Professional Documents

Culture Documents

Country Bankers Insurance Corporation Vs Antonio Lagman

Country Bankers Insurance Corporation Vs Antonio Lagman

Uploaded by

kennethOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Country Bankers Insurance Corporation Vs Antonio Lagman

Country Bankers Insurance Corporation Vs Antonio Lagman

Uploaded by

kennethCopyright:

Available Formats

Carina Amor Claveria.

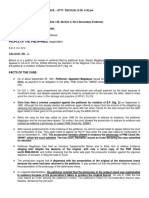

19. COUNTRY BANKERS INSURANCE CORPORATION VS ANTONIO LAGMAN

GR NO 165487; July 13, 2011

PEREZ J:

FACTS:

Nelson Santos (Santos) applied for a license with the National Food Authority

(NFA) to engage in the business of storing not more than 30,000 sacks of palay valued at

P5,250,000.00 in his warehouse at Barangay Malacampa, Camiling, Tarlac. Under Act

No. 3893 or the General Bonded Warehouse Act, as amended, the approval for said

license was conditioned upon posting of a cash bond, a bond secured by real estate, or a

bond signed by a duly authorized bonding company, the amount of which shall be fixed

by the NFA Administrator at not less than thirty-three and one third percent (33 1/3%)

of the market value of the maximum quantity of rice to be received.

Accordingly, Country Bankers Insurance Corporation (Country Bankers) issued

Warehouse Bond No. 03304for P1,749,825.00 on 5 November 1989 and Warehouse

Bond No. 02355[for P749,925.00 on 13 December 1989 (1989 Bonds) through its agent,

Antonio Lagman (Lagman). Santos was the bond principal, Lagman was the surety and

the Republic of the Philippines, through the NFA was the obligee. In consideration of

these issuances, corresponding Indemnity Agreements were executed by Santos, as

bond principal, together with Ban Lee Lim Santos (Ban Lee Lim), Rhosemelita Reguine

(Reguine) and Lagman, as co-signors. The latter bound themselves jointly and severally

liable to Country Bankers for any damages, prejudice, losses, costs, payments, advances

and expenses of whatever kind and nature, including attorneys fees and legal costs,

which it may sustain as a consequence of the said bond; to reimburse Country Bankers

of whatever amount it may pay or cause to be paid or become liable to pay thereunder;

and to pay interest at the rate of 12% per annum computed and compounded monthly,

as well as to pay attorneys fees of 20% of the amount due it.

Santos then secured a loan using his warehouse receipts as collateral. When

the loan matured, Santos defaulted in his payment. The sacks of palay covered by the

warehouse receipts were no longer found in the bonded warehouse. By virtue of the

surety bonds, Country Bankers was compelled to pay P1,166,750.37.

Consequently, Country Bankers filed a complaint for a sum of money docketed

as Civil Case No. 95-73048 before the Regional Trial Court (RTC) of Manila. In his

Answer, Lagman alleged that the 1989 Bonds were valid only for 1 year from the date of

their issuance, as evidenced by receipts; that the bonds were never renewed and

revived by payment of premiums; that on 5 November 1990, Country Bankers issued

Warehouse Bond No. 03515 (1990 Bond) which was also valid for one year and that no

Indemnity Agreement was executed for the purpose; and that the 1990 Bond

supersedes, cancels, and renders no force and effect the 1989 Bonds.

The bond principals, Santos and Ban Lee Lim, were not served with summons because

they could no longer be found. The case was eventually dismissed against them without

prejudice. The other co-signor, Reguine, was declared in default for failure to file her

answer.

On 21 September 1998, the trial court rendered judgment declaring Reguine and

Lagman jointly and severally liable to pay Country Bankers the amount of P2,400,499.87.

CA reversed the decision of RTC

ISSUE:

Whether the 1989 Bonds have expired and the 1990 Bond novates the 1989 Bonds.

