Professional Documents

Culture Documents

Donna Jamison

Uploaded by

Ire LeeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Donna Jamison

Uploaded by

Ire LeeCopyright:

Available Formats

Donna Jamison, a recent graduate of the University of Tennessee with four years of

banking experience, was recently brought in as assistant to the chairman of the board of

Computron Industries, a manufacturer of electronic calculators.

The company doubled its plant capacity, opened new sales offices outside its home

territory, and launched an expensive advertising campaign. Computron’s results were not

satisfactory, to put it mildly. Its board of directors, which consisted of its president and

vice-president plus its major stockholders (who were all local business people), was most

upset when directors learned how the expansion was going. Suppliers were being paid late

and were unhappy, and the bank was complaining about the deteriorating situation and

threatening to cut off credit. As a result, Al Watkins, Computron’s president, was

informed that changes would have to be made, and quickly, or he would be fired. Also, at

the board’s insistence Donna Jamison was brought in and given the job of assistant to Fred

Campo, a retired banker who was Computron’s chairman and largest stockholder. Campo

agreed to give up a few of his golfing days and to help nurse the company back to health,

with Jamison’s help.

Jamison began by gathering financial statements and other data. Assume that you are

Jamison’s assistant, and you must help her answer the following questions for Campo.

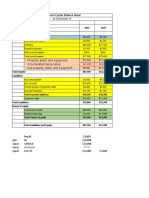

Balance Sheets

Assets 2003 2004

Cash $ 9,000 $ 7,282

Short-term investments. 48,600 20,000

Accounts receivable 351,200 632,160

Inventories 715,200 1,287,360

total current assets $ 1,124,000 $ 1,946,802

Gross fixed assets 491,000 1,202,950

Less: accumulated depreciation 146,200 263,160

net fixed assets $ 344,800 $ 939,790

Total assets $ 1,468,800 $ 2,886,592

Liabilities and equity 2003 2004

Accounts payable $ 145,600 $ 324,000

Notes payable 200,000 720,000

Accruals 136,000 284,960

total current liabilities $ 481,600 $ 1,328,960

Long-term debt 323,432 1,000,000

Common stock (100,000 shares) 460,000 460,000

Retained earnings 203,768 97,632

total equity $ 663,768 $ 557,632

Total liabilities and equity $ 1,468,800 $ 2,886,592

You might also like

- 770976ce9 - DLeon Part IDocument5 pages770976ce9 - DLeon Part IMuhammad sohailNo ratings yet

- Financial Statements, Cash Flows & TaxesDocument26 pagesFinancial Statements, Cash Flows & TaxesCathrene Jen BalomeNo ratings yet

- Coca-Cola Balance Sheet AnalysisDocument3 pagesCoca-Cola Balance Sheet AnalysisashishrajmakkarNo ratings yet

- Assets: Café Richard Balance Sheet As at 31 December 2019 & 2020Document3 pagesAssets: Café Richard Balance Sheet As at 31 December 2019 & 2020Jannatul Ferdousi PrïtyNo ratings yet

- Financial Statement Analysis (Practicum)Document8 pagesFinancial Statement Analysis (Practicum)evlin mrgNo ratings yet

- Group AssignmentDocument4 pagesGroup Assignmentmichaelbarbosa0265No ratings yet

- Integ Case 1 FsDocument7 pagesInteg Case 1 FsIra BenitoNo ratings yet

- Advance Financia AnalysesDocument35 pagesAdvance Financia AnalysesXsellence AccountsNo ratings yet

- Analysis of D'Leon's Financial ProjectionsDocument8 pagesAnalysis of D'Leon's Financial ProjectionsDIPESH KUNWARNo ratings yet

- Chapter 2 Team ProjectDocument2 pagesChapter 2 Team ProjectRaisa TasnimNo ratings yet

- Handout 1 (B) Ratio Analysis Practice QuestionsDocument5 pagesHandout 1 (B) Ratio Analysis Practice QuestionsMuhammad Asad AliNo ratings yet

