Professional Documents

Culture Documents

What Do You Conclude From The Statement of Cash Flows

Uploaded by

Ire LeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

What Do You Conclude From The Statement of Cash Flows

Uploaded by

Ire LeeCopyright:

Available Formats

What do you conclude from the statement of cash flows?

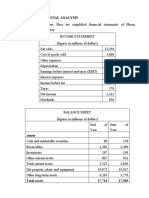

Answer: Net CF from operations = -$503,936, because of negative net income and increases in

working capital. The firm spent $711,950 on FA. The firm borrowed heavily and

sold some short-term investments to meet its cash requirements. Even after

borrowing, the cash account fell by $1,718.

c. What is free cash flow? Why is it important? What are the five uses of FCF?

Answer: FCF is the amount of cash available from operations for distribution to all investors

(including stockholders and debtholders) after making the necessary investments to

support operations. A company’s value depends upon the amount of FCF it can

generate.

1. Pay interest on debt.

2. Pay back principal on debt.

3. Pay dividends.

4. Buy back stock.

5. Buy nonoperating assets (e.g., marketable securities, investments in other

companies, etc.)

d. What are operating current assets? What are operating current liabilities?

How much net operating working capital and total net operating capital does

Computron have?

Answer: Operating current assets are the CA needed to support operations. OP CA include:

cash, inventory, receivables. OP CA exclude: short-term investments, because these

are not a part of operations. Operating current liabilities are the CL resulting as a

normal part of operations. OP CL include: accounts payable and accruals. OP CA

exclude: notes payable, because this is a source of financing, not a part of operations.

NOWC = operating CA – operating CL

NOWC04 = ($7,282 + $632,160 + $1,287,360) - ($324,000 + $284,960)

= $1,317,842.

NOWC03 = $793,800.

Total operating working capital = NOWC + net fixed assets.

Operating capital in 2004 = $1,317,842 + $939,790

= $2,257,632.

Operating capital in 2003 = $1,138,600.

You might also like

- Module - Business Finance Week 4Document7 pagesModule - Business Finance Week 4dorothytorino8No ratings yet

- Exercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotDocument15 pagesExercises: Method. Under This Form Expenses Are Aggregated According To Their Nature and NotCherry Doong CuantiosoNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument44 pagesFinancial Statements, Cash Flow, and TaxesMahmoud Abdullah100% (1)

- Ch02 ShowDocument44 pagesCh02 ShowardiNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument45 pagesFinancial Statements, Cash Flow, and TaxesFridolin Belnovando Abditomo PrakosoNo ratings yet

- Module 15 - Cash Flow, Working Capital and Short-Term FinancingDocument10 pagesModule 15 - Cash Flow, Working Capital and Short-Term FinancingGRACE ANN BERGONIONo ratings yet

- Clase 1 Casos en Finanzas UDDDocument35 pagesClase 1 Casos en Finanzas UDDJuan Gallegos M.No ratings yet

- CH 02 - Financial Stmts Cash Flow and TaxesDocument32 pagesCH 02 - Financial Stmts Cash Flow and TaxesSyed Mohib Hassan100% (1)

- ch13 PDFDocument5 pagesch13 PDFasadzahid212No ratings yet

- Exercises For Chapter 23 EFA2Document16 pagesExercises For Chapter 23 EFA2Thu LoanNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument43 pagesFinancial Statements, Cash Flow, and TaxesshimulNo ratings yet

- Return On Invested CapitalDocument3 pagesReturn On Invested CapitalZohairNo ratings yet

- FIN-573 - Lecture 2 - Jan 28 2021Document33 pagesFIN-573 - Lecture 2 - Jan 28 2021Abdul BaigNo ratings yet

- 0 IntroductionDocument139 pages0 Introduction靳雪娇No ratings yet

- Reporting and Analyzing Cash Flows: QuestionsDocument56 pagesReporting and Analyzing Cash Flows: QuestionsMymie MaandigNo ratings yet

- Assignment 4 Group 4Document6 pagesAssignment 4 Group 4Kristina KittyNo ratings yet

- Important Points 1. 2. 3. 4. 5. 6. 7Document15 pagesImportant Points 1. 2. 3. 4. 5. 6. 7RAVI KUMARNo ratings yet

- Retained Earnings 3Document12 pagesRetained Earnings 3PUTTU GURU PRASAD SENGUNTHA MUDALIARNo ratings yet

- Accounting For ManagerDocument7 pagesAccounting For ManagerMasara OwenNo ratings yet

- Session 1Document85 pagesSession 1So De100% (1)

- Concept Questions: Chapter Seven Viewing The Business Through The Financial StatementsDocument10 pagesConcept Questions: Chapter Seven Viewing The Business Through The Financial StatementsSaguna DatarNo ratings yet

- Ch.10 - The Statement of Cash Flows - MHDocument59 pagesCh.10 - The Statement of Cash Flows - MHSamZhao100% (1)

- FSA Assignment III Group 4Document4 pagesFSA Assignment III Group 4Kristina Kitty100% (1)

- Income Based Valuation - l3Document14 pagesIncome Based Valuation - l3Kristene Romarate DaelNo ratings yet

