Professional Documents

Culture Documents

Cost and Management Accounting - Tugas 5 - 29 Oktober 2019

Uploaded by

Alfiyan0 ratings0% found this document useful (0 votes)

46 views2 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

46 views2 pagesCost and Management Accounting - Tugas 5 - 29 Oktober 2019

Uploaded by

AlfiyanCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

NAMA : FAHMI NUR ALFIYAN

NIM : MAT81766

MATKUL : COST AND MANAGEMENT ACCOUNTING

KELAS : A

Exercise 11.31

1 Calculate the EVA for the Adams Division

Cost of Capital = $ 4.000.000 x 12%

Cost of Capital = $ 480.000

Net (After-Tax) Income $ 605.000

Less: Cost of Capital $ 480.000

EVA $ 125.000

EVA is now positive, and Adams Division is creating wealth.

2 Calculate the EVA for the Jefferson Division

Cost of Capital = $ 3.250.000 x 12%

Cost of Capital = $ 390.000

Net (After-Tax) Income $ 315.000

Less: Cost of Capital $ 390.000

EVA $ (75.000)

Because EVA is negative, Jefferson Dvision is destroying wealth.

3 CONCEPTUAL CONNECTION. Is each division creating or destroying wealth?

No. Adams Division is creating wealth. But, Jefferson Division is destroying wealth.

4 CONCEPTUAL CONNECTION. Describe generally the types of actions that washington's

management team could take to increase Jefferson Division's EVA?

Washington's Management Team should increase Net (After-Tax) Income to increase

Jefferson Division's EVA.

Exercise 11.32

1 Calculate the residual income for the Adams Division.

Residual Income = $ 605.000 - ( 8% x $ 4.000.000 )

Residual Income = $ 285.000

2 Calculate the residual income for the Jefferson Division.

Residual Income = $ 315.000 - ( 8% x $ 3.250.000 )

Residual Income = $ 55.000

Problem 11.41

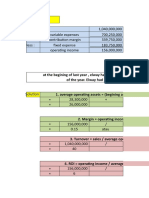

The operating results for the past years are as follows:

Year 1 Year 2 Year 3

Sales $ 10.000.000 $ 9.500.000 $ 9.000.000

Operating Income $ 1.200.000 $ 1.045.000 $ 945.000

Average Assets $ 15.000.000 $ 15.000.000 $ 15.000.000

1 Compute the ROI, Margin, and Turnover for Years 1, 2, and 3.

Year 1 Year 2 Year 3

ROI 8,00% 6,97% 6,30%

Margin 12,00% 11,00% 10,50%

Turnover 0,67 0,63 0,60

ROI = Operating Income / Average Operating Assets

Margin = Operating Income / Sales

Turnover = Sales / Average Operating Assets

2 CONCEPTUAL CONNECTION

She also estimates that sales and operating will be restored to Year 1 level.

ROI = $ 1.200.000 / $ 15.000.000 = 8%

Margin = $ 1.200.000 / $ 10.000.000 = 12%

Turnover = $ 10.000.000 / $ 15.000.000 = 0,67

The ROI increased because expenses decreased and assets turn over at a higher rate

(sales increased).

3 CONCEPTUAL CONNECTION

Operating Assets = $ 15.000.000 x 80% = $ 12.000.000

ROI = $ 945.000 / $ 12.000.000 = 7,88%

Margin = $ 945.000 / $ 9.000.000 = 10,50%

Turnover = $ 9.000.000 / $ 12.000.000 = 0,75

The ROI increased because assets are decreased.

4 CONCEPTUAL CONNECTION

Operating Assets = $ 15.000.000 x 80% = $ 12.000.000

ROI = $ 1.200.000 / $ 12.000.000 = 10%

Margin = $ 1.200.000 / $ 10.000.000 = 12%

Turnover = $ 10.000.000 / $ 12.000.000 = 0,83

The ROI increased because expenses decreased and assets turn over at a higher rate

(sales increased and the amount of assets decreased). Both margin and turnover increased.

