by Shawn Tukan on August 1, 2017

at face value. The effective interest rate of the bonds without its conversion feature is 12% p.a.. Interest of 11% p.a. is payable

semiannually for 3 years. Half of the bonds were converted on October 31, 2019 into 45,000 shares at ₱60 par value per share.

Compute the following:

Share premium - conversion privilege as of December 31, 2017

Interest expense in 2018.

Carrying value of the bonds on December 31, 2018.

Current liability as of December 31, 2019.

Total credit to share premium upon exercise of conversion feature

5-year bonds with share warrants were issued by Shawn Tukan at ₱2,400,000 on January 1, 2017. The interest rate on the bonds

are payable every June 30 and December 31 at 13% interest p.a.. If the bonds were issued without warrants, the effective interest

rate is 14% p.a. After a bond issue cost were incurred as of issue date, the effective interest rate became 15.5%. On April 1, 2019,

500 bonds were retired at quoted price of 94.2. Face value of the bonds is ₱2,000,000.

Compute the following:

Bond issue cost as of January 1, 2017.

Equity component as of issue date

Carrying value of the bonds on January 1, 2017.

Interest expense in 2018

Gain or loss on the retirement of the bonds.

Serial bonds were issued by Shawn Tukan on January 1, 2017 and each ₱1,000,000 is due annually every December 31 plus 7%

p.a.. As of December 31, 2018, the bonds have a carrying value of ₱3,054,498. Effective interest rate is 6%. The first interest

paid on December 31, 2017 is ₱350,000.

Compute for the following:

Issue price

Interest expense in 2018.

Date of maturity

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- L. Michael Hall - Wealth Genius Manual (OCR & Non-OCR)Document284 pagesL. Michael Hall - Wealth Genius Manual (OCR & Non-OCR)chris443197% (32)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Options Trading Crash Course - The Most Complete Guide That Will Show You How To Make Money Trading With OptionsDocument189 pagesOptions Trading Crash Course - The Most Complete Guide That Will Show You How To Make Money Trading With Optionsname100% (1)

- Long Term FinancingDocument5 pagesLong Term Financingjayaditya joshiNo ratings yet

- Incorporating Liquidity Risk Into Funds Transfer PricingDocument30 pagesIncorporating Liquidity Risk Into Funds Transfer PricingapluNo ratings yet

- Group Statements of Cashflows PDFDocument19 pagesGroup Statements of Cashflows PDFObey SitholeNo ratings yet

- Decentralized Operations and Segment Reporting AnalysisDocument130 pagesDecentralized Operations and Segment Reporting AnalysisAilene QuintoNo ratings yet

- Value Chain Analysis - ElardoDocument3 pagesValue Chain Analysis - ElardoFerl ElardoNo ratings yet

- Fundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDocument10 pagesFundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDonald Cacioppo100% (36)

- Case Study MOS Dubai-Destination BrandingDocument12 pagesCase Study MOS Dubai-Destination Brandingarunangshu_pal100% (1)

- De La Salle University Medical Center (Dlsumc) : Hospital AdministrationDocument1 pageDe La Salle University Medical Center (Dlsumc) : Hospital AdministrationFerl ElardoNo ratings yet

- Test Bank Transfer PricingDocument11 pagesTest Bank Transfer PricingFerl Elardo100% (2)

- INB 304 Sec 01 Group 06 Assignment 02Document23 pagesINB 304 Sec 01 Group 06 Assignment 02Adeeb Imtiaz100% (1)

- Compilation of ScreenshotDocument23 pagesCompilation of ScreenshotFerl ElardoNo ratings yet

- Managerial ACCT Quiz 259 PDFDocument4 pagesManagerial ACCT Quiz 259 PDFFerl ElardoNo ratings yet

- Enabling Assessment 5 Businness Level StrategyDocument1 pageEnabling Assessment 5 Businness Level StrategyFerl ElardoNo ratings yet

- Mini Case 8 Starbucks and Schultz PDFDocument2 pagesMini Case 8 Starbucks and Schultz PDFFerl ElardoNo ratings yet

- Value Chain Analysis Enabling Assessment 3Document4 pagesValue Chain Analysis Enabling Assessment 3Ferl ElardoNo ratings yet

- Exercise Workbook6 BasicDocument53 pagesExercise Workbook6 BasicFerl ElardoNo ratings yet

- This Study Resource Was: 1. Describe Starbuck's Business-Level StrategyDocument5 pagesThis Study Resource Was: 1. Describe Starbuck's Business-Level StrategyFerl ElardoNo ratings yet

- Strategic Management EA4 ElardoDocument5 pagesStrategic Management EA4 ElardoFerl ElardoNo ratings yet

- MC The Government and Fiscal Policy - BSA41 2nd Sem. 2019 - 2020 Macroeconomics ECON203 - DLSU-D College - GS PDFDocument6 pagesMC The Government and Fiscal Policy - BSA41 2nd Sem. 2019 - 2020 Macroeconomics ECON203 - DLSU-D College - GS PDFFerl ElardoNo ratings yet

- Final Exam For Logistics 2nd Sem 2019-2020 (A)Document5 pagesFinal Exam For Logistics 2nd Sem 2019-2020 (A)Ferl ElardoNo ratings yet

- Problem1 - The Following Data Are From The Giant Oreo Division at Keebler CookiesDocument29 pagesProblem1 - The Following Data Are From The Giant Oreo Division at Keebler CookiesFerl ElardoNo ratings yet

