Professional Documents

Culture Documents

M-Pesa A Case Study of The Critical Early Adopters

Uploaded by

RupaliVajpayeeOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M-Pesa A Case Study of The Critical Early Adopters

Uploaded by

RupaliVajpayeeCopyright:

Available Formats

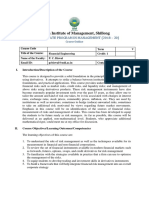

See discussions, stats, and author profiles for this publication at: https://www.researchgate.

net/publication/228638709

M-Pesa: A Case Study of the Critical Early Adopters' Role in the Rapid Adoption

of Mobile Money Banking in Kenya

Article in Electronic Journal of Information Systems in Developing Countries · September 2010

DOI: 10.1002/j.1681-4835.2010.tb00307.x

CITATIONS READS

45 7,595

3 authors:

Benjamin Ngugi Matthew Pelowski

Suffolk University University of Vienna

35 PUBLICATIONS 121 CITATIONS 53 PUBLICATIONS 531 CITATIONS

SEE PROFILE SEE PROFILE

Javier Gordon Ogembo

City of Hope National Medical Center

46 PUBLICATIONS 558 CITATIONS

SEE PROFILE

Some of the authors of this publication are also working on these related projects:

KSHV vaccine development View project

Cervical cancer prevention View project

All content following this page was uploaded by Benjamin Ngugi on 16 May 2014.

The user has requested enhancement of the downloaded file.

EJISDC (2010), 43, 3, 1-16 1

M-PESA: A CASE STUDY OF THE CRITICAL EARLY ADOPTERS’ ROLE IN THE

RAPID ADOPTION OF MOBILE MONEY BANKING IN KENYA

Benjamin Ngugi Matthew Pelowski

Information Systems & Operations Graduate School of Information Science

Management Nagoya University

Suffolk University Nagoya, Japan

Boston, USA mattpelowski@yahoo.com

bngugi@suffolk.edu

Javier Gordon Ogembo

Harvard Medical School/Beth Israel Deaconess Medical Center

Division of Infectious Diseases-Research

Boston, USA

jogembo@bimdc.harvard.edu

ABSTRACT

This study reviews key factors that led to the phenomenal growth of mobile money banking

services in Kenya using M-PESA, “mobile cash money”, the leading mobile money service

provider as a case study. The study considers the outstanding challenges experienced by

users, possible solutions and future trends. These aspects are covered through a critical

review of existing literature, secondary data and a survey targeting mobile phone users living

in the major urban centers, considered to be the early adopters of new technologies in Kenya.

Several lessons learnt from the mobile money rollout in this Kenyan experience are identified

for future researchers and practitioners.

Keywords: Mobile phone, Mobile money banking, M-PESA, Technology, Nokia.

1. INTRODUCTION

Kenya, and to a large extent Eastern Africa as a whole, has recently witnessed a phenomenal

growth in the use of mobile phones. Although only beginning a few years ago, and often

expanding in impoverished areas with no other precedent for technology adoption, mobile

phone usage has exploded beyond the predictions of most experts in the field. It is now

estimated that one in ten Africans have access to mobile phones, with some countries such as

Nigeria, South Africa, Kenya, Egypt and Gambia having an even higher ratio (Djiofack-

Zabaze & Keck, 2009; ITU, 2009).

The major driving element of the adoption of this technology, however, comes from a

second phenomenon, the introduction of “mobile money banking services”, comprised of

services such as transfer of money from person to person, paying bills and salaries, and

purchasing of goods, bypassing the traditional banking system (GSMA, 2010). The growth of

the mobile money service, via the mobile phone, is revolutionizing how consumers gain

access to financial services, especially in the developing world where large sectors of society

have often gone without any formal banking services whatsoever. It is estimated that about

364 million low-income, unbanked Africans will use mobile money by 2012, generating over

US$ 7.8 billion in revenues for the mobile phone industry via transaction fees (GSMA,

2010). This is especially true in Kenya, where M-PESA, a mobile money banking services

provider launched in 2007, is “by far the most successful example of mobile money banking in

Africa’’ (Economist, 2009).

“M-PESA”, derived from a combination of two words, “M”, an abbreviation for

“Mobile”, and “PESA”, a Swahili word for cash money—hence “mobile cash money”—is a

Safaricom Company Ltd. (the leading mobile network operator in Kenya) service allowing

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 2

one to transfer money using a mobile phone. Kenya is the first country in the world to use

this service, which Safaricom is offering in partnership with Vodafone (Pty). M-PESA offers

several financial services to all Safaricom subscribers both prepaid and postpaid, even if one

does not own a bank account, including: transfer of cash from one individual to another

without need of traditional bank accounts; purchasing of airtime credits; paying of wages,

salaries, bills; and purchasing of goods and services (Safaricom, 2009b). Within the first two

years of introducing M-PESA services in Kenya, the company has grown its customer base

for mobile money banking services to over 8.6 million customers with a transaction volume

of over US$ 328, million per month (Safaricom, 2009c).

This phenomenon, and its underlying technology, however, raises two key,

interconnected questions that have an important correlation to both the specific case of Africa

and to the process of technology adoption in general. First, why have some sectors of Africa,

notably Kenya, quickly adopted this technology while others have not? M-PESA in Kenya

has been an extraordinary success, however efforts by Vodacom (Pty) Limited to duplicate

this success in neighboring Tanzania have been much less successful. Whereas the Kenyan

M-PESA had 2.7 million users by its 14th month following its launch, the Tanzanian M-PESA

only had 280,000 users by the same time (Rasmussen, 2009). What combination of factors

involving the technology, the business plan employed by the parent company and the specific

socio-cultural context conspired to create either success or failure in the adoption of this

technology?

Second, why have Kenyans quickly adopted this particular technology, and therefore

the cellular phone, with little initial effort by Safaricom Company Ltd to promote mobile

money, while in general Kenya itself has long been a primary example of low adoption of

new technology in many sectors of economic advancement—including new techniques in

farming, banking, transport, manufacturing and, recently, information communication

technology (ICT); especially regarding the practical and social use of computers? Even after

concerted government efforts and numerous attempts by local and foreign NGOs to bring

these various technologies to local Kenyans, the country is still far from embracing advanced

technology (Oyelaran-Oyeyinka & Adeya, 2004; Suri, 2006). Might there be certain social

structures that pre-dated mobile money and cellular phones that readily fit the Kenyan

society, whereas other technologies have remained largely foreign?

