Professional Documents

Culture Documents

UK Payment Markets Summary 2016 - Free Download PDF

UK Payment Markets Summary 2016 - Free Download PDF

Uploaded by

stennes1Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UK Payment Markets Summary 2016 - Free Download PDF

UK Payment Markets Summary 2016 - Free Download PDF

Uploaded by

stennes1Copyright:

Available Formats

2016

UK Payment Markets – Summary

A summary of recent and emerging developments

and forecasts for all forms of payment

Leading the way we pay

How payments are likely to change in the UK

over the next decade

Every year, Payments UK publishes a series of reports using definitive industry data to

give a complete picture of the UK’s payments landscape, across every different payment

type. By considering the trends that affect cash, cards, cheques and electronic payments,

our expert analysis and forecasts are relied upon by the industry and businesses to help

them plan for the future.

This is a summary of UK Payment Markets 2016, which sets out the way consumers

and businesses chose to pay in 2015 and forecasts how things will change up until 2025.

Details of how to obtain a full copy of the report are available from

paymentsuk.org.uk/industry-information/annual-statistical-publications.

All payments in the UK: What happens in an average minute?

Each minute in the UK in 2015, over 72,000 payments were made by consumers and businesses – totalling more than

38 billion payments during the year.

In the average minute in the UK in 2015, the following payments were made by consumers and businesses:

2015 2025

What happened in a What will happen in a

payments payments

minute? minute?

Cheque

1,038 Standing order Cheque

Faster Payments* Standing order

Faster Payments * C 450

2,089 952 1,042

4,209

Bacs Direct Credit

Bacs Direct Credit

4,132

3,851

Credit/charge card Credit/charge card

4,850 6,912 Cash

21,495

Cash

Direct Debit

7,436

60

seconds

32,740

Direct Debit 60

8,264 seconds

Debit card

19,276 Debit card

32,820 Total

Total Total

79,044

72,514 79,044

payments

payments per minute

payments

per minute per minute

*Faster Payments totals include remote banking payments cleared in-house

In 2025, the number of payments made in the UK is expected to reach 42 billion, worth a total of £9,328 billion

(excluding CHAPS, which dwarfs the value of other payment methods).

2 UK Payment Markets 2016 Summary

Payments made by consumers: Average per adult each month

The average UK adult made 648 payments during 2015, which equates to 54 payments each month. By 2025,

this will increase to 662 payments, or an average of 55 payments each month.

2015

0.7 0.5

0

27

2 116 6 4 2 1

£

C

Cash Debit Direct Credit / Contactless Faster Standing Cheque

card Debit charge card Payments* order

2025

0.7

25

0.2

1

17 6 5 14 2

Note: The contactless card payments shown here are a subset of the debit and credit card payments, not additional payments.

*Faster Payments totals include remote banking payments cleared in-house

It is clear that the way consumers make payments is going to change considerably over the next decade. Whilst

our payment choices when making regular bill payments may not change greatly, our spending habits when making

day-to-day purchases are likely to continue to evolve. The relative positions of cash and debit cards are expected

to switch, with debit cards becoming the most popular payment method among consumers. This will be aided

by the continued rollout and adoption of contactless payments.

UK Payment Markets 2016 Summary 3

Payments made by consumers and businesses

Nine out of 10 of all payments in the UK in 2015 were made by consumers, with the remainder made by businesses,

government and not-for-profit organisations. Almost one in six payments (15%) made by consumers were for regular bills,

with the remaining 85% being spontaneous purchases. On the business side, six out of 10 payments were made to

individuals, with the remaining four out of 10 being payments to other businesses.