HELD:

NO. The Court of Appeals held that the 1989 bonds were effective only for one (1) year,

as evidenced by the receipts on the payment of premiums

RATIO:

The official receipts in question serve as proof of payment of the premium for one year

on each surety bond. It does not, however, automatically mean that the surety bond is

effective for only one (1) year. In fact, the effectivity of the bond is not wholly

dependent on the payment of premium. Section 177 of the Insurance Code expresses:

Sec. 177. The surety is entitled to payment of the premium as soon as the contract of

suretyship or bond is perfected and delivered to the obligor. No contract of suretyship

or bonding shall be valid and binding unless and until the premium therefor has been

paid, except where the obligee has accepted the bond, in which case the bond becomes

valid and enforceable irrespective of whether or not the premium has been paid by the

obligor to the surety:Provided, That if the contract of suretyship or bond is not accepted

by, or filed with the obligee, the surety shall collect only reasonable amount, not

exceeding fifty per centum of the premium due thereon as service fee plus the cost of

stamps or other taxes imposed for the issuance of the contract or bond: Provided,

however, That if the non-acceptance of the bond be due to the fault or negligence of

the surety, no such service fee, stamps or taxes shall be collected.

huhu

You might also like

- Chapter 2 Financial Statement Analysis For StudentsDocument49 pagesChapter 2 Financial Statement Analysis For StudentsRossetteDulinNo ratings yet

- Business Corporations Act (Alberta) (The "Trustee") : IndexDocument8 pagesBusiness Corporations Act (Alberta) (The "Trustee") : IndexNat WilliamsNo ratings yet

- People v. Rullepa - Case DigestDocument1 pagePeople v. Rullepa - Case Digestshezeharadeyahoocom67% (3)

- Evidence Digested CasesDocument27 pagesEvidence Digested CasesRoxanne G. DomingoNo ratings yet

- Evidence Digests Part 5Document59 pagesEvidence Digests Part 5Ahmad Arip50% (2)

- Marcos V Heirs of NavarroDocument5 pagesMarcos V Heirs of Navarrogherold benitezNo ratings yet

- NG Meng Tam Vs ChinabankDocument3 pagesNG Meng Tam Vs ChinabankLex DagdagNo ratings yet

- MALAYAN INSURANCE CO., InC. vs. Alberto Case Digest (Subrogation) 2012Document2 pagesMALAYAN INSURANCE CO., InC. vs. Alberto Case Digest (Subrogation) 2012Sam LeynesNo ratings yet

- E1 - 1 People v. FabreDocument2 pagesE1 - 1 People v. FabreAaron AristonNo ratings yet

- Hernandez v. San Juan-Santos Case DigestDocument2 pagesHernandez v. San Juan-Santos Case DigestReina Fabregas100% (3)

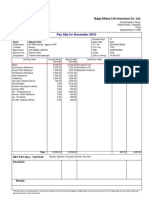

- PayslipDocument1 pagePayslipAshish Agarwal67% (3)

- People v. LeeDocument4 pagesPeople v. LeeAnonymous XvwKtnSrMRNo ratings yet

- BF Homes V Manila Electric DigestDocument11 pagesBF Homes V Manila Electric DigestIvan Montealegre ConchasNo ratings yet

- PEOPLE OF THE PHILS V CIOBALDocument1 pagePEOPLE OF THE PHILS V CIOBALMelvin Ikko EspornaNo ratings yet

- A.M. No. 1625 February 12, 1990 ANGEL L. BAUTISTA, Complainant, Ramon A. GONZALES, Respondent. Resolution Per CuriamDocument68 pagesA.M. No. 1625 February 12, 1990 ANGEL L. BAUTISTA, Complainant, Ramon A. GONZALES, Respondent. Resolution Per CuriamCarina Amor ClaveriaNo ratings yet

- Hull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 9: Xvas Multiple Choice Test BankDocument4 pagesHull: Options, Futures, and Other Derivatives, Tenth Edition Chapter 9: Xvas Multiple Choice Test BankKevin Molly KamrathNo ratings yet

- Madrigal v. CA DigestDocument2 pagesMadrigal v. CA DigestFrancis Guinoo100% (1)

- PP V AlemanDocument1 pagePP V AlemanNic NalpenNo ratings yet

- Law Officer Professional Knowledge Question PaperDocument11 pagesLaw Officer Professional Knowledge Question Papernikunj joshiNo ratings yet

- 06 People v. LagahitDocument2 pages06 People v. LagahitJet SiangNo ratings yet

- Digest Country Bankers V LagmanDocument2 pagesDigest Country Bankers V LagmanAleph JirehNo ratings yet