This paper considers these questions through a case study of both the historical and

social implementation of this M-PESA program in Kenya, offering a theoretical review and

consideration of the factors that allowed it to flourish where other technologies and other

countries’ social structures did not. Second, We then turn to the future application of mobile

banking itself, exploring results from a survey targeting early adopters of mobile phone users

living in the major urban centers of Kenya.

2. LITERATURE REVIEW: FACTORS AFFECTING ADOPTION OF NEW TECHNOLOGIES IN

AFRICA

The mobile money banking service is an evolving technology that proposes to modify the

ways in which users transmit and exchange money. As a new technology in most parts of the

world, it can either be accepted or rejected by users depending on several factors.

Unfortunately, statistics shows that about fifty percent of information technologies are

considered failures as they fall short of meeting these user’s expectations and are hence

rejected (Lippert & Davis, 2006). Therefore, it is imperative that the managers of such

technology, which often itself requires heavy investments in terms of money, research and

infrastructure development, be able to predict the drivers and inhibitors of technology

adoption. Thus understanding and anticipating issues that would lead to adoption or rejection

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 3

of such a technology early in the development process is very critical. M-PESA And mobile

money are no exception.

While there are several models explaining this question of adoption of new

technologies, in this case we will focus on the Technology Acceptance Model (TAM). TAM

originally suggested that the behavioral intention to use a new technology depends on its

perceived usefulness and its perceived ease of use (Venkatesh, 2000). This was later extended

into the Unified Theory of Acceptance and Use of Technology (UTAUT), which proposes

that the use and rate of adoption of a new technology depends on four major theoretical

constructs: performance expectancy, effort expectancy, social influence and facilitating

conditions (Venkatesh et al., 2003). The rate of adoption itself refers to the number of

individuals who adopt a given innovation over a given period of time. This rate depends on

the perceived attributes of an innovation including relative advantage, compatibility,

complexity, trial-ability, observability, type of innovation decision, nature of communication

channel used, nature of social system and promotional effort (Rogers, 1995). Putting M-

PESA into perspective with the above theory, one would want to also ask how this

technology itself is used in Kenya. Does it represent a true innovation, introducing a

significant departure from the current ways of doing things?

Second, it is important to consider what the relationship of these first stakeholders to

this new technology is? Here too, there is much theory that might give us a means of

considering this question. Rogers (1995) suggests that new discontinuous innovations might

be seen as a progression through strata of society. Technologies first attract “innovators”,

technology enthusiasts who are eager to explore and evaluate the technological superiority

that new innovations promise to provide over existing technologies. These innovators, being

lovers of technology, will go to any extent to troubleshoot the new product and will serve as

beta testers for the early product versions. Their adoption of a new product becomes proof to

the other market players that the product really works. These users are then followed by

“visionaries”, also early adopters. The visionaries, as the name suggests, are people with a

particular vision for the new discontinuous innovation. These individuals hold an idea for

how it can be leveraged to provide a significant competitive advantage over competitors.

They are willing to risk the cost of a new technology if there is compelling evidence that the

new technology can help achieve business or personal goals. They are gifted opinion makers

with a purchasing power high enough to give a vendor his or her first visible returns. These

two groups, according to Moore & McKenna (1999), typically form a total of 16% of the

total population.

When a technology has successfully won over these first groups, it moves on to an

“early majority”. These are pragmatists who are averse to risk and want to retain the status

quo by avoiding disruptions. They do not want to be the first to purchase or venture into a

new innovation, but would rather wait and learn from others mistakes. To complicate matters,

they are only willing to take new innovations if they can get reliable references of individuals

or organizations that have experimented with the innovations successfully. They prefer

references that share their risk aversion and pragmatism, and hence do not consider the

technological enthusiast or the visionaries as reliable references. This creates a catch–22

situation and the end result is that there is an indeterminate “chasm” (Wiefel, 2002) in the

diffusion of the innovation, which can be fatal unless properly managed.

Successful strategy for crossing the chasm requires working the technology adoption

through these groups while building momentum high enough to overcome the chasm. Failure

to keep momentum building runs the risk of stagnating in the chasm and being overtaken by

the next emerging technology (Moore & McKenna, 1999). Momentum is built by identifying

pragmatists who are willing to overcome their risk aversion in return for customized solutions

to some of their existing, previously unresolved problems. These early pragmatist are then

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 4

used as a “bowling alley”, providing respected references to other pragmatists—typically

consisting of about 34% of the total population—showing that the innovation is viable as a

solution to immediate challenges (Wiefel, 2002). If successful, these pragmatist’s adoption of

a technology leads to a jump in its profit margins and substantial growth of market share.

This combined with the visionaries and the technology enthusiasts who had adopted earlier

produces a “tornado” growth effect with the customer base shooting to 50% of the total

customer population. The innovation then attains mainstream status by being adopted by

more conservative members, partly because of resulting lowered prices and risks, but also

because of fear of being left behind by the technology bandwagon. The late majority follows

the pragmatists when the technology is well established. They are also about 34% of the total

population, hence getting this market share leads to maximization of profits as most of the

research and development costs have already been covered. The last to adopt are the laggards

who will go to any length to avoid dealing with new technology unless it is hidden so deeply

that they don’t even realize that it is there.

Returning to the discussion of Kenya, it this last group, existing on the far side of the

technology chasm, that had traditionally rejected technology. And it is this process of

reaching this group, which M-PESA represents.

3. M-PESA REVIEW: A CASE STUDY IN MOBILE MONEY BANKING ADOPTION

Even before the introduction of M-PESA, Kenya was in a ripe position for a new approach to

traditional banking. Beginning in the 1990s, the traditional banking sector had left much of

rural Kenya due to the effects of structural adjustment programs (SAPs) introduced by the

World Bank and International Monetary Fund ( Ndirangu, 2005; Rono, 2002). This left the

rural people with no access to financial services, particularly credit facilities and savings

(Manica & Vescovi, 2009). This also meant that they could not meet several critical financial

services needs.