Total volume of payments in the UK, 2015 – business and consumer breakdown

Business-to-Business

1.5 billion

Business

3.9 billion

Business-to-Individual

2.4 billion

All payments

in the UK

38.2 billion Regular

4.9 billion

Consumer

34.3 billion

Spontaneous

29.3 billion

4 UK Payment Markets 2016 Summary

Total payments in 2015 and forecasts to 2025

Cash Cards

Proportion of payments in the UK made • The average adult in the UK made 19 card payments

using cash each month in 2015

• By 2025 the average adult will make 30 card payments

each month, contributing to a total of 20.9 billion card

64% payments in the year

Nine out of ten adults in the UK have a

debit card

45%

27%

Six out of ten have a credit card

2005 2015 2025

Cash was the most popular payment method in 2015, despite

a recent downward trend in its popularity, with consumers

turning instead to debit cards and – increasingly over the

last couple of years - contactless payments. Use of cards continued to grow during 2015. The number of

debit card payments rose by 10% in 2015, exceeding 10 billion

2015 was in fact the first time cash was used for less than

payments for the first time, while 9% growth in credit and

half of payments made by consumers. However there is a

charge card usage saw 2.5 billion of these payments.

lot of variation – 2.2 million consumers relied mainly on cash

to manage their day-to-day spending while 2.7 million others The growth in debit card usage in particular is due to the

almost never used cash, relying chiefly instead on cards majority of people now holding these cards and being

and other payment solutions to manage their spending. comfortable using them. Retailers, including smaller local

shops, have become more likely to accept card payments,

Over the next ten years, the number of cash payments is

and the continued expansion of online shopping has driven

expected to continue to fall as consumers turn to alternative

growth in card payments. Contactless technology has created

payment methods. As a result cash will be used to make

more opportunities to pay using a card – particularly for

27% of all payments in 2025.

lower value payments that may previously have been

made using cash.

Debit cards are forecast to overtake cash as the most

frequently-used method of payment in 2021. In 2025,

there will be 17.3 billion debit card payments made and

3.6 billion credit card payments – with a continually

growing share being contactless payments.

UK Payment Markets 2016 Summary 5

Contactless Direct Debit

At the end of 2015, around half of all cards in the UK had Number of Direct Debit payments

contactless functionality (56% of debit cards and 38% of

credit cards). More than three times as many contactless

card payments were made in 2015 than in 2014, with 3.9

1 billion contactless payments made, accounting for

almost 9% of all consumer card payments.

2015 BILLION

Contactless payments in 2015 were 3.3x

the number in 2014 4.3

2025 BILLION

Direct Debits are a familiar and widely-trusted method for

paying regular bills, with more than five out of six consumers

using them. In 2015, 3.9 billion payments were made by

3.3x

Direct Debit in the UK, worth a total of £1,215 billion.

Consumers are far more likely to use Direct Debits than

businesses, which tend to prefer to retain more direct

increase control over the timing and amount of outgoing payments.

in contactless The economic cycle and consumer confidence are linked to

payments over some extent to Direct Debit payment volumes. When times

last year are tough, households may cut back on non-essential bills

or turn to payment methods that allow them more direct

control over the timing of payments. As the economy

grows or consumer confidence increases, spending may

As of the end of 2015 there were just over 0.3 million increase or households may feel more able to commit to

contactless terminals. Over the next decade, the number paying by Direct Debit.

of contactless cards will continue to increase, as will the

number of card terminals that accept contactless payments. As a well-established method of payment, growth in Direct

This includes contactless payments on public transport Debit payment volumes tends to reflect growth in population

networks throughout the country. figures and household numbers. Due to the established

nature of Direct Debits, we expect only limited growth over

Mobile payment services using Near-Field Communication the next ten years, with 4.3 billion payments forecast in 2025.

(NFC), such as Apple Pay, Samsung Pay and Android Pay,

will also provide new opportunities for consumers to make

contactless card payments, without actually needing to

have their plastic card to hand.

Payments using debit, credit or charge

cards forecast to account for

2025

50% of all payments

made in the UK

6 UK Payment Markets 2016 Summary

Online and mobile banking payments decline slightly. This is because, even though government

forecasts suggest steady economic growth, the rollout of

The number of adults using online banking or mobile Universal Credit will reduce the total volume of benefit

banking (through an app on a phone, tablet or other mobile payments made by the government. As a result, just over

device) grew in 2015, with over two-thirds regularly using 2 billion Bacs Direct Credit payments are forecast in 2025.

online banking and a third using mobile banking. This led to

an increase in the number of payments being sent via the

Cheques

Faster Payments Service.

