Professional Documents

Culture Documents

Finance Project On ITC (Statement Analysis)

Uploaded by

jigar jain0 ratings0% found this document useful (0 votes)

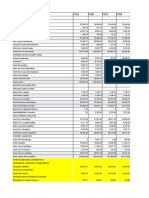

145 views2 pagesThe document is the standalone balance sheet of ITC for the years 2015 to 2019. It shows the company's assets, liabilities, and shareholder equity. Some key highlights are:

- As of March 2019, ITC had total assets of Rs. 69,797.92 crore and total shareholder equity of Rs. 57,949.79 crore.

- Non-current assets included tangible assets of Rs. 17,945.65 crore and investments of Rs. 14,071.45 crore. Current assets included investments of Rs. 12,506.55 crore and inventories of Rs. 7,587.24 crore.

- Total liabilities were Rs. 11,

Original Description:

Moneycontrol.com __ Company Info __ Print Financials

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document is the standalone balance sheet of ITC for the years 2015 to 2019. It shows the company's assets, liabilities, and shareholder equity. Some key highlights are:

- As of March 2019, ITC had total assets of Rs. 69,797.92 crore and total shareholder equity of Rs. 57,949.79 crore.

- Non-current assets included tangible assets of Rs. 17,945.65 crore and investments of Rs. 14,071.45 crore. Current assets included investments of Rs. 12,506.55 crore and inventories of Rs. 7,587.24 crore.

- Total liabilities were Rs. 11,

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

145 views2 pagesFinance Project On ITC (Statement Analysis)

Uploaded by

jigar jainThe document is the standalone balance sheet of ITC for the years 2015 to 2019. It shows the company's assets, liabilities, and shareholder equity. Some key highlights are:

- As of March 2019, ITC had total assets of Rs. 69,797.92 crore and total shareholder equity of Rs. 57,949.79 crore.

- Non-current assets included tangible assets of Rs. 17,945.65 crore and investments of Rs. 14,071.45 crore. Current assets included investments of Rs. 12,506.55 crore and inventories of Rs. 7,587.24 crore.

- Total liabilities were Rs. 11,

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

8/18/2019 ITC | Standalone Balance Sheet > Cigarettes > Standalone Balance Sheet of ITC - BSE: 500875, NSE:

TC - BSE: 500875, NSE: ITC

This data can be easily copy pasted into a Microsoft Excel sheet PRINT

ITC Previous Years »