You might also like

- Chapter 19, Modern Advanced Accounting-Review Q & ExrDocument17 pagesChapter 19, Modern Advanced Accounting-Review Q & Exrrlg4814100% (2)

- Bus 5110 Managerial Accounting Written Assignment Unit 71 PDFDocument10 pagesBus 5110 Managerial Accounting Written Assignment Unit 71 PDFEmmanuel Gift Bernard100% (1)

- Audit Committee Quality of EarningsDocument3 pagesAudit Committee Quality of EarningsJilesh PabariNo ratings yet

- Partnership LiquidationDocument20 pagesPartnership LiquidationIvhy Cruz Estrella0% (1)

- Multiple Choice Tax ReviewDocument1 pageMultiple Choice Tax ReviewQuasi-Delict89% (18)

- Tutorial 3 QnsDocument11 pagesTutorial 3 QnsYong RenNo ratings yet

- Jawaban 6 - Customer ProfitabilityDocument6 pagesJawaban 6 - Customer ProfitabilityfauziyahNo ratings yet

- T24 Account Group Parameters R16 PDFDocument117 pagesT24 Account Group Parameters R16 PDFadyani_0997100% (1)

- Akmen Chapter 12 (Putri Ramadhani)Document22 pagesAkmen Chapter 12 (Putri Ramadhani)Putri RamadhaniNo ratings yet

- Assigment 5.34Document7 pagesAssigment 5.34Indahna SulfaNo ratings yet

- Prelim Exam - ACTG6257 Intermediate Accounting 3Document22 pagesPrelim Exam - ACTG6257 Intermediate Accounting 3Kitchie Rose Dala CruzNo ratings yet

- GROUP ASSIGNMENT (Chapter 3, Case 3-62)Document6 pagesGROUP ASSIGNMENT (Chapter 3, Case 3-62)T Yoges Thiru MoorthyNo ratings yet

- Akmen CH 12 KelarDocument19 pagesAkmen CH 12 KelarFadhliyaFNo ratings yet

- Calculate ROI, EVA, Residual Income for Company DivisionsDocument3 pagesCalculate ROI, EVA, Residual Income for Company DivisionsDhiva Rianitha ManurungNo ratings yet

- Financial Accounting - Tugas 2 - 9 Oktober 2019Document3 pagesFinancial Accounting - Tugas 2 - 9 Oktober 2019AlfiyanNo ratings yet

- MA Session 6 PDFDocument48 pagesMA Session 6 PDFArkaprabha GhoshNo ratings yet

- Financial Accounting - Tugas 1Document6 pagesFinancial Accounting - Tugas 1Alfiyan100% (1)

- Financial Accounting - Tugas 1Document6 pagesFinancial Accounting - Tugas 1Alfiyan100% (1)

- West Chemical Company ABC Costing AnalysisDocument10 pagesWest Chemical Company ABC Costing Analysisrilakkuma6No ratings yet

- Financial Accounting - Tugas 5 - 30 Oktober 2019Document3 pagesFinancial Accounting - Tugas 5 - 30 Oktober 2019AlfiyanNo ratings yet

- Financial Accounting - Tugas 5 - 30 Oktober 2019Document3 pagesFinancial Accounting - Tugas 5 - 30 Oktober 2019AlfiyanNo ratings yet

- Financial Accounting - Tugas 5 - 30 Oktober 2019Document3 pagesFinancial Accounting - Tugas 5 - 30 Oktober 2019AlfiyanNo ratings yet

- Standard Costs and Balanced Scorecard: Managerial Accounting, Fourth EditionDocument43 pagesStandard Costs and Balanced Scorecard: Managerial Accounting, Fourth Editionsueern100% (1)

- Profitability of Products and Relative ProfitabilityDocument5 pagesProfitability of Products and Relative Profitabilityshaun3187No ratings yet

- Cost and Management Accounting - Tugas 6 - 5 November 2019Document3 pagesCost and Management Accounting - Tugas 6 - 5 November 2019AlfiyanNo ratings yet

- Kuis Akuntansi ManajemenDocument5 pagesKuis Akuntansi ManajemenBelinda Dyah Tri YuliastiNo ratings yet