The working members of the society, usually located in the urban areas, needed an

inexpensive but reliable method of sending money to their unemployed relatives back in the

villages (Manica & Vescovi, 2009). A large percentage of seniors, the poor, the unemployed

and young adults depended on the employed sector of society for financial support. Just

before the launch of M-PESA, 14.3 % of the Kenyan population depended on money transfer

from relatives and friends as their main source of income (FSD Kenya, 2009). In addition,

business people who did have bank accounts with traditional banking institutions were also in

need of extra services. They too needed a safe, quick and cheap method of sending money to

clients, paying bills, salaries and services, as well as saving, as banks were charging high fees

for the services that they did offer. Businesses with traveling salesmen and service personnel,

and families living apart, often needed to send money from remote locations, combining to

create a collection of needs that were not being addressed by the financial market.

Furthermore, the services offered by the traditional banking sector were expensive and took a

long period of time to deliver in a more timely fashion in comparison to M-PESA.

The origin of mobile money in Kenya, as a means of addressing these needs, can be

traced from 2002, when the Department for International Development (DFID), United

Kingdom, introduced a pilot study of mobile banking involving around 20 small villages

(Equity Building Society, 2002; Johnson et al., 2006). This service utilized four-wheel-drive

vehicles acting as “mobile banks”, visiting each village once or twice per week and offering

banking services to small business and small farming households. These “banks” offered

saving and essential borrowing services to encourage new and existing business, based on the

“Bottom of the Pyramid” approach which encouraged increased economic activity in poor

areas with the aim of improving their living standard and opportunities (Karnani, 2007;

Pragalad, 2004). It is this innovation, however tentative, that might be considered the first

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 5

wave of mobile banking, essentially representing an “analog” version of the latter digital

mobile money phenomenon. And several other banks followed suit by copying this model.

This left a mobile money mental model, and a group of early adopters who had

witnessed the tangible benefits of mobile banking, which would later connect nicely with the

new M-PESA service. The initiation of digital mobile banking, then, again took the form of a

pilot study carried out by DFID, using, rather than a mobile banker, a mobile phone platform

which allowed customers to receive and repay loans - usually less than US$100 - from

FAULU Kenya, a microfinance institution (Hughes & Susie, 2007). This pilot study was very

successful, eliminating the need for FAULU customers to travel from the slum and semi-

urban areas to the city center, or the bank to come to them, to deposit their weekly loan

payments. This, however, also had the unintended consequence of reducing attendance to

FAULU meetings which was against the business interests of FAULU itself. This original

idea was thus “unsuccessful”, in relation to the business interests of FAULU Kenya; however

market watchers had observed several patterns during the pilot study that turned out to be

beneficial to consumers and came to set the stage for the introduction of M-PESA. These

included individuals making payments for others in return for different trading services,

consumers using the system as an overnight “safebox” and consumers sending airtime,

bought through Safaricom agents, to their friends and relatives living in different parts of the

country increasing mobile phone penetration and utilization of the services.

Thus, the working members of the society and the business people initiated their remote

location employees, parents and relatives—who would normally represent the latter, highly

reluctant, stages of technology usage—into early usage because of the simple fact that every

money transfer, itself with a tangible value to the user, required the receiver to go to a M-

PESA agent and preferably to open an M-PESA account. This partially ignited the rapid

adoption.

Since its introduction, there has been a rapid growth of M-PESA in terms of technology

adoption with reference to number of users and volume of money transferred. The number of

customers increased from 52,000 to about 8.6 million between April 2007 and November

2009, while person-to-person money transfers per month grew from 1 to 328 million US

dollars in the same period (Safaricom, 2009c). This is as a very substantial growth especially

when one considers that Kenya itself has a population of about 38 million people and a per

capital annual income of about US$486 (Central Bank of Kenya, 2010).

3.1 Critical Success Factors for M-PESA: Structural Components

This, however, is only a partial explanation, leading to the first question of this paper; what

factors led to the successful adoption of M-PESA itself in Kenya? As mentioned above, the

first group of factors for its success point to failure by the existing financial institutions to

meet the needs of the unbanked population. Only 19% of the Kenyan population had access

to banking services by the time M-PESA was launched in 2007 (FSD Kenya, 2009). To this

above discussion, we can also add numerous barriers that had prevented this sector of the

population from even having the basic ability of getting a bank account (Manica & Vescovi,

2009). These factors then become both the reasons why this large population had long existed

on the far side of the technology chasm, and, through M-PESA’s unique solutions, the reason

why this chasm was bridged.

The first barrier was illiteracy. Most of the unbanked populations were illiterate,

hence unable to complete the requisite paperwork needed to open a traditional bank account.

This was coupled with the existence of documentation and bureaucratic procedures instituted

by individual banks, or central bank regulations, under the concept of “Know Your

Customer”, required for establishing a traditional bank account. These included the need for

introduction letters from individuals operating current accounts with the bank of interest,

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 6

identification documents, passport photographs, and high minimum amounts of money

required to open and maintain an account. With the introduction of M-PESA, these

bureaucratic procedures proved to be unnecessary, as Safaricom, while still applying the

“Know Your Customer” initiative, does so by only requiring national identity cards and

phone numbers. This in turn is made possible by the micro-transaction and pay-as-you-go

structure of mobile money.

Third, existing financial institutions required a certain minimum amount of money to

remain in the account at all times, and also charged exorbitantly high monthly fees for going

below the minimum requirement. Closure of the accounts for non-performance was also a

common feature among Kenyan banks. These issues simply made the idea of operating and

maintaining banking accounts unattractive and expensive for most people. A survey done in

March 2007 just before the launch of M-PESA indicated that the average amount required to

open a current bank account was US$ 105 while the average cost for operating the same was

US$ 19 per month, suggesting that by the end of the year, if one were to maintain only the

minimum required amount, they would owe the bank at least US$123 in fee charges alone

(Central Bank of Kenya, 2007). To open and operate M-PESA accounts, on the other hand,

one needs no cash; nor is any fee charged for deposits or withdrawals or monthly ledger fees.

The only time one needs to pay fees is when sending money. Even then, the amount of fees

paid per transaction is far less compared to what traditional banks charge.

The fourth barrier was the distribution of banking services themselves. As noted

above, most of the banking services were found in the big town centers or economically

viable areas. However, close to 70% of the Kenyan population lives in the rural areas. Thus

most people were either excluded from these services or had to travel long distances to the

nearest town centers to access banking facilities; travel which itself was expensive and time

consuming increasing the cost of accessing banking services. The above barriers facing the

unbanked poor of the society left a gaping need for financial service with this group. What

they needed was a solution and some change agent to introduce them to the solution. The

solution came via Safaricom who turned the above needs into a business opportunity, having

already implemented wide network coverage with their mobile phone technology and agents

selling airtime all over the country. This enabled the company to widely spread M-PESA

services in a short time. The change agent came in the name of the working and business

people who become the early adopters to satisfy their own unmet need.