Standalone Balance Sheet ------------------- in Rs. Cr. -------------------

Mar 19 Mar 18 Mar 17 Mar 16 Mar 15

12 mths 12 mths 12 mths 12 mths 12 mths

EQUITIES AND LIABILITIES

SHAREHOLDER'S FUNDS

Equity Share Capital 1,225.86 1,220.43 1,214.74 804.72 801.55

Total Share Capital 1,225.86 1,220.43 1,214.74 804.72 801.55

Revaluation Reserves 0.00 0.00 0.00 52.41 52.41

Reserves and Surplus 54,725.99 50,179.64 44,126.22 32,071.87 29,881.73

Total Reserves and Surplus 54,725.99 50,179.64 44,126.22 32,124.28 29,934.14

Employees Stock Options 1,997.94 0.00 0.00 0.00 0.00

Total Shareholders Funds 57,949.79 51,400.07 45,340.96 32,929.00 30,735.69

NON-CURRENT LIABILITIES

Long Term Borrowings 7.89 11.13 17.99 25.83 38.69

Deferred Tax Liabilities [Net] 2,044.14 1,917.94 1,871.70 1,848.42 1,631.60

Other Long Term Liabilities 41.90 73.66 23.86 15.13 7.05

Long Term Provisions 132.64 121.91 131.37 112.19 100.72

Total Non-Current Liabilities 2,226.57 2,124.64 2,044.92 2,001.57 1,778.06

CURRENT LIABILITIES

Short Term Borrowings 0.00 0.00 0.01 3.60 0.02

Trade Payables 3,368.28 3,382.28 2,551.22 2,265.59 1,904.62

Other Current Liabilities 6,228.04 5,435.08 4,237.01 4,000.08 3,671.18

Short Term Provisions 25.24 39.24 41.83 8,318.59 6,106.09

Total Current Liabilities 9,621.56 8,856.60 6,830.07 14,587.86 11,681.91

Total Capital And Liabilities 69,797.92 62,381.31 54,215.95 49,518.43 44,195.66

ASSETS

NON-CURRENT ASSETS

Tangible Assets 17,945.65 15,120.00 14,469.32 13,816.77 13,777.14

Intangible Assets 540.75 445.99 410.92 387.76 401.35

Capital Work-In-Progress 3,391.47 5,016.85 3,491.33 2,470.08 2,085.49

Intangible Assets Under Development 9.89 8.73 45.69 30.75 28.65

Fixed Assets 21,887.76 20,591.57 18,417.26 16,705.36 16,292.63

Non-Current Investments 14,071.45 13,493.77 8,485.51 6,392.90 2,441.64

Long Term Loans And Advances 6.21 7.40 5.84 2,285.43 1,506.36

Other Non-Current Assets 4,263.54 3,785.57 2,769.95 0.00 0.00

Total Non-Current Assets 40,228.96 37,878.31 29,678.56 25,383.69 20,240.63

CURRENT ASSETS

Current Investments 12,506.55 9,903.45 10,099.78 6,461.34 5,963.82

Inventories 7,587.24 7,237.15 7,863.99 8,519.82 7,836.76

Trade Receivables 3,646.22 2,357.01 2,207.50 1,686.35 1,722.40

Cash And Cash Equivalents 3,768.73 2,594.88 2,747.27 6,563.95 7,588.61

Short Term Loans And Advances 5.02 4.15 3.37 501.84 549.89

OtherCurrentAssets 2,055.20 2,406.36 1,615.48 401.44 293.55

Total Current Assets 29,568.96 24,503.00 24,537.39 24,134.74 23,955.03

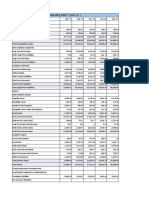

https://www.moneycontrol.com/stocks/company_info/print_main.php 1/2

8/18/2019 ITC | Standalone Balance Sheet > Cigarettes > Standalone Balance Sheet of ITC - BSE: 500875, NSE: ITC

Total Assets 69,797.92 62,381.31 54,215.95 49,518.43 44,195.66

OTHER ADDITIONAL INFORMATION

CONTINGENT LIABILITIES, COMMITMENTS

Contingent Liabilities 2,491.31 2,257.52 2,237.36 2,648.78 2,017.06

CIF VALUE OF IMPORTS

Raw Materials 1,947.00 1,506.00 0.00 1,247.18 1,429.00

Stores, Spares And Loose Tools 0.00 0.00 0.00 61.55 68.92

Trade/Other Goods 0.00 0.00 0.00 15.36 61.63

Capital Goods 426.00 532.00 0.00 211.25 292.56

EXPENDITURE IN FOREIGN EXCHANGE

Expenditure In Foreign Currency 0.00 0.00 0.00 136.35 116.64

REMITTANCES IN FOREIGN CURRENCIES FOR

DIVIDENDS

Dividend Remittance In Foreign Currency - - - 1,521.26 1,460.90

EARNINGS IN FOREIGN EXCHANGE

FOB Value Of Goods 3,828.00 3,480.00 - 3,057.85 4,253.18

Other Earnings - - - 585.89 842.81

BONUS DETAILS

Bonus Equity Share Capital 1,113.14 1,113.14 1,113.14 710.47 710.47

NON-CURRENT INVESTMENTS

Non-Current Investments Quoted Market

11,218.74 11,096.58 6,344.59 3,253.11 1,045.15

Value

Non-Current Investments Unquoted Book

2,882.13 2,432.64 2,191.52 3,596.03 1,862.47

Value

CURRENT INVESTMENTS

Current Investments Quoted Market

4,624.25 1,792.59 2,380.97 1,363.44 1,224.09

Value

Current Investments Unquoted Book

7,885.76 8,111.65 7,723.02 5,098.40 4,740.41

Value

Source : Dion Global Solutions Limited

https://www.moneycontrol.com/stocks/company_info/print_main.php 2/2

You might also like

- 18-3-SA-V1-S1 Solved Problems RaDocument34 pages18-3-SA-V1-S1 Solved Problems RaRajyaLakshmiNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- Horngrens Financial and Managerial Accounting 6th Edition Nobles Test BankDocument85 pagesHorngrens Financial and Managerial Accounting 6th Edition Nobles Test Bankmatthewavilawpkrnztjxs100% (29)