- De peres drug stores audit identifies IS control weaknessesDocument3 pagesDe peres drug stores audit identifies IS control weaknessesRahmad Bari BarrudiNo ratings yet

- Case 5-1Document4 pagesCase 5-1fitriNo ratings yet

- Income Statements For Xcel Energy From 2011 To 2013 AppearDocument1 pageIncome Statements For Xcel Energy From 2011 To 2013 AppearHassan JanNo ratings yet

- Foreword: Financial Auditing 1 - 9 Edition - 1Document37 pagesForeword: Financial Auditing 1 - 9 Edition - 1meyyNo ratings yet

- Ch22S ErrorsDocument2 pagesCh22S ErrorsBismahMehdiNo ratings yet

- Analyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionDocument37 pagesAnalyzing and Interpreting Financial Statements: Learning Objectives - Coverage by QuestionpoollookNo ratings yet

- Lambeth Custom CabinetsDocument14 pagesLambeth Custom CabinetsHaider AliNo ratings yet

- ACCT 460: Principles of Auditing Assignment 1, Version CDocument4 pagesACCT 460: Principles of Auditing Assignment 1, Version CNurul SyakirinNo ratings yet

- MUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeDocument3 pagesMUH - SYUKUR - A031191077) AKUNTANSI MANAJEMEN-PROBLEM 11-18 Return On Investment (ROI) and Residual IncomeRismayantiNo ratings yet

- CH 22 - Lu Solution-Intermediate Acct - Acct ChangesDocument9 pagesCH 22 - Lu Solution-Intermediate Acct - Acct Changesdaotam0% (1)

- Kode QDocument11 pagesKode QatikaNo ratings yet

- CH 3Document19 pagesCH 3hey100% (1)

- TI vs HP management control systemsDocument3 pagesTI vs HP management control systemsMuhammad KamilNo ratings yet

- Garrison 11ce SM ch11 FinalDocument90 pagesGarrison 11ce SM ch11 FinalCoco ZaideNo ratings yet

- Activity Based CostingDocument49 pagesActivity Based CostingEdson EdwardNo ratings yet

- Chapter 3 IT at WorkDocument19 pagesChapter 3 IT at WorkfarisNo ratings yet

- Solution Manual12Document46 pagesSolution Manual12wansurNo ratings yet

- Skyview ManorDocument4 pagesSkyview ManorDwi Handoyo MiharjoNo ratings yet

- Mund Manufacturing Inc Started Operations at The Beginning of TheDocument1 pageMund Manufacturing Inc Started Operations at The Beginning of TheLet's Talk With HassanNo ratings yet

- Jawaban Kasus John Deere Component Works (A)Document2 pagesJawaban Kasus John Deere Component Works (A)Hafizah MardiahNo ratings yet

- Soal Lab 8-24Document1 pageSoal Lab 8-24bellaNo ratings yet

- Programmazione e Controllo Esercizi Capitolo 9Document32 pagesProgrammazione e Controllo Esercizi Capitolo 9Azhar SeptariNo ratings yet

- BMGT 321 Chapter 13 HomeworkDocument11 pagesBMGT 321 Chapter 13 Homeworkarnitaetsitty100% (1)

- SDocument59 pagesSmoniquettnNo ratings yet

- Soal Kuis Asistensi AK1 Setelah UTSDocument6 pagesSoal Kuis Asistensi AK1 Setelah UTSManggala Patria WicaksonoNo ratings yet

- Chapter 9Document3 pagesChapter 9Chan ZacharyNo ratings yet

- Financial Statement Analysis: K R Subramanyam John J WildDocument40 pagesFinancial Statement Analysis: K R Subramanyam John J WildManusha ErandiNo ratings yet

- Contoh Eliminasi Lap - Keu KonsolidasiDocument44 pagesContoh Eliminasi Lap - Keu KonsolidasiLuki DewayaniNo ratings yet

- Chapter 7 Problem 7.3 Nathali, Jeffrey, TasyaDocument6 pagesChapter 7 Problem 7.3 Nathali, Jeffrey, Tasyavtech netNo ratings yet

