Professional Documents

Culture Documents

CACT3730 Work Program 2ND Semester

CACT3730 Work Program 2ND Semester

Uploaded by

Albertus Muheua0 ratings0% found this document useful (0 votes)

12 views1 pageCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views1 pageCACT3730 Work Program 2ND Semester

CACT3730 Work Program 2ND Semester

Uploaded by

Albertus MuheuaCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

CACT3730 WORK PROGRAMME

SECOND SEMESTER 2018

WEEK DATE TOPIC SU CHPT

23-07-2018 Forex 8 15

24-07-2018 Forex 8 15

1

25-07-2018 Interest-bearing Instruments 6 16

26-07-2018 Interest-bearing Instruments 6 16

30-07-2018 Companies & Dividends Tax 4, 11 19

31-07-2018 Individuals 13 5, 7, 17

2

01-08-2018 Individuals 13 5, 7, 17

02-08-2018 Individuals & CGT 13 5, 7, 17

06-08-2018 Individuals & CGT 13 5, 7, 17

07-08-2018 Fringe Benefits 13 8

3

08-08-2018 Fringe Benefits 13 8

09-08-2018 Fringe Benefits 13 8

13-08-2018 Retirement Benefits 13 9

14-08-2018 Retirement Benefits 13 9

4

15-08-2018 Retirement Benefits 13 9

16-08-2018 Employee's Tax 16 10

17-08-2018 CLASS TEST 3

20-08-2018 Employee's Tax 16 10

21-08-2018 Employee's Tax 16 10

5

22-08-2018 Provisional Tax 9 11

23-08-2018 Provisional Tax 9 11

27-08-2018

28-08-2018

6

29-08-2018 SEMESTER BREAK

30-08-2018

03-09-2018

04-09-2018

7

05-09-2018

06-09-2018

TEST WEEK

10-09-2018

11-09-2018 Non-residence & Source rules 14 5, 17, 21

12-09-2018 Non-residence & Source rules 14 5, 17, 21

8

13-09-2018 Non-residence & Source rules 14 5, 17, 21

14-09-2018 CLASS TEST 4

18-09-2018 Trusts 15 24

19-09-2018 Trusts 15 24

9

20-09-2018 Trusts 15 24

21-09-2018 Trusts 15 24

25-09-2018 Tax Avoidance 15 32

26-09-2018 Tax Avoidance 15 32

10 27-09-2018 Tax Administration 1 33

28-09-2018 Tax Administration 1 33

29-09-2018 CLASS TEST 5

02-10-2018 Partnerships 17

03-10-2018 Partnerships 17 18

11

04-10-2018 Farming 18 22

05-10-2018 Farming 18 22

09-10-2018 Revision

10-10-2018 Revision

12

11-10-2018 Revision

12-10-2018 Revision

19-10-2018 EXAM STARTS

Please note: this programme may be amended on short notice.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Philippine Association of Certified Tax TechniciansDocument3 pagesPhilippine Association of Certified Tax Techniciansucc second yearNo ratings yet

- Utility Bills-Kenya-Kenya Power Electricity BillDocument1 pageUtility Bills-Kenya-Kenya Power Electricity Billtianmao5858No ratings yet

- Final TaxDocument26 pagesFinal TaxMarie MendozaNo ratings yet

- 7.3 Answer Key Chapter 6 Banggawan 1 PDFDocument4 pages7.3 Answer Key Chapter 6 Banggawan 1 PDFLuca PacioliNo ratings yet

- Chapter 9 - Interim Financial ReportingDocument8 pagesChapter 9 - Interim Financial ReportingXiena0% (1)

- SOLMAN TAX2 2020 Edition Final PDFDocument41 pagesSOLMAN TAX2 2020 Edition Final PDFsol luna100% (3)

- UntitledDocument17 pagesUntitledAlbertus Muheua0% (1)

- Econ11 HW PDFDocument207 pagesEcon11 HW PDFAlbertus MuheuaNo ratings yet

- Development Planning 2019Document27 pagesDevelopment Planning 2019Albertus MuheuaNo ratings yet