The unmet need of the working and the businesses people, earlier described in the

beginning of Section 3.0, came down to finding a simple and reliable method of sending

money to rural/remote individuals. This need could not be met by the existing methods of

sending money, which had several shortcomings, contributing to the immediate success of M-

PESA. There were five popular methods of sending money to friends, relatives or businesses

by 2007, just before the launch of M-PESA (FSD Kenya, 2007). The most popular (58%) was

sending money via family/friends going to the same place where one intended to send money.

The problem with this approach was that it was random, unpredictable and the possibility that

someone would be going in the same desired direction was quite remote, especially for urgent

cases. Further such friends and relatives were not always trustworthy, and many times, the

money never reached its destination. The second most popular method (27%) was the use of

public bus companies for passengers or goods. These companies offered delivery of letters,

parcels and money as a side business. However, cases of theft, either from bus employees,

passengers or roadside robbers, were common, making this method very unreliable. The third

most popular method (24%) involved sending money through postal services via money order

and telegram. However the commission charges were expensive and coupled with poor

service delivery (FSD Kenya, 2007). The fifth most popular (11%) method was to put money

directly into relatives’ or friends’ bank account. This assumed that the other person had a

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 7

bank account, which, again, was often not the case. The sixth most popular method (9%) was

to use the official money transfers companies like Western Union. However, the existing

money transfer companies charged high commissions and were not always available in most

regions, particularly in rural areas. By reducing the cost of sending money, eliminating

middlemen and utilizing technology to make sending money faster, convenient, reliable and

safe, M-PESA solved these problems associated with other preexisting methods of sending

money, hence its rapid growth and popularity.

The creation of the right government regulatory environment for the providers of

mobile banking was also critical (Mwangi & Njuguna, 2009). This happened at two points in

time. The first milestone was in the liberalization of the telecom sector in 1998, which ended

the Telkom Kenya monopoly and brought in two new mobile phone providers (Safaricom

and KenCell, later Celtel then Zain and now Bharti). This led to the phenomenal growth of

mobile phones. The second instance was when Safaricom applied to start M-PESA money

transfer service. There was no existing law regulating the operation of mobile money. Too

much regulation would have stifled innovation while there were fears that no or too little

regulation might have endangered the country’s financial system. Thus the government had

to walk a tight rope in creating the right environment for innovation while at the same time

ensuring the stability of the financial system (Mwangi & Njuguna, 2009).

In a nutshell, we have highlighted several factors contributing to the rapid adoption of

mobile money in Kenya. However, these factors are not only unique to Kenya but are often

similar across Africa and many other developing countries, whereas mobile money banking

services themselves have not thrived in all of these areas, and this raises the underlying

question regarding the unique factors within Kenya that coupled with these structural needs/

parameters to create the phenomenon growth in mobile money business.

3.2 Critical Factors Unique to the Success of Mobile Money in Kenya

While there are many reasons which we will discuss below, each in turn connects back to

fundamental concepts that we argue drove the growth of mobile phone and mobile money in

Kenya—homogeneity, ubiquity, the use of early adopters to target the poor through a bottom

of pyramid approach and preexisting ownership structures. First, one of the most basic and

critical factors for the success of M-PESA was large market share of Safaricom in Kenya.

This is starkly demonstrated by the slower uptake of Tanzanian M-PESA when compared to

the Kenyan M-PESA. One of the reasons of the slower intake is the fact that Safaricom’s

market share in Kenya is 79%, while Vodacom has a market share of only 39% in Tanzania

(Rasmussen, 2009). The size of the market share of Safaricom in Kenya allowed the company

flexibility to try several new services with its already large customer base, without fear of

causing the migration of already existing subscribers to other networks.

This however fits into the next aspect driving this phenomenon, the use of early

adopters to connect to the poor of the society through a “Bottom of the Pyramid” approach to

pitch the sale of M-PESA technology itself (Prahalad, 2004). In marketing other mobile

phone services such as calling, texting and data, which are their core business, Safaricom

targeted the majority of the population, who are generally poor and usually ignored by the

mainstream banking sector using the early adopters. Initially, Safaricom pioneered this

strategy, through the sale of airtime credits, marketed via the slogan “Sambaza”, a Swahili

word for sharing, and allowing the early adopters (working and business people living in

urban areas) to buy airtime credits in large denominations/volumes and then to “sambaza”, or

share them, in very small units, to poorer friends or relatives or even to other people mainly

in inaccessible rural areas or slums as a business. This allowed people who were unable to

buy credits to get assistance from those who were able, and to make specific important calls.

This meant everyone who had a phone, or could get access to a phone, could spend as low as

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 8

20 cents to make a call, through sharing of credits, increasing the volume of the total airtime

credits sales. This system enabled the company to reach the most poor sectors of the

society—again also the most populous sector—and, transversely, allowed the poor to access

mobile phone services, improving their livelihood, and cementing the phone itself as an

important element in their social relations. In global terms, this meant that due to this simple

structure for sharing minutes, 2.5 billion people who lives on less than $2.50 per day, at the

bottom of the pyramid, and who has not been tapped by most industries, are suddenly eligible

for both calling and mobile banking services (Prahalad, 2004).

This sudden social ubiquity of phones—again whether one’s own or access through

another source—even whether one could afford to pay themselves or one was being parceled

airtime credit by another—connects to the third unique factor contributing to the fast rate

acceptance and adoption of M-PSESA in Kenya, the widespread use of one type of phone. As

will be seen from the consumer survey in the next section, most of the respondents of the

survey indicate the universality of the Nokia phone in Kenyan market, controlling about 88%

of the total market share. While this brand of phone receives high marks in several technical

aspects, as we will see in the following survey, its ubiquity and contribution to the growth of

mobile money banking services largely relied on its easy to use features. Usage became a

matter of learning from the trusted early adopters—i.e., push the green button—to achieve a

specific task—to call me or pay a bill—rather than mastering a new technology with no

connection to one’s life. It is this social structure, and this sharing of techniques, which

themselves became both ubiquitous among Kenyans. At the same time, even as the number of

M-PESA subscribers grew from about 52 thousand to about 8.6 million between April 2007

and November 2009, in Kenya, the social connections were also maintained by Safaricom as

well, which increased the number of agents from 335 to 14, 754 (Safaricom, 2009c). The end

result was that they were able to maintain a reasonable customer to agent ratio of about 600,

and to preserve the communal structure.

