Professional Documents

Culture Documents

Bank Nifty Docter Strategy

Bank Nifty Docter Strategy

Uploaded by

Kumar Manoj0 ratings0% found this document useful (0 votes)

25 views1 pageThe document discusses options trading strategies using the Relative Strength Index (RSI) indicator to determine position sizes. It recommends using delta values below 0.2 for writing options and above 0.5 for buying options. Positions are adjusted dynamically based on changes in RSI levels and momentum/trend rather than using fixed targets or stop losses.

Original Description:

Original Title

bank nifty docter strategy

Copyright

© © All Rights Reserved

Available Formats

TXT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document discusses options trading strategies using the Relative Strength Index (RSI) indicator to determine position sizes. It recommends using delta values below 0.2 for writing options and above 0.5 for buying options. Positions are adjusted dynamically based on changes in RSI levels and momentum/trend rather than using fixed targets or stop losses.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

25 views1 pageBank Nifty Docter Strategy

Bank Nifty Docter Strategy

Uploaded by

Kumar ManojThe document discusses options trading strategies using the Relative Strength Index (RSI) indicator to determine position sizes. It recommends using delta values below 0.2 for writing options and above 0.5 for buying options. Positions are adjusted dynamically based on changes in RSI levels and momentum/trend rather than using fixed targets or stop losses.

Copyright:

© All Rights Reserved

Available Formats

Download as TXT, PDF, TXT or read online from Scribd

You are on page 1of 1

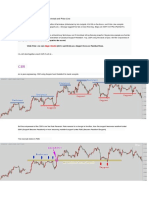

My options writing positions exposure criteria...

I will explain in five lacs trading accounts

I maximum take seven lots positions but delta always below 0.2...

Rsi 45-55

Two puts/two calls

Rsi 55-60

Three puts/two calls

60-65

Four puts/two calls

Dr.Jignesh Shah

Rsi 40-45

Two puts/three calls

Rsi 35-40

Two puts/four calls

Dr.Jignesh Shah

Rsi 65-70 with adx not rising

Three puts

Rsi 65-70 with rising adx

Four puts

Rsi above 70

Five/six puts

What is simple explanation of delta?

Delta indirectly reflects probability of closing in the money...

0.5 delta has 50% probability of closing in the money

0.2 delta has 20% probability of closing in the money....means 0.2 delta options

writers have 80% probability of profit

Delta 0.2 and less for option writing

Delta 0.5 and higher for option buying

Reminder again.....

Our system is dynamic means we adjust our positions according to momentum and

trend...

So our positions changes as per the change of segment in RSI....

So trade on basis of RDX strategy if you have the required flexibility.

So there is no target... No fixed stoploss...

Just do trade as per the change in momentum and trend...

Just like driving... As per the traffic press accelerator or break...

You might also like

- RDX Strategy Book (3rd Edition)Document27 pagesRDX Strategy Book (3rd Edition)jignesh shah84% (64)

- ITJEGAN's Option PPT - Mumbai March 23Document63 pagesITJEGAN's Option PPT - Mumbai March 23Pankaj D. Dani82% (38)

- Pivot - SPH - SPL Trading MethodDocument57 pagesPivot - SPH - SPL Trading MethodA100% (3)

- Machine Learning in Finance: Matthew F. Dixon Igor Halperin Paul BilokonDocument565 pagesMachine Learning in Finance: Matthew F. Dixon Igor Halperin Paul BilokonKumar Manoj67% (6)

- RSI Trading Strategies: Highly Profitable Trading Strategies Using The Relative Strength Index: Day Trading Made Easy, #1From EverandRSI Trading Strategies: Highly Profitable Trading Strategies Using The Relative Strength Index: Day Trading Made Easy, #1Rating: 5 out of 5 stars5/5 (8)

- RSI Indicator Trading Strategy, 5 Systems + Back Test Results!Document22 pagesRSI Indicator Trading Strategy, 5 Systems + Back Test Results!brijendra singh100% (7)

- Buy and Sell Day Trading Signals: Profitable Trading Strategies, #4From EverandBuy and Sell Day Trading Signals: Profitable Trading Strategies, #4No ratings yet

- Binary Options: Steps by Steps Guide To Making Money From Volatility Index TradingFrom EverandBinary Options: Steps by Steps Guide To Making Money From Volatility Index TradingRating: 5 out of 5 stars5/5 (1)

- Pivot Boss 4 EmaDocument1 pagePivot Boss 4 EmaKumar ManojNo ratings yet

- Disciplined Trader Trade Journal (Shares)Document850 pagesDisciplined Trader Trade Journal (Shares)Kumar ManojNo ratings yet

- RDX StrategyDocument75 pagesRDX StrategyChetan Sharma100% (1)

