Professional Documents

Culture Documents

Asistensi 3 MK

Uploaded by

Graciala DenitaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Asistensi 3 MK

Uploaded by

Graciala DenitaCopyright:

Available Formats

Problem 1

a. What are the 4 things that financial planning can accomplish?

b. What is “the plug” variable in financial planning?

c. PT ABC has a great number of investment opportunities but it has limited cash, while PT XYZ has less

investment opportunities but it has ample cash flow. Will you use the same or different “plug”

variable(s) for these companies? Explain.

Problem 2

Based on the following information, calculate the sustainable growth rate:

- Profit margin : 10.7%

- Capital intensity ratio : 0.8

- Debt-equity ratio : 0.45

- Net income : $ 59,530

- Dividends : $ 19,790

Problem 3

PT Alamanda

Income Statement

PT Alamanda

Balance Sheet

Sales 4,250

Costs -3,875 Liabilities & Owner's

Assets equity

Taxable Income 375

Current Assets 900 Current Liabilities 500

Taxes (34%) -127.5

Net Fixed

Assets 2200 Long term debt 1800

Net Income 247.5 Owner's equity 800

Dividends - 82.6

Total liabilities &

Addition to retained earnings 164.9 Total assets 3100 Owner's equity 3100

You are given the Financial Statement of PT Alamanda for year 2018. PT Alamanda projected the sales

will grow 10% in 2019. Assume the interest expense, tax rate, and dividend payout ratio are constant. The

expense, current asset, current liabilities growth following the sales. No new long term debt issue and no

new equity raised.

a. Based on information, how much external financing needed? Use percentage of sales approach

for the pro forma and assume PT Alamanda operates at full capacity and constant dividend payout

ratio.

b. How much the external financing needed if PT Alamanda only operated 60% of its fixed asset

capacity? How about 95 % of its fixed asset capacity?

c. Calculate the internal and sustainable growth rate using data of the year 2018.

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Investment AlternativesDocument32 pagesInvestment AlternativesMadihaBhattiNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Angel InvestorsDocument19 pagesAngel Investorsokk12345No ratings yet

- Decommissioning StrategyDocument20 pagesDecommissioning StrategyTekena FubaraNo ratings yet

- Deloitte - Illustrative Financial Statements For BanksDocument288 pagesDeloitte - Illustrative Financial Statements For BanksErwincont100% (1)

- Easibility Tudy Emplate: Roject AMEDocument9 pagesEasibility Tudy Emplate: Roject AMEaminNo ratings yet

- Chapter 1 Opinion, Offer, SuggestionDocument11 pagesChapter 1 Opinion, Offer, SuggestionGraciala DenitaNo ratings yet

- Soal Asking Giving Opinion 1Document8 pagesSoal Asking Giving Opinion 1bagusNo ratings yet

- Simple Professional Virtual Meeting by SlidesgoDocument13 pagesSimple Professional Virtual Meeting by SlidesgoGraciala DenitaNo ratings yet

- Capital Market Review: IndonesianDocument3 pagesCapital Market Review: IndonesianGraciala DenitaNo ratings yet

- Practice Descriptive TextDocument5 pagesPractice Descriptive TextGraciala DenitaNo ratings yet

- ConsultingDocument24 pagesConsultingGraciala DenitaNo ratings yet

- Case InterviewDocument18 pagesCase InterviewGraciala DenitaNo ratings yet

- You Exec - Meeting and Agenda v2 FreeDocument11 pagesYou Exec - Meeting and Agenda v2 FreeGraciala DenitaNo ratings yet

- IJBS Journal TemplateDocument3 pagesIJBS Journal TemplateGraciala DenitaNo ratings yet

- Paper New Sustainable Cosmetic Products From Food Waste A Joined-Up Approach Between Design and Food ChemistryDocument6 pagesPaper New Sustainable Cosmetic Products From Food Waste A Joined-Up Approach Between Design and Food ChemistryGraciala DenitaNo ratings yet

- Brandstorm 2020 Case FinalDocument2 pagesBrandstorm 2020 Case FinalKrishna SrinivasanNo ratings yet