This in turn leads to the final issue driving the adoption of this technology, community

ownership of the technology itself. The M-PESA program itself was a homegrown solution

with lingering mental models based on the previous four-wheeled vehicle analogue version,

through the pilot project by FAULU Kenya. This reinforced a sense of community ownership

of the technology. On the other side, the M-PESA was not as successful in Tanzania because

they did not feel ownership but rather saw it as a foreign technology smuggled in through

Kenya.

4. CONSUMER SURVEY

While the above discussion attempted to give a theoretical explanation for the phenomenon

of mobile phones and mobile money in Kenya, based on the review of existing literature, the

latter half of this paper will consider a survey designed to test this discussion and to address

the further question posed in the introduction regarding design of mobile money itself. As

noted above, while M-PESA has been a success, it is not the only design for mobile money

banking services that has been implemented in Africa. Further, even the M-PESA design has

not been successful in all countries. There is no consensus on what particular combinations of

elements is best for the implementation of mobile money. Because this is a growing industry,

it is this discussion, built on the theoretical discussion of Kenya above that this paper might

provide.

In order to further understand the reasons why M-PESA adoption was successfully

implemented in Kenya, we conducted a survey targeting specific mobile phone users,

considered to be early adopters, in order to understand the relationship between the service

provider, users, services provided, type of mobile phones used and also the perceptions of the

users about the technology.

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 9

4.1 Methodology

A survey targeting early adopters was distributed via email. The first question sought to

ascertain the mobile provider used by the different respondents. Responses to this question

would allow us to test the issue of dominating service provider. The second question sought

to capture the type of mobile handset(s) preferred by users and the reasons for such

preference. The third question sought to capture the type of mobile phone handsets used by

the respondent friends and relatives. This would show the correlation between what the

respondent used and what their friends and relatives used. The fourth question sought to

capture the other types of services that the respondent was using. This would give us an idea

of the new trends by the early adopters. The fifth question sought to investigate the major

challenges being encountered while using mobile phone-enabled funds transfer service such

as M-PESA. The last question sought to capture respondents’ suggestions on alleviating the

above-identified challenges.

The questionnaire was made available via website and also administered through

email to known addresses in Kenya defining the objectives of the study, and requesting that

the recipient respond to the questions and, where possible, distribute the information about

the questionnaire to their friends or colleagues. The responses from the questionnaire were

automatically recorded online whenever one completed a survey question. A total of 102

people responded but only 67 people completed all of the questions outlined in the

questionnaire, hence only those who completed all questions, including their biographical

data, were incorporated in the analysis.

4.2 Subjects

The survey targeted technology savvy consumers living in the major urban centers with

access to electricity, computer and Internet. In the context of Kenya, it is these individuals

who are the earliest adopters for new technologies, and hence chart the path that is usually

followed by the rest of the population (Rogers, 1995). However, the questions were phrased

to capture the behavior of the respondent living in both urban towns as well as those in the

rural areas. Out of the sixty-seven individuals responding to the questionnaire, the majority

(94%) had ages ranging between 20 and 40 years old, reflecting the younger, internet

frequenting, generation. The majority of these respondents (76.1 %) were also males.

4.3 Preferred Phone Models

The survey found over 88% of respondents relied on Safaricom for mobile phone service

provision, while 9% got their services from Celtel, and the other companies shared the

remaining 3%. Interestingly a significant group (43.6%) also subscribed to at least two

mobile phone service providers, mainly Safaricom and Celtel, at a given time. This suggests

that there are certain services they preferred to get from either of the companies. When the

subscribers were asked which type of mobile phone handset they use or prefer, again a

majority of the people (88%) used Nokia as their preferred phone handset. When asked which

phone they would like to have given the opportunity to change their current mobile handset,

the overwhelming majority (96%) preferred to get another Nokia model series superior to the

type they currently possessed. In keeping with the above discussion, it should be noted that

the Nokia series itself uses the same button configuration for all models, only adding

additional features to offer other services such as camera, calculators, radio, etc which not

everyone intend to use and also defines the cost of the handset. The two main reasons for

Nokia’s popularity was its easy to use features and reasonable cost. Other advantages cited

for the popularity of Nokia phones were long life battery, sufficient memory space, variety of

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 10

models compatible with consumers’ needs and durability. The main other handsets used in

Kenya were Motorola (8%), Samsung (2%), Siemens and others.

Ninety percent of the respondents also indicated that their friends or relatives own

Nokia series phones, suggesting that Nokia is the most popular phone in Kenya. This also

shows a direct correlation between what the respondents who are early adopters own and

what their friends and relatives within the urban and rural parts of the countries own. The

results of this survey are supported by data from external sources. For example a national

analysis of the types of phone models used in Kenya in may 2010 indicated that Nokia “ was

the handset of choice for most Kenyans with the brand accounting for 90% of the market

share” (Opera Software, 2010). Ownership of the same type of phone as argued before

makes the training of handsets usage much easier from the earlier adopters to the older folks

in the upcountry. This knowledge is then passed over from one person to the other. Further,

the fact that the same phone model is still dominating as shown by the May 2010 survey, has

enabled the creation and retention of this knowledge within the social system.

4.4 Outstanding Challenges and Possible Solutions

The next questions sought to investigate the outstanding challenges facing M-PESA and

possible solutions. 46.6% of the respondents indicated that they had no complaints with the

M-PESA service. This suggests that almost half of the respondents are satisfied by the service

as it is. The rest made various complaints and suggestions as shown in Figure 2

Figure 1: Frequency of User Complains of Safaricom M-Pesa Money Services

One of key challenges was the frequent system failure. The access to the M-PESA

services was at times intermittent. This was because of poor network reception, frequent

power outages and overload of Safaricom’s central servers. Further, the respondents

complained of slow service at peak times. A related complaint involved having too few

agents or no agents to handle problems in some parts of the country. The respondents

suggested that a possible solution would involve increasing the penetration of agents. The

hours of service were also an issue. Generally, the M-PESA service operated from early

morning to late afternoon but the respondent wanted these hours extended. The recent

partnership with PesaPoint, a third party ATM network connecting over 33 financial

institutions and with locations in over 46 towns in Kenya might address this problem

(Safaricom, 2009a). Further, recently M-PESA has partnered with Equity bank to start

offering loans and interest on the money saved in MPESA account and also giving M-PESA

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 11

users access to the bank ATM services and other traditional banking services at affordable

rates. The recipient also suggested that one way of making the service more convenient was

to scrap the need to go to an agent when a customer wants to send money. Thus a customer

should be able to send money from their house if they had enough existing “float” with the

company without going to a M-PESA agent.