- Econ UA 2.6 MacroObsPolicies Ed1 QP PDFDocument11 pagesEcon UA 2.6 MacroObsPolicies Ed1 QP PDFMohammad Farhan NewazNo ratings yet

- Payments Processing R12Document76 pagesPayments Processing R12daxmg100% (1)

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDivya PandeyNo ratings yet

- Print: Previous YearsDocument2 pagesPrint: Previous YearsArun BineshNo ratings yet

- Balance Sheet ITCDocument2 pagesBalance Sheet ITCProsenjit RoyNo ratings yet

- Money ControlDocument2 pagesMoney ControlsuryaaNo ratings yet

- Ashok Leyland Balane SheetDocument2 pagesAshok Leyland Balane SheetNaresh Kumar NareshNo ratings yet

- Bharat Petroleum Corporation Standalone Balance Sheet Data for Previous YearsDocument2 pagesBharat Petroleum Corporation Standalone Balance Sheet Data for Previous YearsTaksh DhamiNo ratings yet

- Cipla Balance SheetDocument2 pagesCipla Balance SheetNEHA LAL100% (1)

- Tata SteelDocument14 pagesTata Steeldevansh kakkarNo ratings yet

- Ceat Balance SheetDocument2 pagesCeat Balance Sheetkcr kc100% (2)

- Balance Sheet M&MDocument2 pagesBalance Sheet M&MRitik AggarwalNo ratings yet

- Adani Power Balance Sheet Data for 5 YearsDocument2 pagesAdani Power Balance Sheet Data for 5 YearsPriyankar RaiNo ratings yet

- Asian Paints BsDocument2 pagesAsian Paints BsPriyalNo ratings yet

- Tata Motors Standalone Balance SheetDocument2 pagesTata Motors Standalone Balance SheetSebastian MichaelNo ratings yet

- Apollo Tyres: PrintDocument2 pagesApollo Tyres: PrintTiaNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsNakul RathiNo ratings yet

- Steel Authority of India Balance Sheet and Profit & Loss AnalysisDocument12 pagesSteel Authority of India Balance Sheet and Profit & Loss AnalysisPadmavathi shivaNo ratings yet

- GautamDocument36 pagesGautamMaurya KNo ratings yet

- Mahinda Last Five Years Balance SheetDocument2 pagesMahinda Last Five Years Balance SheetSuman Sarkar100% (1)

- Tata Motors Last 5years Balance SheetDocument2 pagesTata Motors Last 5years Balance SheetSuman Sarkar100% (1)

- Power Grid Corporation of India: PrintDocument2 pagesPower Grid Corporation of India: PrintUtkarsh KhannaNo ratings yet

- Tata Power Balance SheetDocument2 pagesTata Power Balance Sheetakankshakhushi12No ratings yet

- UltraTech Cement Balance Sheet and Profit & Loss AnalysisDocument6 pagesUltraTech Cement Balance Sheet and Profit & Loss AnalysisMOHAMMED KHAYYUMNo ratings yet

- Consolidated Balance SheetDocument2 pagesConsolidated Balance SheetSEHWAG MATHAVANNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsDhruv NarangNo ratings yet

- Bajaj Auto BLDocument2 pagesBajaj Auto BLPrabhakar SinghNo ratings yet

- ABB India Standalone Balance SheetDocument2 pagesABB India Standalone Balance SheetAbhay Kumar SinghNo ratings yet

- Balance Sheet of Tata MotorsDocument6 pagesBalance Sheet of Tata Motorsnehanayaka25No ratings yet

- Adani Ports Balance Sheet DataDocument2 pagesAdani Ports Balance Sheet DataTaksh DhamiNo ratings yet

- Bharat Heavy Electricals Balance Sheet Data for 5 YearsDocument2 pagesBharat Heavy Electricals Balance Sheet Data for 5 YearsTaksh DhamiNo ratings yet

- Housing Development Finance Corporation: PrintDocument2 pagesHousing Development Finance Corporation: PrintAbdul Khaliq ChoudharyNo ratings yet

- Hindalco Industries Balance Sheet AnalysisDocument3 pagesHindalco Industries Balance Sheet AnalysisSharon T100% (1)