Cheques used to make payments:

Payments processed by the

Faster Payments Service

2015 2025

546 237

million million

2015 Cheques were used to make payments 546 million times

1.2 BILLION in 2015. This was a reduction of 13% compared to 2014,

a trend that is seen among both consumers and businesses.

2025 Increasing numbers of card payments and remote banking

2.2 BILLION transfers are now being used where previously a cheque

may once have been written. However, cheques still remain

In addition, more and more small businesses are taking valued by those who choose to use them, and they provide

advantage of the instantaneous functionality and universal a convenient and secure method of paying someone when

reach of the service, particularly for time-critical payments. you do not know the recipient’s bank account details.

In 2015, the Faster Payments Service processed 903 million It is expected that consumers and businesses will continue

one-off and forward-dated payments and 344 million to migrate away from cheques towards alternative methods

standing order payments. Over the next decade, consumers of payment over the next decade, with 237 million cheques

and small businesses will increase their use of online and forecast to be used to make payments in 2025.

mobile banking, with the result that the total number of

payments processed by the Faster Payments Service will CHAPS

more than double to 2.2 billion payments in 2025.

• There were 37.5 million CHAPS payments processed

in 2015

Bacs Direct Credit

• There are forecast to be 48.7 million CHAPS payments

• There were 2.2 billion Direct Credit payments in 2015 in 2025

• There are forecast to be 2.0 billion Direct Credit

CHAPS is used primarily by financial institutions to make

payments in 2025

wholesale financial payments and by large corporates to

Bacs Direct Credit remains overwhelmingly the most-used make corporate treasury payments. As a result, in 2015

payment method among businesses, accounting for more CHAPS accounted for just 0.1% of the total volume of

than half of all business payments made in 2015. Over 90% payments in the UK but over 90% of the total value of

of employees are paid by Bacs Direct Credit, and the payments. In 2015, 37.5 million CHAPS payments were

government uses the service to pay nearly all recipients of processed, worth a total of £68.4 trillion. CHAPS

state benefits and state pensions. Volumes were relatively payment volumes are closely related to the state

stable in 2015, increasing by just over 1% to 2.2 billion of the UK economy. There are forecast to be just

payments. under 49 million CHAPS payments in 2025.

Over the next decade, Bacs Direct Credit is expected to

remain the most popular method for businesses to make

payments. However, the total volume of payments will

UK Payment Markets 2016 Summary 7

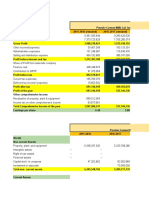

Summary: Total payments in the UK, past and future

2015 Payment Volumes 2025 Payment Volumes

(millions) (millions)

17,208 Cash 11,298

27%

Debit cards 17,250

2%

of which

10,132 contactless 911

of which

contactless 8,159

3,908 Direct Debits 4,343

Credit/charge cards

3,633

of which

2,549 contactless 134

of which

contactless 1,302

2,172 Bacs Direct Credit 2,024

1,098 Faster Payments* 2,212

546 Cheques 237

500 Standing orders 548

*Faster Payments totals include remote banking payments cleared in-house

More detailed information on this subject is published in the full UK Payments report UK Payment Market 2016. This is

available free of charge to members of Payments UK, or alternatively is available for purchase. Further information can be

found at paymentsuk.org.uk/industry-information/annual-statistical-publications.

If you have any queries about this report, For details of other publications,

please contact the research team: please contact our communications team:

Tel: 020 3217 8557 Tel: 020 3217 8368

Email: pmr@paymentsuk.org.uk Email: press@paymentsuk.org.uk

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chequing Statement-2597 2023-08-18Document2 pagesChequing Statement-2597 2023-08-18Terrio Ouimet100% (1)

- Bring Me SunshineDocument2 pagesBring Me Sunshinestennes1100% (1)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Strama LBP MapDocument190 pagesStrama LBP Mapmitti panelNo ratings yet

- Varo Money ReviewDocument6 pagesVaro Money ReviewyadavrajeNo ratings yet

- Banking 2Document8 pagesBanking 2Ashwani KumarNo ratings yet

- FundamentalsofABM2 Q1 M5Revised.-1Document12 pagesFundamentalsofABM2 Q1 M5Revised.-1Jomein Aubrey Belmonte60% (5)