- Financial Analyst - OJKDocument1 pageFinancial Analyst - OJKGraciala DenitaNo ratings yet

- Data DenitaDocument91 pagesData DenitaGraciala DenitaNo ratings yet

- Credit Risk Analysis SoftwareDocument1 pageCredit Risk Analysis SoftwareGraciala DenitaNo ratings yet

- Aic SicDocument1 pageAic SicGraciala DenitaNo ratings yet

- Fama Three and Five FactorsDocument10 pagesFama Three and Five FactorsGraciala DenitaNo ratings yet

- AIG HistoryDocument9 pagesAIG Historysandeepkumar.jha5715No ratings yet

- BreachDocument23 pagesBreachGuguloth DivyaniNo ratings yet

- Analyzing Reverse Merger in India Ease in Tax Implication PDFDocument13 pagesAnalyzing Reverse Merger in India Ease in Tax Implication PDFDhruv TiwariNo ratings yet

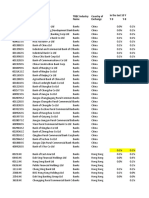

- Participants During The Financial Crisis: Total Returns 2005-2010Document16 pagesParticipants During The Financial Crisis: Total Returns 2005-2010flowerboyNo ratings yet

- Research Report CowenDocument14 pagesResearch Report CowenzevioNo ratings yet

- Guide Questions Liability Management at General MotorsDocument1 pageGuide Questions Liability Management at General MotorsZtreat Nohanih0% (1)

- Donald C. Lampe Womble Carlyle Sandridge & Rice, PLLC Charlotte, NC (704) 350-6398 January 22, 2007Document22 pagesDonald C. Lampe Womble Carlyle Sandridge & Rice, PLLC Charlotte, NC (704) 350-6398 January 22, 2007Ketam ChauhanNo ratings yet

- CircularlistDocument3 pagesCircularlistbrijeshNo ratings yet

- ICICI Bank V/s SBI: Presented byDocument33 pagesICICI Bank V/s SBI: Presented byshalom179222No ratings yet

- Lone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Document142 pagesLone Star College District $149.78 Million Limited Tax General Obligation Bonds Official Statement, 2008Texas WatchdogNo ratings yet

- Dissertation (Finance)Document61 pagesDissertation (Finance)Kalla HimsagarNo ratings yet

- ICE FX Indexes MethodologyDocument19 pagesICE FX Indexes MethodologyRogerio VargasNo ratings yet

- Ross12e Chapter25 TBDocument12 pagesRoss12e Chapter25 TBhi babyNo ratings yet

- Money Market in IndiaDocument51 pagesMoney Market in IndiaAlexandra RossNo ratings yet

- In Re:) : Debtors.)Document44 pagesIn Re:) : Debtors.)Chapter 11 DocketsNo ratings yet

- Audit Legal LiabilitiesDocument40 pagesAudit Legal LiabilitiesUmmu Aiman AyubNo ratings yet

- Kaya 2011Document19 pagesKaya 2011Armeiko TanayaNo ratings yet

- Silk BankDocument15 pagesSilk BankHafizUmarArshadNo ratings yet

- Avoid Bases That Make Too Deep A DropDocument2 pagesAvoid Bases That Make Too Deep A DropAndraReiNo ratings yet

- Making The Trend Your FriendDocument4 pagesMaking The Trend Your FriendACasey101No ratings yet

- DEPRECIATIONDocument14 pagesDEPRECIATIONChikke GowdaNo ratings yet

- Relationship Between Banker & CustomerDocument4 pagesRelationship Between Banker & Customerswati_rathourNo ratings yet

- Cimb Bank Fs 2022 Signed Fs FinalDocument459 pagesCimb Bank Fs 2022 Signed Fs FinalAramNo ratings yet

- Countrywise Withholding Tax Rates Chart As Per DTAADocument8 pagesCountrywise Withholding Tax Rates Chart As Per DTAAajithaNo ratings yet

- Opposition To The SEC's Motion For Protective OrderDocument19 pagesOpposition To The SEC's Motion For Protective OrderamvonaNo ratings yet

- Online Data StorageDocument6 pagesOnline Data StoragehemantkpNo ratings yet