- Circulatory System FunctionsDocument2 pagesCirculatory System FunctionsFerl ElardoNo ratings yet

- PPE1111Document29 pagesPPE1111Ferl ElardoNo ratings yet

- Seatwork in AssociatesDocument4 pagesSeatwork in AssociatesFerl ElardoNo ratings yet

- PCF SummaryDocument4 pagesPCF SummaryFerl ElardoNo ratings yet

- Deductible Non-Deductible: PenaltiesDocument6 pagesDeductible Non-Deductible: PenaltiesFerl ElardoNo ratings yet

- T - F Money Supply - BSA41 2nd Sem. 2019 - 2020 Macroeconomics ECON203 - DLSU-D College - GS PDFDocument3 pagesT - F Money Supply - BSA41 2nd Sem. 2019 - 2020 Macroeconomics ECON203 - DLSU-D College - GS PDFFerl ElardoNo ratings yet

- Seatwork in BondsDocument10 pagesSeatwork in BondsFerl ElardoNo ratings yet

- Ppe 04-22-20Document32 pagesPpe 04-22-20Ferl ElardoNo ratings yet

- Takehome - EPS & BVPS PDFDocument6 pagesTakehome - EPS & BVPS PDFFerl ElardoNo ratings yet

- Prob2-5Document2 pagesProb2-5Ferl ElardoNo ratings yet

- Chapter 2 - Cost Terminology and Cost Behaviors: LO1 LO2 LO3 LO4 LO5Document29 pagesChapter 2 - Cost Terminology and Cost Behaviors: LO1 LO2 LO3 LO4 LO5Chem Mae100% (4)

- C H A P T E R 3: The Interest Factor in FinancingDocument40 pagesC H A P T E R 3: The Interest Factor in FinancingSylvia Al-a'maNo ratings yet

- Printtt Econ ResearchDocument5 pagesPrinttt Econ ResearchFerl ElardoNo ratings yet

- TAX - Allowable DeductionsDocument39 pagesTAX - Allowable DeductionsFerl ElardoNo ratings yet

- Business StimulationDocument33 pagesBusiness StimulationLip SyncersNo ratings yet

- Basics of Bond Mathematics: Sankarshan BasuDocument68 pagesBasics of Bond Mathematics: Sankarshan BasuUdit GuptaNo ratings yet

- Why Investors Must Wring Out HIGH Beta From Portfolio?Document4 pagesWhy Investors Must Wring Out HIGH Beta From Portfolio?Yogesh V GabaniNo ratings yet

- Professional Exam Sylabus IIIDocument37 pagesProfessional Exam Sylabus IIIRahul JaiswalNo ratings yet

- Dividend Policy QuestionsDocument8 pagesDividend Policy QuestionsRonmaty VixNo ratings yet

- Ibf301 Group Assignment AppleDocument25 pagesIbf301 Group Assignment AppleNguyen Ngoc Hai Son (K17 HCM)No ratings yet

- PAA MET 5 Oct 17 1st - pdf-1Document20 pagesPAA MET 5 Oct 17 1st - pdf-1Deul ErNo ratings yet

- ANRS Chaff Cutter Fabrication Plant ProfileDocument23 pagesANRS Chaff Cutter Fabrication Plant ProfileFekadie TesfaNo ratings yet

- Roi Ri EvaDocument14 pagesRoi Ri EvaAhalik HamzahNo ratings yet

- Pinpoint and Synergistic Trading Strategies of CandlesticksDocument12 pagesPinpoint and Synergistic Trading Strategies of CandlesticksS MNo ratings yet

- Financial Statements GuideDocument18 pagesFinancial Statements GuideNadjmeah AbdillahNo ratings yet

- Chapter 8Document40 pagesChapter 8ebrahimnejad64No ratings yet

- Chapter 3 Market EfficiencyDocument32 pagesChapter 3 Market EfficiencyLaura StephanieNo ratings yet

- Financial Markets and Institutions: Abridged 10 EditionDocument45 pagesFinancial Markets and Institutions: Abridged 10 EditionNajmul Joy100% (1)

- Cost of CapitalDocument49 pagesCost of CapitalSatyam JadonNo ratings yet

- Trading JourneyDocument19 pagesTrading Journeysap.dosapatiNo ratings yet

- Pse Anrpt2003Document51 pagesPse Anrpt2003John Paul Samuel ChuaNo ratings yet

- Technical AnaltssssDocument30 pagesTechnical Analtssssshahid veettilNo ratings yet

- Price Change: Cash Flow or Discount Rate?: Asset Pricing Zheng ZhenlongDocument39 pagesPrice Change: Cash Flow or Discount Rate?: Asset Pricing Zheng ZhenlongAryen RajNo ratings yet

- Use The Following Information To Answer The Next Four QuestionsDocument5 pagesUse The Following Information To Answer The Next Four QuestionsAkshadaNo ratings yet

- WCT Berhad: Proposes RM600m Bonds, 1-For-8 Warrant Issue - 29/7/2010Document3 pagesWCT Berhad: Proposes RM600m Bonds, 1-For-8 Warrant Issue - 29/7/2010Rhb InvestNo ratings yet

- Accountancy Notes PDF Class 12 Chapter 2Document4 pagesAccountancy Notes PDF Class 12 Chapter 2Miss Palak.kNo ratings yet