There were also several security and fraud related challenges. The first was the

security of the M-PESA money remittance message, which was usually not password

protected. This meant that anybody who obtained possession of the phone could read the

message and see all of the financial transactions of the phone owner. This is a security and

privacy risk and should be changed such that it can only be accessed by using the owner’s

password. It was not unusual for family members, roommates and work colleagues to have

access to someone’s phone, hence the need for protecting the M-PESA money remittance

message.

The second security related challenge was sending money to the wrong recipient. The

system did not have feedback to confirm that the number that the user had entered indeed

belonged to the intended recipient (due to the fact that mobile phone numbers are typically

not registered with the owner’s name). It was often a common mistake for an individual to

send money to the wrong number by confusing one of the digits or sometimes names. This

becomes more important when one also considers the relatively high level of illiteracy.

Money sent to the wrong number was hard to recover unless the sender noticed immediately

and alerted the provider. The most common scenario, however, would be that the sender

discovers the mistake much later and by then it is too late, as the wrong recipient will have

already cashed the money. The solution to this problem may need to be addressed from

several fronts. First, the government and the mobile phone providers need to work together to

enforce the registration of all individual’s phone numbers. It should be noted, however, that

agencies should be careful not to duplicate the unintentional barriers to banking that were

created from a similar need to register bank account holders. Second, the providers needs to

update their system such that it gives feedback to users that the money was delivered to the

intended recipient and displays delivery details in terms of phone number, time and location.

Third, a fast action mechanism needs to be implemented in case one sends money to the

wrong number as well as remedial measures on money recovery. Uncollected funds should be

returned to a sender within a specified, however short, time to the send.

Another key challenge was lack of “electronic float money” among most agents,

limiting the amount one can receive at any one time. M-PESA transactions require the agent

to exchange cash for electronic float money and vice versa. In an ideal situation, the money

deposits and withdrawals should balance and there would be no problem. However the reality

is that agents will face different “float” issues depending on which part of the country they

are operating in. In the rural villages, the majority of the transactions are withdrawals by the

peasants of money sent by the working relatives from the big towns. So the agent will soon

run out of cash and will need to wait until Safaricom refunds their account and then go to the

nearest bank to get more cash. In the main towns, on the other hand, the majority of people

are sending money to the villages, and the agent will face the opposite problem. The agent

will need to go to the nearest bank to deposit the surplus cash and wait until Safaricom

verifies reception and sends the equivalent electronic float money.

4.5 New Fronts for Early Adopters

We also sought to investigate what other types of mobile phone services were used by the

majority of phone users, apart from calling and message texting. This aimed at identifying

new areas of potential growth by the early adopters which could be duplicated down the other

adopter categories. The vast majority of Kenyans clearly are tied into M-PESA, with about

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 12

74% early adopters using the services already, as shown in Figure 1. This suggests that

Safaricom should now look at the other segments of the community. Another feature widely

used is the access to internet (44%), and there is the likelihood that with the recent enabling

of various internet social networks through mobile phones, the number of people accessing

internet through their mobile phones will increase tremendously. It also seems that the M-

PESA service has replaced plastic money as many people are now purchasing goods and

services through their phone.

Figure 2: Percentage Usage of Mobile Phones to Conduct Related Value added Data

Services Beyond M-PESA

There is a high potential of doing e-commerce or internet related services among the

young urban generation. Bills inquiry and bill payment, at 44% and 33% usage, respectively,

were also well used but can be extended to a wider segment of the society. Bill payment in

this survey referred to either electricity or water bills which are the two utility bills that most

of the homes in the urban areas are required to pay. However this might also be extended to

other bills such as bank balances and loan approval and payment, as recently introduced by

the Higher Loan Education Board for previously sponsored university students.

However other services like salary inquiry, interactive services and news briefs were

highly underutilized. Most of the population depends on snail mail notice to learn when their

paychecks have arrived in the bank, which takes days or weeks, and at times get lost during

the delivery process. Salary notification by text message would solve such problems at a very

low cost. The way forward for M-PESA would be to expand to such value added data

services because they already have an extensive coverage.

The next section discusses the consumer findings and then relates it to the earlier

findings from a review of the M-PESA literature.

5. DISCUSSION, IMPLICATIONS AND CONTRIBUTIONS

This study started by investigating the critical factors that led to the success of M-PESA.

Several factors were indentified. Among such factors was the large unbanked Kenyan

population hungry for financial services and the mobile revolution which gave access to

mobile phones for the majority of the population. M-PESA leveraged this opportunity by

using early adopters to reach the rest of the population with phenomenal success. M-PESA

has revolutionized the way financial services are accessed in Kenya and has a bright future

with several value-added services waiting to be tapped. About 47% of the respondents are

satisfied with the service as it is. However, the remainder suggested various solutions to

address several security and service provision challenges. The registration of all mobile

phone numbers and the particulars of owners will go a long way in enhancing security and in

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 13

tracing and reversing wrong or fraudulent transactions. Safaricom will have to improve the

quality of the wireless connections and the M-PESA agents will have to improve their

services.

There are several lessons that can be learnt from the Kenyan experience. First and

foremost regards the power of early adopters in promoting the use of mobile technology in

the developing world. The M-PESA case shows that it is now possible to profitably extend

financial services to the poor unbanked sectors at the bottom of the society pyramid at

relatively low cost using early adopters to push technology for free. However, as has been

said before, and as is exemplified here, this requires that the technology itself be handled as

an extension to the existing social structure and targeted at a specific social/ practical need

and market segment. Ubiquity and homogeneity, as were explored here in numerous aspects,

would be important keywords to keep in mind when implementing a new technology.