- Group 6 - Management Control System of Measurement and Control of Managed AssetsDocument25 pagesGroup 6 - Management Control System of Measurement and Control of Managed AssetsHernawatiNo ratings yet

- FIN303 - Chap 14Document49 pagesFIN303 - Chap 14Hoang Thanh HangNo ratings yet

- Opportunity ScreeningDocument55 pagesOpportunity ScreeningJaezyle Cuizon100% (1)

- Dev Financial Analysis-2Document8 pagesDev Financial Analysis-2Adam BelmekkiNo ratings yet

- Sample 1Document3 pagesSample 1SandipNo ratings yet

- Chapter 4Document18 pagesChapter 4Amjad J AliNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsNaina GuptaNo ratings yet

- Course: Financial Accounting and Analysis: Answer 1: Introduction: Cash Flow StatementDocument3 pagesCourse: Financial Accounting and Analysis: Answer 1: Introduction: Cash Flow StatementJobin BabuNo ratings yet

- Working Capital ITCDocument75 pagesWorking Capital ITCsaur1No ratings yet

- accounting(分享版)Document7 pagesaccounting(分享版)Siyang QuNo ratings yet

- CH 1 - End of Chapter Exercises SolutionsDocument37 pagesCH 1 - End of Chapter Exercises SolutionssaraNo ratings yet

- Dwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFDocument36 pagesDwnload Full Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manual PDFmiltongoodwin2490i100% (15)

- Full Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions ManualDocument36 pagesFull Download Corporate Finance A Focused Approach 5th Edition Ehrhardt Solutions Manualkisslingcicelypro100% (35)

- Solution Manual For Corporate Finance A Focused Approach 6th EditionDocument37 pagesSolution Manual For Corporate Finance A Focused Approach 6th Editionjanetgriffintizze100% (12)

- Capital Requirement, Raising Cost of Capital: Lecture FiveDocument32 pagesCapital Requirement, Raising Cost of Capital: Lecture FiveAbraham Temitope AkinnurojuNo ratings yet

- Working CapitalDocument17 pagesWorking CapitalHanuman PrasadNo ratings yet

- Financial Statement Analysis Questions We Would Like AnsweredDocument9 pagesFinancial Statement Analysis Questions We Would Like AnsweredthakurvinodNo ratings yet

- Return On Capital EmployedDocument6 pagesReturn On Capital EmployedFrankie LamNo ratings yet

- Financial Statements, Cash Flow, and TaxesDocument18 pagesFinancial Statements, Cash Flow, and TaxesPhearl Anjeyllie PilotonNo ratings yet

- Finance QuestionsDocument14 pagesFinance QuestionsGeetika YadavNo ratings yet

- Solution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108Document36 pagesSolution Manual For Corporate Finance A Focused Approach 6th Edition by Ehrhard Brigham ISBN 1305637100 9781305637108stephanievargasogimkdbxwn100% (26)

- Assignment Number 4Document8 pagesAssignment Number 4AsadNo ratings yet

- 3 - FCF CalculationDocument2 pages3 - FCF CalculationAman ManjiNo ratings yet

- Solution Manual For Financial Management Theory and Practice 14th Edition by Brigham and Ehrhardt ISBN 1111972214 9781111972219Document36 pagesSolution Manual For Financial Management Theory and Practice 14th Edition by Brigham and Ehrhardt ISBN 1111972214 9781111972219caseywestfmjcgodkzr100% (23)

- Participant Guide C Cash FlowDocument45 pagesParticipant Guide C Cash FlowMohamed Ahmed100% (1)

- Financial Accounting 4th Edition. Chapter 1 SummaryDocument13 pagesFinancial Accounting 4th Edition. Chapter 1 SummaryJoey TrompNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsAkash ChauhanNo ratings yet

- 1.0 CFI - FS Primer PDFDocument10 pages1.0 CFI - FS Primer PDFSarthak NautiyalNo ratings yet

- Module 8Document99 pagesModule 8Arnel De Los SantosNo ratings yet

- Statement of Financial ReportingDocument3 pagesStatement of Financial ReportingRandom AcNo ratings yet

- Working Capital Management of SectrixDocument50 pagesWorking Capital Management of SectrixsectrixNo ratings yet

- Lesson 5 The Operating CycleDocument6 pagesLesson 5 The Operating Cyclenonen3872No ratings yet

- L2 - Capital BudgetingDocument53 pagesL2 - Capital BudgetingZhenyi ZhuNo ratings yet

- Acct CH4Document10 pagesAcct CH4Aseel Al NajraniNo ratings yet

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaFrom EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaRating: 4.5 out of 5 stars4.5/5 (14)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successFrom EverandReady, Set, Growth hack:: A beginners guide to growth hacking successRating: 4.5 out of 5 stars4.5/5 (93)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistFrom EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistRating: 4.5 out of 5 stars4.5/5 (73)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingFrom EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingRating: 4.5 out of 5 stars4.5/5 (17)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetFrom EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetRating: 5 out of 5 stars5/5 (2)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisFrom EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisRating: 5 out of 5 stars5/5 (6)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)