- Soal AkuntansiDocument4 pagesSoal AkuntansinairobiNo ratings yet

- MBF5207201004 Strategic Financial ManagementDocument5 pagesMBF5207201004 Strategic Financial ManagementtawandaNo ratings yet

- Midterm Exam Part 2 - AtikDocument8 pagesMidterm Exam Part 2 - AtikAtik MahbubNo ratings yet

- I Ntegrated Case: Financial Statement AnalysisDocument13 pagesI Ntegrated Case: Financial Statement Analysishtet sanNo ratings yet

- Mini Case Chapter 3 Final VersionDocument14 pagesMini Case Chapter 3 Final VersionAlberto MariñoNo ratings yet

- Case Study No. 3 PDFDocument6 pagesCase Study No. 3 PDFMuhammadZahirGulNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument8 pagesFinancial Statements, Cash Flow, and TaxesAdwa Al-NaimNo ratings yet

- Tesla, Inc. Statement of Financial Position (In USD Millions) For The Year EndedDocument19 pagesTesla, Inc. Statement of Financial Position (In USD Millions) For The Year EndedXienaNo ratings yet

- Case Study #1: Bigger Isn't Always Better!Document4 pagesCase Study #1: Bigger Isn't Always Better!Marilou GabayaNo ratings yet

- Pacific Grove Spice Company CalculationsDocument12 pagesPacific Grove Spice Company CalculationsJuan Jose Acero CaballeroNo ratings yet

- Finance ProjectDocument6 pagesFinance Projectrawan joudehNo ratings yet

- Problem Case Financial Manager Chapter 1Document5 pagesProblem Case Financial Manager Chapter 1Sukindar Ari Shuki SantosoNo ratings yet

- Build Cumberland Industries 2004 Income StatementDocument4 pagesBuild Cumberland Industries 2004 Income StatementAngel L Rolon TorresNo ratings yet

- Case Study #2: Growing PainsDocument3 pagesCase Study #2: Growing PainsMissey Grace PuntalNo ratings yet

- Midterm Analysis TestDocument33 pagesMidterm Analysis TestDan Andrei BongoNo ratings yet

- RIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningDocument4 pagesRIZKA NURUL OKTAVIANI - 120110180007 - TugasFinancialPlanningRizka OktavianiNo ratings yet

- 1st-Case-Study_Financial-Statement-Analysis_Group 5.docxDocument18 pages1st-Case-Study_Financial-Statement-Analysis_Group 5.docxgellie villarinNo ratings yet

- HARD ROCK COMPANY Statement of Financial PositionDocument3 pagesHARD ROCK COMPANY Statement of Financial PositionJade Lykarose Ochavillo GalendoNo ratings yet

- Heritage Foundation 2009 Financial ReportDocument22 pagesHeritage Foundation 2009 Financial ReportNicolai AquinoNo ratings yet

- Mid Term ExamDocument4 pagesMid Term ExamChris Rosbeck0% (1)

- Ventura, Mary Mickaella R Chapter 4 - MinicaseDocument5 pagesVentura, Mary Mickaella R Chapter 4 - MinicaseMary Ventura100% (1)

- Tutorial Week 2 - Working With Financial StatementsDocument9 pagesTutorial Week 2 - Working With Financial StatementsQuốc HưngNo ratings yet

- PPP Key Ratio Analysis I Cba June 122019Document33 pagesPPP Key Ratio Analysis I Cba June 122019Kelvin Namaona NgondoNo ratings yet

- Norton Corporation Financial AnalysisDocument7 pagesNorton Corporation Financial AnalysisMichael SanchezNo ratings yet

- Calculating Financial Metrics for Lan & Chen TechnologiesDocument12 pagesCalculating Financial Metrics for Lan & Chen TechnologiesQudsiya KalhoroNo ratings yet

- Mini Case (Financial Statements)Document12 pagesMini Case (Financial Statements)Melissa López GarzaNo ratings yet

- 5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsDocument2 pages5.2 Monahan Manufacturing: Preparing and Interpreting A Statement of Cash FlowsvedeshNo ratings yet