A related second lesson is the power of technology innovation itself. The M-PESA

case shows that the use of non-traditional methods like cell phones has the potential of

revolutionizing the way business is done and profits made in Africa. The goal is now to

provide millions of low cost transactions which accumulate to give a good profit margin,

rather than specifically targeting the upper tier, and least populous sector, of society. In order

to achieve this, Safaricom had to innovate and reengineer the product at certain points. For

example, M-PESA was originally meant to be a microfinance solution which did not work

well but spawned an even more successful solution for the mass market. Related to this was

the innovativeness of the Kenyan people. A big section of the country does not have power

hence it was unimaginable that a service that requires the user to have a charged phone to

place transactions would succeed so well. Only 1.3 million people in Kenya are connected to

electricity, yet the country has over 17.6 million mobile phone users (Ombok, 2009). The

population improvised in different ways. They used solar and car battery chargers. Charging

vendors mushroomed in the village centers with generators. Some of the very poor have even

devised ways of using the M-PESA service without owning phones either by depending on

relatives and friends or by pooling together and buying a community phone. This again

reinforces the community first nature of technology adoption itself.

Third, developing countries should not to be deterred by lack of success of mobile

money banking in the developed countries. The value proposition for mobile banking is

different for users in the developing countries compared to the developed country. Financial

services can at times be taken for granted in the developed countries because of the wide

options available to the common citizen via online banking, credit and debit card, telephone

banking and banking facilities every few miles. Since most of these services are almost non-

existent, especially in the rural areas, in developing countries the value proposition is more

compelling hence there is a higher chance for success.

Fourth is a lesson to the conventional banks. Initially Kenyan conventional banks had

a great fear that M-PESA was going to run them out of business. This fear has proved to be

misplaced. The banks have discovered that they can even create useful alliances with M-

PESA. They can exploit the M-PESA network and the millions of customers to make more

profits. For example, Kenya Commercial Bank, one of the biggest banks in Kenya, has

entered into a partnership with Safaricom with the goal of alleviating the e-float problem

mentioned earlier in the challenges section. M-PESA agents will, for a small commission, be

able to get e-float money immediately after making cash deposits in the Kenya Commercial

bank. This is much faster than the current practice in which the agents have to submit the

bank deposit receipts to Safaricom and wait for several hours until the e-float is deposited

into the agents’ bank account. The agents can do more transactions this way and the bank can

make billions considering it has a big branch network across the county. Again, however,

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 14

these technological or financial solutions only become meaningful when they have a social

structure in place to utilize them.

The fifth lesson concerns the challenges that face Safaricom now. New countries

rolling out mobile money banking services should insist on registering all phones from the

beginning so that there is security and accountability in mobile money transfers. However,

when thinking of poor and potentially illiterate communities, they should be careful to follow

the ubiquitous model of mobile money set by M-PESA, so as not to erect new barriers to

adoption. New mobile money providers should also learn from the way that Safaricom is

working with others to address the “lack of electronic float money” challenge mentioned

earlier.

The study also makes contributions to the technology adoption literature. A key

challenge in the adoption of high tech innovations is how to cross the “chasm” (Moore &

McKenna, 1999). The M-PESA study suggests several strategies that can be added to the

researchers and mobile money provider’s toolbox. For the communication technologies like

mobile money which require a sender and receiver, the trick is to find a set of customers in

the sending market who have leadership in the society; who understand and embrace new

technological issues and can serve as early adopters. These can then be used to penetrate the

majority in the receiving market and thus crossing the “chasm”. The second strategy

addresses the problem of penetrating illiterate to semi illiterate populations. The trick is to

stick to a simple but reliable technology. Push the same technology throughout the

population. This ensures that knowledge will be passed from one group to the other making it

easier to adopt and use. A third strategy is to look for preexisting structures that connect to a

new innovation the way mobile money was connected to the earlier use of four wheeled

mobile trucks. People fear change hence a technology that connects with existing structures

and social systems will have minimal resistance to change. The above lessons and

contributions can be used both by researchers and also by mobile money providers about to

launch new services. For example, Vodafone is already using the M-PESA template to launch

a mobile money service in Tanzania albeit with some challenges (Rasmussen, 2009).

There are several limitations to this study. The first concerns the sample chosen. This

sample followed the strategy used by Safaricom of targeting the young and technology savvy

to point out the challenges and the way forward for M-PESA. The shortcoming of this

strategy is that the population may not be ideally representative of the greater Kenyan

population. Questions were designed to capture behavior both in the urban and rural area. A

future study can expand the population sample to also get input from the rural respondents on

the applicable question items. It is also not obvious that the same strategy can be applied to

all newly introduced technologies, as some cultural norms might impede the use of early

adopters who tend to be young compared with the early majority in the African society where

knowledge is thought to be equivalent with the age.

6. REFERENCES

Central Bank of Kenya. (2007). Survey on Bank Charges and Lending Rates.

http://www.centralbank.go.ke/downloads/bsd/surveys/Mar2007.pdf

Central Bank of Kenya. (2010). Monthly Economic Review: December 2009.

http://www.centralbank.go.ke/downloads/publications/mer/2009/Dec09.pdf

Djiofack-Zebaze, C. & Keck, A. (2009). Telecommunications Services in Africa: The Impact

of WTO Commitments and Unilateral Reform on Sector Performance and Economic

Growth, World Development, 37, 5, 919-940.

Economist. (2009). The Power of Mobile Money, The Economist, September, 26th.

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 15

Equity Building Society. (2002) Remote Village Mobile Banking.

http://www.financialdeepening.org/data/documents/PROJECT%20COMPLETION%

20REPORT.pdf

FSD Kenya. (2007). Financial Access in Kenya: Result of the 2006 National Survey.

http://www.fsdkenya.org/finaccess/documents/FinaccessReportFINALMain.pdf

FSD Kenya. (2009). FinAccess National Survey 2009: Dynamics of Kenya's Changing

Financial Landscape. http://www.fsdkenya.org/finaccess/documents/09-06-

10_FinAccess_FA09_Report.pdf

GSMA. (2010). Mobile Money for the Unbanked: Annual Report 2009.

http://www.gsmworld.com/documents/mmu_2009_annual_report.pdf

Hughes, N. & Susie, L. (2007). M-PESA: Mobile Money for the "Unbanked" Turning Cell

Phones into 24-Hour Tellers in Kenya, Innovations: Technology, Governance,

Globalization, 2, 1/2, 63-81.

International Telecommunication Union. (2009). Information Society Statistical Profiles

2009-Africa. http://www.itu.int/dms_pub/itu-d/opb/ind/D-IND-RPM.AF-2009-PDF-

E.pdf

Johnson, S., Malkamaki, M., & Wanjau, K. (2006). Tackling the 'Frontiers' of Microfinance

in Kenya: The Role for Decentralized Services, Small Enterprise Development, 17, 3,

41-53.