- Tugas Chapter 14Document7 pagesTugas Chapter 14irga ayudiasNo ratings yet

- Comparing Planning and Control Systems of Texas Instruments and Hewlett-PackardDocument20 pagesComparing Planning and Control Systems of Texas Instruments and Hewlett-PackardNaveen SinghNo ratings yet

- Wiley - Chapter 9: Inventories: Additional Valuation IssuesDocument20 pagesWiley - Chapter 9: Inventories: Additional Valuation IssuesIvan BliminseNo ratings yet

- Chapter 02 - Basic Financial StatementsDocument139 pagesChapter 02 - Basic Financial StatementsElio BazNo ratings yet

- Managerial Accounting - 2Document2 pagesManagerial Accounting - 2Layla AfidatiNo ratings yet

- Tugas Cost AccountingDocument7 pagesTugas Cost AccountingRudy Setiawan KamadjajaNo ratings yet

- 3 Assignment of ACCT-301Document3 pages3 Assignment of ACCT-301Tina Bhambbhwani0% (1)

- Acc3 5Document4 pagesAcc3 5dinda ardiyaniNo ratings yet

- Managerial Accounting Chapter 1Document21 pagesManagerial Accounting Chapter 1Ikhlas WauNo ratings yet

- Assignment - CMA - 604Document4 pagesAssignment - CMA - 604Shifat sjtNo ratings yet

- Case Study 1 Week 3 A BoorDocument3 pagesCase Study 1 Week 3 A BoorABoor092113No ratings yet

- Standard Costing Managerial Control ToolDocument20 pagesStandard Costing Managerial Control ToolEnrique Miguel Gonzalez Collado100% (1)

- Tugas ABC PDFDocument4 pagesTugas ABC PDFtutiNo ratings yet

- Chapter 3 Appendix ADocument16 pagesChapter 3 Appendix AOxana NeckagyNo ratings yet

- Tugas Performance Evaluation - Rangga Dhia MDocument2 pagesTugas Performance Evaluation - Rangga Dhia MRangga Dhia MajduddinNo ratings yet

- CFIN 3rd Edition by Besley Brigham ISBN Solution ManualDocument6 pagesCFIN 3rd Edition by Besley Brigham ISBN Solution Manualrussell100% (21)

- Cfin 3 3rd Edition Besley Solutions ManualDocument5 pagesCfin 3 3rd Edition Besley Solutions Manualjenniferdrakenxkzgroiyt100% (10)

- History Intel Chips Timeline PosterDocument1 pageHistory Intel Chips Timeline PosterKellie WarnerNo ratings yet

- StatistikDocument1 pageStatistikAlfiyanNo ratings yet

- Intel RebatesDocument28 pagesIntel RebatesAlfiyanNo ratings yet

- Financial Accounting - Tugas 4 - 23 Oktober 2019Document3 pagesFinancial Accounting - Tugas 4 - 23 Oktober 2019AlfiyanNo ratings yet

- Financial accounting journal entriesDocument3 pagesFinancial accounting journal entriesAlfiyanNo ratings yet

- Financial Accounting - Cheating Page - QUIZ Before UASDocument2 pagesFinancial Accounting - Cheating Page - QUIZ Before UASAlfiyanNo ratings yet

- Cma - Uts - 2019Document1 pageCma - Uts - 2019AlfiyanNo ratings yet

- StatistikDocument1 pageStatistikAlfiyanNo ratings yet

- Financial accounting journal entriesDocument3 pagesFinancial accounting journal entriesAlfiyanNo ratings yet

- Financial Accounting - Quiz 2Document3 pagesFinancial Accounting - Quiz 2AlfiyanNo ratings yet

- StatistikDocument1 pageStatistikAlfiyanNo ratings yet

- Financial Accounting - Tugas 2 - 28 Agustus 2019Document3 pagesFinancial Accounting - Tugas 2 - 28 Agustus 2019AlfiyanNo ratings yet