- ST Sir Gems, Subhadip Sir Pivots and Explanation of IDF by DR - VivekDocument101 pagesST Sir Gems, Subhadip Sir Pivots and Explanation of IDF by DR - VivekUsha JagtapNo ratings yet

- RDX StrategyDocument4 pagesRDX StrategyAfiya Anwar100% (3)

- Report RSI80 20TradingStrategyDocument19 pagesReport RSI80 20TradingStrategyCapitanu Iulian100% (1)

- RSI 80 20TradingStrategyDocument18 pagesRSI 80 20TradingStrategyBobei Dinu100% (6)

- What Markets We Will Trade 3. What Is The Rule of Entry in The TradeDocument8 pagesWhat Markets We Will Trade 3. What Is The Rule of Entry in The TradeNoel MathewsNo ratings yet

- Swing Trading System by TradehunterDocument21 pagesSwing Trading System by Tradehunterjacs6401No ratings yet

- Secrets of Trading With RSIDocument9 pagesSecrets of Trading With RSIHarryNo ratings yet

- Smart Trade - ST Da'S PostsDocument67 pagesSmart Trade - ST Da'S PostsDon BenNo ratings yet

- Smart Trade - ST Da'S PostsDocument68 pagesSmart Trade - ST Da'S PostsSamson KoshyNo ratings yet

- Report Rsi 80 20 Trading Strategy - 63e684a4Document24 pagesReport Rsi 80 20 Trading Strategy - 63e684a4Shahid HussainNo ratings yet

- Santosh BabaDocument137 pagesSantosh BabaAkshi KarthikeyanNo ratings yet

- Rsi Trading StrategyDocument10 pagesRsi Trading StrategyKông Nghiệp NguyễnNo ratings yet

- RSI Trading StrategyDocument12 pagesRSI Trading StrategyTyrone50% (2)

- Rsi r2 Super Rsi FaqDocument14 pagesRsi r2 Super Rsi FaqChandrasekar Chandramohan100% (1)

- Rsi-R2 Super Rsi FaqDocument14 pagesRsi-R2 Super Rsi FaqSapta WirmanNo ratings yet

- Traders Dynamic Indicator TDIDocument26 pagesTraders Dynamic Indicator TDIPurity G. Mugo100% (1)

- Prashant Shah - RSIDocument5 pagesPrashant Shah - RSIIMaths PowaiNo ratings yet

- Bull Trade RulesDocument2 pagesBull Trade RulesmdimranahmedNo ratings yet

- How To Boost Trading ProfitsDocument19 pagesHow To Boost Trading Profitsthava477ceg100% (1)

- Best of Big E IIDocument11 pagesBest of Big E IIchander kant sharmaNo ratings yet

- Intraday Mini-Flow by SAINTDocument5 pagesIntraday Mini-Flow by SAINTtalk_delight100% (2)

- Indicator Trend Lines SystemDocument2 pagesIndicator Trend Lines SystemMarko TomicNo ratings yet

- Indicator Trend Lines SystemDocument2 pagesIndicator Trend Lines SystemMarko TomicNo ratings yet

- Subasish - Pani - Revealed - The - Thread - by - Niki - Poojary - Mar 7, 23 - From - RattibhaDocument16 pagesSubasish - Pani - Revealed - The - Thread - by - Niki - Poojary - Mar 7, 23 - From - RattibhasandeepNo ratings yet

- Intraday Trading Strategy F (Z-Library)Document29 pagesIntraday Trading Strategy F (Z-Library)dheeresh59No ratings yet

- The Best of TEB63Document20 pagesThe Best of TEB63Marc EpsleyNo ratings yet

- Thoughts On Day-Swing Trading - Smart - TradeDocument64 pagesThoughts On Day-Swing Trading - Smart - TradeHeading Heading Ahead AheadNo ratings yet

- Basic Guide To Support and Resistance Trading5Document10 pagesBasic Guide To Support and Resistance Trading5fuzzychanNo ratings yet

- Guide On Trading Indicators: What Is The RSI (Relative Strength Indicator) Indicator?Document9 pagesGuide On Trading Indicators: What Is The RSI (Relative Strength Indicator) Indicator?Saroj PaudelNo ratings yet

- Guide On Trading Indicators: What Is The RSI (Relative Strength Indicator) Indicator?Document9 pagesGuide On Trading Indicators: What Is The RSI (Relative Strength Indicator) Indicator?Saroj PaudelNo ratings yet

- Earn Daily in Your Choice of StockDocument19 pagesEarn Daily in Your Choice of StockRajen VyasNo ratings yet

- Stop Loss Placement, New EditedDocument16 pagesStop Loss Placement, New EditedjohnNo ratings yet

- Multi-Level Trading-Recovery Trading: ND RDDocument11 pagesMulti-Level Trading-Recovery Trading: ND RDAkram BoushabaNo ratings yet