- EGD3872 11 Sup 2018Document4 pagesEGD3872 11 Sup 2018Albertus MuheuaNo ratings yet

- 411 PS4 2018 Ans PDFDocument7 pages411 PS4 2018 Ans PDFAlbertus MuheuaNo ratings yet

- Notes To Financial Statements Urdaneta City Water DistrictDocument8 pagesNotes To Financial Statements Urdaneta City Water DistrictEG ReyesNo ratings yet

- Gov. Walz 2015 Tax Returns - RedactedDocument13 pagesGov. Walz 2015 Tax Returns - RedactedTim Walz for GovernorNo ratings yet

- Corporate Taxes Part 1 (VAT, EWT and Income Tax) CaseDocument4 pagesCorporate Taxes Part 1 (VAT, EWT and Income Tax) CaseMikaela L. RoqueNo ratings yet

- Othuser Guide For Investment Declaration 22-23 - MyPayroll User GuideDocument19 pagesOthuser Guide For Investment Declaration 22-23 - MyPayroll User GuideRiyaan SultanNo ratings yet

- Mini Case 3 - 264831Document13 pagesMini Case 3 - 264831Rubiatul AdawiyahNo ratings yet

- Prelim-Exam-In-Acc417 415 Acc412 RefresherDocument2 pagesPrelim-Exam-In-Acc417 415 Acc412 RefresherNhicoleChoiNo ratings yet

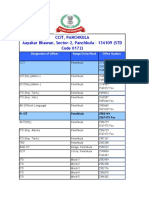

- CCIT PanchkulaDocument7 pagesCCIT PanchkulaNitin AgnihotriNo ratings yet

- The Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDocument8 pagesThe Institute of Chartered Accountants of Nepal: Suggested Answers of Income Tax and VATDipen AdhikariNo ratings yet

- 5000 s6 Fill 21eDocument4 pages5000 s6 Fill 21ebo zouNo ratings yet

- Earthwear Hands-On Mini-Case: Chapter 3 - Materiality and Tolerable MisstatementDocument8 pagesEarthwear Hands-On Mini-Case: Chapter 3 - Materiality and Tolerable MisstatementRuany LisbethNo ratings yet

- Challan 280Document2 pagesChallan 280Rahul SinglaNo ratings yet

- MC 5 Cash-1Document4 pagesMC 5 Cash-1lim qsNo ratings yet

- Purchase of Real PropertyDocument5 pagesPurchase of Real PropertyBogart D AkitaNo ratings yet

- Dealings On PropertiesDocument8 pagesDealings On PropertiesEllah MaeNo ratings yet

- ACCT 4410-Wk3a-Salaries-Scope of Charge+Source of Income (2020S)Document25 pagesACCT 4410-Wk3a-Salaries-Scope of Charge+Source of Income (2020S)Elaine LingxNo ratings yet

- Tax 312 - Quiz #2 Answers FINALDocument1 pageTax 312 - Quiz #2 Answers FINALmarjorie blancoNo ratings yet

- 5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedDocument5 pages5 - Tax Rules For Individuals Earning Income Both From Compensation and From Self-EditedKiara Marie P. LAGUDANo ratings yet

- Part 1 of Chapter 5Document3 pagesPart 1 of Chapter 5RB Janelle YTNo ratings yet

- QuizzerDocument3 pagesQuizzerRyan Prado AndayaNo ratings yet

- Accounting Cycle - Comprehensive ProblemDocument29 pagesAccounting Cycle - Comprehensive ProblemTooba HashmiNo ratings yet

- Case 1Document10 pagesCase 1Shawn VerzalesNo ratings yet

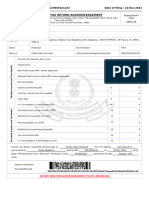

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:566129350221223 Date of Filing: 22-Dec-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:566129350221223 Date of Filing: 22-Dec-2023Rajesh DasNo ratings yet

- Chapter 4 Taxation of TRUSTs-2Document5 pagesChapter 4 Taxation of TRUSTs-2NaikNo ratings yet

- TMRD Sample Comp APR2020 With SpotDocument1 pageTMRD Sample Comp APR2020 With SpotLiv ValdezNo ratings yet