- Break EvenAnalysisDocument24 pagesBreak EvenAnalysisDlsu Amphi-CatNo ratings yet

- People vs. RullepaDocument10 pagesPeople vs. Rullepaferosiac67% (3)

- RCBC Vs OracionDocument1 pageRCBC Vs OracionJelaine Añides100% (2)

- Villanueva vs. Balaguer, G.R. No. 180197, June 23, 2009Document2 pagesVillanueva vs. Balaguer, G.R. No. 180197, June 23, 2009Tootsie GuzmaNo ratings yet

- Republic vs. GimenezDocument3 pagesRepublic vs. GimenezMartin RegalaNo ratings yet

- 92 93 94 RealesDocument6 pages92 93 94 RealesJethroret Reales100% (1)

- Rule 130-Secondary Evid-CASE 6 - MAGDAYAO VS PeopleDocument3 pagesRule 130-Secondary Evid-CASE 6 - MAGDAYAO VS PeopleEdvangelineManaloRodriguezNo ratings yet

- People V YatcoDocument1 pagePeople V YatcoSean ContrerasNo ratings yet

- Tomas P. Tan, Jr. V. Jose G. Hosana: Case SummaryDocument2 pagesTomas P. Tan, Jr. V. Jose G. Hosana: Case Summarykmand_lustregNo ratings yet

- 19 ST Martin Polyclinic Inc Vs LWV ConstructionDocument2 pages19 ST Martin Polyclinic Inc Vs LWV ConstructionRabby Aniban100% (1)

- People V MagpayoDocument2 pagesPeople V MagpayoSean GalvezNo ratings yet

- People Vs AlemanDocument1 pagePeople Vs AlemanTootsie GuzmaNo ratings yet

- People v. GimenezDocument1 pagePeople v. GimenezMan2x Salomon100% (1)

- Heirs of Donton vs. StierDocument3 pagesHeirs of Donton vs. StierCherrie May OrenseNo ratings yet

- Credit Appraisal Process of BanksDocument25 pagesCredit Appraisal Process of Banksbhavikashetty75% (4)

- Country Bakers v. LagmanDocument1 pageCountry Bakers v. LagmanJohney DoeNo ratings yet

- Sps Wilfredo Vs BenedictoDocument5 pagesSps Wilfredo Vs BenedictoSophiaFrancescaEspinosaNo ratings yet

- Malayan Case DigestDocument2 pagesMalayan Case DigestMenchie Ann Sabandal SalinasNo ratings yet

- Lazaro v. Agustin DIGESTDocument4 pagesLazaro v. Agustin DIGESTkathrynmaydevezaNo ratings yet

- Torts and Damages Case Digest Mar.3Document23 pagesTorts and Damages Case Digest Mar.3Van NessaNo ratings yet

- Marcos V Heirs of NavarroDocument3 pagesMarcos V Heirs of NavarroZoe VelascoNo ratings yet

- Case Digest Alvarez Vs RamirezDocument2 pagesCase Digest Alvarez Vs Ramirezowen100% (1)

- Digest PRATS vs. PHOENIX INSURANCE COMPANYDocument1 pageDigest PRATS vs. PHOENIX INSURANCE COMPANYStef OcsalevNo ratings yet

- CASE DIGESTS-evidenceDocument6 pagesCASE DIGESTS-evidenceGeeanNo ratings yet

- Spouses Amoncio VS BenedictoDocument2 pagesSpouses Amoncio VS BenedictoannlaurenweillNo ratings yet

- Cred Trans Case Digests Part3Document13 pagesCred Trans Case Digests Part3Ayeesha PagantianNo ratings yet

- PNOC Shipping and Transport Corporation v. Court of Appeals, G.R. No. 107518, October 8, 1998Document2 pagesPNOC Shipping and Transport Corporation v. Court of Appeals, G.R. No. 107518, October 8, 1998FaithmaeNo ratings yet

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Document2 pagesBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayNo ratings yet

- 5 - Spouses Latip v. Chua PDFDocument2 pages5 - Spouses Latip v. Chua PDFRedd LapidNo ratings yet