- RDXDocument27 pagesRDXPrasanth PalliesseryNo ratings yet

- How To Install This IndicatorDocument5 pagesHow To Install This Indicatorsukabumi juniorNo ratings yet

- Zone Breakout'sDocument78 pagesZone Breakout'sPARTH DHULAM100% (2)

- Stock Market TipsDocument8 pagesStock Market TipsRahul AssawaNo ratings yet

- Trading MindsetDocument28 pagesTrading MindsetAnsh RebelloNo ratings yet

- Clear Buy Signal Needs To Fulfil The Following Criteria: Clear Sell Signal Should HaveDocument7 pagesClear Buy Signal Needs To Fulfil The Following Criteria: Clear Sell Signal Should HaveKalidas SundararamanNo ratings yet

- The ABC of Creating A Mean Reversion StrategyDocument11 pagesThe ABC of Creating A Mean Reversion StrategyAnurag GroverNo ratings yet

- Market Moves From High Level To Low Level, From Oversold To Overbought Areas and Then Reverses. As We Are inDocument3 pagesMarket Moves From High Level To Low Level, From Oversold To Overbought Areas and Then Reverses. As We Are inroughimNo ratings yet

- Banknifty DoctorDocument9 pagesBanknifty DoctorMeghali BorleNo ratings yet

- RSI Strategy Guide PDFDocument7 pagesRSI Strategy Guide PDFcoachbiznesuNo ratings yet

- Rakesh Jhunjhunwala - Case Study PDFDocument2 pagesRakesh Jhunjhunwala - Case Study PDFVAISHVIK SALASIYANo ratings yet

- 11 Habits of Disciplined TraderDocument7 pages11 Habits of Disciplined TraderKirankumar Tadhawala100% (1)

- Risk ManagementDocument20 pagesRisk Managementmike aboladeNo ratings yet

- Intraday Miniflow by Saint 60 Min TF 926Document2 pagesIntraday Miniflow by Saint 60 Min TF 926Jayram VeliyathNo ratings yet

- CSR PLUS - The Magic of Role Reversal and Price Line .Id - enDocument34 pagesCSR PLUS - The Magic of Role Reversal and Price Line .Id - enRanca KentangNo ratings yet

- 3X Trade Boost!Document3 pages3X Trade Boost!mzieNo ratings yet

- Learnings From DJ SirDocument94 pagesLearnings From DJ SirHare KrishnaNo ratings yet

- Earn Daily Profits From Any MarketDocument9 pagesEarn Daily Profits From Any MarketAmit Kumra100% (1)

- International Journal of Forecasting: Andrea Carriero, Ana Beatriz Galvão, George KapetaniosDocument14 pagesInternational Journal of Forecasting: Andrea Carriero, Ana Beatriz Galvão, George KapetaniosKumar ManojNo ratings yet

- International Journal of Forecasting: Michael PedersenDocument8 pagesInternational Journal of Forecasting: Michael PedersenKumar ManojNo ratings yet

- International Journal of Forecasting: Bruno Deschamps Christos Ioannidis Kook KaDocument15 pagesInternational Journal of Forecasting: Bruno Deschamps Christos Ioannidis Kook KaKumar ManojNo ratings yet

- International Journal of Forecasting: Ray Yeutien Chou Tso-Jung Yen Yu-Min YenDocument25 pagesInternational Journal of Forecasting: Ray Yeutien Chou Tso-Jung Yen Yu-Min YenKumar ManojNo ratings yet

- Karan Veer CPR With Moving AverageDocument8 pagesKaran Veer CPR With Moving AverageKumar ManojNo ratings yet

- European Journal of Operational Research: Stefan Feuerriegel, Julius GordonDocument14 pagesEuropean Journal of Operational Research: Stefan Feuerriegel, Julius GordonKumar ManojNo ratings yet

- When Backtests Meet Reality: Johann Christian Lotter / Op Group Germany GMBHDocument23 pagesWhen Backtests Meet Reality: Johann Christian Lotter / Op Group Germany GMBHKumar ManojNo ratings yet

- International Journal of ForecastingDocument18 pagesInternational Journal of ForecastingKumar ManojNo ratings yet

- Position SizingDocument1 pagePosition SizingKumar ManojNo ratings yet

- Auto FibonacciDocument2 pagesAuto FibonacciKumar ManojNo ratings yet

- Sno Complaint Detail Dept Escalation Level and Status 1St 2Nd 3RdDocument7 pagesSno Complaint Detail Dept Escalation Level and Status 1St 2Nd 3RdKumar ManojNo ratings yet

- Pivot Points PHLDocument1 pagePivot Points PHLKumar ManojNo ratings yet

- Pivots Points HL FixDocument1 pagePivots Points HL FixKumar ManojNo ratings yet

- Balance Score Card Full Color RevisiDocument34 pagesBalance Score Card Full Color RevisiKumar ManojNo ratings yet