- Mid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121Document10 pagesMid Term Assessment FALL 2020: Student's Name Ambisat Junejo - Registration Number 2035121rabab balochNo ratings yet

- Analysis of Financial StatementDocument7 pagesAnalysis of Financial StatementMohsin QayyumNo ratings yet

- MI Worksheet Final LectureDocument3 pagesMI Worksheet Final Lecturethapa_bisNo ratings yet

- Practice Set 1Document6 pagesPractice Set 1moreNo ratings yet

- Financial Analysis of National Underground Railroad Freedom Center, IncDocument6 pagesFinancial Analysis of National Underground Railroad Freedom Center, IncCOASTNo ratings yet

- Template - MIDTERM EXAM INTERMEDIATE 1Document7 pagesTemplate - MIDTERM EXAM INTERMEDIATE 1Rani RahayuNo ratings yet

- Prob 7Document1 pageProb 7Angelia TNo ratings yet

- Feb 27 - AssignmentDocument1 pageFeb 27 - AssignmentGeofrey RiveraNo ratings yet

- 1st Case Study - Financial Statement AnalysisDocument6 pages1st Case Study - Financial Statement AnalysisKimberly SoqueNo ratings yet

- CH2 FinmaDocument3 pagesCH2 Finmamervin coquillaNo ratings yet

- Vertical Analysis of Financial Statements - Pepsi V CokeDocument2 pagesVertical Analysis of Financial Statements - Pepsi V CokeCarneades33% (3)

- Cash Flow ExampleDocument10 pagesCash Flow ExampleewaidaebaaNo ratings yet

- Colegio de Dagupan: Solve The Following Problems in The Space ProvidedDocument5 pagesColegio de Dagupan: Solve The Following Problems in The Space ProvidedKurt dela TorreNo ratings yet

- 2017 2018 Total Current Assets: Period Ending: Cifras en Millones de PesosDocument6 pages2017 2018 Total Current Assets: Period Ending: Cifras en Millones de PesosmeNo ratings yet

- Chapter 6 Mini Case: SituationDocument9 pagesChapter 6 Mini Case: SituationUsama RajaNo ratings yet

- Property, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentDocument6 pagesProperty, Plant, and Equipment Accumulated Depreciation Net Property, Plant, and EquipmentEman KhalilNo ratings yet

- Financial Statement Analysis: I Ntegrated CaseDocument13 pagesFinancial Statement Analysis: I Ntegrated Casehtet sanNo ratings yet

- Chapter 4-Profitability Analysis: Multiple ChoiceDocument30 pagesChapter 4-Profitability Analysis: Multiple ChoiceRawan NaderNo ratings yet

- 13 Excelfiles Student Text Assignments 2010Document8 pages13 Excelfiles Student Text Assignments 2010PhoulLitNo ratings yet

- (123doc) Question Financial Statement AnalysisDocument9 pages(123doc) Question Financial Statement AnalysisUyển's MyNo ratings yet

- Below Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Document3 pagesBelow Are Sample Questions Question 1 (1 Point) : Round The Answers To Two Decimal Places in Percentage Form.Ayushi SinghalNo ratings yet

- Economic Scene in Pune Under The Rule of Peshwas - (18th Century)Document2 pagesEconomic Scene in Pune Under The Rule of Peshwas - (18th Century)Anamika Rai PandeyNo ratings yet

- Chapter-5 Contract ManagementDocument43 pagesChapter-5 Contract Managementprem kumarNo ratings yet

- A PROJECT REPORT of SlicDocument51 pagesA PROJECT REPORT of SlicShreya KatreNo ratings yet

- BBA - Recruitment Process Followed by ICICI Bank PDFDocument108 pagesBBA - Recruitment Process Followed by ICICI Bank PDFSahil MavkarNo ratings yet

- Anan University case study examines IT infrastructure relationshipsDocument3 pagesAnan University case study examines IT infrastructure relationshipsSam PatriceNo ratings yet

- MoU - 2023 - 24 - LBAS - MADocument5 pagesMoU - 2023 - 24 - LBAS - MAMetilda AcademyNo ratings yet