- C3h - 2 People v. GatarinDocument2 pagesC3h - 2 People v. GatarinAaron Ariston100% (1)

- Sps Latip Vs ChuaDocument2 pagesSps Latip Vs ChuaLeica JaymeNo ratings yet

- Yap VS InopiquezDocument4 pagesYap VS InopiquezRonnie Garcia Del RosarioNo ratings yet

- 5 Sps Latip Vs Chua PUT TO HEARTDocument4 pages5 Sps Latip Vs Chua PUT TO HEARTSusan LazoNo ratings yet

- Republic of The Philippines Regional Trial Court National Capital Judicial Region Quezon City Branch 75Document2 pagesRepublic of The Philippines Regional Trial Court National Capital Judicial Region Quezon City Branch 75Carina Amor Claveria100% (3)

- AF Sanchez Brokerage IncDocument1 pageAF Sanchez Brokerage IncTrina Donabelle GojuncoNo ratings yet

- WEEK 4-BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. THE MONETARY BOARDDocument3 pagesWEEK 4-BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. THE MONETARY BOARDKrizzle de la PeñaNo ratings yet

- RULE 130 Sec 11-13Document2 pagesRULE 130 Sec 11-13J100% (1)

- Easements HandoutsDocument9 pagesEasements HandoutsCarina Amor ClaveriaNo ratings yet

- PP vs. Victor P. Padit, G.R. No. 202978 DigestDocument1 pagePP vs. Victor P. Padit, G.R. No. 202978 DigestValerie Kaye BinayasNo ratings yet

- 59 LBP v. Honeycomb Farms, IncDocument3 pages59 LBP v. Honeycomb Farms, IncKED100% (1)

- Tan V HosanaDocument2 pagesTan V HosanaMark Joseph M. VirgilioNo ratings yet

- People Vs AlcoberDocument2 pagesPeople Vs AlcobertinctNo ratings yet

- Macababad JR Vs Marisag G.R. No. 161237 January 14, 2009Document5 pagesMacababad JR Vs Marisag G.R. No. 161237 January 14, 2009Yordi PastulioNo ratings yet

- Century Bankers Insurance Corp. vs. LagmanDocument3 pagesCentury Bankers Insurance Corp. vs. LagmanMay Lann LamisNo ratings yet

- Palay Valued at P5,250,000.00 in His Warehouse at Barangay MalacampaDocument7 pagesPalay Valued at P5,250,000.00 in His Warehouse at Barangay MalacampaMaam BabatasNo ratings yet

- Lagman VS BankersDocument13 pagesLagman VS BankersErrol OstanNo ratings yet

- Country Bankers Insurance Corporation vs. Antonio LagmanDocument3 pagesCountry Bankers Insurance Corporation vs. Antonio LagmanRS SamillanoNo ratings yet

- Country Bankers Insurance Corporation Vs Antonio LagmanDocument3 pagesCountry Bankers Insurance Corporation Vs Antonio LagmanJhon Anthony BrionesNo ratings yet

- Second Division: Petitioner RespondentDocument10 pagesSecond Division: Petitioner RespondentAnonymous Wu1rZ8UNo ratings yet

- Digest Country BankersDocument2 pagesDigest Country BankersMichelleMich Mangubat DescartinNo ratings yet

- Atang Dela Rama Corner Zoili Hilario Street CCP Complex Pasay City, PhilippinesDocument1 pageAtang Dela Rama Corner Zoili Hilario Street CCP Complex Pasay City, PhilippinesCarina Amor ClaveriaNo ratings yet

- GDocument91 pagesGCarina Amor ClaveriaNo ratings yet

- Types of Excise TaxDocument4 pagesTypes of Excise TaxCarina Amor ClaveriaNo ratings yet

- Paras, J.:: Bautista, Picazo, Buyco & Tan For Private RespondentsDocument10 pagesParas, J.:: Bautista, Picazo, Buyco & Tan For Private RespondentsCarina Amor ClaveriaNo ratings yet

- Transportation 2Document14 pagesTransportation 2Carina Amor ClaveriaNo ratings yet