Karnani, A. (2007). The Mirage of Marketing to the Bottom of the Pyramid, California

Management Review, 49, 4, 90-111

Lippert, S. & Davis, M. (2006). A Conceptual Model Integrating Trust into Planned Change

Activities to Enhance Technology Adoption Behavior, Journal of Information

Science, 32, 5, 434-448.

Manica, L. & Vescovi, M. (2009). Mobile Telephony in Kenya; is it Making the Life Better?

http://www.it46.se/projects/UNITN_ict4sd/assignments/ICT4SD_

manica_vescovi.pdf

Moore, G.A. & McKenna, R. (1999). Crossing the Chasm: Marketing and Selling High-Tech

Products to Mainstream Customers. New York, NY, USA: HarperCollins.

Mwangi, K.S. & Njuguna, N.S. (2009). Expanding the Financial Services Frontier: Lessons

From Mobile Phone Banking in Kenya. Washington D. C.: Brookings Institution.

Ndirangu, M. (2005). Kenya Today: Breaking the Yoke of Colonialism in Africa. NewYork,

NY, USA: Algora Publishing.

Ombok, E. (2009). Safaricom Releases First Solar-Powered Mobile Phone. Bloomberg.

Opera Software. (2010). State of the Mobile Web, May 2010.

http://www.opera.com/smw/2010/05/

Oyelaran-Oyeyinka, B. & Adeya, C.N. (2004). Dynamics of Adoption and Usage of ICTs in

African Universities: A Study of Kenya and Nigeria. Technovation, 24, 10, 841-851.

Prahalad, C.K. (2004). The Fortune at the Bottom of the Pyramid: Eradicating Poverty

Through Profits, Pennsylvania , USA: Wharton School Publishing, Pearson Education

and University of Pennsylvania.

Rasmussen, S. (2009). The Hype Cycle and Mobile Banking. Paper presented at the GSMA

Mobile Money Summit, Barcelona, Spain

Rogers, E. (1995). Diffusion of Innovations (4th Ed.). New York, USA: The Free Press.

Rono, J. K. (2002). Impact of Social Adjustment Programmes on Kenyan Society, Journal of

Social Development in Africa, 17, 1, 81-98.

Safaricom. (2009a). M-PESA Customers to Withdraw Cash from PesaPoint ATMs.

http://www.safaricom.co.ke/fileadmin/template/main/downloads/m-pesa_resource

_centre/M-PESA_Press%20Briefs/08.09.03%20-%20PesaPoint%20Launch.pdf.

Safaricom. (2009b). M-PESA Services. http://www.safaricom.co.ke/index.php?id=747.

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

EJISDC (2010), 43, 3, 1-16 16

Safaricom (2009c) MPESA Key Performance Statistics. http://www.safaricom.co.ke/

fileadmin/template/main/images/MiscUploads/M-PESA%20Statistics.pdf.

Suri, T. (2006). Selection and Comparative Advantage in Technology Adoption. Yale

University Economic Growth Center Discussion Paper No. 944

http://www.mit.edu/~tavneet/suri.pdf

Venkatesh, V. (2000). Determinants of Perceived Ease of Use: Integrating Control, Intrinsic

Motivation, and Emotion into the Technology Acceptance Model, Information

Systems Research, 11, 4, 342-365.

Venkatesh, V., Morris, M., Davis, G. & Davis, F. (2003). User Acceptance of Information

Technology: Toward a Unified View, MIS Quarterly, 27, 3, 425-478.

Wiefel, P. (2002). The Chasm Companion: A Field book to Crossing the Chasm and Inside

the Tornado. New York: Harper Collins Publishers.

The Electronic Journal on Information Systems in Developing Countries

http://www.ejisdc.org

View publication stats

You might also like

- Session XVIIIDocument31 pagesSession XVIIIRupaliVajpayeeNo ratings yet

- Session XVDocument23 pagesSession XVRupaliVajpayeeNo ratings yet

- Session IIIDocument15 pagesSession IIIRupaliVajpayeeNo ratings yet

- Session XVII PDFDocument49 pagesSession XVII PDFRupaliVajpayeeNo ratings yet

- Session XVIIIDocument31 pagesSession XVIIIRupaliVajpayeeNo ratings yet

- Session XIIIDocument26 pagesSession XIIIRupaliVajpayeeNo ratings yet

- Session XVII PDFDocument49 pagesSession XVII PDFRupaliVajpayeeNo ratings yet

- Session XVII PDFDocument49 pagesSession XVII PDFRupaliVajpayeeNo ratings yet

- Session XVII PDFDocument49 pagesSession XVII PDFRupaliVajpayeeNo ratings yet

- Session XVDocument23 pagesSession XVRupaliVajpayeeNo ratings yet

- Ioc Risk Management Policy For Hedging Oil InventoriesDocument10 pagesIoc Risk Management Policy For Hedging Oil InventoriesAditya VermaNo ratings yet

- Session XIIIDocument26 pagesSession XIIIRupaliVajpayeeNo ratings yet

- Session IV-BDocument31 pagesSession IV-BRupaliVajpayeeNo ratings yet

- Session I PDFDocument23 pagesSession I PDFRupaliVajpayeeNo ratings yet

- Financial Engineering - P C BiswalDocument5 pagesFinancial Engineering - P C BiswalRupaliVajpayeeNo ratings yet

- Lean ManufacturingDocument29 pagesLean ManufacturingltcmenishadNo ratings yet

- Session XVIIIDocument31 pagesSession XVIIIRupaliVajpayeeNo ratings yet

- Session XIVDocument30 pagesSession XIVRupaliVajpayeeNo ratings yet

- Session XVDocument23 pagesSession XVRupaliVajpayeeNo ratings yet

- Session XVIIIDocument31 pagesSession XVIIIRupaliVajpayeeNo ratings yet

- Highlights of 73rd Amendment Act, 1992Document2 pagesHighlights of 73rd Amendment Act, 1992Surendra KhatriNo ratings yet

- Hulsey PresentationDocument67 pagesHulsey PresentationRupaliVajpayeeNo ratings yet

- BoardSketch Sec 1Document6 pagesBoardSketch Sec 1RupaliVajpayeeNo ratings yet

- Decile Lift ChartDocument3 pagesDecile Lift ChartRupaliVajpayeeNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)