- Cost and Management Accounting - Tugas 4 - 10 SEP FIXDocument3 pagesCost and Management Accounting - Tugas 4 - 10 SEP FIXAlfiyanNo ratings yet

- Booklet NAO 2015Document20 pagesBooklet NAO 2015AlfiyanNo ratings yet

- Jogja International Conference - Top 5 EssaysDocument1 pageJogja International Conference - Top 5 EssaysAlfiyanNo ratings yet

- Attempt History: Points 50 Questions 50 Available Oct 7 at 12am - Oct 7 at 11:59pmDocument37 pagesAttempt History: Points 50 Questions 50 Available Oct 7 at 12am - Oct 7 at 11:59pmKent Zirkai CidroNo ratings yet

- Fra Cia 1Document13 pagesFra Cia 1RNo ratings yet

- ACT202 - BFK - 2018 (Here) (Neem Soap)Document20 pagesACT202 - BFK - 2018 (Here) (Neem Soap)Zidan ZaifNo ratings yet

- Chapter 3 - IbfDocument30 pagesChapter 3 - IbfMuhib NoharioNo ratings yet

- Cost Sheet ProblemsDocument5 pagesCost Sheet ProblemsshamilaNo ratings yet

- Tutorial 2Document2 pagesTutorial 2sanjeet kumarNo ratings yet

- FIN 444 Final ProjectDocument13 pagesFIN 444 Final ProjectAli Abdullah Munna 1410788030No ratings yet

- Consolidation: Wholly-Owned SubsidiaryDocument10 pagesConsolidation: Wholly-Owned SubsidiaryAllen GonzagaNo ratings yet

- Unit 1 - Introduction To Cost AccountingDocument13 pagesUnit 1 - Introduction To Cost AccountingVaidehi sonawaniNo ratings yet

- Accounting standards review processDocument2 pagesAccounting standards review processJao FloresNo ratings yet

- Solution Chapter 6 Financial Statements Pre Adjustments 1Document8 pagesSolution Chapter 6 Financial Statements Pre Adjustments 1IsmahNo ratings yet

- Cae05-Chapter 10 Income Tax Problem DiscussionDocument37 pagesCae05-Chapter 10 Income Tax Problem Discussioncris tellaNo ratings yet

- Sonic Healthcare Financial Report ReviewDocument12 pagesSonic Healthcare Financial Report ReviewJaunNo ratings yet

- ROCE, EPS, and Share Value FactorsDocument41 pagesROCE, EPS, and Share Value FactorskateNo ratings yet

- Cost Accounting Project - CSDDocument31 pagesCost Accounting Project - CSDMuhammad TalhaNo ratings yet

- Unit 4 - Depreciation, Income Taxes and Project Cash Flows: 4.0 OverviewDocument3 pagesUnit 4 - Depreciation, Income Taxes and Project Cash Flows: 4.0 OverviewCo-leigh CornerNo ratings yet

- Kona Grill 1Q10 Earnings Beat; SSS Turn PositiveDocument6 pagesKona Grill 1Q10 Earnings Beat; SSS Turn PositiveDsp AlphaNo ratings yet

- Europa Publications Financial AnalysisDocument4 pagesEuropa Publications Financial Analysisbella100% (1)

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1Jaymee Andomang Os-agNo ratings yet

- Case Week 3 Golden Bear Golf Inc.Document7 pagesCase Week 3 Golden Bear Golf Inc.Aisyah FitriNo ratings yet

- Assertion Reasoning Questions: Chapter 2 - Accounting For Partnership: FundamentalsDocument71 pagesAssertion Reasoning Questions: Chapter 2 - Accounting For Partnership: Fundamentalsabhi yadavNo ratings yet

- Financial ReportingDocument8 pagesFinancial ReportingM SameerNo ratings yet

- Us Aers A Roadmap To The Issuers Accounting For Convertible DebtDocument260 pagesUs Aers A Roadmap To The Issuers Accounting For Convertible DebtMANUEL JESUS MOJICA MATEUSNo ratings yet

- Tax Types and Systems ExplainedDocument30 pagesTax Types and Systems Explainedembiale ayaluNo ratings yet