- Spec ProDocument11 pagesSpec ProCarina Amor ClaveriaNo ratings yet

- Transportation Law-Cadc: Definitions Essential ElementsDocument11 pagesTransportation Law-Cadc: Definitions Essential ElementsCarina Amor ClaveriaNo ratings yet

- The Doctrine of Limited LiabilityDocument31 pagesThe Doctrine of Limited LiabilityCarina Amor ClaveriaNo ratings yet

- Short Stay Renewal 151114 PDFDocument1 pageShort Stay Renewal 151114 PDFCarina Amor ClaveriaNo ratings yet

- Motion For Prelim InvestigationDocument1 pageMotion For Prelim InvestigationCarina Amor ClaveriaNo ratings yet

- Attributes or Essential Characteristics (SLEP)Document11 pagesAttributes or Essential Characteristics (SLEP)Carina Amor ClaveriaNo ratings yet

- Petition For BailDocument2 pagesPetition For BailCarina Amor ClaveriaNo ratings yet

- Chemalite - A - UnsolvedDocument5 pagesChemalite - A - UnsolvedUru BhalodeNo ratings yet

- Nationalization and Privatization of Commercial BanksDocument24 pagesNationalization and Privatization of Commercial BanksAli JumaniNo ratings yet

- Internship Report On Askari BankDocument124 pagesInternship Report On Askari Banksajidobry_8476018440% (1)

- December 19, 2014 Strathmore TimesDocument32 pagesDecember 19, 2014 Strathmore TimesStrathmore TimesNo ratings yet

- Account Question 12Document5 pagesAccount Question 12Kapildev SubediNo ratings yet

- Bond Valuation NTHMCDocument24 pagesBond Valuation NTHMCAryal LaxmanNo ratings yet

- Attachment RBI Notification P2P LendingDocument2 pagesAttachment RBI Notification P2P LendingHsjjxnwkNo ratings yet

- Open Banking Architecture: Mayank Mishra Principal Banking Architect Oracle Asia PacificDocument19 pagesOpen Banking Architecture: Mayank Mishra Principal Banking Architect Oracle Asia PacificBich HieuNo ratings yet

- Loans WebquestDocument3 pagesLoans Webquestapi-288392955No ratings yet

- Review Questions Volume 1 - Chapter 31Document2 pagesReview Questions Volume 1 - Chapter 31YelenochkaNo ratings yet

- Pob Scheme of WorkDocument7 pagesPob Scheme of Workapi-320381197100% (1)

- Exit 1: Friends and Neighbors: Cross TalkDocument28 pagesExit 1: Friends and Neighbors: Cross TalkJoyce EnriqueNo ratings yet

- FM Cia 1.1 - 2123531Document15 pagesFM Cia 1.1 - 2123531Rohit GoyalNo ratings yet

- Onward Eservices LTD: Software For Primary Agriculture Coop SocietiesDocument15 pagesOnward Eservices LTD: Software For Primary Agriculture Coop SocietiesSubramaniam SundaramNo ratings yet

- No Demand, No DelayDocument4 pagesNo Demand, No DelayLen MendozaNo ratings yet

- ECGCDocument22 pagesECGCchandran0567No ratings yet

- G.R. No. 70623 PDFDocument6 pagesG.R. No. 70623 PDFAlex Viray LucinarioNo ratings yet

- Microfinance in Myanmar Sector Assessment (Jan 2013) - 1 PDFDocument54 pagesMicrofinance in Myanmar Sector Assessment (Jan 2013) - 1 PDFliftfundNo ratings yet

- Rate of Return Analysis (Online Version)Document35 pagesRate of Return Analysis (Online Version)samiyaNo ratings yet

- The Merchant of Venice: William ShakespeareDocument9 pagesThe Merchant of Venice: William ShakespearebpxamzNo ratings yet

- Status Report Reminder LetterDocument1 pageStatus Report Reminder LetterpopcaanNo ratings yet

- Bengaluru United Breweries Group Airbus A320-200s Mumbai Delhi Bengaluru London Andheri Mumbai UB City Bengaluru Vile Parle (East) Vijay MallyaDocument2 pagesBengaluru United Breweries Group Airbus A320-200s Mumbai Delhi Bengaluru London Andheri Mumbai UB City Bengaluru Vile Parle (East) Vijay MallyaRobin PalanNo ratings yet