- Company Info - Print Financials PDFDocument2 pagesCompany Info - Print Financials PDFSumit KalelkarNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsMohd lakdNo ratings yet

- UltraTech Cement Consolidated Balance Sheet OverviewDocument2 pagesUltraTech Cement Consolidated Balance Sheet OverviewPappu BhatiyaNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsonlyforbusinessusethisNo ratings yet

- ASHIKDocument21 pagesASHIKmohammedaashik.f2022No ratings yet

- AmbujaDocument2 pagesAmbujaMohammad DishanNo ratings yet

- Balance Sheet GodrejDocument2 pagesBalance Sheet GodrejDhruvi PatelNo ratings yet

- MKT Ca1Document96 pagesMKT Ca1Nainpreet KaurNo ratings yet

- Bajaj AutoDocument2 pagesBajaj AutoRinku RajpootNo ratings yet

- Balance SheetDocument2 pagesBalance Sheetprathamesh tawareNo ratings yet

- Dabur India Balance Sheet Data for 5 YearsDocument2 pagesDabur India Balance Sheet Data for 5 YearsDhruvi PatelNo ratings yet

- MBA06070 VinayJaju AsianPaintsDocument15 pagesMBA06070 VinayJaju AsianPaintsVinay JajuNo ratings yet

- Ceat Tyres LTD.: Fsa AssignmentDocument37 pagesCeat Tyres LTD.: Fsa AssignmentSourajit SanyalNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsPrekshitha NNo ratings yet

- SHREE Moneycontrol - Com - Company Info - Print FinancialsDocument2 pagesSHREE Moneycontrol - Com - Company Info - Print FinancialsMohammad DishanNo ratings yet

- Ceat B - SDocument2 pagesCeat B - SRashesh GajeraNo ratings yet

- AbhimanyuDocument46 pagesAbhimanyuMaurya KNo ratings yet

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Document6 pagesRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14No ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print FinancialsPreethaNo ratings yet

- Balance Sheet of Eicher Motors For MonicaDocument4 pagesBalance Sheet of Eicher Motors For MonicaBBA SFNo ratings yet

- STD Balance Sheet 3Document2 pagesSTD Balance Sheet 3AbhijeetBhiseNo ratings yet

- Tata Motors Balance Sheet Analysis 2017-2021Document4 pagesTata Motors Balance Sheet Analysis 2017-2021S. BIKKI KUMARNo ratings yet

- Vodafone Idea Limited: PrintDocument2 pagesVodafone Idea Limited: PrintPrakhar KapoorNo ratings yet

- Tata Motors Balance Sheet Analysis 2017-2021Document4 pagesTata Motors Balance Sheet Analysis 2017-2021Priyanshu GuptaNo ratings yet

- AK Sun Pharma UM21321Document4 pagesAK Sun Pharma UM21321akarshika raiNo ratings yet

- Company Info - Print FinancialsDocument2 pagesCompany Info - Print Financials001AAYUSH NANDANo ratings yet

- Asian PaintsDocument40 pagesAsian PaintsHemendra GuptaNo ratings yet

- Agency ProblemDocument10 pagesAgency ProblemKARNATI CHARAN 2028331No ratings yet

- Synopsis of Organic FoodDocument5 pagesSynopsis of Organic Foodjigar jainNo ratings yet

- Titan CompanyDocument10 pagesTitan Companyjigar jainNo ratings yet

- Synopsis of Joint vENTUREDocument5 pagesSynopsis of Joint vENTUREjigar jainNo ratings yet

- Joint VentureDocument5 pagesJoint Venturejigar jainNo ratings yet

- Joint VentureDocument5 pagesJoint Venturejigar jainNo ratings yet

- Synopsis of Organic FoodDocument5 pagesSynopsis of Organic Foodjigar jainNo ratings yet

- Critical Path MethodDocument11 pagesCritical Path Methodjigar jainNo ratings yet

- GST Certificate CourseDocument4 pagesGST Certificate Coursebmbabu27No ratings yet

- Critical Path MethodDocument11 pagesCritical Path Methodjigar jainNo ratings yet

- Marketing ManagementDocument6 pagesMarketing Managementjigar jainNo ratings yet

- Brokerage Report of Monsanto Agro 2014Document8 pagesBrokerage Report of Monsanto Agro 2014jigar jainNo ratings yet