- Ityukta - MECCADocument31 pagesItyukta - MECCAAditi100% (1)

- Ayeesha QuestionDocument2 pagesAyeesha QuestionMahesh KumarNo ratings yet

- Option 1 Billing: SustainabilityDocument4 pagesOption 1 Billing: SustainabilityArnie Tron NoblezaNo ratings yet

- Sivagnanam PDFDocument213 pagesSivagnanam PDFjohn100% (1)

- SUF ESG Score Methodology 2022-06Document15 pagesSUF ESG Score Methodology 2022-06R N ShuklaNo ratings yet

- Understanding Transactions in The Controlling ModuleDocument31 pagesUnderstanding Transactions in The Controlling ModuleAbdelhamid HarakatNo ratings yet

- Describe The Balanced Scorecard Concept and Explain The Reasoning Behind ItDocument2 pagesDescribe The Balanced Scorecard Concept and Explain The Reasoning Behind ItRamm Raven CastilloNo ratings yet

- Step: 1Document24 pagesStep: 1LajukNo ratings yet

- Chap 6 ProblemsDocument5 pagesChap 6 ProblemsCecilia Ooi Shu QingNo ratings yet

- Summer Project On Chocolate Industry in Lotte India Corporation Ltd1Document51 pagesSummer Project On Chocolate Industry in Lotte India Corporation Ltd1jyotibhadra67% (3)

- Group 3 Presentation - Training Needs AnalysisDocument13 pagesGroup 3 Presentation - Training Needs AnalysisHassaan Bin KhalidNo ratings yet

- Case Study: Alex Sharpe’s Risky Stock PortfolioDocument3 pagesCase Study: Alex Sharpe’s Risky Stock PortfolioBilal Rafaqat TanoliNo ratings yet

- CDP Climate Change Questionnaire 2021Document46 pagesCDP Climate Change Questionnaire 2021KuzivakwasheNo ratings yet

- Essentials of Human Resource ManagementDocument17 pagesEssentials of Human Resource Managementashbak2006#zikir#scribd#2009No ratings yet

- Forward Rates - March 25 2021Document2 pagesForward Rates - March 25 2021Lisle Daverin BlythNo ratings yet

- 9 Q2UCSP Q2 Week 1 M7 STATE AND NON STATE INSTITUTIONSDocument19 pages9 Q2UCSP Q2 Week 1 M7 STATE AND NON STATE INSTITUTIONSDarren Christian Ray LangitNo ratings yet

- Module 13 Cost Accounting ManufacturingDocument23 pagesModule 13 Cost Accounting Manufacturingnomvulapetunia460No ratings yet

- Franchising: Bruce R. Barringer R. Duane IrelandDocument18 pagesFranchising: Bruce R. Barringer R. Duane IrelandWazeeer AhmadNo ratings yet

- ProspectusDocument2 pagesProspectusJuliana Mae FradesNo ratings yet

- Level 1: New Century Mathematics (Second Edition) S3 Question Bank 3A Chapter 3 Percentages (II)Document27 pagesLevel 1: New Century Mathematics (Second Edition) S3 Question Bank 3A Chapter 3 Percentages (II)raydio 4No ratings yet

- Pump Quotation DetailsDocument2 pagesPump Quotation Detailsdhavalesh1No ratings yet

- EXAM About INTANGIBLE ASSETS 1Document3 pagesEXAM About INTANGIBLE ASSETS 1BLACKPINKLisaRoseJisooJennieNo ratings yet

- A Review of Production Planning and ControlDocument32 pagesA Review of Production Planning and ControlengshimaaNo ratings yet

- Furkhan Pasha - ResumeDocument3 pagesFurkhan Pasha - ResumeFurquan QuadriNo ratings yet

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Small Business Startup: How to Start a Business and Go from Idea and Business Plan to Marketing and ScalingFrom EverandSmall Business Startup: How to Start a Business and Go from Idea and Business Plan to Marketing and ScalingRating: 5 out of 5 stars5/5 (1)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetFrom EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetNo ratings yet

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyRating: 4 out of 5 stars4/5 (4)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 5 out of 5 stars5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)