- Fintech NotesDocument5 pagesFintech NotesVivek KavtaNo ratings yet

- A Charming Affair - CastDocument4 pagesA Charming Affair - Caststennes1No ratings yet

- Using Management Consulting ServicesDocument4 pagesUsing Management Consulting Servicesstennes1No ratings yet

- Training - Needs AnalysisDocument4 pagesTraining - Needs Analysisstennes1No ratings yet

- Rudolf The Red Nosed ReindeerDocument2 pagesRudolf The Red Nosed Reindeerstennes1No ratings yet

- Para and Luman: Partnership InvestmentDocument6 pagesPara and Luman: Partnership InvestmentDaphne RoblesNo ratings yet

- 1 Tender - Documents PCD-531Document19 pages1 Tender - Documents PCD-531engineerg165285No ratings yet

- Term Paper Excel Calculations-Premier Cement Mills Ltd.Document40 pagesTerm Paper Excel Calculations-Premier Cement Mills Ltd.Jannatul TrishiNo ratings yet

- Ex - TransExposure SOLDocument5 pagesEx - TransExposure SOLAlexisNo ratings yet

- Acc Closing FormDocument2 pagesAcc Closing FormRohanNo ratings yet

- SAC 2024 Fees Structure and PolicyDocument3 pagesSAC 2024 Fees Structure and PolicyMiriam TamaNo ratings yet

- Business Model Canvas - BkashDocument3 pagesBusiness Model Canvas - BkashShafi MD Abdullah HishNo ratings yet

- 3m Klibor FuturesDocument2 pages3m Klibor FuturesAmirul FarhanNo ratings yet

- Mutual FundDocument84 pagesMutual FundPrakhar TrivediNo ratings yet

- Investment Banking PresentationDocument20 pagesInvestment Banking PresentationShreya ShwetimaNo ratings yet

- Doa MR - IpulDocument29 pagesDoa MR - IpulShindu NagaraNo ratings yet

- Stockquotes 01312020 PDFDocument9 pagesStockquotes 01312020 PDFcraftersxNo ratings yet

- B X00 I WK Ul 6 X 2 WP CaDocument2 pagesB X00 I WK Ul 6 X 2 WP Caunknown_0303No ratings yet

- Aprl To Tii To Date HDFC PDFDocument4 pagesAprl To Tii To Date HDFC PDFanand chawanNo ratings yet

- 3 Required (B) Prepare The Following Accounts For The Year Ended 30 September 2020. Close The AccountsDocument18 pages3 Required (B) Prepare The Following Accounts For The Year Ended 30 September 2020. Close The AccountsalpNo ratings yet

- Sip Report (Idbi Federal)Document16 pagesSip Report (Idbi Federal)humptysharmaNo ratings yet

- Pinnacle Super BrochureDocument14 pagesPinnacle Super BrochureharrisNo ratings yet

- Vanessa Franklin Makawa CV 2022Document3 pagesVanessa Franklin Makawa CV 2022vfranklin882No ratings yet

- Basic Accounting For NCDocument31 pagesBasic Accounting For NCBryle Nikkole DionaldoNo ratings yet

- USAID Financial Audit Guide For Foreign Organizations A Mandatory Reference For ADS Chapter 591 591maa - 101023Document52 pagesUSAID Financial Audit Guide For Foreign Organizations A Mandatory Reference For ADS Chapter 591 591maa - 101023Alonso RamosNo ratings yet

- LT E-BillDocument2 pagesLT E-Billsarika25No ratings yet

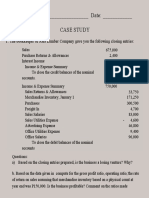

- Case Study AUSCISEDocument2 pagesCase Study AUSCISEsharielles /No ratings yet

- OREN - AC 102 (Quiz 2F)Document4 pagesOREN - AC 102 (Quiz 2F)Leslie Joy OrenNo ratings yet

- AXA Mansard Corporate Profile 040721 CompressedDocument17 pagesAXA Mansard Corporate Profile 040721 Compressedmohammed.sayed9191No ratings yet