- GST E-Way Bill: Requirements, Validity, and EnforcementDocument12 pagesGST E-Way Bill: Requirements, Validity, and Enforcementjigar jainNo ratings yet

- Lec 6-Groups & TeamsDocument38 pagesLec 6-Groups & Teamsjigar jainNo ratings yet

- Body LanguageDocument29 pagesBody LanguageLê HiếnNo ratings yet

- Kesari StoryDocument1 pageKesari Storyjigar jainNo ratings yet

- Banking & Economy PDF - December 2021 by AffairsCloud 1Document153 pagesBanking & Economy PDF - December 2021 by AffairsCloud 1OK BHaiNo ratings yet

- Voucher System-Problem 6 and 7 (ABDULLAH, SALMA B.) - 122631Document9 pagesVoucher System-Problem 6 and 7 (ABDULLAH, SALMA B.) - 122631Salma AbdullahNo ratings yet

- Monetary Policy - Objectives, Tools, and Types of Monetary PoliciesDocument3 pagesMonetary Policy - Objectives, Tools, and Types of Monetary PoliciesVincentNo ratings yet

- Estmt - 2021-05-06 2Document6 pagesEstmt - 2021-05-06 2Moctar GueyeNo ratings yet

- Annu Singh FinalDocument64 pagesAnnu Singh Finalsauravv7100% (1)

- Working Capital Management Sample ProblemsDocument4 pagesWorking Capital Management Sample ProblemsJames InferidoNo ratings yet

- Capital budgeting importance and methodsDocument7 pagesCapital budgeting importance and methodsNamy Lyn GumameraNo ratings yet

- Chapter 1: Introduction To Digital BankingDocument9 pagesChapter 1: Introduction To Digital BankingPriyanka JNo ratings yet

- Platinum Choice Fyf New CompressedpdfDocument11 pagesPlatinum Choice Fyf New CompressedpdfDeepak D MishraNo ratings yet

- Cash Flow Statement Mcqs With AnswerDocument25 pagesCash Flow Statement Mcqs With Answermahesh patilNo ratings yet

- Payments Systems in The U S Third Edition A Guide For Professional 3rdDocument53 pagesPayments Systems in The U S Third Edition A Guide For Professional 3rdedith.beltran702100% (37)

- AP Handout 01 Audit of Cash PDFDocument6 pagesAP Handout 01 Audit of Cash PDFTherese AlmiraNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument20 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, Warfielddystopian au.No ratings yet

- Yosra Turki's Resume Highlighting Financial Analysis and Modeling ExperienceDocument2 pagesYosra Turki's Resume Highlighting Financial Analysis and Modeling ExperienceEmdadul Hoque TusherNo ratings yet

- Investing in Fixed Income SecuritiesDocument16 pagesInvesting in Fixed Income Securitiescao cao100% (1)

- Decimals Answer KeyDocument3 pagesDecimals Answer KeyKathleen EstilloreNo ratings yet

- Pro Forma Balance Sheet Template: Company NameDocument5 pagesPro Forma Balance Sheet Template: Company NamePhương ĐinhNo ratings yet

- IR1qtr 2020Document60 pagesIR1qtr 2020MitchayNo ratings yet

- 22 2Q Earning Release of LGEDocument18 pages22 2Q Earning Release of LGEThảo VũNo ratings yet

- Chapter 2Document4 pagesChapter 2JavNo ratings yet

- Receivables ManagementDocument5 pagesReceivables ManagementInocencio TiburcioNo ratings yet

- ENPL To MSIPL-ENPL SiranchowkDocument1 pageENPL To MSIPL-ENPL SiranchowkDeepak SinghNo ratings yet

- Introduction of Kissan Credit Card SchemeDocument4 pagesIntroduction of Kissan Credit Card SchemeRomen BuragohainNo ratings yet

- Mangalam AR White Kite TransfersDocument7 pagesMangalam AR White Kite TransfersCA Pallavi KNo ratings yet

- CDO GSIS Payment OptionsDocument3 pagesCDO GSIS Payment OptionsLGU MAHINOG MTONo ratings yet

- Week 03 - Bank ReconciliationDocument6 pagesWeek 03 - Bank ReconciliationPj ManezNo ratings yet